Form SSA-1099 Instructions

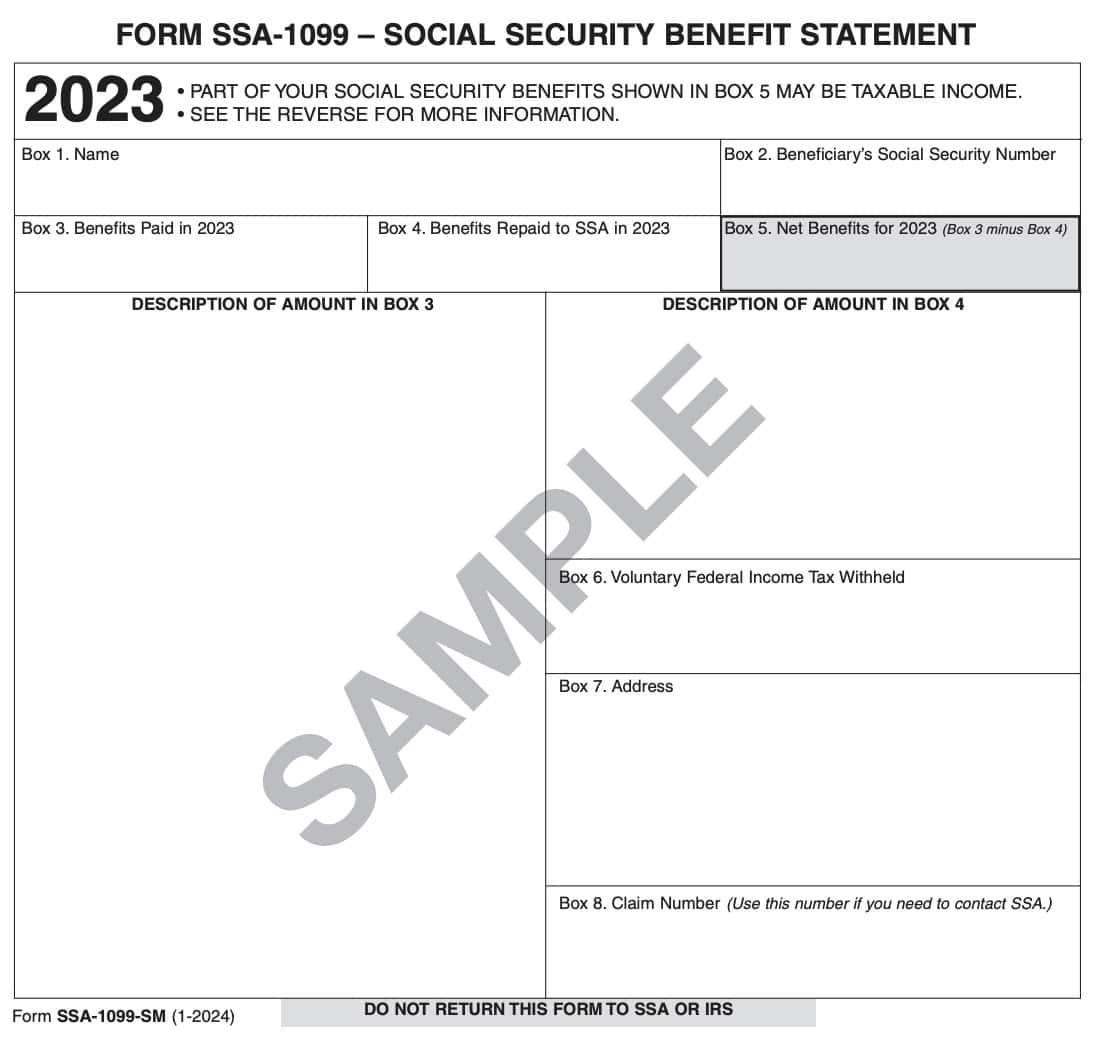

If you received Social Security benefits during the year, you can expect to receive Form SSA-1099, Social Security Benefit Statement, at the beginning of tax season.

In this article, we’ll walk through this tax form, so you can:

- Understand Form SSA-1099 and how to report your Social Security benefits on your tax return

- Learn about adjustments that may have been made to your Social Security benefits

- Determine how much of your Social Security income may be taxable

Let’s start with a breakdown of this tax form.

