IRS Form 4422 Instructions

When handling a decedent’s estate subject to the estate tax, the administrator of the estate is usually responsible for paying estate taxes. But when raising money to actually pay the estate tax, it may be necessary for the administrator to file IRS Form 4422 to discharge one or more assets from the estate tax lien.

This article will walk through what you should know about IRS Form 4422 and obtaining a lien release. This includes:

- How to file IRS Form 4422

- Other tax forms you may need to file with discharging the lien

- Other frequently asked questions

Let’s start with a walk through of the tax form itself.

Table of contents

How do I complete IRS Form 4422?

We’ll walk through this simple tax form, step by step. But first, we’ll go over some prerequisites that the IRS wants you to keep in mind.

You may need to file additional tax forms.

According to the form instructions, you may need to file one (or more) of the following tax forms:

IRS Form 8821, Tax Information Authorization

Use IRS Form 8821 to allow the IRS to share information with, or directly contact individuals and companies for the purpose of determining whether to approve the discharge application. Having this authorization will allow the IRS to move through the approval process more quickly and efficiently.

IRS Form 706, United States Estate (and Generation-Skipping Transfer) Tax Return

If you haven’t completed filing the estate’s tax return, you will at least need a good approximation of the estate’s value at the time of filing Form 4422.

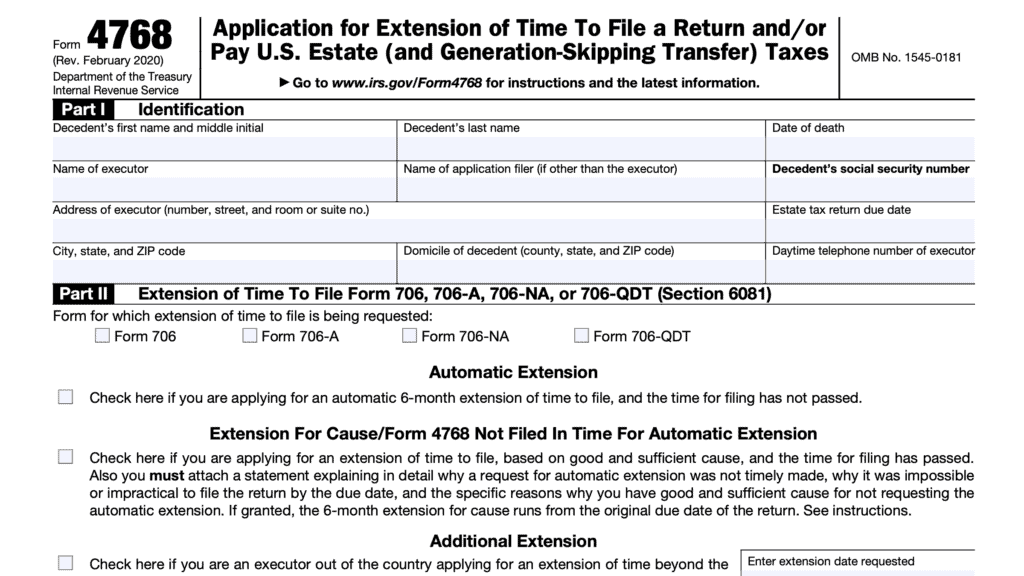

IRS Form 4768, Application for Extension of Time To File a Return and/or Pay U.S. Estate (and Generation-Skipping Transfer) Taxes

If you have filed Form 706, but you need an extension of time to pay off the tax debt, you should go ahead and file IRS Form 4768.

This is true even if you expect that the net proceeds of the sale of the property are sufficient to pay the estimated estate tax.

You should file Form 4422 well ahead of time.

The IRS instructions recommend submitting the certificate application at least 45 days prior to when you actually need to obtain the certificate of discharge.

You’ll need supporting documentation.

At a minimum, you’ll need to provide a written description of the property that you want discharged from the tax lien. You should include the estimated value of the property as well as your basis for determining the property’s value.

If you are trying to sell real property, you’ll need to provide the following:

- Separate legal description of the property

- Physical address

- Preliminary title report

If you’re selling multiple properties, you’ll need to provide this information, including title report, for each unique parcel of real estate.

The form instructions also state that you should attach any of the following that apply:

- Short form of letters testamentary,

- Copy of decedent’s will

- Copy of sale contract and closing statement (or proposed closing statement) for the sale of the property

- Copy of the current title report and appraisal,

- Copy of the Form 706, if filed

- If return is not filed, then submit a draft of Form 706, and/or a copy of the inventory and appraisement reflecting all assets as supporting documentation

Let’s move on to the tax form itself.

