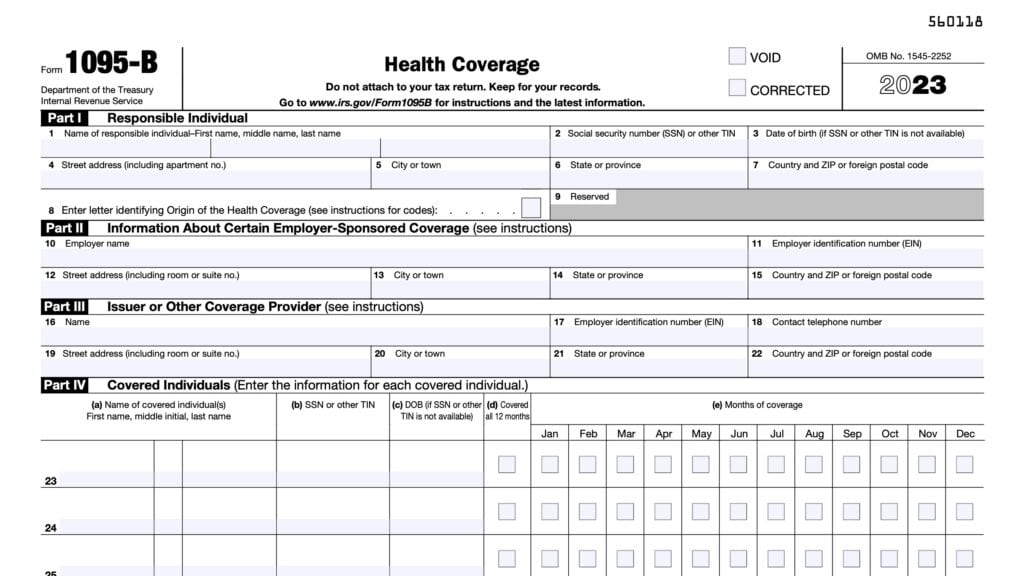

IRS Form 1095-C Instructions

As part of the Affordable Care Act, the Internal Revenue Service requires certain large employers to report their offer of health coverage and enrollment in health coverage on behalf of full-time workers and part-time employees on IRS Form 1095-C, Employer-Provided Health Insurance Offer and Coverage.

In this article, we’ll walk through everything you need to know about IRS Form 1095-C, including:

- How to understand IRS Form 1095-C

- Reporting requirements

- Frequently asked questions

Let’s begin with a step by step walkthrough of IRS Form 1095-C.

Table of contents

IRS Form 1095-C Instructions

There are three parts to IRS Form 1095-C:

- Part I: Employee & Employer Information

- Part II: Employee Offer of Coverage

- Part III: Covered Individuals

We’ll go through each part, step by step, beginning with Part I.

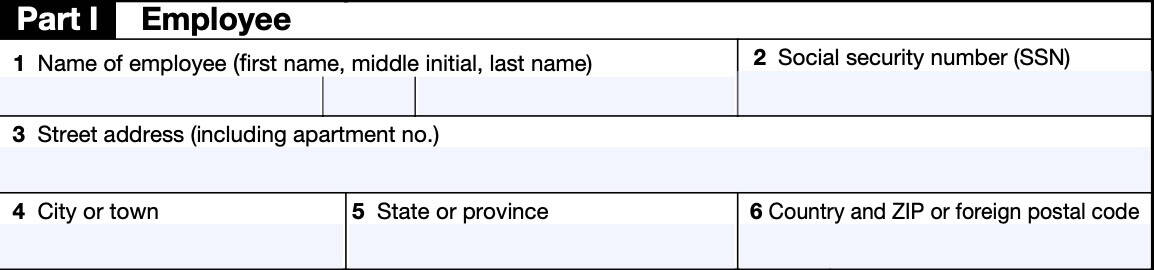

Part I: Employee & Employer Information

There are two sections to Part I:

- Lines 1 through 6: Employee information

- Lines 7 through 13: Applicable large employer member (Employer) information

We’ll begin with the employee information as reported on Lines 1 through 6. Review these lines for accuracy.

