IRS Form 1099-K Instructions

In 2021, Congress passed the American Rescue Plan Act, which provided significant changes to the Internal Revenue Code. One of the biggest changes was the introduction of IRS Form 1099-K, Payment Card and Third Party Network Transactions.

In this article, we’ll walk through everything you need to know about IRS Form 1099-K, including:

- How to read and understand IRS Form 1099-K

- How to report the information you received on your tax return

- What to do if your Form 1099-K is incorrect

- Frequently asked questions

Let’s start with an overview of IRS Form 1099-K.

Table of contents

IRS Form 1099-K instructions

In most of our articles, we walk you through how to complete the tax form. However, since Form-1099 is issued to taxpayers for informational purposes, most readers will probably want to understand the information reported on their 1099-K form, instead of how to complete it.

Before we start breaking down this tax form, it’s important to understand that there can be up to 5 copies of Forms 1099-K. Here is a break down of where all these forms end up:

- Copy A: Internal Revenue Service center

- Copy 1: For state, city, or local tax department

- Copy B: For recipient’s tax records

- Copy 2: To be filed with employee’s state, city, or local tax return

- Copy C: For the filer

For employees who do not pay state, city, or local income tax, copies 1 and 2 are optional.

Let’s get into the form itself, starting with the information fields on the left side of the form.

Taxpayer identification fields

Filer’s Name, Address, And Telephone Number

You should see the filer’s complete business name, address, and telephone number in this field.

Just below this field, you’ll see a couple of fields with check boxes.

Check to indicate if FILER is a(an)

You’ll see this field to indicate whether the filing entity is either a payment settlement entity (PSE) or an electronic payment facilitator (EPF), or other third party.

Payment settlement entities

A PSE is a domestic or foreign entity that is a merchant acquiring entity.

This could be:

- A bank or other organization that has the contractual obligation to make payment to participating payees in settlement of payment card transactions; or

- A third party settlement organization (TPSO)

- A TPSO is the central organization that has the contractual obligation to make payments to participating payees of third party network transactions.

Electronic payment facilitators

An electronic payment facilitator, or EPF, is a third party that a PSE may contract with to make payments in settlement of reportable payment transactions on the PSE’s behalf.

Generally, if there is an EPF or other third party facilitator, then that entity must file IRS Form 1099-K in lieu of the PSE.

In this situation, you can expect the EPF’s information in the filer information fields above. The PSE’s name and telephone number will be located under the payee’s tax information, later in the form.

Check to indicate transactions reported are

There are two check boxes in this area:

- Payment card transactions

- Third party network transactions

For payment card transactions, you can expect the top box to contain a check. For third party network transactions, the second box will have a check.

If you received both payment card transactions and third party network transactions from the same entity, then you can expect a separate Form 1099-K reporting the gross amount of each type of transaction.

Generally, the IRS only requires third party settlement organizations to file IRS Form 1099-K for transactions that total over $600 in a given calendar year.

IRS note for tax years 2023 and 2024

Although the Form 1099-K threshold is listed at $600 in the form instructions, there is additional IRS guidance for tax years 2023 and 2024.

2023 tax year guidance

According to Internal Revenue Notice 2023-74, calendar year 2023 has been marked as a transition year for IRS Form 1099-K filing requirements. For tax year 2023, filers are only required to file IRS Form 1099-K in the following circumstances:

- Gross payments exceed $20,000, and

- There are more than 200 transactions in the given tax year

2024 tax year guidance

In IRS Notice 2024-85, the IRS indicates that the Internal Revenue Service has lowered the reporting threshold to $5,000 per payee, from the 2023 requirement of $20,000. There is no indicated limit based upon the number of transactions

2025 Tax Year Guidance

IRS Notice 2024-85 also indicates that for 2025, the reporting threshold will be $2,500 per payee.

Guidance for tax years after 2025

In IRS Notice 2024-85, the IRS intends to set the permanent reporting threshold for 1099-K forms at $600. This is consistent with the reporting threshold for Forms 1099-MISC and 1099-NEC.

