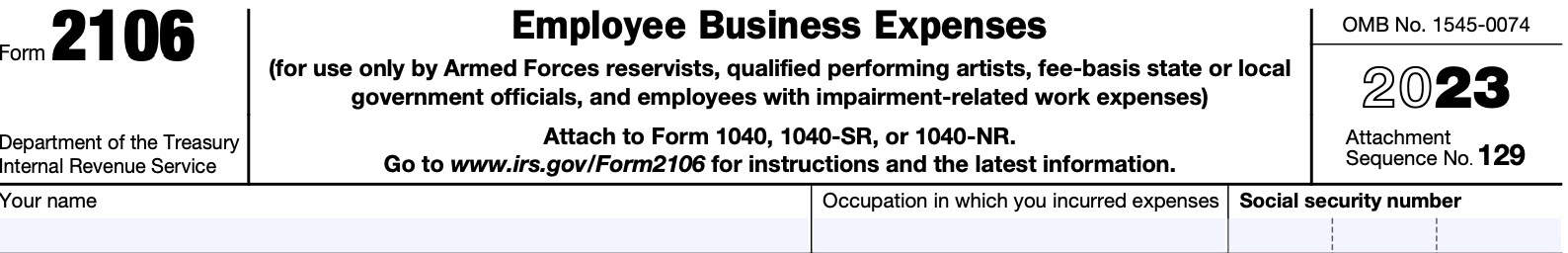

IRS Form 2106 Instructions

For the vast majority of taxpayers, the 2017 Tax Cuts and Jobs Act (TCJA) eliminated the ability to claim miscellaneous deductions, such as unreimbursed employee expenses, on a federal income tax return. But the law still allows a few taxpayers to claim employee business expenses by filing IRS Form 2106 with their individual returns.

This article will walk you through the basics of employee expenses and Form 2106, including:

- What are qualified employee expenses

- Who is eligible to claim employee expense deductions on Form 2106

- How to complete Form 2106

Let’s start with a brief overview of what happened to miscellaneous itemized deductions.

Table of contents

How do I complete IRS Form 2106?

There are 2 parts to this form:

- Part I: Employee Business Expenses and Reimbursements

- Part II: Vehicle Expenses

Before we look at each step, let’s begin at the top of the tax form.

Taxpayer information

Normally, your tax preparation software will complete the taxpayer name and Social Security number (SSN). But you’ll need to complete the field marked, “Occupation in which you incurred expenses.”

If your occupation does not include one of the previously mentioned categories for allowable expenses, the Internal Revenue Service will likely disallow your deduction.

Let’s take a closer look at each step, beginning with Part I.

