IRS Form 1099-A Instructions

If you abandoned property, such as your primary residence or business equipment, you might receive IRS Form 1099-A, Acquisition or Abandonment of Secured Property from your lender the following tax year.

In this article, we’ll break down everything you need to know if you receive this form, including:

- How to read and understand IRS Form 1099-A

- When you can expect to receive IRS Form 1099-A

- Possible tax impacts of abandoned property

- When and how to report this on your income tax return

Let’s start with an overview of the tax form itself.

Table of contents

IRS Form 1099-A Instructions

In most of our articles, we walk you through how to complete the tax form. However, since Form-1099 is issued to taxpayers for informational purposes, most readers will probably want to understand the information reported on their 1099-A form, instead of how to complete it.

Before we start breaking down this tax form, it’s important to understand that there can be up to 3 copies of Forms 1099-A. Here is a break down of where all these forms end up:

- Copy A: Internal Revenue Service center

- Copy B: For borrower’s tax records

- Copy C: For lender’s records

Let’s get into the form itself, starting with the information fields on the left side of the form.

Taxpayer identification fields

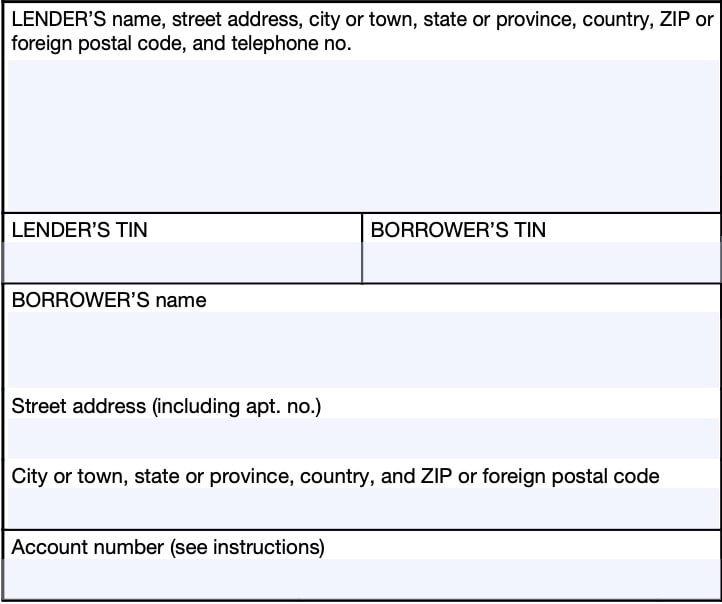

Lender’s Name, Address, And Telephone Number

You should see the lender’s contact information, with complete business name, address, zip code, and telephone number in this field.

Lender’s TIN

This is the payer’s taxpayer identification number (TIN). In most situations, this will be the employer identification number (EIN).

The lender’s TIN should never be truncated.

Borrower’s TIN

As the borrower, you should see your taxpayer identification number in this field. The TIN can be any of the following:

- Social Security number (SSN)

- Individual taxpayer identification number (ITIN)

- Adoption taxpayer identification number (ATIN)

- Employer identification number (EIN)

Please review this field to make sure that it is correct. However, you may see a truncated form of your TIN (such as the last four digits of your SSN), for privacy protection purposes.

Copy A, which is sent to the Internal Revenue Service, is never truncated.

Borrower’s Name And Address

You should see your legal name and address reflected in these fields. If your address is incorrect, you should notify the lender and the IRS.

You can notify the IRS of your new address by filing IRS Form 8822, Change of Address. Business owners can notify the IRS of a change in their business address by filing IRS Form 8822-B, Change of Address or Responsible Party, Business.

Account Number

This field is present in many information returns, such as IRS Form 1099-NEC or IRS Form 1099-MISC.

Your lender have established a unique account number for you, which may appear in this field. If the field is blank, you may ignore it.

Let’s turn to the information fields on the right-hand side of your 1099-A form.