Line 1: Name of employee

In Line 1, you should see the employee’s first name, middle initial, and last name.

Line 2: Social Security number

Line 2 contains your nine-digit Social Security number, or SSN. Employees will find that in their copy of Form 1095-C, the SSN will be redacted, showing only the last four digits. However, your employer is required to report your whole Social Security number to the Internal Revenue Service.

Line 3: Street address

This line contains the employee’s street address, including apartment number, if applicable.

Line 4: City or town

This line shows the city or town where the employee lives.

Line 5: State or province

This line indicates the state or province where the employee lives.

Line 6: Country and ZIP code or foreign postal code

This line contains either the zip code (for addresses inside the United States) or the country and foreign postal code of the employee’s residence.

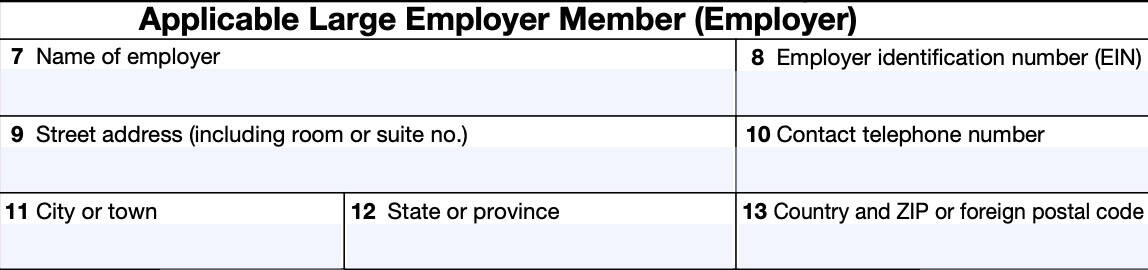

Line 7: Name of employer

Line 7 should contain your employer’s name as an applicable large employer member, or ALE.

Applicable large employer member

In general, an Applicable Large Employer, or ALE, is an employer with 50 or more full-time employees in the previous year. This includes full-time equivalent employees.

For purposes of determining if an employer or group of employers is an Applicable Large Employer, all ALE Members under common control, known as an Aggregated ALE Group, are aggregated together. If the Aggregated ALE Group, employed on average 50 or more full-time employees (including full-time equivalent employees) on business days during the preceding calendar year, then

- The aggregated ALE group is an Applicable Large Employer, and

- Each separate employer within the group is an ALE member

Each ALE member is required to file IRS Forms 1094-C and Forms 1095-C reporting offers of coverage to its full-time employees. This requirement exists even if the individual ALE Member has fewer than 50 full-time employees of its own.

Line 8: Employer identification number (EIN)

This line contains the 9-digit employer identification number, or EIN, associated with the employer.

Line 9: Street address

This line should contain your employer’s street address.

Line 10: Contact telephone number

Your employer’s contact telephone number should appear in Line 10. You may need to keep this phone number in case you need to contact your employer to discuss your Form 1095-C.

This telephone number may be different from the one that the employer reported to the IRS on Line 8 of IRS Form 1094-C.

Line 11: City or town

This line contains the city or town of your employer’s home office or headquarters.

Line 12: State or province

This line contains your employer’s state or province.

Line 13: Country and ZIP or foreign postal code

Line 13 contains the ZIP code or the country and postal code for your employer.