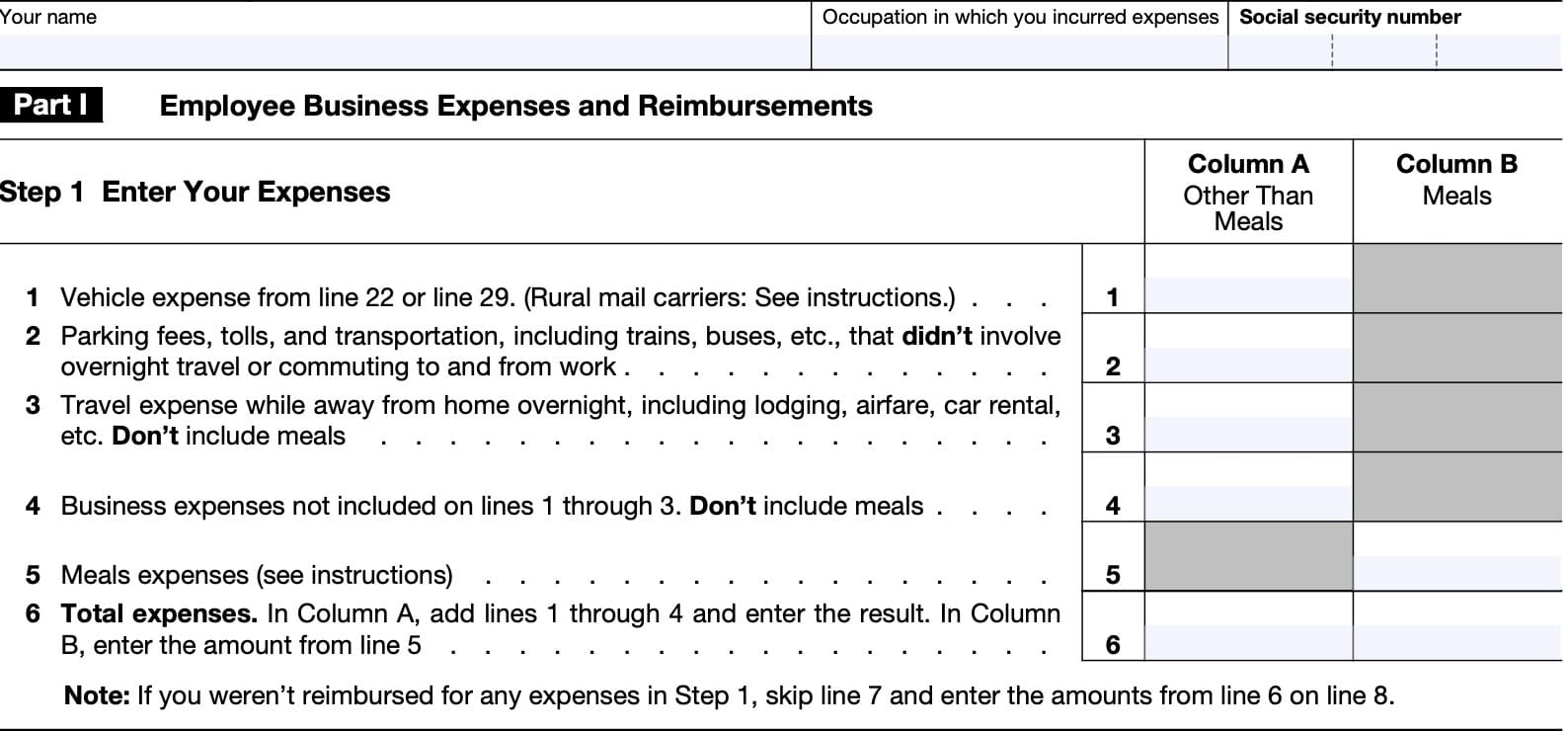

Part I: Employee Business Expenses and Reimbursements

Taxpayers should only complete Steps 1 and 3 if all of their actual expenses were unreimbursed expenses. If the taxpayer received some reimbursement from their employer, then Step 2 is required.

- Step 1: Enter Your Expenses

- Step 2: Enter Reimbursements Received From Your Employer for Expenses Listed in Step 1

- Step 3: Figure Expenses To Deduct

Let’s break this down, line by line.

Line 1: Vehicle expense

This comes from either:

- Line 22, if using the standard mileage rate method

- Line 29, if using the actual expense method

According to the form instructions, if you are a rural mail carrier, the US Postal Service should reimburse your vehicle expenses under an accountable plan, and not include that reimbursement as part of your earned income. This means that you should not have to file Form 2106 to get a tax deduction.

Line 2: Parking fees, tolls, transportation, that DID NOT involve overnight travel or commutes

Commuting expenses are not deductible expenses. According to the IRS, commuting is travel between your home and a work location. However, travel that meets any of the following conditions isn’t commuting.

- You have at least one regular work location away from your home and the travel is to a temporary work location in the same trade or business, regardless of the distance. Generally, a temporary work location is one where your employment is expected to last 1 year or less.

- The travel is to a temporary work location outside the metropolitan area where you live and normally work.

- Your home is your principal place of business under Internal Revenue Code Section 280A(c)(1)(A) (for purposes of deducting expenses for business use of your home) and the travel is to another work location in the same trade or business

- Regardless of whether that location is regular or temporary and

- Regardless of distance

Line 3: Travel expense while away overnight, not including meals

Enter any travel expenses that you incurred while on overnight business trips, but do not include meal expenses.

