Form SSA 1696: Appointing a Representative

If you’ve asked someone to help you claim Social Security benefits, you might be asked to complete a number of SSA forms. One of them is likely to be SSA 1696, Claimant’s Appointment of a Representative.

This article will walk you through everything you need to know as you complete Form SSA 1696. Let’s start with step by step instructions.

Contents

Table of contents

- How do I complete Form SSA 1696?

- Section 1: Claimant’s Information and Number Holder’s Information

- Section 2: Authorization for Disclosure

- Section 3: Principal Representative

- Section 4: Representative’s Information

- Section 5: Representative’s Status, Affiliations, and Certifications

- Section 6: Claim Type

- Section 7: Fee Arrangement

- Section 8: Signatures

- Privacy Act Statement – Collection and Use of Personal Information

- When should I use Form SSA 1696?

- Video walkthrough

- Frequently asked questions

- Where can I find Form SSA-1696?

- Related articles

- What do you think?

How do I complete Form SSA 1696?

We’ll walk through each step of filing Form SSA-1696. Most of the time, your appointed representative services office will help you with this. There are 8 sections.

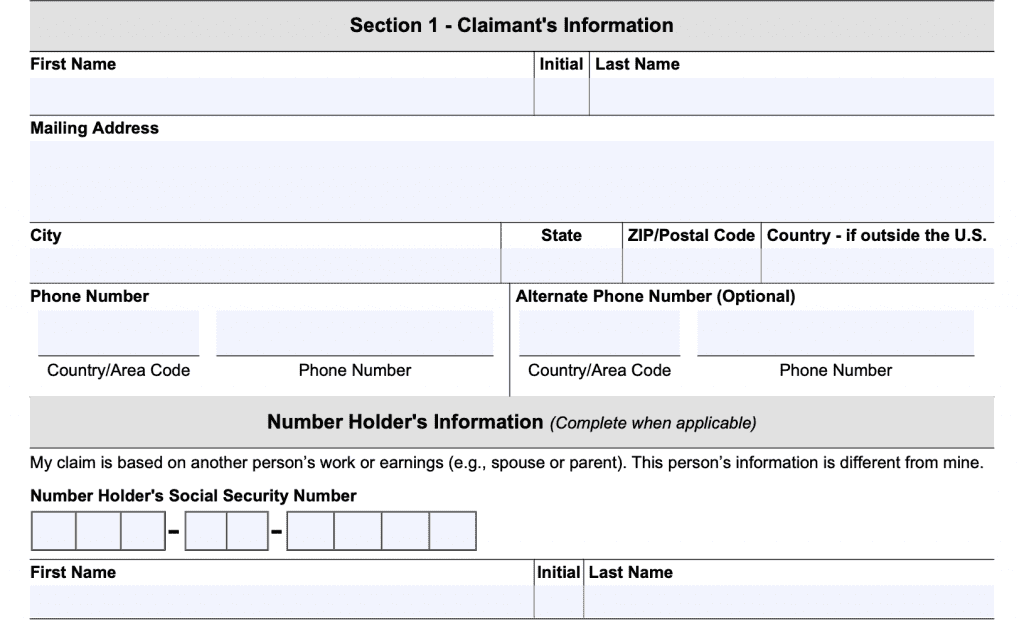

Section 1: Claimant’s Information and Number Holder’s Information

The first part of SSA 1696 contains the claimant’s personal information. Basically, this consists of the claimant’s:

- Full name (first name, middle initial, and last name)

- Mailing address

- Phone number

If you’re filing for benefits based upon another person’s work history or Social Security earnings, you’ll want to include that person’s Social Security number and full name at the bottom of Section 1.

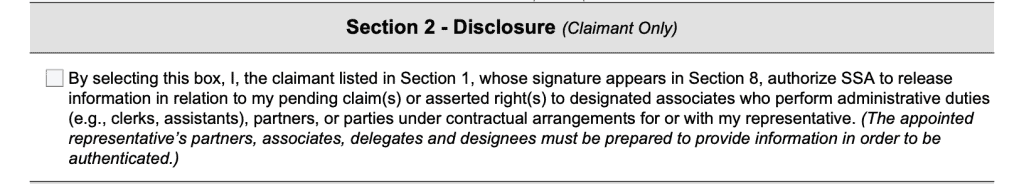

Section 2: Authorization for Disclosure

The second section of the form contains the authorization for disclosure. This states that the claimant authorizes the SSA to release information to designated associates of the authorized representative named on this form.

