Form SSA-4-BK Instructions

If you are looking to apply for Social Security benefits on behalf of one or more qualifying children, you may need to complete Form SSA-4-BK.

In this article, we’ll walk you through everything you need to know about this Social Security form, including:

- How to complete and file Form SSA-4-BK

- Required documentation and questions to expect

- Eligibility requirements and frequently asked questions

Let’s begin with a step by step overview of this form.

Contents

Table of contents

How do I complete Form SSA-4-BK?

We will go over the following steps:

- How to complete the application for your child’s insurance benefits

- Information the Social Security Administration will ask you for

- Required documentation to support your application

Let’s start with completing your Social Security application.

Completing the application

This Social Security form can seem a little daunting. Let’s take it one step at a time, beginning at the top of Page 1.

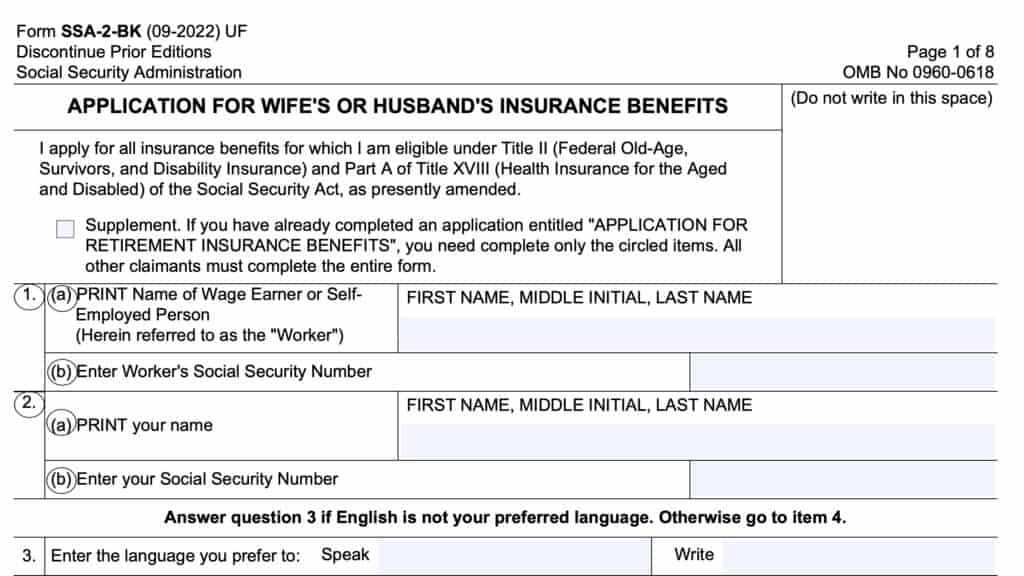

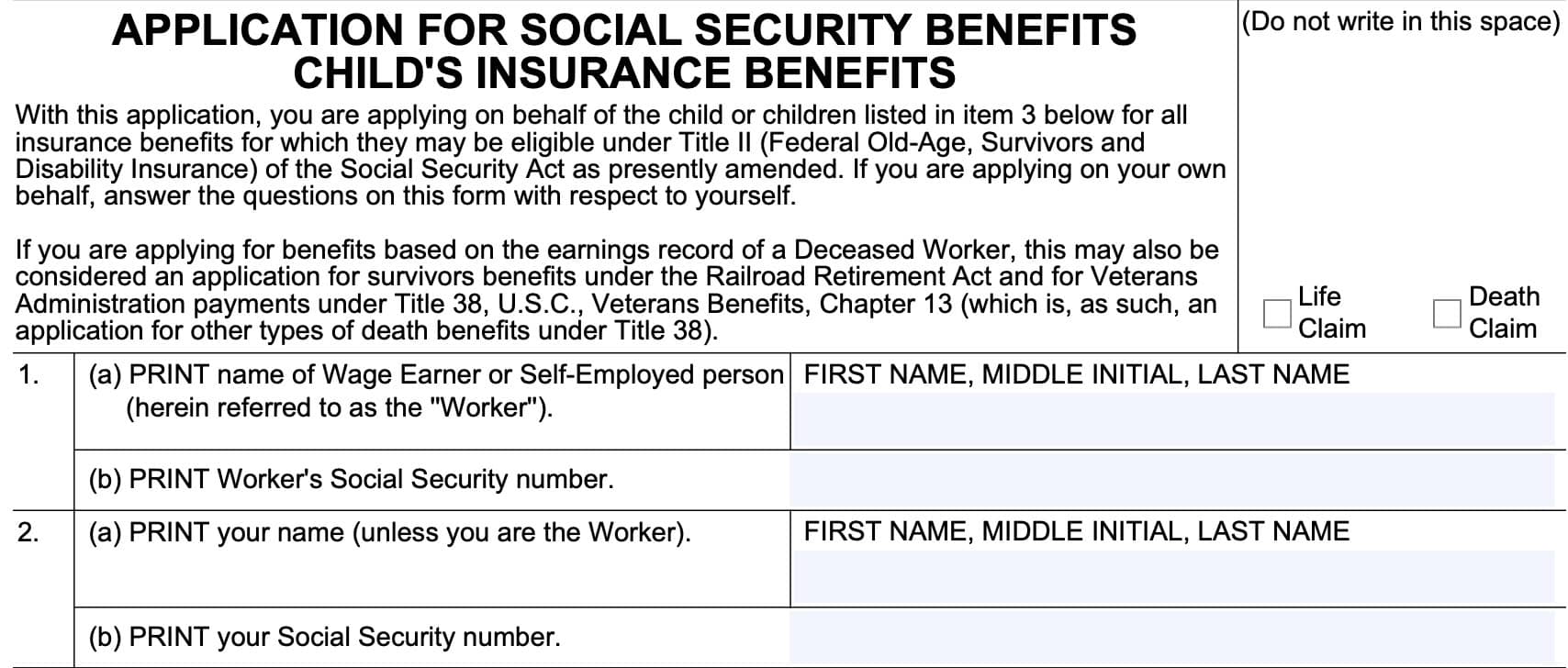

Line 1: Worker’s information

In Line 1, enter information about the wage earner or the self-employed person (also known as the ‘Worker’) whose earnings record you’re applying for child benefits for. This includes the following:

- Line 1a: Worker’s name (first name, middle initial, and last name)

- Line 1b: Worker’s Social Security number (SSN)

Line 2: Applicant’s information

Enter your information, as the applicant, in Line 2, unless you are also the worker whose information appears in Line 1. Include the following information:

- Line 2a: Your name (first name, middle initial, and last name)

- Line 2b: Your Social Security number (SSN)

Line 3: Children’s information

Enter information about qualifying children in Line 3. For each qualifying child, enter the following:

- Full name of the child

- Child’s date of birth (in MM/DD/YYYY format)

- Child’s Social Security number

- Child’s relationship to worker (check the applicable box)

- Natural child

- Adopted child

- Step child

- Dependent grandchild

- Other

For children aged 17 1/2 or older, check the applicable box if the child is a student or has a permanent disability.

