IRS Form 14242 Instructions

According to the Internal Revenue Service, abusive tax promotions are some of the biggest taxpayer scams impacting taxpayers today. To combat this problem, the IRS has established a dedicated office, known as the Lead Development Center, to help track down reported cases of abusive tax schemes. And the IRS encourages taxpayers to report suspected abusive tax promotions on IRS Form 14242.

In this article, we’ll cover IRS Form 14242 in depth, specifically:

- How to complete IRS Form 14242 to report suspected tax schemes

- Examples of abusive tax promotions

- How to report other types of tax fraud

Let’s start with step by step guidance on completing Form 14242.

Table of contents

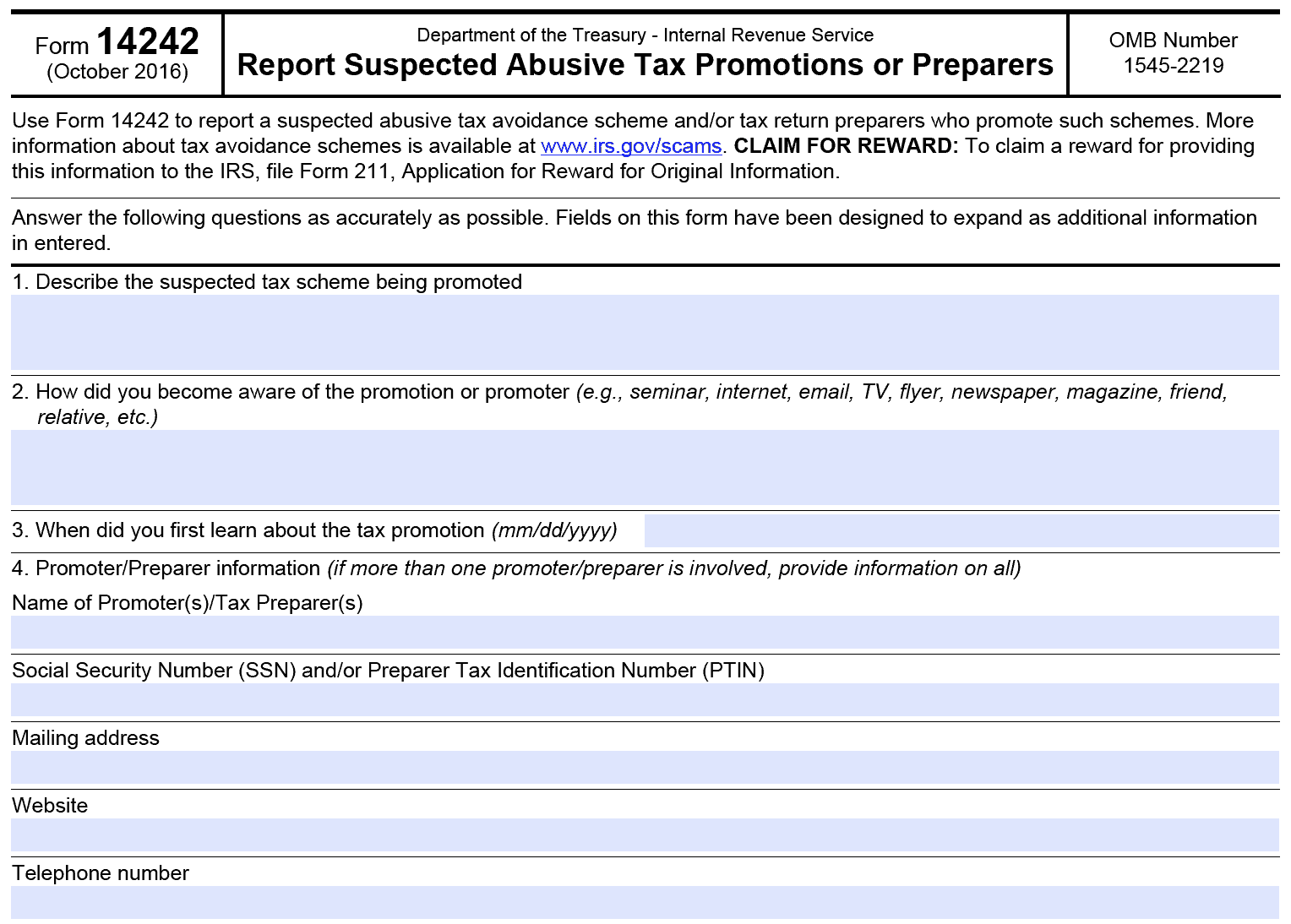

How do I complete IRS Form 14242?

