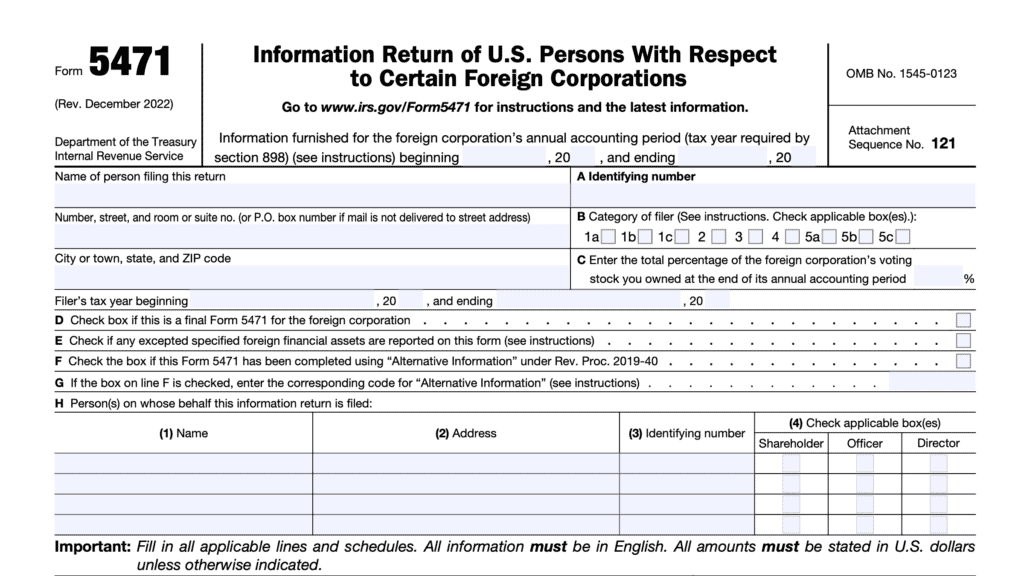

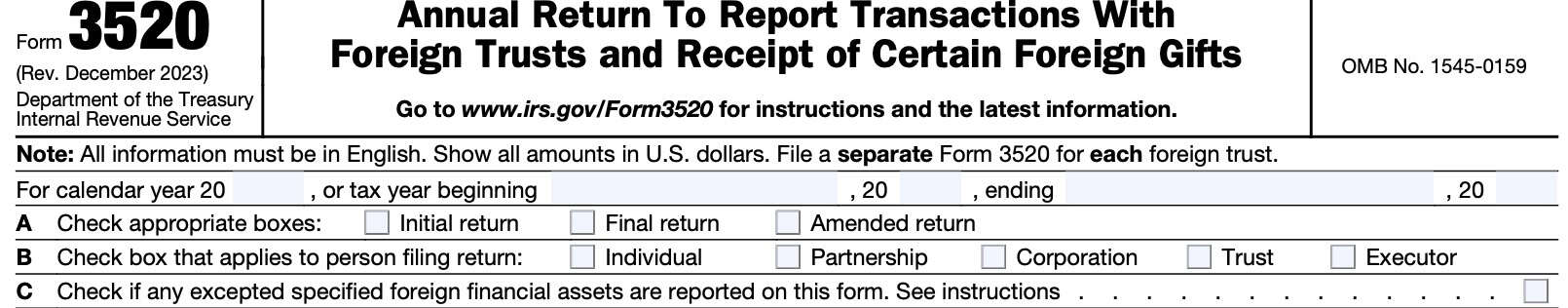

IRS Form 3520 Instructions

If you’ve received or transferred money, assets, or property to or from foreign entities, you may need to declare these transactions on IRS Form 3520, Annual Return To Report Transactions With

Foreign Trusts and Receipt of Certain Foreign Gifts.

In this article, we’ll walk through everything you should know about this tax form, including:

- How to complete and file IRS Form 3520

- Who must file IRS Form 3520, and when

- Other filing considerations

Let’s begin with a step by step overview on how to complete IRS Form 3520.

Table of contents

How do I complete IRS Form 3520?

IRS Form 3520 is one of the more complicated and difficult tax forms. According to the Paperwork Reduction Act Notice, the estimated burden of this official form includes over 50 hours of work per year:

| Recordkeeping | 42 hr., 34 min. |

| Learning about the law or the form | 4 hr., 50 min. |

| Preparing the form | 6 hr., 40 min. |

| Sending the form to the IRS | 16 min. |

This article is intended to help understand how your tax professional might complete the form on your behalf. U.S. taxpayers should hire a tax professional, such as a tax attorney, to complete this federal form.

Please note: ignorance of the applicable federal tax laws or of your state’s estate laws does not constitute a valid excuse, nor free you from your reporting obligations. Significant penalties may apply to taxpayers who do not properly complete this form.

All filers will need to complete the header information and taxpayer information fields on Page 1. Depending on your circumstances, you may need to complete one or more of the following parts:

- Part I: Transfers by U.S. Persons to a Foreign Trust During the Current Taxable Year

- Part II: U.S. Owner of a Foreign Trust

- Part III: Distributions to a U.S. Person From a Foreign Trust During the Current Year

- Part IV: U.S. Recipients of Gifts or Bequests Received During the Current Tax Year From Foreign Persons

Header

In the first part of this form, you’ll provide initial information about the tax return, and why you are filing it.

Calendar year or tax year

Calendar year taxpayers should enter the last two digits of the calendar year for which they are filing.

Fiscal year taxpayers should enter the beginning dates and ending dates of their tax. year.

Item A

Check the appropriate box:

- Initial return: Check this box if this is the initial return you are filing concerning this foreign trust

- Final return: If no further returns for transactions with the foreign trust are required, check this box

- Amended return: Check this box if this Form 3520 is filed to amend a Form 3520 that you previously filed for the same tax year

Item B

Check the box that applies to the taxpayer filing Form 3520:

- Individual

- Partnership

- Corporation

- Trust

- Executor

Item C : Excepted specified foreign financial assets

Check this box if you are reporting any excepted specified foreign financial assets on this return.

Check the box in item C only if the Form 3520 filer

- Also files IRS Form 8938 for the same tax year, and

- Includes this form in the total number of Forms 3520 reported on Line 15 of Part IV, Excepted Specified Foreign Financial Assets, of IRS Form 8938.

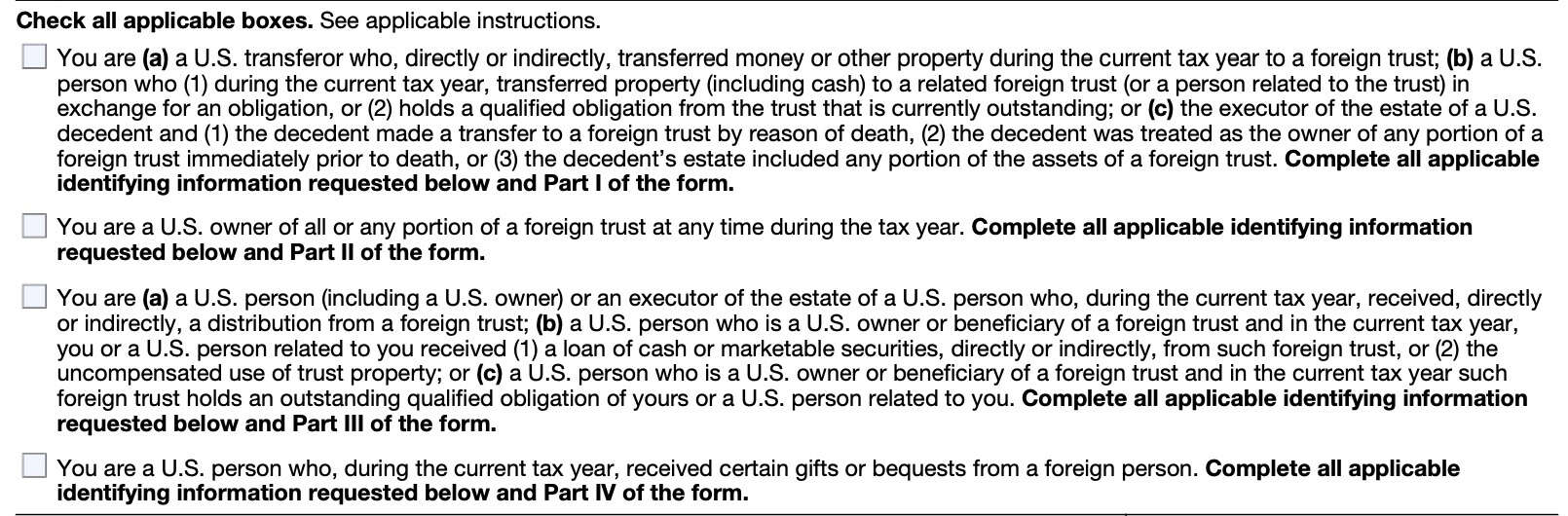

Applicable boxes

Check any of the applicable boxes outlined below.

You are a U.S. Person who transferred assets into or held obligations in a foreign trust

Specifically, check this box if you are any of the following:

- A U.S. transferor who transferred money or other property during the current tax year to a foreign trust, either directly or indirectly

- A U.S. person who:

- During the tax year, transferred property to a related foreign trust (or person related to the trust) in exchange for an obligation

- Holds a qualified obligation from the foreign trust that is currently outstanding

- Executor of the estate of a U.S. decedent, and

- The decedent transferred assets to a foreign trust upon death

- The decedent was treated as the owner of any portion of a foreign trust immediately prior to death, or

- The decedent’s estate included any portion of the assets of a foreign trust

Complete all taxpayer information outlined below, and Part I of this form.