Qualifying children

Under the Social Security Act, a child may qualify for child benefits based on a worker’s history based on any of the following family member relationships:

- Natural child

- Adopted child

- Stepchild

- Dependent grandchild

Ages of qualifying children

To be eligible for Social Security benefits based upon a worker’s history, a qualifying child must be one of the following:

- Under 18 years of age

- Age 18 or 19, while attending high school (or lower)

- Age 18 or older, with a disability beginning before the age of 22

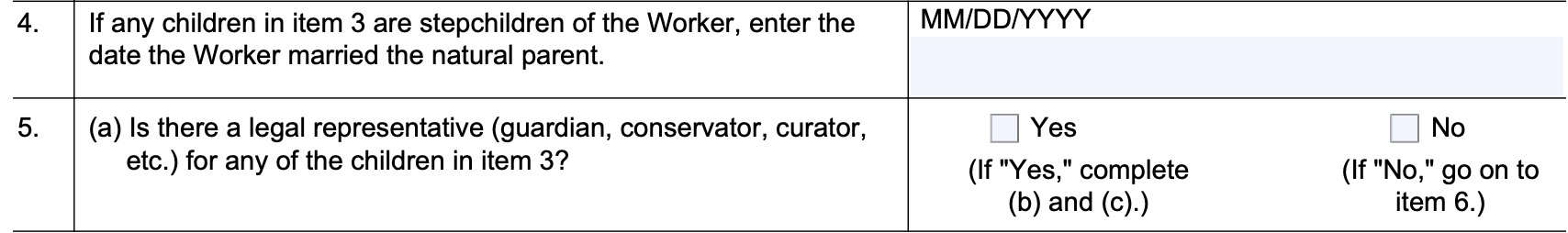

Line 4: Date of marriage

If any children listed in Line 3 are the worker’s stepchildren, enter the date of marriage.

According to the SSA, a qualifying child must have been the worker’s stepchild for a certain minimum of time prior to the application filing:

- If the worker is living: 1 year

- If the worker is deceased: 9 months

- Unless the worker and other parent were previously married & divorced, and

- The 9 month requirement was met at the time of divorce

Line 5

There are several parts to Line 5.

Line 5a: Is there a legal representative for any of the children?

For the children listed in Line 3, answer Yes or No to indicate if any of the children listed in Line 3 have a legal representative. This could be one of the following:

- Legal guardian

- Conservator

- Curator

If Yes, then go to Line 5b, below. Otherwise, go to Line 6.

Line 5b: Legal representative’s name and contact information

In this section, write the following information about the legal guardian:

- Guardian’s name

- Telephone number

- Address

Line 5c

Briefly explain the circumstances that led to the court appointing a legal representative for the listed child. Additional space is available in the Remarks section towards the end of the form, if required.

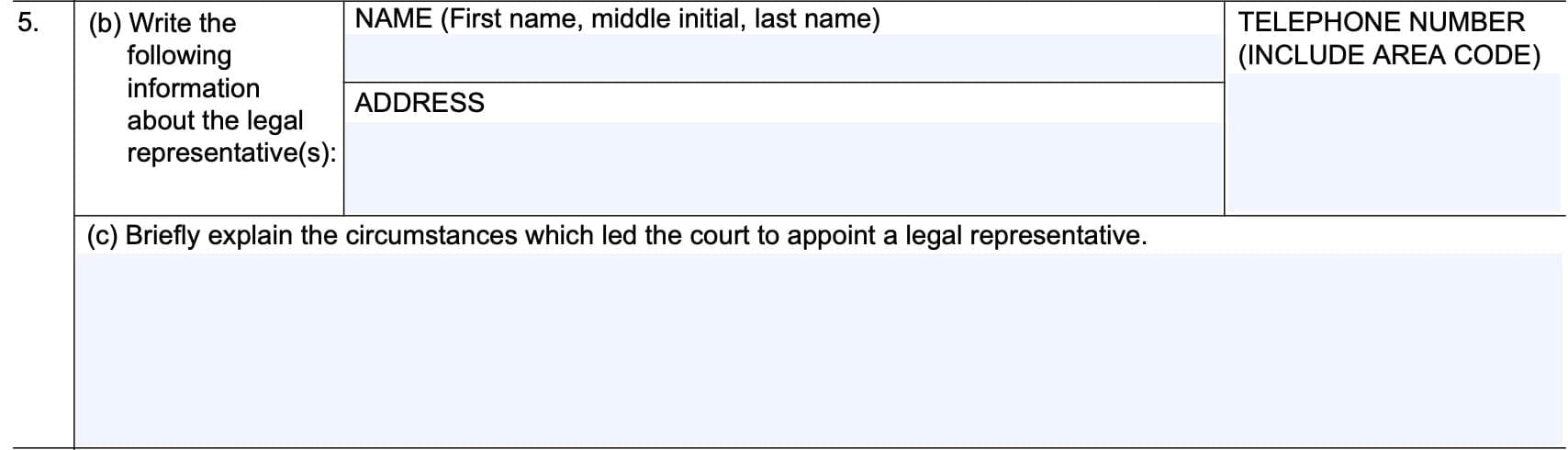

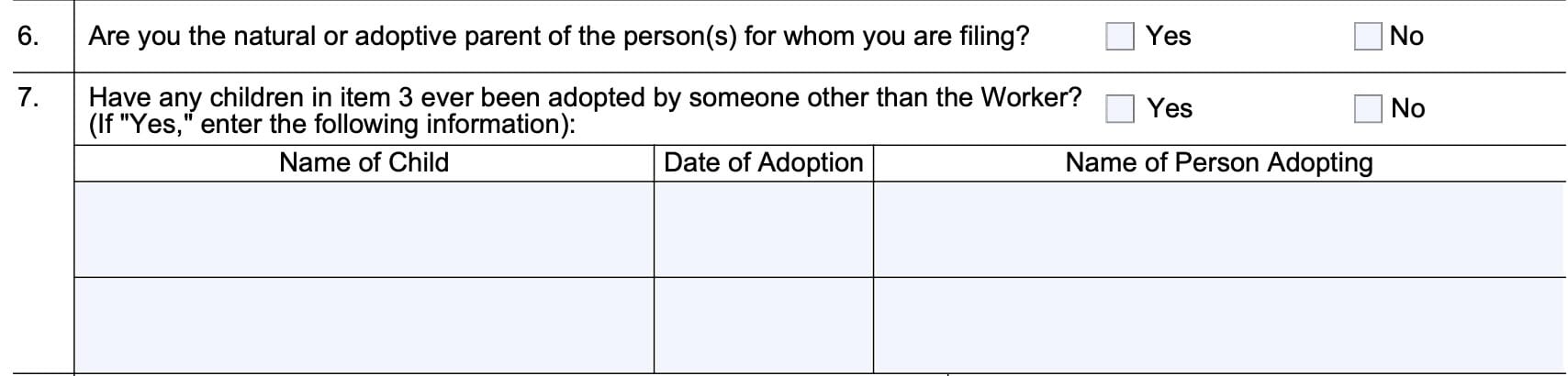

Line 6: Are you the parent of the person or persons for whom you’re filing?