If you do not have a regular place of business because of the nature of your work, then your tax home may be the place where you regularly live.

If you don’t have a regular or a main place of business or post of duty and there is no place where you regularly live, you are considered an itinerant and your tax home is wherever you work.

As an itinerant, you are never away from home and can’t claim a travel expense deduction, even for necessary business expenses.

Line 4: Business expenses not included above

Enter other job-related expenses not listed on any other line of this form. This might include expenses for:

- Business gifts

- Education (tuition, fees, and books)

- Trade publications

IRS Publication 463, Travel, Gift, and Car Expenses, and IRS Publication 529, Miscellaneous Deductions, contain more information on expenses you can deduct for business purposes.

Line 5: Meals expenses

You may be able to claim either the actual cost of your meals, or the standard meal allowance rate for daily meals and incidentals expenses. The standard meal allowance rate depends on locality.

You can find the standard meal allowance rate at the General Services Administration (GSA) website.

Line 6: Total expenses

In Column A, add lines 1 through 4 and enter the result. For Column B, simply bring down the meals expenses number from Line 5.

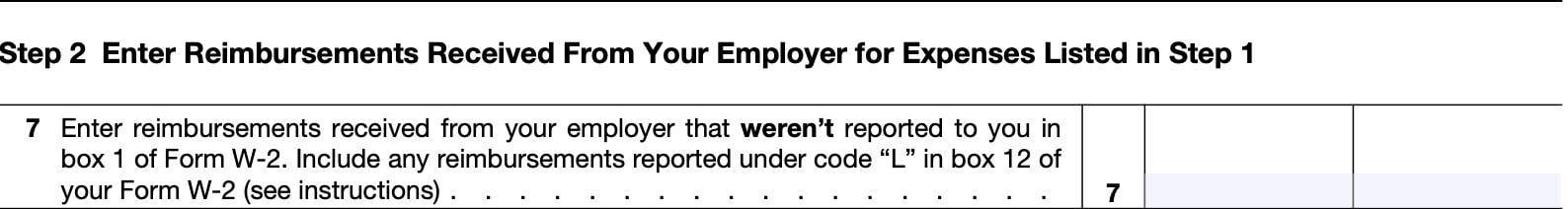

Line 7: Reimbursements received from employer

Enter reimbursements received from your employer, or a third party, for expenses shown in Step 1 that weren’t reported to you in Box 1 of your Form W-2.

This includes reimbursements reported under code “L” in Box 12 of Form W-2.

If your employer gave you a single payment, you might need to allocate this between non-meal expenses and meal-related expenses. The form instructions contain more information on how to allocate reimbursements between expenses.