You are a U.S. owner of a foreign trust

Check this box if you are a U.S. owner who owned any portion of a foreign trust at any time during the tax year.

Complete all taxpayer information outlined below, and Part II of this form.

You are a U.S. person who received assets

Specifically, check this box if you are a U.S person and any of the following applies:

- You received money or other property during the current tax year from a foreign trust, either directly or indirectly

- You are an owner or beneficiary of a foreign trust, and during the tax year, you or a related person received:

- A loan of cash or marketable securities, from the foreign trust, or

- Uncompensated use of trust property

- The foreign trust holds an outstanding qualified obligation of yours or a U.S. person related to you

Complete all taxpayer information outlined below, and Part III of this form.

You are a U.S. person who received certain gifts or bequests

You are a U.S. person who, during the current tax year, received certain gifts or bequests from a foreign individual.

Complete all taxpayer information outlined below, and Part IV of this form.

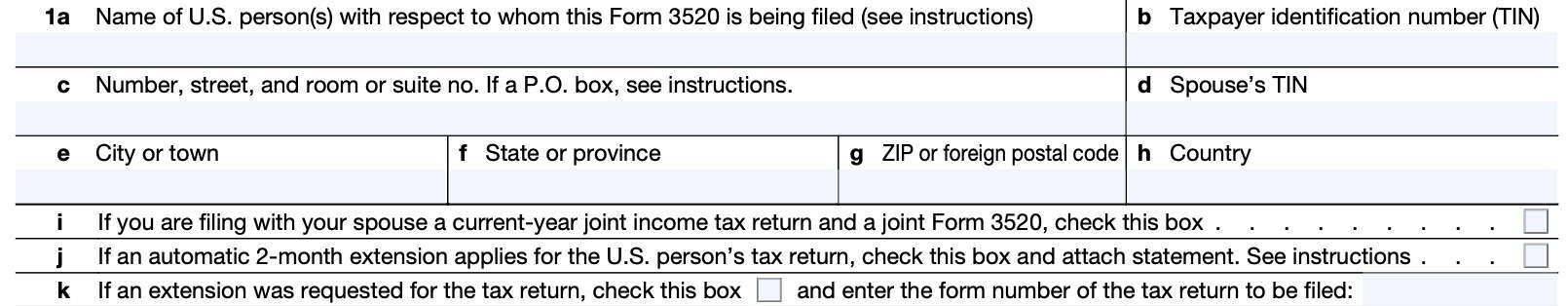

Taxpayer information

Blocks 1-4 contain additional information about the reporting taxpayer. Below are a couple of notes from the IRS instructions.

Line 1a

Enter the name of the person who is filing IRS Form 3520.

Joint filers

If you and your spouse are filing a joint Form 3520, put your names and TINs in the same order as they appear on either:

- IRS Form 1040, U.S. Individual Income Tax Return, or

- IRS Form 1040-SR, U.S. Tax Return for Seniors

Also, check the box on Line 1i.

Line 1b: Taxpayer identification number

Enter the tax ID number of the first person listed in Line 1a.

Line 1c: Street address

Enter the street address for the taxpayer listed in Line 1a.

Post office boxes

If the post office does not deliver mail to the street address and the U.S. person has a P.O. box, show the box number instead.

Line 1d: Spouse’s TIN

If a spouse is listed in Line 1a, enter his or her taxpayer ID number in Line 1d.

Line 1e: City or town

Enter the city or town for the taxpayer’s mailing address.

Line 1f: state or province

Enter the state or province for the taxpayer’s mailing address.

Line 1g: ZIP code or foreign postal code

Enter the ZIP code or foreign postal code for the taxpayer’s mailing address.

Line 1h: Country

If the taxpayer’s address is not the United States, enter the name of the country in Line 1h.

Line 1i: Joint return

If you are filing a current-year joint income tax return and a joint Form 3520, check this box.

Line 1j: Automatic 2-month extension

If an automatic 2-month extension applies for your tax return because you meet one of the following conditions, check the box and attach a statement to the Form 3520 to indicate that you are a U.S. citizen or resident who meets one of these conditions:

- You are in the military or naval service on active duty outside the United States and Puerto Rico, or

- You live outside of the United States and Puerto Rico and your place of business or post of duty is outside the United States and Puerto Rico

Line 1j.

If you qualify for an automatic 2-month extension because you either live and work outside the United States and Puerto Rico, OR you are in the military or naval service on duty outside the United States and Puerto Rico, then you will:

- Check the box

- Attach a statement showing that you are a U.S. citizen or resident who meets the requirements

Line 1k: Tax return extension

If you filed for an extension of time to file your income tax return, check the box on Line 1k. Also, enter the tax form number of the original tax return.

For example, if you’re filing a Form 1040, you will enter “1040” on this line.

Below are examples of common tax filing extension forms and their related tax return:

IRS Form 1040

Form 1040 filers may request a tax extension on either of the following forms:

- IRS Form 4868, Application for Automatic Extension of Time to File U.S. Individual Income Tax Return

- IRS Form 2350, Application for Extension of Time To File U.S. Income Tax Return For U.S. Citizens and Resident Aliens Abroad Who Expect To Qualify for Special Tax Treatment

IRS Form 706 or IRS Form 709

- IRS Form 8892, Application for Automatic Extension of Time To File Form 709 and/or Payment of Gift/Generation-Skipping Transfer Tax

- IRS Form 4768, Application of Extension to File a Return for Estate & GSTT

Business Income Tax, Information, and Other Returns

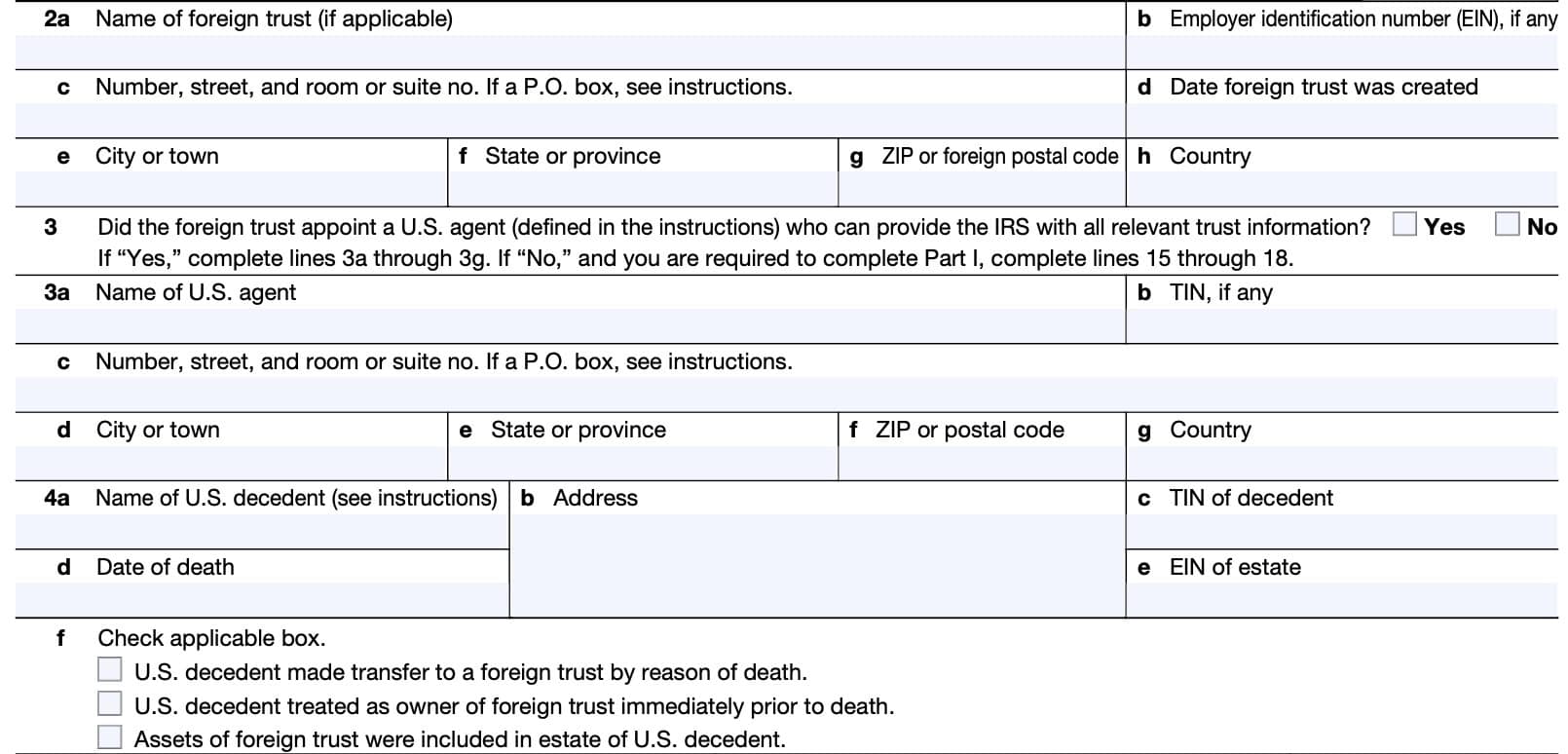

Line 2: Foreign Trust information

In Line 2b, enter the employer identification number (EIN) of the foreign trust. Do not enter an SSN or ITIN.

