IRS Form 433-D Instructions

If you’ve accumulated tax debt, you might have set up an installment agreement with Internal Revenue Service to pay down your back taxes in regular monthly payments. After the IRS has reviewed your financial information, you’re finally ready to set up your IRS installation agreement using IRS Form 433-D.

This article will walk you through Form 433-D so that you understand:

- How to complete Form 433-D

- How to submit Form 433-D for IRS approval

- When you would use Form 433-D instead of another tax form

- Frequently asked questions about Form 433-D

Let’s start with some step by step guidance on completing your installment agreement request.

Table of contents

How do I complete IRS Form 433-D?

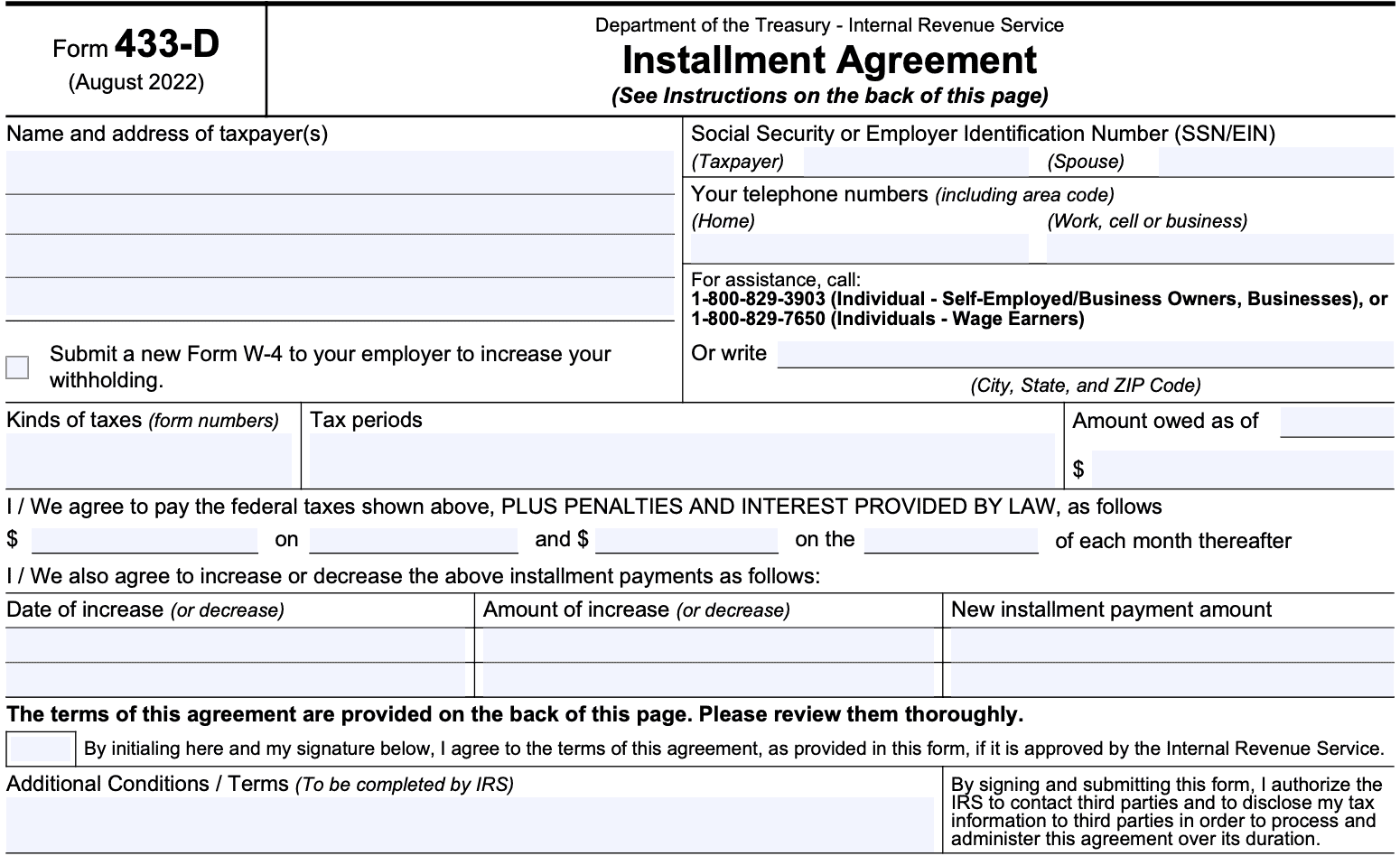

Fortunately, the Form 433-D is pretty straightforward. Furthermore, the IRS representative who sent this form to you has probably already completed the most important information fields. Let’s start at the top.

Top of the form

Much of the information on this form should be completed if part of an existing dialogue with the IRS revenue officers working this case. Nevertheless, we’ll proceed as if this form were completely blank.

Taxpayer information

The first step is to complete the required information fields at the top:

- Taxpayer’s name

- If you file a joint tax return, include your spouse’s information as well

- Address of the taxpayer

- Include city, state, and zip code

- Ensure this is the current address, if you’ve recently changed addresses

- Social Security number

- If this is on behalf of a business owner, use the employer identification number instead

- Telephone numbers

If already entered, review this section for accuracy.

Below the personal information fields is the tax information.

Tax information

In this section, the IRS revenue officer should have included the tax information that had previously been discussed. This should include:

- Kinds of taxes the taxpayer owes

- As indicated by the tax form number cited

- For example, federal income tax liability for wage earners would be reported on IRS Form 1040, while delinquent employment taxes might be reported on IRS Form 940 or Form 941

- Tax periods covered

- Amount of federal taxes owed

Below this section is the payment amount information. It should contain details on the automatic payments themselves, to include:

- Initial payment amount and date

- Monthly payment arrangement amounts

If there are changes to an existing IRS installment agreement, then you might see information in the fields below. This might include:

- Date of increase

- Amount of increase

- New installment payment amount

All of this precedes the taxpayer acknowledgment of the agreement terms, which the taxpayer should initial. Next, we’ll proceed to the direct debit information

