IRS Form 3468 Instructions

In the United States, the federal government often passes laws to provide tax incentives for businesses to invest in projects that benefit the general public. One of the oldest existing tax incentives is the investment tax credit, which taxpayers claim by filing IRS Form 3468.

In this article, we’ll walk through everything that you need to know about claiming investment credits with IRS Form 3468, including:

- How to complete IRS Form 3468

- Types of investment credits available

- Frequently asked questions

Let’s begin with step by step guidance on completing this tax form.

Table of contents

How do I complete IRS Form 3468?

This form contains 7 parts:

- Part I: Facility Information

- Part II: Qualifying Advanced Coal Project Credit and Qualifying Gasification Project Credit

- Part III: Qualifying Advanced Energy Project Credit Under Section 48C

- Part IV: Advanced Manufacturing Investment Credit Under Section 48D

- Part V: Reserved for Future Use

- Part VI: Energy Credit Under Section 48

- Part VII: Rehabilitation Credit Under Section 47

As a general guideline, you will need to complete a separate Form 3468 for each facility or property for which you want to claim an investment credit. On each form, you’ll complete Part I and the appropriate part (Part II through Part VII), depending on the type of tax credit you’re trying to claim.

Let’s begin at the top with Part I.

Part I: Facility information

The lines that you’ll need to complete in Part I depend on which other part you are completing. Although we will provide step by step instructions for all of Part I, you should use the following table to help determine which lines you actually need to complete.

| If you are completing…. | Then complete the following lines |

| Part II | Lines 1–5, and 14 |

| Part III | Lines 1–5, and 8 |

| Part IV | Lines 1–5, and 14 |

| Part VI | Lines 1–14 (and Line A for credit figured in section M) |

| Part VII | Lines 1–5, and 14 |

Let’s start at the top.

Taxpayer information

At the very top of the form, the taxpayer name and identifying number should appear. If using tax preparation software, these information fields should be auto-populated by your tax software. However, you should verify this information for accuracy.

Line A

Check the box in Line A if you have:

- Petitioned for provisional emission rates, and

- Received written approval from a certified third-party verifier or a letter from the IRS

Provisional emission rates

Check the box on Line A to indicate that you petitioned the Treasury Secretary for a provisional emissions rate, or PER.

As part of the process to petition for a PER, you must have submitted an application to the Department of Energy for an emissions value that you used to figure your energy credit for a clean hydrogen production facility.

Line 1: Description of the facility

Your facility description depends on which part of the form you will complete to claim the investment credit. However, if the facility owner is different from the filer, you’ll need to include the owner’s name and taxpayer ID number in the description.

Part II, Part III, and Part VI filers

Enter a detailed technical description of the facility or property that is an integral part of such facility.

Part IV filers

Enter a detailed technical description of the manufacturing process(es) and end product(s) for the advanced manufacturing investment credit.

Part VII filers

Enter a detailed description of the rehabilitated building.

Line 2a: IRS-issued registration number for the facility

As applicable, enter the pre-filing registration number for the property or facility that you received from the Internal Revenue Service before making an election under any of the following statutes:

- Internal Revenue Code (IRC) Section 48D(d): Advanced Manufacturing Credit

- IRC Section 6417: Elective Payment of Applicable Credits

- IRC Section 6418: Transfer of Certain Credits

Line 2b: Type of facility

Enter the type of facility qualifying for the investment credit, such as solar, geothermal, etc.

Line 3: Location of the facility

In Line 3, enter the location of the facility. Use Line 3a to enter the facility’s address. If there is not address, use Line 3b to enter the coordinates of the facility’s location.

Line 3a: Address of the facility

If available, enter the facility’s address in Line 3a.

Line 3b: Coordinates

If no address of the facility is available, enter the coordinates:

- Latitude

- Longitude

Be sure to enter a ‘+’ or ‘-‘ sign in the first box, as applicable.

Line 4: Date construction began

Enter the date that construction began on the qualifying facility.

Line 5: Date placed into service

In Line 5, enter the date that you placed the facility into service.

Line 6

Is the facility part of an expansion of an existing closed-loop biomass or open-loop biomass facility? Indicate Yes or No.

Line 7

Does the project produce a net output of less than 1 megawatt (MW) alternating current (AC) or equivalent thermal energy? Select one of the following choices:

- Line 7a: Yes

- Line 7b: No

- Line 7c: Not applicable, the facility doesn’t produce electricity

Line 8

Does the project satisfy the prevailing wage and apprenticeship requirements? Choose from one of the following answers:

- Line 8a: Yes, and Sections 48C(e)(5) and (6) apply, and it was declared as provided per Notice 2023-18

- Line 8b: Yes, and either of the following applies:

- Section 48(a)(i)(B)(ii) if construction began before January 29, 2023, or

- Sections 48(a)(10) and (11) apply

- Line 8c: No

- Line 8d: Not applicable

Filers completing Part III

For an increased tax credit under IRC Section 48C, a taxpayer must meet the prevailing wage and apprenticeship requirements with respect to any qualified advanced energy project.

As part of a Section 48C(e) application, an applicant must confirm that it intends to meet the prevailing wage and apprenticeship requirements by filing the “Initial PWA Confirmation” statement with the Department of Energy (DOE). When the taxpayer notifies the DOE that it has placed the project in service, the taxpayer must also confirm that it met the prevailing wage and apprenticeship requirements by filing the “Final PWA Confirmation” statement with the DOE.

If a taxpayer doesn’t provide an Initial and Final PWA Confirmation statement to the DOE, the IRS will require the taxpayer to claim the Section 48C credit at the 6% credit rate and forfeit the remainder of the Section 48C credits allocated to the project.

Prevailing wage requirements

Generally, the taxpayer must ensure that laborers and mechanics employed in the re-equipping, expansion, or establishment of a manufacturing facility are paid wages at least equal to the prevailing rates for construction, alteration, or repair of similar nation in the locality where the project takes place.

The Secretary of Labor determines prevailing rates by locality.

For more information, see the following:

- Internal Revenue Notice 2022-61: Prevailing Wage and Apprenticeship Initial Guidance Under Section 45(b)(6)(B)(ii) and Other Substantially Similar Provisions

- Internal Revenue Notice 2023-18: Initial Guidance Establishing Qualifying Advanced Energy Project Credit Allocation Program Under Section 48C(e)

Apprenticeship requirements

Each taxpayer (or contractor or subcontractor) who employs four or more workers to perform construction, alteration, or repair work on a facility must employ one or more qualified apprentices from a registered apprenticeship program.

Qualified apprentices must perform a minimum percentage of the total labor hours of the construction, alteration, or repair work. This percentage depends on the date that facility construction began:

- Facilities beginning construction before 2023: 10%

- Facilities beginning construction in 2023: 12.5%

- Facilities beginning construction in 2024 or later: 15%

Taxpayers must also ensure to meet any applicable ratios of apprentices to journeyworkers as established by the registered apprenticeship program. An exception may apply if the taxpayer has requested apprentices but none are available.

See the following for additional details:

- IRC Section 48C(e)(6)

- IRC Section 45(b)(8)

- Internal Revenue Notice 2022-61: Prevailing Wage and Apprenticeship Initial Guidance Under Section 45(b)(6)(B)(ii) and Other Substantially Similar Provisions

- Internal Revenue Notice 2023-18: Initial Guidance Establishing Qualifying Advanced Energy Project Credit Allocation Program Under Section 48C(e)

Filers completing Part VI

For an increased tax credit under IRC Section 48(a)(9)(A)(i), a taxpayer needs to meet one of the project requirements in an energy project.

Energy project

An energy project is a project consisting of one or more energy properties that are part of a single project under IRC Section 48. A project meets the project requirements if it’s any of the following:

- It has a maximum net output of less than 1 megawatt of electrical (as measured in alternating current) or thermal energy;

- Construction began before January 29, 2023; or

- The energy project meets the prevailing wage and apprenticeship requirements in Sections 48(a)(10)(A) and (11).

The prevailing wage requirements and apprenticeship requirements are the same as for filers completing Part III.

Line 9

Does the property qualify for a domestic content bonus credit, as outlined in Section 45(b)(9)(B)? Choose from the following:

- Line 9a: Yes, and Section 48(a)(9)(B) is satisfied: 10% bonus

- Line 9b: Yes, and Section 48(a)(9)(B) is not satisfied: 2% bonus

- Line 9c: No

Domestic content certification statement

If you checked Line 9a or 9b to claim a domestic content bonus credit amount in Part VI, you must also attach a domestic content certification statement to Form 3468 for each applicable project. You must attach this certification statement at the time of your return.

The domestic content certification statement should include the following information:

- Your name and taxpayer identification number shown on the federal tax return

- The facility description and the IRS-issued registration number (if applicable) of the applicable project from Part I, Line 2a.

- Including the owner information, if different from the filer

- A statement that any steel, iron, or manufactured product that is a component of the facility was produced in the United States

- As determined under Section 661 of Title 49, Code of Federal Regulations, Buy America Requirements

- A declaration, applicable to the statement and any accompanying documents:

- Must be signed by you, or signed by a person currently authorized to bind you in such matters

- Must state the following: “Under penalties of perjury I declare that I have examined the information contained in this Domestic Content Certification Statement and to the best of my knowledge and belief, it is true, correct, and complete.”

Line 10

Does the project qualify for an energy community bonus credit per Section 48(a)(14)? Choose one of the following answers:

- Line 10a: Yes, and Section 48(a)(9)(B) is satisfied: 10% bonus

- Line 10b: Yes, and section 48(a)(9)(B) is not satisfied: 2% bonus

- Line 10c: No

Energy community bonus credit rate

Section 48(a)(14) allows an energy community bonus credit rate increase for an energy project eligible for the credit under this section that is placed in service during the tax year within an energy community (EC Project).

For energy property that is part of an EC Project, the energy percentage of the basis of each energy property under Section 48(a)(2) is increased by:

- 2% if none of the following requirements are met, and

- 10% if any one of the following requirements is met:

- The energy project has a maximum net output of less than 1 megawatt of electrical (as measured in alternating current) or thermal energy;

- Construction of the energy project began before January 29, 2023;

- The energy project meets the prevailing wage requirements and apprenticeship requirements in Sections 48(a)(10)(A) and (11).

Line 11

Does the project qualify as a solar or wind facility in connection with low-income communities bonus credit per Section 48(e)(2)? Check one of the following:

- Line 11a: Yes, and the facility is located in a low-income community per Section 45D(e): 10% bonus

- Line 11b: Yes, and the facility is located on Indian land per Section 2601(2) of P.L. 102-486: 10% bonus

- Line 11c: Yes, and the facility is part of a qualified low-income residential building project facility per IRC Section 48(e)(2)(B): 20% bonus

- Line 11d: Yes, and the facility is part of a qualified low-income economic benefit project facility per Section 48(e)(2)(C): 20% bonus

- Line 11e: If “Yes” to 11a, 11b, 11c, or 11d, enter your Section 48(e) Control Number:

- Line 11f: No

Low-income communities bonus credit amount

Section 48(e) provides a low-income community bonus credit for certain qualified solar and wind facility energy projects by increasing the energy percentage provided in section 48(a)(2), by either 10% or 20%, depending on the category of the facility.

Energy percentage

The increased energy percentage with respect to categories of eligible property and limitation is:

- 10% for a facility located in a low-income community or on Indian land

- 20% for a facility that is part of:

- A qualified low-income residential building project, or

- A qualified low-income economic benefit project

Eligibility requirements

For purposes of this increase, eligible energy property includes:

- Wind facility property defined in Section 45(d)(1) for which an election was made to treat qualified facilities as energy property;

- Solar energy property to generate electricity defined in Section 48(a)(3)(i);

- Qualified small wind energy property defined in Section 48(a)(3)(vi); and

- Energy storage technology described in Section 48(a)(3)(A) (ix) installed in connection with the above facility properties.

The property also has to produce a maximum net output of less than 5 megawatts as measured in alternating current.

Line 12: Nameplate capacity or storage capacity

Enter the nameplate capacity or storage capacity of the qualifying property:

- Line 12a: Solar energy property or facility nameplate capacity: kilowatt (kW) direct current (dc)

- Line 12b: Small wind energy property or facility nameplate capacity: kW

- Line 12c: Wind energy property or facility nameplate capacity: kW

- Line 12d: Energy storage power capacity rating kW, and energy storage capacity, if applicable, associated with the energy property or facility: kWh (hour)

- Line 12e: Solar or wind nameplate capacity is 5MW ac or more

- Line 12f: Not applicable.

Line 13: nameplate capacity (AC) for all electric generating energy properties

Enter the nameplate capacity in alternating current (ac) for all electricity generating energy properties or facilities in kW:

- Line 13a: Solar energy property

- Line 13b: Wind energy property

- Line 13c: Other

- Line 13d: Not applicable

Line 14

Are you claiming the investment credit as a lessee based on a Section 48(d) (as in effect on November 4, 1990) election?

If ‘Yes,’ then complete Lines 14a through 14e as outlined below. If not, skip to the part that pertains to your qualifying project.

- Line 14a: Name of lessor of property

- Line 14b: Address of lessor

- Line 14c: Description of property

- Line 14d: Amount for which you were treated as having acquired the property

- Line 14e: Income inclusion amount reported for the year under Treasury Regulations Section 1.50-1

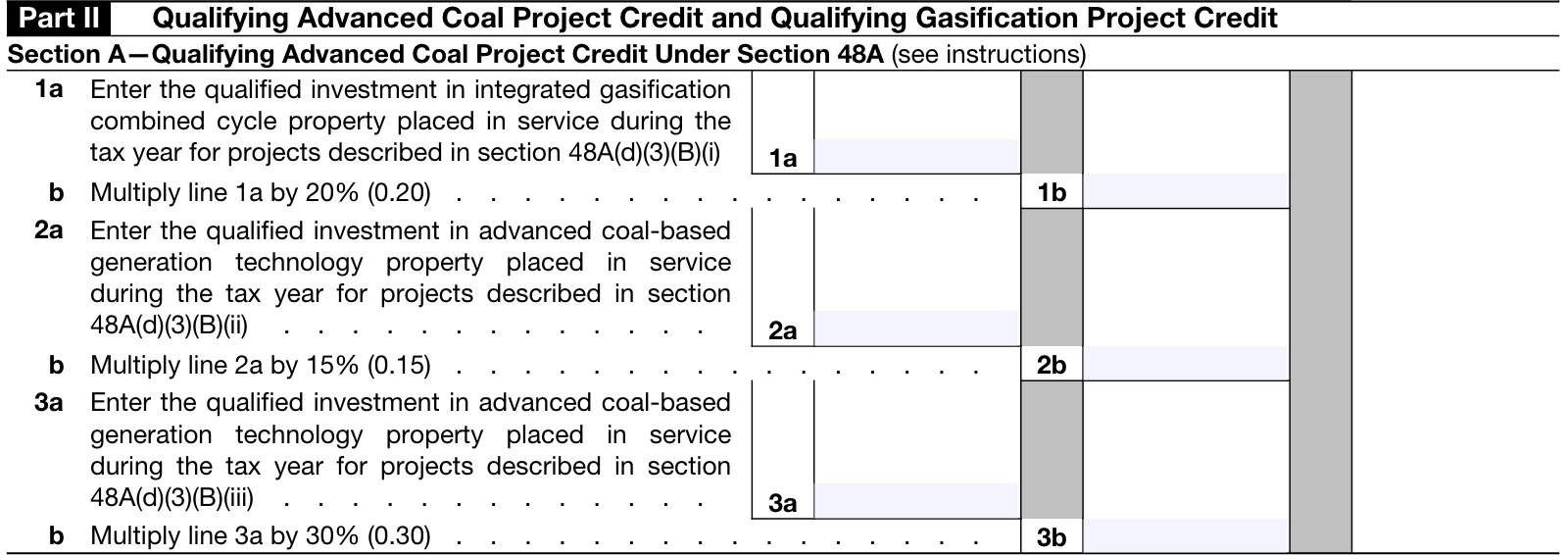

Part II: Qualifying Advanced Coal Project Credit and Qualifying Gasification Project Credit

Part II helps calculate the total amount of tax credits for either:

- Section A: A qualifying advanced coal project under IRC Section 48A

- Section B: A qualifying gasification project under IRC Section 48B

Section A: qualifying advanced coal project under IRC Section 48A

A qualifying advanced coal project is a project that:

- Uses advanced coal-based generation technology (as defined in Section 48A(f)) to power a new electric generation unit or to refit or repower an existing electric generation unit (including an existing natural gas-fired combined cycle unit);

- Has fuel input that, when completed, will be at least 75% coal;

- Has an electric generation unit or units at the site that will generate at least 400 megawatts;

- Has a majority of the output that is reasonably expected to be acquired or utilized;

- Is to be constructed and operated on a long-term basis when the taxpayer provides evidence of ownership or control of a site of sufficient size;

- Will be located in the United States; and

- Includes equipment that separates and sequesters at least 65% of the project’s total carbon dioxide emissions for project applications described in Section 48A(d)(2)(A)(ii).