Only EINs should be used to identify the foreign trust.

Line 3.

If the foreign trust did not appoint a U.S. agent who can provide the IRS with all relevant trust information, then:

- Check No

- Complete Lines 15 through 18, in Part I, below

Lines 4a through 4f.

If you are the executor of the estate of a U.S. citizen or resident, you must provide information about the decedent on lines 4a through 4e.

On Line 4f, you must also check the applicable box to indicate which of the following applies:

- The U.S. decedent made a transfer to a foreign trust by reason of death,

- The U.S. decedent was treated as the owner of a portion of a foreign trust immediately prior to death, or

- The estate of the U.S. decedent included assets of a foreign trust.

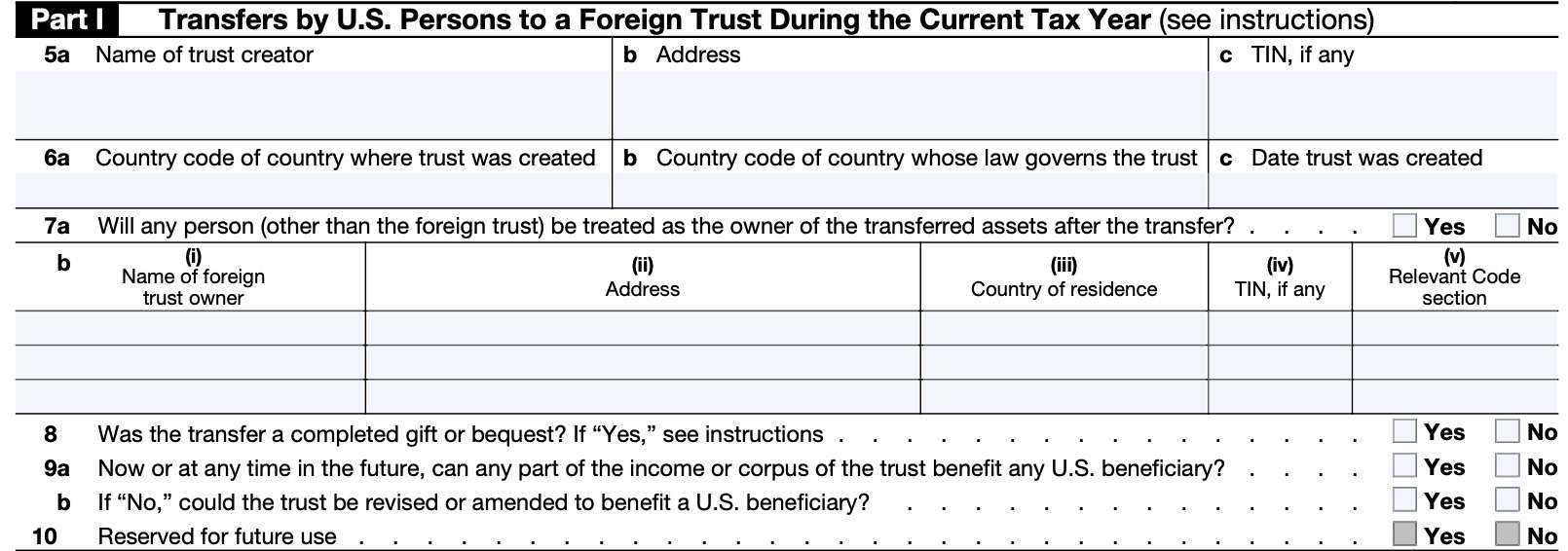

Part I: Transfers by U.S. Persons to a Foreign Trust During the Current Tax Year

In this section, you’ll complete:

- Name of trust creator.

- Address of the creator.

- TIN of the creator.

- 2-letter country code and date where foreign trust was created

- Other owners of the transferred assets

Line 8

Was the transfer a completed gift or bequest? If Yes, then you may have to file either of the following:

- For a gift: IRS Form 709, United States Gift (and Generation-Skipping Transfer) Tax Return

- For a bequest: IRS Form 706, U.S. Estate Tax Return

Line 9

Answer Yes to Line 9a if at any point, any part of the trust’s income or corpus benefit any U.S. beneficiary.

If No, then answer whether the trust could be amended or revised to benefit a U.S. beneficiary in the future.

Line 10: Reserved for future use

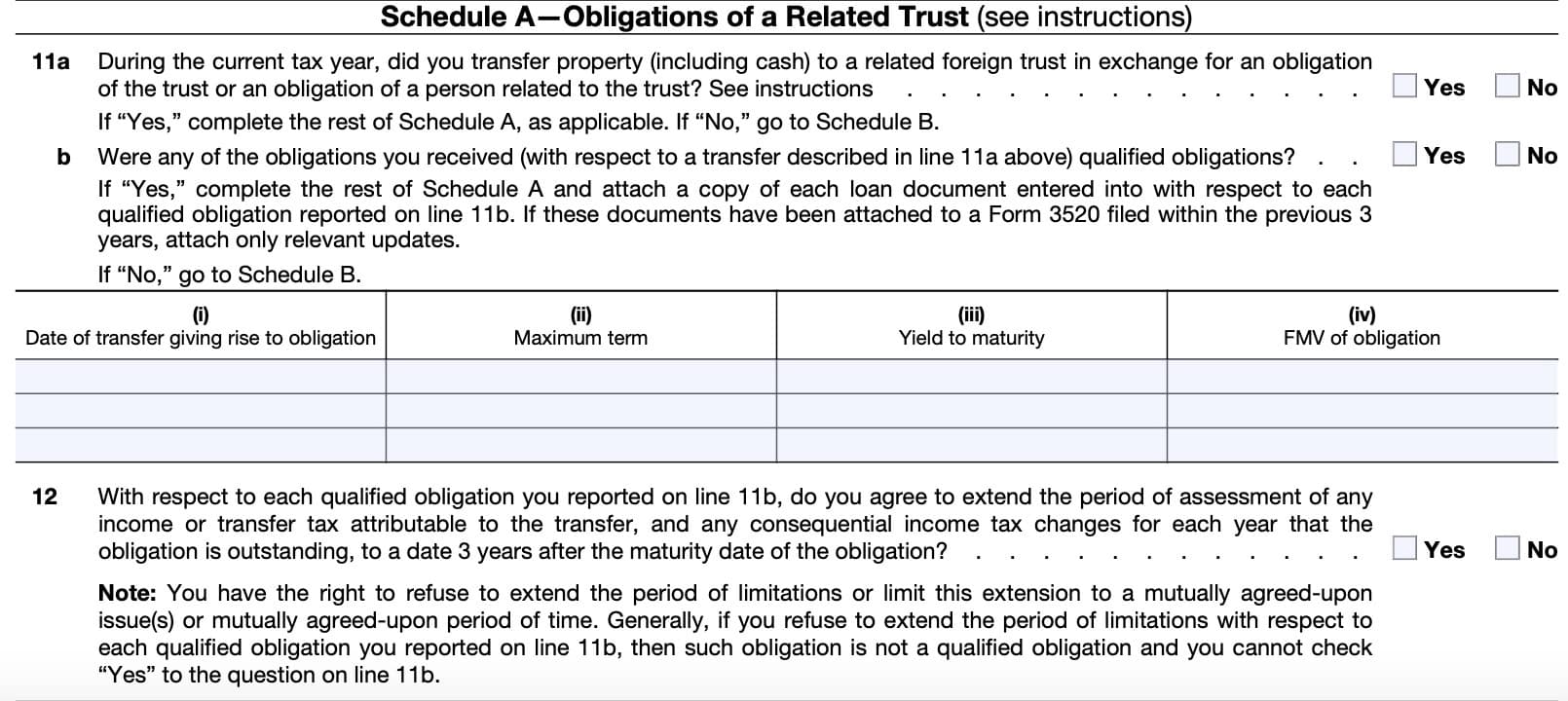

Schedule A: Obligations of a Related Trust

According to the IRS instructions, taxpayers will “complete the applicable portions of Schedule A with respect to all transfers to a related foreign trust in exchange for an obligation of the trust or a person related to the trust that took place during the current tax year.”

Line 11a

Did you transfer property to a related foreign trust in exchange for an obligation of the trust or a person related to the trust?

If Yes, complete the rest of Schedule A. If No, go to Schedule B, below.

Line 11b

Were any of the obligations considered to be qualified obligations?

If Yes, complete the rest of Schedule A, then attach a copy of each loan document with respect to each qualified obligation reported below. You must list:

- Date of transfer giving rise to obligation

- Maximum term

- Yield to maturity

- Future market value of obligation

For any documents attached to a Form 3520 filed within the 3 prior years, only attach updates.

If No, go to Schedule B, below.

Qualified obligation

A qualified obligation, for purposes of IRS Form 3520, is any obligation only if:

- The obligation is reduced to writing by an express written agreement;

- The term of the obligation does not exceed 5 years

- Including options to renew and rollovers

- All payments on the obligation are denominated in U.S. dollars;

- The yield to maturity of the obligation is:

- Not less than 100% of the applicable federal rate under Internal Revenue Code Section 1274(d) for the day on which the obligation is issued, and

- Not greater than 130% of the applicable federal rate;

- The U.S. person agrees to extend the period for assessment of any income or transfer tax attributable to the transfer and any consequential income tax changes for each year that the obligation is outstanding to a date not earlier than 3 years after the maturity date of the obligation

- Unless the maturity date of the obligation does not extend beyond the end of the U.S. person’s tax year and is paid within such period

- Done on Part I, Schedule A, line 12, and Part III, line 26, as applicable; and

- The U.S. person reports the status of the obligation, including principal and interest payments, on Part I, Schedule C, line 19, and Part III, line 28, as applicable, for each year that the obligation is outstanding.

