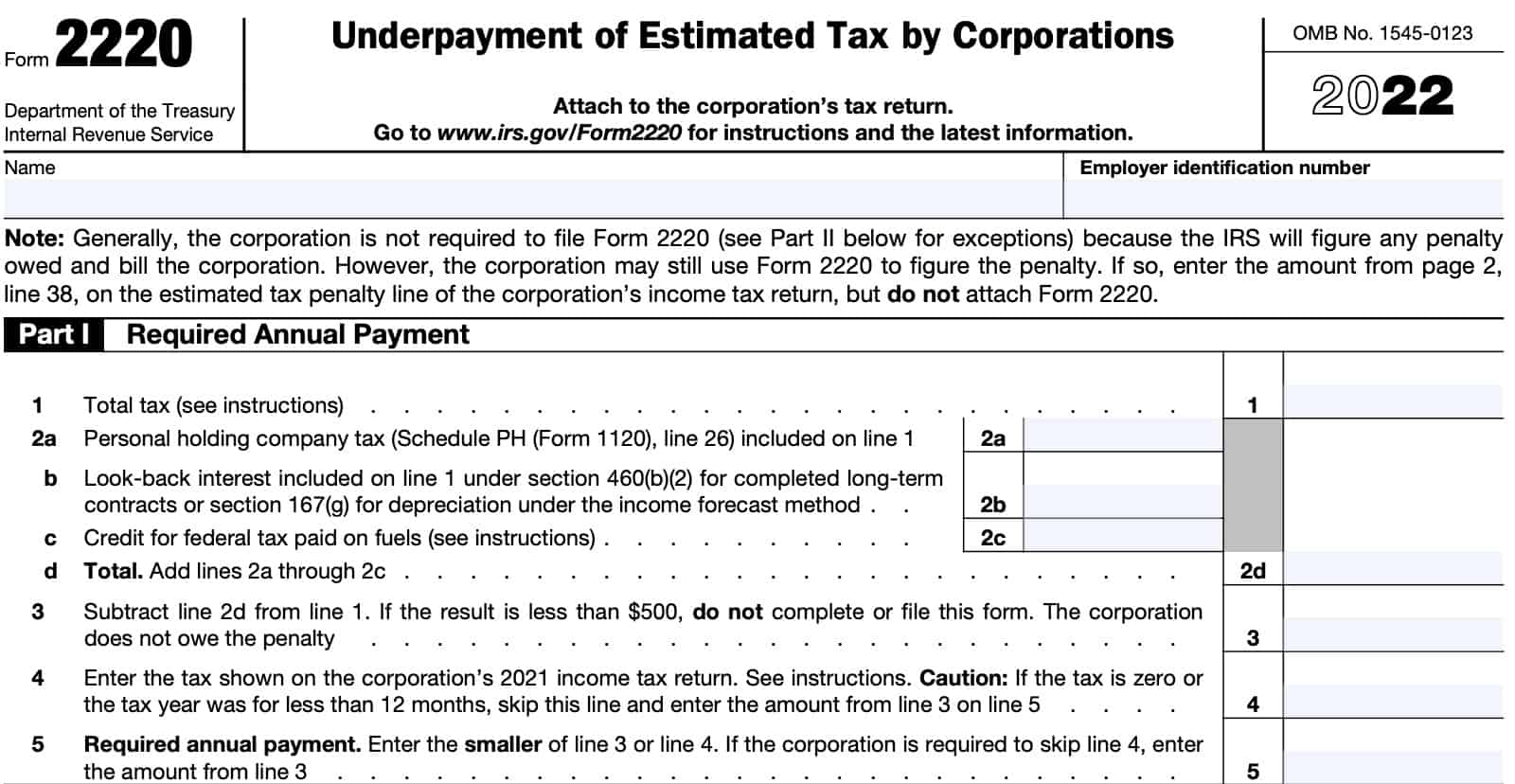

IRS Form 2220 Instructions

The Internal Revenue Service expects corporations to pay estimated taxes throughout the entire tax year. Corporations may have to complete IRS Form 2220 to determine if they have paid enough tax to avoid paying a penalty when they file their tax return.

In this article, we’ll walk through what you need to know about IRS Form 2220, including:

- How to complete IRS Form 2220

- When to complete Schedule A

- Frequently asked questions

Let’s start with an overview of IRS Form 2220 and Schedule A.

Table of contents

How do I complete IRS Form 2220?

There are 4 parts to this two-page tax form:

- Part I: Required Annual Payment

- Part II: Reasons for Filing

- Part III: Figuring the Underpayment

- Part IV: Figuring the Penalty

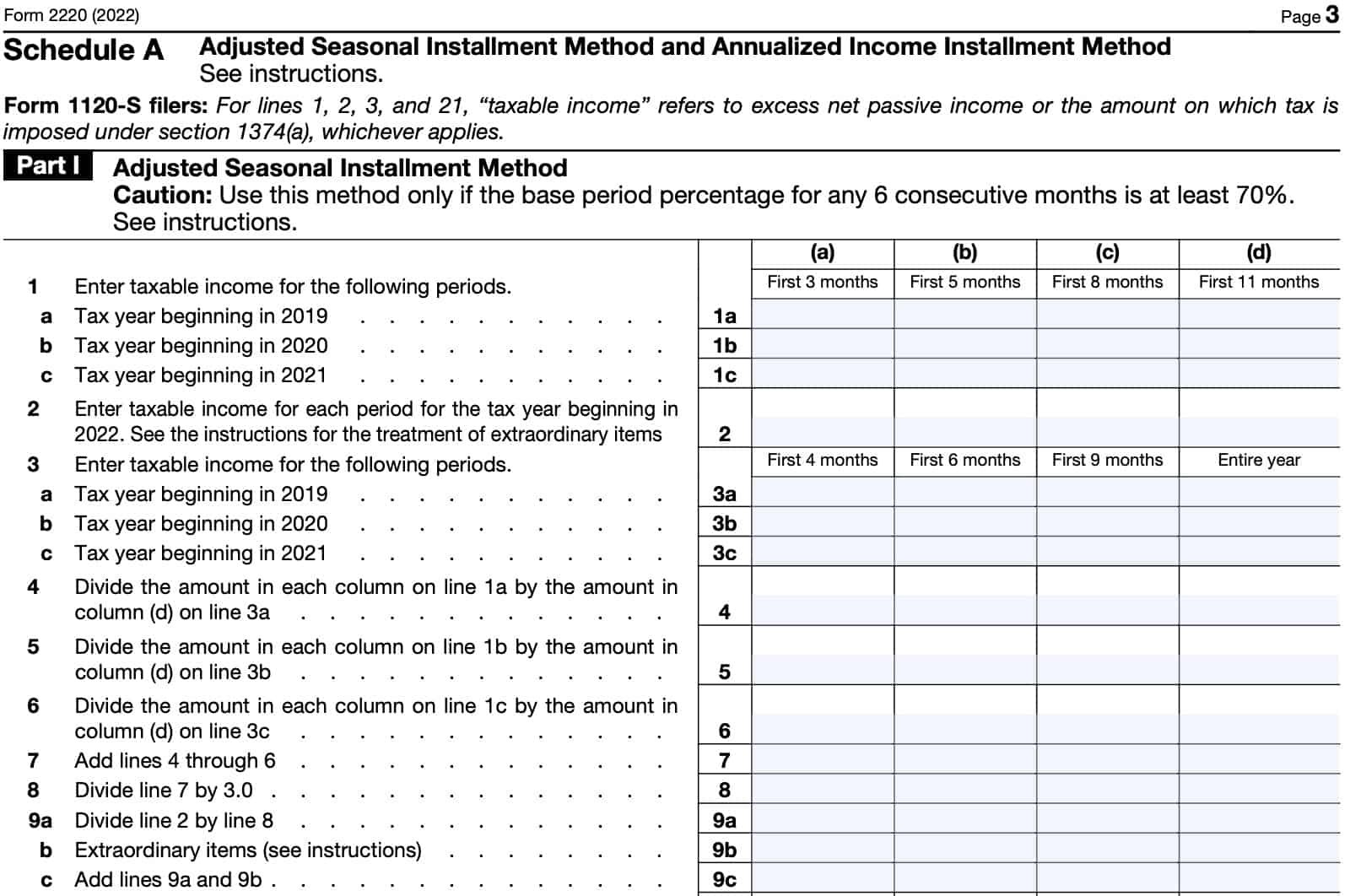

Additionally, Schedule A exists for certain tax filers. There are 3 parts to Schedule A, if required:

- Part I: Adjusted Seasonal Installment Method

- Part II: Annualized Income Installment Method

- Part III: Required Installments

Let’s start at the top by calculating the required annual payment in Part I of the tax form.

Part I: Required Annual Payment

In Part 1, we’ll calculate the total annual tax payment required.

Line 1: Total tax

In general, you should enter the tax from IRS Form 1120, Line 31, or the applicable line from one of the other tax returns listed below:

- IRS Form 990-PF: Return of Private Foundation or Section 4947(a)(1) Nonexempt Charitable Trust Treated as a Private Foundation

- IRS Form 990-T: Exempt Organization Business Income Tax Return

- IRS Form 1120-C: U.S. Income Tax Return for Cooperative Associations

- IRS Form 1120-F: U.S. Income Tax Return of a Foreign Corporation

- IRS Form 1120-FSC: U.S. Income Tax Return of a Foreign Sales Corporation

- IRS Form 1120-L: U.S. Life Insurance Company Income Tax Return

- IRS Form 1120-ND: Return for Nuclear Decommissioning Funds and Certain Related Persons

- IRS Form 1120-PC: U.S. Property and Casualty Insurance Company Income Tax Return

- IRS Form 1120-REIT: U.S. Income Tax Return for Real Estate Investment Trusts

- IRS Form 1120-RIC: U.S. Income Tax Return for Regulated Investment Companies

- IRS Form 1120-S: U.S. Income Tax Return for an S Corporation

- IRS Form 1120-SF: U.S. Income Tax Return for Settlement Funds (Under Section 468B)

However, if this amount includes any tax attributable to a sale described in Internal Revenue Code Section 338(a)(1), do not include that tax on Line 1. Instead, write “Sec. 338 gain” and show the amount of tax in brackets on the dotted line next to Line 1.

This exclusion from the Line 1 amount does not apply if you make a Section 338(h)(10) election.

Line 2

There are several line items to add under Line 2.

Line 2a: Personal holding company tax

If you included any personal holding company tax on Line 1, enter this amount on Line 2a. You can find this on IRS Form 1120, Schedule PH, Line 26.

Line 2b: Look-back interest

In Line 2b, enter any look-back interest on Line 1 under either of the following:

- IRC Section 460(b)(2) for completed long-term contracts

- IRC Section 167(g) for depreciation under the income forecast method

Line 2c: Credit for federal tax paid on fuels

Enter the amount from Form 1120, Schedule J, Line 20b, or the applicable line for other income tax returns. This amount should be the the credit reported from IRS Form 4136, Federal Taxes Paid on Fuels.

Line 2d

Add Lines 2a, 2b, and 2c. Enter the total in Line 2d.

Line 3

Subtract Line 2d from Line 1. If the result is less than $500, then you do not owe any estimated tax penalties, and you can stop here.

Line 4: Tax on corporation’s previous income tax return

Except for S-corporations, enter the tax for the corporation’s previous tax return by subtracting the credits from taxes the same way you determined the Line 3 amount. However, you should skip Line 4 if either of the following

Figure the corporation’s 2021 tax the same way the amount on line 3 of this form was determined, using the taxes and credits from its 2021 tax return. However, skip Line 4 and enter on Line 5 the Line 3 amount if either of the following applies.

- The corporation did not file a tax return for the tax year indicating a tax liability for at least some amount of tax

- The corporation had a fiscal year of less than 12 months

S corporations

For S-corporations, enter on line 4 the sum of:

- The total of the investment credit recapture tax and the built-in gains tax shown on the return for the tax year, and

- Any excess net passive income tax shown on the S corporation’s return for the tax year.

If the previous year was less than 12 months, skip Line 4. Instead, enter the Line 3 amount on Line 5.

Line 5: Required annual payment

Enter the smaller of:

- Line 3

- Line 4

If the corporation was required to skip Line 4, simply carry the Line 3 number down to Line 5.

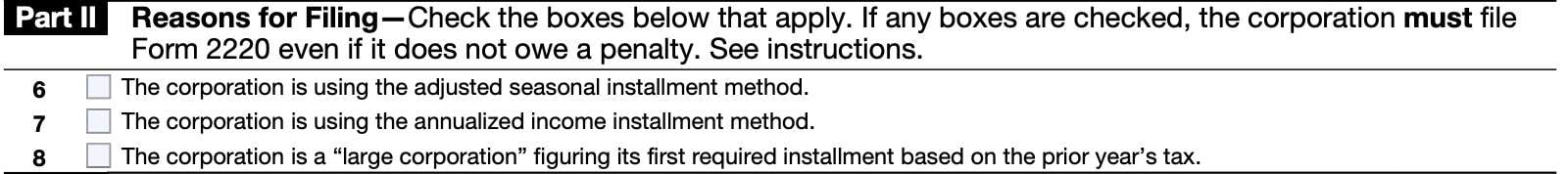

Part II: Reasons for Filing

In Part II, we will indicate the reasons for filing IRS Form 2220. If any of the below boxes are checked, the corporation must file Form 2220, even if there is no tax penalty.

Line 6: Adjusted seasonal installment method

Check this box if you are using an adjusted seasonal installment method.