For example, if you appointed a law firm as your representative, this disclosure would allow employees of that law firm, like clerks or legal assistants, to interact with the SSA, even if their name isn’t on the form itself.

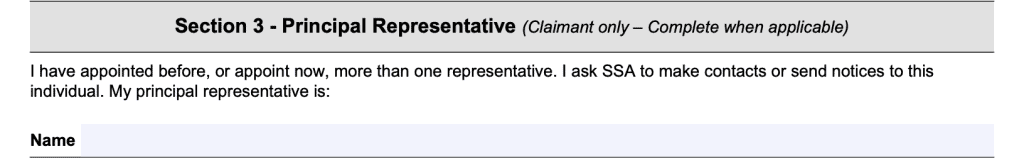

Section 3: Principal Representative

The third section of the form contains the name of your representative. According to the instructions, if you have multiple parties, then you would put down the name of the principal representative, or the primary point of contact in this section.

This is the person that the SSA will recognize as being authorized to work with them on your behalf.

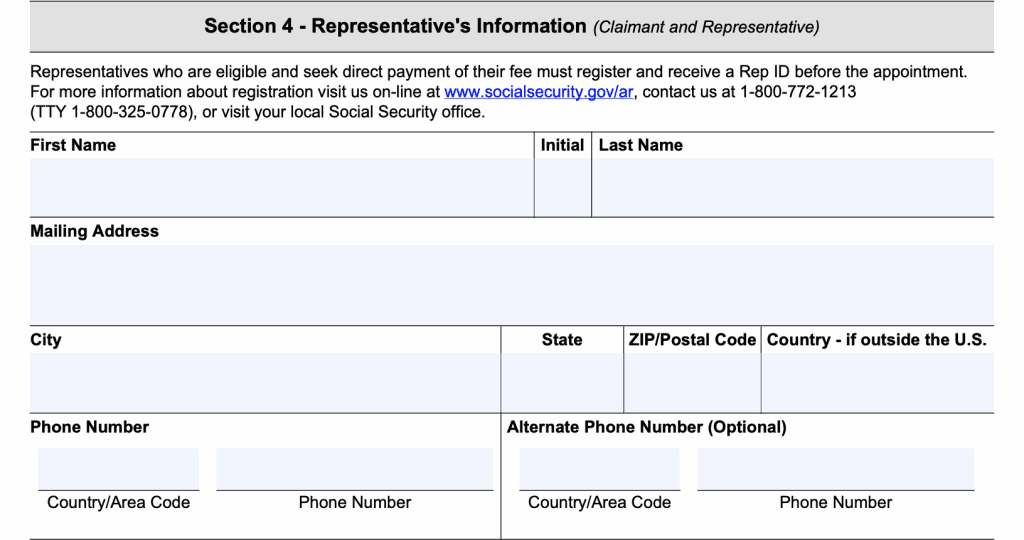

Section 4: Representative’s Information

This section contains the representative’s contact information. This includes the representative’s:

- Complete name (first name, middle initial, last name)

