Form SSA-7008 Instructions

Most taxpayers will expect to claim Social Security benefits within their lifetime. This might be Social Security disability benefits, retirement benefits, or survivor benefits. The Social Security Administration calculates the amount of benefits based upon the taxpayer’s employment record.

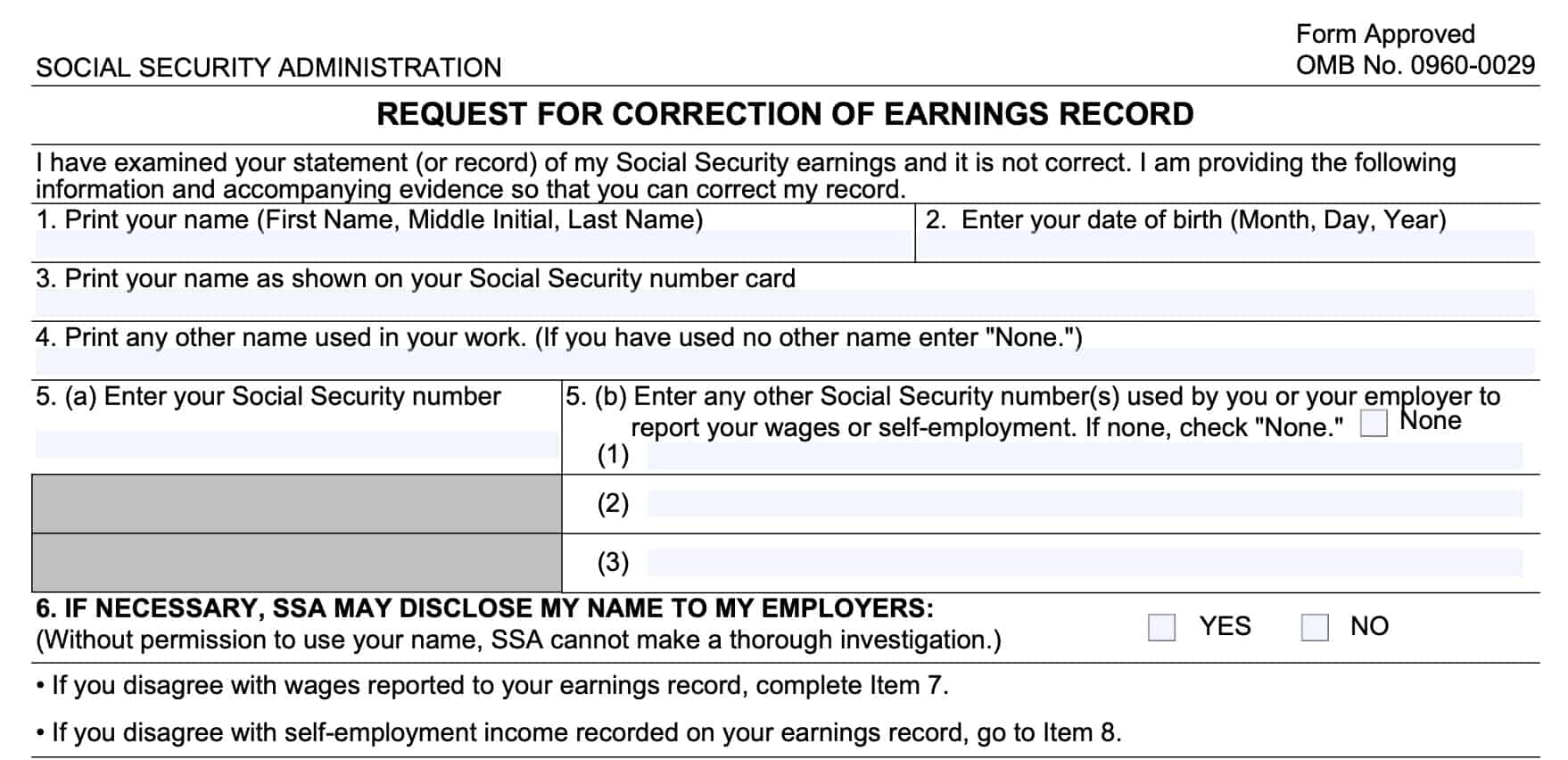

By regularly checking your earnings record, you can tell if there are any discrepancies between your earnings and the Social Security records. If you notice a discrepancy in your earnings, you may need to file Form SSA 7008, Request for Correction of Earnings Record, to update your earnings and preserve your benefits.

