IRS Form 14950 Instructions

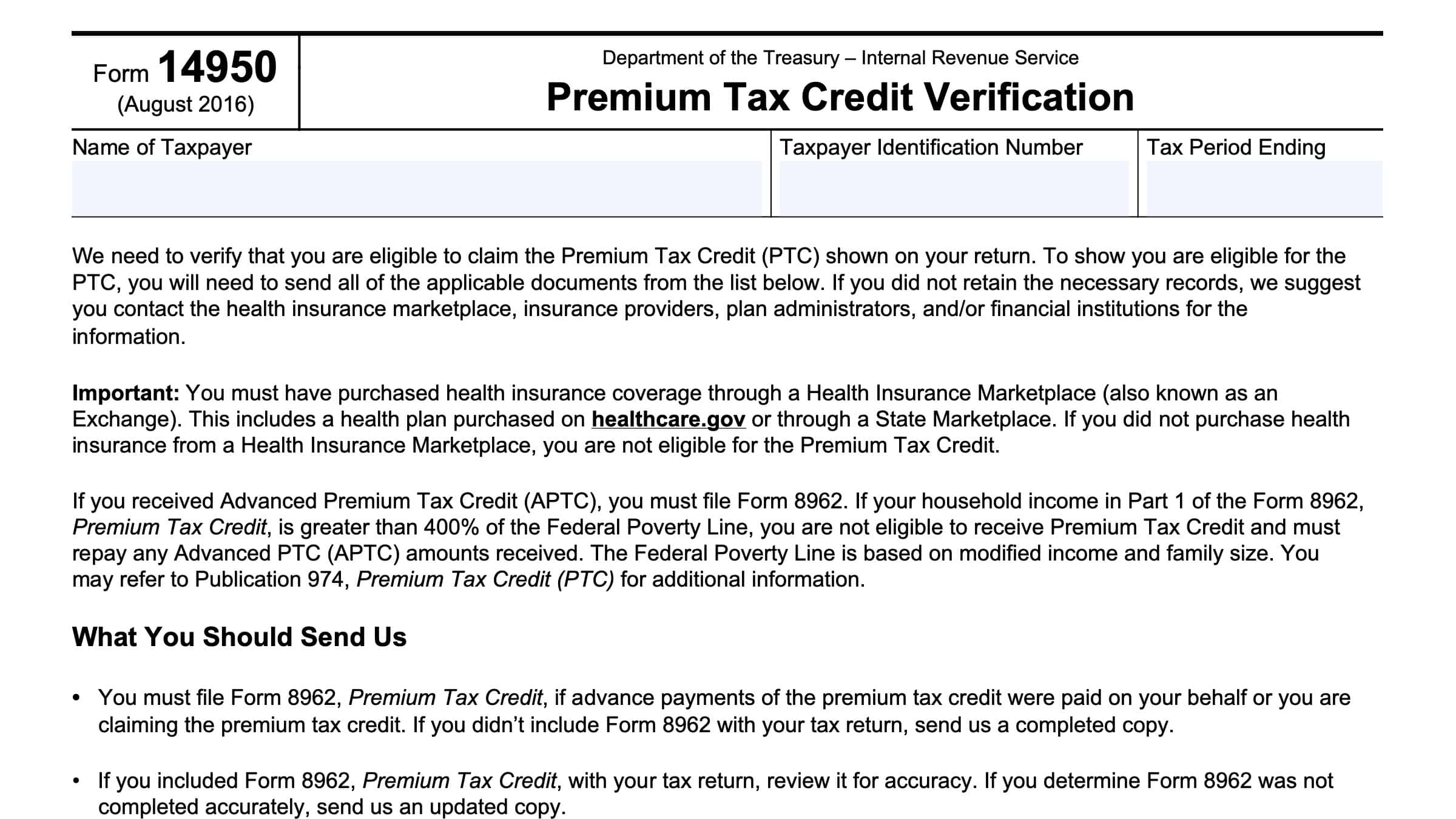

If you received an IRS notice asking to verify your premium tax credit information, you may need to complete IRS Form 14950, Premium Tax Credit Verification.

In this article, we’ll cover everything you need to know about IRS Form 14950, including:

- How to complete IRS Form 14950

- Required documentation

- Tax notices you may need to know about

Let’s begin with the tax form itself.

Contents

Table of contents

How do I complete IRS Form 14950?