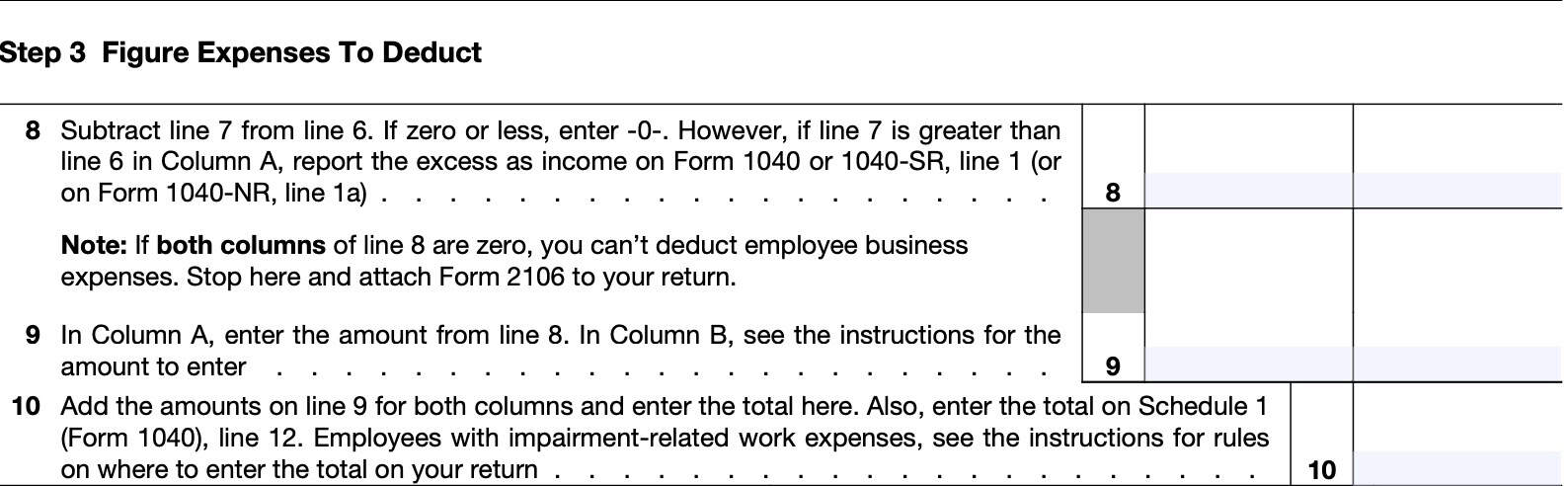

Line 8

Subtract Line 7 from Line 6. For Column A, report any excess reimbursement as income on one of the following:

- IRS Form 1040, Line 1

- IRS Form 1040-SR, Line 1

- IRS Form 1040-NR, Line 1a

Column B should not contain any calculations. If both columns are zero, then you cannot deduct employee business expenses. Stop here.

Line 9

For Column A, carry down the amount from Line 8.

For Column B, you may add the total of:

- 100% of unreimbursed business meals provided by a restaurant

- 50% of all other unreimbursed business meals

Line 10

In Line 10, add the amounts on Line 9 for both Column A and Column B. Enter the total here and on Schedule 1, Line 12.

Employees with impairment-related work expenses must instead enter the total on one of the following:

- Form 1040, Schedule A, Line 16

- Form 1040-NR, Schedule A, Line 7

Part II: Vehicle Expenses

There are two methods for figuring vehicle expenses:

- Standard mileage rate

- Actual expense method

You can use the standard mileage rate only if:

- You owned the vehicle and used the standard mileage rate for the first year you placed the vehicle in service, or

- You leased the vehicle and are using the standard IRS mileage rate for the entire lease period (except the period, if any, before 1998).

You can’t use actual expenses for a leased vehicle if you previously used the standard mileage rate for that vehicle.

If you have the option of using either the standard mileage rate or actual expense method, you should figure your expenses both ways to find the method most beneficial to you.

But when completing Form 2106, fill in only the sections that apply to your chose method. If you used more than 2 vehicles, you may need to complete an additional Form 2106.

Line 11: Date vehicle was placed in service

If this was a personal use vehicle that you converted to business use, enter the date that you placed the vehicle into service.

Line 12: Total miles driven during the year

Self-explanatory

Line 13: Business miles driven during the year

Do not include commuting miles in Line 13.

Line 14: Percentage of business use

Divide Line 13 by Line 12. This represents the percentage of your driving miles allocated to business use.

Line 15: Average daily round trip commuting distance

Enter the average distance you drive for your normal commute.

Line 16: Commuting miles included on Line 12

If you don’t know the actual number of commuting miles, multiply Line 15 by the number of days you commuted. Otherwise, enter the commuting miles only for the period that you used the vehicle for business.

Line 17: Other miles

Add Lines 13 and 16, then subtract this total from Line 12.

Line 18: Available for personal use during off-duty hours?

Select yes or no.

Line 19: Do you (or your spouse) have another vehicle available for personal use?

Select yes or no.

Line 20: Do you have evidence?

Select yes or no.

Line 21: Is the evidence written?

Select yes or no. You should always keep written documentation or use a mileage-tracking app.