If the corporation’s gross income varied during the year because it operated its business on a seasonal basis, it may be able to lower or eliminate the amount of one or more required quarterly installments. You may be able to calculate this by using the adjusted seasonal installment method in Schedule A instead of the regular installment method.

Line 7: Annualized income installment method

Check this box if you are using an annualized income installment.

If the corporation’s income varied during the year because it operated its business on a seasonal basis, it may be able to lower or eliminate the amount of one or more required installments. You may be able to calculate this by using the annualized income installment method in Schedule A.

Line 8: Large corporation figuring first required installment

Check this box for a large corporation calculating its first required installment based upon the prior year tax liability.

A large corporation is a corporation that had, or whose predecessor had taxable net income of $1 million or more for:

- Any of the 3 tax years immediately preceding the tax year, or

- Any of the number of years the corporation has been in existence, if less than 3 years.

See Treasury Regulations Section 1.6655-4 for additional information. This definition does not apply to S-corporations.

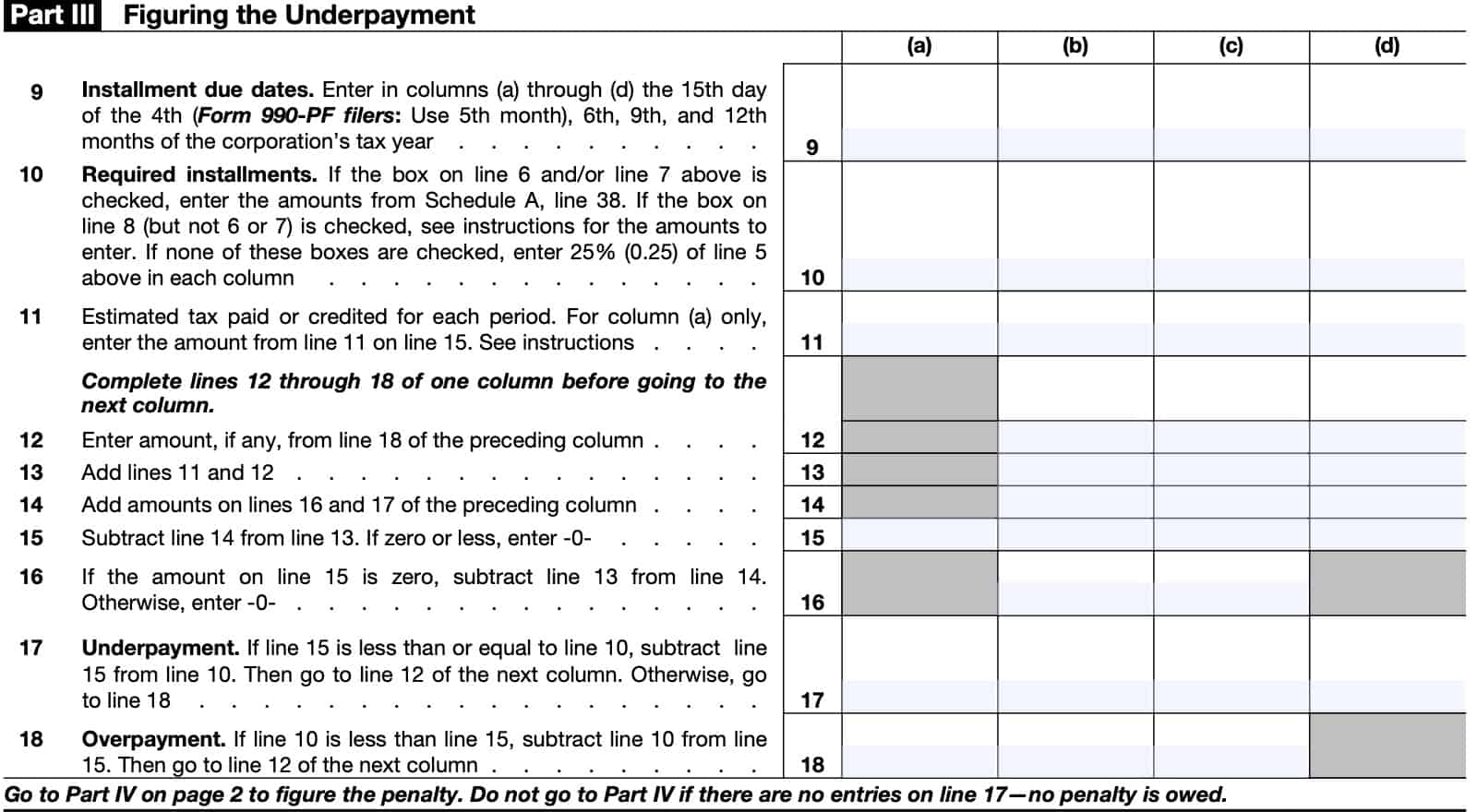

Part III: Figuring the Underpayment

In Part III, we’ll calculate the underpaid amount of any tax liability. There are four columns in Part III, for each quarter of the given taxable year.

Line 9: installment due dates

In Line 9, enter the tax return due date for each quarter. Generally, a corporation will enter the 15th day of the following months for its tax year:

- 4th month (first quarter)

- 6th month (second quarter)

- 9th month (third quarter)

- 12th month (fourth quarter)

Private foundations should use the 5th month for its first quarter due date, instead of the 4th month.

If the IRS has provided relief (such as disaster relief) that extends a due date, it is possible for multiple columns to have the same due date.

Line 10: Required installments

If the box on Line 6 or Line 7 is checked, then enter the amounts from Schedule A, Line 38.

Large corporations must follow these steps:

If the box on Line 8 is checked, but not Line 6 or Line 7:

- If Line 3 is smaller than Line 4:

- Enter 25% of the Line 3 amount in Columns (a) through (d)

- If Line 3 is greater than Line 4:

- Enter 25% of the Line 4 amount in Column (a)

- Figure Column (b) by doing the following:

- Subtract Line 4 from Line 3

- Add the result to the Line 3 amount

- Multiply the total by 25%, then enter the result in Column (b)

- For columns (c) and (d), enter 25% of the Line 3 amount.

the Box on Line 8 is checked, and either Line 6 or Line 7 are checked:

- If Line 3 is smaller than Line 4, enter 25% of the Line 3 amount in columns (a) through (d) of Schedule A, Line 35.

- If Line 4 is smaller than Line 3, enter 25% of Line 4 in Column (a) of Schedule A, Line 35.

- Figure Column (b) by doing the following:

- Subtract Line 4 from Line 3

- Add the result to the Line 3 amount

- Multiply the total by 25%, then enter the result in Column (b)

- For columns (c) and (d), enter 25% of the Line 3 amount.

If none of the boxes in Line 6, Line 7, or Line 8 are checked, then enter 25% of the Line 5 amount in each column.