This form is very straightforward.

Simply enter the following information:

- Taxpayer name

- Taxpayer identification number

- Tax period end date

As a general rule of thumb, you should consider IRS Form 14950 as a cover document for the supporting documentation that we’ll cover in the next section.

Filing considerations

Generally speaking, taxpayers will only receive IRS Form 14950 if they’ve received an IRS notice, such as CP06 or CP06A. Watch the video below to learn more about what to do when receiving a CP06 notice.

If responding to an IRS notice, you probably will need to respond to the notice with required documentation to support your claim for premium tax credit.

Below, we’ll outline the supporting documents that you may need to send to the Internal Revenue Service with your Form 14950.

IRS Form 8962, Premium Tax Credit

Taxpayers who claim the premium tax credit (PTC), or who received advanced premium tax credit (APTC) payments must file IRS Form 8962, Premium Tax Credit, with their income tax return.

If you did not file IRS Form 8962 with your tax return

If you did not already file IRS Form 8962, or if you did not include it with your federal tax return, then be sure to provide a completed form with your Form 14950.

Learn more about the premium tax credit in this video.

If you did file IRS Form 8962 with your tax return

For taxpayers who already reported the premium tax credit amount on IRS Form 8962 when filing your income tax return, you should double-check your form for accuracy.

If your form was incomplete or incorrect, complete and submit a corrected copy. Let’s take a closer look at the health insurance forms.

IRS Form 1095-A, Health Insurance Marketplace Statement

IRS Form 1095-A, Health Insurance Marketplace Statement, is the tax form you should have received if you acquired your health insurance coverage through the federal marketplace or through a state-sponsored marketplace.

This YouTube video contains more details about IRS Form 1095-A.

IRS Form 1095-B, Health Coverage

IRS Form 1095-B, Health Coverage, is the tax form you should have received from your health insurance provider, if you have your own health insurance not provided by an employer or the marketplace.

This YouTube video contains more details about IRS Form 1095-B.

IRS Form 1095-C, Employer-Provided Health Insurance Offer and Coverage

If you obtained health coverage from your employer, then you may have received IRS Form 1095-C, Employer-Provided Health Insurance Offer and Coverage.

Additional information requirements

IRS Form 14950 also includes required information that you should submit to the IRS, along with the documents mentioned above.

Records showing the names of the individuals for whom you are claiming the Premium Tax Credit for their Marketplace coverage.

These records can include copies of the following:

- Insurance enrollment forms

- Invoices

- Statements from insurance providers

Information to support the entries made in Part 4 of Form 8962, Premium Tax Credit, regarding your shared policy allocation

If you completed Part 4 of IRS Form 8962, be sure to include documentation to support these entries for each person that you claimed:

- Allocated Policy Number

- Allocation SSN

- Allocation Percentages

- Allocation Start/Stop months

Information to support the entries made in Part 5 of Form 8962, Premium Tax Credit, regarding Alternative Calculation for Year of Marriage

If you completed Part 5 of IRS Form 8962, be sure to include documentation to support these entries:

- Alternative Family Size

- Alternative Start/Stop months

- Your date of marriage

Proof that you paid health insurance premiums

Acceptable documentation includes the following:

- Copies of canceled checks (both sides)

- Paid receipts

- Certificates of group health plan coverage

- Credit card statements

- Bank records indicating direct debit payments

When you have all required documentation

Once you have all of the required documents, send copies to the IRS office location indicated in your IRS notice.

Video walkthrough

Watch this video for step by step guidance on IRS Form 14950.

Do you use TurboTax?

If you don’t, is it because the choices are overwhelming to you?

If so, you should check out our TurboTax review page, where we discuss each TurboTax software product in depth. That way, you can make an informed decision on which TurboTax offering is the best one for you!

Click here to learn more about which TurboTax option is best for you!

Frequently asked questions

IRS Form 14950, Premium Tax Credit Verification, is sent to taxpayers by the Internal Revenue Service when additional information is required for the premium tax credit. Taxpayers can use this form as a checklist for submitting required documents to the IRS to claim the credit.

Once you verify the information requested in your IRS notice and gather the required documents, send your completed IRS Form 14950 to the address indicated in your notice.

Where can I find IRS Form 14950?

You should have received IRS Form 14950 with your IRS notice. If not, you can download and use this copy.