In this article, we’ll walk through how to correct your earnings record with Form SSA-7008 and discuss some frequently asked questions about your earnings record.

Let’s start with a step-by-step walkthrough of this SSA Form.

Table of contents

How do I complete Form SSA 7008?

This Social Security form is fairly straightforward to complete. Let’s go through it, line by line.

Line 1: Applicant’s name

In Line 1, print your name as it would appear on your latest income tax return. When entering your name in this field, do not use nicknames or aliases. Simply write:

- First name

- Middle initial

- Last name

Line 2: Date of birth

Enter your date of birth, in month, date, year format.

Line 3: Name as shown on Social Security card

If your name is different on your Social Security number card is different from the name you entered in Line 1, enter it exactly as shown. Normally, your Social Security card will include your full middle name, instead of your middle initial.

Line 4: Other names used

If you’ve used any other name in your occupation, then enter that name in Line 4. If you’ve never used another name for employment purposes, then you may enter ‘None.’

Line 5: Social Security number

In Line 5a, enter your Social Security number, as it appears on your Social Security card, or in your Social Security statement.

For Line 5b, if you’ve used other Social Security numbers to report self-employment income, or if your employer reported your wages using a different Social Security number, enter those numbers here. If no other Social Security numbers have been used, check the box marked, ‘None.’

Line 6: Permission to disclose your name to employers

If you give the Social Security Administration permission to disclose your name to your employer in order to verify your earnings history, check ‘Yes.’ If you do not wish to give the SSA permission to talk to your current or previous employer, check ‘No.’

If you check ‘No,’ the SSA may not be able to verify your earnings history, and may not be able to update your Social Security record with your reported earnings. Before making this decision, you may wish to contact your local Social Security office to learn more.

If you need to report inaccuracies in your employment history, go to Line 7. If you only need to correct your self employment earnings, then proceed to Line 8.