Answer Yes or No.

Line 7: Have any children been adopted by someone other than the worker?

Answer Yes or No. If Yes, then enter the following information:

- Child’s name

- Date of adoption

- Name of adoptive parent

Line 8: Are all the listed children now living in the same household with you?

Answer Yes or No. If No, then enter the following information in the space provided:

- Child’s name

- Person with whom the child lives

- Person’s name

- Address

- Relationship to the child

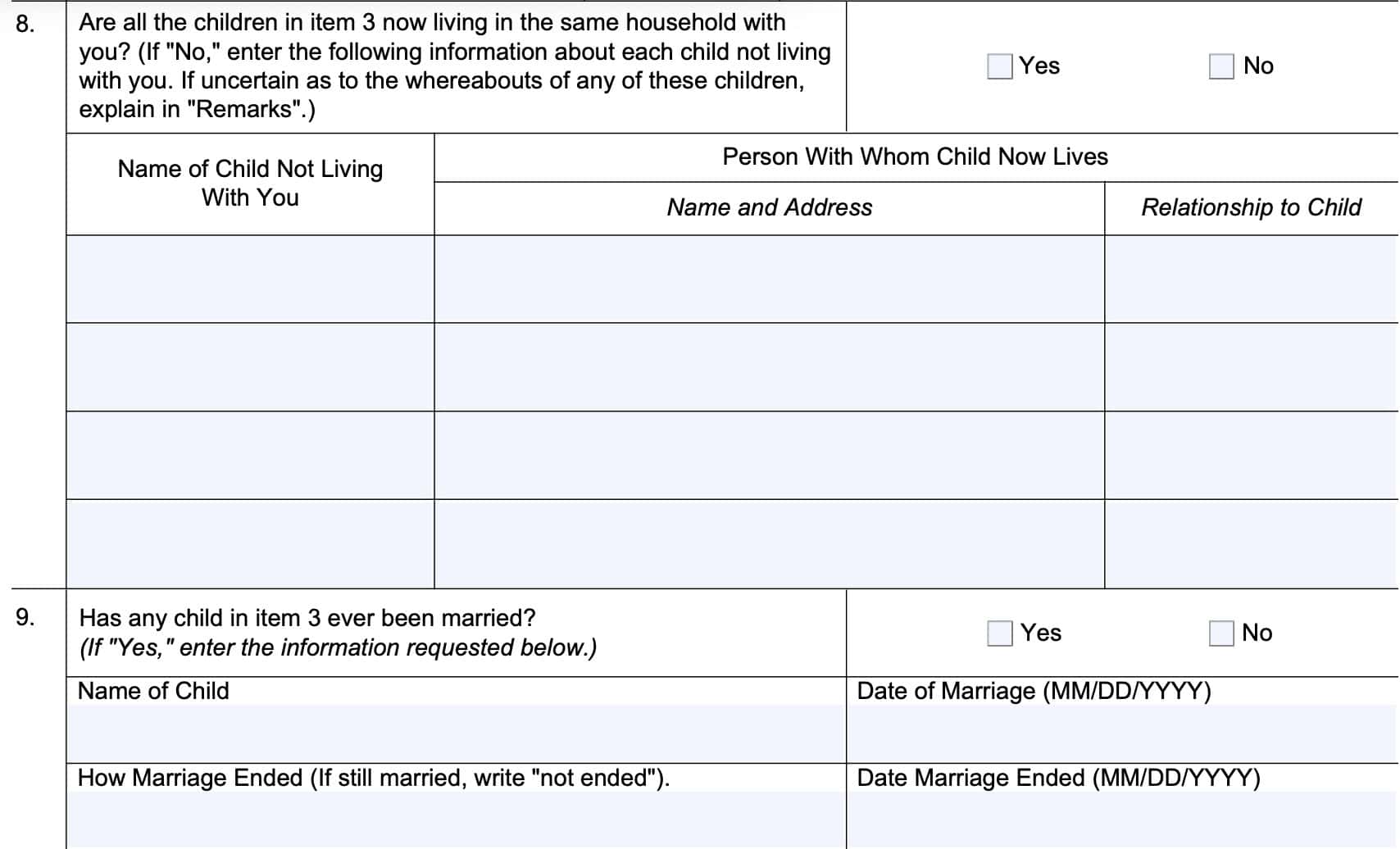

Line 9: Has any child been married?

Answer Yes or No. If Yes, then enter the following information:

- Child’s name

- Date of marriage

- How marriage ended

- If still married, write ‘not ended‘

- Date that the marriage ended

Line 10: Last year’s earnings information

Do not complete Line 10 if the Worker died during this year.

Line 10a: did any child earn more than the exempt amount last year?

Answer Yes or No. If Yes, answer Line 10b. Otherwise, go to Line 11, below.

Earnings exempt amounts

According to the SSA website, the exempt earnings amount for people who have not reached full retirement age (FRA) is $22,320 for 2024.

Line 10b

If you answered Yes to Line 10a, then enter the following:

- Name of child who earned over the exempt amount

- Total earnings

- Each month that the child did not:

- Earn more than $1,860 in wages, and

- Perform substantial services in self-employment

Substantial services in self-employment

According to the SSA, substantial services in self-employment means that:

- You devote more than 45 hours to the business during the month, or

- Between 15 and 45 hours to a business in a highly skilled occupation

Line 11: Current year’s earnings information

Complete Lines 11a and 11b based on your best estimate of current year earnings.

Line 11a: Do you expect the total earnings of any child to exceed the exempt amount this year?

Answer Yes or No. If Yes, answer Line 11b. Otherwise, go to Line 12, below.

Line 11b

If you answered Yes to Line 11a, then enter the following:

- Name of child who expects to earn over the exempt amount

- Total expected earnings

- Each month that the child did not or will not:

- Earn more than $1,860 in wages, and

- Perform substantial services in self-employment

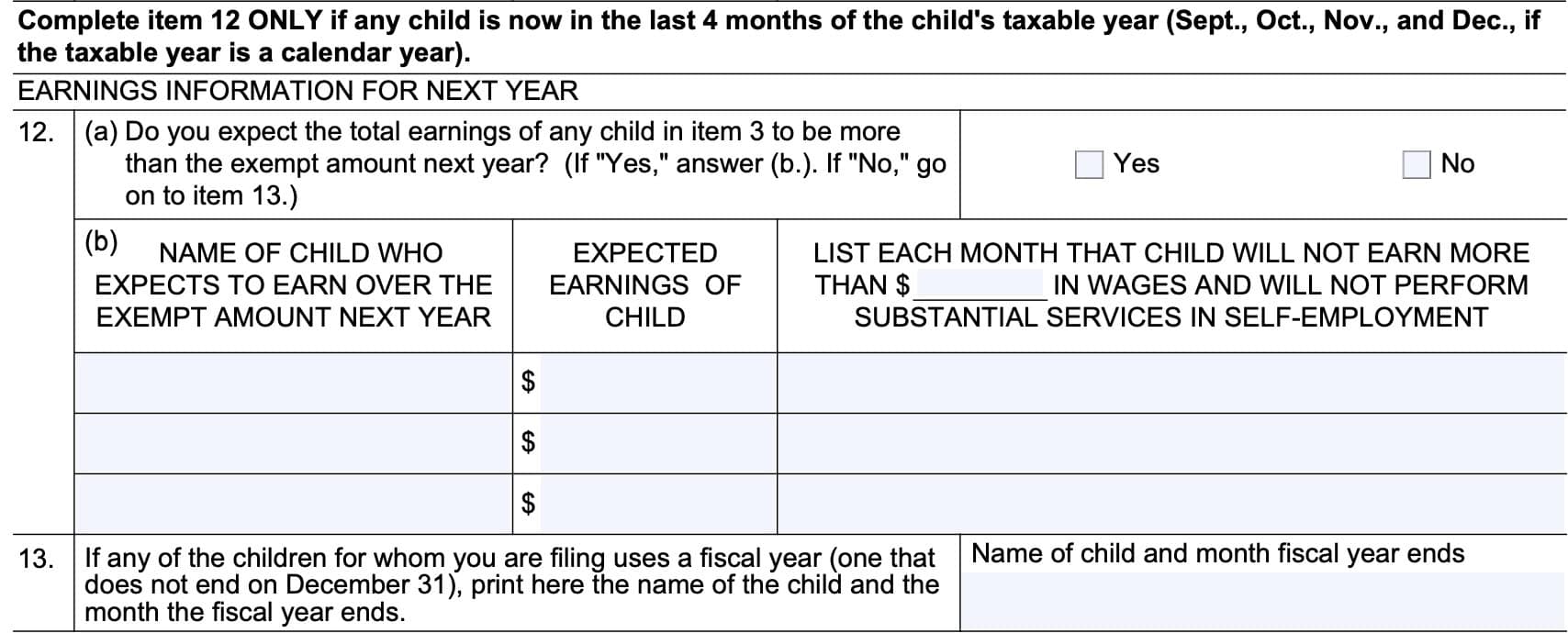

Line 12: Next year’s earnings information

Only complete Line 12 if any child is in the last 4 months of the child’s taxable year.

Unless the child files taxes on a fiscal year basis, you can assume that the last four months of a child’s taxable year are:

- September

- October

- November

- December

If you are not in the last 4 months of the taxable year, go to Line 13.

Line 12a: Do you expect the earnings of any child to be more than the exempt amount next year?

Answer Yes or No. If Yes, answer Line 12b. Otherwise, go to Line 13, below.

Line 12b

- Name of child who expects to earn over the exempt amount

- Total expected earnings

- Each month that the child did not or will not:

- Earn more than next year’s exempt amount in wages, and

- Perform substantial services in self-employment

Towards the end of the year, the SSA website should contain information about the exempt amounts for the coming year. If not, leave the space blank.

Line 13: Does any child use a fiscal year?

Answer Yes or No. If Yes, enter the name of the child and the month that marks the end of the child’s fiscal year.

Fiscal year explained

According to the Internal Revenue Service, a fiscal year is:

- Any 12 month continuous period that

- Ends on the last day of any month except December

For example, the federal government operates on a fiscal year that goes from October 1 to September 30.

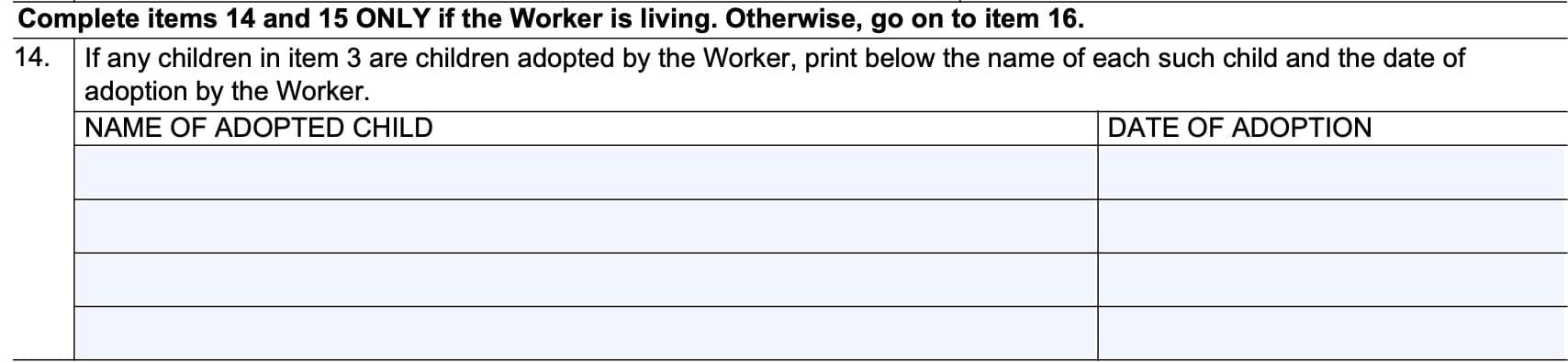

Line 14

Complete Lines 14 and 15 only if the worker is living. If the worker is deceased, proceed to Line 16, below.

If any children are children that the worker adopted then enter the following information for each child:

- Adopted child’s name

- Date of adoption

Proceed to Line 15.

Line 15: Have all children lived with the worker during each of the last 13 months?

Answer Yes or No. If No, then enter the following information for each child

- Child’s name

- Each month that the child did not live with the worker

- Name and address of the person with whom the child lived

- Relationship

Line 16: do you want to file for Supplemental Security Income?

If any children meet any of the following criteria, they may be eligible for Supplemental Security income (SSI) benefits:

- Within 2 months of turning age 65 or older

- Blind

- Disabled

Check Yes or No.

Supplemental Security Income explained

SSI recipients are often eligible for other federal and state benefits, due to their financial situation.

For example, many people who meet the SSI eligibility requirements also meet the Medicaid eligibility requirements if they are not able to obtain health care coverage or health insurance.