Line 11: Estimated tax paid or credited

Enter the estimated tax payments made by the corporation for its tax year. Include any overpayment from the corporation’s previous tax return that was credited to the corporation’s current year tax payments.

If an installment is due on a Saturday, Sunday, or legal holiday, payments made on the next business day are considered made timely if the estimated tax payment is applied against that required installment.

For Column (a), enter any quarterly payment made by the date outlined in Line 9, Column (a).

For Columns (b), (c), and (d), enter payments made by the due date on Line 9 for that column, but after the Line 9 date for the preceding column.

Example

Let’s imagine Acme Corporation. Acme Corp. has the following due dates:

- Column (a): April 15

- Column (b): June 15

- Column (c): September 15

- Column (d): December 15

Any tax overpayments from the prior tax year would be credited in Column (a) against the April 15 due date. You would credit a May 15 for the Column (b) against the June 15 due date.

For Column (a) only, enter the Line 11 figure into Column (a) for Line 15 below. This will be the starting point for Lines 12-18, as addressed in the Line 12 instructions.

Line 12

For Lines 12 through 18, proceed through each column in chronological order. Begin Column (a) at Line 15, below.

For Columns (b) through (d), enter the amount from Line 18, if any, from the preceding column.

Line 13

For Columns (b) through (d), add Lines 11 and 12. Enter the result in Line 13.

Line 14

For Columns (b) through (d), add Line 16 and Line 17 of the preceding column. Enter the result in Line 14.

Line 15

For Column (a), enter the Line 11 here.

For all other columns, subtract Line 14 from Line 13. Enter the result here. If the result is zero or a negative number, enter ‘0.’

Line 16

If the Line 15 amount is zero, then subtract Line 13 from Line 14. Otherwise, enter ‘0.’

Line 17: Tax underpayment

If Line 15 is less than or equal to Line 10, subtract Line 15 from Line 10. Then proceed to Line 12 of the next column.

If Line 15 is greater than Line 10, go to Line 18.

Line 18: Tax overpayment

As applicable, subtract Line 10 from Line 15. Then proceed to Line 12 of the next column.

If there are no Line 17 entries for any column, you may stop here. There is no estimated tax penalty, and you do not need to complete Part IV. Otherwise, proceed to Part 4 to calculate the underpayment of tax penalty amount.

If any Line 17 entries show an underpayment, then proceed to Part IV.

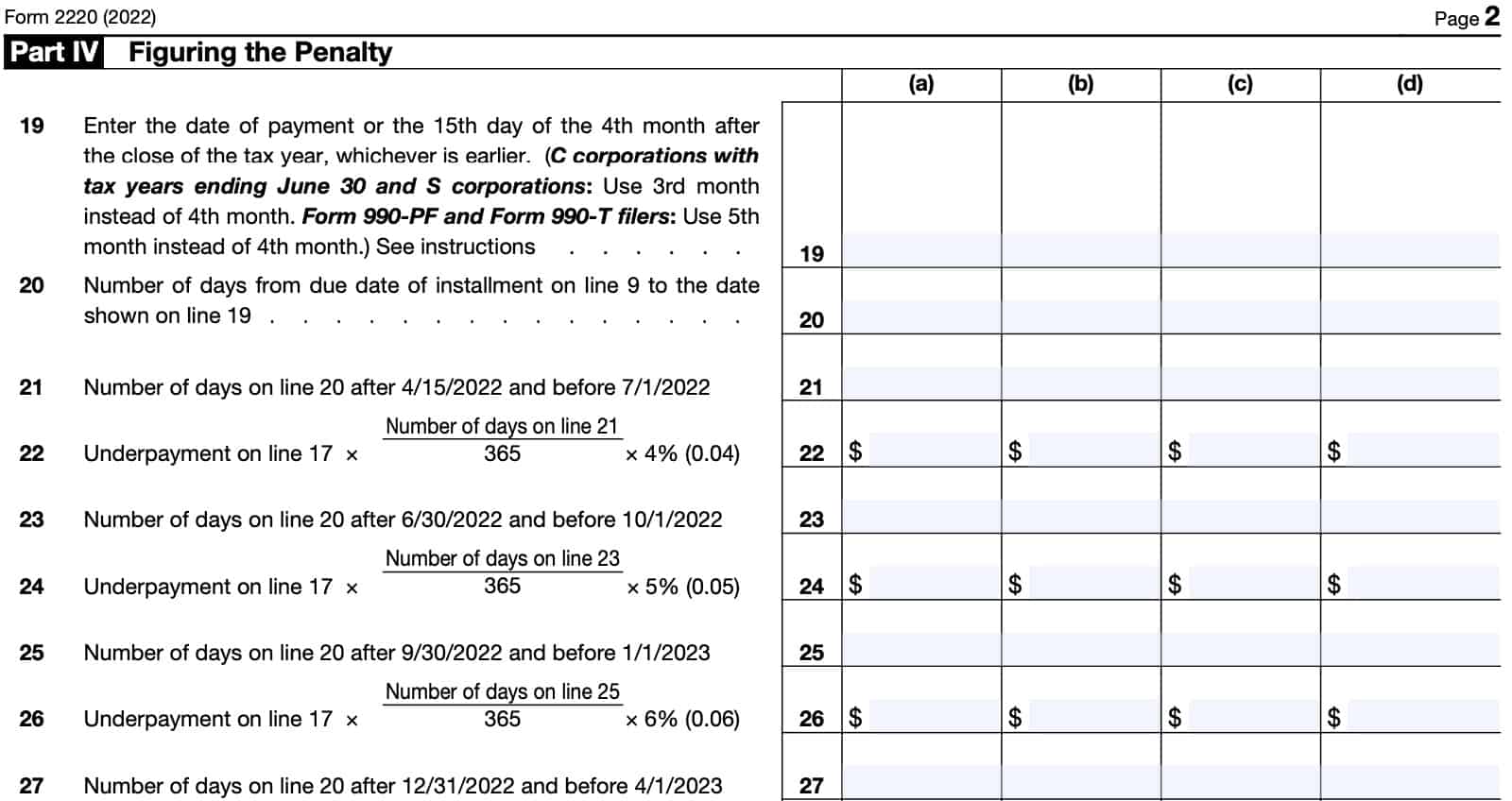

Part IV: Figuring the Penalty

Taxpayers will complete Lines 19 through 38 to determine the amount of any underpayment penalty for the period of underpayment using the underpayment rate determined under IRC Section 6621.

The period of underpayment generally runs from the installment due date to the earlier of:

- The date the underpayment is actually paid, or

- The 15th day of the 4th month after the close of the tax year.

C corporations with tax years ending June 30 and S corporations will use the 3rd month instead of the 4th month. Form 990-PF and 990-T filers will use the 5th month instead of the 4th month.

