IRS Form 1099-SA Instructions

If you received distributions from a health savings account or a medical savings account, you should receive a copy of IRS Form 1099-SA, Distributions From an HSA, Archer MSA, or Medicare Advantage MSA the following tax year.

In this article, we’ll walk you through what you need to know about this tax form, including:

- How to read and understand IRS Form 1099-SA

- Types of distributions that may be reported to you

- How to report distributions on your income tax return

Let’s start by taking a closer look at the tax form itself.

Table of contents

IRS Form 1099-SA instructions

In most of our articles, we walk you through how to complete the tax form. However, since Form-1099 is issued to taxpayers for informational purposes, most readers will probably want to understand the information reported on their 1099-SA form, instead of how to complete it.

Before we start breaking down this tax form, it’s important to understand that there can be up to 3 copies of Forms 1099-SA. Here is a break down of where all these forms end up:

- Copy A: Internal Revenue Service center

- Copy B: For recipient’s tax records

- Copy C: For the trustee or payer

Let’s get into the form itself, starting with the information fields on the left side of the form.

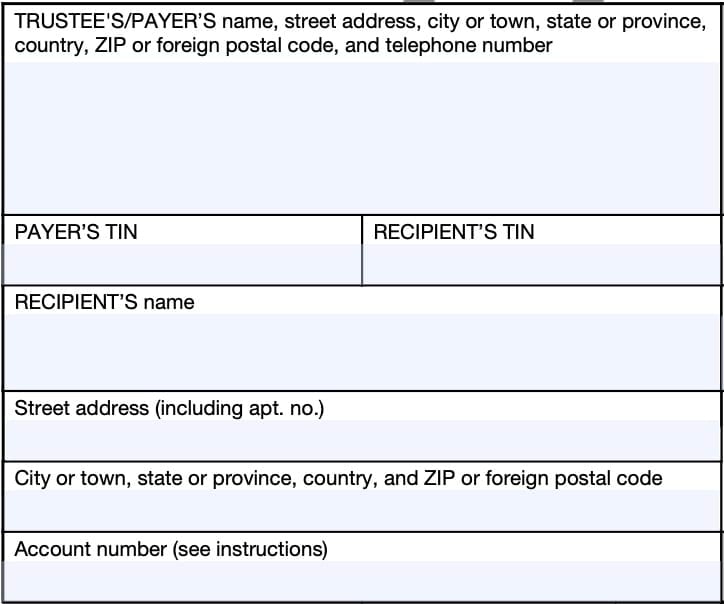

Taxpayer identification fields

Trustee/Payer’s Name, Address, And Telephone Number

You should see the trustee’s or payer’s contact information, with complete business name, address, zip code, and telephone number in this field.

Trustee/Payer’s TIN

This is the payer’s taxpayer identification number (TIN). In most situations, this will be the employer identification number (EIN).

The payer’s TIN should never be truncated.

Recipient’s TIN

As the recipient, you should see your taxpayer identification number in this field. The TIN can be any of the following:

- Social Security number (SSN)

- Individual taxpayer identification number (ITIN)

- Adoption taxpayer identification number (ATIN)

- Employer identification number (EIN)

Please review this field to make sure that it is correct. However, you may see a truncated form of your TIN (such as the last four digits of your SSN), for privacy protection purposes.

Copy A, which is sent to the Internal Revenue Service, is never truncated.

Recipient’s Name And Address

You should see your legal name and address reflected in these fields. If your address is incorrect, you should notify the lender and the IRS.

You can notify the IRS of your new address by filing IRS Form 8822, Change of Address. Business owners can notify the IRS of a change in their business address by filing IRS Form 8822-B, Change of Address or Responsible Party, Business.

Account Number

This field is present in many information returns, such as IRS Form 1099-NEC or IRS Form 1099-MISC.

Your trustee or payer have established a unique account number for you, which may appear in this field. If the field is blank, you may ignore it.

Let’s turn to the information fields on the right-hand side of your 1099-SA form.