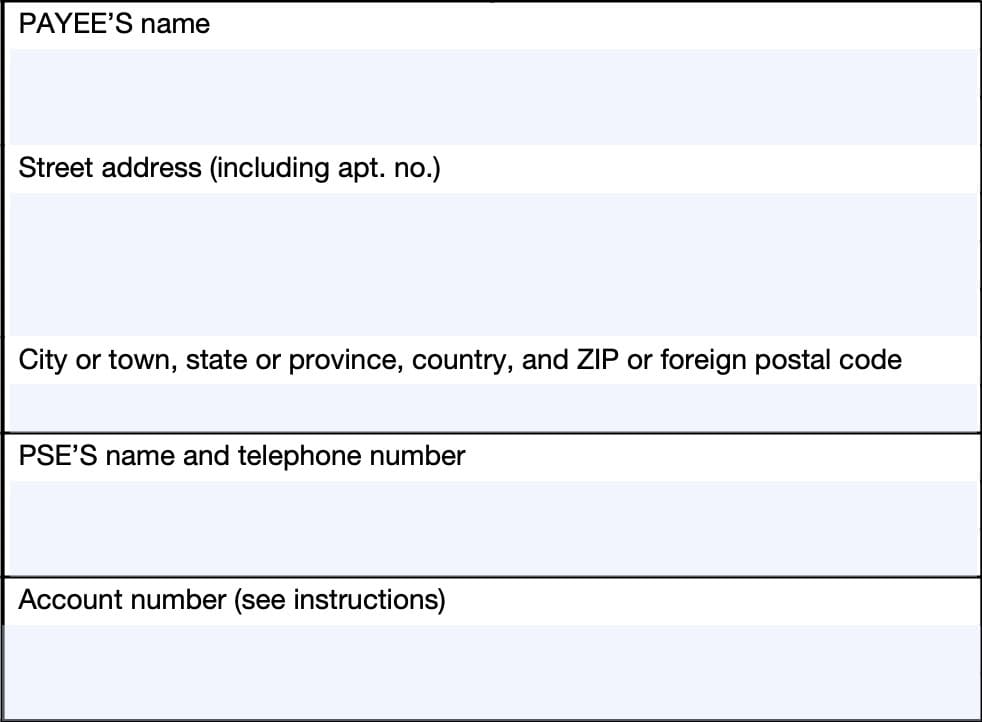

Payee’s name and address

You should see your legal name and address reflected in these fields. If your address is incorrect, you should notify the payer and the IRS.

You can notify the IRS of your new address by filing IRS Form 8822, Change of Address. Business owners can notify the IRS of a change in their business address by filing IRS Form 8822-B, Change of Address or Responsible Party, Business.

PSE’s name and telephone number

If the EPF/Other third party box is checked in the Check to see if FILER is field above, then you should expect to see the contact information for the PSE listed in this information field.

Account number

On the bottom left-side of the 1099-K tax form, you’ll see a box marked, ‘Account number.’

The IRS requires the filer to complete this box only if the filer has multiple accounts for the same recipient, and the filer is preparing more than one Form 1099-K for that recipient.

Let’s go to the top right-hand side of the form.

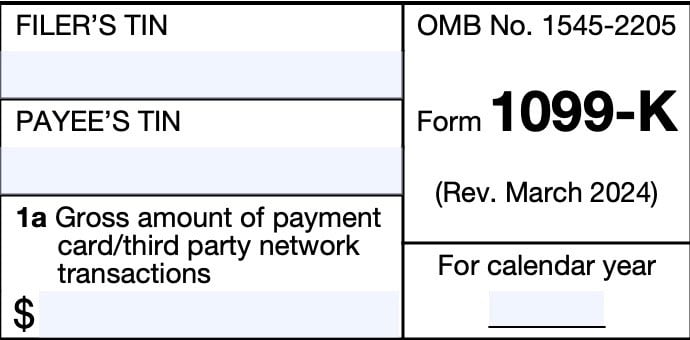

Tax information

On the right-hand side of the form, below the TIN fields, you should see information that may need to be reported on your income tax return. Before we start with Box 1a, let’s cover what you should expect in the TIN fields.

Filer’s TIN

This is the filer’s taxpayer identification number (TIN). In most situations, the payer’s tax identification number will be an employer identification number (EIN).

The payer’s TIN should never be truncated.