Line 22: Standard mileage rate calculation

For 2023, multiply your total business miles by 65.5 cents per mile. This is your total mileage deduction.

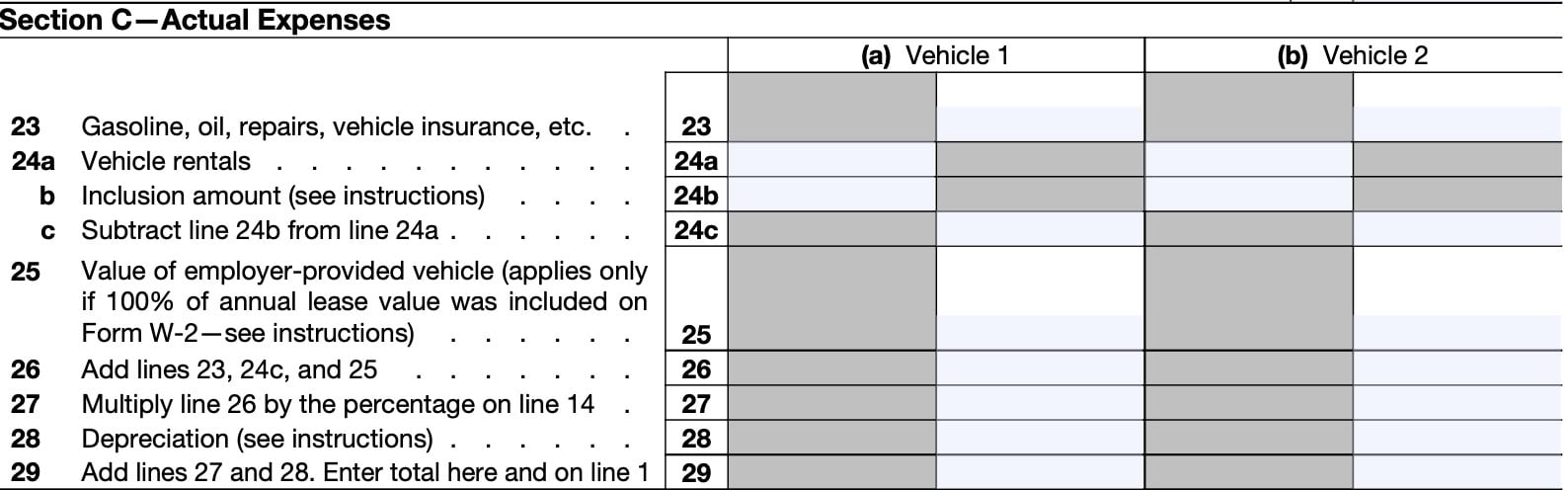

Line 23: Gasoline, oil, repairs, insurance, etc.

Enter your total annual expenses for gasoline, oil, repair expenses, insurance, tires, license plates, and similar items. Don’t include state and local personal property taxes or interest expense you paid.

Deduct state and local personal property taxes on Schedule A (Form 1040), Line 5c. Car loan interest is not deductible for employees.

Line 24: Vehicle rentals

Include the cost of vehicle rentals unless already included in Line 3 as a travel expense.

If you leased a vehicle for a term of 30 days or more, you may have to reduce your deduction for vehicle lease payments by an amount called the inclusion amount. If this applies to you, see IRS Publication 463 for more details.

Line 25: Value of employer-provided vehicle

If your employer provided a vehicle for your business use and included 100% of its annual lease value in Box 1 of your Form W-2, enter this amount on Line 25. Otherwise, skip Line 25.

Line 26

Add Lines 23 through 25 and enter the total.

Line 27

Multiply Line 26 by the percentage on Line 14.

Line 28: Depreciation

If you completed Section D, enter the amount from Line 38, below.

If you used IRS Form 4562 to figure your depreciation deduction, enter the total of the following amounts.

- Depreciation allocable to your vehicle(s) from Line 28

- Any section 179 deduction allocable to your vehicle(s) from Line 29

Line 29

Add Lines 27 and 28, then enter here and on Line 1.