- Mailing address

- Phone number

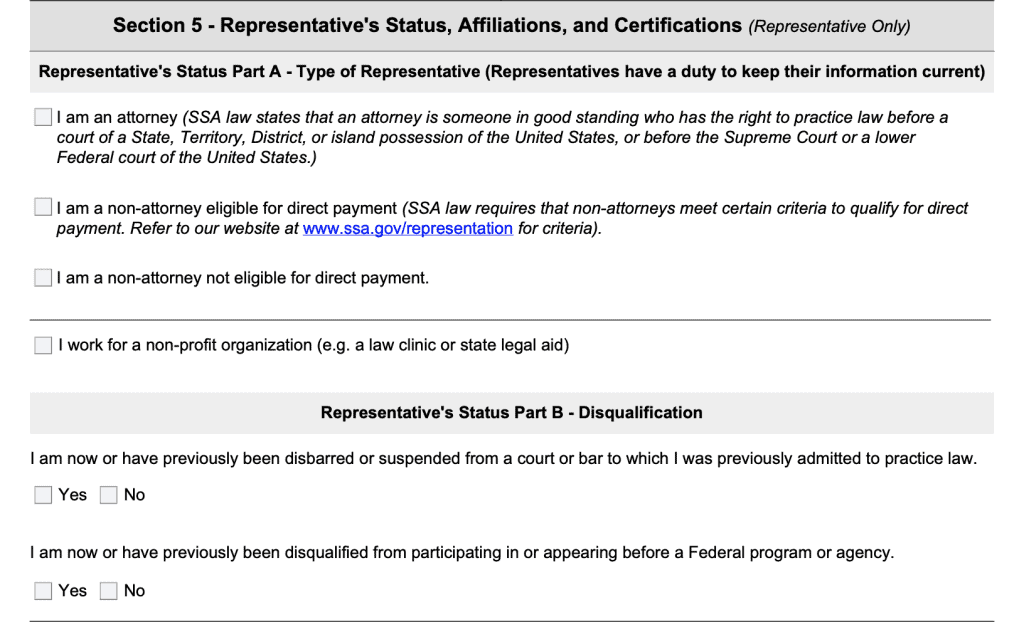

Section 5: Representative’s Status, Affiliations, and Certifications

This is representatives section of the form, which your representative is responsible for completing. But you should be familiar with each of the separate parts in this section.

Representative’s Status

This is broken up into 2 separate parts, Part A and Part B.

Part A states what kind of representation this third party is declaring. Your representative could be:

An attorney

Social Security law states that an attorney is considered to be someone in good standing and who has the right to practice law before any state or federal court, who is not disqualified or suspended, and who not otherwise prohibited from acting as a representative

A non-attorney eligible for direct payment

Non-attorneys must meet certain criteria to qualify for direct fee payment. These criteria include:

- Possessing a bachelor’s degree

- Passing a written examination administered by the Social Security Administration

- Fulfilling a professional liability insurance requirement

- Completing a criminal background check

- Completing & maintaining continuing education courses

Otherwise, a non-attorney would be ineligible for direct payment by the SSA.

Part B forces the third party to disclose whether:

- They’ve been disbarred

- They’ve been suspended from practicing law or

- They’ve been disqualified from participating in a federal program or appearing before a federal agency.