Line 19

For each column, in Line 19, enter the earlier of:

- Date of payment

- 15th day of the 4th month after the end of the tax year

As outlined above, C corporations with tax years ending June 30 and S corporations will use the 3rd month instead of the 4th month. Form 990-PF and 990-T filers will use the 5th month instead of the 4th month.

Line 20

In Line 20, enter the number of days from the installment due date (Line 9) to the date in Line 19 for each column.

Line 21

Enter the number of days on Line 20 after April 15 2022, and before July 1, 2022.

Line 22

Multiply the following:

Divide this total by 365. Multiply the result by 4%.

Line 23

Enter the number of days on Line 20 after June 30, 2022, and before October 1, 2022.

Line 24

Multiply the following:

Divide this total by 365. Multiply the result by 5%.

Line 25

Enter the number of days on Line 20 after September 30, 2022 and before January 1, 2023.

Line 26

Multiply the following:

Divide this total by 365. Multiply the result by 6%.

Line 27

Enter the number of days on Line 20 after December 31, 2022, and before April 1, 2023.

Line 28

Multiply the following:

Divide this total by 365. Multiply the result by 7%.

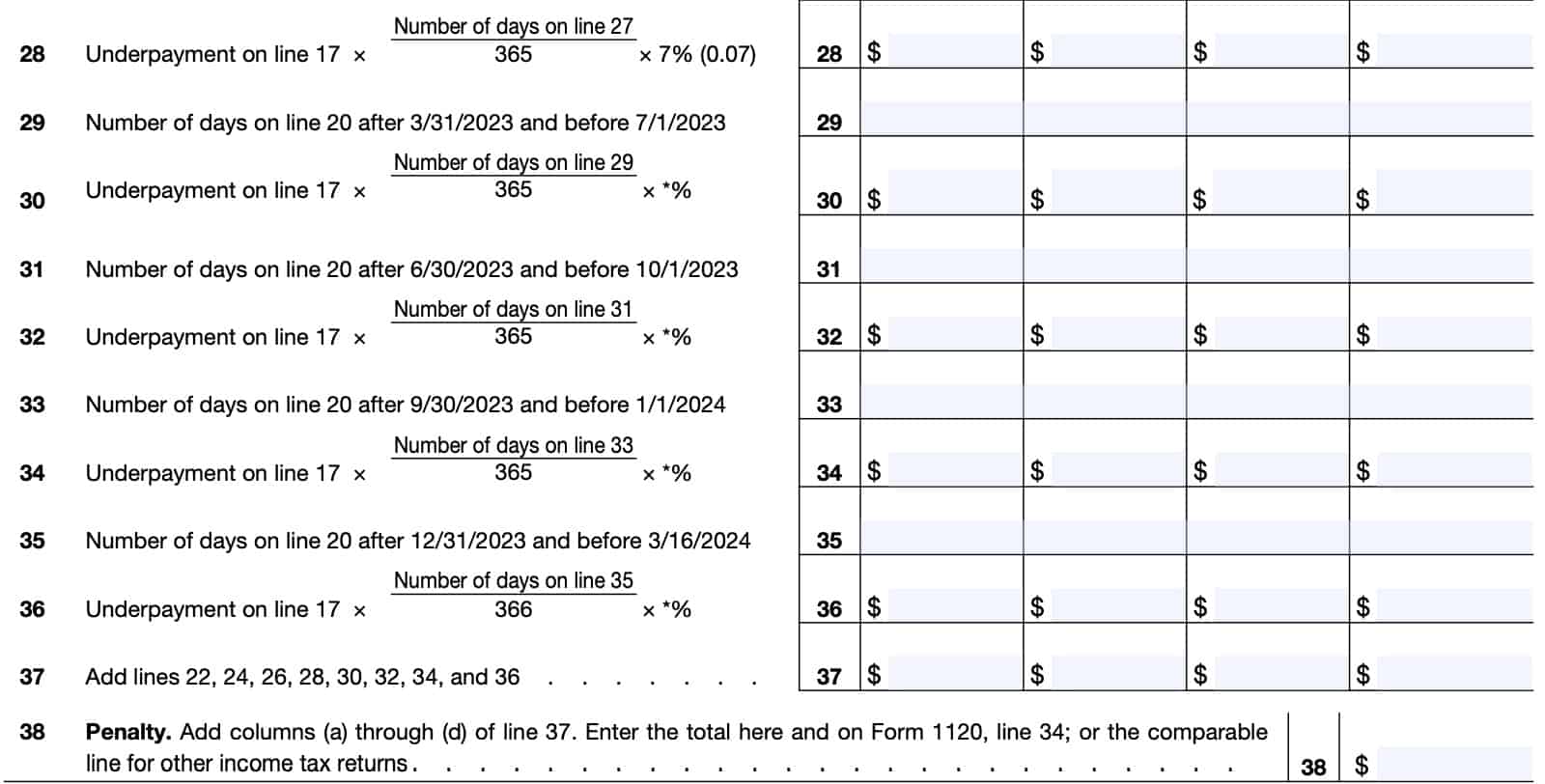

Line 29

Enter the number of days on Line 20 after March 31, 2023, and before July 1, 2023.

Line 30

Multiply the following:

Divide this total by 365. Multiply the result by the interest rate published by the IRS on its quarterly bulletin.

Line 31

Enter the number of days on Line 20 after June 30, 2023, and before October 1, 2023.

Line 32

Multiply the following:

Divide this total by 365. Multiply the result by the interest rate published by the IRS on its quarterly bulletin.

Line 33

Enter the number of days on Line 20 after September 30, 2023, and before January 1, 2024.

Line 34

Multiply the following:

Divide this total by 365. Multiply the result by the interest rate published by the IRS on its quarterly bulletin.

Line 35

Enter the number of days on Line 20 after December 31, 2023, and before March 16, 2024.

Line 36

Multiply the following:

Divide this total by 365. Multiply the result by the interest rate published by the IRS on its quarterly bulletin.

Line 37

Add the following lines:

Enter the total in Line 37.

Line 38: Penalty

Add columns (a) through (d) of Line 37.

Enter the total here and on Form 1120, Line 34; or the comparable line for a different federal income tax return. This represents the amount of penalty owed for underpayment of income tax.

Schedule A Part I: Adjusted Seasonal Installment Method

In general, under the annualized income installment method or the adjusted seasonal installment method, taxpayers must take extraordinary items into account after annualizing the taxable income for the annualization period.

Extraordinary items

An extraordinary item includes:

- Any item identified in Treasury Regulations Section 1.1502-76(b)(2)(ii)(C)(1), (2), (3), (4), (7), and (8);

- A net operating loss carryover;

- A Section 481(a) adjustment;

- Net gain or loss from the disposition of 25% or more of the fair market value of the corporation’s business assets during the tax year;

- Any other item designated as an extraordinary item in the Internal Revenue Bulletin.

The corporation can use the adjusted seasonal installment method only if the corporation’s base period percentage for any 6 consecutive months of the tax year is 70% or more.