- 70% in the case of an application for reallocated credits

Line 1a

Enter the qualified investment in integrated gasification combined cycle property placed in service during the tax year for projects described in Section 48A(d)(3)(B)(i).

Integrated gasification combined cycle property is an electric generation unit that produces electricity by converting coal to synthesis gas, which in turn is used to fuel a combined cycle plant to produce electricity from both:

- A combustion turbine (including a combustion turbine/fuel cell hybrid), and

- A steam turbine

Line 1b

Multiply Line 1a by 20% and enter the result.

Line 2a

Enter the qualified investment in advanced coal-based generation technology property placed in service during the tax year for projects described in Section 48A(d)(3)(B)(ii).

Eligible property is any property that is part of a qualifying advanced coal project, defined earlier, not using an integrated gasification combined cycle.

Line 2b

Multiply Line 2a by 15% and enter the result.

Line 3a

Enter the qualified investment in advanced coal-based generation technology property placed in service during the tax year for projects described in Section 48A(d)(3)(B)(iii).

Eligible property is any certified property that is:

- Located in the United States, and

- Is part of a qualifying advanced coal project that has equipment that separates and sequesters at least 65% of the project’s total carbon dioxide emissions. If the IRS later reallocates these credits, the percentage increases to 70%.

A recapture will apply if the project fails to maintain carbon dioxide separation and sequestration requirements.

Line 3b

Multiply Line 3a by 30% and enter the result.

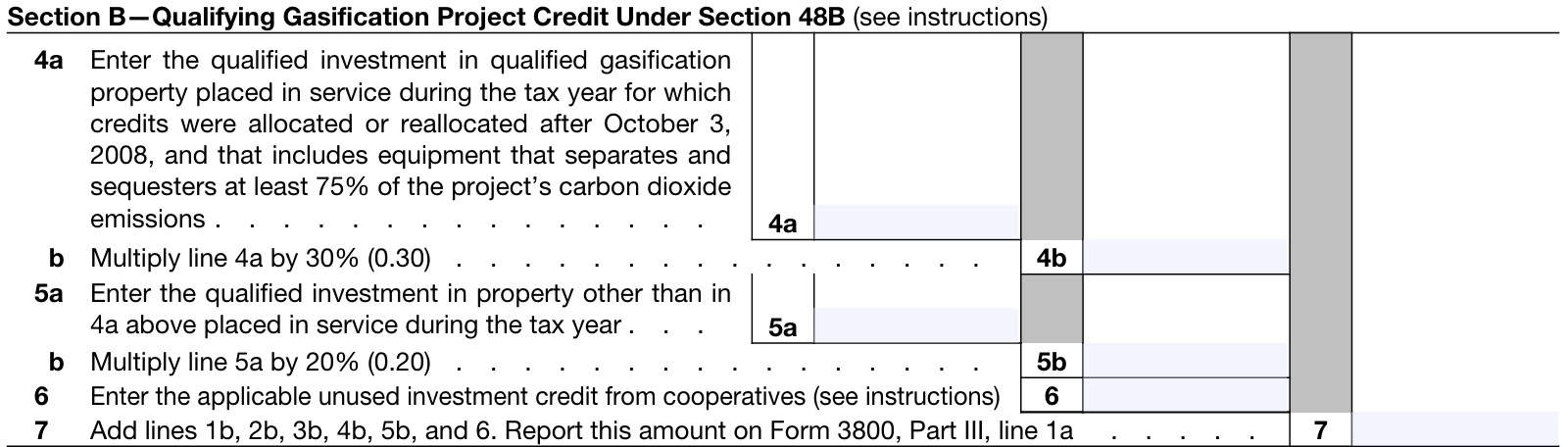

Section B: qualifying gasification project under IRC Section 48B

A qualifying gasification project is a project that:

- Employs gasification technology, as defined in Section 48B(c)(2),

- Is carried out by an eligible entity as defined in Section 48B(c)(7), and

- Includes a qualified investment of which an amount not to exceed $650 million is certified under the qualifying gasification program as eligible for credit

The total amount of credits that may be allocated under the qualifying gasification project program may not exceed $600 million.

If property is financed in whole or in part by subsidized energy financing or by tax-exempt private activity bonds, then you may need to reduce the basis of the property accordingly.

Line 4a

Enter the qualified investment in qualifying gasification project property placed in service during the tax year for which:

- Tax credits were allocated or reallocated after October 3, 2008, and

- Includes equipment to separate and sequester at least 75% of the project’s carbon dioxide emissions

Qualified investment is the basis of eligible property placed in service during the tax year that is part of a qualifying gasification project.

For purposes of this credit, eligible property includes any property that is:

- Part of a qualifying gasification project, and

- Necessary for the gasification technology of the project

The IRS must recapture any allocated credits for a project that fails to attain or maintain carbon dioxide separation and sequestration requirements.

Line 4b

Multiply Line 4a by 30% and enter the result.

Line 5a

Enter the qualified investment, other than any amount included in Line 4a, in qualifying gasification project property placed in service during the tax year.

Line 5b

Multiply Line 5a by 20% and enter the result.

Line 6: Unused investment credit from cooperatives

Patrons of cooperatives should enter the unused investment credit from the qualifying advanced coal project credit or qualifying gasification project credit allocated from the cooperative.

Line 7

Add the following lines:

Report this amount as a general business credit on IRS Form 3800, Part III, Line 1a.

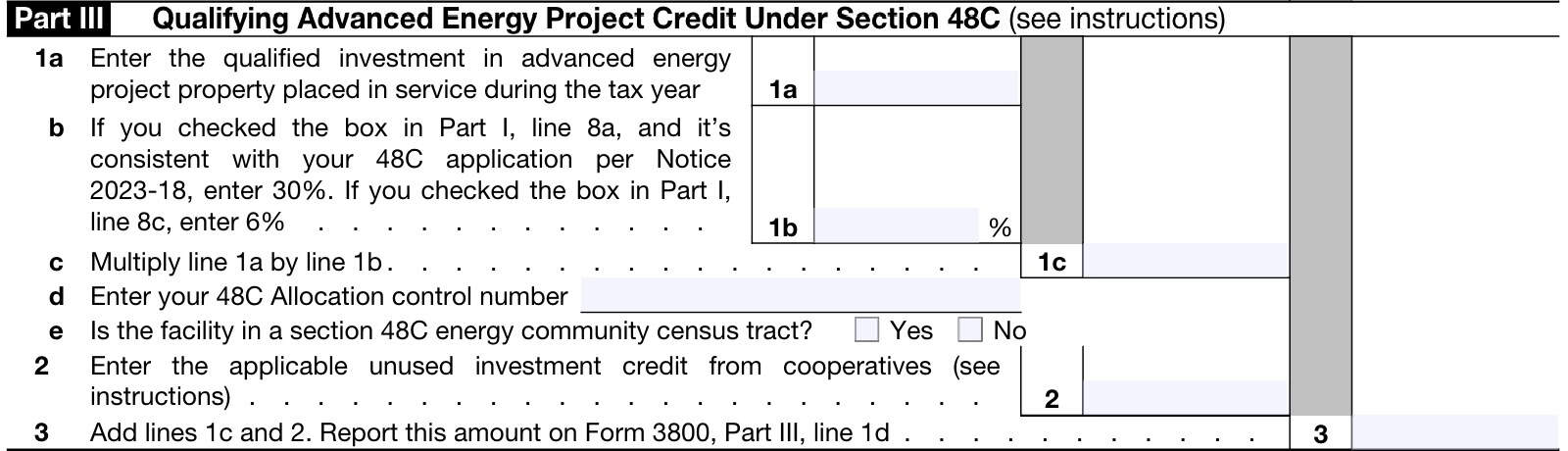

Part III: Qualifying Advanced Energy Project Credit Under Section 48C

Complete Part III to claim a qualifying advanced energy project credit under Section 48C.

Qualifying advanced energy project definition

Qualifying advanced energy project means a project that:

- Re-equips, expands, or establishes an industrial or a manufacturing facility for the production or recycling of specified advanced energy property;

- Re-equips any industrial or manufacturing facility, with equipment designed to reduce greenhouse gas emissions by at least 20% through the installation of:

- Low- or zero-carbon process heat systems;

- Carbon capture, transport, utilization, and storage systems;

- Energy efficiency and reduction in waste from industrial processes; or

- Any other industrial technology designed to reduce greenhouse gas emissions, as determined by the Secretary;

- Re-equips, expands or establishes an industrial facility for the processing, refining or recycling of critical materials (as defined in Section 7002(a) of the Energy Act of 2020);

- The Secretary has certified per section 48C(e)(3) that part or all of the qualified investment in the qualifying advanced energy project is eligible for a section 48C credit; and

- The project does not include any portion of a project for the production of any property that is used in the refining or blending of any transportation fuels (other than renewable fuels).

Specified advanced energy property

The term specified advanced energy property means any of the following:

- Property designed for use in the production of energy from the sun, water, wind, geothermal deposits (within the meaning of Section 613(e)(2)), or other renewable resources;

- Fuel cells, microturbines, or energy storage systems and components;

- Electric grid modernization equipment or components;

- Property designed to capture, remove, use, or sequester carbon oxide emissions;

- Equipment designed to refine, electrolyze, or blend any fuel, chemical, or product which is renewable, or low-carbon and low-emission;

- Property designed to produce energy conservation technologies (including residential, commercial, and industrial applications);

- Light-, medium-, or heavy-duty electric or fuel cell vehicles, as well as technologies, components, or materials for such vehicles, and associated charging or refueling infrastructure;

- Hybrid vehicles with a gross vehicle weight rating of not less than 14,000 pounds as well as technologies, components, or materials for such vehicles; or

- Other advanced energy property designed to reduce greenhouse gas emissions as may be determined by the Secretary

Line 1a

Enter the qualified investment in qualifying advanced energy project property placed in service during the tax year.

Qualified investment is the basis of eligible property placed in service during the tax year that is part of a qualifying advanced energy project.

Line 1b

If you met the prevailing wage and apprenticeship requirements described earlier, including the certification for these requirements was met, as part of the 48C(e) application per Internal Revenue Notice 2023-18, Section 5.07, then enter 30%.

Otherwise, enter 6%.

Line 1c

Multiply Line 1a by Line 1b. Enter the result here.

Line 1d

Enter your 48C Allocation control number.

Line 1e

Is the facility in a Section 48C energy community census tract? Answer Yes or No.

Line 2

Enter any unused investment credit from the qualifying advanced energy property credit allocated from cooperatives.

Line 3

Add Line 1c and Line 2, then enter the result here. Also report this amount as a general business credit on IRS Form 3800, Part III, Line 1d.

Part IV: Advanced Manufacturing Investment Credit Under Section 48D

Part IV helps taxpayers calculate the advanced manufacturing credit under Section 48D.

The advanced manufacturing investment credit is equal to 25% of the qualified investment with respect to any advanced manufacturing facility of an eligible taxpayer in the tax year.

Qualified investment

The qualified investment for any advanced manufacturing facility is the tax basis of any qualified property placed in service by the taxpayer during the tax year that is part of an advanced manufacturing facility.

Qualified property includes any building or its structural components and all of the following:

- Tangible property

- Property that is allowed depreciation or amortization

- Property that is constructed, reconstructed, or erected by the taxpayer or acquired by the taxpayer if the original use of the property commences with the taxpayer

- Property that is integral to the operation of the advanced manufacturing facility

Advanced manufacturing facility

Advanced manufacturing facility means a facility whose primary purpose is the manufacturing of semiconductors or semiconductor manufacturing equipment.

Eligible taxpayer

An eligible taxpayer is a taxpayer who:

- Is not a foreign entity of concern, as defined in Section 9901(6) of P. L. 116-283, and

- Has not made an applicable transaction, as defined in Section 50(a), during the taxable year.

Line 1a

Check the box that corresponds to your advanced manufacturing investment project:

- Semiconductor manufacturing facility

- Semiconductor equipment manufacturing facility

Line 1b: Basis of property placed in service during the tax year

Enter the basis in qualified property as part of the advanced manufacturing facility placed in service during the tax year.

If construction began prior to 2023, the basis of property placed in service during the tax year, includes the portion of basis attributable to the construction, reconstruction, or erection after August 9, 2022.

Line 1c

Multiply Line 1b by 25%. Enter the result in Line 1c.

Line 2

Enter any unused investment credit from the advanced manufacturing investment credit allocated from cooperatives.

Line 3

Add Line 1c and Line 2. Enter this amount here, and on IRS Form 3800, Part III, Line 1o.

Part V: Reserved for future use

Do not use Part V, as it is reserved for future use.

Part VI: Energy Credit Under Section 48

Part VI contains 14 sections. Most taxpayers will not need to complete every section. Use the hyperlink to jump to the section that pertains to your tax situation.

- Section A: Geothermal Energy Credit

- Section B: Solar Energy Credit

- Section C: Qualified Fuel Cell Property

- Section D: Qualified Microturbine Property

- Section E: Combined Heat and Power System Property

- Section F: Qualified Small Wind Energy Property

- Section G: Waste Energy Recovery Property

- Section H: Geothermal Heat Pump Systems

- Section I: Energy Storage Technology Property

- Section J: Qualified Biogas Property

- Section K: Microgrid Controllers Property

- Section L: Qualified Investment Credit Facility Property

- Section M: Clean Hydrogen Production Facilities as Energy Property

- Section N: Totals and Credit Reduction for Tax-Exempt Bonds

Section A: Geothermal Energy Credit

Geothermal energy property is used to produce, distribute, or use energy derived from a geothermal deposit, as defined in IRC Section 613(e)(2).

For electricity produced by geothermal power, equipment qualifies only up to, but not including, the electrical transmission stage.

Line 1a: Basis of property placed in service during the tax year

In Line 1a, enter the basis of property placed into service during the tax year that uses geothermal energy.

Line 1b: applicable energy percentage

If you checked the box in Part I, Line 7a or Line 8b, enter 30%.

If you checked the box in Part I, Line 7b or Line 8c, enter 6%.

Line 1c

Multiply Line 1a by Line 1b. Enter the result here.

Line 1d: domestic content bonus credit percentage

If you checked the box in Part I, Line 9a, enter 10%.

If you checked the box in Part I, Line 9b, enter 2%.

Otherwise, go to Line 1f.

Line 1e

Multiply Line 1a by Line 1d. Enter the result here.

Line 1f: applicable energy community bonus credit percentage

If you checked the box in Part I, Line 9a, enter 10%.

If you checked the box in Part I, Line 10b, enter 2%.

If the facility or property was not placed in service within an energy community, leave blank and go to Line 2.

Line 1g

Multiply Line 1a by Line 1f. Enter the result here.

