IRS Form 15400 Instructions

In 2022, the Inflation Reduction Act change the tax rules for the purchase of alternative fuel, electric, and hybrid vehicles. As a result to this change to the tax law, the Internal Revenue Service created IRS Form 15400, Clean Vehicle Seller’s Report, which car dealers must provide to buyers of qualifying vehicles.

In this article, we’ll walk through everything you should know about IRS Form 15400, including:

- Ensuring your clean vehicle report contains the required data for your income tax return

- Clean vehicle tax credit amounts & eligibility requirements

- Frequently asked questions

Let’s begin by going over this form.

Table of contents

IRS Form 15400 Instructions

Normally, we provide step by step instructions for taxpayers to complete tax forms. However, most taxpayers will be interested in understanding IRS Form 15400, instead of completing it.

As a result, we’ll walk through this one-page tax form, step by step, so that you can understand what you should expect to receive from the seller. Let’s start at the very top, so we can understand the restrictions that apply to the clean vehicle tax credit.

Required information

The top of IRS Form 15400 contains certain key points that every taxpayer should take some time to understand. Not taking the time to understand the clean vehicle seller’s report may reduce or eliminate your eligibility to claim the clean vehicle tax credit.

Let’s highlight some of the fine points.

This report does not guarantee that you are eligible to receive a tax credit

According to the Internal Revenue Service, dealer requirements involve the following:

- Providing the Internal Revenue Service with an eligible clean vehicle report for each qualifying clean vehicle sale

- Furnishing a copy of the seller report to buyers, so they can claim the clean vehicle credit when filing their income tax return

While auto dealerships are responsible for properly verifying a clean vehicle’s qualifications, they are not responsible for ensuring that the buyer is eligible for the tax credit. The buyer must perform his or her own due diligence based upon their tax situation.

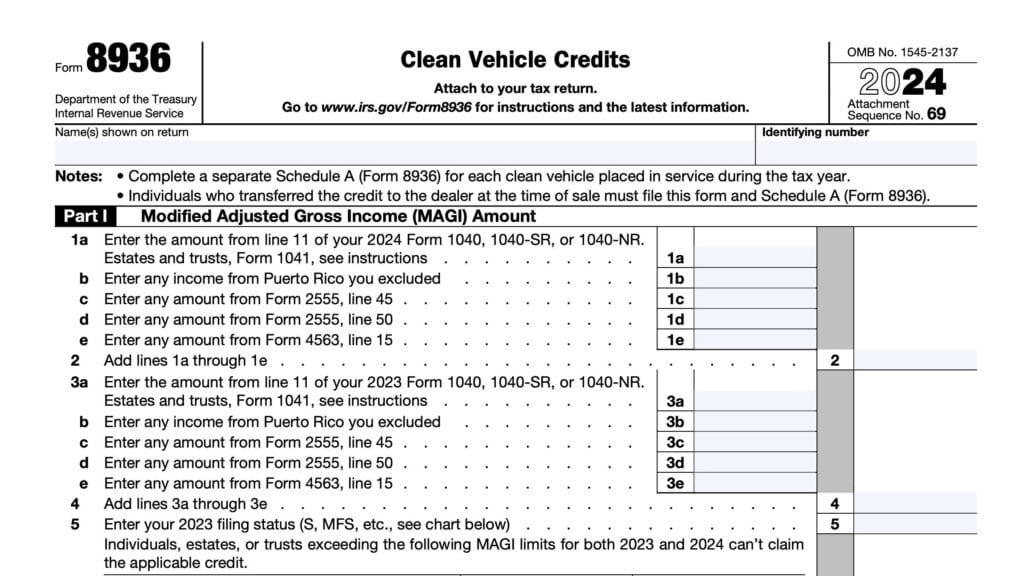

Taxpayer eligibility requirements

In addition to purchasing an eligible clean vehicle, a taxpayer must meet certain income requirements. To claim the clean vehicle credit, a taxpayer’s modified adjusted gross income must not exceed the following:

- $300,000 or less for joint filers and surviving spouses

- $225,000 or less for head of household filers, or

- $150,000 or less for other filers

Taxpayers who do not meet the income requirements are ineligible for the clean vehicle credit, even if they purchase a qualifying clean vehicle.

