Financial Plan Vs Financial Planning: Key Differences

When people become disappointed in their financial adviser, sometimes it’s because there is a misalignment of expectations. Sometimes, that misalignment comes from confusing the difference between a financial plan and the financial planning process.

Clients who know what to expect from their financial planning relationship are less likely to be disappointed. As a result, those clients will probably get more value from their relationship.

With that said, having a better understanding of the difference between a financial plan and the financial planning process should help. That way, if you decide to hire a financial planner, you know what to expect.

Contents

Introduction

I remember the first time I received my own financial plan. Actually, it was for my mother. It was a while ago, before I decided to become a financial advisor myself, and is probably one of the reasons why I did so.

My mother had inherited some money from my grandmother. After a couple of years of waiting for the broker to do anything, my mother decided that she wanted me to help her move her investments elsewhere.

I’d researched some financial planners in the local area. We decided to work with an hourly financial planner that I had found online. For $800, she presented us with a beautifully designed, articulate personal financial plan.

My mother paid the flat fee, smiled at the planner, and graciously thanked her for her work. As we left, she turned to me and said, “What am I going to do with this? I want you to tell me what we’re going to do, and to help me do it.”

I didn’t realize it at the time, but that statement highlighted one of the key differences between a financial plan and financial planning.

Before we begin, I’d like to make a couple of points clear:

This isn’t a pitch to hire a financial planner.

I am a Certified Financial Planner™. This credential represents the gold standard in the financial planning industry. In obtaining these marks, I was required to learn a holistic approach to financial planning.

This approach requires knowledge & experience in the following areas:

- Investment planning

- Insurance planning

- Retirement planning

- Estate planning

- Tax planning

However, this article is for educational purposes only. My only goal is to illustrate to you, the reader, some points for consideration. It’s up to you to decide whether you want to hire a financial planner or whether you can manage this on your own.

There are many people who are clearly capable of managing their financial relationships & living their best life. This is essentially the primary goal of the financial planning process.

A comprehensive financial plan isn’t better or worse than an ongoing process.

It’s simply different. There are situations in which one or the other might be more suitable for your needs.

For example, self-starters might benefit best from a solid financial plan that points them in the right direction. Others might feel more comfortable with a long-term financial planning relationship with financial professionals they can trust.

This article attempts to point this out. Let’s start by discussing what a financial plan is.

What’s a financial plan?

Simply put, a financial plan is a document containing:

- Your current financial situation

- A list of long-term financial goals

- Financial decisions or smart financial moves required to achieve your future goals

This usually ends up simply being a list of things that need to be done, reviewed, or considered as you align your finances to your life. Often, this definition depends on the viewpoint of the person you’re working with.

For example, an investment manager will develop a plan that addresses your investments. Insurance agents will develop a plan that discusses insurance products. Your accountant might be able to help you with taxes.

However, it might be hard to assemble different financial aspects of your life into a plan that makes sense.

Putting it all together is the true purpose of a financial plan.

In other words, a financial plan should address all the areas where your life & money intersect. And it should do so in such a way that all the moving pieces work together. This is known as the holistic, or comprehensive planning approach.

Otherwise, you’re creating challenges in one area as you’re solving problems in another area.

For example, implementing an investment strategy for your retirement makes no sense if it doesn’t incorporate short-term goals like college goals for your children. Performing a Starker exchange to postpone your tax bill doesn’t do any good if you’re sick and tired of being a landlord and have no plans to live in the new property.

Let’s take a look at the financial planning process.

What’s financial planning?

According to the Certified Financial Planner Board of Standards (CFP® Board), there are seven steps in the financial planning process, otherwise known as financial planning standards:

- Understanding the client’s personal & financial circumstances

- Identifying & selecting goals

- Analyzing the client’s current course of action & potential alternative course(s) of action

- Developing the financial planning recommendation(s)

- Presenting the financial planning recommendation(s)

- Implementing the financial planning recommendation(s)

- Monitoring progress & updating

In other words, financial planning is an iterative process. Developing a financial plan is a part of that process.

After plan presentation, there’s implementing the plan, and monitoring that plan. Plan monitoring presumes that new information will be incorporated into adjustments to the financial plan.

