IRS Form 1127 Instructions

Taxpayers who cannot pay their full tax bill when filing their tax return, or those who receive a notice of deficiency may request a payment extension by filing IRS Form 1127, Application for Extension of Time for Payment of Tax Due to Undue Hardship.

In this article, we’ll help you better understand IRS Form 1127, including:

- How to complete and file IRS Form 1127

- When you should and should not file IRS Form 1127

- IRS eligibility criteria that you must meet to qualify for a payment extension

Let’s start with an overview of this tax form.

Table of contents

How do I complete IRS Form 1127?

There are three parts to this one-page tax form:

Before we start Part I, let’s go over the taxpayer information fields at the top of your IRS Form 1127.

Taxpayer information

Prior to beginning this form, you should use the Determination Chart to decide whether you need to file IRS Form 1127. If you have, then you’ll need to complete this section.

Individual taxpayers

Individual taxpayers should enter the following necessary information:

- Taxpayer name

- Taxpayer address

- Identifying number

- Can be either your Social Security number or Individual Taxpayer Identification Number (ITIN)

For taxpayers completing this application for a joint tax return or a joint tax liability determined as a deficiency, you should:

- Include both spouses’ names in the order of appearance on your income tax return

- Enter the identifying number of the spouse whose name appears first

Businesses

Business owners should enter your company’s name, address, and employer identification number (EIN).

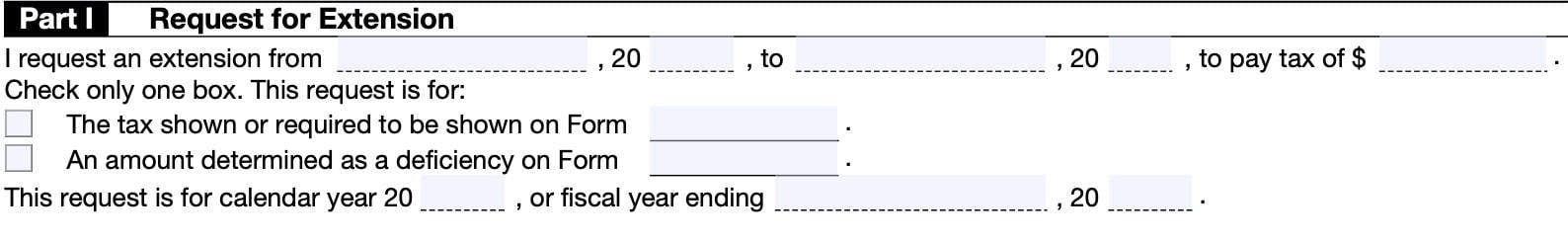

Part I: Request for Extension

In Part I, you’ll outline your extension request.

First, enter one of the following due dates, as applicable to your situation:

- Due date of your tax return (not including extensions)

- Due date for paying the amount that the IRS has determined to be a tax deficiency

Next, enter the following information:

- Date that you propose to pay the tax

- Amount of tax you owe

Date you propose to pay tax

The date that you propose to pay tax may depend on your circumstances.

Tax return

For an extension for paying your tax liability as calculated on your regular tax return, you can request up to 6 months from your tax filing deadline.

For taxpayers located outside the United States, you can propose a date that is more than 6 months after your tax return’s original due date.

Tax deficiency

If your request is for payment of an amount determined as a tax deficiency, you can request an extension of up to 18 months from the date that payment is due to the IRS.

For exceptional circumstances, you can request an additional 12 months.

At the bottom of Part I, indicate whether your extension request is for a calendar year or fiscal year tax return.