Line 12

With respect to each qualified obligation reported on Line 11b, do you agree to extend the period of assessment of any income or transfer tax, and any income tax changes to a date 3 years after the obligation’s maturity date?

If No, then the obligation is not considered a qualified obligation. Do not check Yes in Line 11b with regards to this item.

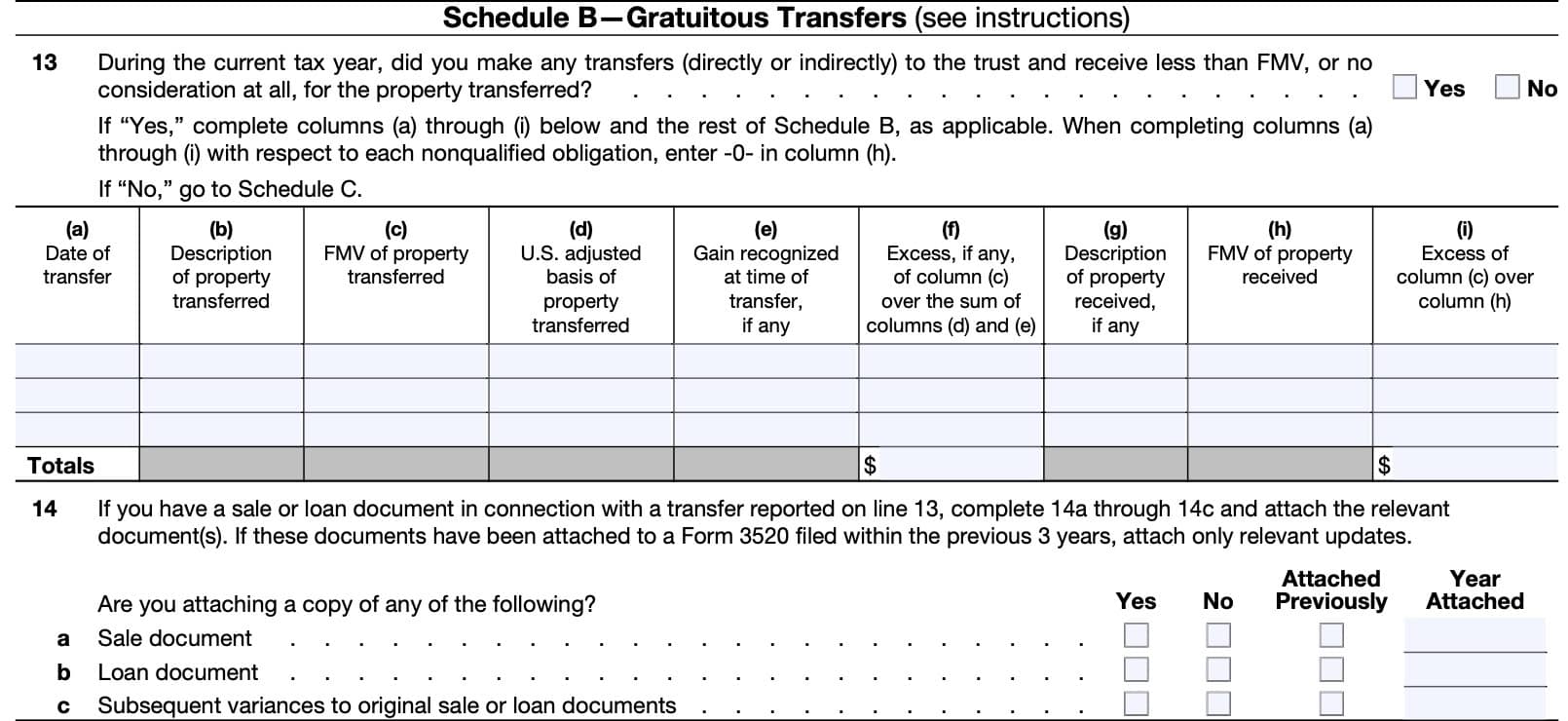

Schedule B: Gratuitous Transfers

Schedule B reports all reportable events that occurred during the tax year. You’ll also use Schedule B as the guide for the required supporting documents that you must attach to the form.

A partial list of these documents includes:

- Sale or loan documents

- Trust documents

- Memoranda or letters

- Financial statements associated with the trust

Line 13

Did you make any indirect or direct transfers to the trust, for which you received less than fair market value, during the tax year?

If Yes, complete columns (a) through (i) below, and the rest of Schedule B:

- Column (a): Date of transfer

- Column (b): Description of property transferred

- Column (c): FMV of transferred property

- Column (d): U.S. adjusted basis of transferred property

- Column (e): Recognized gain at time of transfer, if applicable

- Column (f): Excess, if any, of Column (c) over the sums of Columns (d) and (e)

- Column (g): Description of property received

- Column (h): FMV of property received

- Column (i): Excess of Column (c) over Column (h)

Line 14: Sale or loan documents

If you have a sale or loan document regarding a transfer that you reported on Line 13, check the appropriate boxes in Lines 14a-14c below, and attach the documents. If a document has already been attached to a Form 3520 filed in the past 3 years, only attach relevant updates.

- Line 14a: Sale document

- Line 14b: Loan document

- Line 14c: Subsequent variances to original sale or loan documents

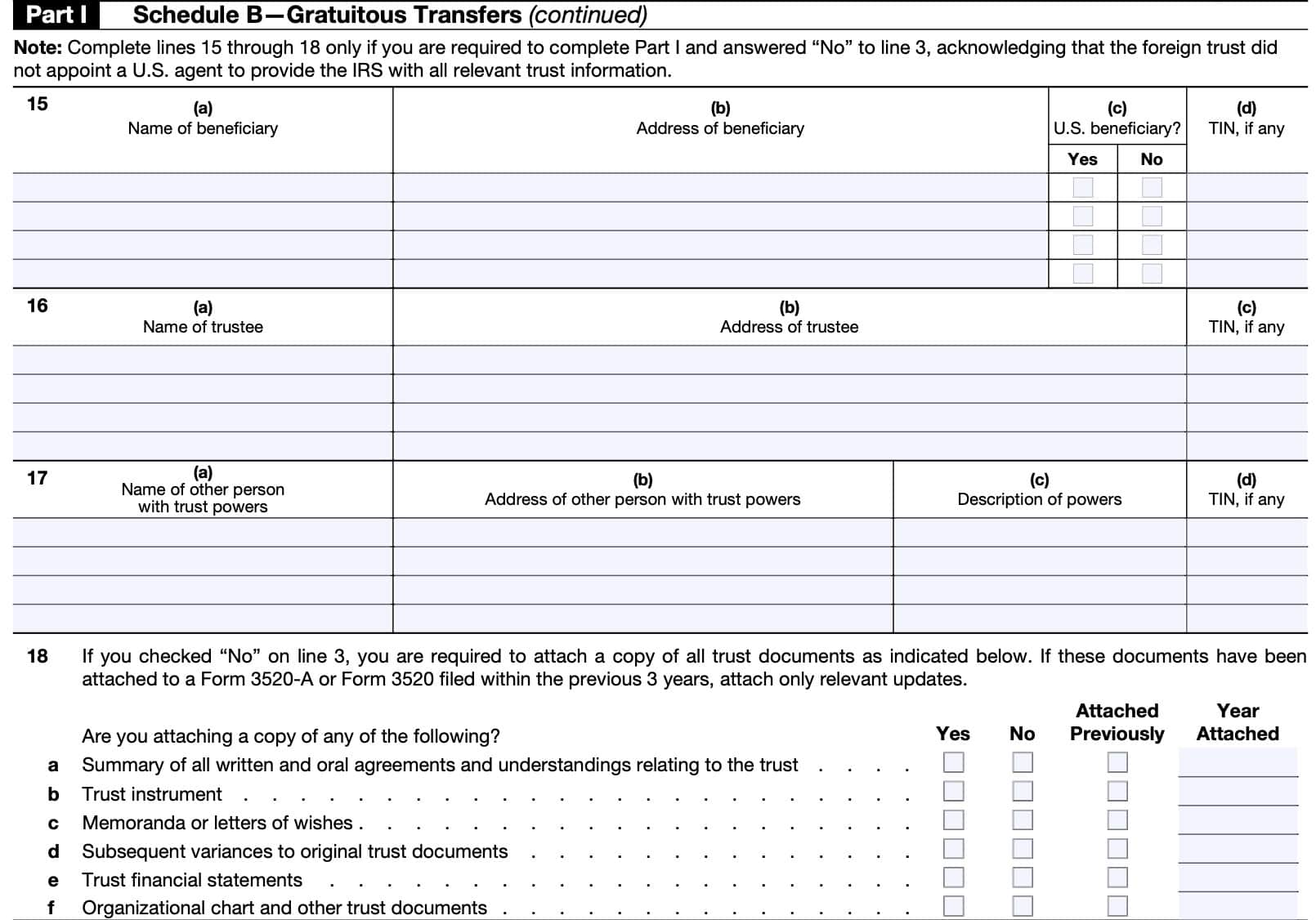

Line 15: Beneficiary information

Only complete Lines 15 through 18 if you answered No to Line 3. This acknowledges that the foreign trust did not appoint a U.S. agent to report trust information to the Internal Revenue Service.