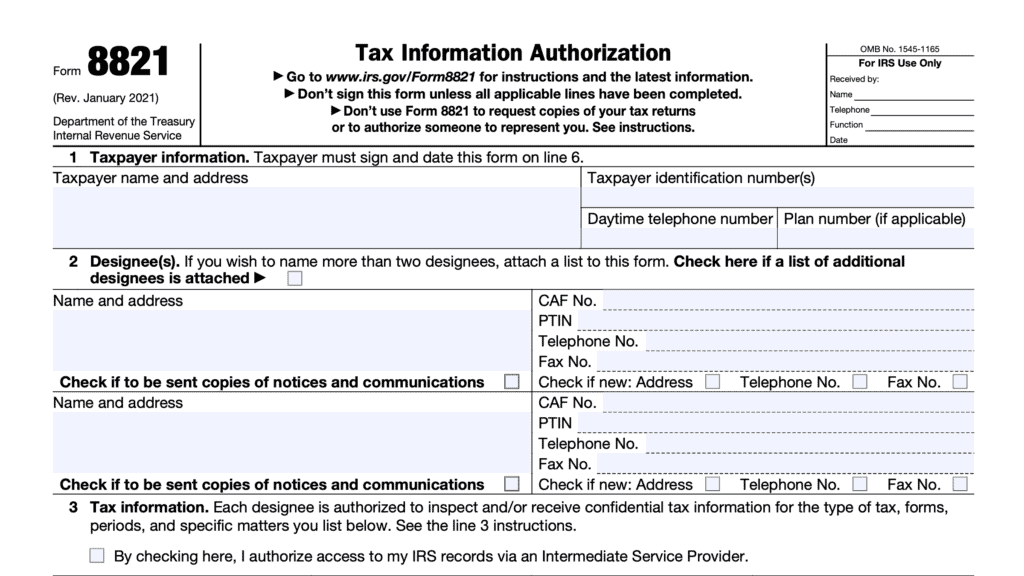

There are a couple of things you should know before trying to use Form 14242.

First, this tax form seems to be confusing because when you Google it, you’re most likely going to get the wrong file.

Second, it will probably appear in a format that most people cannot open from their internet browsers. So let’s make sure we’ve got the most correct version of the form.

Form accessibility

The most current version of Form 14242 was updated in 2016. So make sure that you download this form, not the 2011 version that is still floating around the Internet.

You can find the most current version on the IRS website, but it’s in a format that most people cannot view in their browsers. If you choose, you can:

- Download the form and save it to your computer

- Open the form using Adobe Acrobat Reader (not your browser)

If that appears difficult, or you cannot get the form to work, you can download the version at the end of this article.

Now that we’ve got the right form, let’s move on to filling it out.

Line 1: Describe the suspected tax scheme

As best possible, describe the tax promotion as you see it. Include details that you think would be beneficial if the IRS opens an investigation.

Line 2: How did you become aware of the promotion?

What form of communication was used to make you aware of this tax scheme? Did you find it online, receive an email, or watch a TV commercial?

Fill out as much information as possible.

Line 3: Date you first learned about the tax promotion

Write down the date (or approximate date) that you first learned of this tax scheme.

Line 4: Promoter/Preparer information

If you can, list the following information for each person that you believe to be involved:

- Name

- Social Security Number and/or Preparer Tax Identification Number (PTIN)

- Mailing address

- Website

- Telephone number

If you have additional information, you can include it in Line 8 below.

