IRS Form 15112 Instructions

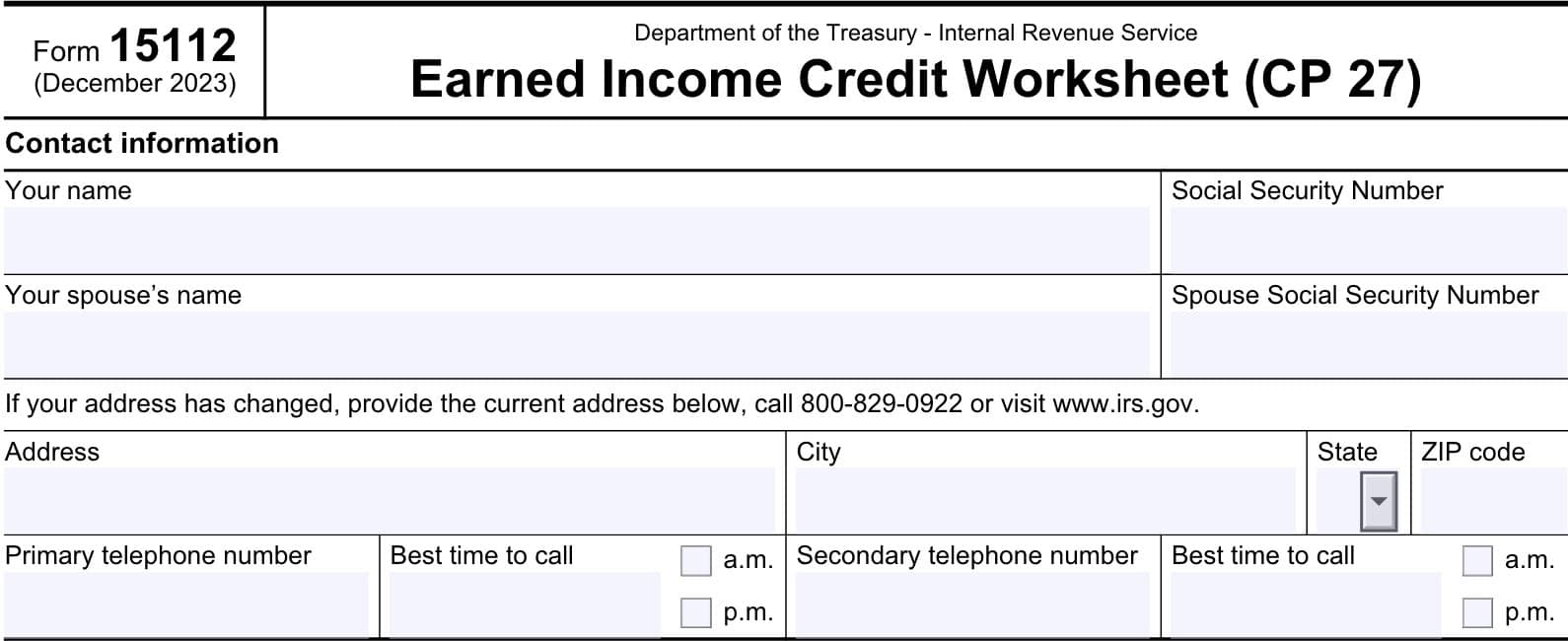

If you received a CP27 tax notice from the Internal Revenue Service, you might be eligible for the earned income tax credit (EITC) for a tax return you previously filed. In this case, the IRS will ask you to complete IRS Form 15112, Earned Income Credit Worksheet (CP 27), to verify your eligibility for the tax credit.

In this article, we’ll walk you through everything you need to know about IRS Form 15112, including:

- How to complete IRS Form 15112

- EITC eligibility criteria

- Filing considerations

Let’s begin with a step by step overview of this tax form.

Table of contents

How do I complete IRS Form 15112?

This one-page tax form is relatively straightforward to complete. Let’s begin with the taxpayer information fields below.

Contact information

At the top of IRS Form 15112, you’ll enter your contact information, as outlined below:

Taxpayer name and Social Security number

In the space provided, enter your full name and Social Security number as they appear on your income tax return.