Table of contents

Form SSA-1099 Instructions

Let’s start with Box 1.

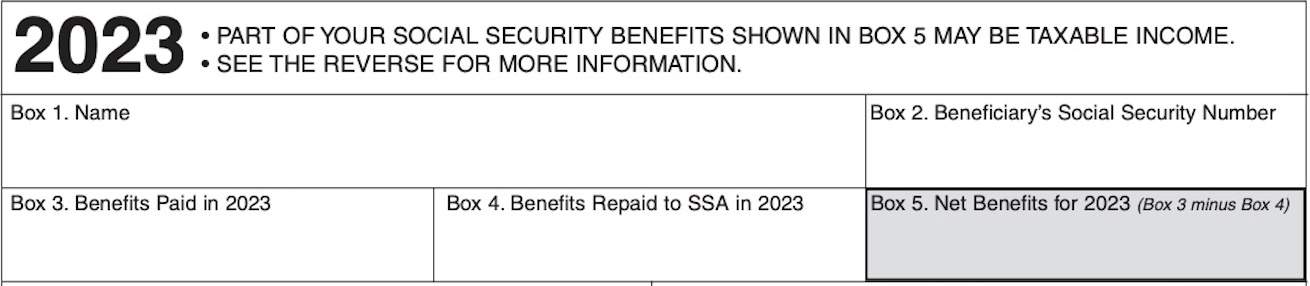

Box 1: Name

The name shown in this box refers to the person for whom the social security benefits shown on the statement were paid.

If you received benefits for yourself, your name will appear here.

Box 2: Beneficiary’s Social Security number

You should see the Social Security number for the recipient named in Box 1.

Box 3: Benefits paid in the tax year

The figure that appears in this box is the total amount of benefits the Social Security Administration paid to the person named in Box 1.

This figure may not agree with the amounts you actually received because the SSA may have made some adjustments to your Social Security benefits before you received them.

What does an asterisk in Box 3 mean?

An asterisk (*) after the figure shown in Box 3 means that it includes benefits received in 2023

for at least one prior year.

Description of amount in Box 3

This part of the form describes the items included in the amount shown in Box 3, above. It lists the benefits paid and any adjustments made, which can be either additions or subtractions.

Only the adjustments that apply to you will appear here. If the SSA made no adjustments to the benefits paid, the word “none” will appear.

Paid by check or direct deposit

This is the amount you actually received or that was deposited directly into your account in a financial institution in the calendar year.

Additions

The SSA may have deducted one or more of the following adjustment items from your benefits in 2023.

If amounts appear on your Form SSA-1099 next to these items, they will be added to the amount shown in “Paid by check or direct deposit.”

When calculating the taxable portion of your benefits, do not use these amounts to reduce the total benefits reported in Box 5. These adjustments have already taken place.

Medicare premiums deducted from your benefits

If you have Medicare premiums deducted from your Social Security benefits, this reflects the amount withheld during the tax year.

For 2023, the basic monthly premium was $164.90 for most people. However, the Medicare premiums could be higher for any (or all) of the following circumstances:

- If you were a new Medicare enrollee

- You enrolled after your first eligibility period

- You had a break in Medicare coverage

- You paid an Income-Related Monthly Adjustment Amount (IRMAA)

- For 2023, IRMAA generally applied to taxpayers whose 2021 modified adjusted gross income was greater than $97,000 ($194,000 for taxpayers whose filing status is married filing jointly)

You may also pay other Medicare adjustments, such as:

- Medicare Part C

- Medicare Advantage Premium

- Medicare Part D

Workers’ compensation offset

If you are disabled and receive workers’ compensation or Part C Black Lung payments, your benefits may be subject to a payment limit. An entry will appear here if the SSA reduced your benefits to stay within this limit.

An entry will also appear here if the SSA reduced your benefits because the person on whose Social Security record you were paid:

- Is disabled, and

- Also received workers’ compensation or Part C Black Lung payments

Disability payments (including Social Security Disability Insurance (SSDI) payments)

These disability benefits are generally not included in income for tax purposes if they are for injuries incurred as a direct result of a terrorist attack directed against the United States or its allies.

If these payments are incorrectly reported as taxable on Form SSA-1099, do not include the nontaxable portion of income on your tax return.