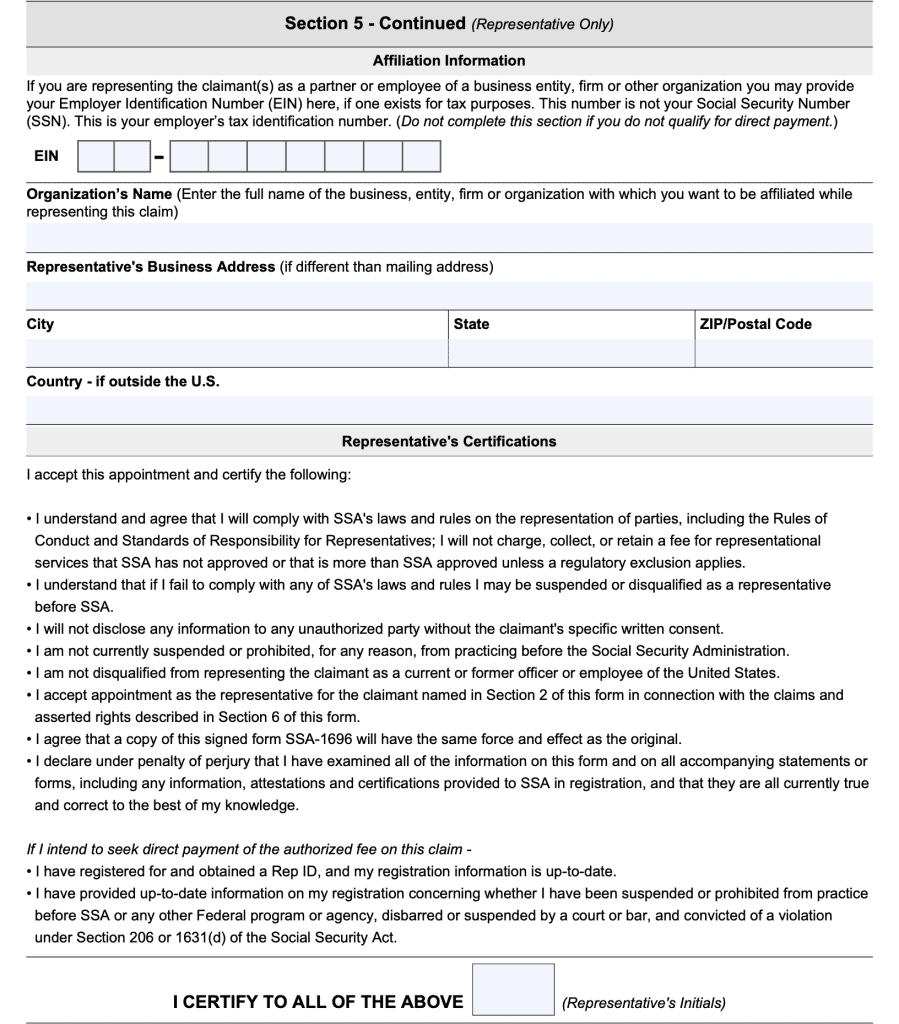

Affiliation Information

The affiliation information section is for an organization, such as a business entity, firm, or partnership, that may be affiliated with the appointed representative. The affiliation information section includes:

- Employer Identification Number (EIN)

- Organization’s name

- Business address

Representative’s certifications

This section is the representative’s declaration of a number of things. This includes:

- That the representative will not negotiate a fee agreement that is not acceptable to the SSA

- The representative will not disclose sensitive information without the claimant’s written permission.

- The representative is not disqualified from representing the claimant

- Any copies of the Form SSA-1696 will have the same force as the original

- All information is accurate to the best of the representative’s knowledge, under penalty of perjury.

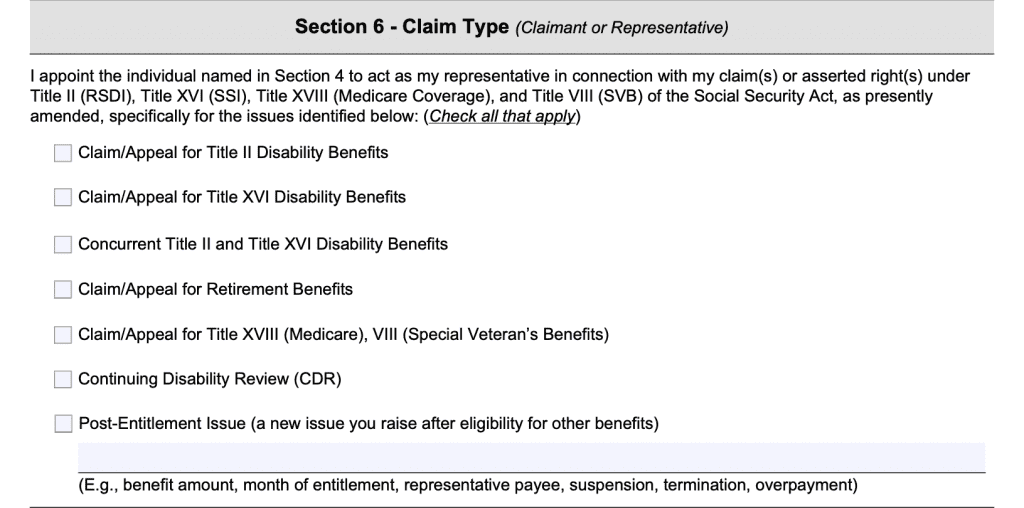

Section 6: Claim Type

Section 6 states the type of benefits that the claimant is applying for. The claimant or representative will check the appropriate box or boxes.

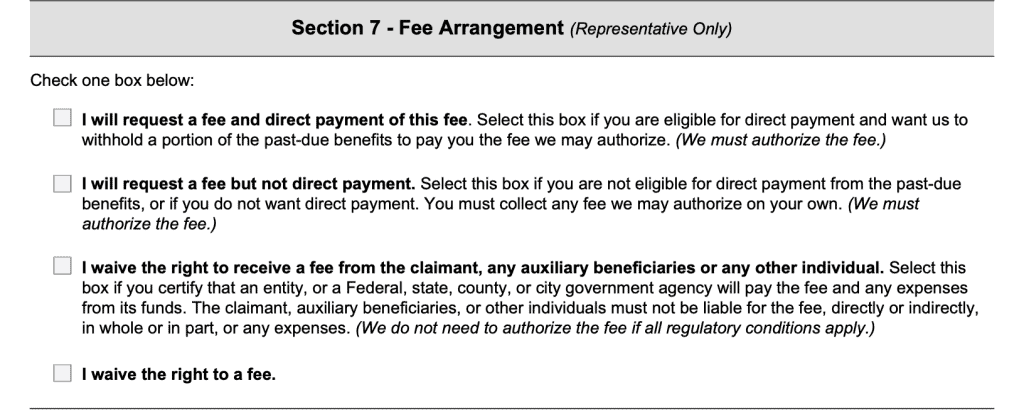

Section 7: Fee Arrangement

Section 7 lists acceptable fee arrangements that the representative may pursue. Here are possible options your representative may request.

