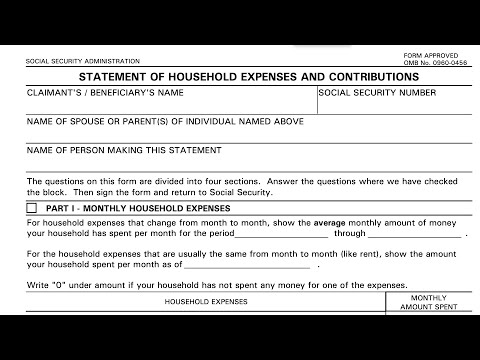

Form SSA 8011-F3 Instructions

When an eligible individual’s average monthly contribution to household expenses is significantly less than the amount of their Social Security benefits, the SSA may request additional information about that claimant’s contributions to the household’s expenses. The individual need to complete Form SSA-8011-F3, Statement of Household Expenses and Contributions to provide additional information.

In this article, we’ll walk through this Social Security form, including:

- How to complete Form SSA 8011-F3

- Routine uses for Form SSA 8011-F3

- Frequently asked questions

Let’s start with a step by step overview of this Social Security form.

Table of contents

How do I complete Form SSA 8011-F3?

There are 4 parts to this two-page Social Security form:

- Part I: Monthly household expenses

- Part II: Contributions to household expenses

- Part III: Other arrangements

- Part IV: Remarks

Before we go through Part I, let’s start with the beneficiary information at the top of the form.

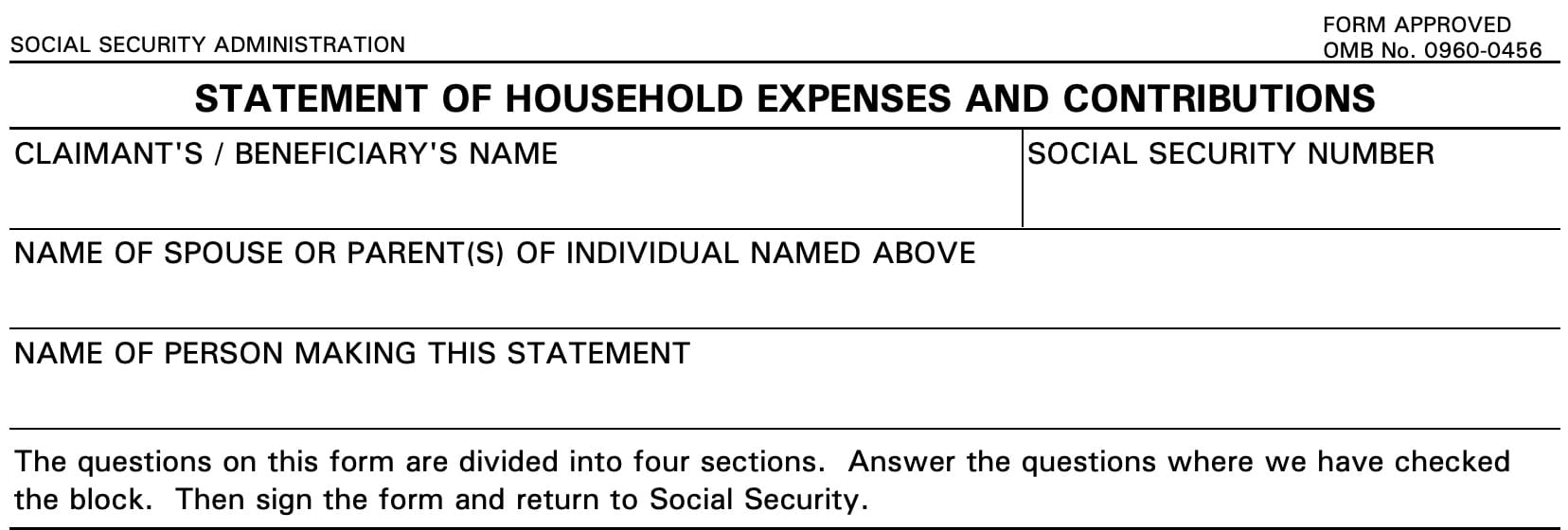

Beneficiary information

The beneficiary information fields are relatively straightforward. The SSA website does not provide any additional guidance, but we will walk through each line.