Line 2

Enter the total of the following:

- Line 1c

- Line 1e

- Line 1g

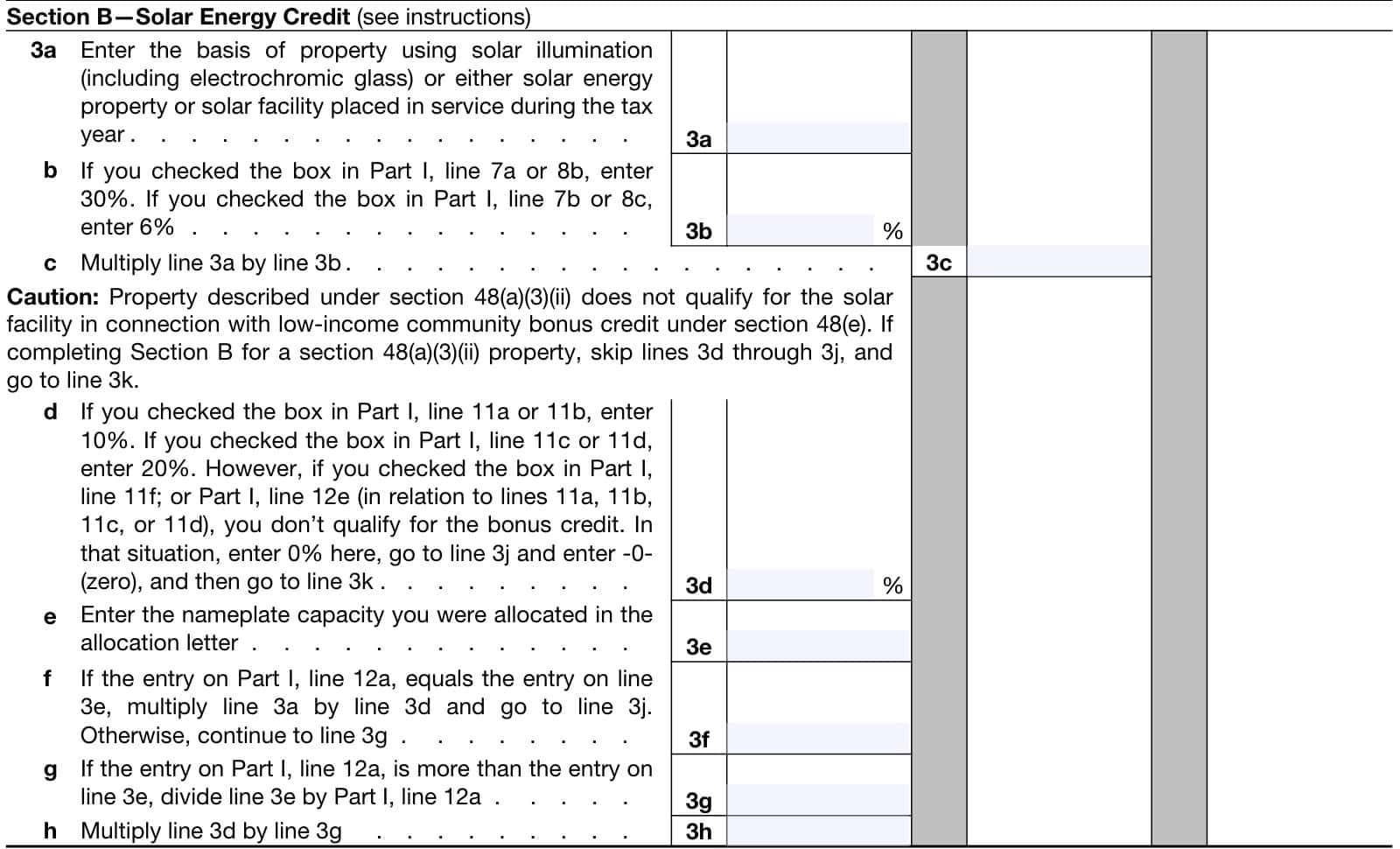

Section B: Solar Energy Credit

Solar energy property is property that has the following:

- Equipment that uses solar energy to illuminate the inside of a structure using fiber-optic distributed sunlight.

- Electrochromic glass that uses electricity to change its light transmittance properties in order to heat or cool a structure.

- Equipment that uses solar energy to:

- Generate electricity,

- Heat or cool a structure

- Provide hot water for use in a structure

- Provide solar process heat

- Not for swimming pools

Line 3a: Basis of property placed in service during the tax year

Enter the basis of the following placed into service during the tax year:

- Property using solar illumination, including electrochromic glass

- Solar energy property

- Solar facility

Line 3b: Applicable energy percentage

Enter the applicable percentage.

If you checked the box in Part I, Line 7a or Line 8b, enter 30%.

If you checked the box in Part I, Line 7b or Line 8c, enter 6%.

Line 3c

Multiply Line 3a by Line 3b. Enter the result in Line 3c.

Line 3d: Applicable low-income community bonus credit percentage

If you checked the box in Part I, Line 11a or 11b, enter 10%.

If you checked the box in Part I, Line 11c or Line 11d, enter 20%.

If you checked either the box in Part I, Line 11f, or Part I, Line 12e, you do not qualify for the bonus credit. Instead, enter 0% on Line 3d and on Line 3j, then go to Line 3k.

Line 3e: Nameplate capacity

Enter the nameplate capacity allocated in the allocation letter.

Line 3f

If Part I, Line 12a, equals Line 3e in this section, multiply Line 3a by Line 3d, then go to Line 3j. Otherwise, continue to Line 3g.

Line 3g

If Part I, Line 12a, exceeds Line 3e in this section, then divide Line 3e by Part I, Line 12a.

Line 3h

Multiply Line 3d by Line 3g. Enter the result here.

Line 3i

Multiply Line 3a by Line 3h, then enter the result.

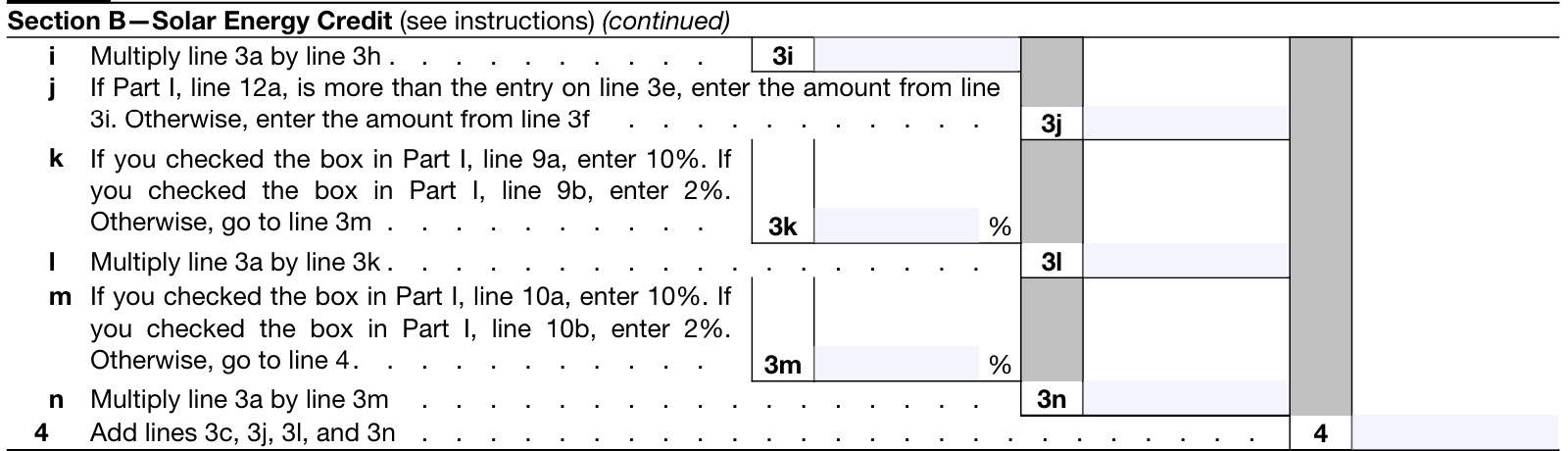

Line 3j

If Part I, Line 12a, exceeds Line 3e in this section, enter the amount from Line 3i. Otherwise, enter the Line 3f amount here.

Line 3k: Domestic content bonus credit percentage

If you checked the box in Part I, Line 9a, enter 10%.

If you checked the box in Part I, Line 9b, enter 2%.

If the facility or property did not meet the requirements for the domestic content bonus credit, leave Line 3k blank, skip Line 3l, and go to Line 3m.

Line 3l

Line 3m: energy community bonus credit percentage

If you checked the box in Part I, Line 10a, enter 10%.

If you checked the box in Part I, Line 10b, enter 2%.

Line 3n

Line 4

Enter the total of the following lines:

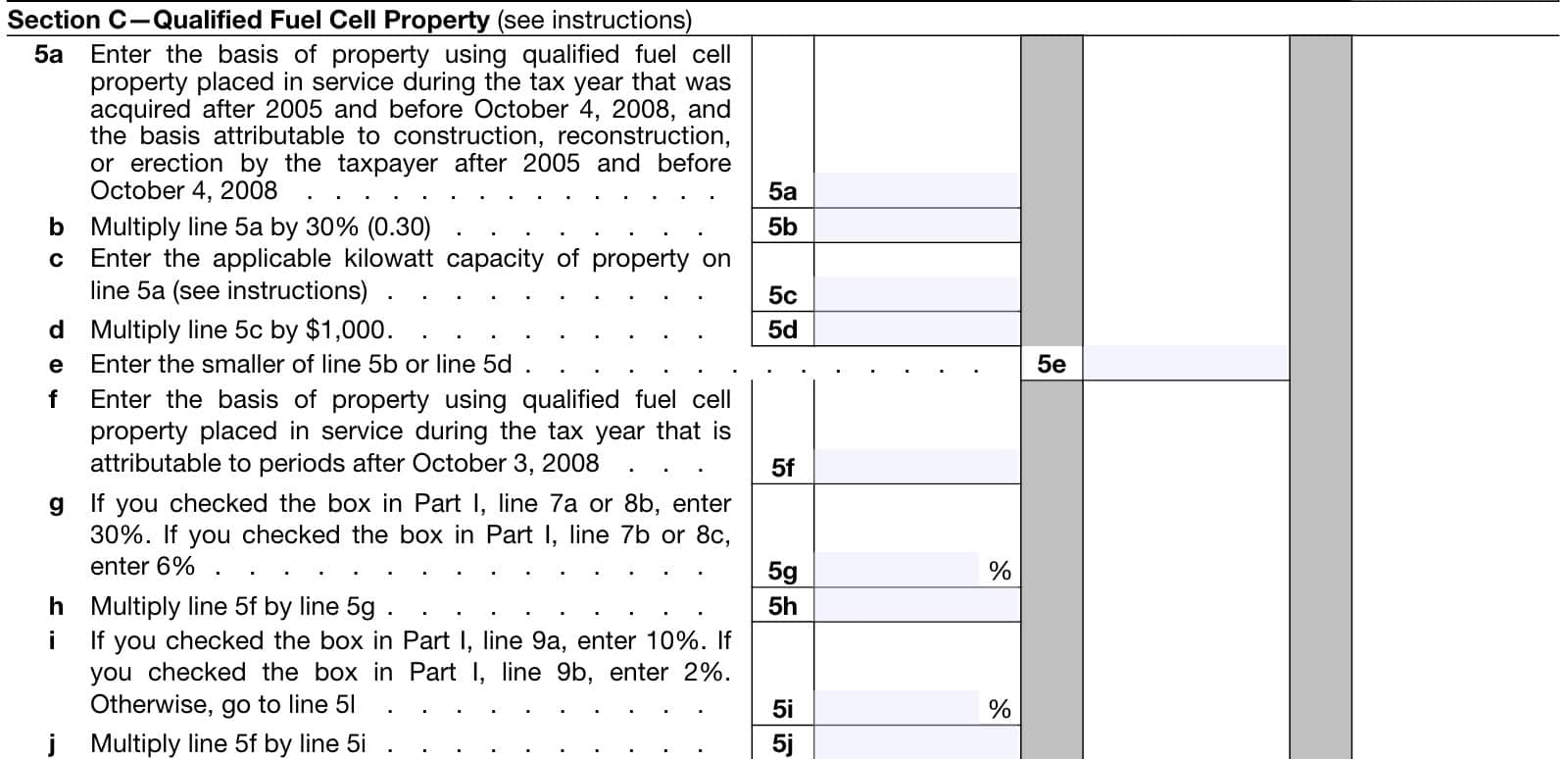

Section C: Qualified Fuel Cell Property

Qualified fuel cell property is a fuel cell power plant that:

- Has a nameplate capacity of at least 0.5 kilowatts of electricity using an electrochemical or electromechanical process, and

- 1 kilowatt in the case of a fuel cell plant with a linear generator assembly

- Has electricity-only generation efficiency greater than 30%.

IRC Section 48(c)(1) contains further details.

Fuel cell power plant

Fuel cell power plant means an integrated system comprised of a fuel cell stack assembly or linear generator assembly, and associated balance of plant components that converts a fuel into electricity using electrochemical or electromechanical means.

Linear generator assembly

Linear generator assembly doesn’t include any assembly that contains rotating parts.

Line 5a: Basis of property placed in service during the tax year

Enter the basis of property using qualified fuel cell property placed into service during the tax year that was:

- Acquired after 2005, and before October 4, 2008, and

- Basis attributable to construction, reconstruction, or erection after 2005, and before October 4, 2008

Line 5b

Multiply Line 5a by 30%. Enter the result here.

Line 5c

In whole numbers, enter the applicable number of kilowatts of capacity attributable

to the basis on Line 5a.

Line 5d

Multiply Line 5c by $1,000.

Line 5e

Enter the smaller of:

- Line 5b

- Line 5d

Line 5f: Basis of property placed in service during the tax year

Enter the basis of property using qualified fuel cell property placed in service during the tax year attributable to periods after October 3, 2008.

Line 5g: Applicable energy percentage

If you checked the box in Part I, Line 7a or Line 8b, enter 30%.

If you checked the box in Part I, Line 7b or Line 8c, enter 6%.

Line 5h

Multiply Line 5f by Line 5g.

Line 5i: applicable domestic content bonus credit percentage

If you checked the box in Part I, Line 9a, enter 10%.

If you checked the box in Part I, Line 9b, enter 2%.

If the facility or property did not meet the requirements for the domestic content bonus credit, leave Line 5i blank, skip Line 5j, and go to Line 5l.

Line 5j

Multiply Line 5f by Line 5i.

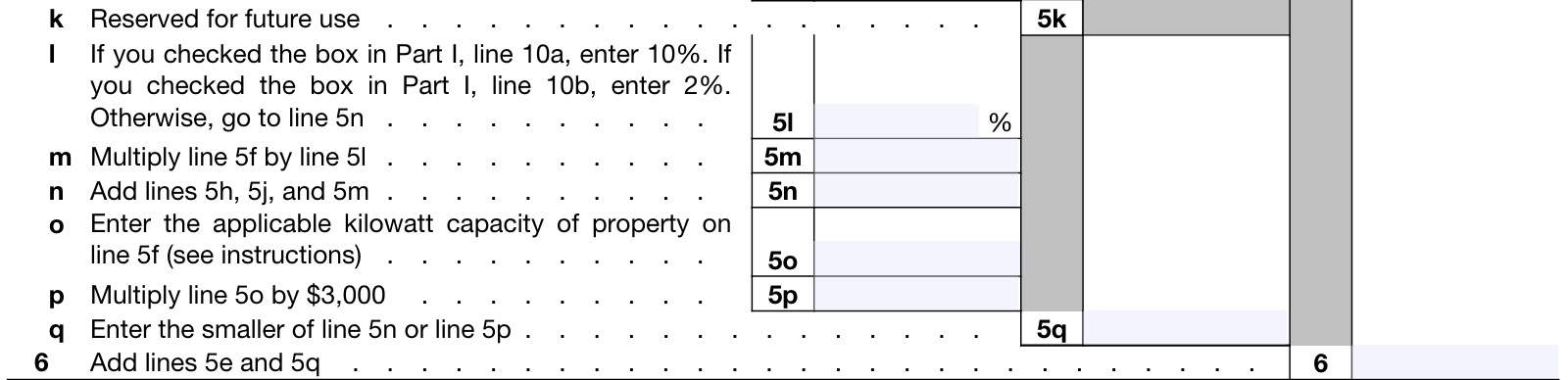

Line 5k: reserved for future use

Do not enter any values in Line 5k.

Line 5l: applicable energy community bonus credit percentage

If you checked the box in Part I, Line 10a, enter 10%.

If you checked the box in Part I, Line 10b, enter 2%.

Otherwise, go to Line 5n.

Line 5m

Multiply Line 5f by Line 5l.

Line 5n

Add the following:

Line 5o: Applicable kilowatt capacity of property

Enter the applicable kilowatt capacity of the property on Line 5f, in whole numbers.

Line 5p

Multiply Line 5o by $3,000.

Line 5q

Enter the smaller of:

- Line 5n

- Line 5p

Line 6

Add Line 5e and Line 5q, then enter the result in Line 6.

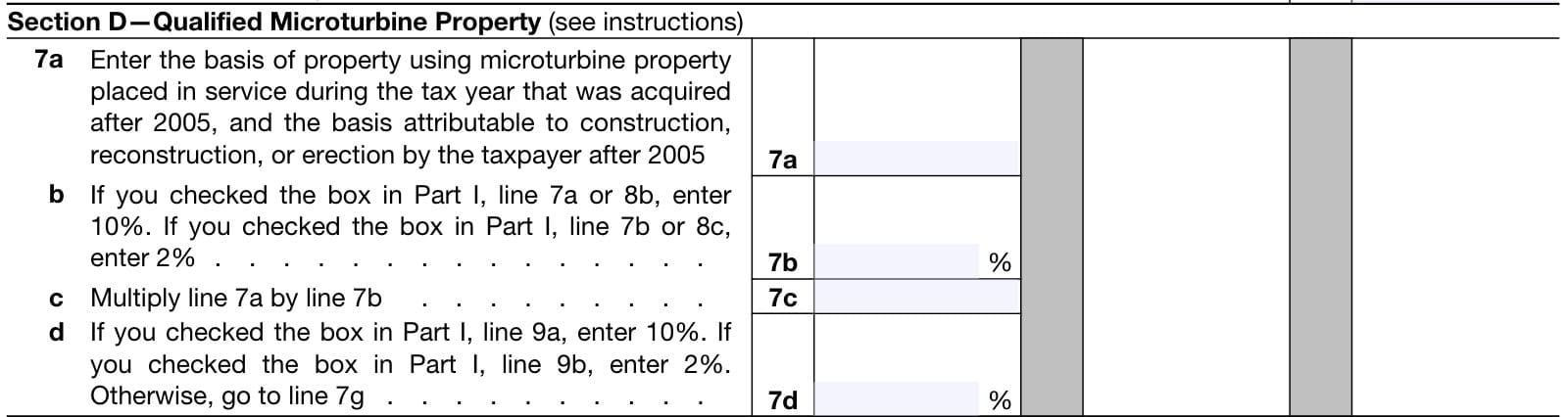

Section D: Qualified Microturbine Property

Qualified microturbine property is a stationary microturbine power plant that has:

- A nameplate capacity of less than 2,000 kilowatts, and

- An electricity-only generation efficiency of not less than 26% at International Standard Organization conditions.

