IRS Form 1310 Instructions

Dealing with the death of a loved one is very difficult. In addition to the emotional loss, the family of the deceased person often has to deal with financial difficulties, including taxes. If the deceased person already filed a tax return, but did not receive a refund, then you might need to file IRS Form 1310 to make sure that tax refund goes to the decedent’s estate.

In this article, we’ll walk through everything you need to know about IRS Form 1310, Statement of Person Claiming Refund Due a Deceased Taxpayer, including:

- How to complete and file IRS Form 1310

- Filing considerations

- Frequently asked questions

Let’s begin with a step by step guide of how to complete this tax form.

Table of contents

Let’s begin by walking through Form 1310, step by step.

How do I complete IRS Form 1310?

In this section, we’ll go through each part of the form, step by step. That way, you’ll have a better understanding of how to complete the form.

There are 3 parts to this form, not including the taxpayer information fields at the top:

- Part I: Check the box that applies to you

- Part II: Complete this part only if you checked the box on line C above

- Part III: Signature and Verification

Let’s start with the taxpayer information first.

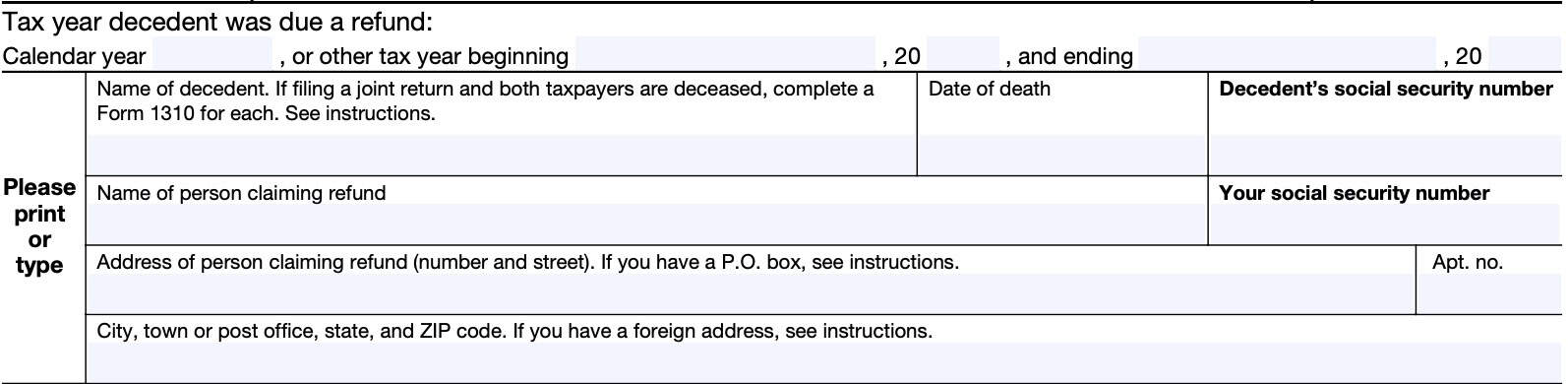

Taxpayer information

In this section, we’ll go through each information field to provide the IRS information about the decedent and the person claiming the tax refund on the decedent’s behalf. Let’s begin at the top.

Tax year decedent was due a refund

Most individual taxpayers file individual income tax returns in which the taxable year and calendar year are identical. In these cases, simply enter the calendar year of the final tax return.

If the decedent was a fiscal year taxpayer, enter the beginning and ending dates of the most recent fiscal year for which the final return was filed.

Decedent’s name

Enter the name of the decedent here. In the case that the refund is for a joint return, and both taxpayers are deceased, then you would do the following:

- Complete a Form 1310 for each taxpayer

- Attach both forms to the joint tax return as you file it.

Decedent’s date of death

Enter the decedent’s death as shown on his or her death certificate.

Decedent’s Social Security number

Enter the SSN of the deceased.

Name of person claiming refund

Enter the name of the person who is claiming the deceased taxpayer’s tax refund. Information about the deceased taxpayer goes at the top of Form 1310.

Social Security number

Enter the claimant’s SSN.

Home Address

Enter the home address for the claimant, not the address of the decedent. Enter a PO Box in the address fields only if the United States Postal Service (USPS) does not deliver mail to your home address.

City, state, and zip code

Enter the claimant’s city, state, and zip code.

Foreign address

If your address is outside the United States or its possessions or territories, enter the information in the following order:

- City

- Province or state, and

- Country

Follow the country’s practice for entering the postal code. Do not abbreviate the country name.