Claimant’s/Beneficiary’s name

Enter the name of the beneficiary in this line. If completing this form on behalf of a minor child or someone who cannot complete this form on their own, enter that person’s name here.

Social Security number

This space is provided for the claimant’s Social Security number.

The Social Security Administration’s operations manual instructs SSA employees to not enter the complete Social Security number in this space. However, your local Social Security office may give you different instructions.

Name of spouse or parent of individual named above

Enter the name of either the beneficiary’s spouse or parent, as applicable.

Name of person making this statement

Enter your name in this line.

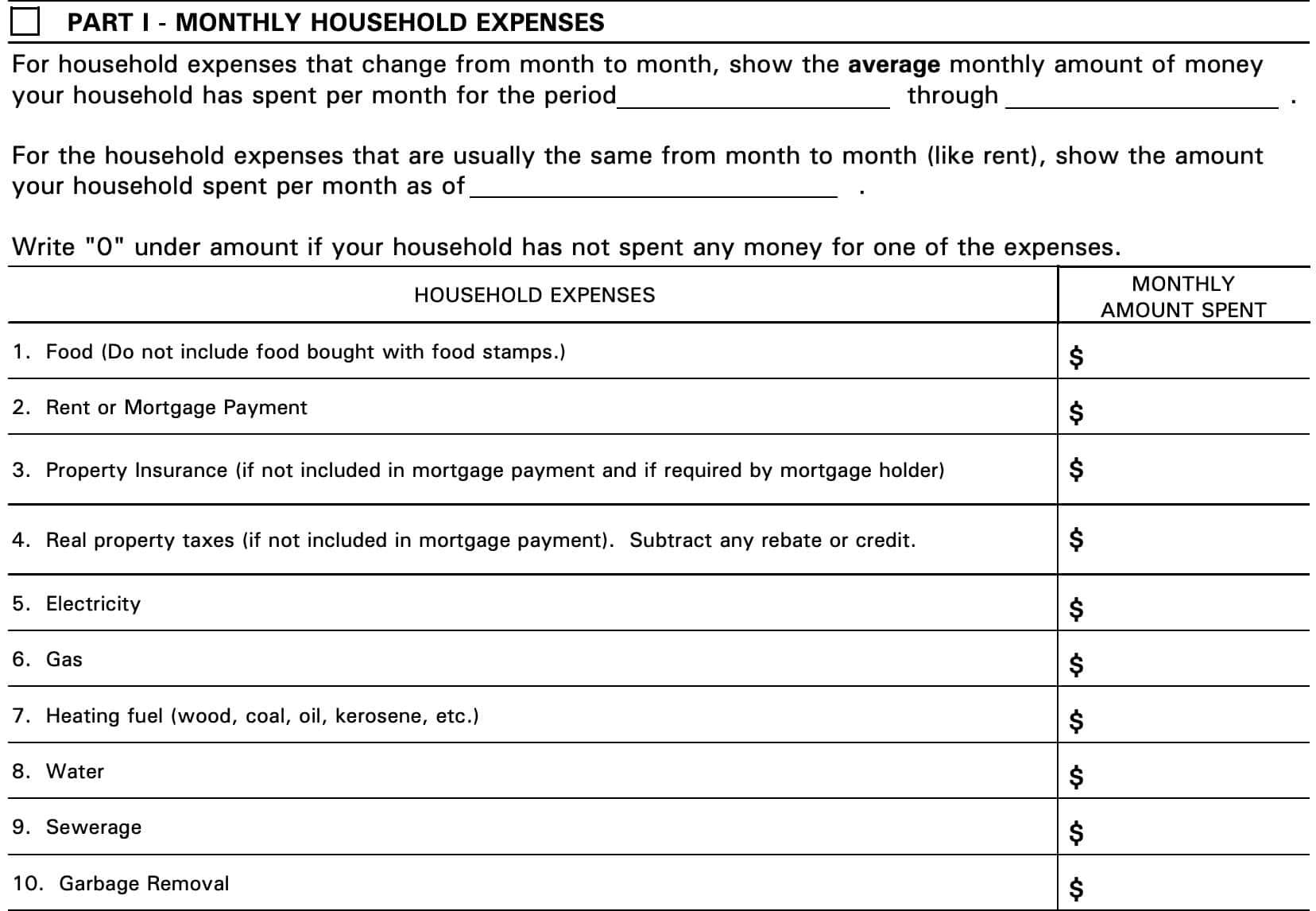

Part I: Monthly household expenses

The Social Security Administration may complete part of this section for you, then ask you to complete the remaining spaces. This should be indicated by a check mark in the box at the top left corner of this section.

We’ll cover this section as if you have a blank form in front of you.

General instructions

You will be asked to identify household expenses based on the following categories:

- Expenses that change from month to month

- Fixed expenses

Variable expenses

For expenses that change every month, such as groceries or utilities, you’ll be asked to provide an average of the monthly spending for those items for a certain period of time.

If the SSA office provides you instructions, you should follow them. If not, the SSA website provides additional information about averaging household expenses in its operations manual.

Fixed expenses

For fixed expenses, you’ll simply be asked to indicate the monthly expense for that item. As an example, if your monthly rent is $1,500, then you would simply enter $1,500 in that line.

For expense categories where you do not pay anything, enter ‘$0.’

Line 1: Food

Enter the average monthly amount that you spend on food. Do not include any form of food purchased with food stamps.

The SSA operations manual directs employees to line through “Food” if the claimant/recipient alleges separate consumption/purchase of food.