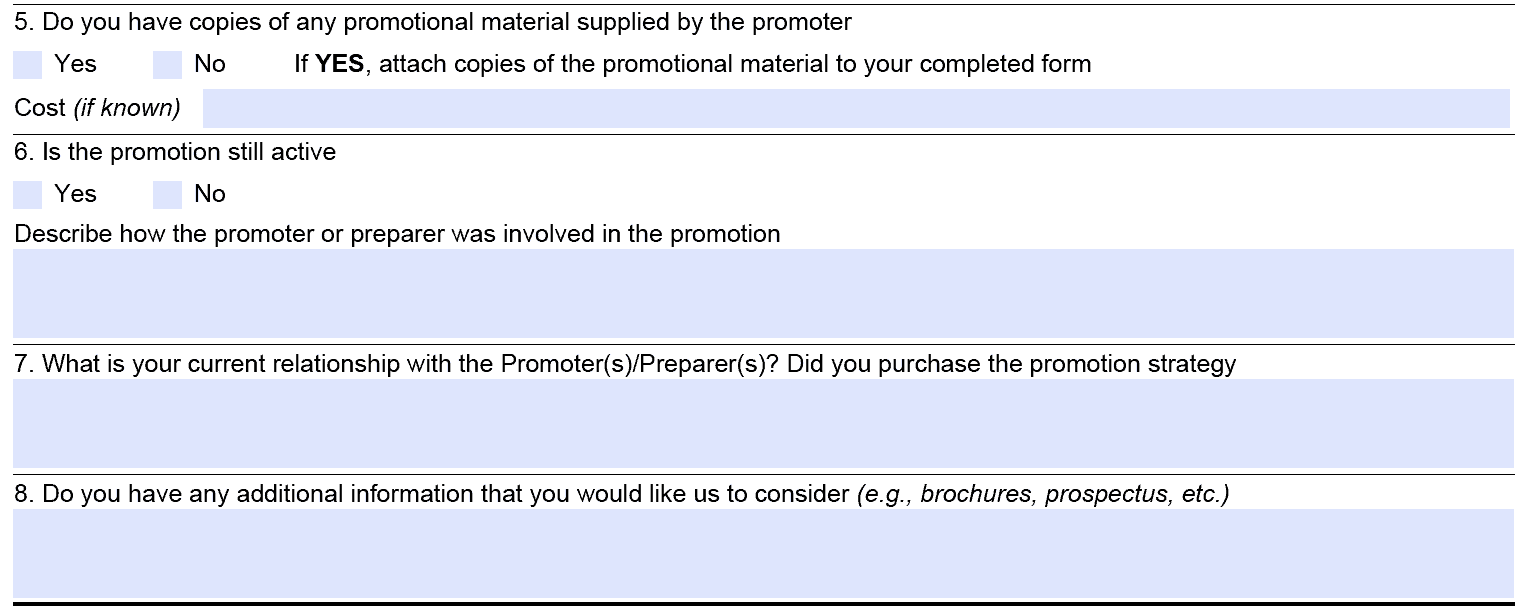

Line 5: Do you have copies of promotional material supplied by the promoter?

If so, attach copies of the material to your completed form for when you fax or mail it in.

Line 6: Is the promotion still active?

Check the appropriate box. Also, describe how the promoter was actually involved in this scheme.

Line 7: Relationship to promoter

Describe your relationship to the promoter or preparer? Also, did you actually purchase the strategy that was being peddled?

Line 8: Additional information

If you have additional information for the IRS to consider, please disclose it here.

Contact information

The contact information fields are optional. However, the IRS will not be able to follow up with questions or acknowledge receipt of the complaint if you do not include your information.

Enter the following:

- Name

- Date of form

- Mailing address

- Telephone number

- Email address

What is an abusive tax scheme?

According to the Internal Revenue Manual, a tax shelter is a ‘tax strategy that shelters or protects income from taxation.’ The IRS website goes on to cite two types of tax shelters, which depend on the facts at hand and application of tax law:

- Tax shelters that represent lawful tax avoidance

- Tax shelters that represent unlawful tax evasion

The latter category are tax positions that are not supported by law or manipulate the law in a way that is not consistent with the law’s intent. That is the definition of an abusive tax scheme or tax promotion (these terms are used interchangeably in this article).

Why abusive tax schemes are bad for the individual taxpayer

There are three primary reasons that abusive tax promotions are so bad for taxpayers:

- Tax fraud deprives normal taxpayers of the benefits they are normally entitled to

- Taxpayers who fall for abusive tax promotions usually pay a lot of money to someone who takes their money and disappears

- In addition to falling for the tax scam, the taxpayers can face civil and criminal charges

The biggest challenge most people face is that this type of fraud is often presented to unsuspecting persons as a form of tax planning strategy. Not only do they fall prey to the scam itself, but some tax schemes open the taxpayer up to tax fraud investigations. And because many of these promotions are highly technical, it’s often difficult for a taxpayer to tell whether or not the tax promoter is telling the truth.

This happens frequently enough that the IRS regularly posts abusive tax schemes in its annual “Dirty Dozen” tax scams. In fact, abusive tax promotions have appeared in the Dirty Dozen almost every year since its inception in 2014.

Examples of abusive tax schemes

Abusive tax promotions change quite frequently to keep ahead of tax law changes and enforcement actions. However, the IRS consistently publishes notices, bulletins, and other updates to its website to help keep people informed.

Here are some examples of abusive tax promotions, all of which have appeared on the IRS website’s “Dirty Dozen” list multiple times over the past 10 years.

Improper use of trusts

When properly utilized, trusts can be a powerful estate planning tool. Trusts can also help individual taxpayers legally defer or shelter income from taxation for the benefit of themselves, other family members, or charitable organizations.

