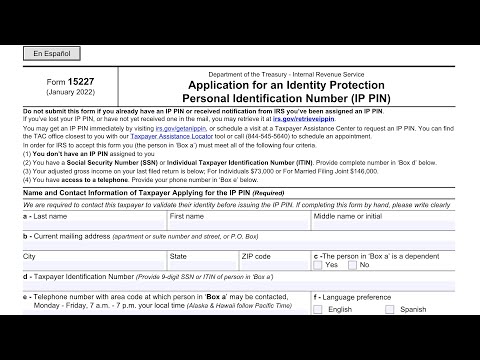

IRS Form 15227 Instructions

According to the IRS, fraudulent federal income tax returns have been on the rise for years. To lower the chances of a fraudulent return, victims of identity theft can participate in the IRS Identity Protection PIN program, known as the IP PIN Program by filing IRS Form 15227, Application for an Identity Protection Personal Identification Number (IP PIN).

In this article, we’ll walk through everything you need to know about IRS Form 15227, including:

- How to complete and file IRS Form 15227

- Details about the IRS’ IP PIN tool

- Frequently asked questions

Let’s start by going through this one-page tax form.

Table of contents

How do I complete IRS Form 15227?

Before we get into the step by step instructions, there is some guidance at the top of the form worth visiting.

Let’s take a closer look.

Taxpayer considerations

Don’t complete IRS Form 15227 if you’ve already received an IP PIN

First, this form is not necessary to receive an IP PIN.

There are other ways to obtain an IP PIN from the Internal Revenue Service:

- Online

- In person

Online

If you do not wish to visit an IRS center, or if you want to receive your IP PIN immediately, you can go to the Internal Revenue Service website: irs.gov/getanippin.

In person appointment

You can also make an in person appointment by calling the IRS at: 844-545-5640.

Requirements for the IRS to accept your completed Form 15527

If you plan to file IRS Form 15527, the IRS wants you to be aware of 4 criteria:

- You don’t already have an IP PIN

- You have either a Social Security number (SSN) or individual taxpayer identification number (ITIN)

- Obtain an SSN by filing Form SS-5

- Obtain an ITIN by filing Form W-7

- Your adjusted gross income (AGI) is below certain limits:

- Single taxpayers: $73,000

- Married filing jointly : $146,000

- You have access to a telephone

If you meet these four criteria, then you can apply for your own IP PIN by filing Form 15227.

Taxpayer information

Let’s get to the heart of this one-page tax form, beginning with your name.

Box a: Taxpayer Name

Enter your name, as shown in your most recently filed federal tax return, in the fields provided:

- Last name

- First name

- Middle name or initial

If your first name or middle name does not fit in the space provided, you may show your first or middle initials. However, you must provided your complete last name.

Box b: Mailing Address

Enter the complete mailing address of the person indicated in Box a. If you recently moved, you may consider filing IRS Form 8822, Change of Address, to ensure that your tax record is updated accordingly.

Box c

Use the appropriate box to determine whether the person in Box a is a dependent.

Box d: Taxpayer Identification Number

Use Box d to list the person’s taxpayer ID number. This can be an SSN or ITIN.

Box e

Enter the telephone number where the person in Box a can be reached between 7 a.m. and 7 p.m. local time. For security reasons, an IRS employee will call this phone number during this time to verify the taxpayer’s identity.

Alaska and Hawaii taxpayers

The instructions specifically state that eligible taxpayers living in Alaska & Hawaii should follow Pacific time standards. Keep this in mind when determining your availability.

Box f: Language preference

If your preferred language is Spanish, then check the appropriate box. If you prefer English, check that box instead.

Box g

This is the signature line. Sign the form and enter the date in the appropriate field.

Filing considerations

There are some other things you may want to consider when you file Form 15227.

Keep your current tax returns available.

When you file Form 15227, the IRS will call you to verify your personal information prior to assigning your six-digit IP PIN. As part of the verification process, you may need to provide certain information from your most recent income tax return.

You will receive a new IP PIN each year.

You will receive a new IP PIN in early January of each year in a mailed CP01A Notice. Keep this in mind, as your new six-digit IP PIN will replace the prior one.

Make sure you keep the current IP PIN to use when you file your tax return(s) during the following

filing season.

You cannot opt out of the IP PIN process

Once they decide to participate in the IP PIN opt-in program, IP PIN users cannot opt out of using this security tool in later years.

Use the correct filing address

You can request this extra layer of protection by mail or by fax. However, the IRS asks that you do not use both.

Filing by mail

To submit Form 15227 by mail, send your completed form to:

Department of the Treasury

Internal Revenue Service

Fresno, CA 93888-0025

Filing by fax

If sending your request by fax, be sure to fax your request to the IRS at: 855-807-5720. Be sure to use a cover sheet marked, ‘Confidential’ with your submission.

Video walkthrough

Frequently asked questions

An Identity Protection Personal Identification Number, or IP PIN, is a six-digit code that the IRS issues to eligible taxpayers to use when filing an electronic tax return during the current tax season. Each calendar year, IP PIN users receive a new PIN to use for the next filing season.

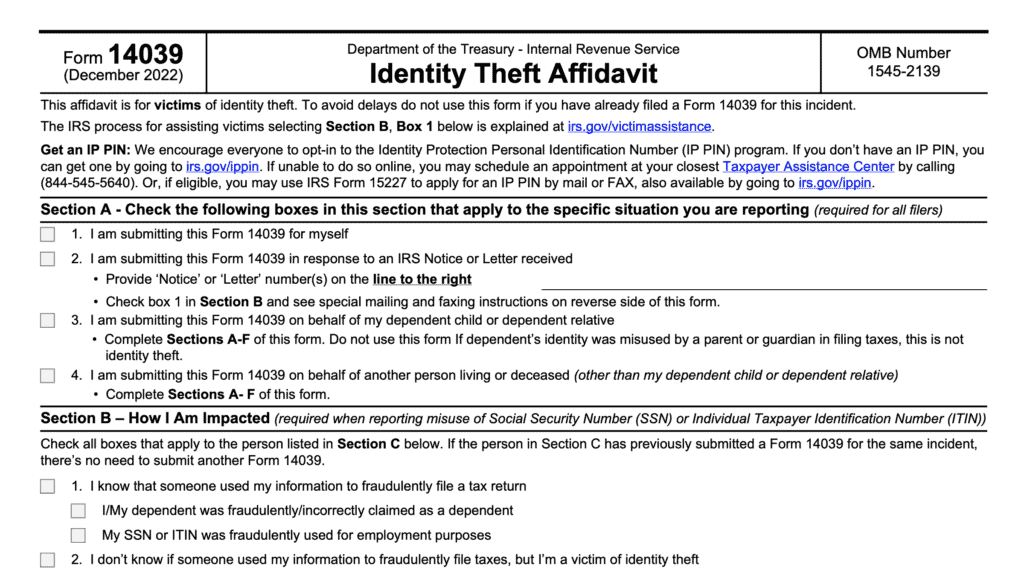

Although the IP PIN provides an extra layer of protection for identity theft victims, you do not need to file IRS Form 14039, Identity Theft Affidavit, to request an IP PIN or to use this security tool.

Where can I find IRS Form 15227?

You may access the latest versions of IRS forms on the IRS website. For your convenience, we’ve enclosed the latest version of IRS Form 15227 here, in this article.