The base period percentage for any period of 6 consecutive months is the average of the 3 percentages figured by dividing the taxable income for the corresponding 6-consecutive-month period in each of the 3 preceding tax years by the total taxable income for each of the 3 preceding tax years, respectively.

Figure the base period percentage using the 6-month period in which the corporation normally receives the largest part of its taxable income.

Line 1: Taxable income

For Part I, there are four columns: Columns (a) through (d).

In Line 1, we will enter taxable income for the following tax years:

- Line 1a: Tax year beginning in 2019

- Line 1b: Tax year beginning in 2020

- Line 1c: Tax year beginning in 2021

Across Line 1, enter the taxable income for each of the following periods in the respective column:

- Column (a): First 3 months

- Column (b): First 5 months

- Column (c): First 8 months

- Column (d): First 11 months

Line 2

In Line 2, enter taxable income for each corresponding period for the tax year beginning in 2022. Do not include the de minimis items that the corporation chooses to include on Line 9b.

Line 3

Across Line 3, enter the taxable income for each of the following periods in the respective column:

- Column (a): First 4 months

- Column (b): First 5 months

- Column (c): First 9 months

- Column (d): entire year

As in Line 1, this tax information is across the following 3 tax years:

- Line 3a: Tax year beginning in 2019

- Line 3b: Tax year beginning in 2020

- Line 3c: Tax year beginning in 2021

Line 4

Across each column, divide the Line 1a amount by the amount in Line 3a, Column (d).

Line 5

Across each column, divide the Line 1b amount by the amount in Line 3b, Column (d).

Line 6

Across each column, divide the Line 1c amount by the amount in Line 3c, Column (d).

Line 7

Add Lines 4 through 6.

Line 8

Divide Line 7 by 3.0. Enter the result in Line 8.

Line 9

For Line 9a, divide the Line 2 figure by Line 8.

In Line 9b, include any extraordinary items defined above. Include de minimis items not included in Line 2.

Add Lines 9a and 9b. Enter the result in Line 9c.

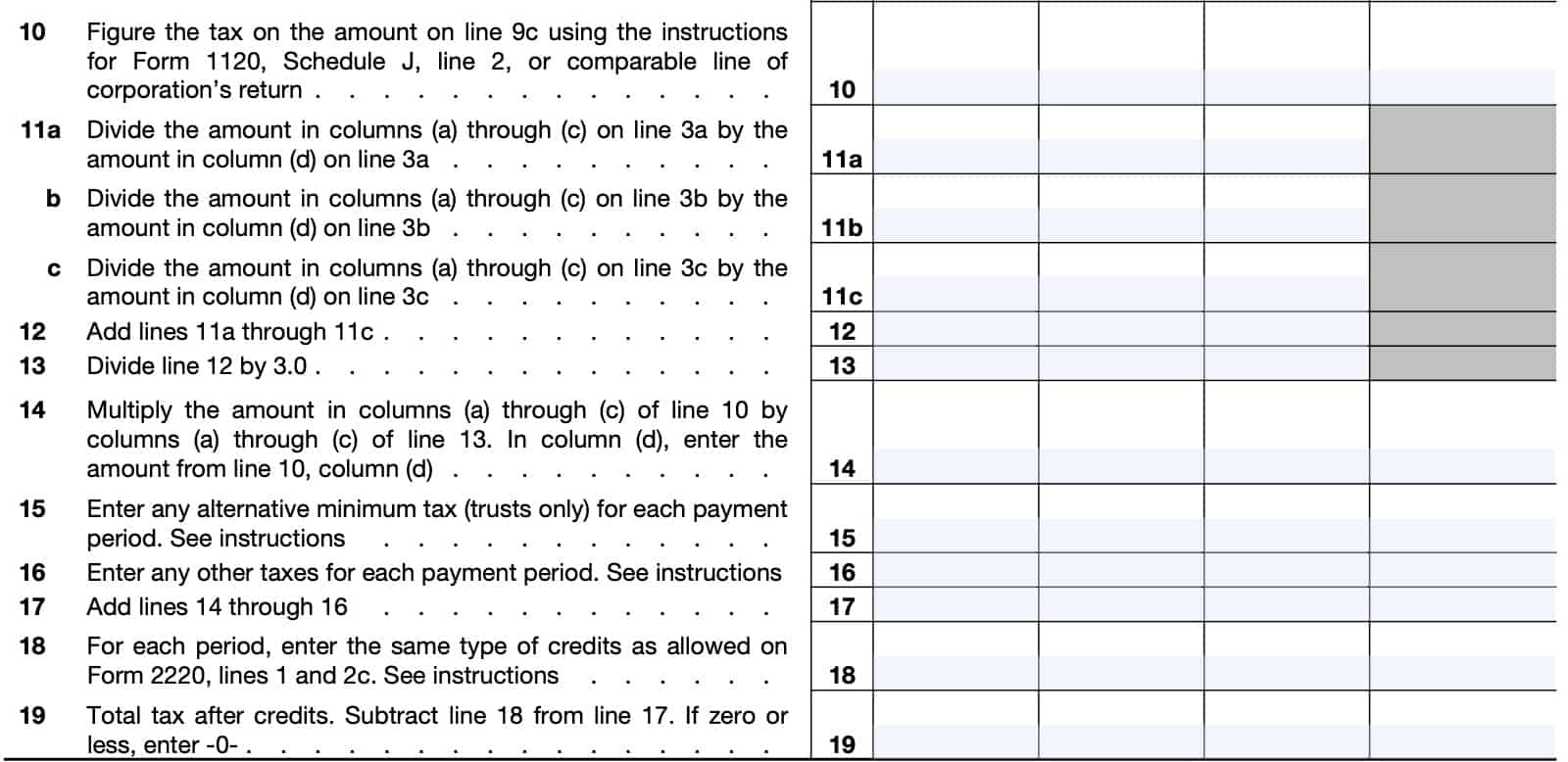

Line 10

Using the instructions for IRS Form 1120, Schedule J, Line 2 (or a comparable line of your applicable corporation), calculate the tax on the amount in Line 9c.

Line 11

In Line 11a: Divide the amounts in Columns (a) through (c) on Line 3a by the amount in Column (d) of Line 3a.

Line 11b: Divide the amounts in Columns (a) through (c) on Line 3b by the amount in Column (d) of Line 3b.

In Line 11c: Divide the amounts in Columns (a) through (c) on Line 3c by the amount in Column (d) of Line 3c.

Line 12

Add Lines 11a through 11c. Enter the result in Line 12.

Line 13

Divide Line 12 by 3.0.

Line 14

For Columns (a) through (c):

Multiply the Line 10 amount by the Line 13 amount.

For Column (d), enter the Column (d) amount from Line 10.