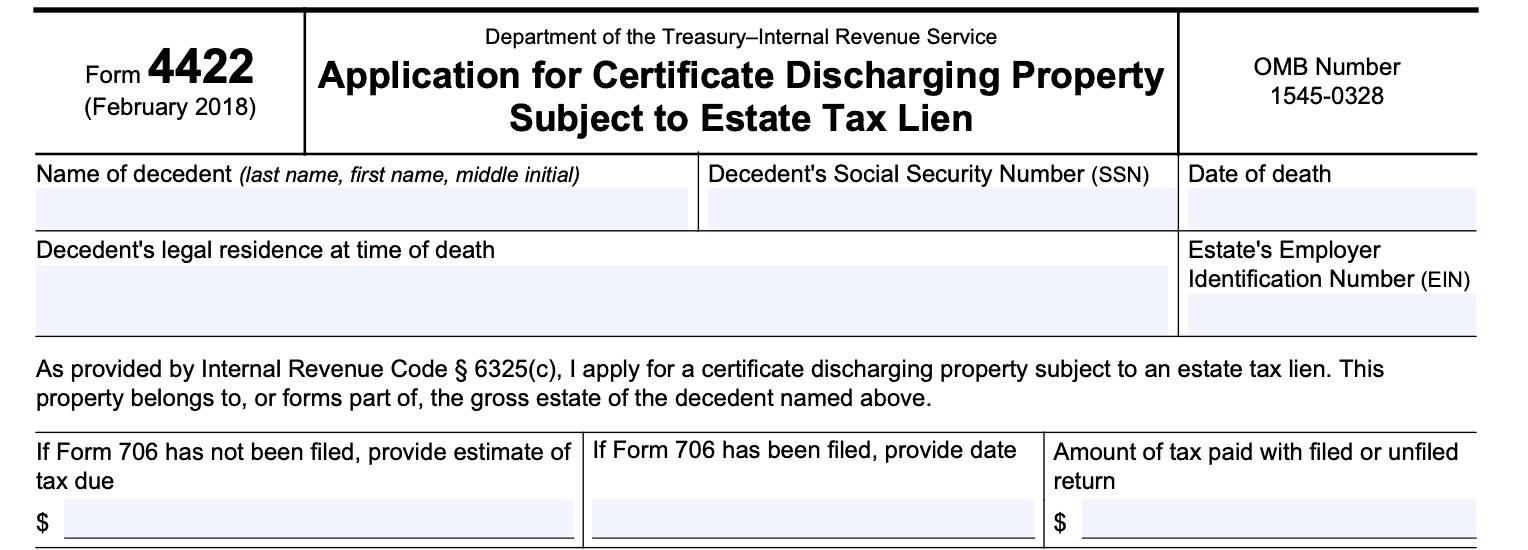

Top of IRS Form 4422

At the top of the form, you’ll need to enter:

- Name of the decedent

- Decedent’s Social Security number

- Date of death

- Estate’s employer identification number (EIN)

If you filed Form 706, provide the date that you filed it and the amount of estate tax that you paid. If you have not yet filed Form 706, provide an estimate of the tax due, as well as any estimated payment or partial payment that you may have already made on behalf of the estate.