Taxpayers must have a valid Social Security number (SSN) in order to claim the earned income credit (EIC). If you do not have a valid SSN, you cannot claim the EIC, even if you have an individual taxpayer identification number, or ITIN.

Obtaining an SSN

According to IRS Publication 596, Earned Income Credit, you must have an SSN by the due date of your tax return. You may apply for an SSN by filing Form SS-5, Application for a Social Security Number.

If you’ve applied for an SSN but have not received it by the due date of your tax return, you may consider requesting an automatic tax extension by filing IRS Form 4868, Application for Automatic Extension of Time To File U.S. Individual Income Tax Return.

Filing IRS Form 4868 grants most taxpayers an automatic six month extension to file their income tax returns. According to Publication 596, taxpayers who obtain a valid SSN during the six-month extension may qualify for the EIC.

Amended tax returns

Finally, if you did not have a valid SSN at the time of your return, but later obtain one, you cannot file an amended tax return to go back and claim the EIC later on.

However, you can file an amended return on IRS Form 1040-X to claim the EITC in prior years where you were eligible for the credit, but did not claim it. The Internal Revenue Service will allow taxpayers to go back up to 3 years to make EITC claims.

Due dates for amended tax returns

Taxpayers can still make EITC claims for the following tax years:

- For 2022 if you file your tax return by April 18, 2026

- For 2021 if you file your tax return by April 18, 2025

Spouse’s name and Social Security number

If your filing status is married filing jointly, then enter your spouse’s name and SSN in the spaces provided.

Taxpayers who are married but filing separate returns generally cannot claim the EITC. However, there are special rules that applies when a person files a separate return from his or her spouse.

Married filing separately

According to Publication 596, a taxpayer may claim the EITC if he or she had a qualifying child who lived with them for more than half of the year, and either of the following apply:

- Both spouses lived apart for the last 6 months of the year, or

- Both spouses are legally separated according to state law under a written separation agreement or a decree of separate maintenance and both spouses lived apart at the end of the year

Address

Enter your address as it appears on your federal income tax return. Include the following information:

- Street number and street name

- City

- State

- Zip code

If you changed your address after filing your most recent tax return

If you recently changed your address, you may want to update your address with the IRS. The best way to update your address is by filing your income tax return.

If you’re filing this form as part of a response to an IRS notice, then you may need to do one of the following:

- Call the IRS and update your address over the phone, or

- File IRS Form 8822, Change of Address

Primary telephone number

Enter your primary telephone number here. This can be a mobile phone number or a home number.

Secondary telephone number

If applicable, enter a second phone number in the designated field.

After completing the taxpayer information fields, it’s time to move on to Step 1.

Step 1

In Step 1 of the Earned Income Credit Worksheet, you’ll review 4 statements to verify whether any of them apply to your situation. If any of the statements apply, then you are not eligible for the Earned Income Tax Credit.

Let’s look at each statement in detail.

I did not live in the United States for more than 6 months during the tax year.

In Publication 596, Rule 14 states the following:

Your home (and your spouse’s, if filing a joint return) must have been in the United States for more than half the year.

There are a couple of finer points worth digging into here.

United states definition

Publication 596 defines the United States as the 50 states and the District of Columbia. For purposes of the EITC, this doesn’t include Puerto Rico or U.S. territories such as Guam.

U.S. Servicemembers stationed abroad

The IRS considers U.S. military personnel stationed outside the United States on extended active duty to live in the United States during that duty period for purposes of the EIC.

Extended active duty

Publication 596 further defines extended active duty as follows:

Extended active duty means you are called or ordered to duty for an indefinite period or for a period of more than 90 days.

Once you begin serving your extended active duty, you are still considered to have been on extended active duty even if you don’t serve more than 90 days.

I can be claimed as a dependent by another person and did not file a joint return for the year.

Anyone who may be claimed as a dependent by another taxpayer is ineligible for the EITC. However, there is one notable exception.

Married taxpayers filing jointly

You generally can’t be claimed as a dependent by another person if you are married and file a joint return.