Payee’s TIN

As the recipient or payee, you should see your taxpayer identification number in this field. For payees, the TIN can be any of the following:

- Social Security number (SSN)

- Individual taxpayer identification number (ITIN)

- Adoption taxpayer identification number (ATIN)

- Employer identification number (EIN)

Please review this field to make sure that it is correct. However, you may see a truncated form of your TIN (such as the last four digits of your SSN), for privacy protection purposes.

Copy A, which the filer will send to the Internal Revenue Service, should not appear truncated.

Box 1a: Gross amount of payment card/third party network transactions

Box 1a shows the aggregate gross amount of payment card or third-party payment network transactions made to you through the PSE during the calendar year.

Definition of gross amount

Gross amount means the total dollar amount of total reportable payment transactions for each participating payee without regard to any of the following adjustments:

- Credits

- Cash equivalents

- Discount amounts

- Fees

- Refunded amounts

- Other amounts

The dollar amount of each transaction is determined on the date of the transaction.

De minimis payments exception

Generally, the IRS requires a TPSO to report information concerning third-party network

transactions of any participating payee only if the gross amount of total reportable payment transactions exceeds $600 for the calendar year, regardless of the number of transactions.

As previously indicated, for tax years 2023 and 2024, the IRS has raised the de minimis payments exception to:

- 2023 tax year: $20,000 and 200 transactions

- 2024 tax year: $5,000

- 2025 tax year: $2,500

- 2026 and beyond: $600

For additional information, Treasury Regulations Section 1.6050W-1(e) contains examples of reportable payment transactions.

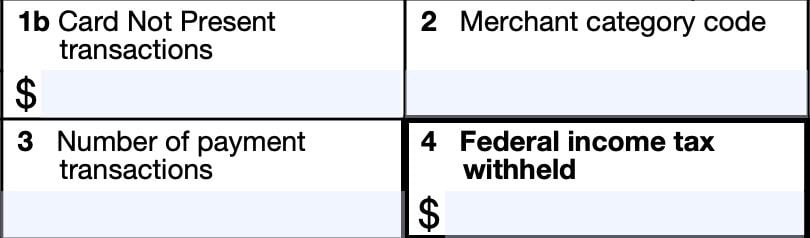

Box 1b: Card not present transactions

Box 1b shows the aggregate gross amount of all reportable payment transactions made to you through the PSE during the calendar year where either:

- The payment was not present at the time of the transaction, or

- The card number was manually keyed into the credit card terminal

Generally, this applies to online sales, phone sales, or catalogue sales. You will not see Card Not Present transactions reported here if:

- There is a check in the box for third party network, or

- There are third party network transactions

Box 2: Merchant category code

This box may contain a four-digit category code, known as a merchant category code, or MCC.

MCCs are used to classify payees for payment card transactions. If the filer uses a different industry classification system, instead of, or in addition to MCCs, this field may correspond to the closest description of the recipient’s business.

However, if the filer is a TPSO, or does not use any industry classification system for its payees, this box may be blank.

If a payee has receipts classified under multiple MCCs

If a payee has receipts classified under more than one MCC, the IRS form instructions direct the filer to do one of the following:

- File separate Forms 1099-K reporting the gross receipts for each MCC, or

- File a single Form 1099-K reporting total gross receipts and the MCC which corresponds to the largest portion of the total gross receipts.

Box 3: Number of payment transactions

Box 3 shows the number of payment transactions processed through the payment card or third party network during the tax year.

This amount does not include refund transactions.

Box 4: Federal income tax withheld

You should see backup withholding amounts reported in Box 4.

If you have not given your TIN to the payer, you may be subject to backup withholding rules on payments made on IRS Form 1099-K.

In this case, you may be asked to complete IRS Form W-9, Request for Taxpayer Identification Number and Certification. This will allow the payer to report the correct TIN to the Internal Revenue Service.

How To Report Federal Income Tax Withheld On Your Tax Return

Report any income taxes withheld as taxes paid when filing your income tax return.