You may receive a notice from the IRS regarding the omitted payments. If you did receive a notice, you should follow the instructions in the notice to explain that your excluded disability payments are not taxable.

IRS Publication 3920, Tax Relief for Victims of Terrorist Attacks, contains additional information.

Paid to another family member

This entry shows total payments withheld from your benefits if you are required to pay child support or alimony.

Deductions for work or other adjustments

Amounts withheld from your benefits because of work or to recover an overpayment of any type of benefit will appear here as benefits paid to you.

They may also be treated as benefits repaid to the SSA and included in the amount in Box 4.

Attorney fees

If you had an attorney handle your social security claim, the figure shown here is the fee withheld from your benefits and paid directly to your attorney. This should match the fee agreement that you signed when filing Form SSA 1693.

Voluntary federal income tax withheld

This shows the total amount of federal income tax withheld from your benefits. Include this amount on your income tax return as tax withheld.

This should match the amount that you agreed to withhold on your most recently filed IRS Form W-4V.

Treasury benefit payment offset, garnishment, and/or tax levy

Part of your Title II Social Security benefit may be withheld on behalf of the Treasury Department

to recover debts you owe to other federal agencies. Examples include:

- Child support

- Alimony or court-ordered victim restitution

- IRS tax debt

Total additions

The figure shown here is the sum of the amounts paid by check or direct deposit plus all of the previously described additions.

Subtractions

The following adjustment items may have been included in the payments you received during the tax year.

If amounts appear on your tax form SSA-1099 next to these items, they will be subtracted from the figure in Total Additions, above.

Payments for months before December 1983.

The figure shown here is the amount of benefits you received in the tax year that was for months before December 1983.

These benefits aren’t taxable no matter when they are paid.

Lump-sum death payment

The lump-sum death payment isn’t subject to tax. An entry here means you received this kind of payment last year.

Amounts refunded to you

The amount shown here may include either of the following:

- Medicare premiums you paid in excess of the amount actually due

- Amounts withheld in the previous tax year to pay your attorney in excess of the actual fee

Nontaxable payments

This entry shows nontaxable payments such as lump-sum death payments.

However, if you receive Supplemental Security Income (SSI), the SSA will not generate an annual benefit statement for you. SSI is not taxable income, and the Internal Revenue Service does not expect you to report it on your federal income tax return.

Amounts paid to you for other family members

This entry shows benefit payments paid to you on behalf of a minor child or disabled adult.

Total subtractions

The figure shown here is the sum of all the subtractions previously.

Box 4: Benefits repaid to SSA in the tax year

Box 4 contains benefits that you repaid to the SSA last year.

Description of amount in Box 4

This part of the form describes the items included in the amount shown in Box 4. It lists:

- The amount of benefit checks you returned to the SSA, and

- Adjustments for other types of repayments

The amounts listed include all amounts repaid last year, regardless of when you actually received the benefits.

Only the repayments that apply to your situation will appear. If you did not make any repayments, the word ‘None’ will appear in this box.

Checks returned to the SSA

If any of your benefit checks were returned to the SSA, the total is shown here.

Deductions for work or other adjustments

The total amount withheld from your benefits because of work or to recover an overpayment of retirement, survivors, or disability benefits will appear here.

This may also appear as Deductions for work or other adjustments under Description of Amount in Box 3, earlier.

Other repayments

This is the amount you directly repaid to the SSA.

Benefits repaid to the SSA

The amount shown here is the sum of all your repayments. This total is the same as that shown in Box 4.

Box 5: Net benefits for the tax year

The figure in this box represents the net benefits paid to you for the year. This amount should equal the difference between Box 3 and Box 4.

If parentheses surround the number in Box 5

If you see parentheses around the figure in Box 5, this means that the Box 4 number is larger than Box 3. In other words, this is a negative number, and you repaid more money than you received during the tax year.

For specific questions about this negative figure, you may need to contact the local Social Security office. To find the nearest local office, you can use the Social Security office locator on the SSA website.

Here are a couple of scenarios, as outlined in IRS Publication 915, and how you may be able to report them.