Below is a list of other government programs, listed on the SSA website, that may be available to SSI beneficiaries:

- Supplemental Nutrition Assistance Program (SNAP)

- SNAP benefits help families pay for essential food

- Temporary Assistance for Needy Families (TANF)

- Temporary cash assistance for specific low-income households

- Plan to Achieve Self-Support (PASS)

- Written plan of action for getting a particular kind of job or starting a business

- If SSA approves your PASS, they do not count the money you spend on your plan when determining SSI eligibility

- If you are already eligible for SSI, this will increase your SSI payment, which will replace all of the money you spend on your PASS

- Achieving a Better Life Experience (ABLE) account

- Tax-advantaged account that helps cover disability-related expenses for people who become disabled before turning age 26

- The first $100,000 in an ABLE account won’t count toward your SSI resource limit

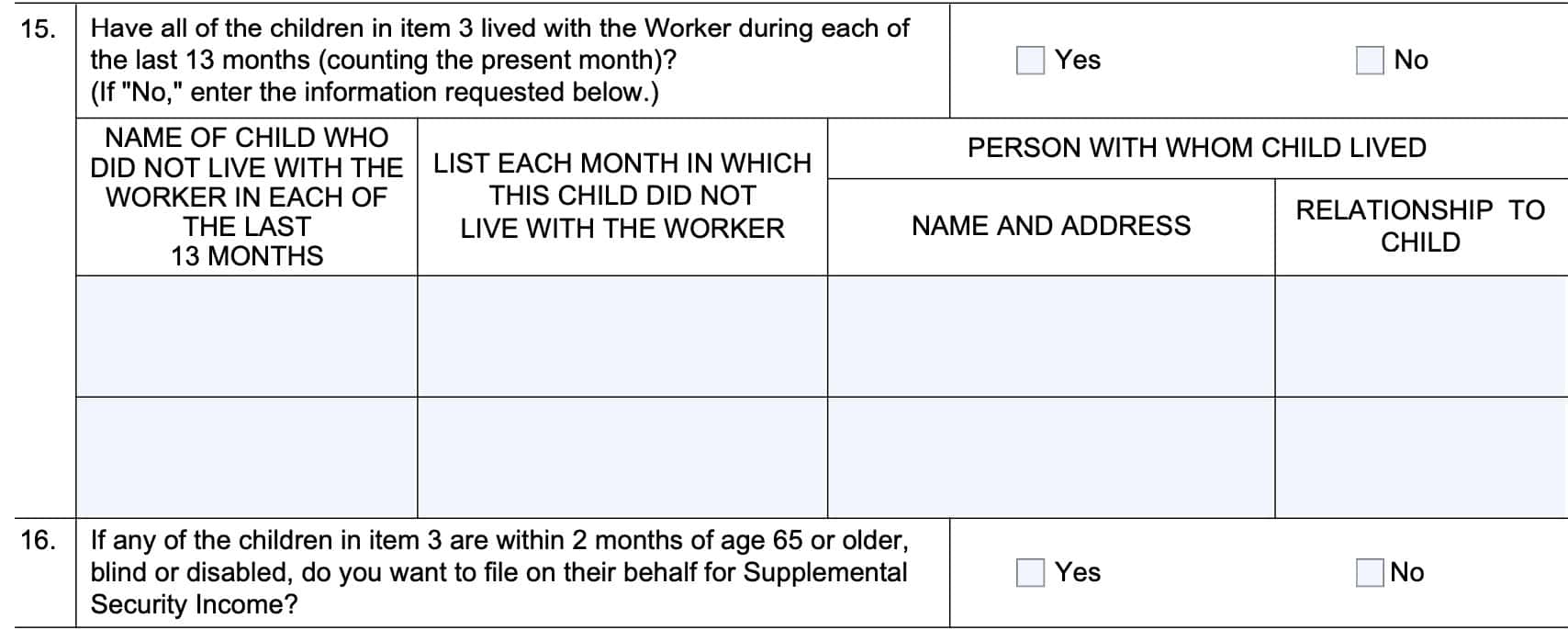

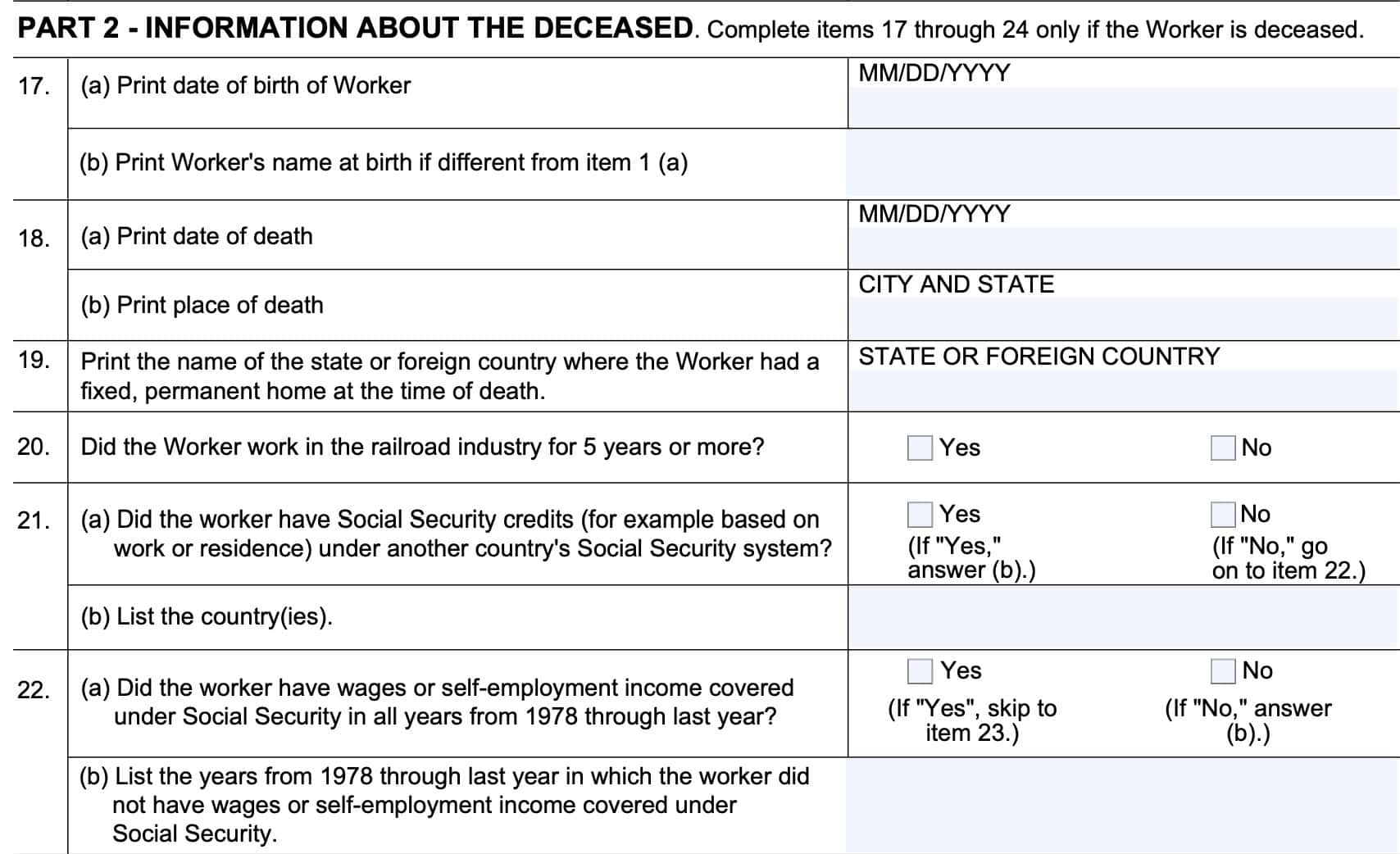

Line 17

If the worker is deceased, complete Lines 17 through 24. Otherwise, skip these lines and proceed to Line 25.

- Line 17(a): Print the worker’s date of birth in MM/DD/YYYY format.