Boxes 5a through 5l

These fields break down the gross amount of the total reportable payment transactions for each month of the calendar year

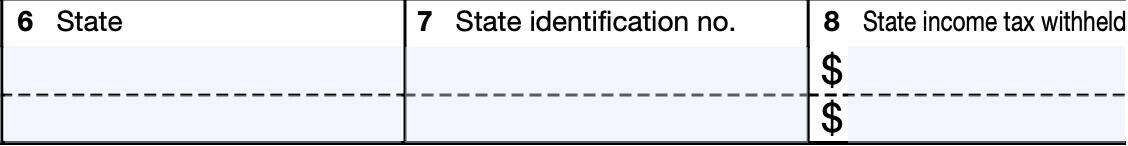

State tax information

If you live in a state without income tax, you may not see any information in Boxes 16 through 18. However, Boxes 6 through 8 may contain relevant tax information for up to 2 different states.

Box 6: State

If applicable, Box 6 will contain the name or the two-letter acronym of the state for which you had income tax withheld.

Box 7: State identification number

If your payer has a specific state tax identification number, that TIN will appear in Box 7.

Box 8: State Income tax withheld

Box 8 contains the actual tax withheld for state tax purposes.

What you should do with your IRS Form 1099-K form

The IRS website recommends the following actions for taxpayers who receive IRS Form 1099-K and don’t know what to do:

- Check the information on the form

- Check your records

- Use your Form 1099-K to report your income

- Specific actions if the form doesn’t accurately reflect your tax situation

Check the information on your tax form

You should check two pieces of information when examining your form: your taxpayer ID number (TIN) and the gross payment amount in Box 1a.

Taxpayer identification number

The number listed should be your last 4 digits of the appropriate taxpayer ID number.

However, you may need to have your Form 1099-K corrected if your name and TIN are on the form, and you report business income on any of the following tax forms:

- IRS Form 1120, U.S. Corporation Income Tax Return

- IRS Form 1120-S, U.S. Income Tax Return for an S Corporation

- IRS Form 1065, U.S. Return of Partnership Income

Gross payment amount

You should check Box 1a for the total value of payments that you received through payment cards, such as credit cards and debit cards, as well as third-party networks.

This amount is not adjusted for any of the following:

- Fees

- Credits

- Refunds

- Shipping

- Cash equivalents

- Discounts

These amounts are not taxable income. You should check your records for expenses that you may be able to deduct.

If your Form 1099-K has incorrect information

If your TIN or gross payment amounts are incorrect, you have several options:

- Contact the issuer

- File your tax return if you cannot get a corrected form

Contact the issuer

You should contact either the filer (listed in the top left corner), or the payment settlement entity, in the lower left side of the form.

Keep a copy of your corrected Form 1099-K with your tax records. The IRS warns taxpayers that the federal government cannot correct your Form 1099-K.

File your tax return

You should still file your tax return, even if you cannot get a corrected form. The IRS shows two ways to use Schedule 1 to report incorrect payments so that they do not increase your tax liability:

- Tax years 2023 and earlier

- Tax years 2024 and later

2023 and earlier

If your TIN is incorrect, you should still report payments from the Form 1099-K and any other sources of personal or business income that you would normally report.

If your gross payment amount, you should report the incorrect amount on Line 8z of IRS Schedule 1 as Other Income, then note the adjustment on Line 24z, Other adjustments.

The IRS provides the following example:

Example

You receive Form 1099-K that includes $20,500 your family sent you for college tuition and books.

On Schedule 1 (Form 1040):

- Enter the error on Part I – Line 8z – Other income: “Form 1099-K received in error, $20,500”

- Adjust it on Part II – Line 24z – Other adjustments: “Form 1099-K received in error, $20,500”

These 2 entries note the error and result in a $0 net effect on your adjusted gross income (AGI). In a similar situation (the sale of a personal item for a loss), this YouTube video walks through how to use Schedule 1 to ensure that your Form 1099-K does not result in an increase in your tax bill.

2024 and subsequent years

In tax year 2024, Schedule 1 has been updated to include a space at the top of the form to report erroneous amounts, or amounts for personal items sold at a loss. This eliminates the need to report the 1099-K gross amount as an addition to income (in Part I) and an adjustment to income in Part II.

Check your records

Your records might include reports from payment apps or online marketplaces, payment card receipts, or merchant statements. You can use these records to:

- Confirm the accuracy of amounts paid to you

- Check for expenses that you can deduct from your business income

Now, more than ever, good recordkeeping is vital.