If you purchase your own food, or if you have questions about how to report food purchases, you may want to discuss this with the employee to make sure that you have a shared understanding of what you need to report.

Line 2: Rent or mortgage payment

If you pay rent, enter the monthly rent amount in this line.

If you have a mortgage, then you may enter the entire mortgage payment amount here. Since most mortgages also include property insurance and real estate taxes, you may want to ensure that you don’t report the same expense in different places (such as Line 3 and Line 4, below).

Line 3: Property insurance

Enter the monthly amount that you pay for property insurance, but only if it is not already included in your mortgage payment, in Line 2, above.

You may have to calculate a monthly amount, based upon your annual property insurance bill. If this is the case, remember to divide your annual property insurance bill by 12 to arrive at your monthly insurance amount.

Line 4: Real property taxes

Enter the monthly amount that you pay for for real estate taxes, but only if it is not already included in your mortgage payment, in Line 2, above.

You may have to calculate a monthly amount, based upon your annual real estate tax bill. If this is the case, remember to divide your annual tax bill by 12 to arrive at your monthly insurance amount.

Line 5: Electricity

You may be asked to calculate your average electric bill. If so, follow the guidance provided by the SSA employee on how to calculate your average monthly expense.

Line 6: Gas

If applicable, you may be asked to calculate your average gas bill. If so, follow the guidance provided by the SSA employee on how to calculate your average monthly expense.

Line 7: Heating fuel

If applicable, you may be asked to calculate your average heating fuel bill. This can include any of the following ways you might use to heat your home:

- Wood

- Coal

- Heating oil

- Kerosene

If so, follow the guidance provided by the SSA employee on how to calculate your average monthly expense.

Line 8: Water

If applicable, you may be asked to calculate your average water bill. If so, follow the guidance provided by the SSA employee on how to calculate your average monthly expense.