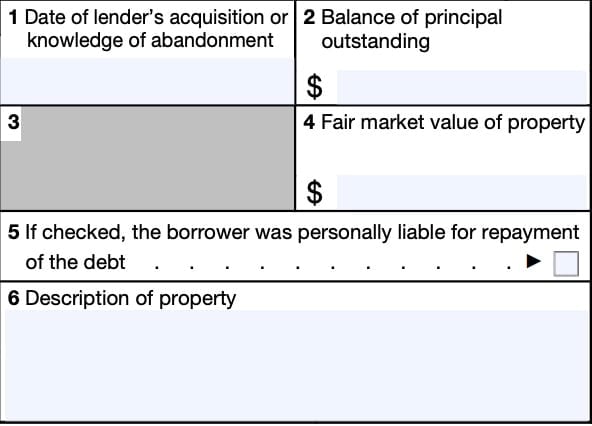

Boxes 1 through 6

On the right side of the form, we’ll go through each line. Specifically, we’ll go over the tax information you should see, and how you might report it on your federal tax return.

Box 1: Date of lender’s acquisition or knowledge of abandonment

For a lender’s acquisition of property that was security for a loan, the date shown is generally the earlier of:

- Date that the title was transferred to the lender, or

- Date that possession and the burdens and benefits of ownership were transferred to the lender

This could include the date of one of the following events:

- Foreclosure sale

- Execution sale

- Date that your right of redemption or objection expired

In the case of an abandonment, the date shown is the date on which the lender first knew or had reason to know that the property was abandoned or the date of a foreclosure, execution, or similar sale of the property.

Box 2: Balance of principal outstanding

Box 2 shows the debt owed to the lender on the loan when the lender either:

- Acquired the interest in the property, or

- Knew, or had reason to know, that the property was abandoned

This box shows principal only, and does not include interest.

Box 3: Reserved for future use

Skip. Go to Box 4.

Box 4: Fair market value of property

Shows the fair market value of the property.

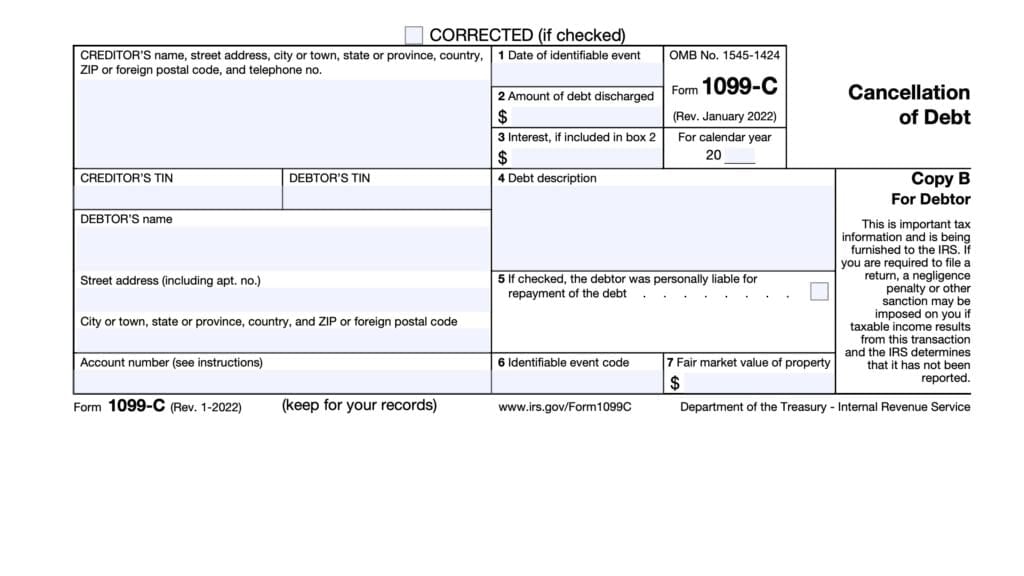

If the property’s fair market value in Box 4 is less than the outstanding loan balance in Box 2, and your debt is canceled, you may have cancellation of debt income.

Debt cancellation should be reported on IRS Form 1099-C, Cancellation of Debt. A commercial lender does have the option to include information about the foreclosed property or repossession on IRS Form 1099-C instead of sending you Form 1099-A.

For a foreclosure of real property, execution, or similar sale, your lender should enter the fair market value of the property, according to Temporary Regulations Section 1.6050J-1T, Q/A-32.

As a general rule of thumb, the gross foreclosure bid price or sales price is considered to be the property’s fair market value.

If an abandonment or voluntary conveyance to the lender in lieu of foreclosure

occurred, and your mortgage lender placed an “X” in the checkbox in Box 5, this field may contain the appraised value of the property instead.