Here, enter the following:

- Line 15(a): Beneficiary’s name

- Line 15(b): Address of beneficiary

- Line 15(c): U.S. beneficiary

- Line 15(d): Taxpayer identification number

Line 16: Trustee information

Here, enter the following:

- Line 16(a): Trustee’s name

- Line 16(b): Address of trustee

- Line 16(c): Taxpayer identification number

Line 17: Other persons with trust powers

In this section, enter the following:

- Line 17(a): Name of other person with trust powers

- Line 17(b): Address of other person with trust powers

- Line 17(c): Description of powers

- Line 17(d): Taxpayer identification number

Line 18

If you checked No in Line 3, then attach a copy of all relevant trust documents as indicated below. If a document has already been attached to a Form 3520 filed in the past 3 years, only attach relevant updates.

- Line 18a: Summary of all written and oral agreements and understandings related to the trust

- Line 18b: Trust instrument

- Line 18c: Memoranda or letters of wishes

- Line 18d: Subsequent variances to original trust documents

- Line 18e: Trust financial statements

- Line 18f: Organizational chart and other trust documents

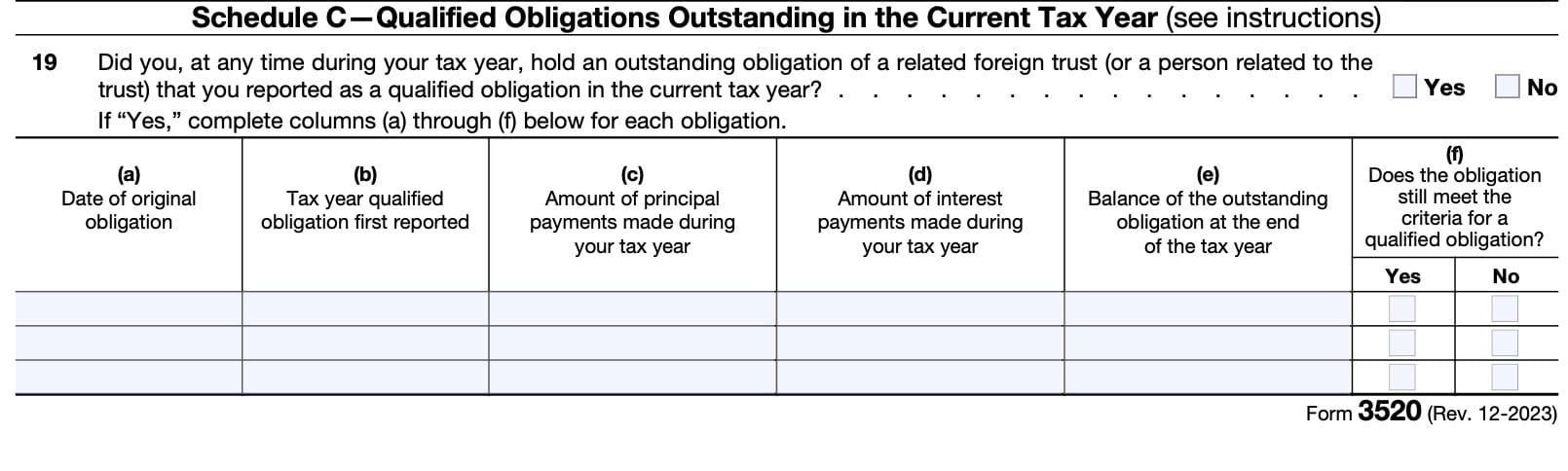

Schedule C: Qualified Obligations Outstanding in the Current Tax Year

You’ll use Schedule C to report qualified obligations outstanding in the current tax year. If the obligation is not a ‘qualified obligation,’ you may need to report it as a gratuitous transfer to the trust under Schedule B.

Line 19

Did you, at any time during your tax year, hold an outstanding obligation of a related foreign trust (or a person related to the trust) that you reported as a qualified obligation in the current tax year?

If Yes, then complete the following columns for each obligation:

- Line 19(a): Date of original obligation

- Line 19(b): Tax year qualified obligation was first reported

- Line 19(c): Amount of principal payments made during the tax year

- Line 19(d): Amount of interest payments made during the tax year

- Line 19(e): Balance of the outstanding obligation at the end of tax year

- Line 19(f): Does the obligation still meet the criteria for a qualified obligation?

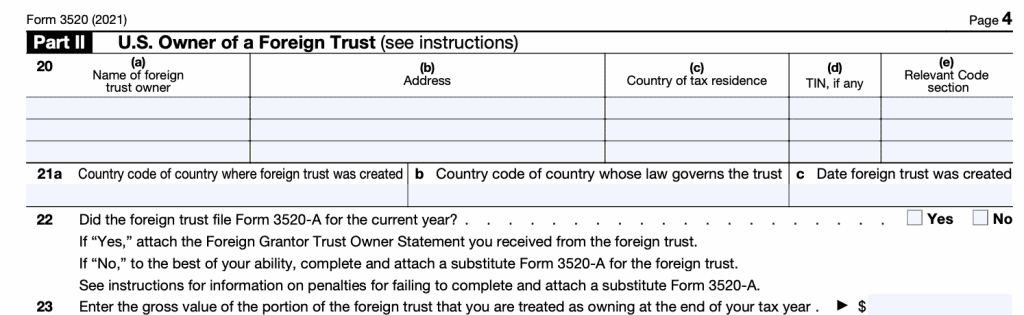

Part II: U.S. Owner of a Foreign Trust

You will complete Part II if you are considered an owner of any assets of a foreign trust under IRC Sections 671 through 679. This is required even if there are no transactions to report.

Line 20

Enter the following information:

- Line 20(a): Foreign trust owner name

- Line 20(b): Foreign trust owner address

- Line 20(c): Country of tax residence

- Line 20(d): Taxpayer identification number, if applicable

- Line 20(e): Relevant code section

Line 21a

Here, enter the following information:

- Line 21(a): Country code of the country where the foreign trust was created

- Line 21(b): Country code of the country whose laws govern the trust

- Line 21(c): Date of foreign trust creation

Line 22

Did the foreign trust file Form 3520-A for the current tax year?

If Yes, attach the Foreign Grantor Trust Owner Statement you received from the foreign trust. If No to the best of your ability, complete and attach a substitute Form 3520-A for the foreign trust.

Penalties for failure to complete and attach a substitute Form 3520-A

The penalty is 5% of the gross value of the portion of the foreign trust’s assets treated as owned by a U.S. person under the grantor trust rules, if the foreign trust

- Fails to file a timely Form 3520-A and furnish the required annual statements to its U.S. owners and U.S. beneficiaries, or

- Does not furnish all of the information required by IRC Section 6048(b) or includes incorrect information.

No penalties will be imposed if the taxpayer can demonstrate that the failure to comply was due to reasonable cause and not willful neglect.

Line 23: Gross value at end of tax year

Enter the gross value of the portion of the foreign trust that you are treated as owning at the end of your tax year.