Line 9: Sewage

If applicable, you may be asked to calculate your average sewage bill. If so, follow the guidance provided by the SSA employee on how to calculate your average monthly expense.

Warning: In some municipalities, sewage expenses may be bundled with other utilities, such as water service. Please review your expenses to ensure that you are not reporting the same expense twice.

Line 10: Garbage removal

If applicable, you may be asked to calculate your average sewage bill. If so, follow the guidance provided by the SSA employee on how to calculate your average monthly expense.

Warning: In some municipalities, garbage removal may be bundled with other utilities, such as water service. Please review your expenses to ensure that you are not reporting the same expense twice.

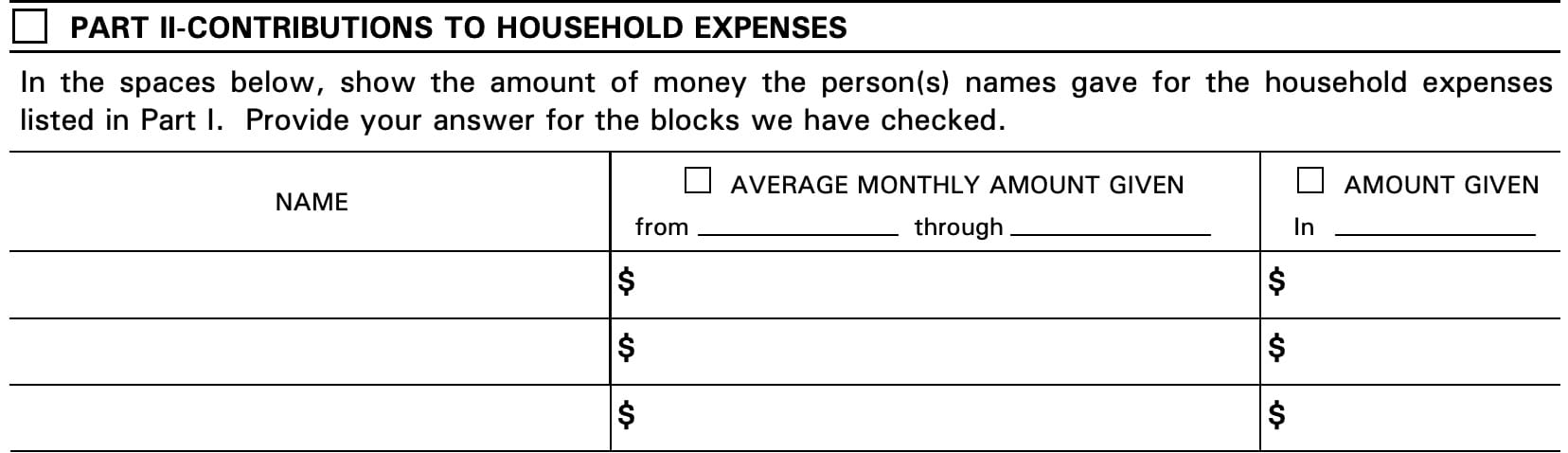

Part II: Contributions to household expenses

In Part II, we will enter information about other people who may have contributed to paying for some of the household expenses reported in Part I. If you need to complete this section, you should see a check in the box next to Part II.

If required, enter the following information for each person:

- Contributer’s name

- Average monthly amount given during specified dates

- Dates should be indicate on the form for you

- Amount given in a certain month

- This should be indicated for you

Once completed, or if not required, proceed to Part III, below.