Box 5

When checked, Box 5 indicates that you were personally liable for repayment of the debt when the debt was created or, if modified, at the time of the last modification.

If you are personally liable for repaying the debt, this is known as recourse debt. Conversely, if you are not personally liable to repay the debt, then it is nonrecourse debt.

Depending on your tax situation, this may impact whether or not you need to report the amount of the canceled debt as part of your taxable income on your individual tax return.

Box 6: Description of property

Box 6 contains a description of the property acquired by the lender or abandoned by you.

For real property, your mortgage lender must generally enter the address of the

property. If the address doesn’t sufficiently identify the property, then your lender will enter the section, lot, and block.

For tangible personal property, such as a motor vehicle, your lender would enter the applicable type, make, and model. For example, they may describe a car as “Car—2017 Honda Accord.”

You may see a category such as “Office Equipment” to describe more than one piece of personal

property, such as six desks and seven computers.

If “CCC” is shown, the form indicates the amount of any Commodity Credit Corporation loan outstanding when you forfeited your commodity.

Filing IRS Form 1099-A

For tax entities who must file this tax form with the Internal Revenue Service, the IRS requires certain paper versions of information returns to be accompanied by IRS Form 1096, Annual Summary and Transmittal of U.S. Information Returns.

Check out our step-by step instructional guide for more information on how to submit your information return with IRS Form 1096.

Reporting abandonment of secured property on your tax return

If the property’s fair market value is less than the amount of debt outstanding, then you may need to determine a capital gain or loss on the disposition of the property, based on the amount realized.

Amount realized

The amount realized depends on whether you were personally liable or not personally liable for the debt.

Recourse debt: If you were personally liable for the debt, your realized amount is the fair market value of the property.

Nonrecourse debt: If you were not personally liable for the debt, your realized amount is:

- Entire amount of nonrecourse debt, plus

- Cash and fair market value of any property received

Property not used in business

To determine the loss or gain on property that was not used for business, then you may need to use the realized amount and report the gain or loss on IRS Form 8949, Sales and Dispositions of Capital Assets, and IRS Schedule D of your Form 1040 or Form 1040-SR.

Primary residence

If the abandoned property was your primary personal residence, the current tax law allows you to exclude part or all of the gain. The Qualified Principal Residence Indebtedness (QPRI) Exclusion allows taxpayers to exclude up to $750,000 of a capital gain generated by abandonment of the property.

Property used in business

For property used in business, calculate the gain or loss on IRS Form 4797, Sales of Business Property. You may need to report this amount on your business tax return.

Individual taxpayers may report this gain or loss on either Schedule C or Schedule F, based on the nature of the property.

Video walkthrough

Watch this instructional video for a brief overview about IRS Form 1099-A.

Do you use TurboTax?

If you don’t, is it because the choices are overwhelming to you?

If so, you should check out our TurboTax review page, where we discuss each TurboTax software product in depth. That way, you can make an informed decision on which TurboTax offering is the best one for you!

Click here to learn more about which TurboTax option is best for you!

Frequently asked questions

After claiming abandoned property, lenders, such as credit unions or other financial institutions, file IRS Form 1099-A to report the portion of the debt outstanding as well as the fair market value of the property that was abandoned.

Lenders reporting abandonment of the property must file IRS Form 1099-A with the IRS by February 28 of the calendar year following the tax year of abandonment. Recipients should receive their copy of Form 1099-A no later than January 31 of the following year.

Look at your Form 1099-A, Box 5, which should say, “Check if the borrower was personally liable for repayment of the debt.” If the box is marked “Yes,” you have a recourse loan. If it’s marked “No,” you have a nonrecourse loan.

Where can I find IRS Form 1099-A?

As with other tax forms, you can find an online version of IRS Form 1099-A on the IRS website. For your convenience, we’ve included the latest version of this federal tax form here, in this article.

Related tax articles

This tax form is one of the fillable tax forms provided by the Internal Revenue Service, to help taxpayers reduce their tax preparation costs. To see more forms like this, visit our free fillable tax forms page, where you’ll also find articles like this.

Unlike the IRS, our articles contain step by step instructions for each tax form, as well as video walkthroughs. You can also check out all of our videos by subscribing to our YouTube channel!