But trusts also can be misunderstood and misused. This leaves the door open to abuse.

In 2015, the IRS warned about how “unscrupulous promoters continue to urge taxpayers to transfer large amounts of assets into trusts.” While there’s nothing wrong with placing large amounts of assets into trusts, the IRS also warned about questionable transactions that result in:

- Reduced taxable income

- Inflated deductions for personal expenses

- Reduced (even to zero) self-employment taxes and

- Reduced estate or gift transfer taxes

In 2022, the IRS specifically warned against charitable remainder annuity trusts (CRATs) that misrepresent parts of the tax code in order to avoid or minimize capital gains on appreciated properties. The IRS also has an entire page dedicated to abusive trusts and their involvement in tax fraud.

Misuse of tax treaties

Tax treaties exist to help the United States government establish agreement with a foreign country on how to properly treat taxpayers in both countries. Because of the complexities involved, many abusive promotions arise when the promoter touts ‘little known’ aspects of an obscure tax treaty to people looking for a tax deduction.

In 2022, the IRS cited the example of investing in retirement accounts in Malta of this kind of tax scheme. In this promotion, a taxpayer invests in a retirement account set up in Malta, which purportedly allows the person to set up an account similar to a traditional IRA. However, the Maltese account is portrayed as having tax benefits not available to an account holder in the United States.

In this reference, the IRS article states, “By improperly asserting the foreign arrangement is a “pension fund” for U.S. tax treaty purposes, the U.S. taxpayer misconstrues the relevant treaty to improperly claim an exemption from U.S. income tax on earnings in, and distributions from, the foreign arrangement.”

Captive insurance

A captive insurance company is an entity that is established and owned by its insured businesses. This allows those businesses or business owners to protect against certain types of risk. This is legal, and there are tax benefits to captive insurance.

However, there have historically been many ways that captive insurance has been abused in order to create outsized tax benefits. Here are three citations from the IRS Dirty Dozen:

- 2015: Captive insurance first cited as a tax scheme in the IRS Dirty Dozen

- 2019: IRS cites several examples of captive insurance cases prosecuted in tax court

- 2022: IRS warns about captive insurance arrangements involving foreign jurisdictions (specifically Puerto Rico, which is a U.S. commonwealth)

Warning signs of abusive tax promotions

Most people who work with a competent tax professional, such as an enrolled agent or certified public accountant (CPA), won’t have to worry about abusive tax promotions. You can easily schedule a tax planning meeting to look at your situation and evaluate legal tax planning and tax avoidance options during the year.

But if you do your own taxes, consistently search around for the best deal, or are always looking for new ways to save on taxes, then you need to be careful. This is how abusive tax schemes are sold. Here are some things to look out for:

Too good to be true

This literally is written on every IRS Dirty Dozen warning. If the proposal were true, you probably would see it in mainstream online articles or news media. The big media and finance companies are always putting out fluff pieces about ways to save on your tax bill by increasing your 401k contributions or giving more to charity.

So pause the next time you read something that causes you to think, “Why hasn’t anyone else thought of this?” Odds are, there’s a reason: “It’s not legal.”

The proposal involves multiple jurisdictions, entities, or organizations

Scammers often hide in complexity. In other words, many scammers get away with a crime simply because it’s too hard to prosecute the offender. This is especially true when an abusive tax scheme involves:

- Trusts, which are legal documents subject to state law

- Tax treaties, which involve U.S. law and the tax laws of another foreign country

- Multiple corporations and entities, which make it difficult for law enforcement officials to focus on the actual offender

So when you see the IRS’ warning about setting up an IRA in Malta because there’s language that allows you a tax benefit you feel that you shouldn’t have, heed it. You’ll likely get flagged on your tax return, but the promoter will have taken off with your money.

The hidden aspect of this complexity: It justifies an increased cost to you. Because all of this sounds pretty expensive, the promoter can justify higher fees. Which you’ll never get back, even if you straighten out your tax and legal issues with the IRS.

The promoter balks when you ask too many questions

Tax schemes operate on quick sales to an uninformed customer base filled with people willing to believe in the myth. When customers ask few questions, the operators can swiftly get the transaction closed and move onto the next victim.

But when someone asks a lot of questions, that opens up a lot of problems. Slowing things down causes the scammer to spend more time on that person than expected. Not only that, it opens the door to the operator’s biggest fear: Getting reported to the authorities.

Reporting Tax abuse

The IRS has many different ways to report tax abuse. You can use IRS Form 14242 to report abusive tax promotions or preparers. However, tax crimes are not limited to tax promotions.