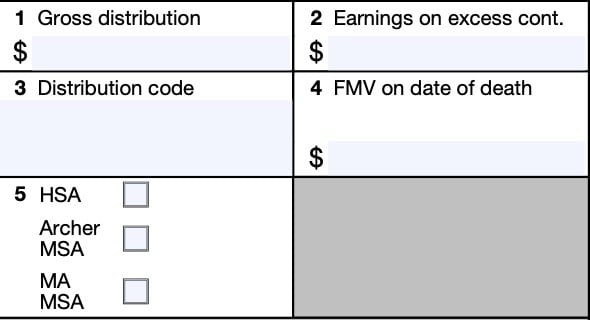

Boxes 1 through 5

On the right hand side of Form 1099-SA, you’ll see the information fields regarding your distributions. Let’s start at the top with Box 1.

Box 1: Gross distribution

Box 1 shows the total amount of distributions received in the tax year. The total distributions may be either:

- Direct payments to a medical service provider, or

- Distributions issued directly to the account owner

This amount also includes any earnings separately reported in Box 2. However, the form issuer does not have to determine the taxable amount of an HSA distribution or MSA distribution.

This amount should not be a negative number.

Excess contribution removal

This box will not report the withdrawal of excess employer contributions (and the earnings on them) returned to an employer as a distribution from an employee’s HSA.

Also, this box will not report excess MA MSA contributions returned to the Secretary of Health and Human Services or his or her representative.

Box 2: Earnings on excess contributions

Box 2 will contain the earnings on any excess contributions that you withdrew from either a health savings account (HSA) or an Archer MSA by the tax filing deadline. This amount is also included in Box 1.

For HSAs and Archer MSAs, your form issuer should use the method under Treasury Regulations Section 1.408-11 for calculating net income attributable to IRA contributions that are distributed as a returned contribution.

If the amount in box 2 includes earnings on excess contributions, you should also expect to see distribution code 2 in Box 3.

Reporting earnings on excess MSA or HSA contributions

If you withdrew the excess, plus any earnings, by your federal income tax return’s due date, you must include the earnings in your taxable income in the year you received the distribution even if you used it to pay qualified medical expenses.

Include these earnings on the ‘Other income’ line of your income tax return. The IRS will impose an excise tax of 6% for each calendar year for excess individual and employer contributions that remain in your account.

If this applies, you may also need to file IRS Form 5329, Additional Taxes on

Qualified Plans (Including IRAs) and Other Tax-Favored Accounts, with your tax return.

Annual contribution limits

The IRS prescribes annual contributions limits for HSAs and Archer MSAs, which are adjusted each calendar year for inflation. Let’s start with HSA contribution limits.

HSA contribution limits

The annual HSA contribution limit is the total limit for both employer contributions and employee contributions to an HSA account.

For 2023, the limit for total contributions are as follows:

- $3,850 for self-only coverage

- $7,750 for family coverage

For 2024, the annual HSA contribution limits are as follows:

- $4,150 for self-only coverage

- $8,300 for family coverage

Each year, the HSA contribution deadline is the due date for the tax return from the previous tax year. Taxpayers who are age 55 and older can contribute an additional $1,000 into their HSA account per year as a catch-up contribution.

MSA contribution limits

For an Archer medical savings account, or Archer MSA, the contribution rules are a little different. Archer MSA contributions are subject to both an annual contribution limit as well as an income limit.

Annual MSA contribution limit

You or your employer can make tax-free contributions of up to 75% of the annual deductible of your high deductible health plan (HDHP) to your Archer MSA. If you have a self-only plan, your contribution limit is 65% of the deductible.

To contribute the full amount, you must have the HDHP for the entire tax year. If you don’t qualify for the full deduction, you must determine your annual deductible limit by using the Line 3 Limitation Chart and Worksheet in the Instructions for IRS Form 8853, Archer MSAs and Long-Term Care Insurance Contracts.

Income limits for MSA contributions

You can’t contribute more than you earned for the year from the employer through whom you have your HDHP.

If you are self-employed, you can’t contribute more than your net self-employment income. This is your income from self-employment minus expenses (including the deductible part of self-employment tax as calculated on Schedule SE of your tax return).