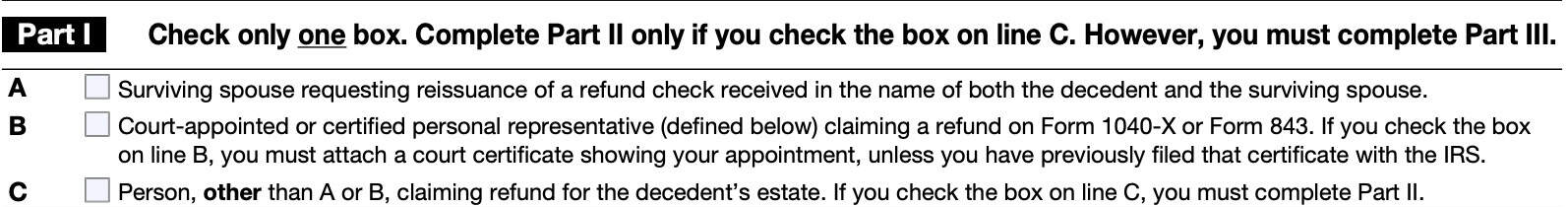

Part I: Check the box that applies to you

Part I is pretty straightforward. You will only check one box in Part I:

Let’s take a closer look at each one in depth.

Line A: Surviving spouse requesting reissuance of a refund check received in the name of both the decedent and the surviving spouse

Check the box in Line A if you:

- Are a surviving spouse, and

- Are requesting a refund check to be reissued in your name only

This might be necessary if you filed a tax return together, received a refund check in both your names, but you cannot deposit the check.

If you check this box, you can return the joint-name check by writing “VOID” across the front. Send this check, along with the completed form to your local IRS office or the Internal Revenue Service Center where you filed your return. You’ll also have to send a written request for reissuance of the refund check.

Once the IRS receives this, they will issue a new check in your name and mail it to your address.

If you check the box in Line A, you can skip Part II and sign Part III below.

Line B: Court-appointed or certified personal representative (defined below). Attach a court certificate showing your appointment, unless

previously filed

Check the box in Line B if you are a court-appointed or certified personal representative filing a claim for a tax refund on either:

- IRS Form 1040-X, Amended U.S. Individual Income Tax Return, or

- IRS Form 843, Claim for Refund and Request for Abatement.

If you check Line B, you will need to attach a copy of the probate court document showing your appointment. If you’ve previously filed paperwork with this certificate attached, you do not need to do this again. Instead, you’ll complete Form 1310 and write “Certificate Previously Filed” at the bottom of the form.

If you check the box in Line B, you can skip Part II and sign Part III below.

What is a personal representative?

According to the instructions, the IRS considers a personal representative to be the executor or administrator of the estate for the deceased individual, specifically court-appointed representatives.

The IRS specifically disallows a copy of the decedent’s will as proof that someone is a personal representative.

Line C: Person, other than A or B, claiming refund for the decedent’s estate

Check the box in Line C if you have to fill out the form, but neither of these situations apply to you. If you select Line C, you must accompany the Form 1310 with proof of death.

Proof of death can be either of the following:

- Copy of the death certificate

- Formal notification from the appropriate government office informing the next of kin of the decedent’s death.

- For example, the surviving spouse of a deceased service member would send a copy of the Department of Defense notification letter.

If you select option C, you’ll need to complete Part II before signing Part III below.