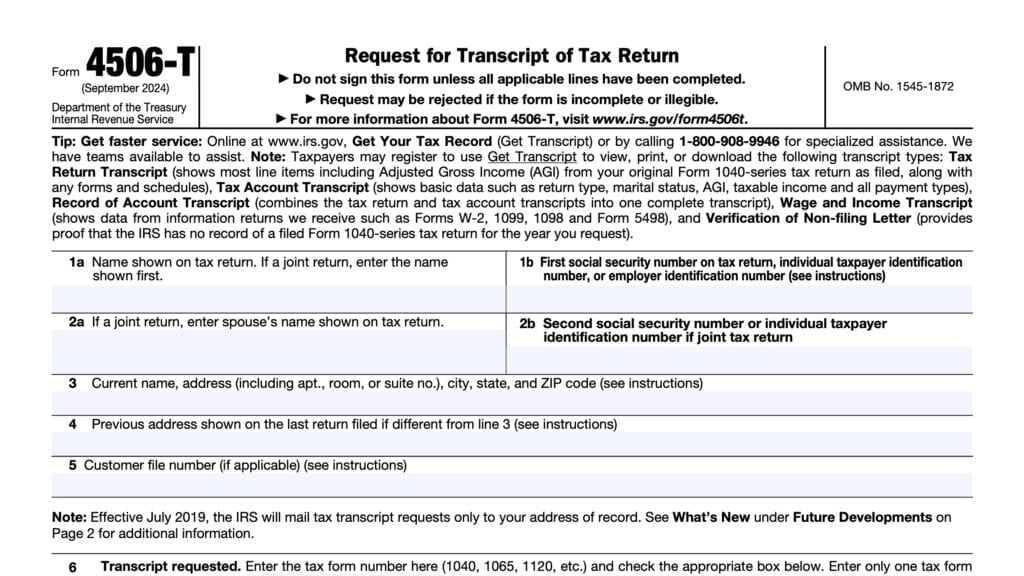

Here are some other tax forms you may use to report suspected tax activity. We’ve written in depth on most of these forms, and have included links to those articles if there’s another form that better suits your needs.

IRS Form 3949-A: Information Referral

The IRS encourages taxpayers to use IRS Form 3949-A if they suspect an individual or business is not complying with tax laws. This form specifically discusses types of tax fraud, including:

- Organized crime

- Illegal kickbacks

- Unreported income

- Failure to pay tax or to withhold taxes

- Falsifying or altering documents used in reporting income

IRS Form 211: Application for Award for Original Information

The IRS Whistleblower Office pays monetary awards to certain individuals who report tax crimes and other noncompliance matters involving excessive amounts of money. File IRS Form 211 if you believe that your information meets the reporting criteria.

IRS Form 14157: Return Preparer Complaint

Use IRS Form 14157 if you have a specific complaint about your tax return preparer. If you believe that your tax return preparer filed a tax return on your behalf without your express permission, you may need to also file IRS Form 14157-A Tax Return Preparer Fraud or Misconduct Affidavit.

IRS Form 14039: Identity Theft Affidavit

If you are the victim of identity theft and you believe that your information is being used to commit tax fraud, then you should consider filing IRS Form 14039. This will provide the IRS with notification in the case of a fraudulent tax return, and may provide the government with crucial information to catch the identity thief.

Where do I file IRS Form 14242?

The IRS provides two options for reporting abusive tax promotions:

- Fax: You can fax your completed form to (877) 477-9135

- Mail: Mail the form and all supporting documentation to the following address:

Internal Revenue Service

Lead Development Center Stop MS5040

24000 Avila Road

Laguna Niguel, CA 92677

Video walkthrough

Watch this informational video to learn more about reporting abusive tax promotions by filing IRS Form 14242.

According to the Government Accountability Office, Often, abusive tax schemes are marketed by promoters and include complex, multi-layer transactions to attempt to conceal the true nature and ownership of the taxable income or assets. The IRS created a special office, the Office of Promoter Investigations, to address abusive tax schemes and their promoters.

No. Although IRS Form 14242 contains a contact information section, providing your contact information is optional. However, the IRS may need to contact you to ask additional questions, so providing your contact information could be helpful.

Unfortunately, no. The Internal Revenue Code prevents the federal government from notifying taxpayers about the status of tax fraud investigations, even if the taxpayer initially reported the suspected crime.

Where can I find IRS Form 14242?

You can download this tax form from the IRS website or by selecting the file below.

If you see ‘Please wait….’ then you may have to download the file and open it separately using Adobe Acrobat Reader, instead of in your internet browser.

By using Adobe Acrobat Reader to open the file, you’ll be able to view it as outlined in the instructions above.