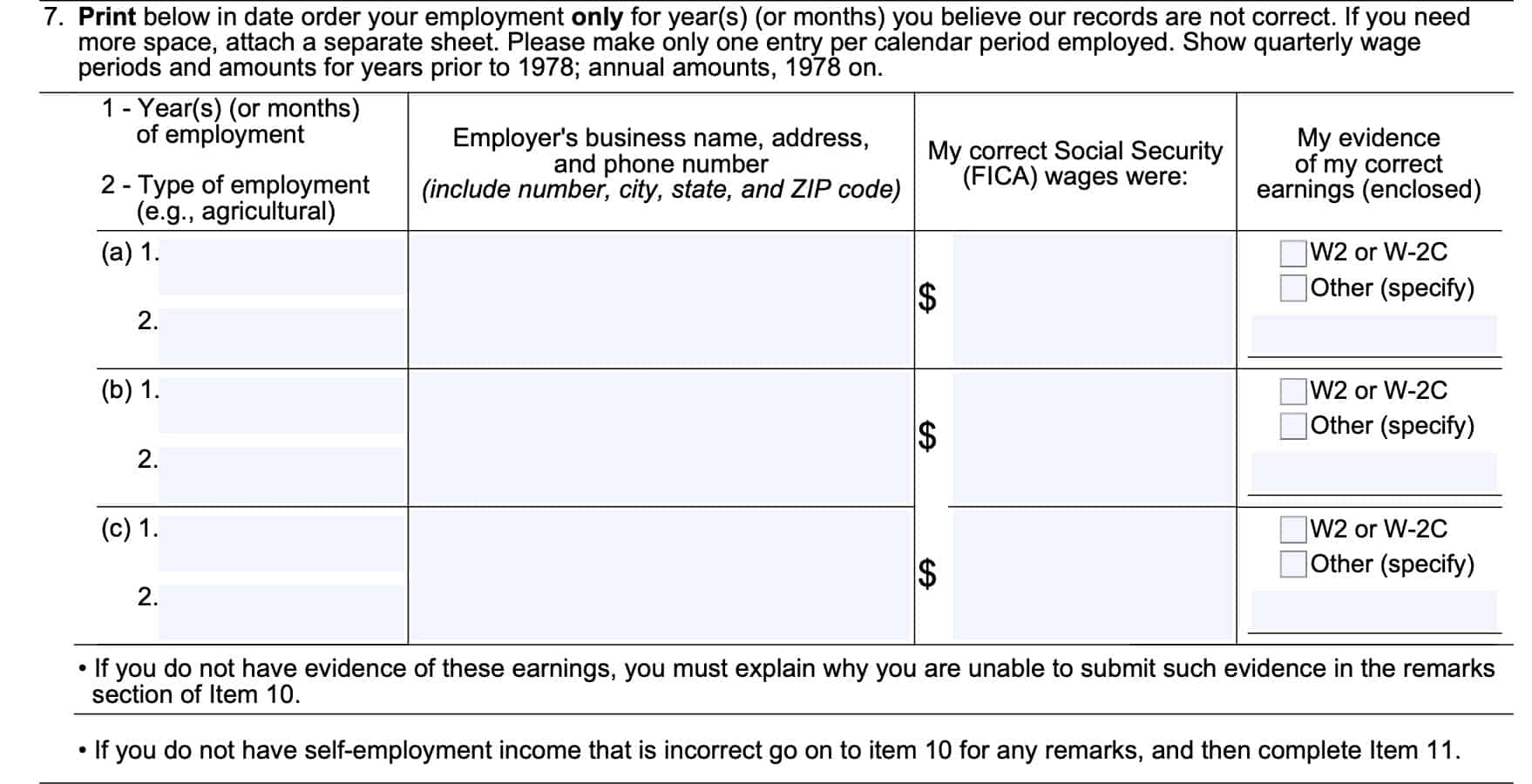

Line 7: Employment history

In Line 7, we’ll update your employment history. However, there are a couple of guidelines.

Only enter the years where you believe the SSA records are incorrect

The SSA uses your highest 35 years of employment history to calculate Social Security benefits. However, your SSA earnings record is probably mostly correct.

You only need to enter years that are missing earnings, or years where you believe that incorrect earnings were reported.

One year for each line

According to the form instructions, you should enter one period of Social Security earnings in each line. For earning periods prior to 1978, you would enter incorrect or missing wages based upon quarterly earnings. For calendar year 1978 and later, enter annual earnings.

Start from the most recent employer and work backwards

The most recent year containing missing or incorrect earnings information should be at the top. After that, proceed in order, going in reverse order, until you reach the final year with discrepancies.

For each field, you’ll enter:

- Year(s) or month(s) of employment

- Type of employment

- Employer’s business name, address, and phone number

- Include the employer’s street address, city, state, and zip code

- Your corrected Social Security wages, also known as FICA wages

- Evidence of your correct earnings information (check the appropriate box)

If you need to correct earnings information for more than three reporting periods, you may need to enter the additional years on a separate sheet that you attach to the form.

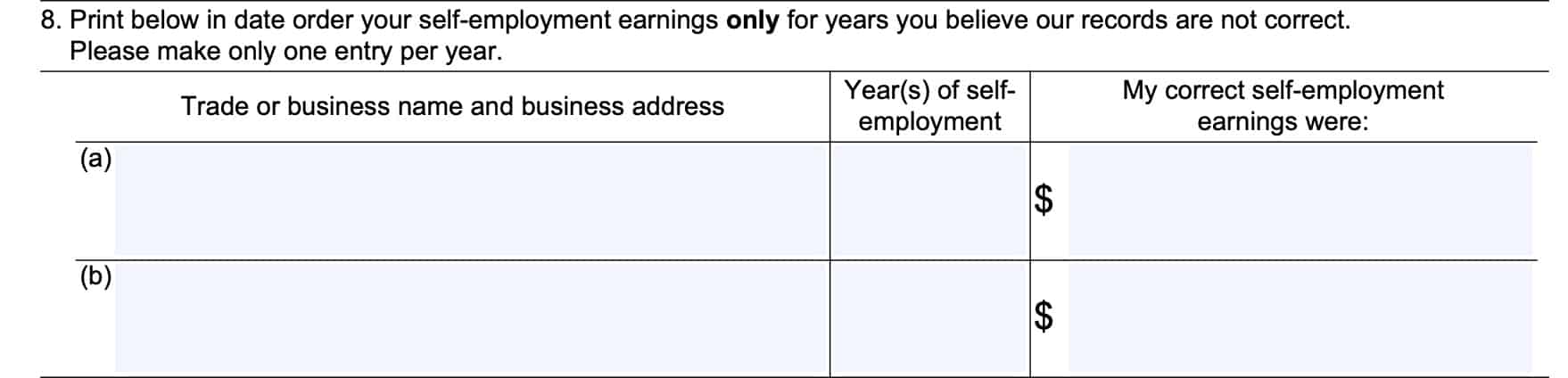

Line 8: Self-employment earnings

In Line 8, you’ll report self-employment earnings only for the years where you believe there is an earnings discrepancy.