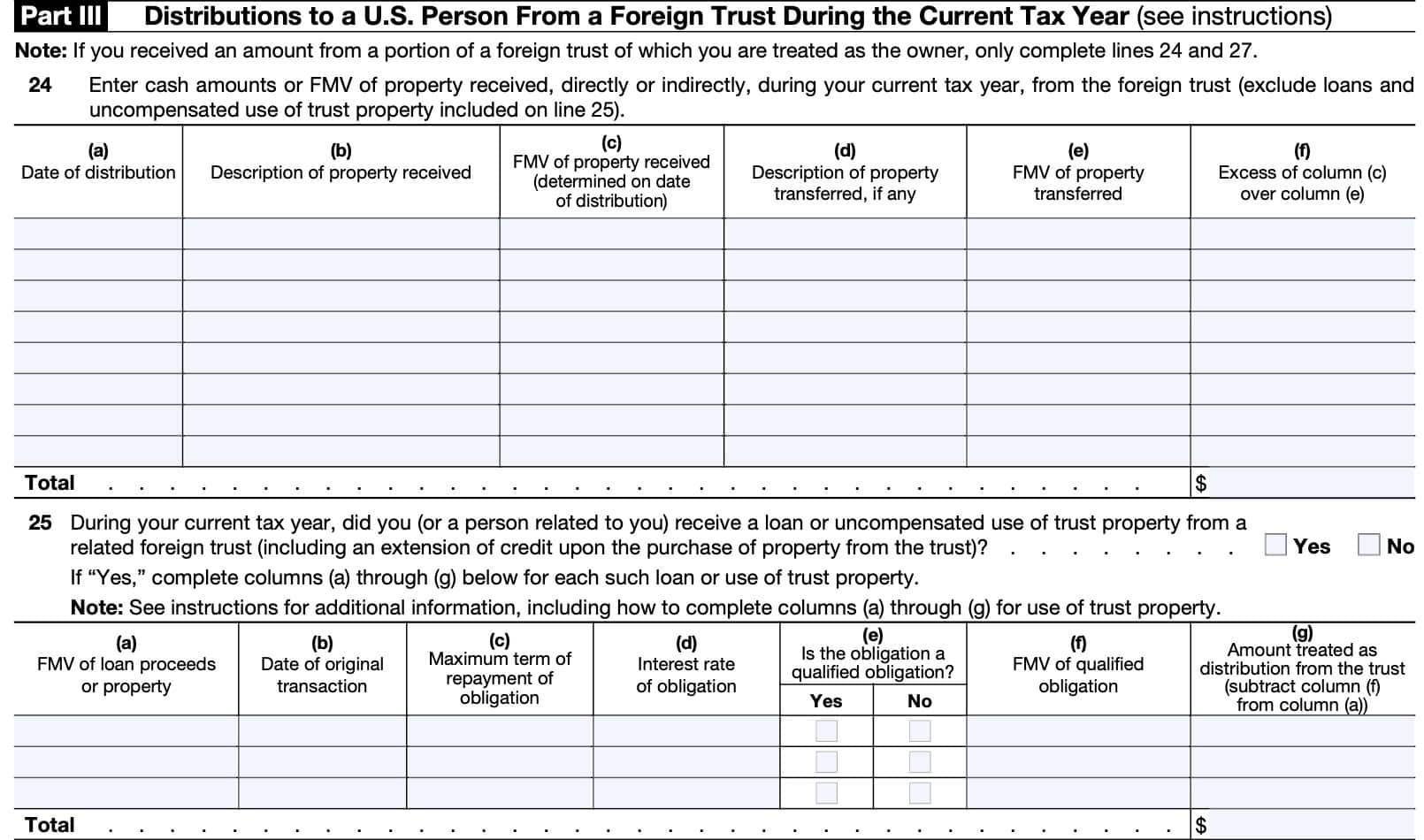

Part III: Distributions to a U.S. Person From a Foreign Trust During the Current Tax Year

Part III is used to report distributions from a foreign trust to a U.S. person during the tax year. If you received an amount from a portion of a foreign trust of which you are considered the owner, only complete Lines 24-27.

Line 24: Cash amounts or FMV of property received from the foreign trust

Enter the following information:

- Line 24(a): Date of distribution

- Line 24(b): Description of property received

- Line 24(c): FMV of property received (on date of distribution)

- Line 24(d): Description of property transferred, if applicable

- Line 24(e): FMV of property transferred

- Line 24(f): Excess of column (c) over column (e)

Line 25

During your current tax year, did you (or a person related to you) receive a loan or uncompensated use of trust property from a related foreign trust (including an extension of credit upon the purchase of property from the trust)?

If Yes, then enter the following information for each loan or use of trust property:

- Line 25(a): FMV of loan proceeds or property

- Line 25(b): Date of original transaction

- Line 25(c): Maximum term of repayment of obligation

- Line 25(d): Interest rate

- Line 25(e): Qualified obligation (Y or N)

- Line 25(f): FMV of qualified obligation

- Line 25(g): Amount treated as distribution

- Column (a) minus column (f)

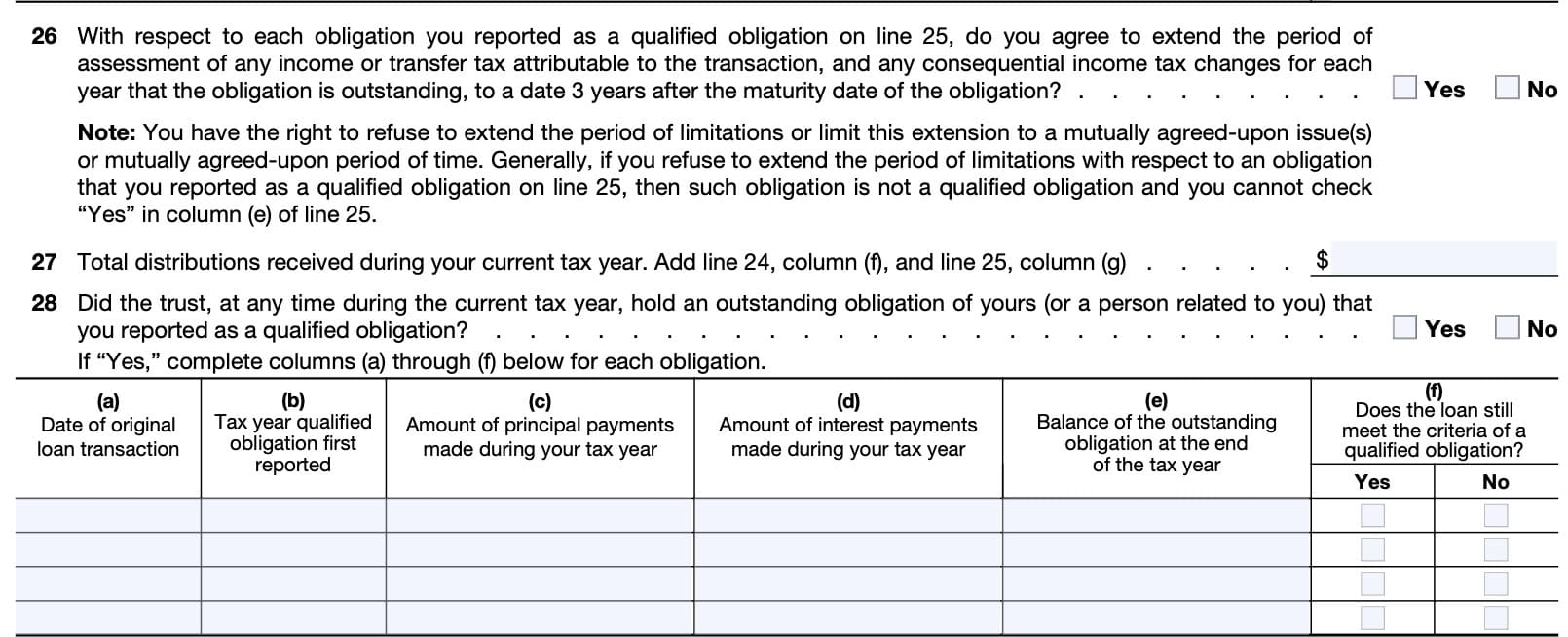

Line 26

With respect to each obligation you reported as a qualified obligation on Line 25, do you agree to extend the period of assessment of any income or transfer tax attributable to the transaction, and any consequential income tax changes for each year that the obligation is outstanding, to a date 3 years after the maturity date of the obligation?

If No, then this cannot be considered a qualified obligation. Do not check Yes in Column (e) of Line 25 for this item.

Line 27: Total distributions received during the current tax year

Enter the total amount of distributions received during your current tax year. You can do this by adding the following:

- Line 24, Column (f), and

- Line 25, Column (g)

Line 28

Did the trust, at any time during the current tax year, hold an outstanding obligation of yours (or a person related to you) that you reported as a qualified obligation?

If Yes, then enter the following information for each obligation:

- Line 28(a): Date of original transaction

- Line 28(b): Tax year that the qualified obligation was first reported

- Line 28(c): Amount of principal payments made during the tax year

- Line 28(d): Amount of interest payments made during the tax year

- Line 28(e): Balance of the outstanding obligation

- Line 28(f): Is this still a qualified obligation?

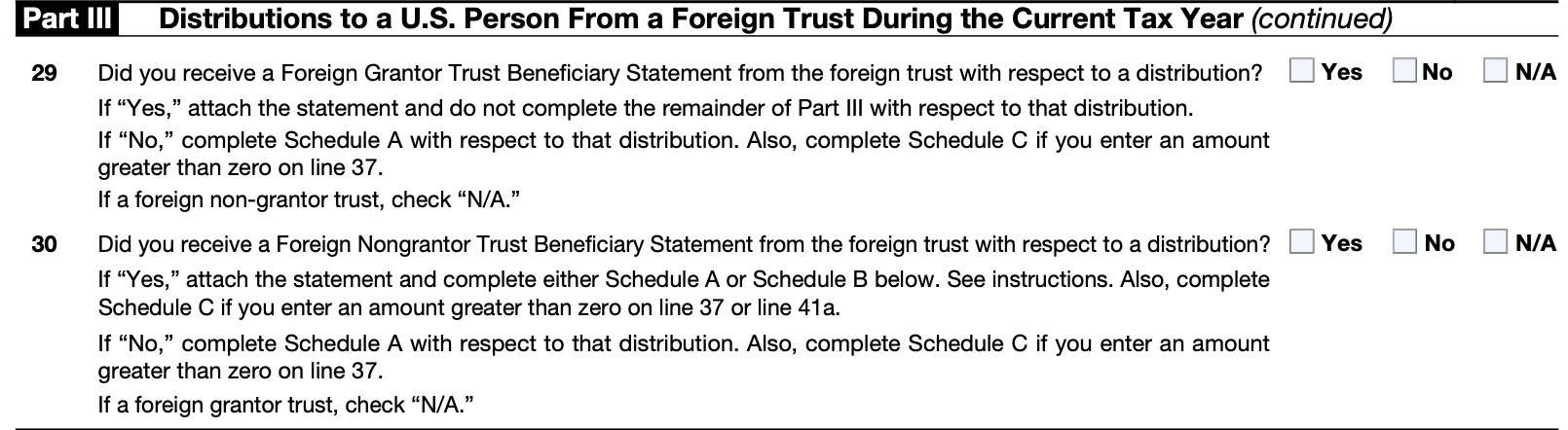

Line 29: Foreign grantor trust beneficiary statement

Did you receive a Foreign Grantor Trust Beneficiary Statement from the foreign trust with respect to a distribution?