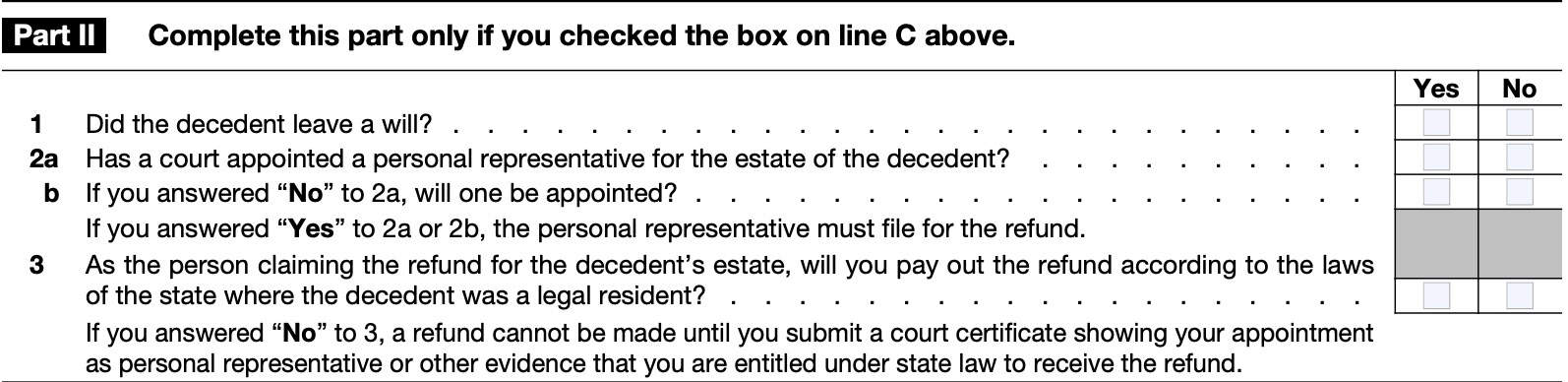

Part II: Complete this part only if you checked the box on Line C above

This section is required only if:

- You are not a surviving spouse requesting a reissued refund check, and

- You are not a court-appointed or certified personal representative of the decedent or the decedent’s estate

For each question below, you’ll answer Yes or No. Let’s take a closer look.

Line 1: Did the decedent leave a will?

Answer Yes or No.

Line 2a: Has a court appointed a personal representative for the estate of the decedent?

If Yes, then the personal representative must file for the decedent’s tax refund.

If No, go to Line 2b.

Line 2b: If you answered “No” to 2a, will one be appointed?

If Yes, then the personal representative must file for the decedent’s tax refund.

If No, go to Line 3.

Line 3: As the person claiming the refund for the decedent’s estate, will you pay out the refund according to the laws of the state where the decedent was a legal resident?

If you answer No, then the IRS will not issue a refund until you submit either of the following:

- A court certificate showing your appointment as personal representative, or

- Other evidence that you are entitled, under state law, to receive the refund

If you affirm this, but later renege on this commitment, the federal government can hold you accountable (see Part III below).

Part III: Signature and verification

This section is simply the signature area that affirms the accuracy of this filing. Please note, this signature is under the penalty of perjury.

So if you filled out Part II above, and you selected “Yes” to the question in Line 3, then you are binding yourself to a legal obligation with a proper signature in this field.

Filing considerations

Below are some filing considerations about how to request the decedent’s tax refund from the IRS.

Who must file IRS Form 1310?

Below are the filing requirements for IRS Form 1310.

Anyone who expects to receive an income tax refund on behalf of a decedent should file IRS Form 1310 if he or she is:

- A surviving spouse who is requesting that the IRS reissue a refund check in the surviving spouse’s name only, OR

- A court-appointed personal representative filing IRS Form 1040-X to request a refund from an amended tax return or filing Form 843, Claim for Refund and Request for Abatement, OR

- A beneficiary or personal representative of an estate who is requesting a refund to be disbursed to the decedent’s estate.

How should I file IRS Form 1310?

The IRS guidance on how to file IRS Form 1310 depends on the specific situation.

If you’re a surviving spouse

For a surviving spouse requesting a reissued refund check, you can return the joint-name check with Form 1310 to your local IRS office or the IRS Center where you filed your return.

If you’re not the surviving spouse

For a claimant who, checked the box on Line B or Line C, you can either:

- Send the completed form to the IRS center where you filed the original tax return, or

- Follow the instructions for the form to which you are attaching Form 1310.

If the original federal return was filed electronically, mail Form 1310 to the IRS Center designated for the mailing address on the form. See the instructions for the original return to obtain the address.

Who must file IRS Form 1310?

According to the form instructions, you must file Form 1310 if both of the following conditions apply:

- You are NOT a surviving spouse who is filing a joint return with the decedent.

- This could be an original or amended joint return.

- You are NOT a personal representative of the decedent, filing an original tax return on the decedent’s behalf.

- This could be IRS Form 1040, 1040-SR, 1040A, 1040EZ, 1040NR, or 1040NR that has a copy of the court certificate showing your appointment attached.

In other words, if the decedent’s refund hasn’t already been accounted for in a tax return filing after the decedent died, then an IRS Form 1310 must be filed.

Case study examples

To help better understand the purpose of Form 1310, we’ve included a couple of case studies. The first involves a situation where the taxpayer should file Form 1310, while the second walks through an example where the beneficiary does not need to file in order to claim the decedent’s unpaid tax refund.