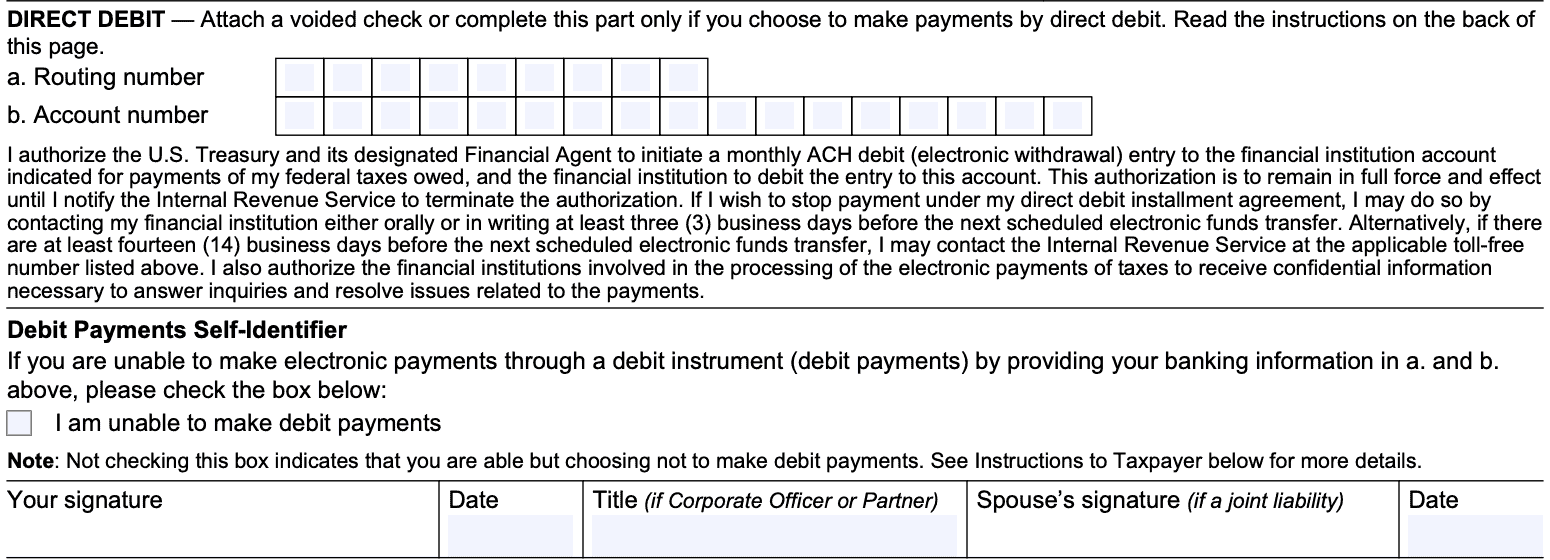

Direct debit information

It is possible to set up an installment agreement without establishing a direct debit installment agreement. However, direct debit payments make it easier for the taxpayer to make the installment payments and comply with the terms of the payment plan. As a result, the user fee application is less for individual taxpayers who set up direct debit payments.

Should you choose to use direct debit, you can fill in the routing number and account number fields for the bank account that you wish to debit from.

Pro tip: To minimize mistakes, you may consider attaching a voided check to this form. This tip will provide the required information without data entry mistakes.

If you cannot make electronic payments, check the appropriate box.

After you have verified that all of the information is correct, sign and date on the signature line. If married, your spouse needs to sign this document as well.

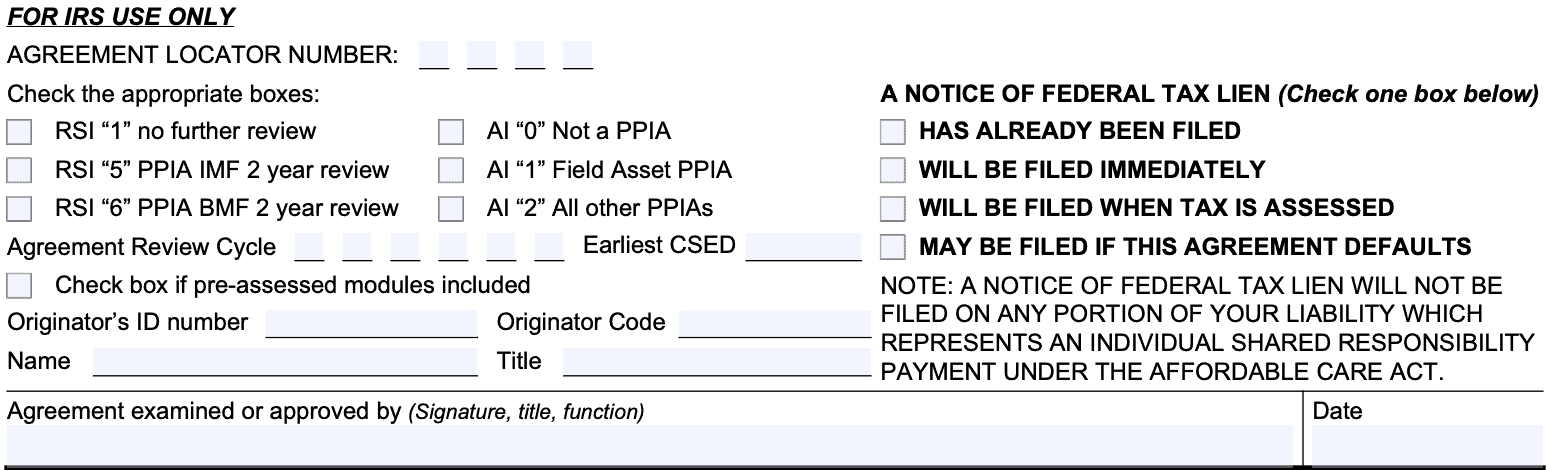

For IRS use only

There is a section marked, “For IRS use only.” While most of this information is for IRS use only, it’s important to note a couple of areas.