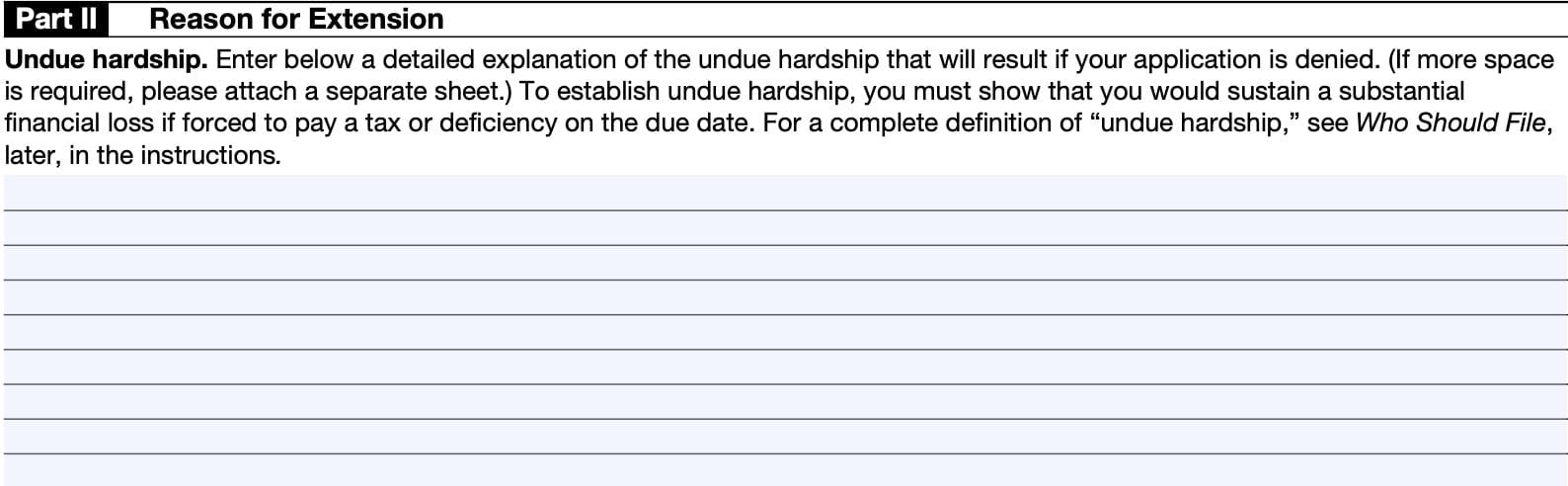

Part II: Reason for Extension

In Part II, you’ll need to enter a detailed explanation of the undue hardship that would occur if your application is denied. If you need more space, then attach additional sheets to this form.

Undue hardship

To increase your chances of having this form approved by the IRS, we should have a better understanding of undue hardship.

Treasury Regulation 1.6161-1(b) provides that an extension to pay shall be granted only upon a satisfactory showing that payment on the due date will result in an undue hardship.

What is undue hardship?

In Internal Revenue Manual 5.1.12.26, the IRS provides some guidance about undue hardship. Generally speaking, the IRS uses the following criteria to determine undue hardship.

- The term “undue hardship” means more than an inconvenience to the taxpayer.

- It must appear that substantial financial loss will result to the taxpayer from making payment on the due date

- For example, a loss due to the sale of property at a sacrifice price

- If a market exists, the sale of property at the current market price is not ordinarily considered as resulting in an undue hardship.

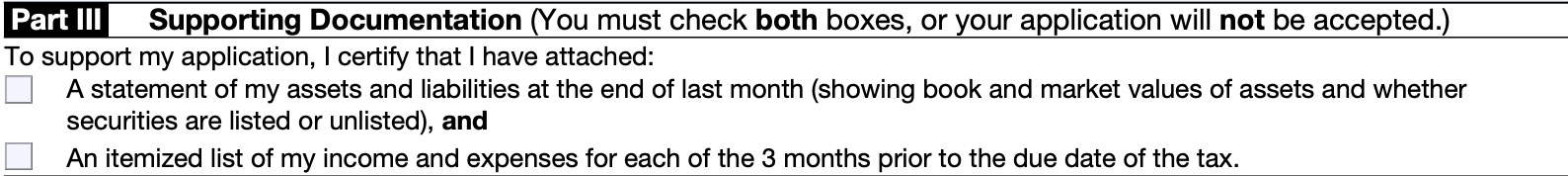

Part III: Supporting Documentation

If you do not check both boxes, then the IRS will not accept your application. Attach a copy of both of the following to your Form 1127:

- Statement of assets and liabilities at the end of last month

- Itemized list of income and expenses

If you don’t submit both documents, the IRS will return your application as nonprocessable.