IRC Section 48(c)(2) contains additional details.

Stationary microturbine power plant

Stationary microturbine power plant means an integrated system comprised of a gas turbine engine, a combustor, a recuperator or regenerator, a generator or alternator, and associated balance of plant components that converts a fuel into electricity and thermal energy.

It also includes all secondary components located between the existing infrastructure for fuel delivery and the existing infrastructure for power distribution, including equipment and controls for meeting relevant power standards, such as voltage, frequency, and power factors.

Line 7a: Basis of property placed in service during the tax year

In Line 7a, enter the basis of property using microturbine property placed in service during the tax year that was acquired after 2005, and the basis attributable to construction, reconstruction, or erection by the taxpayer after 2005.

Line 7b: Applicable energy percentage

If you checked the box in Part I, Line 7a or Line 8b, enter 30%.

If you checked the box in Part I, Line 7b or Line 8c, enter 6%.

Line 7c

Multiply Line 7a by Line 7b. Enter the result here.

Line 7d: Applicable domestic content bonus credit percentage

If you checked the box in Part I, Line 9a, enter 10%.

If you checked the box in Part I, Line 9b, enter 2%.

If the facility or property did not meet the requirements for the domestic content bonus credit, leave Line 7d blank, skip Line 7e, and go to Line 7g.

Line 7e

Multiply Line 7a by Line 7d. Enter the result here.

Line 7f: Reserved for future use

Do not enter anything in Line 7f.

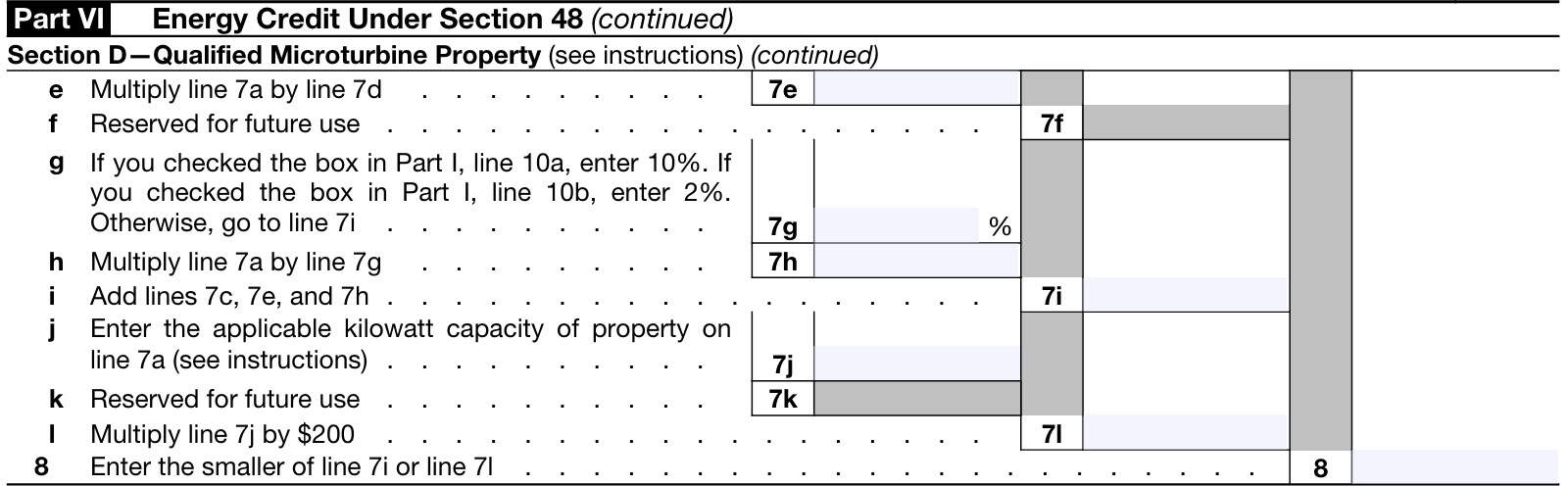

Line 7g: Applicable Energy Community Bonus Credit Percentage

If you checked the box in Part I, Line 9a, enter 10%.

If you checked the box in Part I, Line 10b, enter 2%.

If the facility or property was not placed in service within an energy community, leave blank and go to Line 7i.

Line 7h

Multiply Line 7a by Line 7g. Enter the result here.

Line 7i

Enter the total of the following:

Line 7j: Applicable kilowatt capacity of property

In whole numbers, enter the applicable kilowatt capacity of the property listed on Line 7a.

Line 7k: Reserved for future use

Do not enter anything in Line 7k.

Line 7l

Multiply Line 7j by $200.

Line 8

Enter the smaller of:

- Line 7i

- Line 7l

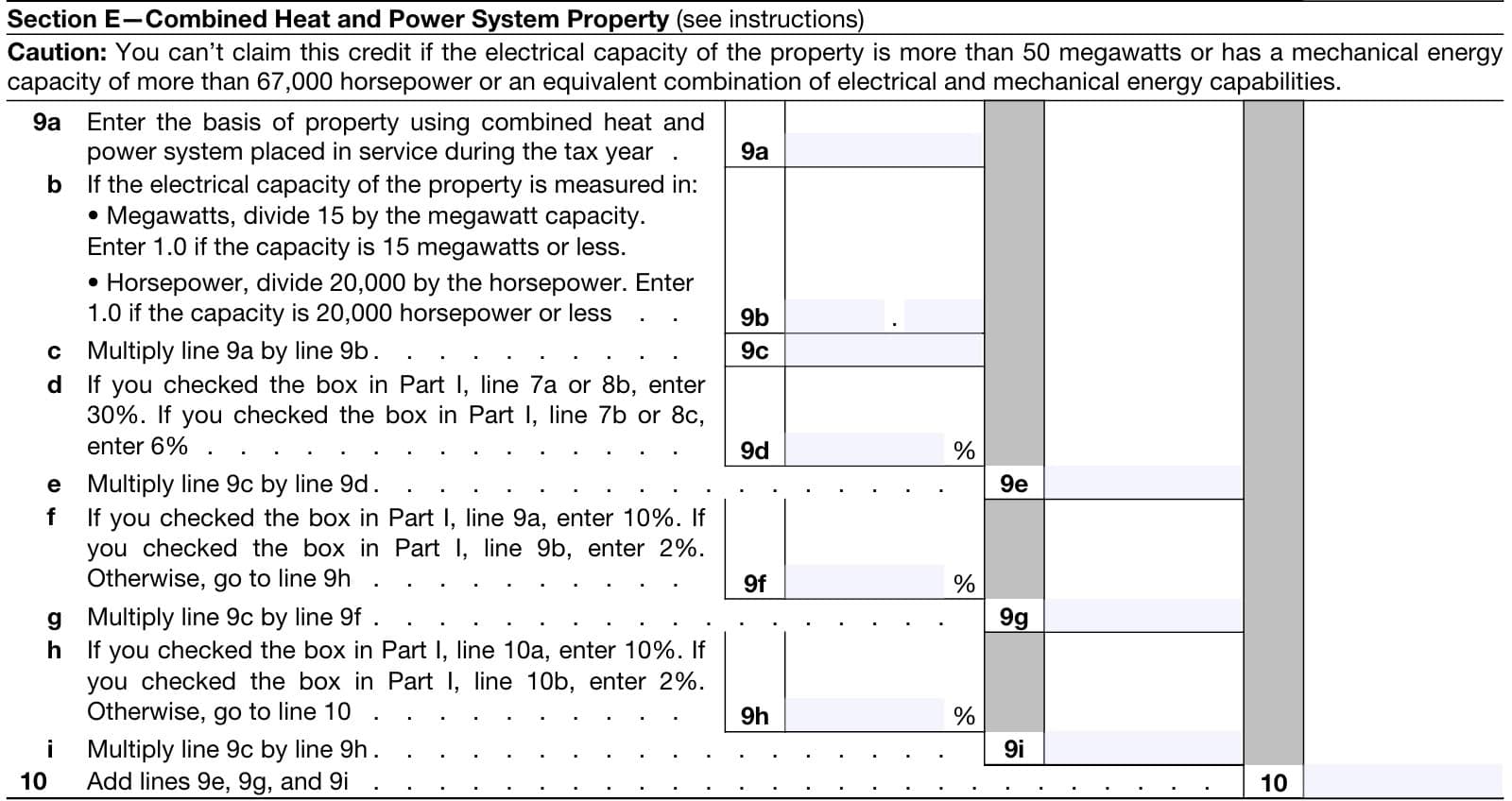

Section E: Combined Heat and Power System Property

Combined heat and power system property means property comprising a system that:

- Uses the same energy source for the simultaneous or sequential generation of electrical power, mechanical shaft power, or both;

- In combination with the generation of steam or other forms of useful thermal energy (including heating and cooling applications); and

- Has an energy efficiency percentage determined on a British thermal unit (BTU) basis over 60% and it produces:

- At least 20% of its total useful energy in the form of thermal energy that isn’t used to produce electrical and/or mechanical power,

and - At least 20% (determined on a BTU basis) of its total useful energy in the form of electrical and/or mechanical power.

- At least 20% of its total useful energy in the form of thermal energy that isn’t used to produce electrical and/or mechanical power,

Additional details can be found in IRC Section 48(c)(3).

Line 9a: Basis of property placed in service during the tax year

Enter the basis of property using combined heat and power system placed in service during the tax year.

Line 9b

Enter the electrical capacity of the property.

If the electrical capacity of the property is measured in megawatts, divide 15 by the megawatt capacity.

Enter 1.0 if the capacity is 15 megawatts or less.

If the electrical capacity of the property is measured in horsepower, divide 20,000 by the horsepower. Enter 1.0 if the capacity is 20,000 horsepower or less.

Line 9c

Multiply Line 9a by Line 9b, then enter the result here.

Line 9d: Applicable energy percentage

If you checked the box in Part I, Line 7a or Line 8b, enter 30%.

If you checked the box in Part I, Line 7b or Line 8c, enter 6%.

Line 9e

Multiply Line 9c by Line 9d, then enter the result here.

Line 9f: Applicable domestic content bonus credit percentage

If you checked the box in Part I, Line 9a, enter 10%.

If you checked the box in Part I, Line 9b, enter 2%.

If the facility or property did not meet the requirements for the domestic content bonus credit, leave Line 9f blank, skip Line 9g, and go to Line 9h.

Line 9g

Multiply Line 9c by Line 9f, then enter the result here.

Line 9h: Applicable Energy Community Bonus Credit Percentage

If you checked the box in Part I, Line 9a, enter 10%.

If you checked the box in Part I, Line 10b, enter 2%.

If the facility or property was not placed in service within an energy community, leave blank and go to Line 10.

Line 9i

Multiply Line 9c by Line 9h, then enter the result here.

Line 10

Enter the total of the following lines:

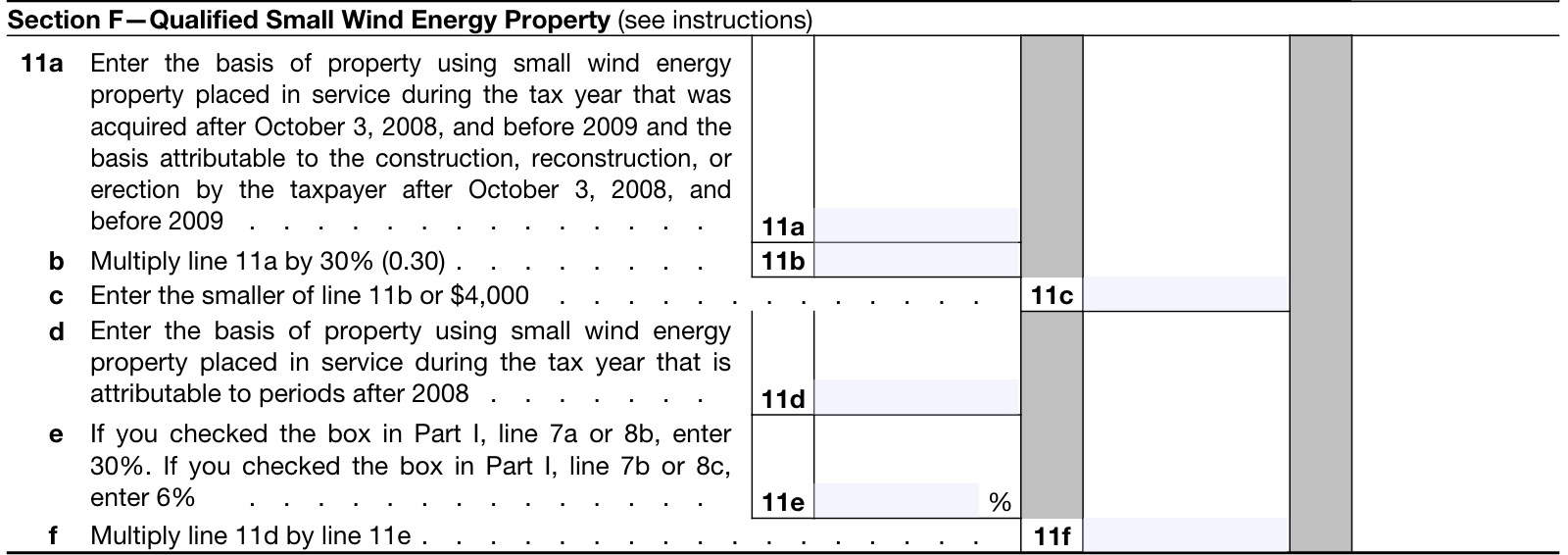

Section F: Qualified Small Wind Energy Property

Qualified small wind energy property refers to property that uses a qualifying small wind turbine to generate electricity.

For this purpose, a qualifying small wind turbine means a wind turbine that has a nameplate capacity of not more than 100 kilowatts. IRC Section 48(c)(4) contains more details.

Property placed into service after February 2, 2015

In addition, for small wind energy property acquired (or placed in service in the case of property constructed, reconstructed, or erected) after February 2, 2015, see Notice 2015-4, 2015-5 I.R.B. 407, as modified by Notice 2015-51, 2015-31 I.R.B. 133, for performance and quality standards that small wind energy property must meet to qualify for the energy credit.

Line 11a: Basis of property placed in service during the tax year

Enter the basis of property using small wind energy property placed in service during the tax year that was acquired after October 3, 2008, and before 2009 and the basis attributable to the construction, reconstruction, or erection by the taxpayer after October 3, 2008, and before 2009

Line 11b

Multiply Line 11a by 30%.

Line 11c

Enter the smaller of:

- Line 11b

- $4,000

Line 11d: Basis of property placed in service during the tax year

Enter the basis of property using small wind energy property placed in service during the tax year that is attributable to periods after 2008.

Line 11e: Applicable energy percentage

If you checked the box in Part I, Line 7a or Line 8b, enter 30%.

If you checked the box in Part I, Line 7b or Line 8c, enter 6%.

Line 11f

Multiply Line 11d by Line 11e, then enter the result here.