However, another person may be able to claim you as a dependent if you and your spouse file a joint return merely to claim a refund of income tax withheld or estimated tax paid. But neither you nor your spouse can be claimed as a dependent by another person if you claim the EIC on your joint return.

The bottom line: If you are married and filing a joint return, there are situations in which your parents (or your spouse’s parents) can claim you as a dependent.

If this happens, then you cannot claim the EITC. If you claim the EITC, then your parents cannot claim you as a dependent.

My Social Security card reads, “Not Valid for Employment,” and was issued to receive a federally funded benefit, such as Medicaid.

As previously mentioned, you must have a Social Security card, with a Social Security number, to be eligible to claim the EITC.

However, you may ask the Social Security Administration for a new Social Security card, without this legend, if you:

- Have a social security card with “Not valid for employment” printed on it, and

- Your immigration status has changed so that you are now a U.S. citizen or permanent resident

This also applies to any member of your household, such as your spouse or a dependent child, who meets this criteria.

I am an EITC qualifying child of another person for the tax year.

You are a qualifying child of another taxpayer (such as your parent, guardian, or foster parent) if all of the following statements are true:

- You are that person’s sibling, half-sibling, stepsibling, son, daughter, stepchild, foster child, or a descendant of any of them.

- You were:

a. Under age 19 at the end of the year and younger than that person (or that person’s spouse, if the person files jointly);

b. Under age 24 at the end of the year, a student, and younger than that person (or that person’s spouse, if the person files jointly); or

c. Permanently and totally disabled, regardless of age. - You lived with that person in the United States for more than half of the year.

- You aren’t filing a joint return for the year (or are filing a joint return only to claim a refund of withheld income tax or estimated tax paid).

As a reminder, if you checked any of the boxes in Step 1, then you cannot claim the earned income credit for the year. Accordingly, you do not have to complete IRS Form 15112.

Next year’s tax return

A final note before moving on to Step 2: Before you file your next tax return, you should consider using the EITC Assistant tool located on the IRS website to see if you still qualify for the EITC.

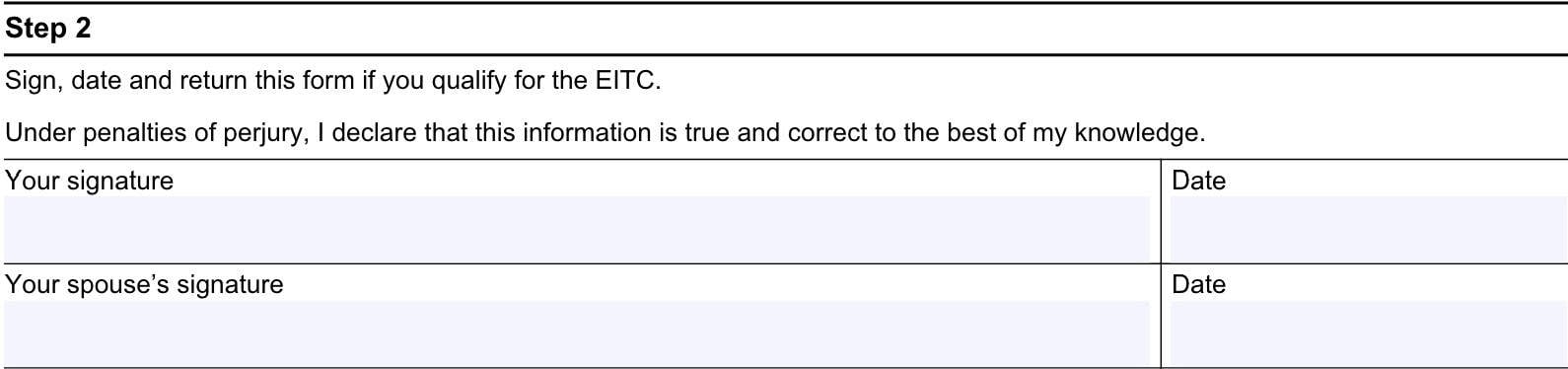

Step 2

In Step 2, you’ll simply sign the EIC worksheet, under penalties of perjury, to declare that this information is true and correct to the best of your knowledge.