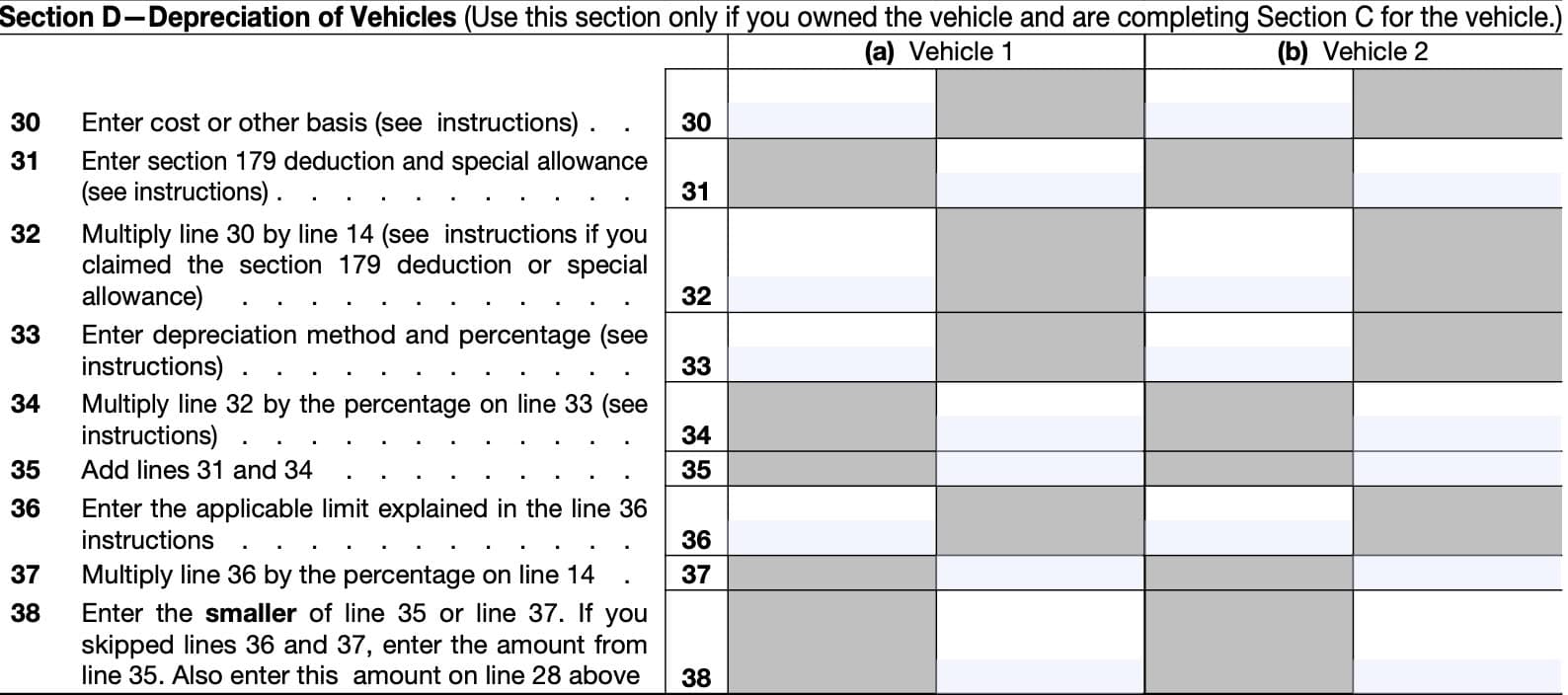

Line 30: Cost or other basis

Enter the vehicle’s actual cost or other basis. Don’t reduce your basis by any prior year’s depreciation.

However, you must reduce your basis by any of the following, if previously claimed:

- Any deductible casualty loss

- Deduction for clean-fuel vehicle

- Deduction for gas guzzler tax

- Alternative motor vehicle credit, or

- Qualified plug-in electric vehicle credit

Increase your basis by:

- Sales tax paid (unless you deducted sales taxes in the year you purchased your vehicle), and

- Any substantial improvements to your vehicle

Line 31: Section 179 deduction and special allowance

If applicable, see the form instructions for additional information.