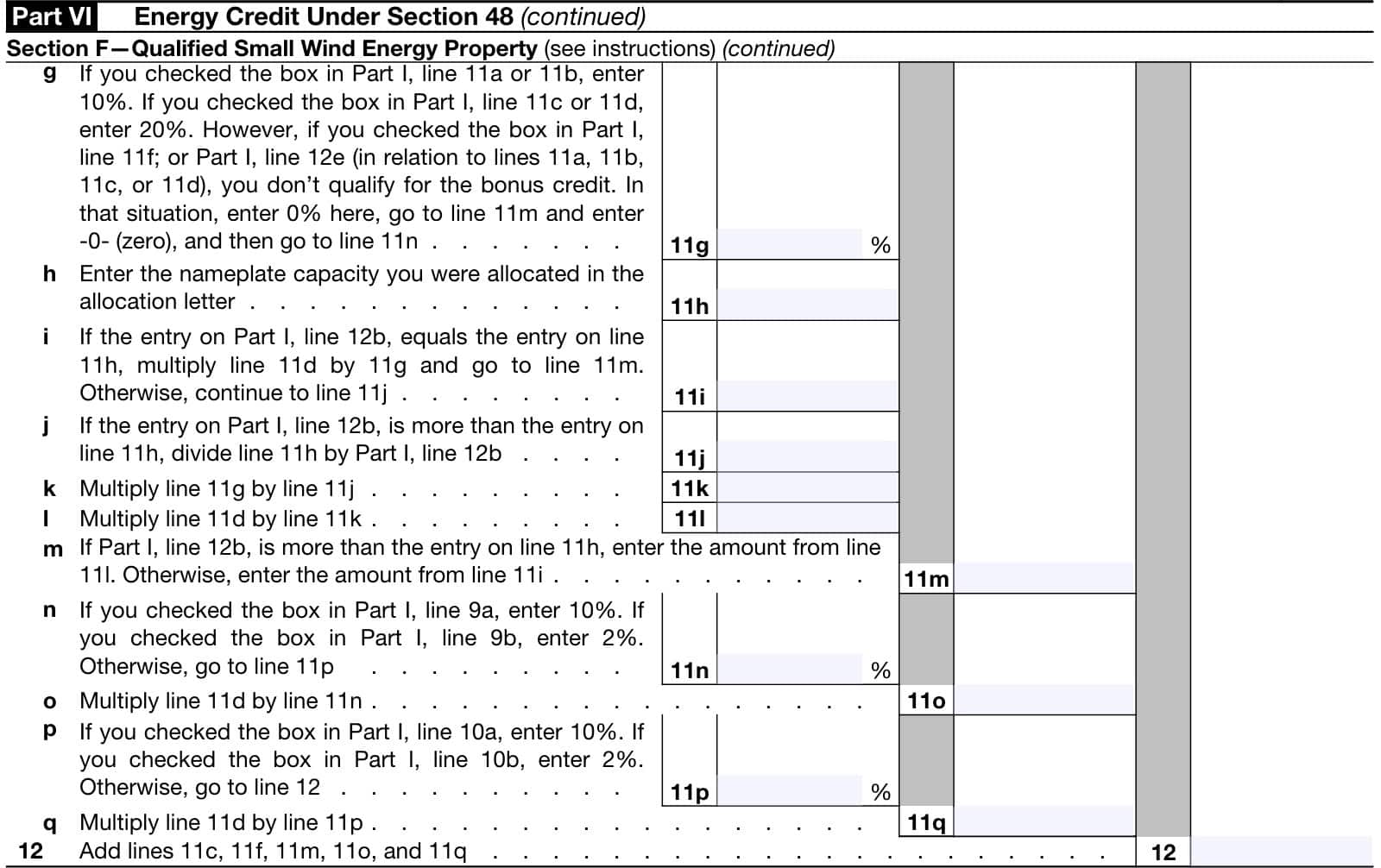

Line 11g: Applicable low-income community bonus credit percentage

If you checked the box in Part I, Line 11a or 11b, enter 10%.

If you checked the box in Part I, Line 11c or Line 11d, enter 20%.

If you checked either the box in Part I, Line 11f, or Part I, Line 12e, you do not qualify for the bonus credit. Instead, enter 0% on Line 11d and on Line 11m, then go to Line 11n.

Line 11h

Enter the nameplate capacity you were allocated in the allocation letter.

Line 11i

If the amount on Part I, Line 12b, equals the amount on Line 11h, multiply Line 11d by Line 11g and go to Line 11m.

Otherwise, continue to Line 11j.

Line 11j

If the amount on Part I, Line 12b, is more than the amount on Line 11h, divide Line 11d by Line 11g and go to Line 11m.

Line 11k

Multiply Line 11g by Line 11j, then enter the result here.

Line 11l

Multiply Line 11d by Line 11k, then enter the result here.

Line 11m

If Part I, Line 12b, is more than the entry on Line 11h, enter the amount from Line 11l.

Otherwise, enter the amount from Line 11i.

Line 11n: Applicable domestic content bonus credit percentage

If you checked the box in Part I, Line 9a, enter 10%.

If you checked the box in Part I, Line 9b, enter 2%.

If the facility or property did not meet the requirements for the domestic content bonus credit, leave Line 11n blank, skip Line 11o, and go to Line 11p.

Line 11o

Multiply Line 11d by Line 11n, then enter the result here.

Line 11p: Applicable Energy Community Bonus Credit Percentage

If you checked the box in Part I, Line 9a, enter 10%.

If you checked the box in Part I, Line 10b, enter 2%.

If the facility or property was not placed in service within an energy community, leave blank and go to Line 12.

Line 11q

Multiply Line 11d by Line 11p, then enter the result here.

Line 12

Enter the total of the following lines:

Section G: Waste Energy Recovery Property

Qualified waste energy recovery property means property that generates electricity solely from heat from buildings or equipment if the primary purpose of such building or equipment is not the generation of electricity.

The term “waste energy recovery property” shall not include any property that has a capacity in excess of 50 megawatts. For details, see IRC Section 48(c)(5).

Taxpayers cannot take a credit for both combined heat and power system property and waste energy recovery property for the same property.

Taxpayers must elect not to treat such property as combined heat and power system Property for section 48 purposes. The transitional rules of IRC Section 48(m) apply to waste energy recovery property for periods after 2020.

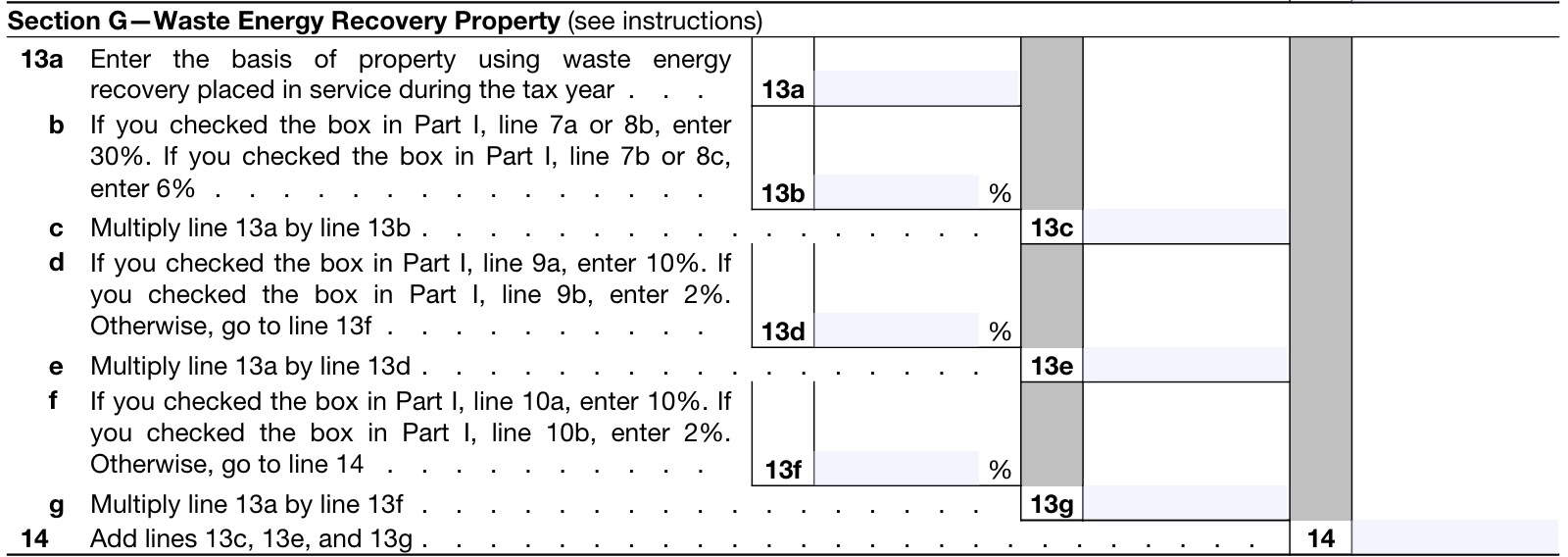

Line 13a: Basis of property placed in service during the tax year

Enter the basis of property using waste energy recovery placed in service during the tax year.

Line 13b: Applicable energy percentage

If you checked the box in Part I, Line 7a or Line 8b, enter 30%.

If you checked the box in Part I, Line 7b or Line 8c, enter 6%.

Line 13c

Multiply Line 13a by Line 13b, then enter the result here.

Line 13d: Applicable domestic content bonus credit percentage

If you checked the box in Part I, Line 9a, enter 10%.

If you checked the box in Part I, Line 9b, enter 2%.

If the facility or property did not meet the requirements for the domestic content bonus credit, leave Line 13d blank, skip Line 13e, and go to Line 13f.

Line 13e

Multiply Line 13a by Line 13d, then enter the result here.

Line 13f: Applicable Energy Community Bonus Credit Percentage

If you checked the box in Part I, Line 9a, enter 10%.

If you checked the box in Part I, Line 10b, enter 2%.

If the facility or property was not placed in service within an energy community, leave blank and go to Line 14.

Line 13g

Multiply Line 13a by Line 13f, then enter the result here.

Line 14

Enter the total of the following lines:

Section H: Geothermal Heat Pump Systems

Geothermal heat pump systems constitute equipment that uses the ground or ground water as either:

- A thermal energy source to heat a structure, or

- A thermal energy sink to cool a structure

For details, see IRC Section 48(a)(3)(A)(vii).

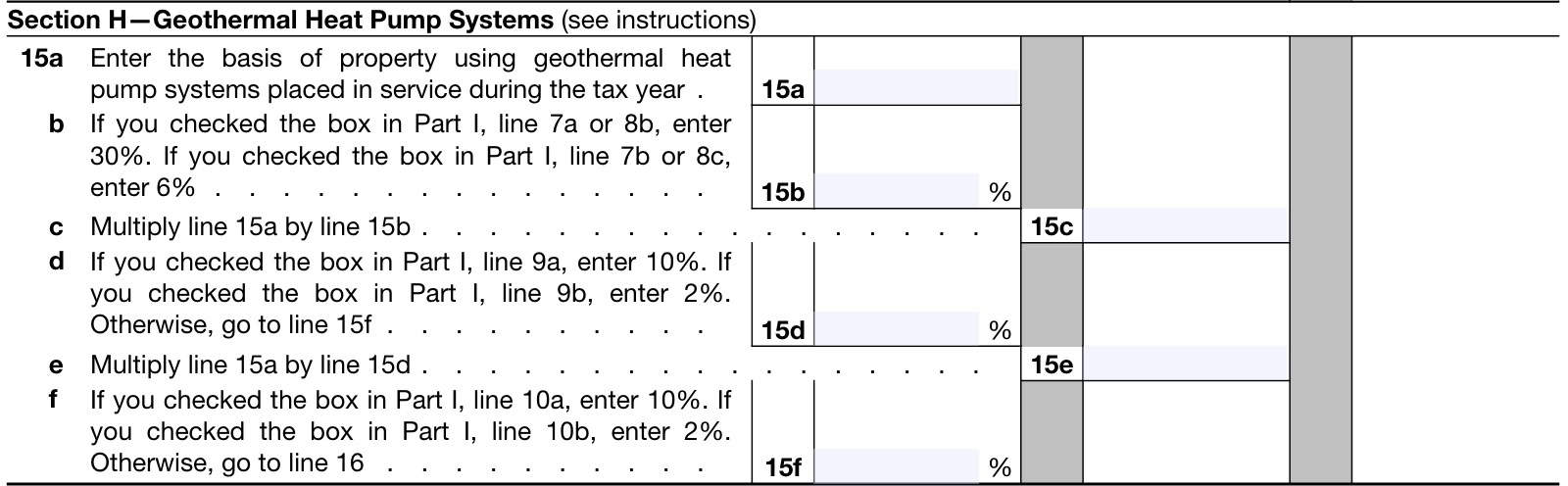

Line 15a: Basis of property placed in service during the tax year

Enter the basis of property using geothermal heat pump systems placed in service during the tax year.

Line 15b: Applicable energy percentage

If you checked the box in Part I, Line 7a or Line 8b, enter 30%.

If you checked the box in Part I, Line 7b or Line 8c, enter 6%.

Line 15c

Multiply Line 15a by Line 15b, then enter the result here.

Line 15d: Applicable domestic content bonus credit percentage

If you checked the box in Part I, Line 9a, enter 10%.

If you checked the box in Part I, Line 9b, enter 2%.

If the facility or property did not meet the requirements for the domestic content bonus credit, leave Line 15d blank, skip Line 15e, and go to Line 15f.

Line 15e

Multiply Line 15a by Line 15d, then enter the result here.

Line 15f: Applicable Energy Community Bonus Credit Percentage

If you checked the box in Part I, Line 9a, enter 10%.

If you checked the box in Part I, Line 10b, enter 2%.

If the facility or property was not placed in service within an energy community, leave blank and go to Line 16.

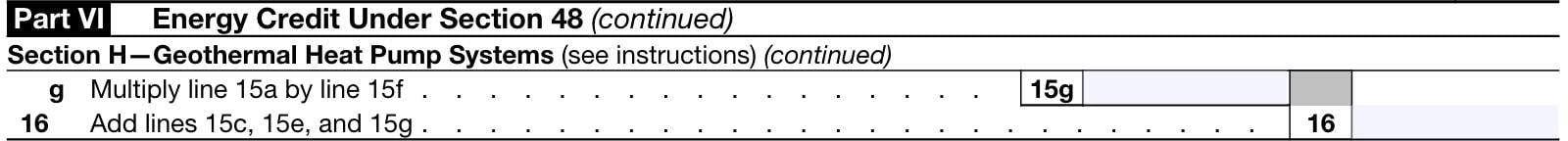

Line 15g

Multiply Line 15a by Line 15f, then enter the result here.

Line 16

Enter the sum of the following:

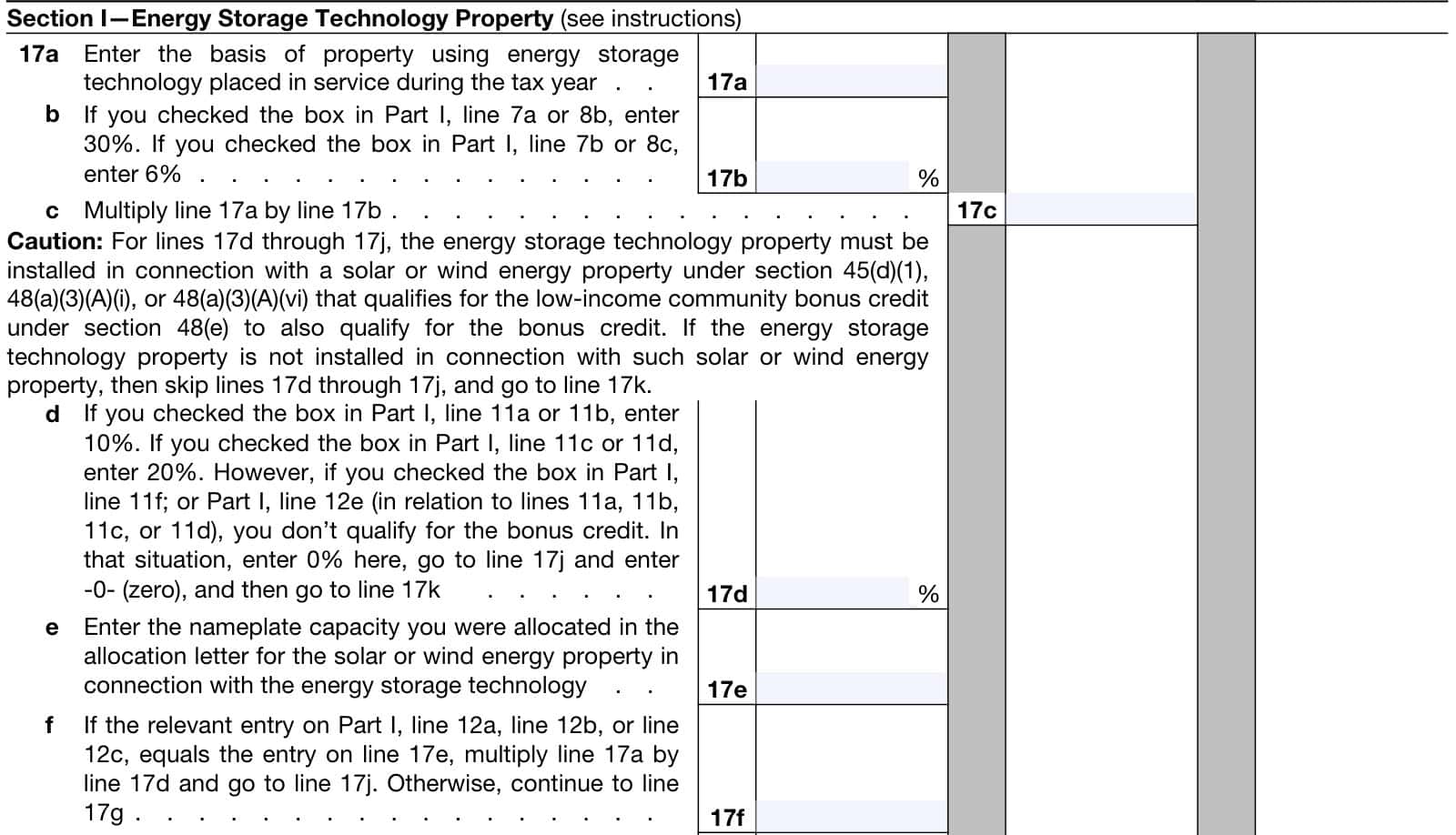

Section I: Energy Storage Technology Property

Energy storage technology is:

- Property that receives, stores, and delivers energy for conversion to electricity (or, in the case of

hydrogen, stores energy), and has a nameplate capacity of not less than 5 kilowatt hours; and- Not including property primarily used in the transportation of goods or individuals and not for the production of electricity

- Thermal energy storage property

Thermal energy storage property

Thermal energy storage property is property comprising a system that:

- Is directly connected to a heating, ventilation, or air conditioning system;

- Removes heat from, or adds heat to, a storage medium for subsequent use; and

- Provides energy for the heating or cooling of the interior of a residential or commercial building.