For each line, you’ll enter:

- The name of your trade or your business name

- Business address

- Year of self-employment

- Correct self-employment earnings in that year

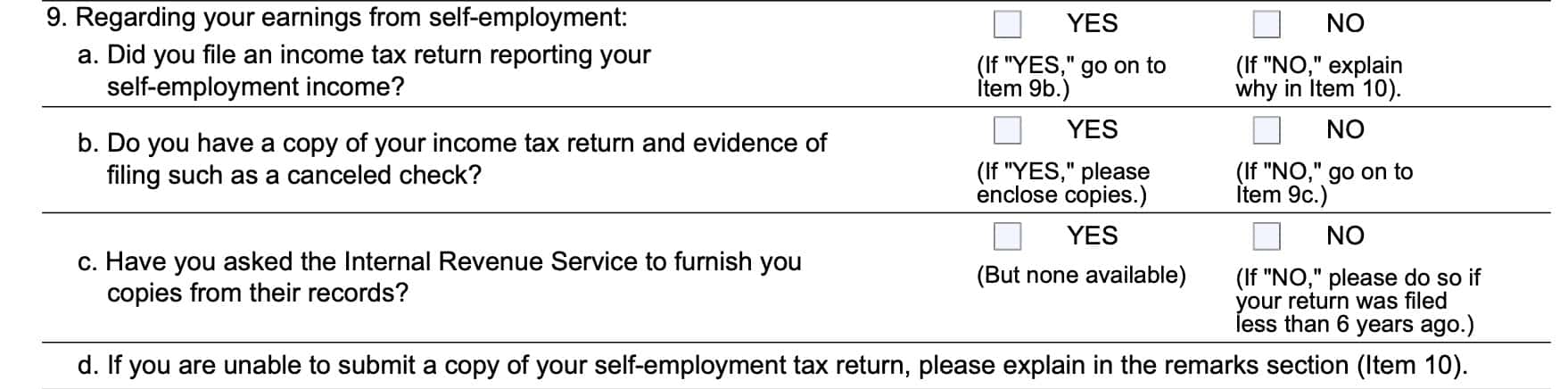

Line 9

In Line 9, you’ll clarify your self-employment earnings.

Specifically, in 9a, answer whether you’ve filed a federal tax return reporting your self-employment income. For most taxpayers, this would be on your IRS Form 1040, accompanied by Schedule C. If you answer ‘Yes,’ proceed to Line 9b. If not, go to Line 10, and provide additional information in the remarks section.

For Line 9b, if you have a copy of your income tax return, and evidence of filing your return, select ‘Yes,’ and plan to provide copies of your tax return. If you do not have a copy of your income tax return, select ‘No.’ You may also want to check with your tax preparer.

If you selected ‘No,’ for 9b, then you may need to request your records from the Internal Revenue Service. You may be able to request a tax return transcript by filing IRS Form 4506 or IRS Form 4506-T. You may also be able to obtain this information through your online IRS account, if you’ve established one.

If you have not already requested your self-employment records from the IRS, you may need to do so if earnings discrepancy is from a tax return filed less than 6 years ago.

Finally, if you are not able to submit a copy of your self-employment tax return, and you cannot obtain copies from the IRS for the specified time periods, you should provide a written explanation in Line 10.

Line 10: Remarks

In the remarks section, you’ll provide additional information to help support your case. This information should support your statements in either Line 7 or Line 9.

Additionally, if you aren’t able to provide income tax returns, you may consider any information or files that you do have access to. This could include pay stubs, Form W-2, or personal self-employment records.