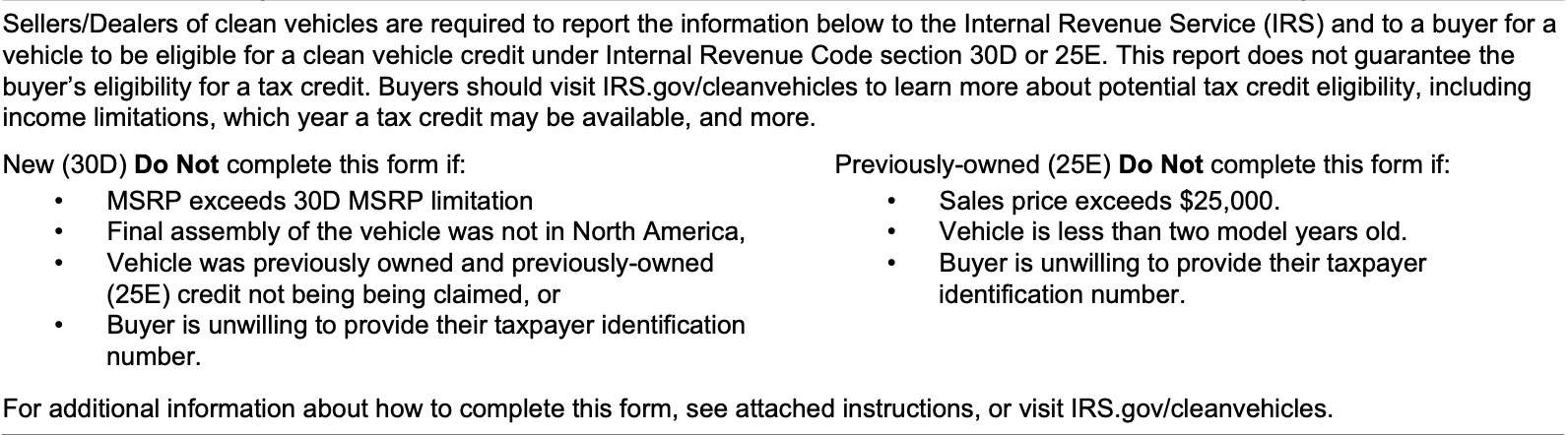

You will not receive a seller’s report for a new clean vehicle credit under these conditions

In addition to the income requirements, the Internal Revenue Code contains certain restrictions on qualifying clean vehicle sales.

Sellers of new clean vehicles will not issue a clean vehicle report under any of the following circumstances:

- The manufacturer’s suggested retail price (MSRP) exceeds the following:

- Vans, SUVs and pick-up trucks: $80,000

- Other vehicles: $55,000

- Final assembly of the vehicle was not in North America

- Does not have to be in the United States

- Vehicle was previously owned

- Buyer is unwilling to provide their taxpayer identification number

- Individuals: Social Security number (SSN) or Individual Taxpayer Identification Number (ITIN)

- Businesses: Employer identification number (EIN)

You will not receive a seller’s report for a used clean vehicle credit under these conditions

As with the new vehicle requirements, used vehicles have restrictions. Used vehicle sellers will not issue IRS Form 15400 if:

- The sales prices exceeds $25,000

- The vehicle is less than two years old

- Buyer is unwilling to provide their taxpayer identification number

You can find more information about clean vehicle requirements on the IRS website. Let’s switch gears and go to the next part of the tax form.