If filing with your spouse, both spouses must sign IRS Form 15112.

Filing considerations

Below are some filing considerations about IRS Form 15112.

When do I use IRS Form 15112?

Most taxpayers will not use IRS Form 15112 with their income tax return. Generally, the IRS may send written notification, in the form of an IRS notice, CP 27, to certain taxpayers who:

- May be eligible for the EITC but did not claim it on their tax return, and

- Do not appear to have dependent children who are eligible

If you respond to your IRS notice using the enclosed form, you do not have to file IRS Form 15112 separately. Either form contains the information that the IRS needs to make a determination.

How do I file IRS Form 15112?

If responding to a CP27 notice, you may use the envelope provided. If you have lost the envelope, then you should contact the IRS office listed on the CP27 notice for mailing instructions.

Do I need to file IRS Form 15112?

You do not need to file IRS Form 15112. This tax form provides an opportunity to claim the EITC, but is not required.

Video walkthrough

Watch this instructional video to learn more about going through IRS Form 15112 to claim the earned income credit.

Frequently asked questions

The IRS may allow certain taxpayers to use IRS Form 15112 to claim the earned income tax credit (EITC) if the IRS determines they may be eligible for the EITC, but did not claim it on their income tax return. Usually, the IRS will send a tax notice, known as CP27, to make this notification.

If you received a CP27 notice, the IRS has determined that you may be eligible for the earned income tax credit, even if you did not claim it on your federal tax return. You may complete the enclosed form or IRS Form 15112 to claim the credit, if eligible.

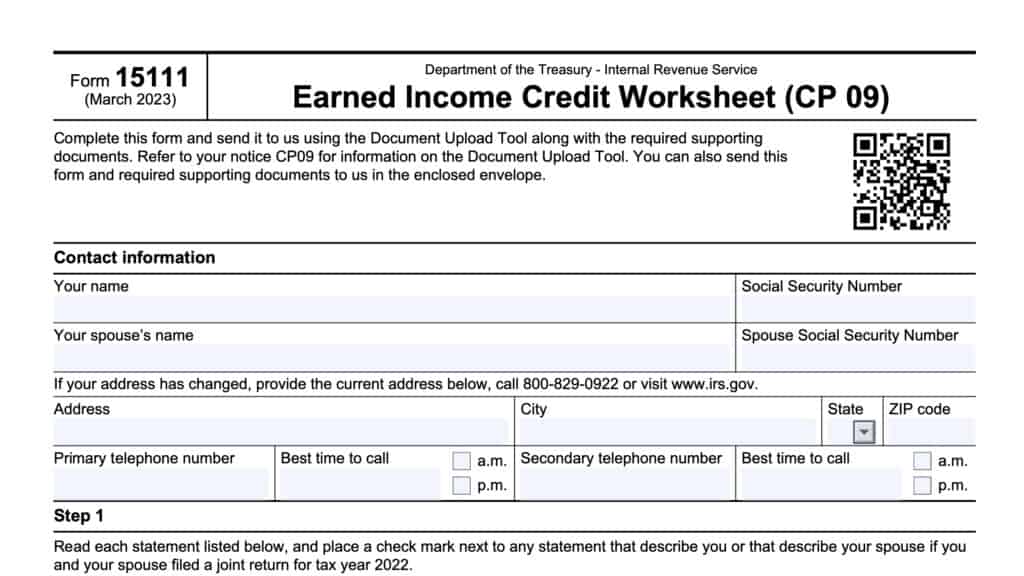

Both tax notices are issued to taxpayers who might be eligible for the earned income credit, but did not claim it on their tax return. CP09 seems to apply to taxpayers who may have qualifying children, while CP27 may be sent to eligible taxpayers without qualifying children.

Where can I find IRS Form 15112?

You may find the latest versions of IRS forms on the IRS website. For your convenience, we’ve included the most recent version of IRS Form 15112, as well as the Spanish version, in PDF forms, right here in this article.