Thermal energy storage property doesn’t include:

- A swimming pool

- Combined heat and power system property, or

- A building or its structural components

Line 17a: Basis of property placed in service during the tax year

Enter the basis of property using energy storage technology placed in service during the tax year.

Line 17b: Applicable energy percentage

If you checked the box in Part I, Line 7a or Line 8b, enter 30%.

If you checked the box in Part I, Line 7b or Line 8c, enter 6%.

Line 17c

Multiply Line 17a by Line 17b, then enter the result here.

Line 17d: Applicable low-income community bonus credit percentage

If you checked the box in Part I, Line 11a or 11b, enter 10%.

If you checked the box in Part I, Line 11c or Line 11d, enter 20%.

If you checked either the box in Part I, Line 11f, or Part I, Line 12e, you do not qualify for the bonus credit. Instead, enter 0% on Line 17d and on Line 17j, then go to Line 17k.

Line 17e

Enter the nameplate capacity you were allocated in the allocation letter for the solar or wind energy property in connection with the energy storage technology.

Line 17f

If the relevant entry on Part I, Line 12a, Line 12b, or Line 12c equals the entry on Line 17e, then multiply Line 17a by Line 17d and go to Line 17j.

Otherwise, continue to Line 17g.

Line 17g

If the relevant entry on Part I, Line 12a, Line 12b, or Line 12c is more than the entry on Line 17e, then divide Line 17e by Part I, Line 12a, Line 12b, or Line 12c.

Line 17h

Multiply Line 17d by Line 17g, then enter the result here.

Line 17i

Multiply Line 17a by Line 17h, then enter the result here.

Line 17j

If the relevant entry on Part I, Line 12a, Line 12b, or Line 12c is more than the entry on Line 17e, enter the amount from Line 17i.

Otherwise, enter the amount from Line 17f.

Line 17k: Applicable domestic content bonus credit percentage

If you checked the box in Part I, Line 9a, enter 10%.

If you checked the box in Part I, Line 9b, enter 2%.

If the facility or property did not meet the requirements for the domestic content bonus credit, leave Line 17k blank, skip Line 17l, and go to Line 17m.

Line 17l

Multiply Line 17a by Line 17k, then enter the result here.

Line 17m: Applicable Energy Community Bonus Credit Percentage

If you checked the box in Part I, Line 9a, enter 10%.

If you checked the box in Part I, Line 10b, enter 2%.

If the facility or property was not placed in service within an energy community, leave blank and go to Line 18.

Line 17n

Multiply Line 17a by Line 17m, then enter the result here.

Line 18

Enter the total of the following:

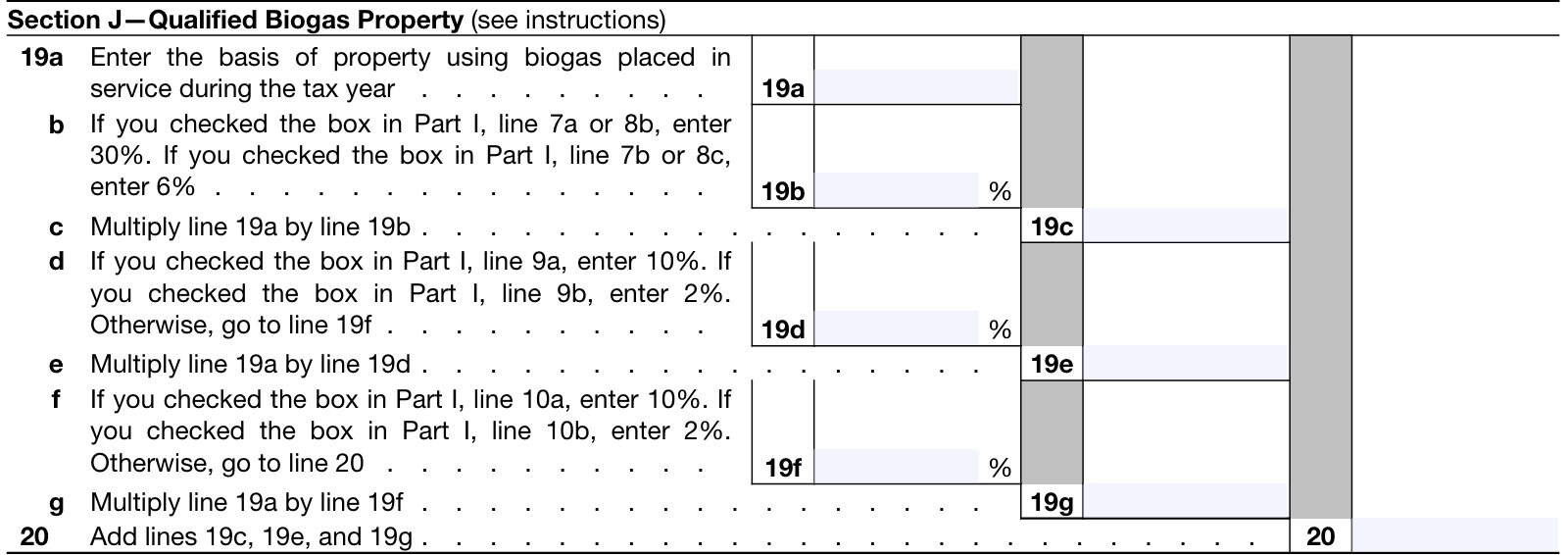

Section J: Qualified Biogas Property

Qualified biogas property is property comprising a system that:

- Converts biomass (as defined in Section 45K(c)(3), as in effect on August 16, 2022), into a gas that:

- Consists of not less than 52% methane by volume, or

- Is concentrated by such system into a gas that consists of not less than 52% methane, and

- Captures such gas for sale or productive use, and not for disposal by means of combustion.

Qualified biogas property includes any property, described above, that is part of a system that cleans or conditions gas.

Line 19a: Basis of property placed in service during the tax year

Enter the basis of property using biogas placed in service during the tax year.

Line 19b: Applicable energy percentage

If you checked the box in Part I, Line 7a or Line 8b, enter 30%.

If you checked the box in Part I, Line 7b or Line 8c, enter 6%.

Line 19c

Multiply Line 19a by Line 19b and enter the result here.

Line 19d: Applicable domestic content bonus credit percentage

If you checked the box in Part I, Line 9a, enter 10%.

If you checked the box in Part I, Line 9b, enter 2%.

If the facility or property did not meet the requirements for the domestic content bonus credit, leave Line 19d blank, skip Line 19e, and go to Line 19f.

Line 19e

Multiply Line 19a by Line 19d and enter the result here.

Line 19f: Applicable Energy Community Bonus Credit Percentage

If you checked the box in Part I, Line 9a, enter 10%.

If you checked the box in Part I, Line 10b, enter 2%.

If the facility or property was not placed in service within an energy community, leave blank and go to Line 20.

Line 19g

Multiply Line 19a by Line 19f and enter the result here.

Line 20

Enter the total of the following:

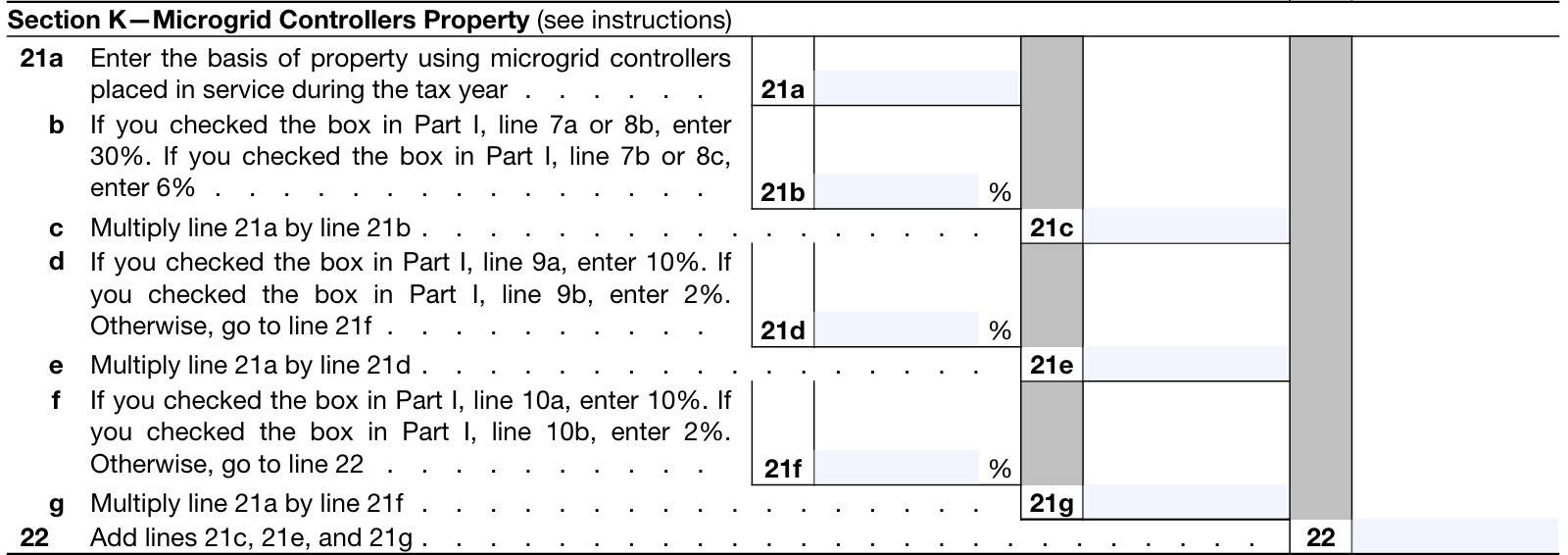

Section K: Microgrid Controllers Property

Microgrid controller means equipment that is:

- Part of a qualified microgrid, and

- Designed and used to monitor and control the energy resources and loads on such microgrid

Qualified microgrid

A qualified microgrid is an electrical system that:

- Includes equipment that is capable of generating not less than 4 kilowatts and not more than 20 megawatts of electricity;

- Is capable of operating:

- In connection with the electrical grid and as a single controllable entity with respect to such grid,

- Independently (and disconnected) from such grid, and

- Is not part of a bulk-power system.

Line 21a: Basis of property placed in service during the tax year

Enter the basis of property using microgrid controllers placed in service during the tax year.

Line 21b: Applicable energy percentage

If you checked the box in Part I, Line 7a or Line 8b, enter 30%.

If you checked the box in Part I, Line 7b or Line 8c, enter 6%.

Line 21c

Multiply Line 21a by Line 21b and enter the result here.

Line 21d: Applicable domestic content bonus credit percentage

If you checked the box in Part I, Line 9a, enter 10%.

If you checked the box in Part I, Line 9b, enter 2%.

If the facility or property did not meet the requirements for the domestic content bonus credit, leave Line 21d blank, skip Line 21e, and go to Line 21f.

Line 21e

Multiply Line 21a by Line 21d and enter the result here.

Line 21f: Applicable Energy Community Bonus Credit Percentage

If you checked the box in Part I, Line 9a, enter 10%.

If you checked the box in Part I, Line 10b, enter 2%.

If the facility or property was not placed in service within an energy community, leave blank and go to Line 22.

Line 21g

Multiply Line 21a by Line 21f and enter the result here.

Line 22

Enter the total of the following:

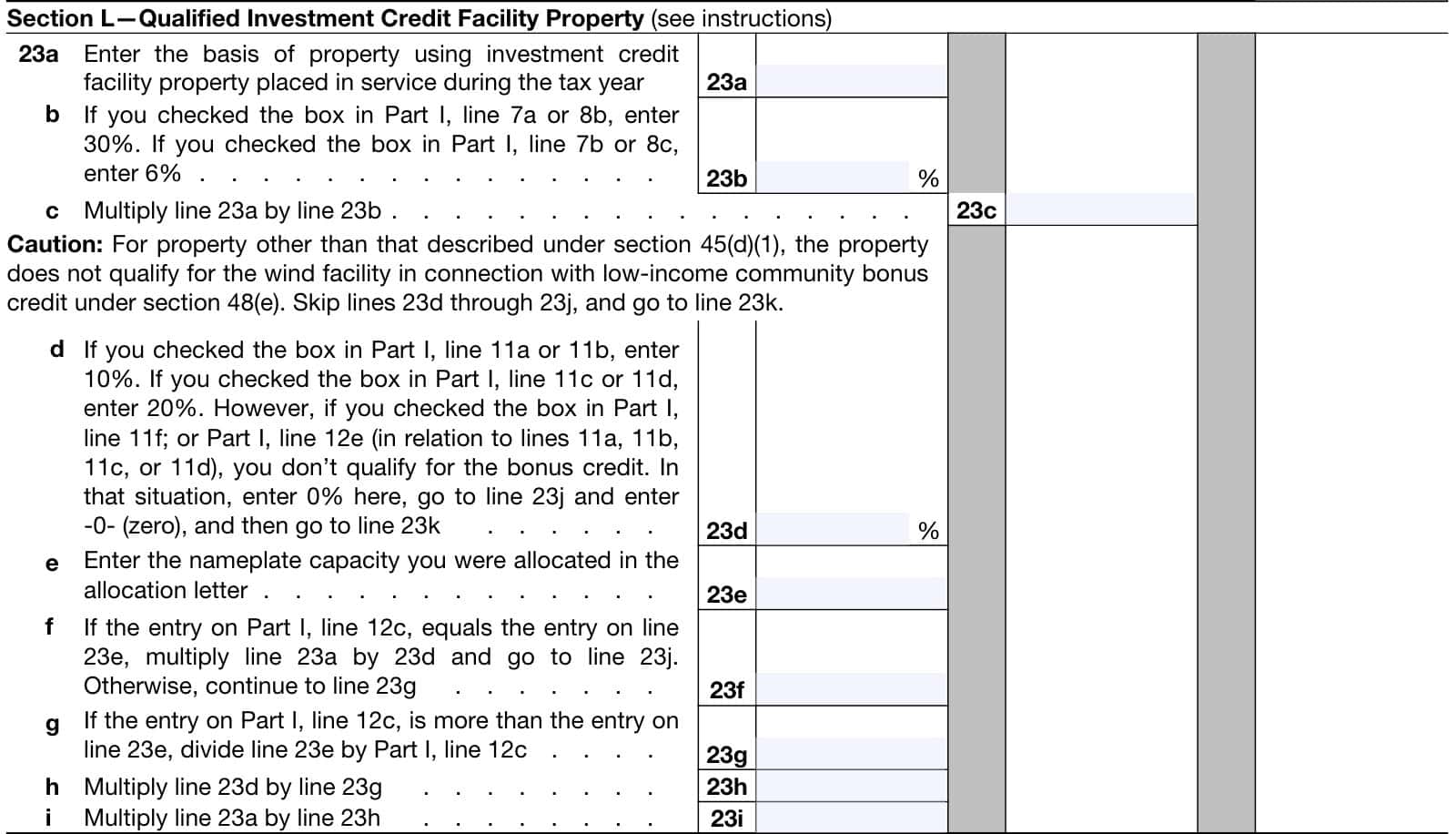

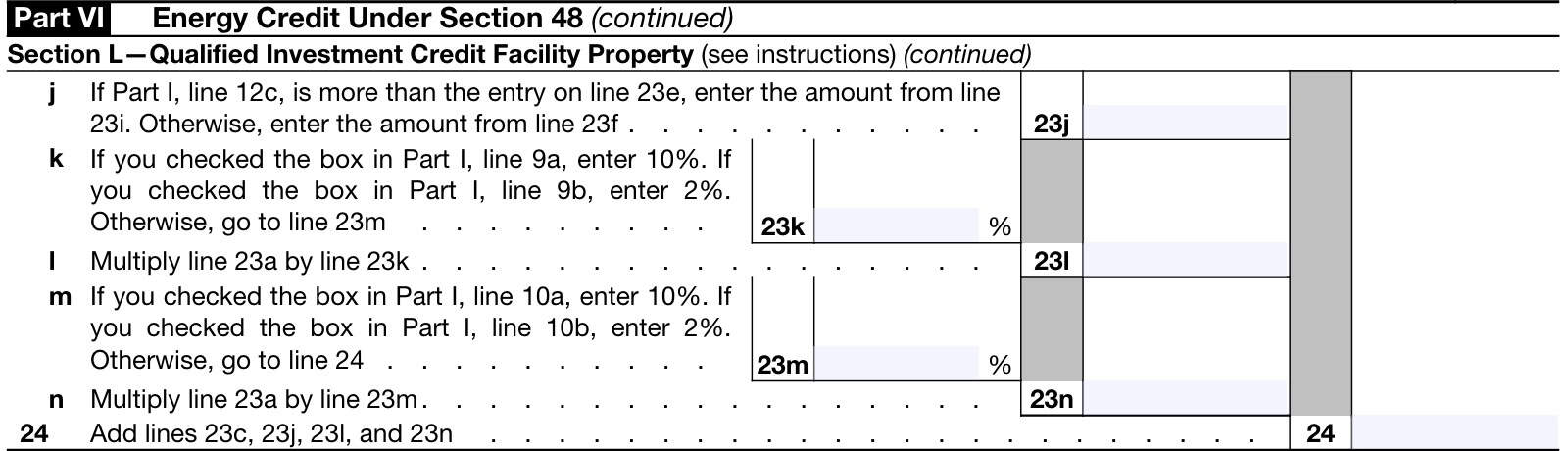

Section L: Qualified Investment Credit Facility Property

Qualified investment credit facility property is property:

- That is tangible personal property or other tangible property, but only if the property is used as an integral part of the qualified investment credit facility

- Does not include a building or its structural components

- That is constructed, reconstructed, erected, or acquired by the taxpayer

- With respect to which depreciation or amortization is allowable and

- For which the original use begins with the taxpayer

IRC Section 48(a)(5) contains more details.

Line 23a: Basis of property placed in service during the tax year

Enter the basis of property using investment credit facility property placed in service during the tax year.

Line 23b: Applicable energy percentage

If you checked the box in Part I, Line 7a or Line 8b, enter 30%.

If you checked the box in Part I, Line 7b or Line 8c, enter 6%.

Line 23c

Multiply Line 23a by Line 23b and enter the result here.

Line 23d: Applicable low-income community bonus credit percentage

If you checked the box in Part I, Line 11a or 11b, enter 10%.

If you checked the box in Part I, Line 11c or Line 11d, enter 20%.

If you checked either the box in Part I, Line 11f, or Part I, Line 12e, you do not qualify for the bonus credit. Instead, enter 0% on Line 23d and on Line 23j, then go to Line 23k.

Line 23e

Enter the nameplate capacity allocated in the allocation letter.

Line 23f

If the entry on Part I, Line 12c, equals the entry on Line 23e, multiply Line 23a by Line 23d and go to Line 23j.

Otherwise, continue to Line 23g.

Line 23g

If the entry on Part I, Line 12c, is more than the entry on Line 23e, divide Line 23e by Part I, Line 12c.

Line 23h

Multiply Line 23d by Line 23g and enter the result here.

Line 23i

Multiply Line 23a by Line 23h and enter the result here.

Line 23j

If Part I, Line 12c, is more than the entry on Line 23e, enter the amount from Line 23i.

Otherwise, enter the amount from Line 23f.

Line 23k: Applicable domestic content bonus credit percentage

If you checked the box in Part I, Line 9a, enter 10%.

If you checked the box in Part I, Line 9b, enter 2%.

If the facility or property did not meet the requirements for the domestic content bonus credit, leave Line 23k blank, skip Line 23l, and go to Line 23m.

Line 23l

Multiply Line 23a by Line 23k and enter the result here.

Line 23m: Applicable Energy Community Bonus Credit Percentage

If you checked the box in Part I, Line 9a, enter 10%.

If you checked the box in Part I, Line 10b, enter 2%.

If the facility or property was not placed in service within an energy community, leave blank and go to Line 24.

Line 23n

Multiply Line 23a by Line 23m and enter the result here.

Line 24

Enter the sum of the following:

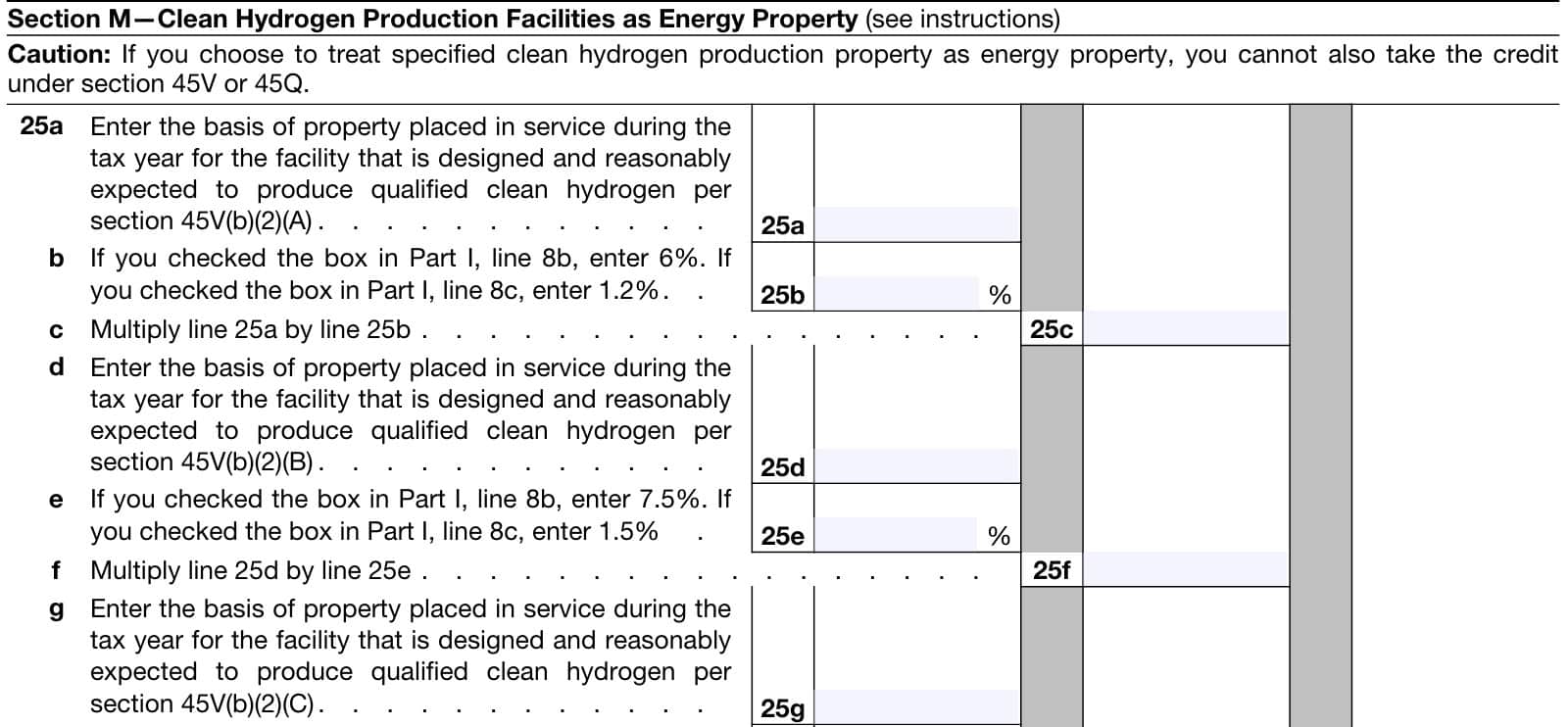

Section M: Clean Hydrogen Production Facilities as Energy Property

Election to treat clean hydrogen production facilities as energy property

In the case of any qualified property (as defined in section 48(a)(5)(D)) that is part of a specified clean hydrogen production facility, such property will be treated as energy property for purposes of this section.

The energy percentage with respect to such property is outlined below:

- 1.2% in the case of a facility that is designed and reasonably expected to produce qualified clean hydrogen that is described in Section 45V(b)(2)(A).

- 1.5% in the case of a facility that is designed and reasonably expected to produce qualified clean hydrogen that is described in Section 45V(b)(2)(B).

- 2% in the case of a facility that is designed and reasonably expected to produce qualified clean hydrogen that is described in Section 45V(b)(2)(C).

- 6% in the case of a facility that is designed and reasonably expected to produce qualified clean hydrogen that is described in Section 45V(b)(2)(D).

Line 25a: Basis of Property Placed in Service During the Tax Year (Section 45V(b)(2)(A)

Enter the basis of property placed in service during the tax year for the facility that is designed and reasonably expected to produce qualified clean hydrogen per Section 45V(b)(2)(A).

Line 25b: Applicable energy percentage

If you checked the box in Part I, Line 8b, enter 6%.

If you checked the box in Part I, Line 8c, enter 1.2%.

Line 25c

Multiply Line 25a by Line 25b, then enter the result here.

Line 25d: Basis of Property Placed in Service During the Tax Year (Section 45V(b)(2)(B))

Enter the basis of property placed in service during the tax year for the facility that is designed and reasonably expected to produce qualified clean hydrogen per Section 45V(b)(2)(B).

Line 25e: Applicable energy percentage

If you checked the box in Part I, Line 8b, enter 7.5%.

If you checked the box in Part I, Line 8c, enter 1.5%.

Line 25f

Multiply Line 25d by Line 25e, then enter the result here.

Line 25g: Basis of Property Placed in Service During the Tax Year (Section 45V(b)(2)(C))

Enter the basis of property placed in service during the tax year for the facility that is designed and reasonably expected to produce qualified clean hydrogen per Section 45V(b)(2)(C).

Line 25h: Applicable energy percentage

If you checked the box in Part I, Line 8b, enter 10%.

If you checked the box in Part I, Line 8c, enter 2%.

Line 25i

Multiply Line 25g by Line 25h, then enter the result here.

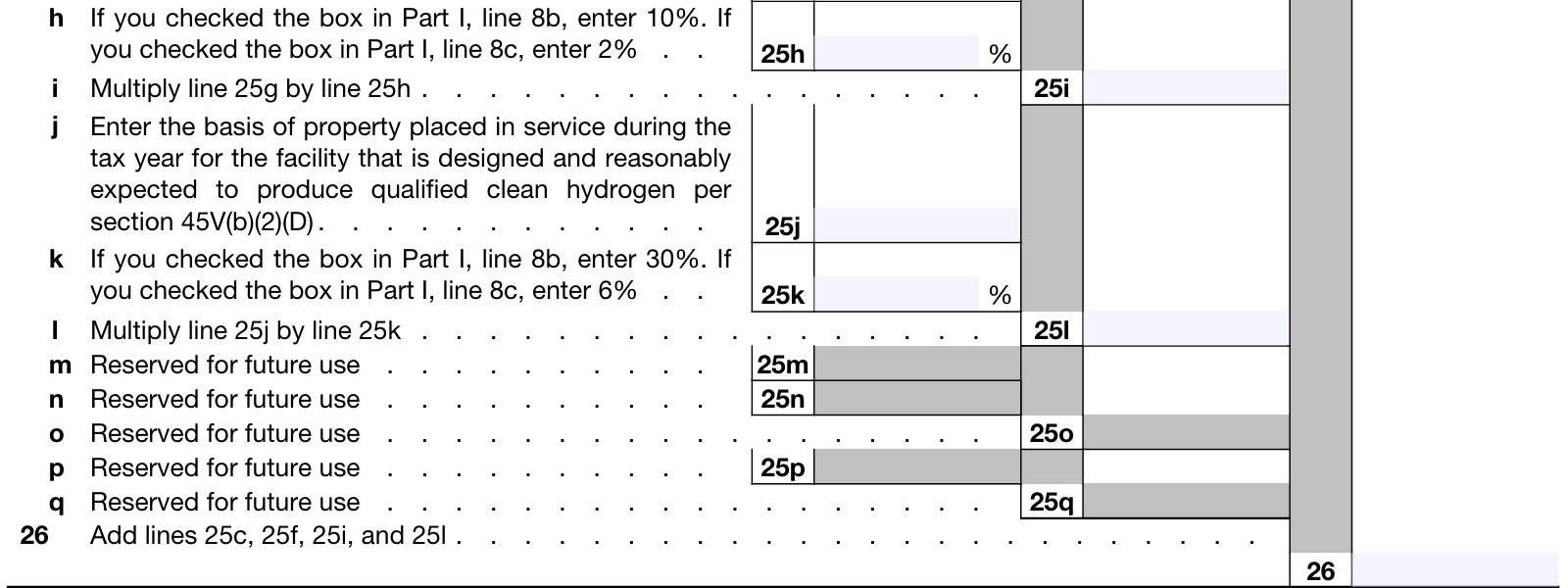

Line 25j: Basis of Property Placed in Service During the Tax Year (Section 45V(b)(2)(D))

Enter the basis of property placed in service during the tax year for the facility that is designed and reasonably expected to produce qualified clean hydrogen per Section 45V(b)(2)(D).

Line 25k: Applicable energy percentage

If you checked the box in Part I, Line 8b, enter 30%.

If you checked the box in Part I, Line 8c, enter 6d%.

Line 25l

Multiply Line 25j by Line 25k, then enter the result here.

Line 25m: Reserved for future use

Do not enter anything in Line 25m.

Line 25n: Reserved for future use

Do not enter anything in Line 25n.

Line 25o: Reserved for future use

Do not enter anything in Line 25o.

Line 25p: Reserved for future use

Do not enter anything in Line 25p.

Line 25q: Reserved for future use

Do not enter anything in Line 25q.

Line 26

Enter the total of the following:

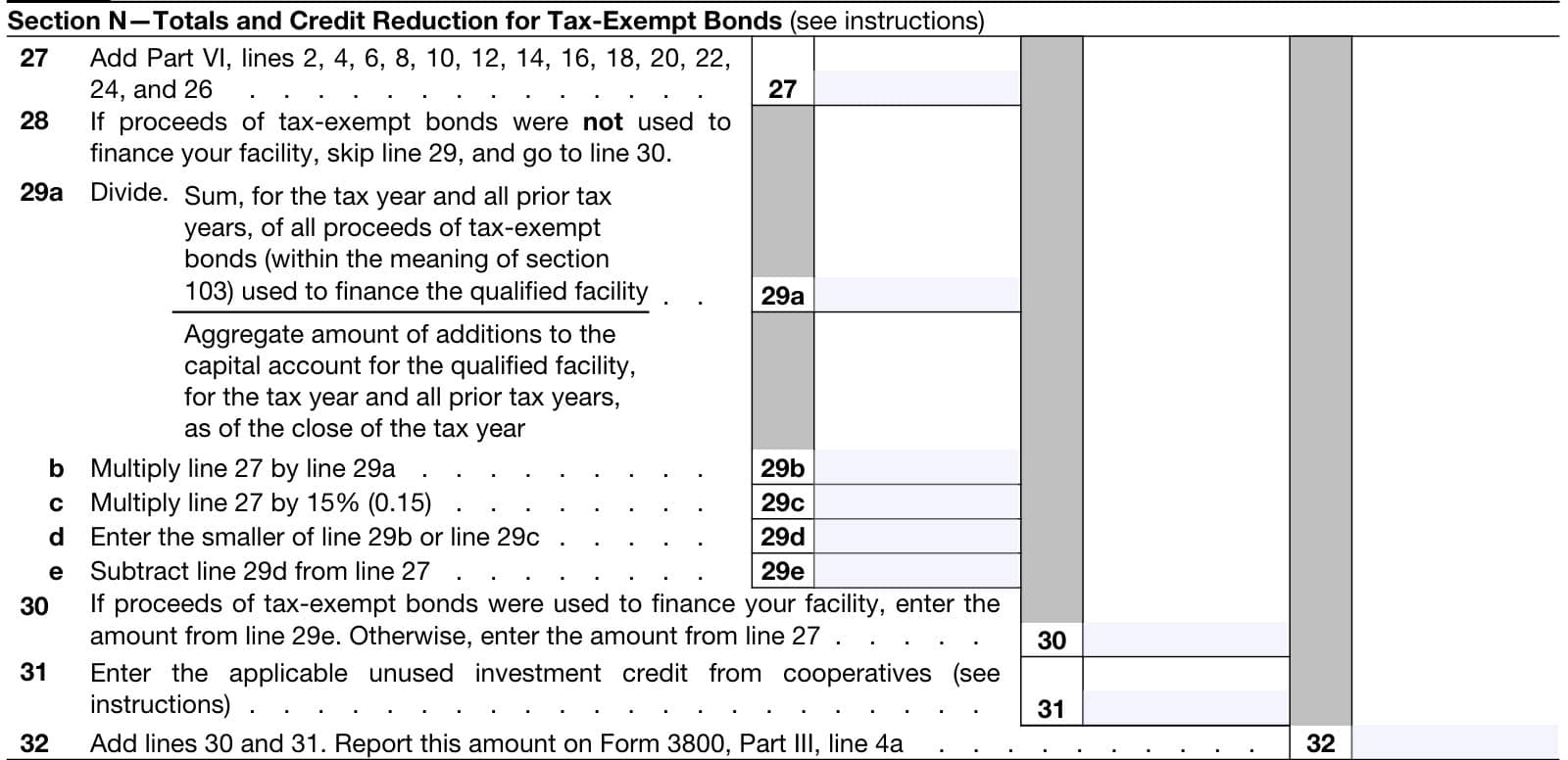

Section N: Totals and Credit Reduction for Tax-Exempt Bonds

Line 27

Add the following lines from previous sections in Part VI:

Line 28

If proceeds of tax-exempt bonds were not used to finance your facility, then skip Line 29 and go to Line 30.