Request a fee and direct payment of this fee.

According to the Social Security Administration, a representative may generally not accept a fee greater than either:

- $6,000

- 25% of the unpaid benefits due to the claimant, whichever is smaller

Direct payment means that the representative will be paid directly by the SSA from the claimant’s benefits.

For certain situations, the representative may request an increase in fee. However the representative must file a separate fee petition in writing. In all cases, SSA reserves the right to approve or disapprove any proposed fee, if the fee is not in line with written guidelines.

Request a fee but not direct payment.

A representative may request a fee, but is either ineligible for direct payment, or does not want direct payment. The representative is responsible for collecting authorized fees. However, the SSA must allow the fee.

Waive the right to receive a fee from the claimant, auxiliary beneficiaries, or another individual.

The representative may waive the right to collect a fee from the claimant or any associated individuals. This might happen if another entity, such as a non-profit organization or government agency is paying the costs.

Waive the right to a fee.

This box would be selected if the representative is not requesting a fee.

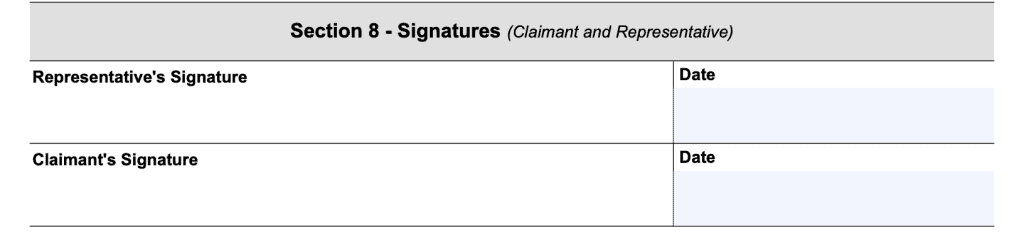

Section 8: Signatures

Both claimant and representative sign and date Section 8 of this form. Your representative’s office may ask that you provide an electronic signature instead of in writing.

Privacy Act Statement – Collection and Use of Personal Information

There is no required action in this section. But it’s good information to know, as there are certain federal laws that dictate what may (and what may not happen).

The Social Security Act authorizes the SSA to collect personal information, but the claimant doesn’t have to provide it. The SSA may share this information with other agencies, or in response to a congressional inquiry.

The Paperwork Reduction Act states that it should take about 30 minutes to complete this form.

When should I use Form SSA 1696?

If you are filing for Social Security retirement benefits on your own behalf, you probably won’t need to use this form. However, if you’ve asked someone to help you, or if you’ve hired a third party to help you, then they will probably ask you to complete this form. Here are some of the situations in which you might need to complete SSA 1696:

- You’re filing for Social Security Disability benefits (SSDI) and you’ve asked someone to help you with the SSDI application process

- You’ve hired non-attorney representatives to help navigate the intricacies of the SSA as you apply for supplemental security income, or SSI payments

- You’ve hired a law firm to give you legal advice to file an appeal of a Social Security decision regarding your benefits

In any of these cases, having this form on file will enable the SSA to work directly with your appointed representative.

Video walkthrough

Watch this instructional video for step by step guidance on completing Form SSA-1696.

Frequently asked questions

Form SSA-1696, Appointment of Representative, form informs the Social Security Administration that as the claimant, you’ve appointed someone to help you with your claim to Social Security benefits. Having Form 1696 on file enables the Social Security Administration to share information with your appointed representative on your behalf.

If you are filing by yourself, you do not need Form SSA-1696. You only need SSA-1696 if someone is helping you complete the form and you want the Social Security Administration to work directly with that person on your behalf.

Yes. You may file Form SSA-1696 electronically through the SSA website.

Your representative should have clear guidance on what happens to this form once you’ve signed it. They will send the signed document to SSA for processing and approval, but should give you copies of the form as well.

Where can I find Form SSA-1696?

You can get copies of this form at your local Social Security Office, on the SSA website, or by clicking on the file below.