Joint tax return

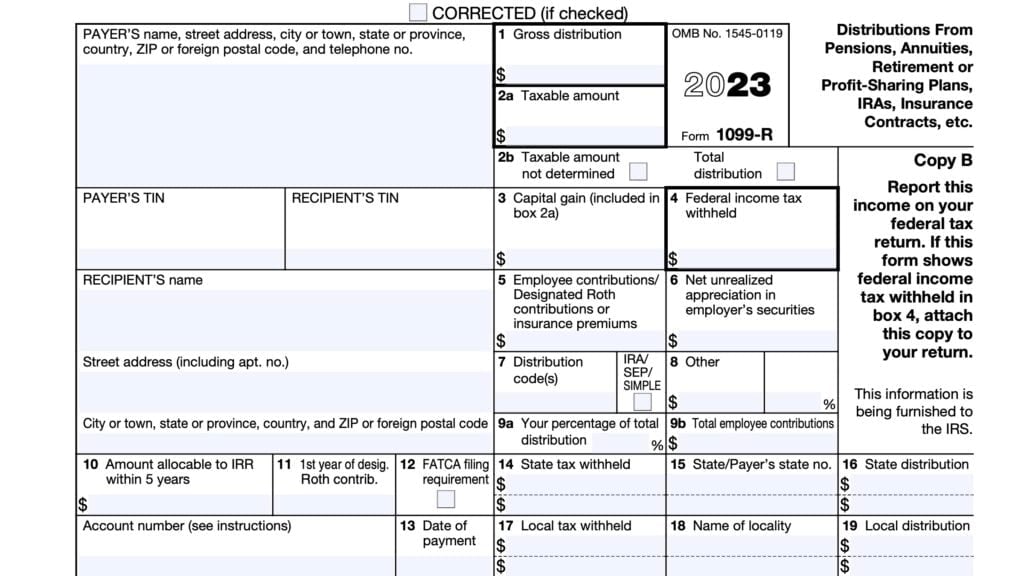

Let’s imagine that you and your spouse file a joint return, and your Form SSA-1099 or Form RRB-1099 (for railroad retirement benefits) has a negative figure in Box 5, but your spouse’s form does not.

In this situation, you can subtract the negative subtract the amount in Box 5 from the copy of your SSA-1099 from the amount of benefits reported on your spouse’s form. You do this to get your net benefits when figuring if your combined benefits are taxable.

Repayment of benefits received in an earlier year

If the total amount shown in Box 5 of all of your Forms SSA-1099 and RRB-1099 is a negative figure, you may be able to deduct part of this negative figure that represents benefits you included in gross income in an earlier year, if the figure is more than $3,000.

If the figure is $3,000 or less, it is a miscellaneous itemized deduction and can no longer be deducted.

Deduction more than $3,000

If this deduction is more than $3,000, you should figure your tax two ways. Then, choose the calculation method that presents the lowest tax liability.

Method #1

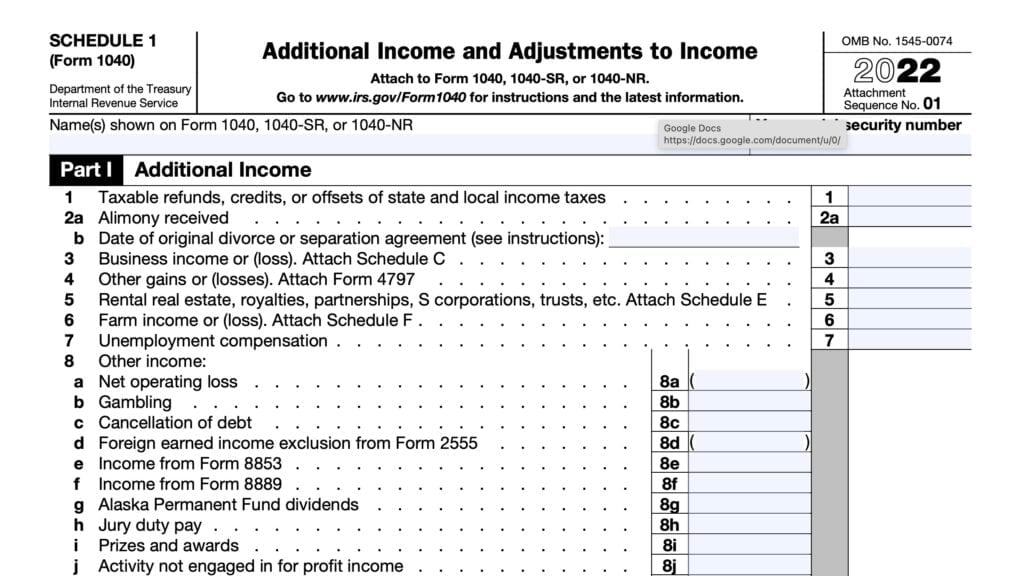

Figure your tax with the itemized deduction included on Schedule A of your Form 1040, on Line 16.