Line 29a

In Line 29a, divide the sum of all proceeds of tax-exempt bonds used to finance the qualified facility (including current tax year and all prior tax years), by the aggregate amount of additions to the capital account for the qualified facility, as of the close of the tax year.

Credit reduced for tax-exempt bonds.

The amount of the credit with respect to any facility for any tax year will be reduced by the lesser of one of the following:

- 15%, or

- The fraction calculated in Line 29a

Line 29b

Multiply Line 27 by Line 29a. Enter the result.

Line 29c

Multiply Line 27 by 15%. Enter the result.

Line 29d

Enter the smaller of Line 29b or Line 29c.

Line 29e

Subtract Line 29d from Line 27. Enter the total here.

Line 30

If proceeds of tax-exempt bonds were used to finance your facility, enter the amount from Line 29e. Otherwise, enter the amount from Line 27.

Line 31: Unused investment from cooperatives

Enter the applicable unused investment credit from cooperatives in Line 31.

Line 32: Total credit allowed

Add Line 30 and Line 31. Enter the total here and on IRS Form 3800, Part III, Line 4a.

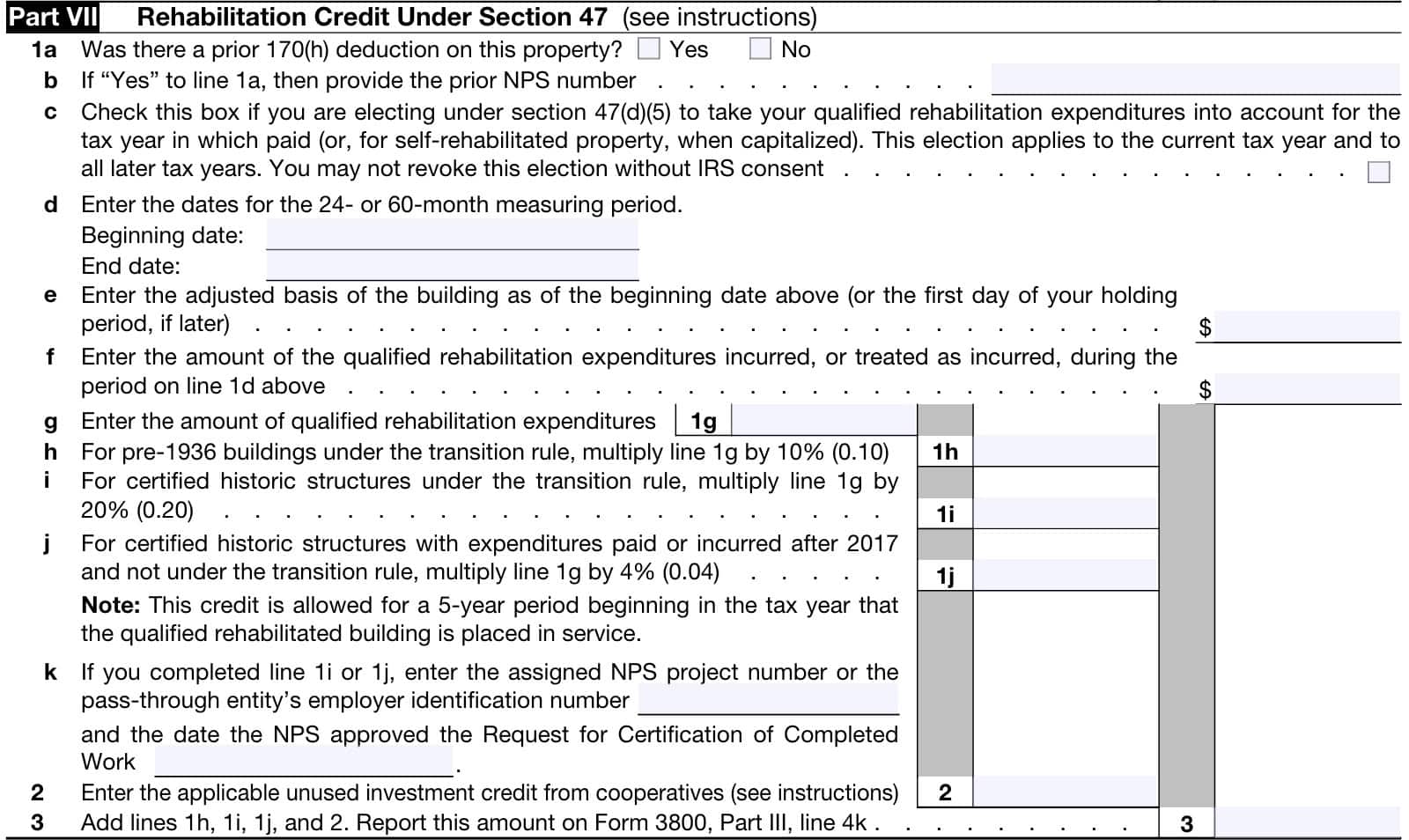

Part VII: Rehabilitation Credit Under Section 47

Line 1a: Was there a prior Section 170(h) deduction on the property?

Check the appropriate box whether there was any charitable conservation contribution deduction under Section 170(h) claimed for the property on which you are claiming a credit for a certified historic building.

Line 1b

If you answered ‘Yes’ to Line 1a, provide the prior NPS number.

Line 1c

If you elect, under Section 47(d)(5), to take your qualified rehabilitation expenditures into account for the tax year in which paid (or, for self-rehabilitated property, when capitalized).

This election applies to the current tax year and to all subsequent years. You may not revoke this election without IRS consent.

Line 1d

Enter the beginning dates and ending dates of the applicable 24 or 60 month measuring period.

Line 1e

Enter the adjusted basis of the building as of the beginning date above. If the first day of your holding period is later, use that date instead.

Line 1f

Enter the amount of qualified rehabilitation expenses incurred, or treated as incurred, during the period in Line 1d, above.

Qualified rehabilitation expenditures.

To be qualified rehabilitation expenditures, your expenditures must meet all six of the following requirements:

- The expenditures must be for one of the following:

- Nonresidential real property

- Residential rental property (only if a certified historic structure), or

- Real property that has a class life of more than 12.5 years

- The expenditures must be incurred in connection with the rehabilitation of a qualified rehabilitated building

- The expenditures must be capitalized and depreciated using the straight line method

- The expenditures can’t include the costs of acquiring or enlarging any building

- If the expenditures are in connection with the rehabilitation of a certified historic structure or a building in a registered historic district, the rehabilitation must be certified by the Secretary of the Interior as being consistent with the historic character of the property or district in which the property is located, unless:

- The building isn’t a certified historic structure;

- The Secretary of the Interior certifies that the building isn’t of historic significance to the district; and

- If the certification in (b) occurs after the rehabilitation began, the taxpayer certifies in good faith that the taxpayer wasn’t aware of that certification requirement at the time the rehabilitation began.

- The expenditures can’t include any costs allocable to the part of the property that is (or may reasonably be expected to be) tax-exempt use property (as defined in section 168(h) except that “50%” shall be substituted for “35%” in paragraph (1)(B)(iii)).

- This exclusion doesn’t apply for Line 1f

Line 1g

Enter the amount of qualified rehabilitation expenditures incurred.

Line 1h

For a pre-1936 building under the transition rule, multiply Line 1g by 10%.

Line 1i

For certified historic structures under the transition rule, multiply Line 1g by 20%.

Line 1j

For certified historic structures with expenditures paid or incurred after 2017 and not under the transition rule, multiply Line 1g by 4%.

Line 1k

If you completed Line 1i or Line 1j, enter the assigned NPS project number or the pass-through entity’s employer identification number (EIN) and the date the NPS approved the Request for Certification of Completed Work in the spaces provided.

Line 2: Unused investment credit from cooperatives

Enter any applicable unused investment credit received from cooperatives.

Line 3

Add the following:

Enter the result here and on IRS Form 3800, Part III, Line 4k.

Video walkthrough

Watch this video to learn how to walk through IRS Form 3468.

Do you use TurboTax?

If you use TurboTax, and you’re completing this tax form for the first time, you might be ready to try TurboTax Federal Premium instead of the free or deluxe versions. TurboTax Federal Premium comes in two offerings, DIY or Live Assisted.

Do it yourself

To learn more about using TurboTax Federal Premium’s DIY option, click here.

Live Assisted

If you feel more comfortable having a tax expert guide you for the first time through this new form (or any other new forms), get started here.

Ready to hand the reins over to someone else completely? Go here to learn more about TurboTax’s Live Assisted Full Service offering!

What is IRS Form 3468?

IRS form 3468, Investment Credit, is the tax form that the Internal Revenue Service uses to allow businesses to reduce corporate income taxes by investing in certain projects designed for society’s overall benefit. Examples of eligible projects include:

- Purchasing eligible property, such as historic buildings, to enhance urban development

- Creating affordable housing

- Certain investments in renewable energy sources or energy conservation projects

What investment credits are available?

Eligible taxpayers may claim the following investment credits by filing IRS Form 3468:

Rehabilitation credit

The IRS permits taxpayers to receive a rehabilitation tax credit for qualified rehabilitation expenditures for any qualified rehabilitated building.

What is a qualified rehabilitated building?

According to the IRS, a qualified rehabilitated building must meet 5 requirements:

Must be a certified historic structure

To be considered a certified historic structure, the building must either be:

- Listed in the National Register of Historic Places, or

- Certified by the Secretary of the Interior and located in a registered historic district as defined in Internal Revenue Code Section 47(c)(3)(B)

The building must be substantially rehabilitated

To meet this criteria, the taxpayer’s expenditures during a 24-month period must be more than the greater of:

- Taxpayer’s adjusted basis in the building and its structural components, or

- $5,000

If the taxpayer is rehabilitating the building in phases under a written architectural plan and specifications that were completed before the rehab began, then the expenditures can take place over a 60-month period.

Depreciation must be allowable

For depreciation to be allowable, the taxpayer must place the building into service within a reasonable period of time. If the building is permanently retired from service, depreciation is not allowed.

The building must have been placed in service before starting rehabilitation

The taxpayer can meet this requirement by placing the building into service at any time before rehabilitation begins.

Certain structural components must remain in place

For a building under the transition rule, it must meet two criteria:

- At least 75% of the external walls must be retained with 50% or more kept in place as external walls, and

- At least 75% of the existing internal structural framework of the building must be retained in place.

What are qualified rehabilitation expenditures?

Qualified rehabilitation expenditures must meet the following six criteria:

Only certain property qualifies

The rehabilitation expenditures must be for one of the following:

- Nonresidential real property

- Residential rental property that is also a certified historic structure; Treasury Regulations Section 1.48-1(h) contains additional information

- Real property with a class life of more than 12.5 years

Expenditures must be connected to the rehabilitation project

The property owner must be able to prove that all expenditures were directly related to the structure’s rehabilitation costs.

Taxpayer must use straight-line depreciation for expenditures

The rehabilitation costs must be depreciated using the straight line method. No accelerated depreciation or Section 179 depreciation allowed.

The taxpayer cannot include acquisition or expansion costs

The total costs only include rehabilitation, not acquiring the building or creating an expansion project.

If not directly connected to a certified historic structure or district, the rehabilitation must be certified by the Secretary of the Interior

This requirement does not apply if:

- The building is not a certified historic structure

- The Secretary of the Interior certifies that the building isn’t of historic significance, or

- Certification occurred after rehab began, and the taxpayer certifies in good faith that he or she wasn’t aware of the certification requirement when the project started

The expenditures cannot be made on tax-exempt property

The expenditures cannot include costs allocable to the part of the property that is reasonably expected to be tax-exempt use property

However, claiming this tax credit results in a dollar-for-dollar reduction in the taxpayer’s basis in the rehabilitated building.

In essence, claiming the rehabilitation credit in the current year will reduce today’s tax liability, but might raise taxable income in a subsequent tax year.

Energy credit

Energy credits consist of one or more of the following:

- Qualified geothermal energy property

- Qualified solar illumination or solar energy property

- Qualified fuel cell property

- Qualified microturbine property

- Combined heat and power system property

- Qualified small wind energy property

- Waste energy recovery property

- Geothermal heat pump systems

- Qualified investment credit facility property

To qualify for the energy credit, property must meet the following criteria:

Meet certain performance and quality standards

If there are standards prescribed by regulations, and in effect at the time of acquisition, the property must meet or exceed those standards.

Be depreciable property

The taxpayer must be able to amortize or depreciate the property in question.

Be either constructed or acquired by the taxpayer

The taxpayer must either build the property or be the person that places the property into original use.

Energy property doesn’t include any property acquired before February 14, 2008, or to the extent of basis attributable to construction, reconstruction, or erection before February 14, 2008, that is public utility property.

Generally, the taxpayer must reduce the tax basis of the property by 50% of the claimed tax credit.

Qualifying advanced coal project credit

IRC Section 48A(d)(3)(B)(i) authorizes a federal income tax credit for qualifying coal projects. To qualify, a coal project must be located in the United States and meet the following criteria:

- Uses advanced coal-based generation technology to power a new electric generation unit or to refit or repower an existing electric generation unit (including an existing natural gas-fired combined cycle unit);

- As defined in section 48A(f)

- Has fuel input which will be at least 75% coal when completed;

- Has an electric generation unit or units at the site that will generate at least 400 megawatts;

- Has a majority of the output that is reasonably expected to be acquired or utilized;

- Is to be constructed and operated on a long-term basis when the taxpayer provides evidence of ownership or control of a site of sufficient size;

- Includes equipment that separates and sequesters at least 65% (70% in the case of an application for reallocated credits) of the project’s total carbon dioxide emissions for project applications described in section 48A(d)(2)(A)(ii)

Qualifying gasification project credit

Likewise, a gasification project must meet certain criteria to qualify for a tax credit:

A qualifying gasification project is a project that:

- Employs gasification technology as defined in IRC Section 48B(c)(2),

- Is carried out by an eligible entity, defined in section 48B(c)(7), and

- Includes a qualified investment of which an amount not to exceed $650 million is certified under the qualifying gasification program as eligible for credit.

Qualifying advanced energy project credit

Finally, to be eligible for the qualifying advanced energy project credit, some or all of the qualified investment in the qualifying advanced energy project must be certified by the IRS under Section 48C(d).

The following references contain more information about the advanced energy project credit:

- Notice 2009-72, 2009-37 I.R.B. 325

- Notice 2013-12, 2013-10 I.R.B. 543

How do I file IRS Form 3468?

File IRS Form 3468 as an accompaniment to your regularly filed federal income tax return. If you file electronically, you may also need to send a paper Form 8453, U.S. Individual Income Tax Transmittal, for any attachments that you cannot include with IRS Form 3468 and your income tax return.

Where can I find IRS Form 3468?

You may find this tax form on the IRS website or download the file below.

This tax form is one of the fillable tax forms provided by the Internal Revenue Service, to help taxpayers reduce their tax preparation costs. To see more forms like this, visit our free fillable tax forms page, where you’ll also find articles like this.

Unlike the IRS, our articles contain step by step instructions for each tax form, as well as video walkthroughs. You can also check out all of our videos by subscribing to our YouTube channel!