Line 32

Multiply Line 30 by Line 14. Then subtract any Section 179 deduction or special depreciation allowance already taken in this year or a prior tax year.

Line 33

If you used the standard mileage rate in the first year the vehicle was placed in service and now elect to use the actual expense method, you must use the straight line method of depreciation for the vehicle’s estimated useful life.

Otherwise, use the following Depreciation Method and Percentage Chart to find the depreciation method and percentage to enter on Line 33.

Line 34

Multiply the number on Line 32 by the percentage on Line 33.

Line 35

Add Lines 31 and 34.

Line 36

If your vehicle was placed into service during the tax year, you may need to use one of the following tables to determine the applicable depreciation limitations.

If your vehicle is not subject to a depreciation limit, you may skip Line 36 and Line 37.

Line 37

Multiply Line 36 by the percentage in Line 14.

Line 38

Enter the smaller of:

- Line 35

- Line 37

Also enter this number in Line 28, above.

What happened to miscellaneous itemized deductions?

In 2017, Congress passed the TCJA, which simplified the entire tax return process. As a result, taxpayers noticed a couple of things that directly impacted their tax situation:

- Significant increase in the standard deduction

- Suspension of personal exemptions

- Suspension of miscellaneous itemized deductions

Both personal exemptions and miscellaneous itemized deductions are scheduled to re-emerge in 2025, unless Congress passes new legislation before then.

How do miscellaneous itemized deductions work?

Before TCJA, taxpayers were able to calculate miscellaneous deductions. Any miscellaneous deductions that totaled more than 2% of the taxpayer’s adjusted gross income, or AGI, went onto Schedule A as an itemized deduction.

From there, a taxpayer could take the greater of:

- Standard deduction, or

- Total itemized deductions calculated on Schedule A

What is considered a miscellaneous itemized deduction?

The following are considered miscellaneous itemized deductions. If you’re self-employed or an independent contractor, some of these deductions may be deductible on a business tax return or on Schedule C as a business expense.

However, they are not tax-deductible by anyone on Schedule A until tax year 2025 (as it currently stands):

- Appraisal fees for a casualty loss or charitable contribution

- Casualty and theft losses from property used in performing services as an employee

- Clerical help and office rent in caring for investments

- Credit or debit card convenience fees

- Depreciation on home computers used for investments

- Fees to collect interest and dividends

- Hobby expenses, but generally not more than hobby income

- Indirect miscellaneous deductions from pass-through entities

- Investment fees and expenses

- Legal fees related to producing or collecting taxable income or getting tax advice

- Loss on deposits in an insolvent or bankrupt financial institution

- Loss on traditional IRAs or Roth IRAs, when all amounts have been distributed to you

- Repayments of income

- Repayments of social security benefits

- Safe deposit box rental, except for storing jewelry and other personal effects

- Service charges on dividend reinvestment plans

- Tax advice fees

- Trustee’s fees for your IRA, if separately billed and paid

However, certain taxpayers are still eligible to deduct unreimbursed employee business expenses on Form 2106.

Video walkthrough

Watch this instructional video to learn more about who can take an employee business deduction, and how to do so using IRS Form 2106.

Do you use TurboTax?

If you don’t, is it because the choices are overwhelming to you?

If so, you should check out our TurboTax review page, where we discuss each TurboTax software product in depth. That way, you can make an informed decision on which TurboTax offering is the best one for you!

Click here to learn more about which TurboTax option is best for you!

Who can file IRS Form 2106?

According to IRS Publication 529, Miscellaneous Deductions, there are four classes of taxpayers who may still take an employee business expense deduction on Form 2106:

- Armed forces reservists (including National Guard members)

- Qualified performing artists

- Fee-basis state or local government officials

- Employees with impairment-related work expenses

Watch this brief video to better understand whether your tax situation warrants filing IRS Form 2106.