- Line 17(b): Print the worker’s name at birth, if it differs from the name entered into Line 1

Line 18: Date and place of death

Enter the following information:

- Line 18(a): Date of death (MM/DD/YYYY)

- Line 18(b): Place of death: City and State

Line 19: State or foreign country of residence

In Line 19, print the name of the state or foreign country where the worker had a fixed, permanent home at the time of death. If the worker had multiple residences, enter the one where the worker spent the most time.

Line 20: Did the worker work in the railroad industry for at least 5 years?

Answer Yes or No.

Line 21: Did the worker have Social Security credits under another country’s system?

In Line 21(a), answer Yes or No. If Yes, then list the country or countries with Social Security benefits in Line 21(b). Otherwise, go to Line 22.

Line 22: Did the worker have wages or self-employment income in all years?

In Line 22(a), answer Yes if the worker had wage income or self-employment income in all tax years from 1978 through the most recent prior tax year.

If No, then enter the years in which the worker did not have wages or self-employment income.

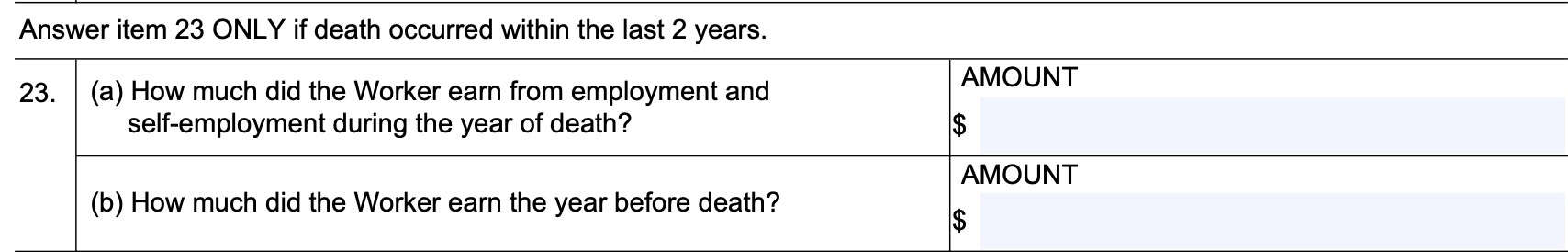

Line 23

Answer Line 23 questions only if the worker’s death occurred within the last 2 years.

Line 23(a): How much did the worker earn from employment or self-employment during the year of death?

Enter the dollar amount in Line 23(a).

Line 23(b): How much did the worker earn from employment or self-employment during the year before death?

Enter the dollar amount in Line 23(b).

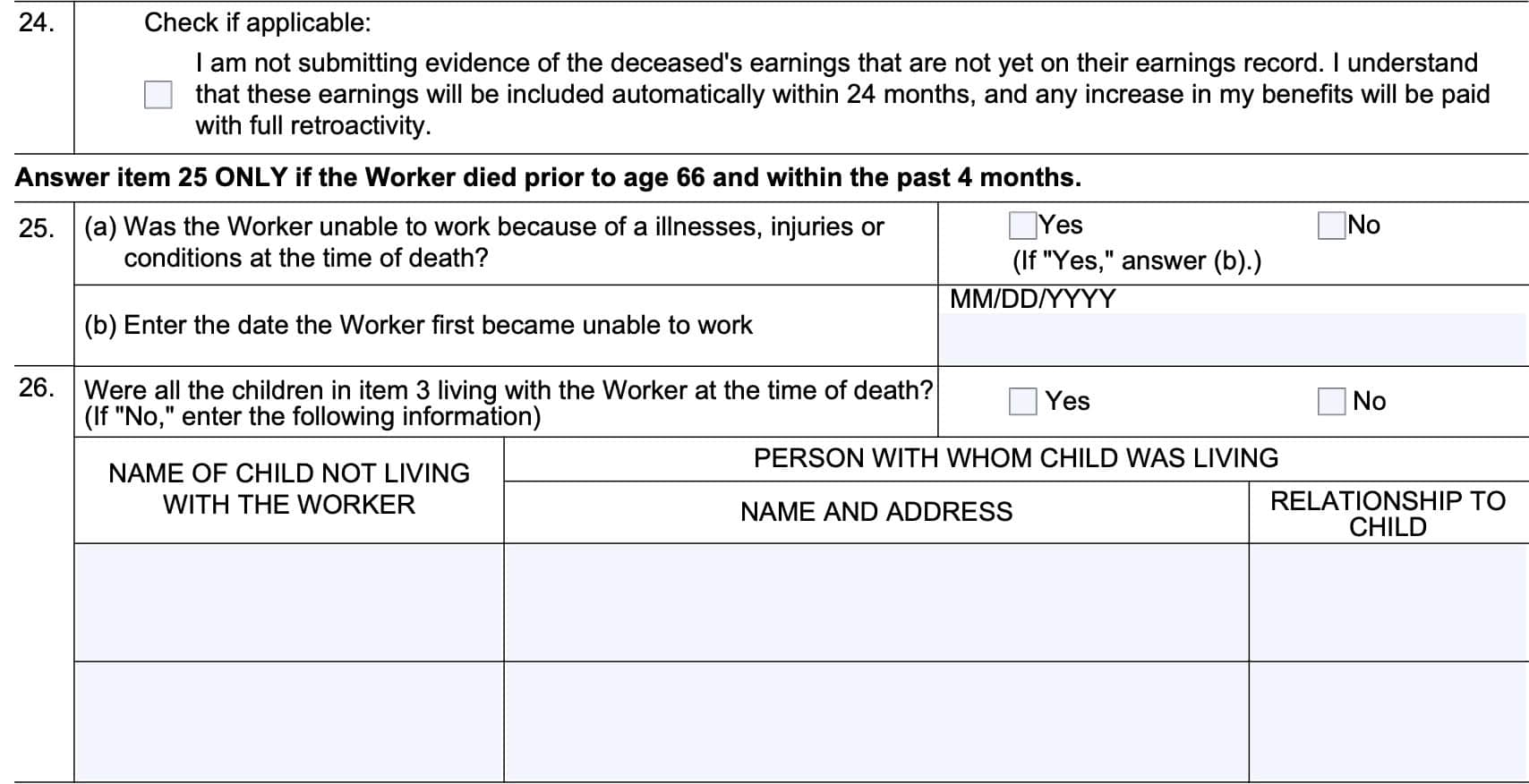

Line 24

Check this box if the following applies:

- You are not submitting evidence of a decedent’s earnings that are not already on their Social Security earnings record

- Earnings not already on an earnings record will be included automatically within 2 years

- Your benefits will be paid retroactively

Line 25

Answer Line 25 only if the following conditions apply:

- Worker died prior to age 66, and

- Worker died within the past 4 months

Line 25(a)

At the time of death, was the worker unable to work because of any of the following:

- Illness

- Injury

- Other medical conditions

Answer Yes or No. If Yes, go to Line 25(b). Otherwise, go to Line 26.