Earliest CSED: This is the Collection Statute Expiration Date. The CSED represents the last date that the IRS can take collection actions for an outstanding tax liability.

Agreement Review Cycle: Most payment agreements allow for a periodic review to assess the taxpayer’s situation. If the IRS determines that the taxpayer’s circumstances have changed during the review, then the revenue officer may modify or increase the monthly payment arrangement based upon the new circumstances.

This date indicates when the agreement may be reviewed.

Notice of federal tax lien: This indicates whether there is a federal tax lien in place, or whether such a tax lien is expected to be filed.

Approval signature: When you receive the final copy back from the IRS, it should be marked as approved by an IRS representative authorized to do so.

What is IRS Form 433-D?

IRS Form 433-D, Installment Agreement, is the IRS form that a taxpayer may submit to actually set up a basic installment agreement with the IRS. The IRS might send the Form 433-D installment agreement to the taxpayer to ascertain the taxpayer’s bank details and actually establish the monthly installment agreement.

Once they receive the agreement, the taxpayer will complete the necessary information fields, agree to the terms of the agreement by signing the form, and return the Form 433-D to the IRS for processing.

Let’s discuss the set up fees for establishing your installment plan.

How much does it cost to set up an installment agreement?

The IRS imposes a user fee to partially offset the administrative costs of establishing an agreement. This user fee depends on several factors:

- Whether or not the taxpayer sets up automatic payments

- Whether or not the taxpayer qualifies as a low-income taxpayer

- A low-income taxpayer may qualify for a reduced user fee by filing IRS Form 13844

According to the instructions, here is the current fee schedule:

- User fee: $255

- Reduced to $107 with direct debit payment option

- Low-income taxpayer user fee (with approved Form 13844): $43

- Waived with direct debit payment option

- Reinstatement fee (for taxpayers who have defaulted on a previous plan): $89

- Low-income taxpayers: $43 (may be waived with direct debit payment option)

Why are there so many different versions of Form 433?

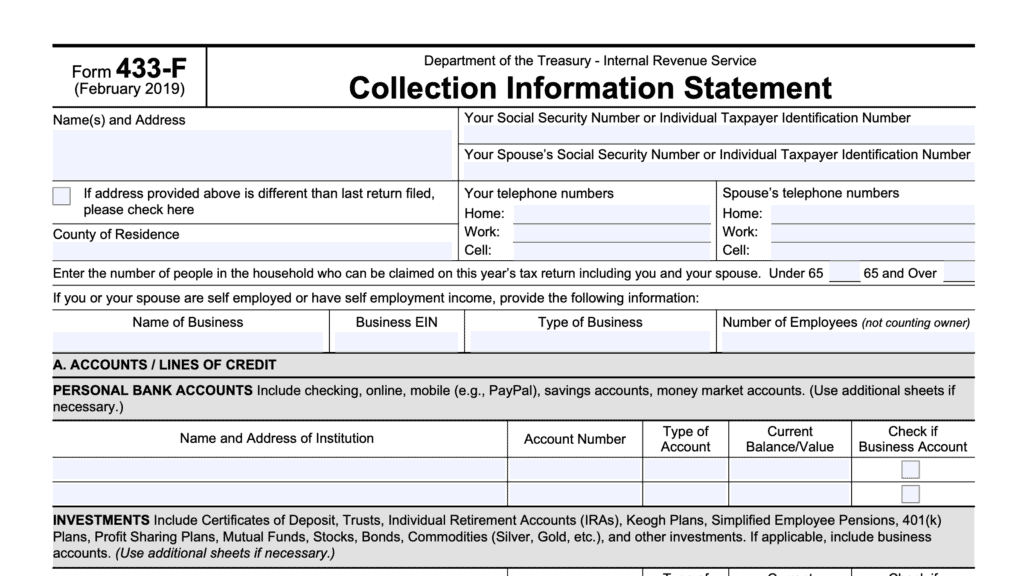

Not all Form 433 versions are the same. Below is a list of the 5 main versions of this tax form, and their intended use:

- Form 433-A Collection Information Statement for Wage Earners and Self-Employed Individuals

- The IRS may ask that taxpayer file Form 433-A when more information is required than what is provided on Form 433-F

- Form 433-B Collection Information Statement for Businesses

- Form 433-D Installment Agreement

- Form 433-F Collection Information Statement

- Form 433-H Installment Agreement Request and Collection Information Statement

- Used by wage earners requesting an installment agreement who either:

- Owe more than $50,000, or

- Cannot pay their entire tax debt within 72 months

- Used by wage earners requesting an installment agreement who either:

Video walkthrough

Watch this educational video for detailed guidance on your installment agreement request.

Frequently asked questions

Below are some frequently asked questions about Form 433-D and installment agreements.

If the IRS sent you Form 433-D, you should follow the instructions on the form or with accompanying correspondence. If you are using a version of the form from the IRS website, you should call one of the toll-free numbers at the top right corner of the form itself.

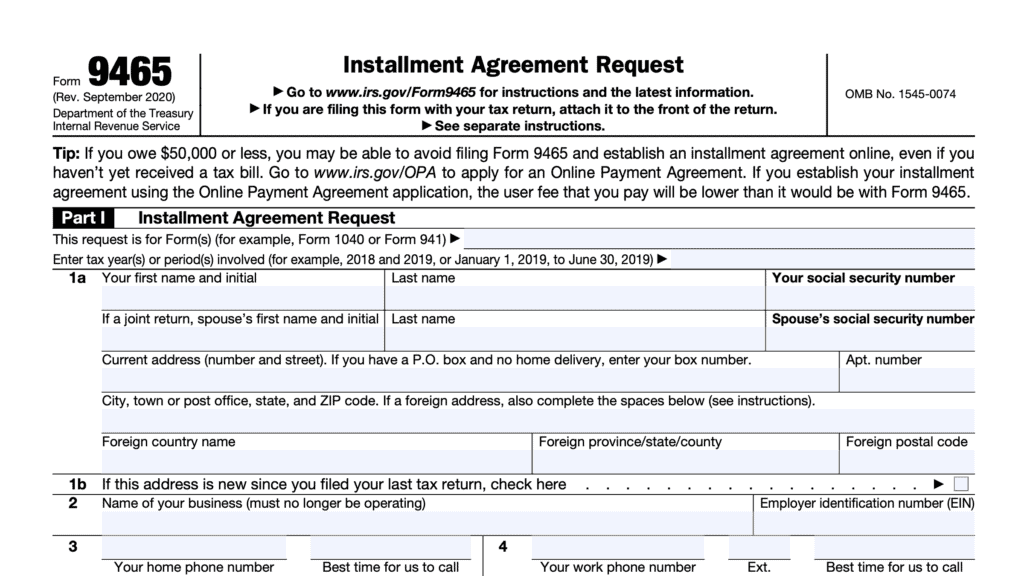

IRS Form 9465, Installment Agreement Request, is the tax form that a taxpayer may use to request consideration for payment terms. Conversely, Form 433-D is used to finalize payment terms and formalize payment details to actually initiate the installment agreement.

The IRS may terminate an existing installment agreement if the taxpayer stops making regular payments, does not file all required returns in a timely manner, does not provide information as requested by the IRS, or if the IRS determines that the taxpayer’s ability to maintain payments is in jeopardy.

Generally speaking, an installment agreement is a payment plan where the expected timeline is 6 months or greater. Usually, installment agreements will be approved for up to a maximum of 72 months (6 years). Taxpayers may choose a payment plan that resolves their tax debt in less than 6 months. Some individual taxpayers may be able to use the IRS’s online payment agreement tool to set up, review, or modify their payment plan.

Where can I get a copy of IRS Form 433-D?

You should have received a pre-filled version of this form with your IRS correspondence.

If you require a blank version, or you cannot find the copy that the IRS mailed to you, we’ve included the latest version at the end of this article.