IRS Form 1098-T Instructions

If you’re a college student or the parent of a college student, then you may receive IRS Form 1098-T, Tuition Statement, in the year after you paid tuition and other qualified education expenses.

In this article, we’ll walk through everything you need to know about IRS Form 1098-T, including:

- How to read and understand IRS Form 1098-T

- How to find out if you can take a tax deduction on amounts reported on IRS Form 1098-T

- Other frequently asked questions

Let’s take a closer look at the tax form itself.

Table of contents

IRS Form 1098-T Instructions

In most of our articles, we walk you through how to complete the tax form.

However, since Form-1098 is issued to taxpayers for informational purposes, most readers will probably want to understand the information reported on their 1098-T form, instead of how to complete it.

Before we start breaking down this tax form, it’s important to understand that there can be up to 3 versions of 1098-T forms.

Here is a break down of where all these forms end up:

- Copy A: Internal Revenue Service center

- Copy B: For student’s tax records

- Copy C: For filer’s tax records

Let’s take a closer look at the information fields on Form 1098-T.

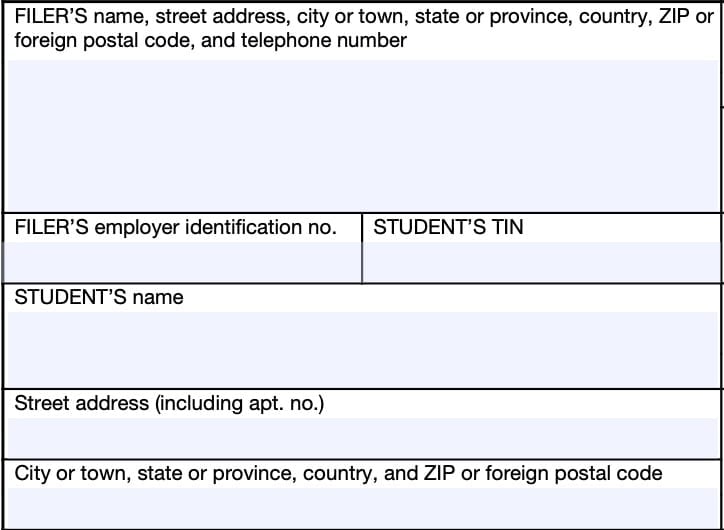

Taxpayer Information

On the left side, you’ll see the information for both the filer and the student. You’ll want to review these for accuracy.

Filer’s Name, Address, And Telephone Number

You should see the educational instituion’s complete name, address, and phone numbers in this field.

Filer’s TIN

This is the educational institution’s taxpayer identification number (TIN). This should be an employer identification number, or EIN.

The filer’s TIN should never be truncated.

Student’s TIN

As the student, you should see your taxpayer identification number in this field. For students, the TIN can be any of the following:

- Valid Social Security number (SSN)

- Individual taxpayer identification number (ITIN)

- Adoption taxpayer identification number (ATIN)

- Employer identification number (EIN)

Please review this field to make sure that it is correct.

However, you may only see part of your taxpayer identification number (such as the last four digits of your SSN), for privacy protection purposes. Copy A, which educational institutions send directly to the Internal Revenue Service, is never truncated.

Student’s Name And Address

You should see your name and street address reflected in these fields. If your address is incorrect, you should notify the educational institution and the IRS.

You can notify the IRS of your new address by filing IRS Form 8822, Change of Address. Business owners can notify the IRS of a change in their business address by filing IRS Form 8822-B, Change of Address or Responsible Party, Business.

Next, let’s look at the numbered boxes on the right-hand side of the form.

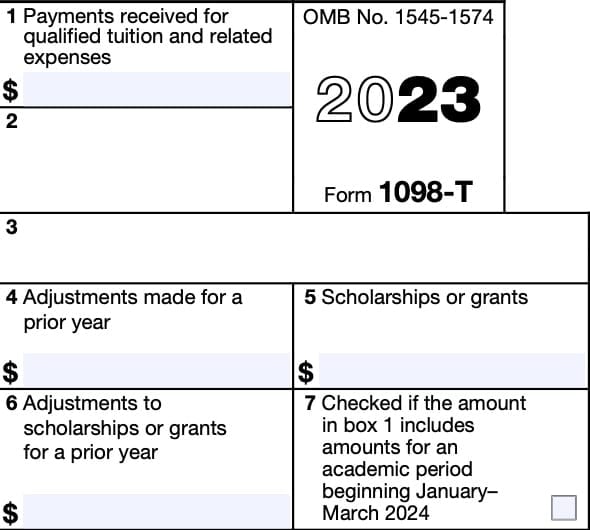

Boxes 1 Through 7

Box 1: Payments received for qualified tuition and related expenses

Box 1 shows the total payments received by an eligible educational institution during the tax year from any source for qualified tuition and related expenses, after subtracting any reimbursements or refunds made during the tax year related to those payments.

Eligible educational institution

The Internal Revenue Service (IRS) defines an eligible educational institution as a college, university, vocational school, or other postsecondary educational institution that is:

- Described in Section 481 of the Higher Education Act of 1965, and

- Is eligible to participate in the Department of Education’s student aid programs

This includes most accredited public, nonprofit, and private postsecondary institutions.