Method #2

Figure your tax by following these steps:

- Calculate your tax bill without the itemized deduction included on Schedule A

- For each year after 1983 in which the negative figure represents a repayment of benefits, recalculate your taxable benefits as if the total benefits for that year were reduced by that portion of the negative figure. Then recalculate the tax.

- Subtract the total recalculated tax amounts (in Item 2) from the actual tax in Item 1.

Compare the two methods. If Method 1 ends up in a lower tax bill, claim the itemized deduction on Schedule A, Line 16.

If Method 2 results in a lower tax, then claim a tax credit for the amount from Method 2 on IRS Schedule 3, Line 13z. Enter “I.R.C. 1341” on the entry line.

If both methods result in the same tax bill, take the itemized deduction on Schedule A.

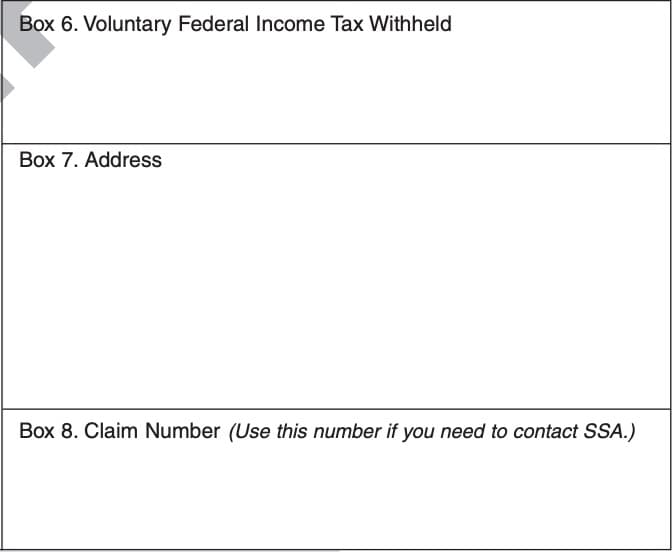

Box 6: Voluntary federal income tax withheld

If you had taxes withheld from your monthly benefit at the federal level, then Box 6 will show the amount of taxes withheld. Report this amount as taxes paid on your Form 1040 or Form 1040-SR.

Box 7: Address

Box 7 shows your last address as it appears in your Social Security account record. If your mailing address has changed since your last tax return, you may need to notify the Internal Revenue Service by filing IRS Form 8822, Change of Address.

Box 8: Claim number

Box 8 contains your claim number. If you need to contact the SSA to discuss issues related to your Social Security benefits, you may need to refer to your claim number.

How to determine the taxability of your Social Security benefits

There are several ways for a Social Security recipient to determine how much Social Security income is taxable. Let’s walk through some of them.

