IRS Form 1095-B Instructions

If you received health coverage from your employer or from a government source, such as Medicare or TRICARE, you might receive IRS Form 1095-B during tax season.

In this article, we’ll cover everything you need to know about IRS Form 1095-B, including:

- What tax information IRS Form 1095-B contains

- What information you should know from Form 1095-B

- Why you should keep this in your tax records

Let’s begin by going over this tax form, step by step.

Table of contents

IRS Form 1095-B Instructions

In most of our articles, we walk you through how to complete the tax form. However, most readers will probably want to understand the information reported on their IRS Form 1095-A, instead of how to complete it.

There are four parts to this tax form:

- Part I: Responsible Individual

- Part II: Information About Certain Employer-Sponsored Coverage

- Part III: Issuer or Other Coverage Provider

- Part IV: Covered Individuals

Let’s get into the form itself, beginning with Part I.

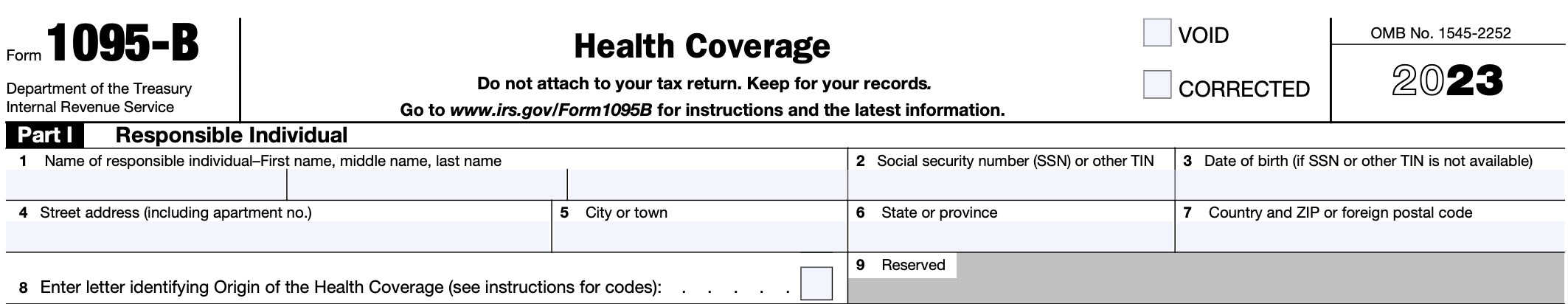

Part I: Responsible Individual

Part I contains information about the responsible individual receiving the Form 1095-B. Before we get to Line 1, let’s take a moment to better understand what a responsible individual is.

Responsible individual defined

According to the Form 1095-B instructions, a responsible individual is the person who, based on a

relationship to the covered individuals, the primary name on the minimum essential coverage, or some other circumstances, should receive the statement. Generally, the statement recipient should be the primary taxpayer in the household.

Line 1: Name of responsible individual

This line contains the first name, middle name, and last name of the responsible individual.

Line 2: Social Security number or other TIN

Line 2 reports your social security number (SSN) or other taxpayer identification number, such as an individual taxpayer identification number (ITIN), if applicable. According to the Internal Revenue Service, this form may show only the last four digits of your identifying number.

However, the coverage provider is required to report your complete SSN or other TIN, if applicable, to the IRS. Your date of birth will be entered on Line 3 only if Line 2 is blank.

Line 3: Date of birth

If Line 2 contains a taxpayer ID number, then this field should be blank. Otherwise, Line 3 will contain the responsible individual’s date of birth.

Line 4: Street address

This line should contain the street address where you live. If you live in an apartment building, Line 4 should contain your apartment number.

Line 5: City or town

Line 5 contains your city or town of residence.

Line 6: State or province

This line contains the state or province where you live.

Line 7: Country and ZIP or foreign postal code

If you live outside the United States, Line 7 will contain the country name and foreign postal code where you live. Otherwise, you should just see your ZIP code.

Line 8: Origin of the health coverage

Line 8 will contain a letter that identifies the origin of your health care coverage. Below is the list of possible health coverage providers that will be reported to you.