Taxpayer filing IRS Form 1310

Jane Smith is the personal representative and sole heir to her father’s estate. Her father’s accountant noticed an error in a previously filed tax return and is filing an amended tax return on behalf of Jane’s father’s estate.

As the sole heir, Jane will eventually receive the refund. However, to properly receive the money, she would follow the tax code:

- As the personal representative, Jane would sign the amended tax return AND the Form 1310.

- Jane would accompany the tax forms with a copy of the court certification.

- Jane would receive the funds on behalf of her father’s estate, into a banking account in the name of the estate.

- Jane, at her discretion as personal representative, would issue a check to her self as the beneficiary.

Taxpayer doesn’t have to file IRS Form 1310

Using the above example, let’s imagine that Jane’s father died before he was able to file an income tax return for the previous tax year. As his estate’s personal representative, Jane would file an income tax return on behalf of the estate.

If the income tax return shows that Jane’s father was due a refund, Jane would not need to file IRS Form 1310. Jane would simply attach a copy of the court certificate to the tax return showing that she was appointed personal representative.

Video walkthrough

Watch this instructional video to learn more about claiming a tax refund on behalf of a decedent’s estate using IRS Form 1310.

Do you use TurboTax?

If you don’t, is it because the choices are overwhelming to you?

If so, you should check out our TurboTax review page, where we discuss each TurboTax software product in depth. That way, you can make an informed decision on which TurboTax offering is the best one for you!

Click here to learn more about which TurboTax option is best for you!

Frequently asked questions

IRS Form 1310, Statement of Person Claiming Refund Due a Deceased Taxpayer, is the tax form that you can use to notify the Internal Revenue Service of a taxpayer’s death. If the taxpayer was owed a tax refund at the time of death, IRS Form 1310 will direct the IRS where to send the refund.

If filing with an amended tax return, you may attach IRS Form 1310 to the amended return. However, you do not need to attach IRS Form 1310 to a previously filed tax return or a future tax return.

There are certain tax preparation software programs that may be able to electronically file IRS Form 1310. However, you should discuss this with a qualified tax professional to avoid filing errors.

Generally speaking, a surviving spouse or personal representative of the decedent’s estate (usually the executor) will claim the refund on behalf of the taxpayer. A personal representative or person who is not a surviving spouse must distribute the refund according to the state laws where the decedent resideded.

If you are a beneficiary who is not the surviving spouse, filing this form does not forward the refund to you directly. It simply instructs the IRS to send the check to the decedent’s estate. It is the personal representative’s responsibility to ensure the money is properly distributed according to the decedent’s wishes and the laws of the state.

Where can I get a copy of IRS Form 1310?

You may download a copy of the original Form 1310 from the IRS website. For your convenience, we’ve included the most recent version of this tax form below.