Box 3: Distribution code

Box 3 contains distribution codes that describe the type of distribution being reported. Below is a complete list of distribution codes you might see on Form 1099-SA.

| Distribution code | Meaning | Description |

| 1 | Normal distribution | For normal distributions to the account holder and any direct payments to a medical service provider. Also used for payments to a decedent’s spouse beneficiary after the year of death. This code is used if no other code applies. |

| 2 | Excess contributions | This code applies to distributions of excess HSA or Archer MSA contributions to the account holder. |

| 3 | Disability | Applies to distributions after the account holder was disabled (according to IRC Section 72(m)(7)). |

| 4 | Death distribution other than code 6 | Used for payments to a decedent’s estate in the year of death, or for payments to an estate after the year of death. |

| 5 | Prohibited transaction | As defined by IRC Section 220(e)(2) and Section 223(e)(2) |

| 6 | Death distribution after year of death to a nonspouse beneficiary | Used for payments to a decedent’s nonspouse beneficiary, other than an estate, after the year of death. |

Box 4: FMV on date of death

If the account holder died, shows the fair market value of the account on the date of death.

Death of the account holder

MSAs and HSAs have similar rules regarding what happens when the account holder dies. Let’s take a closer look at each.

Archer MSAs and MA MSAs

When the account holder dies and the designated beneficiary is the surviving spouse, the following apply:

- The spouse becomes the account holder of the Archer MSA.

- The IRS considers a Medicare Advantage Medical Savings Account as an Archer MSA of the spouse for distribution purposes.

- Distributions from these accounts are subject to the rules that apply to Archer MSAs.

If the designated beneficiary is not the spouse or there is no named beneficiary, the account ceases to be an MSA as of the date of death, and the fair market value on that date is reported.

For more than one recipient, the FMV should be allocated among them, as appropriate.

If the beneficiary is the estate, the estate’s name and TIN should appear in place of the recipient’s on the form.

Health savings accounts

When the account holder dies, the following applies:

- If the designated beneficiary is the surviving spouse, the spouse becomes the account holder of the HSA.

- If the designated beneficiary is not the surviving spouse, the account ceases to be an HSA on the date of the account holder’s death.

The FMV of the account as of the date of death will appear in Box 4.

Box 5

Shows the type of account reported on this Form 1099-SA:

- Health savings account

- Archer MSA

- Medicare Advantage MSA

Filing IRS Form 1099-SA

For tax entities who must file this tax form with the Internal Revenue Service, the IRS requires certain paper versions of information returns to be accompanied by IRS Form 1096, Annual Summary and Transmittal of U.S. Information Returns.

Check out our step-by step instructional guide for more information on how to submit your information return with IRS Form 1096.

Reporting distributions on your tax return

Generally, taxpayers must report distributions on their annual tax return, whether or not they are part of taxable income. How you report these distributions depends on the type of savings account you have.

Reporting HSA distributions

Taxpayers should report distributions from an HSA on IRS Form 8889, Health Savings Accounts. You can complete this form and submit it with your tax return.

Reporting MSA distributions

Taxpayers should report distributions from an Archer MSA or an MS MSA on IRS Form 8853 Archer MSAs and Long-Term Care Insurance Contracts. You can complete this form and submit it with your tax return.

Video walkthrough

Watch this instructional video to learn about IRS Form 1099-SA, and how you should report savings account distributions on your tax return.

Do you use TurboTax?

If you don’t, is it because the choices are overwhelming to you?

If so, you should check out our TurboTax review page, where we discuss each TurboTax software product in depth. That way, you can make an informed decision on which TurboTax offering is the best one for you!

Click here to learn more about which TurboTax option is best for you!

Frequently asked questions

Account custodians will file IRS Form 1099-SA, Distributions From an HSA, Archer MSA, or Medicare Advantage MSA, to report distributions made from a health savings account (HSA), Archer medical savings account (Archer MSA), or Medicare Advantage MSA (MA MSA).

Taxpayers should expect to receive IRS Form 1099-SA by January 31 of the year following the tax year of the savings account distribution.

IRS Form 1099-SA simply reports distributions from an HSA or MSA. The taxability of your distribution depends on whether it was used for qualified health expenses and other eligibility requirements.

Where can I find IRS Form 1099-SA?

As with other IRS tax form, you may find IRS Form 1099-SA on the IRS website. For your convenience, we’ve enclosed the latest version in this article.

Related tax articles

This tax form is one of the fillable tax forms provided by the Internal Revenue Service, to help taxpayers reduce their tax preparation costs. To see more forms like this, visit our free fillable tax forms page, where you’ll also find articles like this.

Unlike the IRS, our articles contain step by step instructions for each tax form, as well as video walkthroughs. You can also check out all of our videos by subscribing to our YouTube channel!