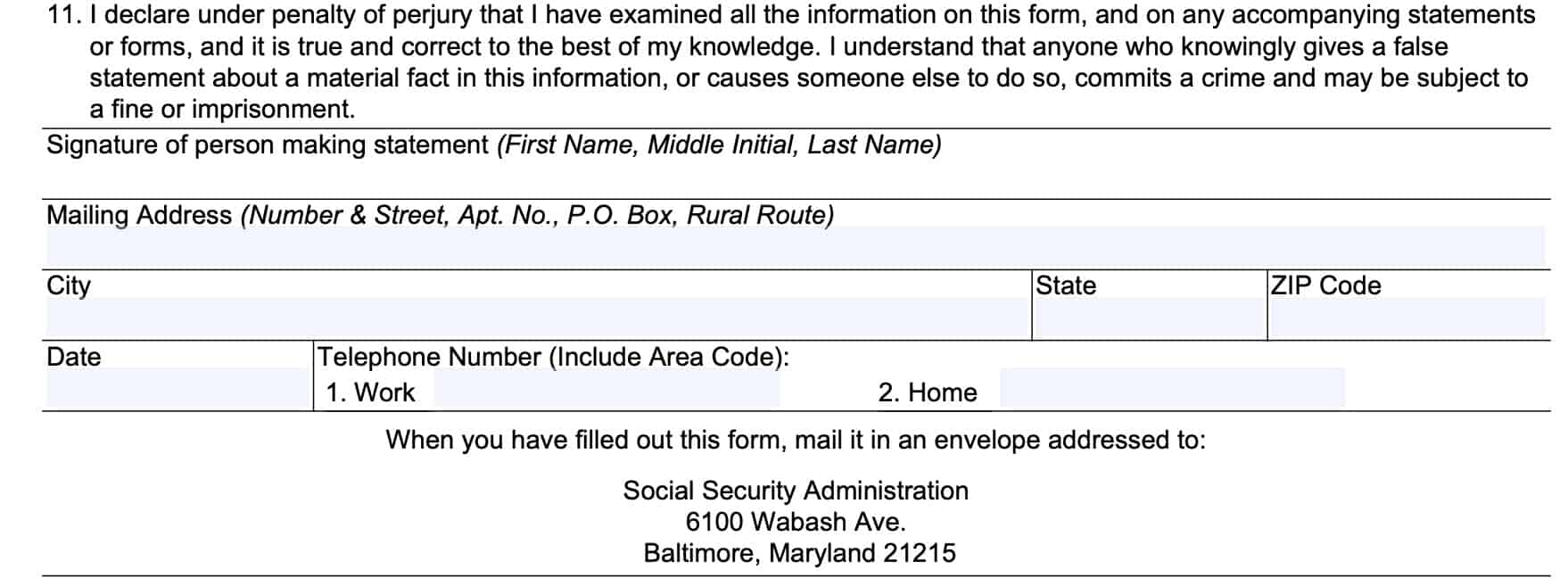

Line 11: Signature

In this section, you are signing this form, under penalty of perjury, as to the accuracy of your statement. Keep in mind that providing false information may result in civil or criminal penalties.

In this section, you’ll include:

- Your signature

- Your mailing address

- City, state, and zip code

- Date of signature

- Work and home telephone numbers

How should I file Form SSA 7008?

At the bottom of the SSA Form, you’ll see a mailing address for the SSA office in Baltimore, Maryland. However, this form and its accompanying documents contain personal information, which should not be mailed. To reduce the risk of becoming a victim of identity theft, you should bring your completed Form SSA-7008 to your local Social Security office.

Video walkthrough

Watch this video walkthrough for a step by step tutorial on correcting your Social Security statement by filing Form SSA 7008.

Frequently asked questions

According to the SSA website, most people have to correct their earnings within 3 years, 3 months, and 15 days from the end of the taxable year in which the wage income was earned. However, exceptions may exist for earnings reported on a filed tax return, employee omissions from employer reports, internal Social Security records errors, or wages reported as being paid by an employer, yet not in the SSA files.