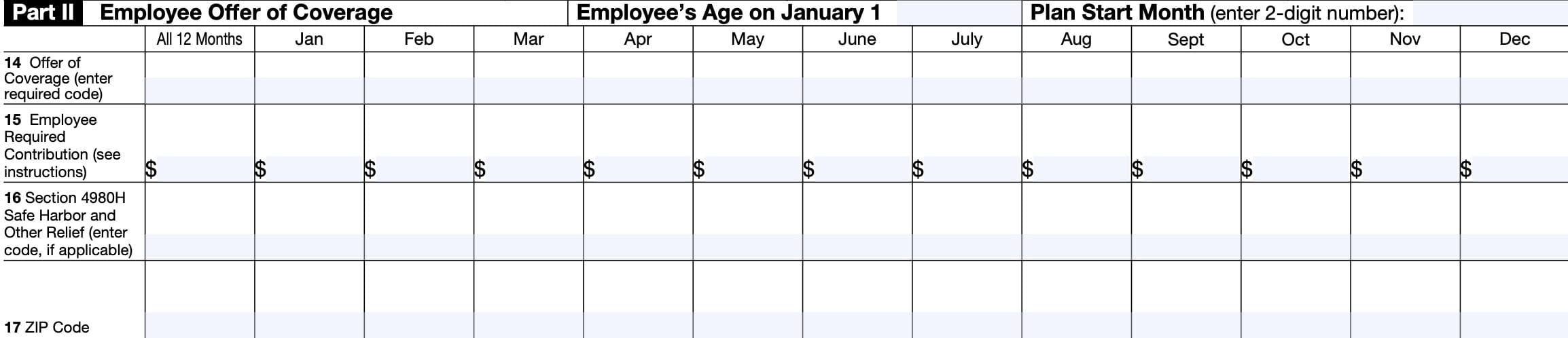

Part II: Employee Offer of Coverage

In Part II, we’ll cover each of the lines that pertain to the employee offer of coverage. Before we begin with Line 14, we’ll address two things at the top of Part II:

- Employee’s age on January 1

- Plan start month

Employee’s age on January 1

This should reflect the age of the employee as of January 1 of the current year, if the employee was offered an individual coverage health reimbursement account (HRA).

Plan start month

This box is required for the 2023 Form 1095-C and the ALE Member may not leave it blank.

In this box, you should see the 2-digit number (01 through 12) indicating the calendar month during which the plan year begins of the health plan in which your employer:

- Offered you health insurance coverage, or

- Would have offered you health care coverage if you were eligible to participate in the plan

If more than one plan year can apply (for example, if your employer changes the plan year during the tax year), then you should expect to see the earliest applicable month.

If there is no health plan under which your employer offered you coverage, you should see “00.”

Line 14: Offer of coverage

The codes listed below for Line 14 describe the coverage that your employer offered to you

and your spouse and dependent(s), if available. However, if you received an offer of coverage through a

multiemployer plan due to your union membership, that offer may not appear here.

The information on Line 14 relates to eligibility for coverage subsidized by the premium tax credit for:

- Yourself

- Your spouse

- Your dependent(s)

Line 14 should contain a value for each calendar month or portion of a month where that situation applies. If the same situation applies for every month of the year, then you should see the value in the column marked, All 12 Months.

Line 14 codes

Below is a table containing all applicable codes and their meaning. We’ll break them down into two sections:

- If you don’t have a health reimbursement account (HRA)

- If you do have an HRA

If you don’t have an HRA

| Code | Code Meaning |

| 1A | Minimum essential coverage (MEC) providing minimum value offered to you with an employee required contribution for self-only coverage equal to or less than 9.5% (as adjusted) of the 48 contiguous states single federal poverty line and minimum essential coverage offered to your spouse and dependent(s). This is known as a Qualifying Offer. |

| 1B | MEC providing minimum value offered to you but NOT offered to your spouse or dependent(s). |

| 1C | MEC providing minimum value offered to you and your dependents but NOT offered to your spouse. |

| 1D | MEC providing minimum value offered to you and your spouse but NOT offered to your dependents. |

| 1E | MEC providing minimum value offered to you and offered to your dependent(s) and spouse. |

| 1F | MEC NOT providing minimum value offered to you, or you and your spouse or dependent(s), or you, your spouse, and dependent(s). |

| 1G | You were NOT a full-time employee for any month of the calendar year but were enrolled in self-insured employer-sponsored coverage for one or more months of the calendar year. |

| 1H | No offer of coverage. You were NOT offered any health coverage or you were offered coverage that is NOT minimum essential coverage. |

| 1I | Reserved for future use. |

| 1J | MEC providing minimum value offered to you; MEC conditionally offered to your spouse; and MEC NOT offered to your dependent(s). |

| 1K | MEC providing minimum value offered to you; MEC conditionally offered to your spouse; and MEC offered to your dependent(s). |