Use IRS Form 1099-K to report your income

Taxpayers must report all income received on their tax return, whether it’s reported on your Form 1099-K or another form, such as IRS Form 1099-NEC or IRS Form 1099-MISC.

There are several ways the IRS instructs taxpayers to report income reported on IRS Form 1099-K:

- Selling personal items

- Selling goods, rented property, or providing services

Selling personal items

If you sold a personal item, you either sold it for a loss or for a profit.

Selling personal items for a loss

If you sold a personal item for a loss, you can’t deduct this loss from your tax liability. However, beginning in 2024, you can report the sale of a personal item for a loss directly at the top of Schedule 1.

For tax years 2023 and earlier, see the guidance mentioned earlier in this article.

Selling personal items for a gain or profit

If you made a profit or gain on the sale of a personal item, your profit is taxable. The profit is the difference between:

- The amount you received for selling the item, and

- The amount you originally paid for the item

If you receive a Form 1099-K for a personal item sold at a gain, then you will need to figure and report the gain on both IRS Form 8949 and Schedule D. You can watch this video for a demonstration on how this works.

Selling goods, rented property, or providing services

You may get a Form 1099-K if you received payments through payment cards, payment apps or online marketplaces.

These transactions can include payments that you received:

- As a gig worker, freelancer, or independent contractor, or

- From selling items as a hobby

Depending on the nature of your business, you may need to report in different places when filing your tax return.

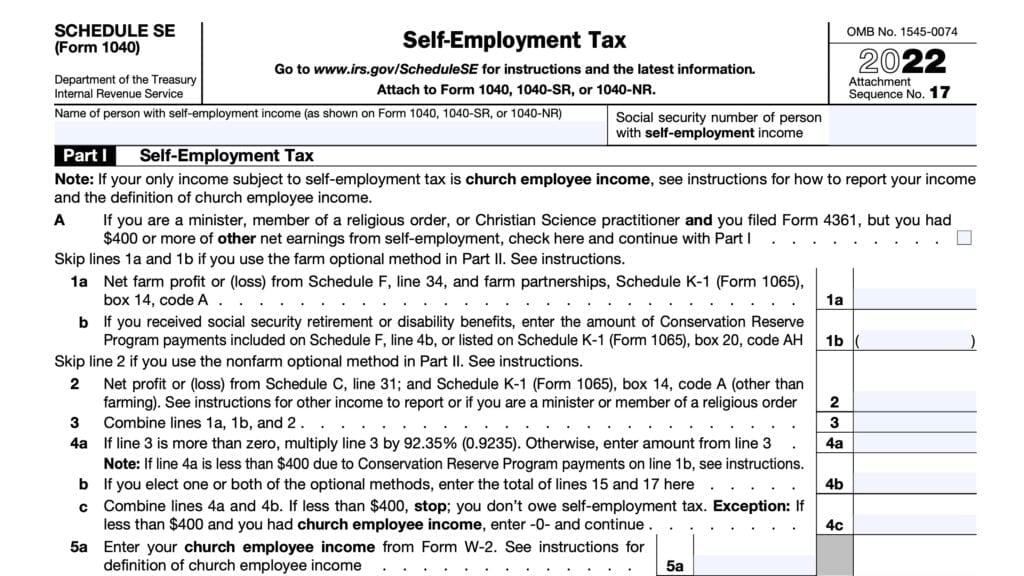

Gig worker, freelancer, hobby seller, or other self-employed individuals

Generally, the IRS considers you to be a sole proprietor, under any of these circumstances. Sole proprietors calculate their income tax liability on Schedule C, Profit or Loss from Business, when filing their tax return.

Partnerships

Partnerships would report payments received on Schedule E, Supplemental Income and Loss.

Corporations

Corporations will report their income on a corporate tax return.

Rental income

People who received rental income may report it on either Schedule E or Schedule C, depending on whether this is your primary occupation.