Line 15: Alternative minimum tax

Only trusts liable for unrelated business income tax may be liable for alternative minimum tax (AMT) on certain adjustments and tax preference items.

Form 990-T filers compute AMT on Schedule I (Form 1041), Alternative Minimum Tax—Estates and Trusts, if applicable.

Calculate alternative minimum taxable income (AMTI) based on the trust’s income and deductions for the months shown in the column headings directly above Line 1.

Line 16

In Line 16, enter on any other taxes the corporation owed for the months shown in each column heading directly above Line 1.

Include the same taxes used to figure Form 2220, Part I, line 1, including the base erosion minimum tax, if applicable.

Do not include the personal holding company tax and interest due under the look-back method of either:

- IRC Section 460(b)(2) for completed long-term contracts or

- IRC Section 167(g)(2) for property depreciated under the income forecast method.

Line 17

Add Lines 14 through 16. Enter the corresponding result in each column of Line 17.

Line 18

For each period, enter the amount of credits allowed on Form 2220, Line 1 and Line 2c.

Line 19: Total tax after credits

Subtract Line 18 from Line 17 in each column. The result is the amount of tax due for each quarter.

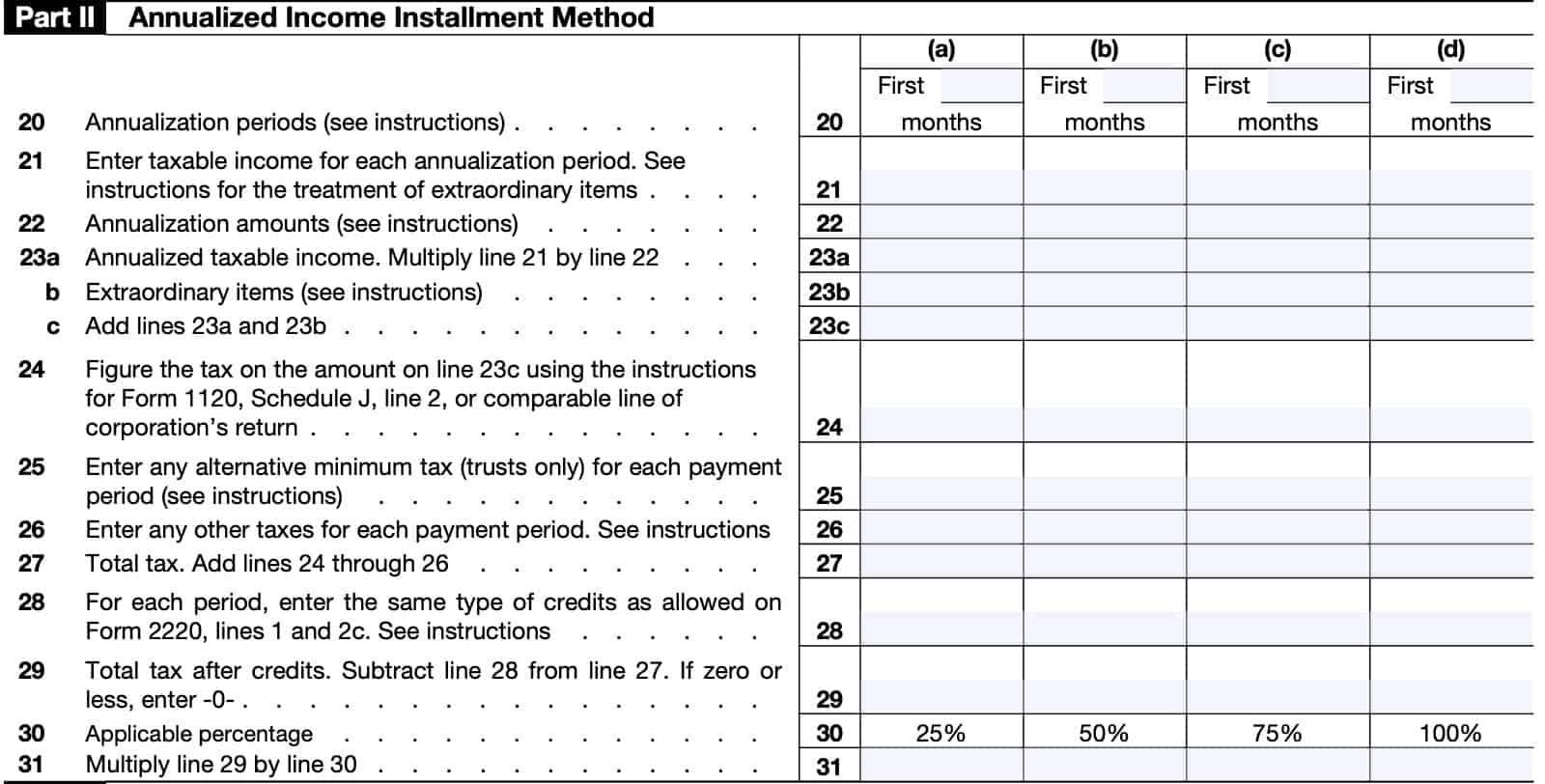

Schedule A Part II: Annualized Income Installment Method

Use Part II to calculate estimated tax based upon the annualized income installment method.

Line 20: Annualization periods

Enter on Line 20, Columns (a) through (d), respectively, the annualization periods for the option shown in the tables below.

Option table for corporations

| 1st installment | 2nd installment | 3rd installment | 4th installment | |

| Standard option | 3 | 3 | 6 | 9 |

| Option 1 | 2 | 4 | 7 | 10 |

| Option 2 | 3 | 5 | 8 | 11 |

Option table for Tax-Exempt Organizations and Private Foundations

| 1st installment | 2nd installment | 3rd installment | 4th installment | |

| Standard option | 2 | 3 | 6 | 9 |

| Option 1 | 2 | 4 | 7 | 10 |

For example, if the corporation elected Option 1, enter on Line 20 the annualization periods 2, 4, 7, and 10, in columns (a) through (d), respectively.

Line 21

Enter the taxable income that the corporation received for the months entered for each annualization period in Columns (a) through (d) on Line 20.

Do not include on line 21 the de minimis extraordinary items that the corporation chooses to include on Line 23b. See Extraordinary items, earlier.

Line 22: Annualization amounts

Enter on Line 22, Columns (a) through (d), respectively, the annualization amounts for the option shown in the tables below.

Option table for corporations

| 1st installment | 2nd installment | 3rd installment | 4th installment | |

| Standard option | 4 | 4 | 2 | 1.33333 |

| Option 1 | 6 | 3 | 1.71429 | 1.2 |

| Option 2 | 4 | 2.4 | 1.5 | 1.09091 |

Option table for Tax-Exempt Organizations and Private Foundations

| 1st installment | 2nd installment | 3rd installment | 4th installment | |

| Standard option | 6 | 4 | 2 | 1.33333 |

| Option 1 | 6 | 3 | 1.71429 | 1.2 |

For example, if the corporation elected Option 1, enter on Line 20 the annualization periods 2, 4, 7, and 10, in columns (a) through (d), respectively.