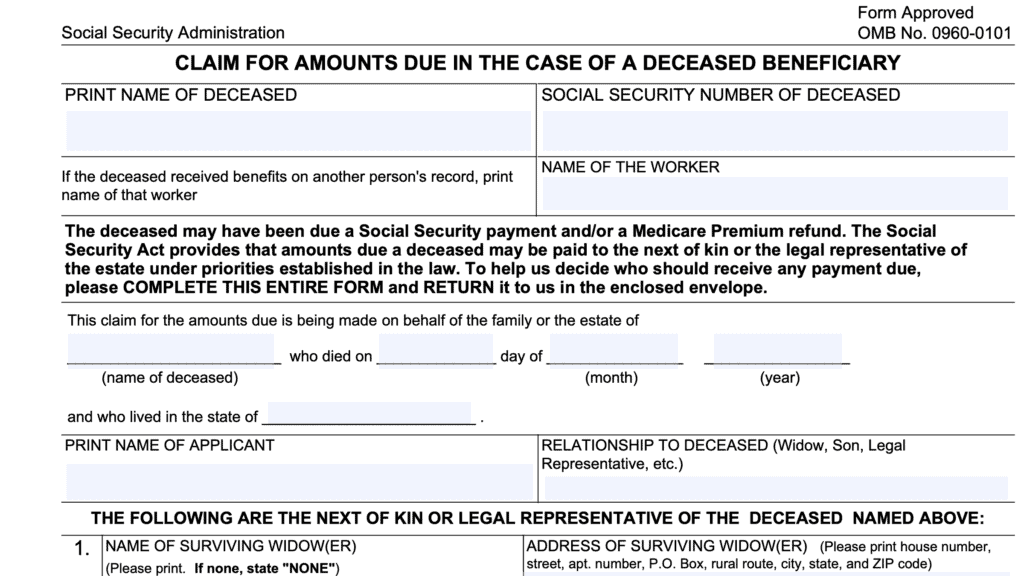

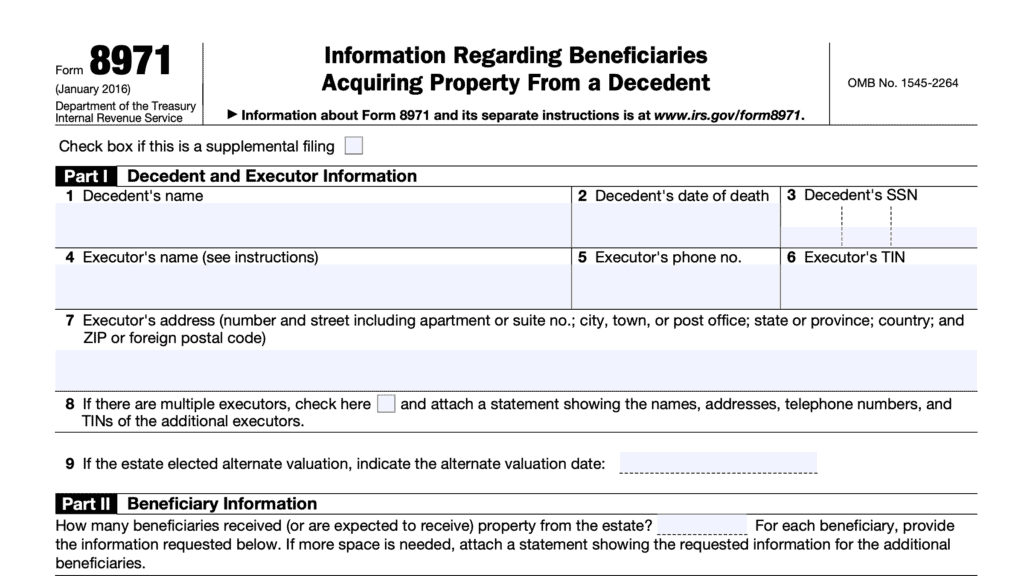

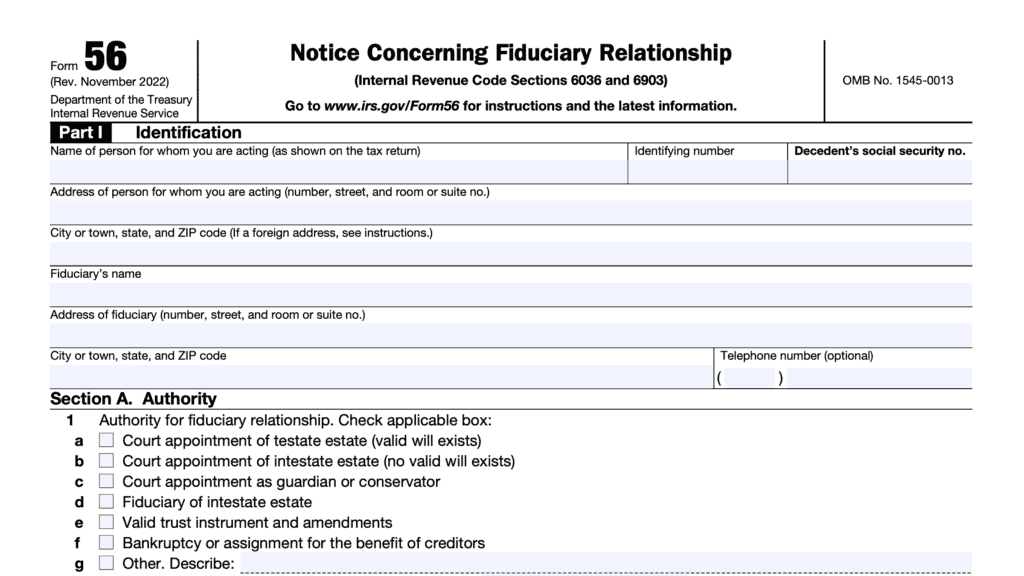

Related forms

This tax form is one of the fillable tax forms provided by the Internal Revenue Service, to help taxpayers reduce their tax preparation costs. To see more forms like this, visit our free fillable tax forms page, where you’ll also find articles like this.

Unlike the IRS, our articles contain step by step instructions for each tax form, as well as video walkthroughs. You can also check out all of our videos by subscribing to our YouTube channel!