Line 25(b): Date worker first became unable to work

Enter the date that the worker was first unable to work in MM/DD/YYYY format.

Line 26: Were all children living with the worker at the time of death?

Answer Yes or No. If No, then enter the following information for each child:

- Child’s name

- Name and address of the person with whom the child was living

- Relationship

Remarks

At the end of the form, there is extra space for additional information or explanations you may have. If needed, you can also attach one or more separate sheets.

Tip: Be sure to start each remark with the line number of the associated question or statement. For example, Line 26 contains 2 spaces for children not living with a deceased taxpayer. Before entering the third child’s information in the remarks section, simply enter “26.” followed by the required information.

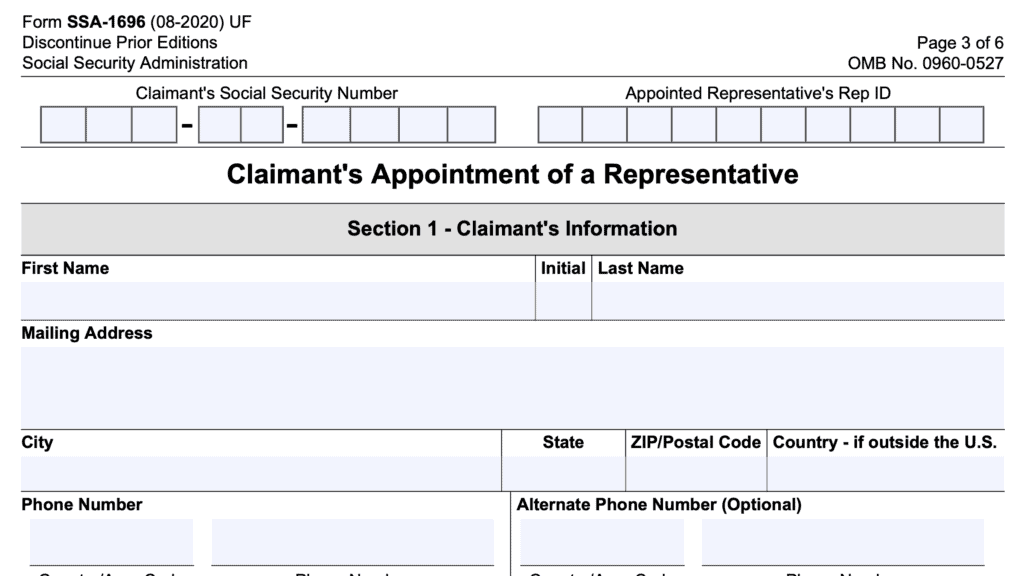

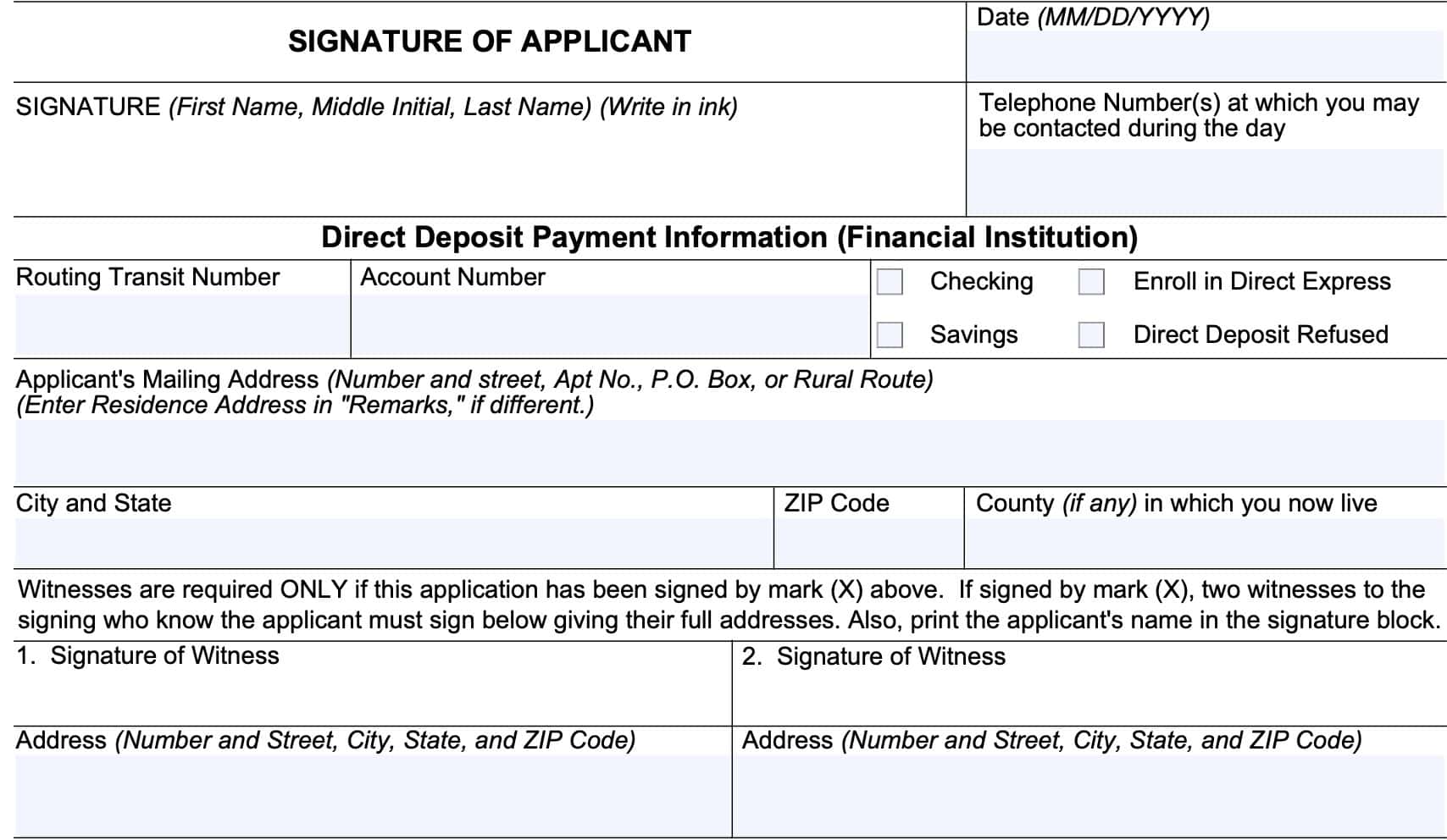

Signature

Sign and date this form, using an ink pen. Enter the telephone number where you can be contacted in the case an SSA employee has additional questions during the application process.