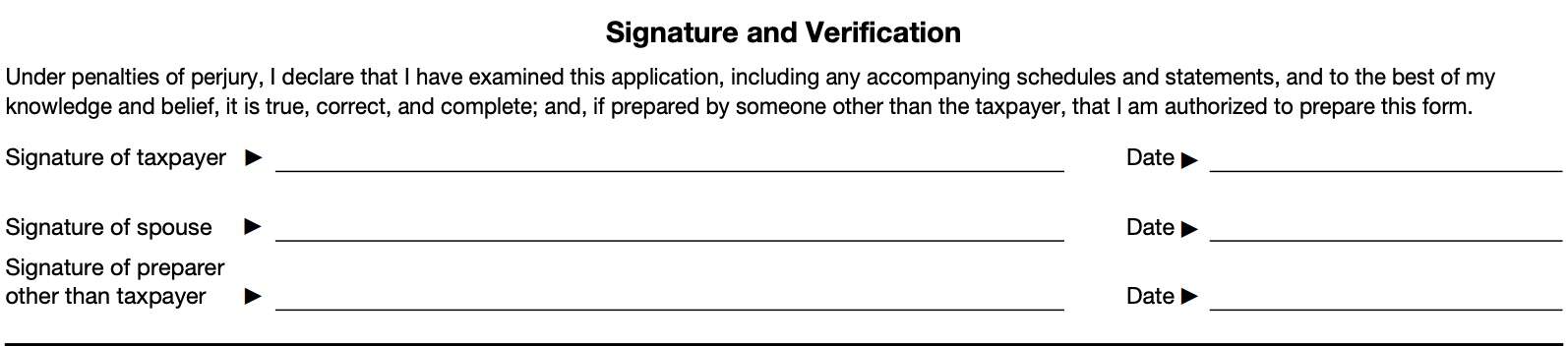

Signature & verification

This section contains required signature information.

For joint income tax returns, both spouses must sign and date the form. Your tax preparer can sign at the bottom, if preparing this form on your behalf as part of your tax return.

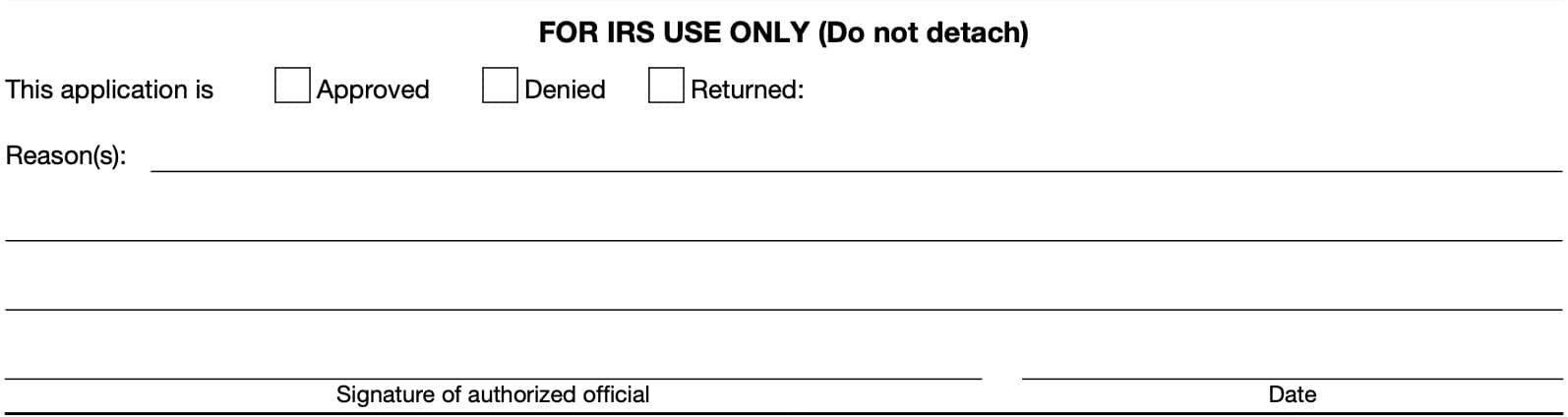

IRS Use only

Once the receives your completed Form 1127, it will process this application in one of 3 ways:

- Approval

- Denial

- Return

Approval

If you receive notification that your request was approved, then the IRS has determined that you proved an undue hardship that would occur had you paid the taxes on time.

Denial

If your request is denied, then the IRS has made a determination that you do not meet the undue hardship requirements as defined by Internal Revenue Code Section 6161.

Returned

If your application is returned, then the IRS has not made a determination about this request. Generally, the IRS should include one of the following explanations:

- Application untimely

- Inadequate or no supporting documentation

- Improper use of Form 1127

- Extension period requested for payment of a tax shown or to be shown on a return exceeds that allowable by statute

- Extension period requested for payment of a deficiency exceeds that allowable by statute

Application untimely

If you did not file in a timely manner, then you may receive this response. See When to file, below, for more details about filing on time.

Inadequate or no supporting documentation

You may see the following if you did not provide sufficient documentation to prove your case:

Your Form 1127 application is being returned to you as nonprocessable because you did not include with your application:

____ a statement of your assets and liabilities

____ an itemized list of your income and expenses for each of the three months prior to the due date of the tax.

You may be able to re-file this form with the required documentation in order to reach a determination.