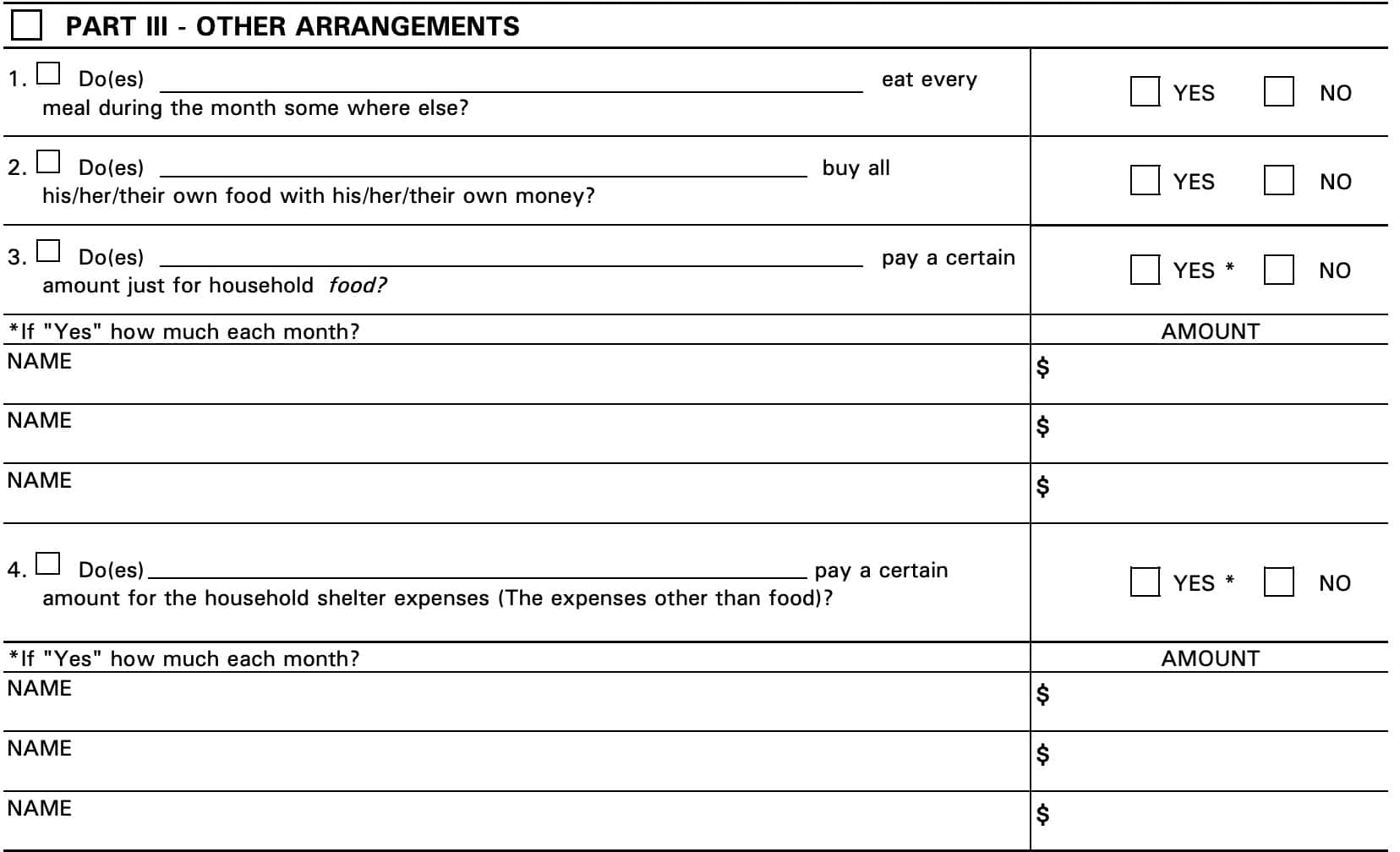

Part III: Other arrangements

If Part III has a check, then you should provide certain information to help explain payment arrangements that you may have with the other party.

If appropriate, check the block(s) in Part III that describes the alleged arrangement for food and shelter and enter the name(s) of the person(s) who has the arrangement (claimant/recipient or deemors).

Complete the following information as applicable.

Line 1

Does this person eat every meal during the month at another location?

Line 2

Does the other party purchase all of their own food with their own money/

Line 3

Does the other person pay a certain amount solely for food expenses? If so, indicate the person’s name and monthly amount you receive for food.