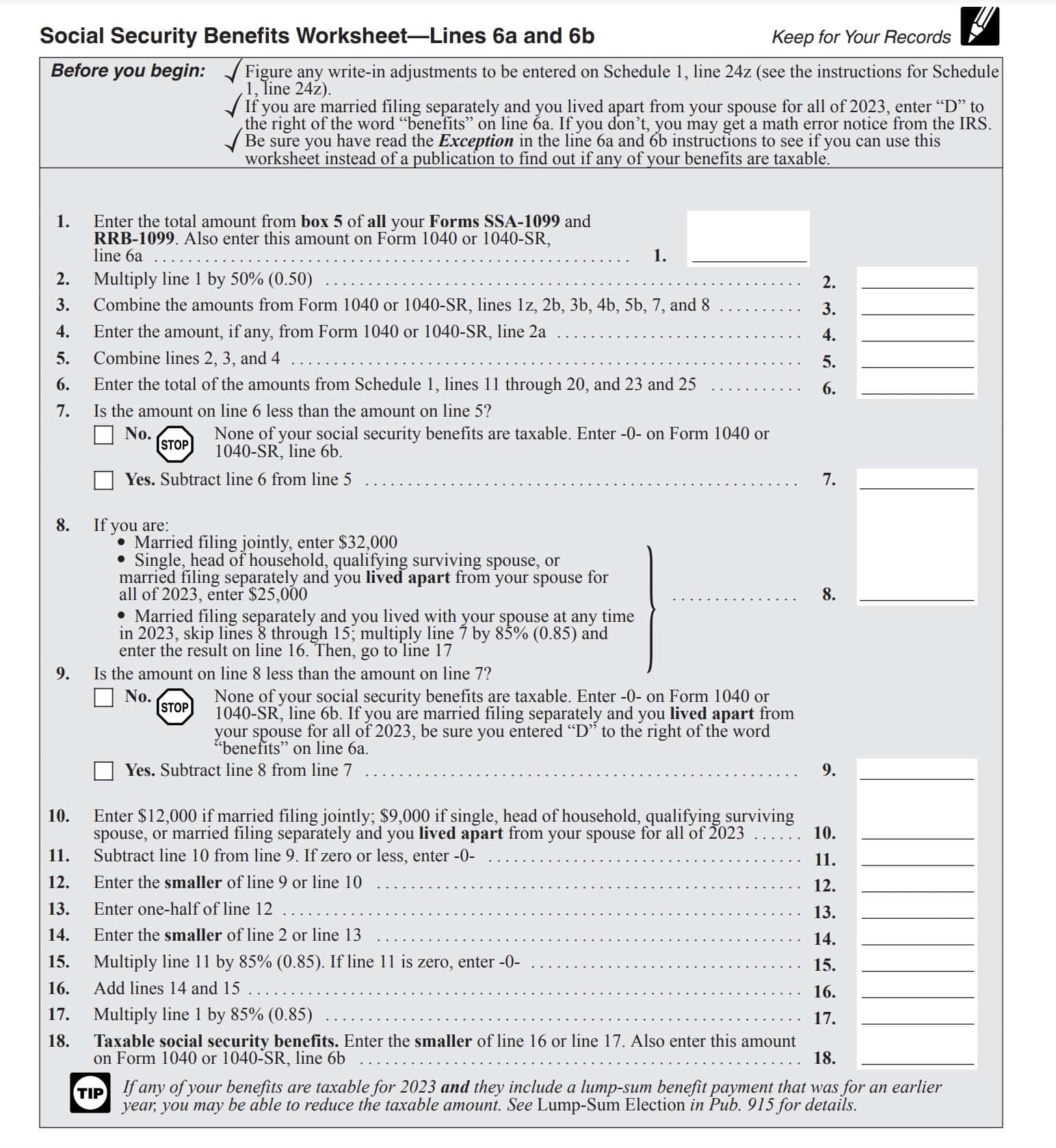

General worksheet from Form 1040 instructions

Most taxpayers can use the worksheet from the IRS Form 1040 instructions to calculate their taxable Social Security benefits.

However, you cannot use this worksheet to calculate the taxable amount of your benefits if:

- You contributed to an IRA and you or your spouse participate in a workplace retirement plan

- Must use the worksheet in IRS Publication 590-A

- You repaid your benefits in the previous year and your total repayments were more than your gross benefits

- None of your benefits are taxable

- You filed any of the following tax forms:

- You are excluding income from Puerto Rico

Watch this video to learn more about how to determine the taxability of your Social Security benefits using the worksheet in the Form 1040 instructions.