These adjustments will be implemented over time. As new information comes up, new adjustments are implemented, etc.

What’s the difference between a plan and planning?

There are two key points that are worth considering:

1. Plans are worthless, but planning is everything.

If you’ve ever been in the military, you’ve might have heard this quote from President Eisenhower.

However, it’s an incomplete quote. The rest of the quote, from President Eisenhower’s public papers, goes:

There is a very great distinction because when you are planning for an emergency you must start with this one thing: the very definition of “emergency” is that it is unexpected, therefore it is not going to happen the way you are planning.

Dwight D. Eisenhower

That quote contains the essence of the financial planning process. When you put together a financial plan, it cannot reasonably contain every single possible scenario that you might face. In fact, when the financial plan is finished, it might not even address the scenarios that exist at that time!

As you implement that financial plan, you will encounter unexpected events. Or shortly after you implement it.

These events might render the original financial plan completely useless. However, having a financial planning process in place can help you update an existing plan with new information as it comes in.

By design, there is no end to the financial planning process, because there’s always something around the corner. The financial planning process helps you address things that come up as life disrupts your plan.

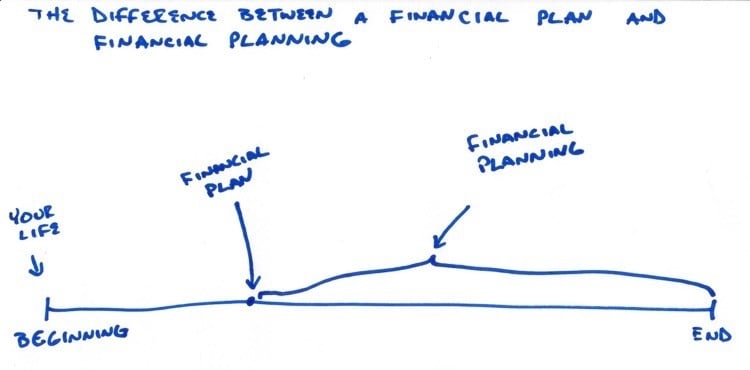

The following picture is a simple illustration that I’ve used in the past to illustrate this concept.

A financial plan covers one point in time. The financial planning process is an iterative one, consistently making adjustments to account for unexpected changes.

In other words, a financial plan is static, while the financial planning process is dynamic.

2. A financial plan might be part of the financial planning process.

When you look at the CFP® Board’s financial planning standards, you’ll note that presenting the financial plan is actually Step 5 of the financial planning process. The first three steps involve developing a relationship, understanding a client’s long-term goals and gathering information. Those steps are actually more important than the delivery of a financial plan itself.

If the expectation is that the planner will present a good financial plan that the client implements on their own, then both parties probably see little incentive to focus on the first two steps.

But let’s look a little closer from each person’s perspective.

For the client

The client might just want an investment plan and asset allocation model. Or they might want a ‘to-do’ list so they can move out and start executing.

The client might not want to get bogged down in telling their story, or might feel it’s not appropriate to mention for the brief time they’re working with the planner.

For the planner

The financial planner probably will have developed a streamlined process to simplify things for the client. This might include an acquaintance meeting and a way to securely upload or drop off a number of documents.

These documents might include:

- A cash flow statement

- Financial statements

- Life insurance policies

- Tax returns, etc.

Then the financial planner will analyze the information. Then the planner presents the plan, as complete as the holes in the information allow it to be, provides recommendations, and they part ways.

Challenges

There are several challenges involved in simply developing a comprehensive financial plan, then parting ways. Here are a few.

Information gathering

Gathering the right information is a big challenge for financial planners. Just getting the requested documents can be hard enough.

The bigger challenge, though, is finding out all of those deep-rooted issues that really impact someone’s finances. These details don’t come out in a two-hour meeting.

Those details only start coming out when a client knows, likes, and trusts their planner. In a transactional relationship, it’s hard to get to this level of understanding. That makes gathering the correct information difficult.

Plan accuracy

Even if it’s a full financial plan, how complete is that financial plan if you can’t be sure you’re operating with all the required information?

Plan implementation

It’s great to have a plan. But the best plans are the ones where the work actually gets done. But it’s not just that.