If you have an HRA

| 1L | Individual coverage health reimbursement arrangement (HRA) offered to you only with affordability determined by using employee’s primary residence ZIP code. |

| 1M | Individual coverage HRA offered to you and dependent(s), but not your spouse with affordability determined by using employee’s primary residence ZIP code. |

| 1N | Individual coverage HRA offered to you, spouse, and dependent(s) with affordability determined by using employee’s primary residence ZIP code. |

| 1O | Individual coverage HRA offered to you only using the employee’s primary employment site ZIP code affordability safe harbor. |

| 1P | Individual coverage HRA offered to you and dependent(s), but not your spouse using the employee’s primary employment site ZIP code affordability safe harbor. |

| 1Q | Individual coverage HRA offered to you, spouse, and dependent(s) using the employee’s primary employment site ZIP code affordability safe harbor. |

| 1R | Individual coverage HRA that is NOT affordable offered to you; employee and spouse or dependent(s); or employee, spouse, and dependents. |

| 1S | Individual coverage HRA offered to an individual who was not a full-time employee. |

| 1T | Individual coverage HRA offered to employee and spouse (no dependents) with affordability determined using employee’s primary residence ZIP code. |

| 1U | Individual coverage HRA offered to employee and spouse (no dependents) using employee’s primary employment site ZIP code affordability safe harbor. |

| 1V through 1Z | Reserved for future use. |

Line 15: Employee required contribution

Line 15 reports the employee required contribution. This is your monthly cost for the lowest cost self-only minimum essential coverage, providing minimum value that your employer offered to you.

Individual coverage HRA

For an individual coverage HRA, the employee required contribution is the excess of the monthly premium based on the employee’s applicable age for the applicable lowest cost silver plan over the monthly individual coverage HRA amount. The monthly individual coverage HRA amount is generally the annual amount divided by 12.

Line 15 will show an amount only if one of the following codes appears on Line 14:

- 1B

- 1C

- 1D

- 1E

- 1J

- 1K

- 1L

- 1M

- 1N

- 1O

- 1P

- 1Q

- 1T

- 1U

Coverage at no cost

If you were offered coverage but there is no cost to you for the coverage, this line will report “0.00” for the amount.

Line 16: Section 4980H Safe Harbor and other relief

This code provides the IRS information to administer the employer shared responsibility provisions. Other than a code 2C, which reflects your enrollment in your employer’s coverage, this information does not affect your eligibility for the premium tax credit.

Line 17: ZIP code

This line reports the applicable ZIP code your employer used for determining affordability if you were offered an individual coverage HRA. Your ZIP code can be based upon your primary residence location, or your primary employment site.

Primary residence location

If code 1L, 1M, 1N, or 1T was used on Line 14, this will be your primary residence location.

Primary employment site

If code 1O, 1P, 1Q, or 1U was used on Line 14, this will be your primary employment site.