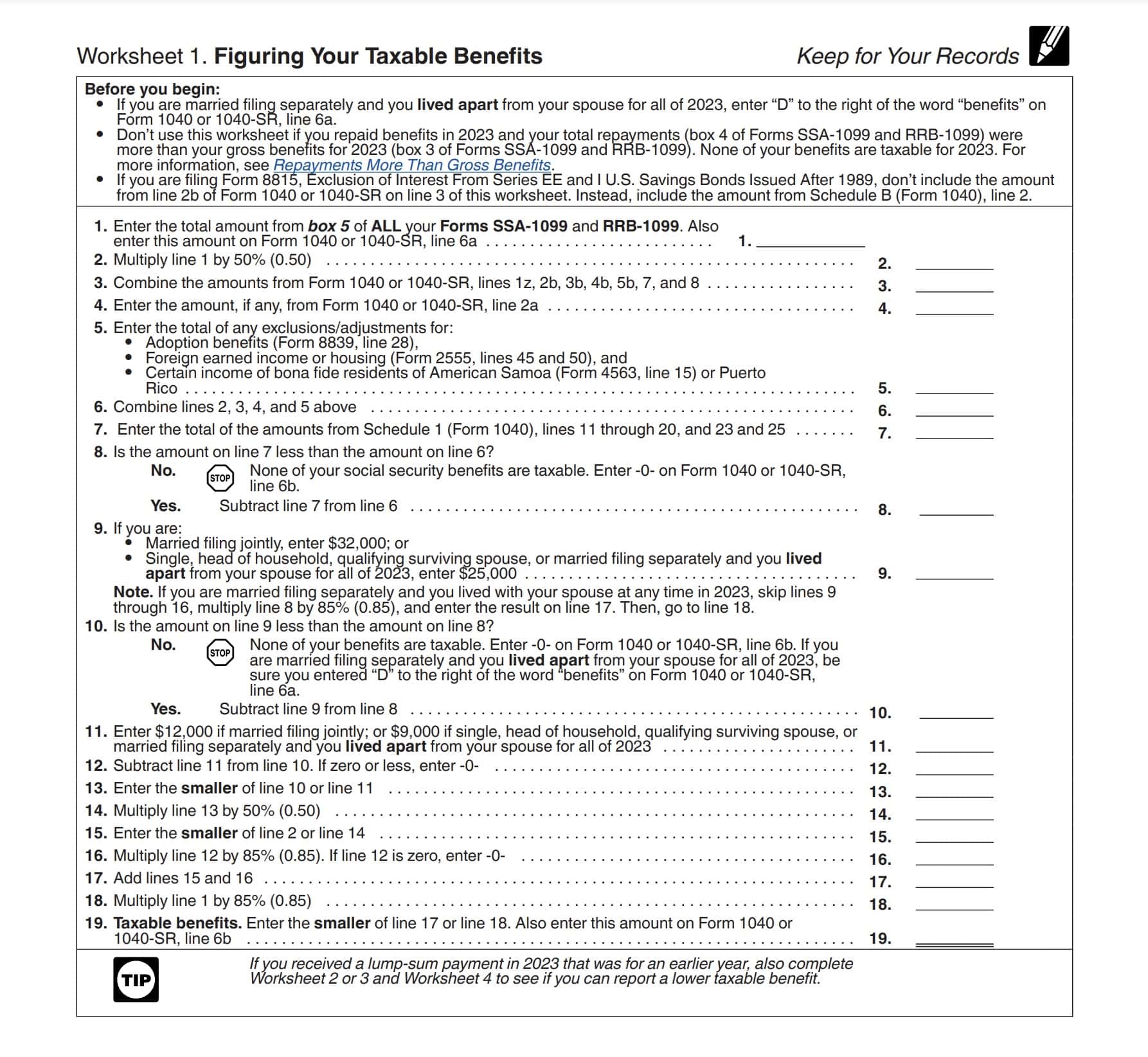

Worksheet 1

Most taxpayers who cannot use the Form 1040 instructions can use the Worksheet 1 from IRS Publication 915 to determine the taxability of their Social Security benefits.

However, you cannot use this worksheet if you are required to use the Publication 590-A worksheet, or if you received a lump-sum payment.

If you received a lump-sum payment, you may need to refer to additional guidance in IRS Publication 915.

Video walkthrough

Watch this instructional video to learn more about reporting your Social Security benefits once you receive your Form SSA-1099.

Do you use TurboTax?

If you don’t, is it because the choices are overwhelming to you?

If so, you should check out our TurboTax review page, where we discuss each TurboTax software product in depth. That way, you can make an informed decision on which TurboTax offering is the best one for you!

Click here to learn more about which TurboTax option is best for you!

Frequently asked questions

Report the Social Security benefits on your income tax return as applicable, and keep your form in your records. The form explicitly states not to send it to the IRS or the SSA.

You may obtain a replacement Form SSA-1099 from your SSA online account, by visiting a local SSA office, or by calling the Social Security toll-free number at: 1-800-772-1213.

Where can I find Form SSA-1099?

The IRS and the SSA do not make blank versions of this form readily available. If you want to see a blank version of this form, there is one in the back of IRS Publication 915.

We’ve included this form below, for your convenience.