Improper use of Form 1127

You may have your form returned because it was not the correct form. You may wish to revisit the Determination Chart, below, to decide your course of action.

Extension period requested for payment of a tax shown or to be shown on a return exceeds that allowable by statute

You may only request a six-month extension, unless you can verify that you are located outside the country. If you cannot, and your request is for more than 6 months after your tax return, the IRS will return your application.

If you have sufficient time remaining, you may be able to re-file IRS Form 1127 to request an appropriate extension period.

Extension period requested for payment of a deficiency exceeds that allowable by statute

The IRS will initially approve an extension for paying a tax deficiency of up to 18 months.

If you have sufficient time remaining, you may be able to re-file IRS Form 1127 to request an appropriate extension period.

Filing IRS Form 1127

There are some additional things you should know about IRS Form 1127.

Let’s start by looking over the Determination Chart, which will help you decide whether Form 1127 is the correct form for your financial situation.

Determination chart

The following chart is an identical replica of the determination chart located in the form instructions. Use this to determine whether you need to file IRS Form 1127 or another tax form.

| If you | Then |

| Are requesting to postpone payment of the full amount of tax shown or required to be shown on your return or an amount determined as a deficiency | File IRS Form 1127 |

| Are seeking an extension of time to file your income tax return | Do not file IRS Form 1127. Instead, file: IRS Form 4868, Application for Automatic Extension of Time To File U.S. Individual Income Tax Return. Certain overseas taxpayers expecting special tax treatment may file: IRS Form 2350, Application for Extension of Time To File U.S. Income Tax Return |

| Are seeking an extension of time to pay estate (and generation-skipping transfer) taxes | Do not file IRS Form 1127. Instead, file IRS Form 4768, Application for Extension of Time To File a Return and/or Pay U.S. Estate (and Generation-Skipping Transfer) Taxes. |

| Are requesting a monthly installment payment plan | Do not file IRS Form 1127. Instead, File IRS Form 9465, Installment Agreement Request, or go to Online Payment Agreement Application at www.irs.gov/OPA |

| Owe any tax and are not requesting, or do not qualify for, either a monthly installment payment plan or an extension of time to pay the full amount | Do not file IRS Form 1127. Instead, contact the IRS or visit your local IRS office to discuss your unpaid taxes. |

Who should file

Taxpayers can file Form 1127 if you will owe any of the following types of taxes, and paying the tax at the time it is due will cause an undue hardship.

- Income taxes

- Self-employment taxes

- Withheld taxes on nonresident aliens and foreign corporations

- Taxes on private foundations and certain other tax-exempt organizations

- Taxes on qualified investment entities

- Taxes on greenmail, calculated on IRS Form 8725

- Taxes on structured settlement factoring transactions, calculated on IRS Form 8876

- Gift taxes

When to file

You should file IRS Form 1127, along with supporting documents, as soon as you are aware of a tax liability or a tax deficiency that you cannot pay without undue financial hardship.

Extension to pay taxes calculated on your tax return

If you are requesting an extension of time to pay the full amount of tax shown or required to be shown on an upcoming return, the IRS must receive your completed Form 1127 on or before the tax filing deadline of that return (before filing extensions).

Extension to pay taxes calculated as part of a deficiency notice

If you are requesting an extension of time to pay an amount determined as a tax debt or deficiency, the IRS must receive your Form 1127 on or before the due date for payment indicated in the tax bill.

Where to file

File Form 1127 with the Internal Revenue Service, (Attention to: Advisory Group Manager) for the area where you maintain your legal residence or principal place of business.

IRS Publication 4235, Collection Advisory Group Numbers and Addresses, contains additional information about your local advisory group.

If the tax due is a gift tax reportable on IRS Form 709, send your completed Form 1127 to:

Department of the Treasury

Internal Revenue Service

Stop 824G

7940 Kentucky Drive

Florence, KY 41042-2915

Video walkthrough

Watch this instructional video to learn more about filing a payment extension request using IRS Form 1127.

Frequently asked questions

If the IRS approves your Form 1127, you may avoid late payment penalties such as the failure-to-pay penalty as long as the IRS receives the payment of taxes by the approved extension date.

No. Taxpayers can use Form 1127 to request extra time to pay their outstanding balance. As long as the IRS receives payment of the tax in full before the deadline, you should not incur a late payment penalty.

Where can I find IRS Form 1127?

You can find IRS Forms on the Internal Revenue Service’s official website. For your convenience, we’ve enclosed the latest version of IRS Form 1127 here as a PDF file, in this article.