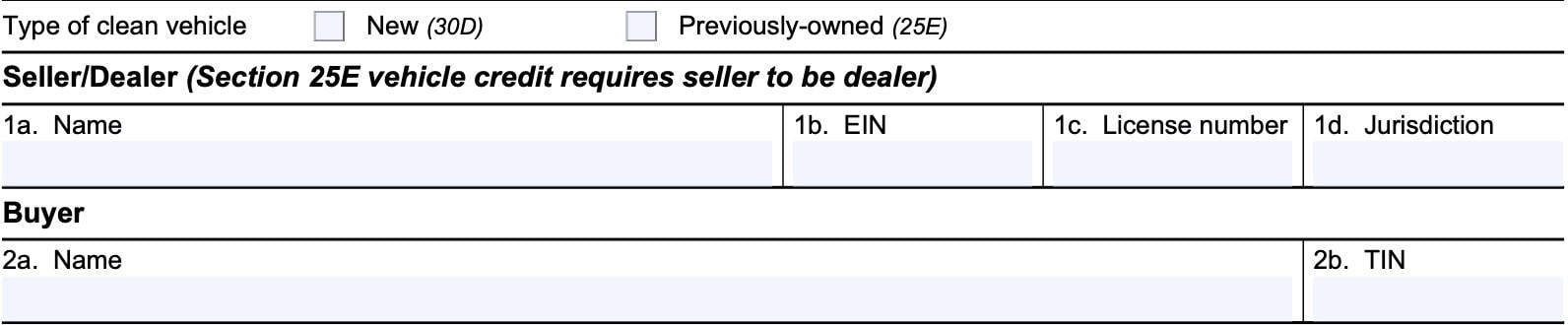

Buyer and seller information

Here, you should see the seller and buyer information. First, let’s take a look at the type of clean vehicle.

Type of clean vehicle

There are two types of clean vehicle tax credits, as a result of changes to the Internal Revenue Code based on the Inflation Reduction Act:

- IRC Section 30D: New Vehicle Credit

- IRC Section 25E: Previously-owned Vehicle Credit

Let’s take a closer look at the credit amount for each type of tax credit.

IRC Section 30D: New Vehicle Credit Amounts

The new vehicle credit amounts depend on when the vehicle was placed into service, not when the vehicle was purchased.

Vehicles placed into service between January 1, 2023 and April 17, 2023

Vehicles that were placed into service during this time frame are subject to a formula-based calculation, depending on the type of vehicle.

For plug-in electric vehicles and plug-in hybrid vehicles: Qualifying vehicles must be rated for a minimum of 7 kilowatts. The credit is calculated as $3,751 plus $417 for each kilowatt hour above 7 kilowatts, up to a maximum credit amount of $7,500.

For an alternative fuel cell vehicle, the credit is $2,500.

Vehicles placed into service after April 17, 2023

Eligible vehicles may qualify for a tax credit of up to $7,500, broken down into two components:

- Critical minerals requirement: $3,750

- Battery components requirement: $3,750

A vehicle meeting neither requirement will not receive a credit. A vehicle meeting only one requirement may be eligible for a $3,750 credit, and a vehicle meeting both requirements may be eligible for the full $7,500 credit.

Qualified manufacturers are responsible for reporting whether an eligible vehicle meets either the critical minerals requirement or the battery components requirement.

IRC Section 25E: Previously-owned Vehicle Credit amounts

According to Internal Revenue Code Section 25E, the previously owned vehicle credit is the lesser of:

- $4,000, or

- 30% of the vehicle’s sale price

Let’s get to the form itself.

Line 1: Seller’s information or dealer’s information

Line 1 should contain the following information:

- Line 1a: Seller’s name or dealer’s name

- To qualify for the used vehicle credit, the seller must be a registered dealer

- Line 1b: Employer identification number (EIN)

- Line 1c: License number

- Line 1d: Jurisdiction

Line 2: Buyer’s information

Review Line 2 to ensure that your information is accurate:

- Line 2a: Taxpayer name

- Line 2b: Taxpayer identification number (TIN)

Reminder: If you do not provide your TIN to the seller, then you cannot claim the clean vehicle tax credit.