Line 4

Does the other person pay a certain amount solely for non-food expenses? This might include things like:

- Utilities

- Rent, lodging, or shelter expenses

If so, indicate the person’s name and monthly amount you receive for these expenses.

Part IV: Remarks

You may be asked to provide additional information, particularly about a living arrangement basis or a sharing arrangement you may have, based upon the block(s) that you checked in Part III.

Beneficiary signature

By signing in this part, you are declaring, under penalty of perjury, that the the information you have provided is correct and accurate to the best of your knowledge.

The witness signature fields do not need to be completed unless the applicant signs with a mark (X). In this case, the signatures and addresses of two witnesses who personally know the applicant, must go on to the signed statement.

Turn in your completed form to the local SSA office.

Filing Form SSA 8011-F3

This SSA form is generally not available online. The SSA maintains Form SSA-8011-F for employees to complete during an in-office or telephone interview.

Purpose of Form SSA 8011-F3

Form SSA 8011-FE exists to record and calculate the following information:

- Total household operating expenses

- The individual’s contribution to household operating expenses

- Separate consumption

- Separate purchase of food, or

- Earmarked contributions

When to complete Form SSA 8011-F3

The form instructions indicate that a statement of claimant may need to be completed in the following situations as indicated in the Social Security operations manual:

Separate consumption

An individual or an individual’s spouse is taking all meals elsewhere (i.e., they consume all their food outside of the household in which they resides) and is not reimbursed by the householder.

Separate purchase of food

An individual (or at least one member of an eligible couple) physically shops for their own food or gives instructions and money to someone to buy the food for them.

Sharing arrangement

A sharing arrangement exists when an individual’s contribution equals or exceeds their pro rata share of the household operating expenses, provided the household expenses include both food and shelter.

Earmarked sharing

Earmarked sharing exists when an individual (or at least one of the members of an eligible couple) designates part or all of their contribution toward household operating expenses for food or shelter and the contribution equals or exceeds the pro rata share of household expenses for food or shelter.

When the Value Of The One-Third Reduction (VTR) Applies

According to the SSA:

When a claimant or couple lives throughout a month in another person’s household and receives both food and shelter from others living in the household, we reduce the applicable federal benefit rate (FBR) by one-third.

This reduction in the FBR has an income value, known as the VTR or the value of the one-third reduction.

Program Operations Manual System, SI 00835.200 The One-Third Reduction Provision

In other words, the one-third reduction provision applies to someone who is receiving SSA benefits, such as Supplemental Security Income, but not using those benefits to help contribute to their own food or shelter needs.

When computing In-Kind Support And Maintenance Within A Household

The purpose of this in-kind support and maintenance (ISM) computation is to determine the actual value (AV) of food, shelter, or both that other household members provide to a claimant when the value of the one-third reduction (VTR) does not apply.

The computation for in-kind support can be done in one of two ways from within a household: claimant only and eligible couple.

However, there may be certain circumstances where sufficient documentation exists to avoid having to file Form SSA-8011-F3.

Video walkthrough

Watch this instructional video for more detail about completing Form SSA 8011-F3.

Frequently asked questions

Form SSA 8011-F3, Statement of Household Expenses and Contributions, is used by the Social Security Administration to document household expenses for an eligible individual or eligible child living in another household.

This form may be completed by an SSA employee conducting an office or telephone interview with an eligible individual. In the case of an eligible child, this form may be completed by a knowledgeable adult member of the household.

The SSA states that if an eligible individual lives with a third party, that eligible individual’s contribution to household expenses must represent his or her pro rata share of the household expenses. If there is not sufficient documentation to support this, the SSA may reduce their benefits by one-third.

Where can I find Form SSA 8011-F3?

This form is not readily available on the SSA website, although you can ask for a paper form at your SSA office. The most current version available online is below, for reference.