What happens when there are things that come up as you start to check off things on your to-do list? What happens if something on your to-do list disrupts something that is important, but didn’t get discussed?

A one-time plan can work, but once the plan is presented, it’s the client’s responsibility to know what to do once they part ways with the planner.

Does this mean that a financial plan isn’t for me?

If a financial planner is given the choice between offering a one-time financial plan or an ongoing financial planning relationship, the economic incentive leans towards the ongoing relationship. After all, you can charge more.

But being able to charge more implies that there’s more value to be had. And having an ongoing relationship also falls in line with today’s subscription-model society.

Everything in today’s society is subscription based. Just look at your phone. Or how you consume music, movies, or books.

Long gone are the days where you bought an album and listened to it over and over again because you didn’t have the money to buy another one. Now, you just subscribe to iTunes and listen to whatever you want.

You don’t need a library of movies. You just need Netflix, Amazon, or Hulu, all of which come with unlimited access for a subscription.

Why wouldn’t an ongoing financial planning relationship be the same? It could be. But it could also be like joining a gym when you’re an outdoor runner—why bother if you aren’t getting a benefit?

Here are a couple of scenarios where you might not need an ongoing relationship:

Your financial planning needs aren’t that complex.

20+ years ago, I was an E-4 in the military. I made $200 per paycheck and I lived in the enlisted quarters. I didn’t have a car, a wife, children, debt, or a house.

All I had to do was keep out of trouble and make sure that I lasted until the next payday. Since I had adopted the principle of paying myself first, everything that ended up in my account was spending money.

I probably could have used a financial plan to help me focus my savings efforts. But I surely didn’t need to talk to someone every month or every quarter to keep me on task.

However, as your life becomes more complex, this can change.

You’ve got a handle on your finances, but you want a check-up.

If you call a financial planner, it might be worthwhile to see if they offer reviews. Many planners call them different names, like “financial tune-ups,” or “financial check-ins.”

Essentially, you’ve got your own plan (even if it’s not formalized), and you’d like to share it with someone to see if you’re on track.

This is perfectly fine, and there are plenty of financial planners that will offer this service.

You’ve got a basic understanding of your finances, and would like a checklist of action items.

Unlike before, you don’t have a plan. But you’re doing all the right things (or so you think). You’ve got good financial habits, but you’ve got ‘next-level questions,’ like:

- How do I invest my money once I’ve established an emergency fund and maxed out my retirement savings options?

- I’ve got estate planning documents, but can someone give me a once over?

- I think I’ve got enough life insurance, but can someone double check?

These are questions that financial planners LOVE to analyze. And answer.

You’ve got ONE problem to solve.

Maybe you have a rental property that you’re looking to sell and want one-time tax advice on. You might be able to buy an insurance policy, then move on.

As long as you know the difference between a one-time situation and an ongoing situation, you can probably do this on your own with a one-time assist.

For example, you might pay taxes one time on the sale of your rental property. But your insurance needs might change over time, so you might want to re-evaluate them periodically.

So why do financial planning at all?

That’s a good question. While a lot of people would be just fine with a simple plan, checkup, or a to-do list, there are many people who would benefit from a long term financial planning relationship.

Here are a few situations where financial planning might help:

You have a financial plan, but you just don’t know how to take the first step.

Receiving that huge checklist of ‘to-do’ items can be daunting. The most paralyzing part is trying to figure out which issue to tackle first.

This can be very difficult if you’re unfamiliar with how all the moving pieces of your financial life work together. By helping you develop your plan, then breaking it down into bite-size action items, a financial planner can help you execute that plan.

You know about personal finances, but you don’t have the time, interest, or energy to keep on top of everything.

Keeping on top of topics that might impact you does require some time, energy, and interest. Even if you have a base of knowledge, keeping on top of changes can require time you just don’t have.

Just like you wouldn’t trust a doctor who is up to date on the latest techniques from the 1980s, your financial planning should reflect changes in the law as well as the financial services landscape.

If you’re not willing to do keep up to date, you might want to think about hiring a financial planner to do the legwork for you and provide well-researched, current recommendations.

You aren’t sure of the difference between ‘good’ and ‘optimal.’