Specific actions

If you receive a Form 1099-K, even though you shouldn’t have

You may get a Form 1099-K when you shouldn’t have if it:

- Reports personal transactions from family or friends

- Examples include gifts (such as concert tickets) or reimbursements (splitting the cost of a car ride)

- Doesn’t belong to you

- Duplicates a Form 1099-K you already received

If this happens:

- Contact the issuer immediately – see “Filer” on the top left corner of Form 1099-K to find out the name and contact information of the issuer.

- Ask for a corrected Form 1099-K that shows a zero amount.

- Keep a copy of the original form and all correspondence with the issuer for your records.

- Don’t wait to file your taxes. File your tax return, and report the information at the top of Schedule 1

If the gross amount should be shared

There may be several situations where the gross payment amount must be shared with other parties. Below are examples of the most common scenarios, and what to do.

Shared credit card terminal

If you shared your credit card terminal with another person or business, your Form 1099-K will include payment card transactions that belong to them, plus your own payments.

What to do

You should do the following:

- If required, file and furnish the appropriate information return or information returns for each person or business with whom you shared a card terminal

- Include the total payment card transaction amount, plus any other income that belongs to that person or business

- Keep records of payments issued to each person or business sharing your terminal, including:

- Shared terminal written agreements

- Cancelled checks

Business bought or sold

If you bought or sold your business during the year, your Form 1099-K may include payments for transactions made before or after the sale. This can happen when the card terminal isn’t updated with the new business owner’s tax ID number and business name.

What to do

- Request a corrected Form 1099-K from the PSE or FILER on the form

- Keep a copy of corrected Form(s) 1099-K with your records

- Along with the purchase or sales agreement that shows the timing of the ownership change

Business entity change

A business entity or tax ID change can affect your Form 1099-K reporting.

For example, if you converted from a sole proprietorship (Schedule C) to a partnership (Form 1065) and continued using the same card terminal, the amount shown on the Form 1099-K won’t match with your new entity’s tax return.

What to do

- Immediately notify your merchant acquirer of any change to the name and tax ID number that links the terminal to your current business structure.

- Keep records to support the correct income and deductions for both business entities.

Cash back payments

If you allow customers to get cash back when they use their debit cards, these payments will be reported on Form 1099-K.

Generally, you wouldn’t include cash back amounts as part of your gross receipts. You also wouldn’t claim them as a business expense.

Instead, keep records of customer cash back activity during the year for your tax records.

Multiple sources of business income

You might report multiple sources of income on more than one line of a return or on multiple returns or schedules.

For example, you may operate a retail business as a sole proprietor and have rental income. You may accept payment cards for both businesses.

If you process the payments on one terminal, your Form 1099-K would include gross payment amounts for both businesses.

What to do

- Use your books and records to report all gross receipts on the appropriate line or schedule.

- In this example, you report gross receipts from the retail business on Schedule C and amounts for rental activity in the rental income on Schedule E.

Video walkthrough

Watch our instructional video to learn more about IRS Form 1099-K!

Do you use TurboTax?

If you don’t, is it because the choices are overwhelming to you?

If so, you should check out our TurboTax review page, where we discuss each TurboTax software product in depth. That way, you can make an informed decision on which TurboTax offering is the best one for you!

Click here to learn more about which TurboTax option is best for you!

Frequently asked questions

The IRS requires payment settlement entities and other third-party settlement organizations to provide each taxpayer a copy of IRS Form 1099-K no later than January 31. The IRS version must be filed by February 28.

Receiving a Form 1099-K doesn’t automatically mean you’ll owe income tax on the gross sales amount reported to you. This form only reports your gross proceeds from business transactions or personal transactions. You must calculate your tax bill on your income tax return.

If you forget to report the income documented on a 1099 form, the IRS will probably catch this error. If you owe taxes, the IRS will usually calculate interest and any penalties that may apply to your unreported amount.

Where can I find IRS Form 1099-K?

As with other tax forms, you can find IRS Form 1099-K on the IRS website. For your convenience, we’ve included this form here in our article.

Related tax articles

This tax form is one of the fillable tax forms provided by the Internal Revenue Service, to help taxpayers reduce their tax preparation costs. To see more forms like this, visit our free fillable tax forms page, where you’ll also find articles like this.

Unlike the IRS, our articles contain step by step instructions for each tax form, as well as video walkthroughs. You can also check out all of our videos by subscribing to our YouTube channel!