Below is how each of these taxpayers may claim a deduction for unreimbursed business expenses.

Armed forces reservists

If you are an armed forces reservist and you travel more than 100 miles away from home in connection with your performance of services as a reservist, you can deduct some of your travel expenses as an adjustment to gross income.

This adjustment to gross income is limited to the:

- Regular federal per diem rates (for lodging, meals, and incidental expenses) and

- Standard mileage rate (for car expenses), plus

- Any parking fees, ferry fees, and tolls

Because this qualifies as an adjustment to gross income, the deduction goes on Schedule 1 of the reservist’s federal tax return.

Qualified performing artists

If you are a qualified performing artist, you can deduct your employee business expenses as an adjustment to gross income (Schedule 1) rather than as a miscellaneous itemized deduction (Schedule A).

What is a qualified performing artist?

According to the IRS, a taxpayer is considered to be a qualified performing artist if he or she meets the following criteria:

- Performed services in the performing arts as an employee for at least two employers during the tax year,

- Received from at least two of the employers wages of $200 or more per employer,

- Had allowable business expenses attributable to the performing arts of more than 10% of gross income from the performing arts, and

- Had adjusted gross income (AGI) of $16,000 or less before deducting expenses as a performing artist.

Married taxpayers must meet the following additional criteria:

- Must file a joint tax return unless they lived apart the entire calendar year

- Must calculate the first three criteria independently of their spouse

- Combined AGI must be $16,000 or less combined

Fee-basis state or local government officials

Like military reservists and qualified performing artists, fee-basis state or local government officials may deduct work-related expenses as an adjustment to AGI on Schedule 1 instead of an itemized expense on Schedule A.

What is a fee-basis official?

Fee-basis officials are persons who are employed by a state or local government and who

are paid in whole or in part on a fee basis.

Employees with impairment-related work expenses

Unlike the other three taxpayer categories, employee with impairment-related work expenses must itemize their tax deductions using Schedule A to take advantage of this tax planning opportunity.

What employees are eligible?

The IRS considers an employee to be eligible for this deduction if he or she meets one of the following criteria:

- Employee has a physical or mental disability (for example, blindness or deafness) that functionally limits being employed; or

- Employee has a physical or mental impairment that substantially limits one or more major life activities, such as:

- Performing manual tasks

- Walking

- Speaking

- Learning

What are impairment-related work expenses?

An eligible employee may deduct work-related expenses that meet the following criteria:

- Necessary for satisfactory work performance

- For goods and services not required or used, other than incidentally, in personal activities, and

- Not specifically covered under other income tax laws

All of these may be itemized on Schedule A. However, if the standard deduction is greater than itemized deductions in a given year, the taxpayer may be better off taking the standard deduction.

Frequently asked questions

IRS Form 2106 is the tax form that certain employees may use to claim a tax deduction for unreimbursed business expenses. Only armed forces reservists, qualified performing artists, certain government officials, and employees with impairment-related expenses may file IRS Form 2106.

If you wish to deduct unreimbursed employee expenses and are authorized to do so, then you must file IRS Form 2106 with your individual tax return on or before the tax return’s due date (including extensions).

Taxpayers may only deduct unreimbursed employee expenses that are paid or incurred during the current tax year, intended to enable the taxpayer’s trade or business of being an employee, and ordinary and necessary expenses.

An expense is ordinary if it is common and accepted in a taxpayer’s trade, business, or profession. The expense is necessary if it is appropriate and helpful to the taxpayer’s business. An expense doesn’t have to be required to be considered necessary.

Where can I find IRS Form 2106?

You may download a copy of Form 2106 from the IRS website or by selecting the file below.

Related tax articles

This tax form is one of the fillable tax forms provided by the Internal Revenue Service, to help taxpayers reduce their tax preparation costs. To see more forms like this, visit our free fillable tax forms page, where you’ll also find articles like this.

Unlike the IRS, our articles contain step by step instructions for each tax form, as well as video walkthroughs. You can also check out all of our videos by subscribing to our YouTube channel!