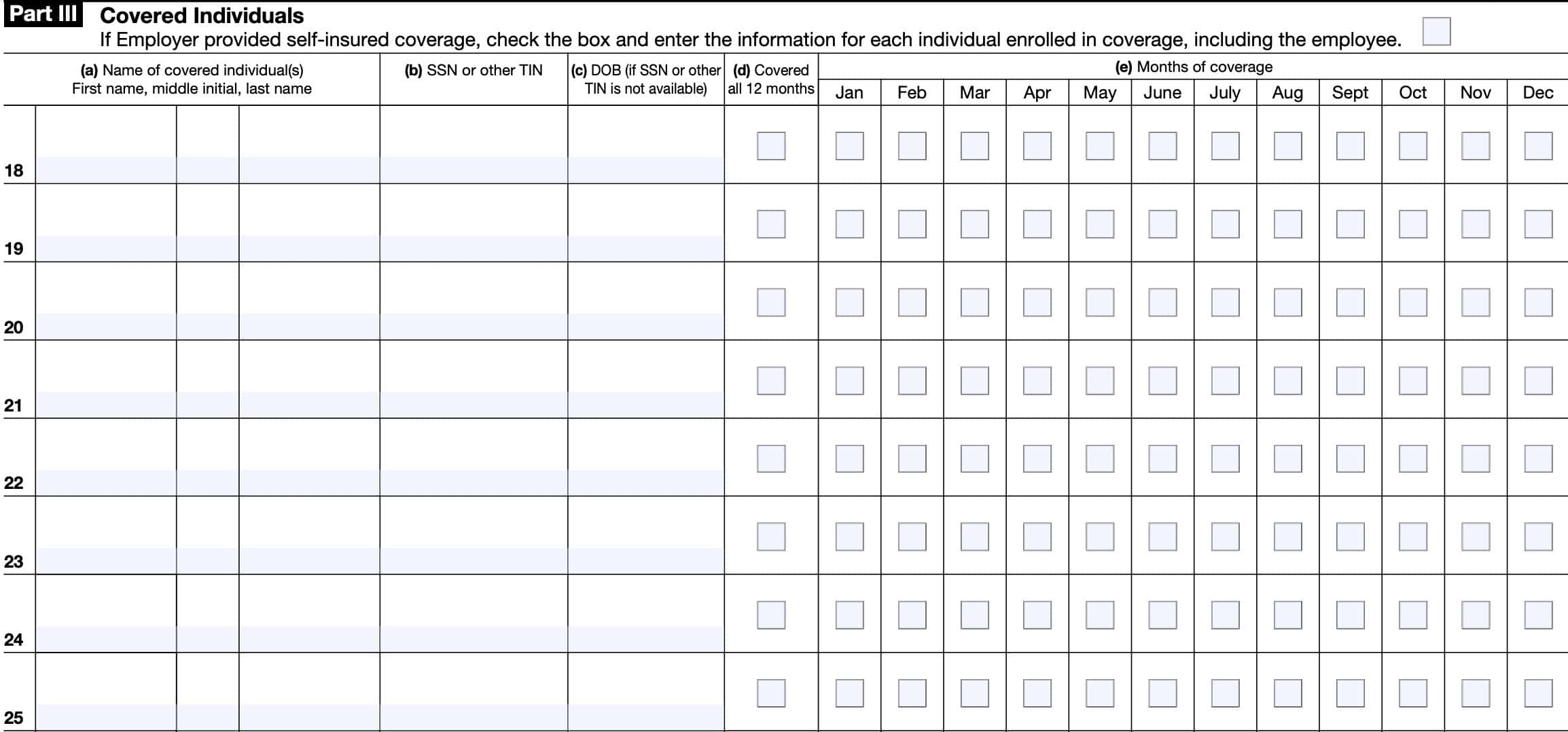

Part III: Covered Individuals

Part III contains information about covered individuals. At the very top, your employer will check the box if they provided self-insured coverage.

Additionally, each line will contain the following information about each family member:

- Name of covered individual

- SSN or TIN

- Date of birth

- Months of coverage

- Column (d) if covered all 12 months (at least 1 day in every month of the year)

- Column (e) to indicate specific months of coverage

Video walkthrough

Frequently asked questions

IRS Form 1095-C, Employer-Provided Health Insurance Offer and Coverage, is the tax form that large employers must provide to applicable employees to document the offer of health coverage or participation in the employer’s health plan.

The due date for employers to provide each employee a copy of their Form 1095-C form for the prior year is January 31. If you have not received your copy by early February, you should contact your employer for a replacement form.

No. Federal tax returns do not require individual taxpayers to report information from IRS Form 1095-C. However, taxpayers should provide a copy to family members filing a separate individual tax return, and keep a copy of IRS Form 1095-C in their tax records.

Where can I find IRS Form 1095-C?

You can find tax forms such as the 1095-C form on the IRS website. For your convenience, we’ve included the most recent version of IRS Form 1095-C right here, in our article.