Qualified tuition and related expenses

The IRS considers qualified tuition and related expenses to be tuition, fees, and course materials that are required for a student to be enrolled at or attend an eligible educational institution.

Not qualified tuition and related expenses

The following expenditures are not considered to be qualified expenses:

- Money paid for any course or education involving sports, games or hobbies

- Unless part of the student’s degree program or taken to acquire or improve job skills

- Room and board

- Insurance

- Medical expenses

- Transportation

- Other personal, living, or family expenses

Box 2: Reserved

Reserved for future use.

Box 3: Reserved

Reserved for future use.

Box 4: Adjustments made for a prior year

Box 4 shows any adjustment made by the educational institution for a prior year, for qualified educational expenses previously reported on Form 1098-T.

This amount may reduce any allowable education credit that you claimed on IRS Form 8863 for the prior tax year. In this situation, you may need to recapture the previously claimed tax credit, then recalculate your new tax liability based upon the adjusted amount.

IRS Publication 970, Tax Benefits for Education, contains additional information about how to recapture education credits and recalculate tax liability in several different situations.

Box 5: Scholarships or grants

Box 5 shows the total amounts of all scholarships or grants administered and processed by the eligible educational institution.

The amount of scholarships or grants for the calendar year (including those not reported by the institution) may reduce the amount of the education credit you can claim for the year.

Box 6: Adjustments to Scholarships or grants for a prior year

Box 6 shows adjustments to the amount of scholarships or grants for a prior calendar year. This might impact the amount of either of the following federal education tax benefits claimed in that preceding year:

- Allowable tuition and fees deduction, or

- Education tax credit

You may have to file an amended federal income tax return, using IRS Form 1040-X, for the previous year.

Box 7

If Box 7 is checked, this indicates that the Box 1 amount also includes qualified educational expenses for an academic period beginning between January and March of 2024.

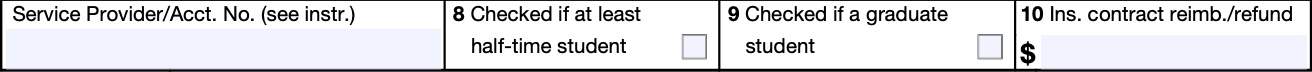

Boxes 8 through 10

At the bottom of the form lie boxes 8 through 10. We’ll go over each, but let’s first look at the information field to the left of Box 8.

Service Provider/Account number

On the lower left-hand side of the 1098-T statement, you will see a box marked, ‘Service Provider/Acct. No.’

According to the form instructions, the institution, or a service provider, must include the following information about the point of contact that works with eligible students:

- Name

- Address

- Telephone number

- Service provider information, if applicable

This contact is usually a staff member or part of the administrative office. It is an IRS requirement to give specific contact information, not just a general toll-free number.

The account number is required if the filer:

- Has multiple accounts for a recipient

- Is filing more than one Form 1098-T for that recipient

In all other cases, the IRS encourages, but does not mandate, the use of an account number in this section.

Box 8

If Box 8 is checked, this indicates that the student is enrolled at least half-time in a course of study towards an educational credential.

Box 9

If Box 9 is checked, this means that the educational institution recognizes the student as a graduate student. The student is considered to be a graduate student if he or she is enrolled in a graduate program or programs leading to one of the following:

- Graduate degree

- Graduate-level certificate

- Other recognized graduate-level educational credential

Box 10: Insurance contract reimbursement or refund

Box 10 shows the total amount of reimbursements or refunds of qualified tuition and related expenses made by an insurer.

This amount may reduce the amount of any education credit you can claim for the year on your individual tax return. In turn, this may result in an increase in tax liability for the year of the refund.

Filing IRS Form 1098-T

For tax entities who must file this tax form with the Internal Revenue Service, the IRS requires certain paper versions of information returns to be accompanied by IRS Form 1096, Annual Summary and Transmittal of U.S. Information Returns.

Check out our step-by step instructional guide for more information on how to submit your information return with IRS Form 1096.

Video Walkthrough

Watch this instructional video to learn more about how to read your IRS Form 1098-T.

Do you use TurboTax?

If you don’t, is it because the choices are overwhelming to you?

If so, you should check out our TurboTax review page, where we discuss each TurboTax software product in depth. That way, you can make an informed decision on which TurboTax offering is the best one for you!

Click here to learn more about which TurboTax option is best for you!

Frequently Asked Questions

The IRS requires educational institutions and other filers to provide each recipient a completed IRS Form 1098-T by January 31 of the calendar year following the tax year in which they incurred qualified educational expenses.

If you don’t receive IRS Form 1098-T by January 31, you should contact your college’s educational services office. Colleges may issue Form 1098-T by mail or by electronic delivery, by taxpayer consent.

There are two federal education tax credits available to taxpayers, the American Opportunity Tax Credit, and the Lifetime Learning Credit. Taxpayers may claim either educational tax credit by filing IRS Form 8863, Education Credits.

Where Can I Find IRS Form 1098-T?

You may find fillable 1098-T forms on the official IRS website. For your convenience, we’ve included the most recent version of this form in PDF format right here in this article.