- A: Small Business Health Options Program (SHOP)

- B: Employer-sponsored coverage

- C: Government-sponsored program

- D: Individual market insurance

- E: Multiemployer plan

- F: Other designated minimum essential coverage

- G: Individual coverage health reimbursement arrangement (HRA)

Line 9: Reserved

Reserved for future use.

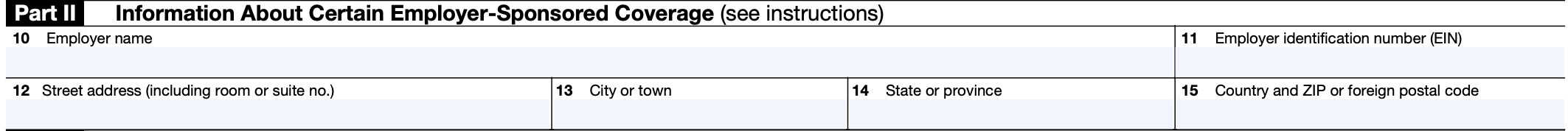

Part II: Information About Certain Employer-Sponsored Coverage

Part II covers information about certain types of employer-sponsored health insurance coverage.

This part may also be left blank, even if you had employer-sponsored health coverage. If this part is blank, you do not need to fill in the information or return it to your employer or other coverage provider.

Generally, this part is completed only by issuers or carriers of insured group health plans, including coverage purchased through the Small Business Health Options Program, otherwise known as SHOP.

Line 10: Employer name

Your employer’s name should appear in Line 10.

Line 11: Employer identification number

Your employer’s employer identification number, or EIN may appear here. If it does, it may be truncated so that you may only see the last four digits of the EIN number.

Line 12: Street address

This line contains the mailing address for your employer’s office.

Line 13: City or town

This line contains the city or town where your employer’s office or headquarters is located.

Line 14: State or province

In Line 14, you should see your employer’s state or province.

Line 15: Country and ZIP or foreign postal code

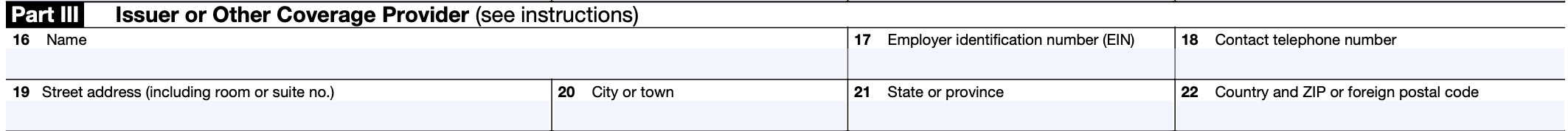

Part III: Issuer or Other Coverage Provider

This part contains contact information about the health insurance provider. Your health coverage provider may consist of any of the following:

- Insurance company

- Employer providing self-insured coverage

- Government agency sponsoring coverage under a government program like Medicaid or Medicare

- Other coverage sponsors

Line 16: Name

The name of your health care coverage provider should appear in Line 16.

Line 17: Employer identification number (EIN)

Your health care provider’s EIN will appear in Line 17.

Line 18: Contact telephone number

Line 18 reports a telephone number for the coverage provider. You should be able to call this phone number if you have questions about the information reported on your copy of Form 1095-B.

Line 19: Street address

You should see the complete address for your health care provider in Lines 19 through 22. Line 19 contains the street address for your health provider’s main offices.

Line 20: City or town

This line should contain the city or town where your health provider is located.

Line 21: State or province

This is the state or province where your health provider’s headquarters are located.

Line 22: Country and ZIP or foreign postal code

Line 22 contains the ZIP code of your provider’s headquarters. If located outside the United States, there should be a country listed and a foreign postal code in Line 22.