Look, personal finances aren’t that hard. For a lot of people, most of the time, personal finance can be as simple as earning more than you spend, not developing bad habits, and protecting yourself from worst-case scenarios.

However, everyone reaches some point where they need to make a decision. Depending on their situation, that decision point can be:

- What type of college savings plan should I enroll my children in?

- At what income level does a traditional IRA become a better option than a Roth one?

- When should I start taking Social Security?

- What can I do to lower my tax liability?

- Where does my money go when I die?

Whatever it may be, the difference between a good decision and the optimal one can be thousands of dollars. And it can be a different optimal between two seemingly identical families.

A good financial planner might earn their fee just by helping you make the optimal decision for your particular situation. In fact, most good financial planners strive to demonstrate their value by doing just that.

And if they can demonstrate that value, you probably should hire them.

You feel like you’re making all the right steps, but you don’t know where it’s going to lead.

This is possibly the most important point, so I’m going to expand upon it in the next section.

What do you mean, “You don’t know where it’s going to lead?”

By nature, I talk with many people who plan to retire from the military. Many of them ask me tactical questions like, “Should I choose SBP or a term insurance policy?” or “tax implications on selling their rental property.”

However, with most of my close friends & colleagues, I get a different picture. While I do get some of these tactical questions, I’m also able to infer a lot more information, because I know them and their families.

Many times, that additional level of insight leads to a more important question:

“What do I do once I no longer have my career to define my life?”

Think about it. When people leave the military, the default question isn’t “What am I going to do with my life,” but “What job am I going to have?”

That assumes that you’re going to have a job when you leave the military. Even if you’ve achieved financial independence, you’re not going to live your best life unless your new job is part of how you envision your best life.

If you have all the money you could ever spend, but don’t know what your best life looks like, you could be that guy. You know who that guy is.

He’s the one who takes off his uniform on Friday, puts on khakis and a polo shirt on Monday, and nothing else has changed.

About 1% of the time, ‘that guy’ LOVES his job. He feels like it’s his life’s goal. Most of the time, ‘that guy’s’ attitude can range from ambivalence (hey, it’s a paycheck so I can do what want on the weekends), to downright misery (IHTFP has a meaning, right?).

All so they can ensure financial security, right?

And that’s where a financial planner really earns their money. First of all, a financial planner or an investment adviser can help you run the numbers.

But that’s table stakes…you can do that yourself on Mint or Personal Capital.

A really engaged financial planner will take the time to sit down with you and discuss what your life will look like once you no longer need to work. And that’s often more difficult than just trying to figure out what your number is.

Many of my peers have told me that their favorite conversations are the ones where they tell their clients:

- Why don’t you retire already?

- You’re not spending enough money (i.e. you’re limiting yourself unnecessarily)?

- You want it? Go for it?

After a lifetime of frugality, living within your means, or delayed gratification, it can be difficult to know when you can start enjoying life. Even if you know that you have enough money, sometimes, you need to have permission to spend it.

Believe it or not, this happens to a LOT of retirees. Their financial planners actually give them ‘permission’ to splurge on that car, or take the grandkids to Disney.

That might seem like years away from where you are now, but how do you know when you’ll get there? And if you got there, what would you do?

Imagine you had a financial planner look at your finances today.

You’re planning to work another 10 years just to make sure you’re in good shape. If the planner told you that, even after his fee, you could live the way you want to, and quit your job today, would you:

- Be willing to quit your job?

- Hire that planner to help you keep your finances in order so you don’t have to go back to work?

‘That guy’ would, in a heartbeat. But then he’s been so busy complaining about his job he’d have to find something else to fill his life.

It’s not a zero-sum game, even though it appears that way. But a good financial planner can help you take control of the emotion-driven aspects of your finances, as well as running the numbers.

And if you do it right, you can ensure that your finances are aligned with the things you want to spend most of your time doing.

Would avoiding an extra 10 years of work be worth having a relationship with a financial planner and paying their fee? Only you can decide that.

Summary

This was supposed to be a short primer on the difference between financial plans and financial planning. Sorry. But I hope it helps to fill that communications gap between people looking for a financial planner and the financial planners looking to serve them.