Line 23

For Line 23a, Multiply Line 21 by Line 22. Enter the result in each corresponding column.

In Line 23b, include any extraordinary items defined above. Include de minimis items not included in Line 21.

Add Lines 23a and 23b. Enter the result in Line 23c for each column.

Line 24

Using the instructions for IRS Form 1120, Schedule J, Line 2 (or a comparable line of your applicable corporation), calculate the tax on the amount in Line 23c.

Line 25: Alternative minimum tax

Only trusts liable for unrelated business income tax may be liable for alternative minimum tax (AMT) on certain adjustments and tax preference items.

Form 990-T filers compute AMT on Schedule I (Form 1041), Alternative Minimum Tax—Estates and Trusts, if applicable.

Calculate alternative minimum taxable income (AMTI) based on the trust’s income and deductions for the months shown in the column headings directly above Line 20.

Line 26: Other taxes

In Line 26, enter on any other taxes the corporation owed for the months shown in each column heading directly above Line 20.

Include the same taxes used to figure Form 2220, Part I, line 1, including the base erosion minimum tax, if applicable.

Do not include the personal holding company tax and interest due under the look-back method of either:

- IRC Section 460(b)(2) for completed long-term contracts or

- IRC Section 167(g)(2) for property depreciated under the income forecast method.

Line 27: Total tax

For each column, add Lines 24 through 26. Enter the result in Line 27.

Line 28

For each period, enter the amount of credits allowed on Form 2220, Line 1 and Line 2c.

Line 29: Total tax after credits

Subtract Line 28 from Line 27 in each column.

Line 30: Applicable percentage

Enter nothing. The appropriate percentage should already be in Line 30.

Line 31

Multiply Line 29 by Line 30. Enter the result in Line 31.

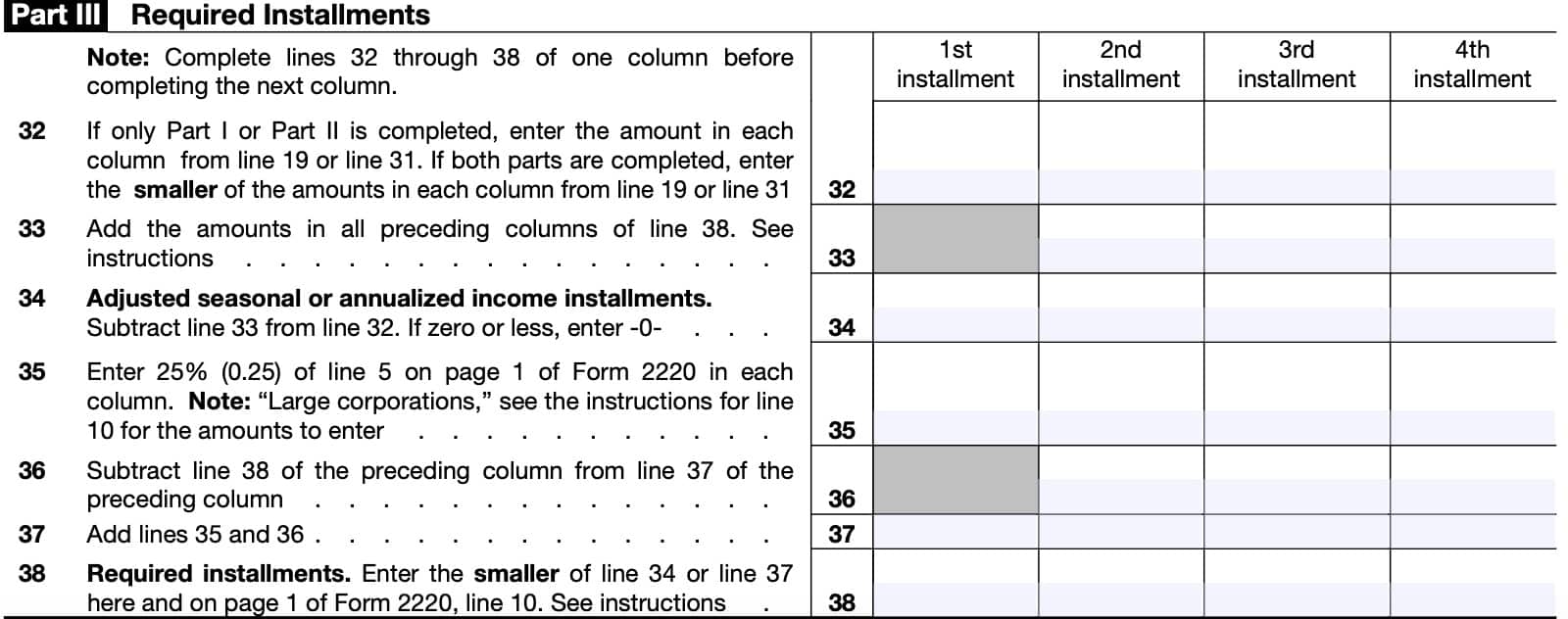

Schedule A Part III: Required Installments

For Part III, complete each column in order. For example, you must complete the column marked, 1st installment before proceeding to the column marked 2nd installment.

Line 32

If you have only completed Part I or Part II, then enter the amount from either Line 19 or Line 31, as applicable.

If you have completed both parts, then enter the smaller of Line 19 or Line 31.

Line 33

Except for Column (a), add the amounts in all preceding columns of Line 38. You must have completed Lines 34 through 38 of the preceding column before entering a number in Line 33 of the next column.

Line 34: Adjusted seasonal or annualized income installments

Except for Column (a), subtract Line 33 from Line 32. Enter the result in Line 34.

If the result is zero or less, enter ‘0.’

Line 35

Enter 25% of the Line 5 amount from Form 2220 in each column. For large corporations, additional instructions are on Line 10.

Line 36

Except for Column (a), subtract Line 38 of the preceding column from Line 37 of the preceding column.

Line 37

Add Lines 35 and 36. For Column (a), simply bring the Line 35 number down to Line 37.

Line 38: Required installments

Enter the smaller of:

- Line 34

- Line 37

Enter the same number on Line 10 of Form 2220.

Video walkthrough

Watch this instructional video to learn more about calculating underpayment of estimated tax using IRS Form 2220.

If you’re interested in using either the annualized income installment method or the adjusted seasonal installment method to determine estimated tax liability, watch this video on how to use Schedule A.

Frequently asked questions

The failure to pay penalty for corporate income tax is .5% (0.005) of the unpaid tax for each month that the tax remains unpaid, up to a maximum of 25%.

The Internal Revenue Service calculates the tax penalty on underpayment of estimated corporate tax depending on the amount of the underpayment, periods of underpayment, and prevailing interest rates.