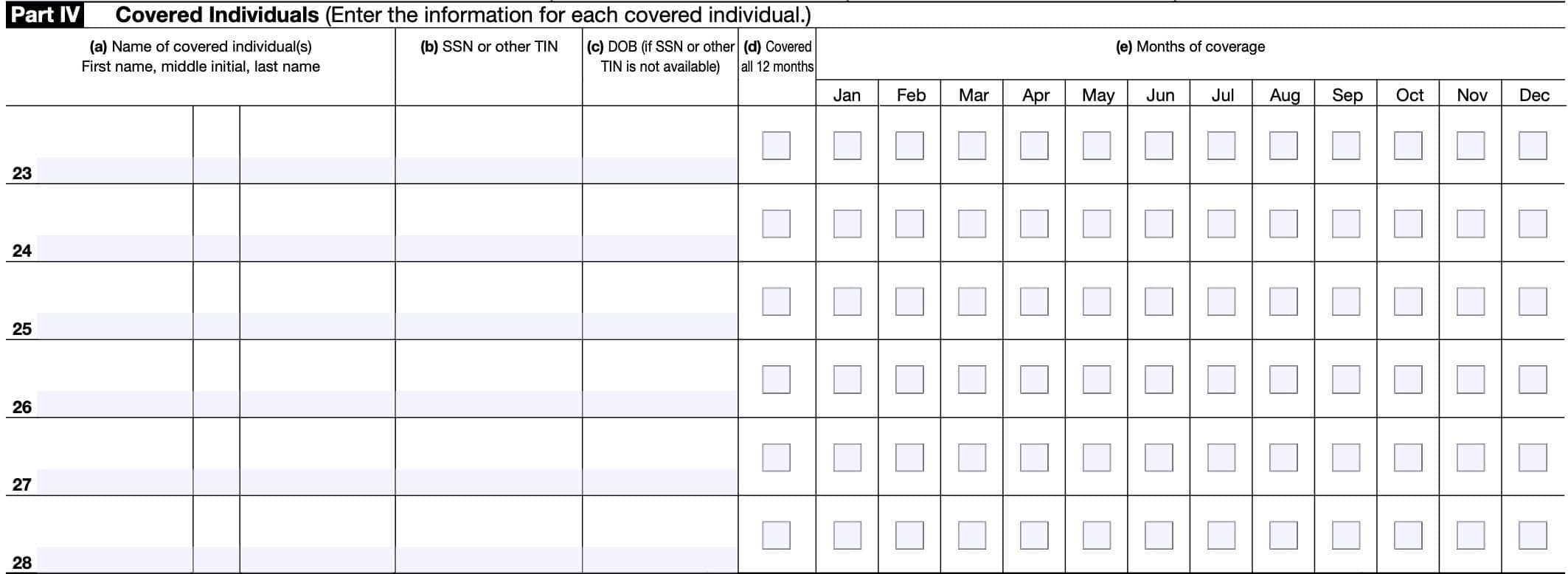

Part IV: Covered Individuals

Part IV contains information about family members or other covered individuals receiving health care coverage as members of your household.

Lines 23-28 contain information fields for up to 6 individuals, with a continuation page for Lines 29 through 40. For individuals who were covered for some but not all months, information will be entered in column (e) indicating the months for which these individuals were covered.

Let’s take a look at Part IV one column heading at a time, starting with Column (a).

Column (a): Name of covered individual

This should include the first name, middle initial, and last name of the covered individual.

Column (b): SSN or other TIN

This column should contain the SSN or other tax ID number for the covered individual.

Column (c): Date of birth

If an identifying number is not listed in Column (b), then you should see a date of birth reported in Column (c).

Column (d): Covered all 12 months

For individuals who were covered by a health plan for the entire year, Column (d) should be checked. Otherwise, you should see one or more boxes checked in Column (e).

Column (e): Months of coverage

For persons who were not covered the entire prior year, you will see one or more checks for each month of the year that the person did receive coverage.

Video walkthrough

For a step by step walkthrough on IRS Form 1095-B, check out our YouTube tutorial!

Frequently asked questions

As a result of the Affordable Care Act, IRS Form 1095-B is an information return that health care providers and health insurers must issue to taxpayers to demonstrate proof of coverage in the previous year. Each taxpayer should receive a copy of Form 1095-B no later than January 31.

No. IRS Form 1095-B solely reports persons who received minimum essential coverage for the entire year or for part of the year. When filing taxes, you may wish to give a copy of Form 1095-B to members of your household, but you should keep a copy of your 1095-B form in your tax records.

Where can I find IRS Form 1095-B?

As with other tax forms, you may find a copy of Form 1095-B on the IRS website. For your convenience, we’ve attached the most recent version here, in this article.