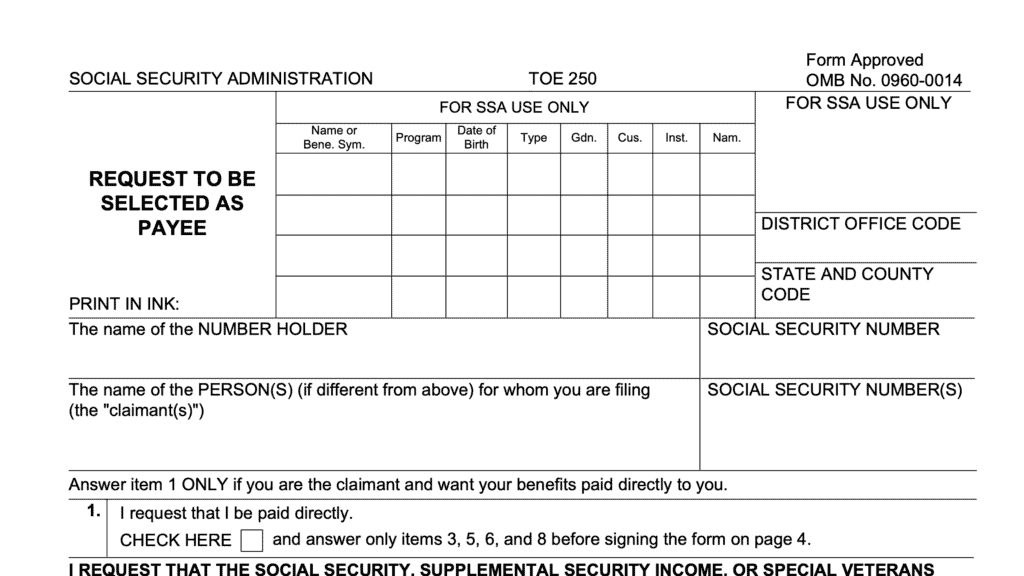

Direct deposit information

In this section, enter the following information about your bank account.

Routing transit number

Also known as a routing number, this is a nine-digit number that is unique to each bank or financial institution. You can usually find this number on:

- Any checks that you use (usually on the left-hand side)

- Official websites for major banks

Account number

The account number is unique to each account. You can also find your account number on a check, or through a secure portal on your bank’s website or mobile app.

Type of account

Select checking or savings account.

Direct deposit

Check the appropriate box, depending on whether you wish to participate in Direct Express, which federal agencies use to deliver benefits to recipients. Participation in direct deposit is not mandatory.

Reasons to choose direct deposit

There are several reasons that the federal government encourages people to participate in direct deposit:

- Security: Electronic deposits are more secure

- Traceability: Electronic deposits are easier to track down than checks or cash payments

- Convenience: No deposit required

Witness signatures

The SSA still accepts applications from individuals signing with a mark (‘X’). However, if a mark is used, then two witness who personally know the applicant must sign Form SSA-4-BK and enter their complete address in the space provided.

Application receipt

You should receive an application receipt from the SSA when you bring your completed Form SSA-4-BK to the local Social Security office. You should check your receipt to make sure it includes the following information:

- Telephone numbers to contact before and after you receive a notice of award

- SSA office handling your application

- Date the SSA received your completed form

- Number of days which you can expect to wait for the SSA determination

Other filing considerations

Here are some other things you should consider when applying for your child’s benefits.

Required documentation

From the SSA.gov website, below is a list of required documents that you may need to show or provide when you apply for benefits:

- The child’s birth certificate or other proof of birth or adoption

- Proof of the worker’s marriage to the child’s natural or adoptive parent if the child is the worker’s stepchild

- Proof of the child’s U.S. citizenship or lawful alien status if the child was not born in the United States

- W-2 form(s) and/or self-employment tax returns if the child had earnings last year

If the worker is deceased, you may also need to bring proof of the worker’s death and U.S. military discharge paper(s), if applicable.

Documents required for a disabled child

If applying for SSA benefits on behalf of an adult child who was disabled before the age of 22, you may also need to bring the following completed SSA forms:

- Form SSA 3368, Adult Disability Report, and

- Form SSA 827, Authorization to Disclose Information to the Social Security Administration

Learn more about the Adult Disability Report in this YouTube video.

Required identification documents

The SSA may ask for the following identification documents to verify your eligibility for having a child in your care:

- Your birth certificate or other proof of birth;

- Proof of marriage if you are or were married to the worker; and

- Proof of your U.S. citizenship or lawful alien status if you were not born in the United States

Tip: The SSA office can accept copies of certain documents, such as a W-2 statement (which you should have in paper form from your employer).

However, you should bring actual copies of identification documents, such as state-issued driver’s licenses, U.S. passport or passport card, or another identification card. During an in-person appointment, the SSA employee should make copies of the required documents and return the original versions to you.

Questions that the SSA will ask you

During your eligibility interview appointment, be prepared to discuss the following questions about your application:

- Your name and Social Security number

- The worker’s name and Social Security number

- Each child’s date of birth, Social Security number and relationship to the worker

- The child’s citizenship status;

- Whether any child 17 1/2 years of age or older is a student or is disabled;

- If any child is the worker’s stepchild, when and where the worker and the child’s parent married;

- Whether you are the natural or adoptive parent of the child(ren) for whom you are filing;

- Whether any child has a legal representative

- If so, the SSA will ask for that representative’s name and contact information

- Whether any child has been adopted by someone other than the worker;

- Whether any child is not living in the same household with you.

- If any child does not live with you, the SSA will ask for name and address of the person with whom the child now lives

- Whether each child lived with the worker during each of the last 13 months

- Whether any child has ever been married and, if so, the dates and locations of the marriages.

- Whether you or anyone else has ever filed for Social Security benefits, Medicare or Supplemental Security Income on behalf of the child(ren).

- The amount of each child’s earnings for this year, last year and next year;

- The dates of adoption for any children adopted by the worker;

- If you want to file on his or her behalf for Supplemental Security Income for any child who qualifies

- Whether you have ever been convicted of a felony if you want to apply to be a representative payee; and

- Whether you ever served as a representative payee for someone’s Social Security benefits

If the worker is deceased

If the worker is deceased, the SSA will probably ask the following additional questions:

- The worker’s date of birth and his or her name at birth (if different);

- The worker’s date of death and the place of death;

- The State or foreign country of the worker’s fixed permanent residence at the time of death;

- Whether the worker was unable to work because of illnesses, injuries or conditions at any time during the 14 months before his or her death.

- Whether the worker was in the active military service before 1968 or ever worked for the railroad industry.

- Whether the worker earned Social Security credits under another country’s Social Security system;

- Whether the worker was employed or self-employed in all years from 1978 through last year;

- How much the worker earned in the year of death and the year before death;

- Whether the worker ever filed for Social Security benefits, Medicare or Supplemental Security Income; and

- Whether each child was living with the worker at the time of death.

How you can apply

You can start your Social Security application by calling the SSA at 800-772-1213. However, you will need to follow up with an in-person meeting at an SSA office, as the SSA will not accept your Form SSA-4-BK by mail.

Video walkthrough

Watch this video for a step-by-step example of your child’s Social Security application.

Frequently asked questions

No. The Social Security Administration allows applicants to begin the application process by phone. However, phone appointments must be followed by an in-person meeting, where the completed form will be accepted by an employee. The SSA does not give an address for mailing applications.

According to the SSA website, office appointments are not necessary. However, the SSA advises applicants to schedule an appointment to reduce waiting time.