If Yes, attach the statement. Do not complete the remainder of Part III with respect to that distribution.

If No, complete Schedule A with respect to that distribution. Also, complete Schedule C if you enter an amount greater than zero on Line 37.

If a foreign non-grantor trust, check N/A.

Line 30: Foreign nongrantor trust beneficiary statement

Did you receive a Foreign Nongrantor Trust Beneficiary Statement from the foreign trust with respect to a distribution?

If Yes, attach the statement. Complete Schedule A or Schedule B. Also complete Schedule C if you enter an amount greater than zero on either:

- Line 37

- Line 41a

Generally, however, if you complete Schedule A in the current year (or did so in prior years), you must continue to complete Schedule A for all future years, even if you are able to answer Yes to Line 30 in that future year. The only exception to this consistency rule is that you may use Schedule B in the year that a trust terminates, but only if you are able to answer Yes to Line 30 in the year of termination.

If No, complete Schedule A with respect to that distribution. Also, complete Schedule C if you enter an amount greater than zero on Line 37.

Which schedule to complete

Your answer to Part III will help to determine which Schedule you complete below:

- Complete Schedule A if:

- You may use either Schedule A or B if you answered Yes to question 30. However, if you use Schedule A in the initial year, you must continue using it in subsequent years.

- Complete Schedule B if:

- You answered Yes to Question 30

- If you’ve never used Schedule A

- You attach a copy of the Foreign Nongrantor Trust Beneficiary Statement to the return

- Complete Schedule C if:

- You entered a value in either Block 37 or Block 41a.

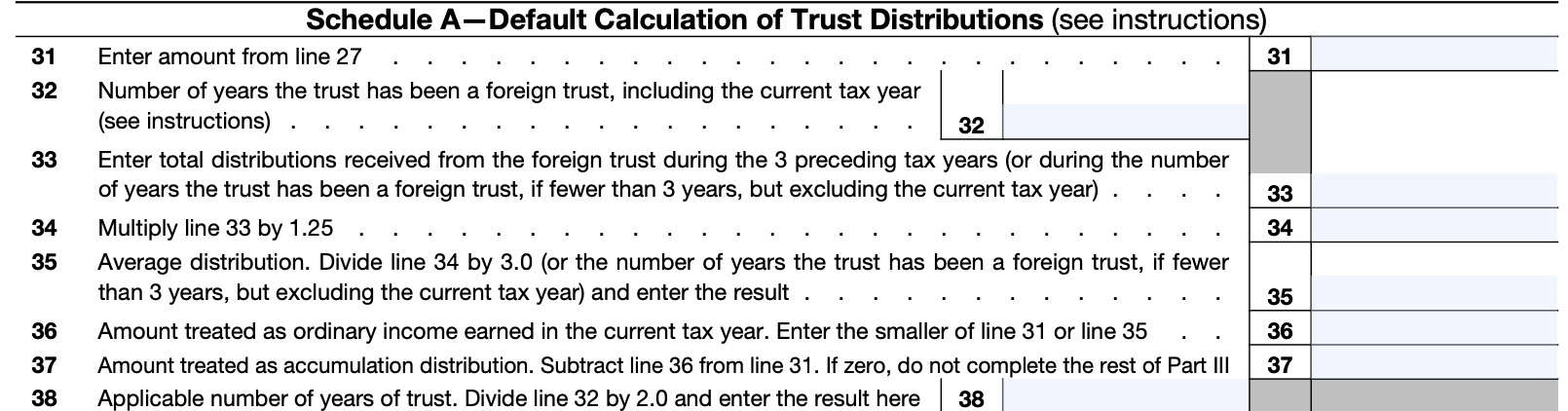

Schedule A

Schedule A is the default calculation of the trust distributions. Once you use this calculation, you must use Schedule A in future tax years.

Schedule B

You can use Schedule B to calculate trust distributions if you have not already used Schedule A in previous tax years.

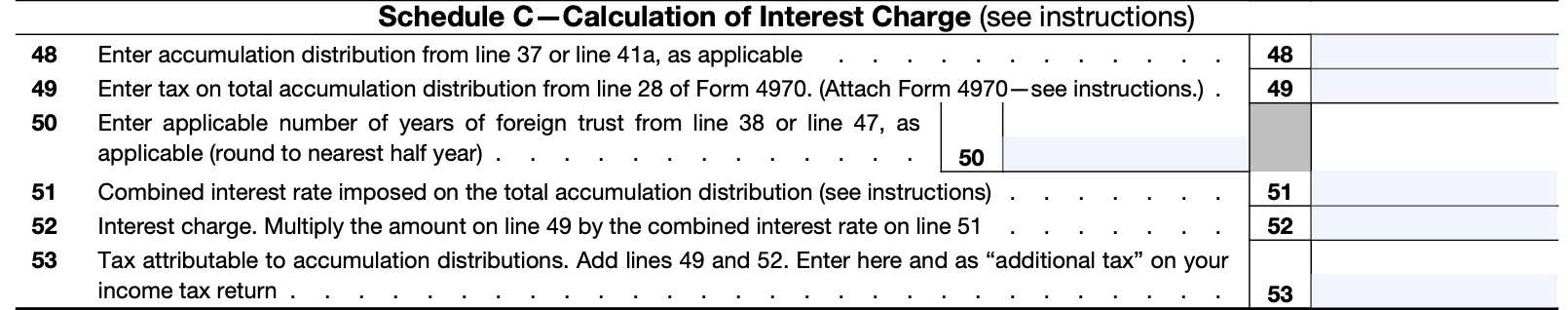

Schedule C

You’ll complete Schedule C if you entered any amount as accumulation distribution. If you did not receive any accumulation distribution, do not fill in Schedule C.