Vehicle information

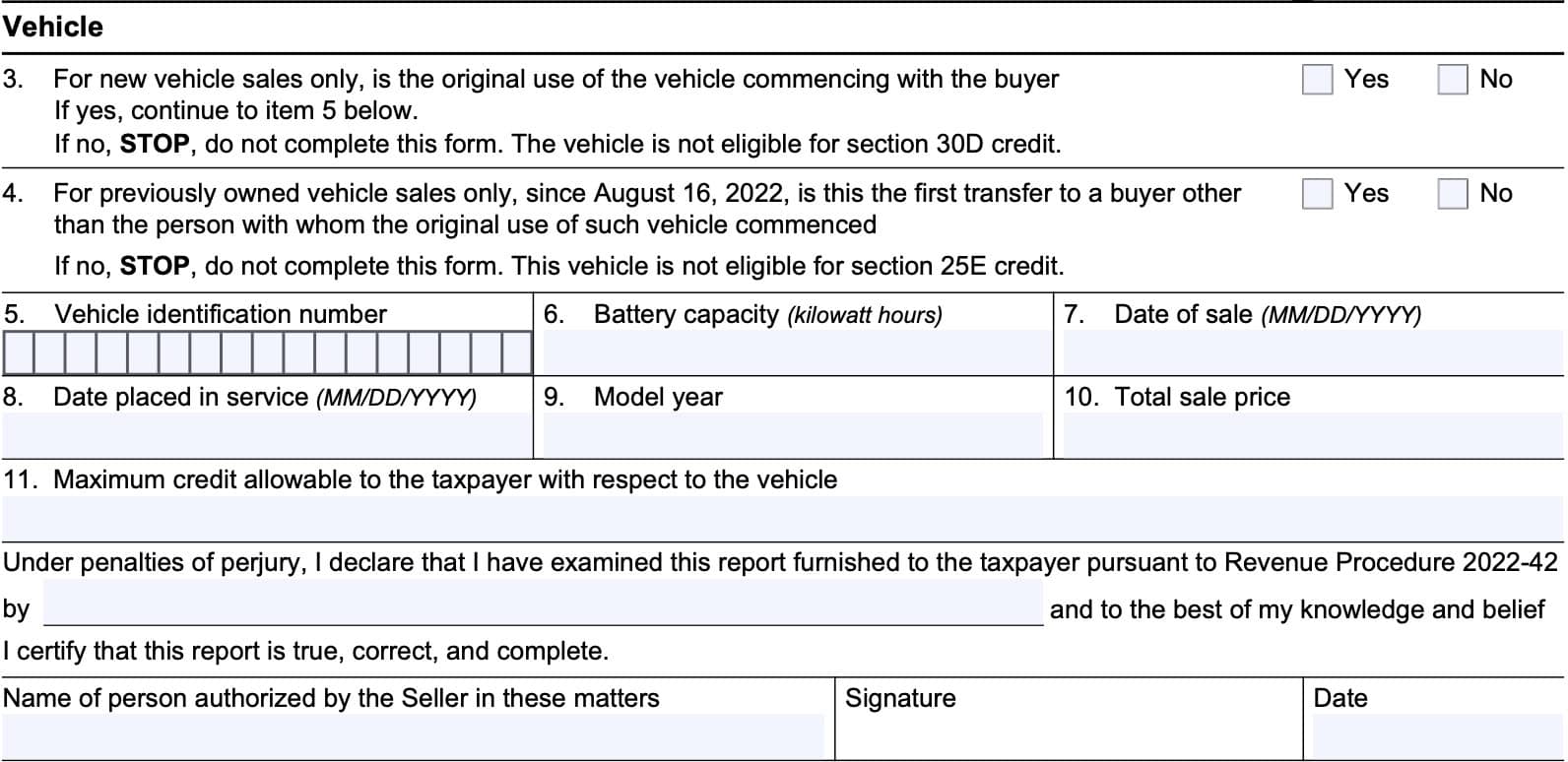

This section contains information about the clean vehicle purchase. Let’s start with Line 3 or Line 4, whichever applies:

- If you’ve purchased a new vehicle, then go to Line 3

- If you’ve purchased a previously owned vehicle, go to Line 4

Line 3: For new vehicle sales only

For new vehicle sales only, is the original use of the vehicle commencing with the buyer?