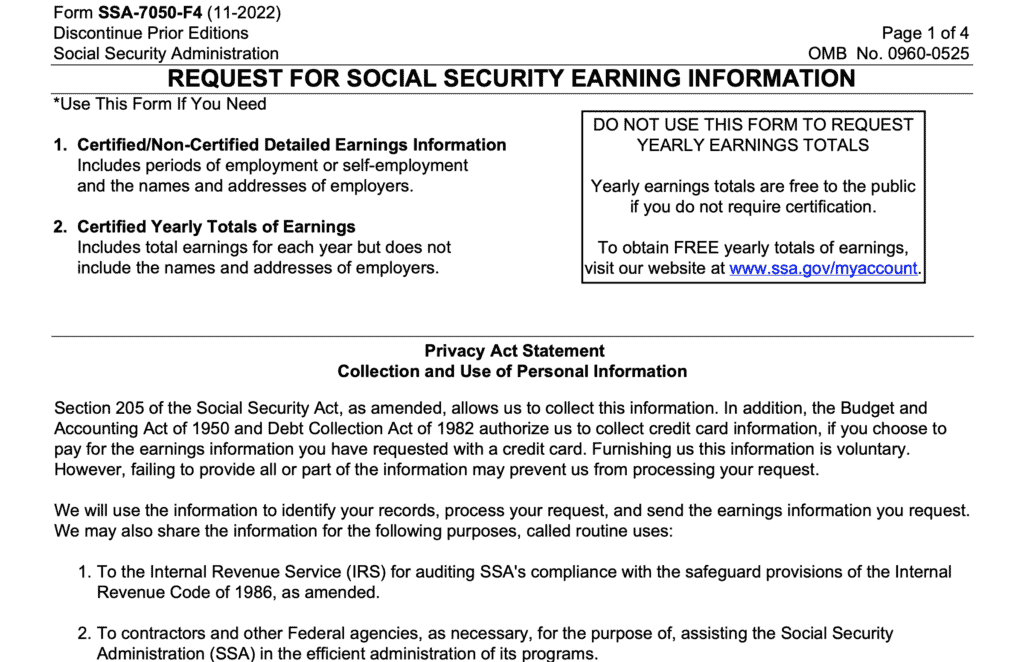

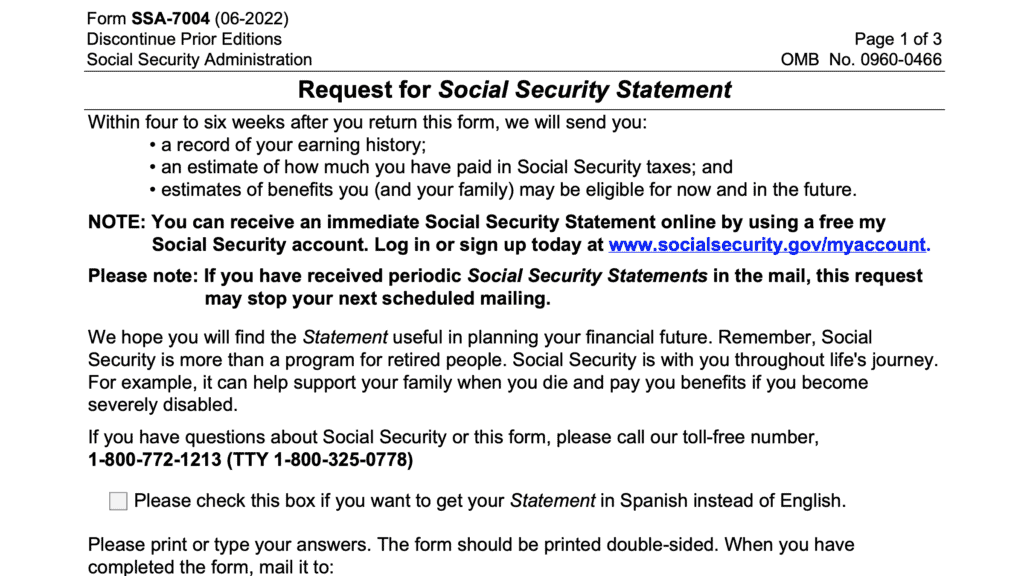

Anyone with earnings history may create an online account through the Social Security Administration. However, you may also request a certified or detailed Social Security earnings statement by filing Form SSA 7050.

Earnings may represent taxable wages, tips, and other compensation, which may be eligible for pre-tax deductions, such as employer plan contributions. However, Social Security wages consist solely of income for which the participant paid Social Security taxes.

Where can I find Form SSA 7008?

You may download this form from the SSA website. For your convenience, we’ve attached the most current version to this article.