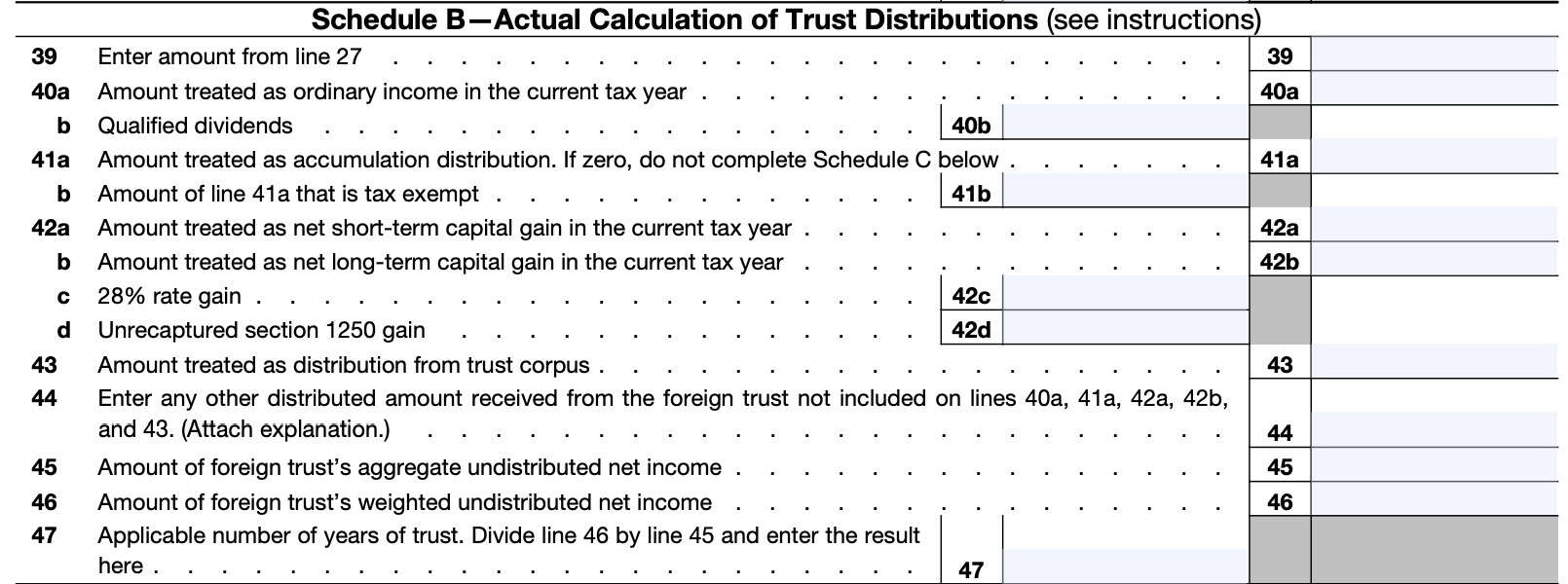

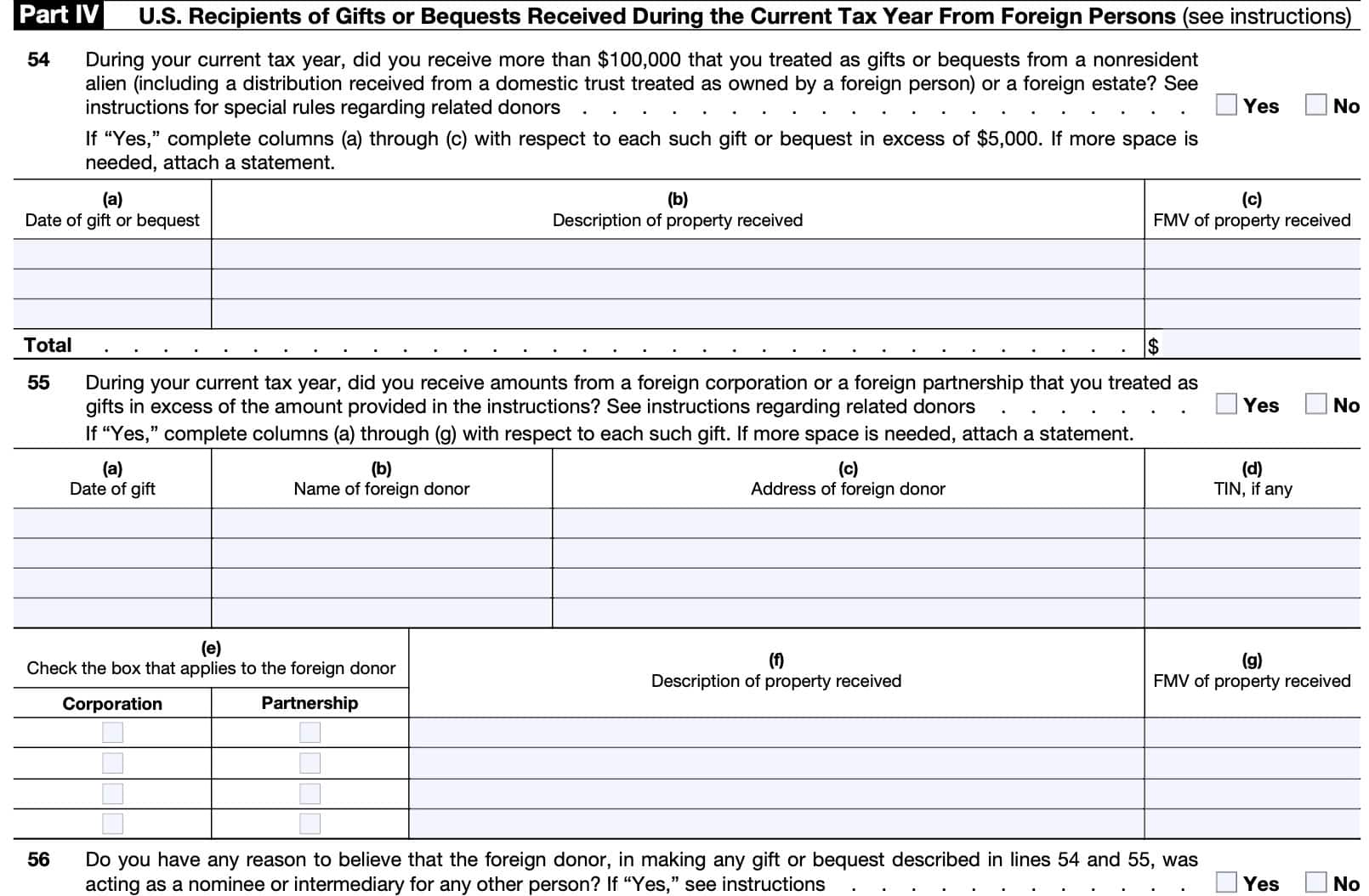

Part IV: U.S. Recipients of gifts or bequests received during the current tax year from foreign persons

Part IV is the section where you report reportable events. Again, reportable events include:

- Any amount over $100,000 from a nonresident alien or foreign estate, or

- Any amount from a foreign corporation or foreign partnership in excess of the annual amount ($16,815 for 2021).

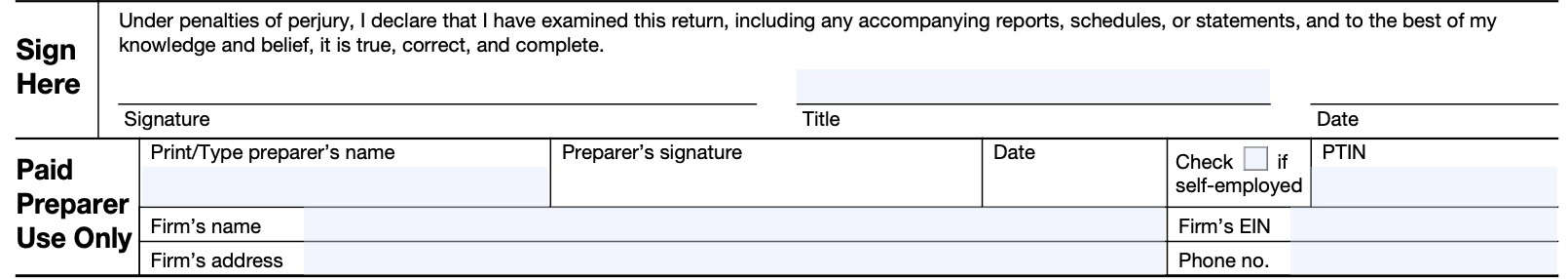

Below Part IV, either you or your paid preparer (read: tax professional) will sign and date the return. Since this is a declaration under penalty of perjury, you should have a tax professional complete this informational tax return.

Signature

Filing considerations

Below are certain filing considerations for taxpayers with regarding IRS Form 3520.

Who must file IRS Form 3520?

According to the IRS, you must file Form 3520 if any of the following apply:

- You are a responsible party reporting a reportable event that occurred during the current tax year

- You are a U.S. person who transferred property to a foreign trust in exchange for an obligation

- You are a U.S. person who is treated as the owner of any part of the assets of the foreign trust

- You are a U.S. person who received a distribution from a foreign trust during the tax year

- You are a U.S. person who received above a certain amount from foreign sources

You are a responsible party reporting a reportable event that occurred during the current tax year

Responsible party

A responsible party is defined as any one of the following:

- The grantor or creator of an inter vivos trust. An inter vivos trust, also known as a living trust, is a trust created by one living person for the benefit of another person.

- The transferor in the case of a reportable event.

- The executor of the decedent’s estate in any case (whether the executor is a US citizen or not)

Anyone meeting the definition of a responsible party must report any reportable event on Form 3520. So what is a reportable event?

Reportable event

A reportable event is defined as one of the following:

- A United States person creating a foreign trust

- The transfer of property by a U.S. person into a foreign trust. This can be a direct transfer or indirect transfer, and includes transfers upon death.

- The death of a U.S. citizen or resident if:

- The decedent was considered the owner of any part of a foreign trust under the rules of the Internal Revenue Code, Sections 671 through 679, or

- Any part of a foreign trust was included in the decedent’s gross estate

Even if you’re not a responsible party reporting a reportable event, you may still be required to file this form, especially if you transferred property to a foreign trust.

If this is true, the IRS expects you to complete the identifying information on page 1 and applicable portions of Part I of this form.

You are a US person who transferred property to a foreign trust in exchange for an obligation.

Or if you currently hold an outstanding qualified obligation from the foreign trust. There is also an IRS definition of what a qualified obligation is.

You are a U.S. person who is treated as the owner of any part of the assets of the foreign trust.

If this is your situation, the IRS expects you to complete the identifying information on page 1 and applicable portions of Part II of this form.

You are a U.S. person who received a distribution from a foreign trust during the tax year.

Filing this form is mandatory if you received a distribution from a foreign trust. You also must file this form if any of the following apply:

- You received a loan of cash or marketable securities during the year. This also includes lines of credit.

- You received the uncompensated use of property owned by a foreign trust.

- If you are the U.S. owner or beneficiary of a foreign trust, and the foreign trust holds an outstanding qualified obligation of yours

If any of these apply to you, you’ll have to complete the identifying information on page 1 and applicable portions of Part III of this form.

You are a U.S. person who received above a certain amount from foreign sources

Filing this form is either of the following apply:

- You received $100,000 or more in gifts from a nonresident alien individual or foreign estate that you treated as gifts or bequests. This includes related foreign persons.

- You received more than a certain amount from a foreign corporation or a foreign partnership. This is known as the IRC Section 6039F threshold. For 2024, the 6039F threshold is $19,570.

When is IRS Form 3520 due?

According to the IRS reporting requirements, Form 3520 is an informational return that is due on the 15th day of the fourth month after an individual’s tax year is complete. For individuals, this usually is April 15th.

However, there are a couple of points worth noting:

- This is an informational return, and is filed separately from a Form 1040.

- If you live outside the United States (and Puerto Rico), or are a service member serving overseas, then your due date is June 15.

- If you are granted an extension for your income tax return, then your new due date is October 15.

- If the foreign entity or trust fails to file Form 3520-A, then the taxpayer must file a substitute Form 3520-A to accompany their Form 3520.

- The due date for the foreign trust to file Form 3520-A is the 15th day of the third month after the end of the trust’s tax year.

How do I file IRS Form 3520?

When this informational return is complete, the IRS instructs taxpayers to send Form 3520 to the following address:

Internal Revenue Service Center

P.O. Box 409101

Ogden, UT 84409

Form 3520 must have all required attachments to be considered complete.

IRS Form 3520 is an informational form that certain individuals, trusts, or tax entities must file with the IRS to report ownership of foreign trusts, certain transactions with foreign trusts, or receipt of certain large gifts or bequests from foreign persons.

According to the form instructions, you must mail your completed IRS Form 3520 and all supporting documentation to the IRS Service Center in Ogden, UT.

No. The IRS instructions specifically state that taxpayers must use a different Form 3520 for each foreign trust.

How can I obtain a copy of IRS Form 3520?

You may obtain a copy of IRS Form 3520 from the IRS website, or by clicking the link below.