Verify that this box is checked, ‘Yes.’ Otherwise, you are ineligible for the Section 30D tax credit.

Vehicle leases

For purposes of the new clean vehicle credit, “original use” means that the vehicle has never been used by any buyer for any purpose. A person leasing a vehicle is not the owner/buyer and is not eligible for the credit.

Line 4: For previously owned vehicle sales only

For previously owned vehicle sales only, since August 16, 2022, is this the first transfer to a buyer other

than the person with whom the original use of such vehicle commenced?

Verify that this box is checked, ‘Yes.’ Otherwise, you are ineligible for the Section 25E tax credit.

Line 5: Vehicle identification number

Review the 17-digit vehicle identification number (VIN) to ensure that it matches the vehicle’s VIN or the VIN that appears in your registration.

Line 6: Battery capacity

Line 6 should contain the vehicle’s battery capacity as expressed in kilowatt hours.

Tip: Check with the qualified manufacturer of this vehicle as necessary for additional information and to ensure that this information is correct. This space should not be blank.

Line 7: Date of sale

Date of vehicle sale should be reported in MM/DD/YYYY format. Ensure that this date matches your records.

Line 8: Date placed in service

Generally, the date placed in service should be the same as the sale date, if you took possession of the vehicle at the time of purchase.

Line 9: Model year

Review Line 9 to ensure the model year matches your records.

For used vehicles: the model year must be at least two years earlier than the calendar year when sold to the buyer.

For example, a previously-owned clean vehicle sold in 2023 has to be model year 2021 or earlier.

Line 10: Total sale price

Review Line 10 to ensure the purchase price matches your records. This should include the total sale price, including all dealer-imposed costs or fees not required by law. However, this should not include any costs or fees required by law, including:

- Taxes

- Title fees

- Registration fees

For used vehicles: If the total sale price prior to the consideration of any credit or rebate exceeds $25,000, this vehicle is not eligible for Section 25E credit.

Line 11: Maximum credit allowable to the taxpayer

You should see the maximum credit allowable under either IRC Section 30D (new clean vehicles) or IRC Section 25E (previously owned clean vehicles).

To review how the credits are calculated, select the link that applies:

Certification and signature

Check this section to ensure that it has been completely filled out. According to the form instructions, the report must be signed and dated by a person currently authorized to bind the car dealer in these matters.

Certification statement

As part of the certification, the dealer must certify that the information reported about this clean vehicle is correct and complete:

Under penalties of perjury, I declare that I have examined this report furnished to the taxpayer pursuant to Revenue Procedure 2022-42 by and to the best of my knowledge and belief I certify that this report is true, correct, and complete.

Qualified clean vehicles without this certification are ineligible for either clean vehicle credit.

Video walkthrough

Watch this video to learn more about what you should look out for when you receive your clean vehicle seller’s report.

Frequently asked questions

IRS Form 15400, Clean Vehicle Seller Report, is the tax form that car dealers and sellers must use to certify specific information about the sale of qualified clean vehicles. Taxpayers use information from IRS Form 15400 to claim a clean vehicle when filing their income tax return.

No. The IRS instructs buyers to keep IRS Form 15400, often referred to as a time of sale report, for their records. However, taxpayers may use pertinent information from the clean vehicle report to claim a clean vehicle tax credit when filing their tax return.

There are two federal clean vehicle credits for tax years 2024 through 2032: the new clean vehicle credit and the previously-owned vehicle credit. Taxpayers may only claim one credit for each vehicle placed into service.

Where can I find IRS Form 15400?

You can find tax forms on the Internal Revenue Service website. For your convenience, we’ve enclosed the latest version of IRS Form 15400 here in this article.