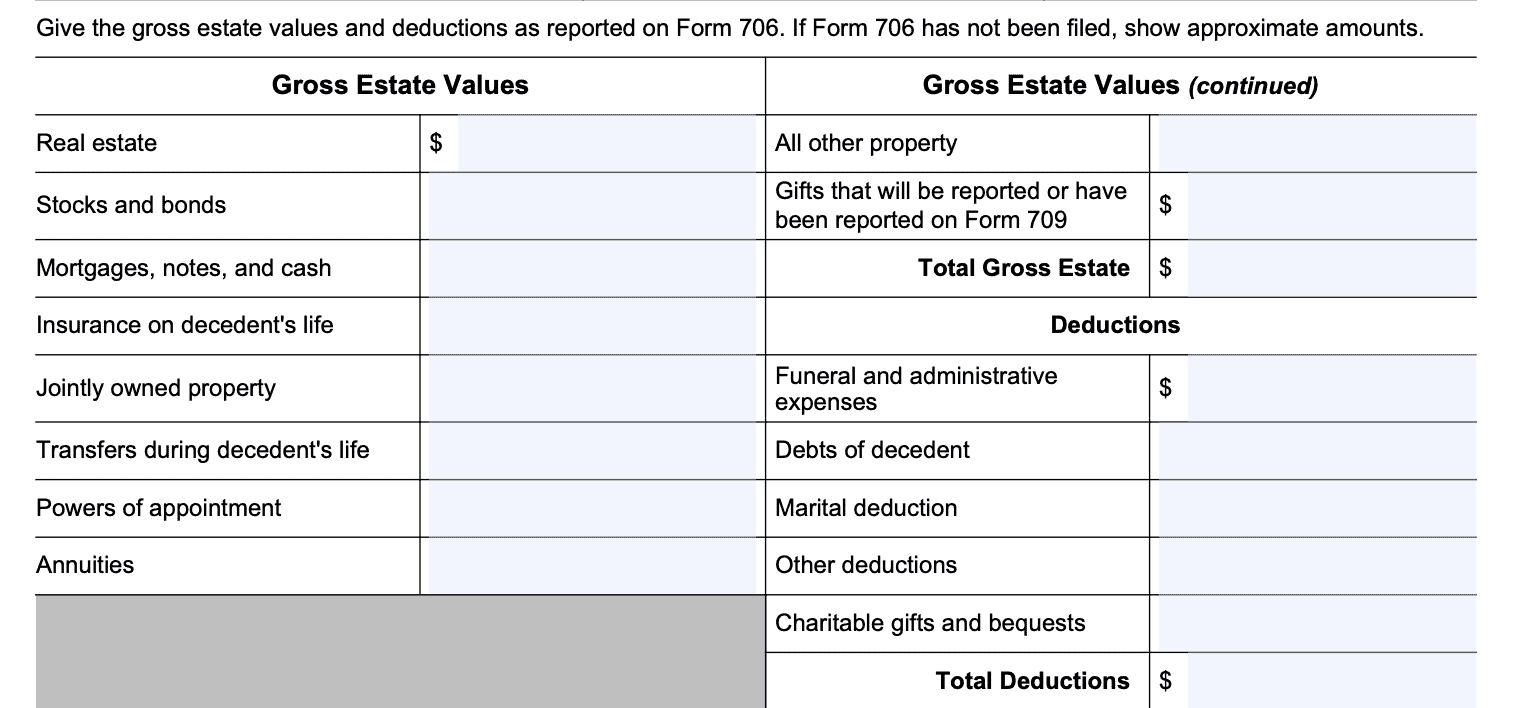

Gross estate values

In this section, you can enter the gross estate values and deductions that you reported on your estate tax return. If you have not already filed Form 706, then you should use approximations that are as accurate as possible.

Complete gross estate values for the following:

- Real estate

- Securities (i.e. stocks and bonds)

- Mortgages, notes, or cash

- Life insurance policies on the deceased

- Jointly owned property

- Transfers during the decedent’s lifetime

- Powers of appointment

- Annuities

- All other property, including gifts that have already been reported, or will be reported on IRS Form 709

From there, you can subtract the following deductions:

- Funeral expenses and other administrative expenses

- See Treasury Regulations § 20.2053-8 for examples of deductible administrative expenses for estate tax purposes

- Debts of the decedent

- Marital deduction

- Other deductions

- Charitable gifts and bequests

Additional instructions

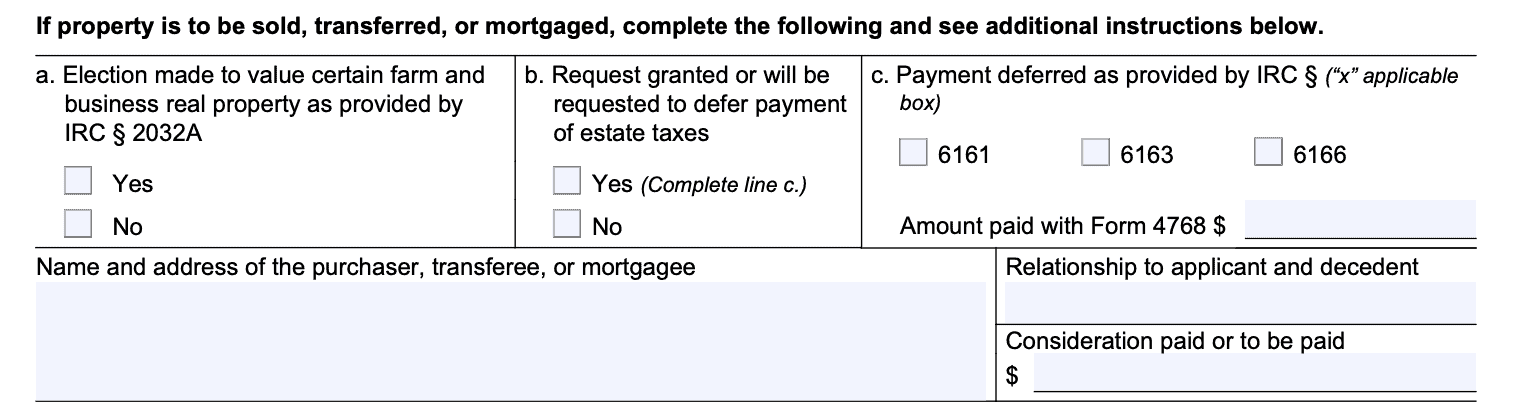

If your intent is for the subject property to be sold, transferred, or mortgaged with a finance company, then you’ll need to complete this section. If not, you may proceed directly to the signature portion.

Are you electing to value certain farm and business real property as outlined in IRC Section 2032A?

Also known as a special-use valuation, Section 2032A allows taxpayers to include certain real property in the decedent’s gross estate at a reduced value. In turn, this provides a certain amount of tax relief for taxpayers whose farm or business property might create significant estate tax problems for heirs of the decedent.

If applicable, check ‘Yes.’ Otherwise, check ‘No.’

Will you request to defer estate tax payment?

Or have you already received approval for such tax deferment? If so, check ‘Yes.’ Otherwise, check ‘No.’

Payment deferred as provided by _____

In this section, there are three different tax authorities for which you may have received deferment:

IRC Section 6161: Extension of time for paying tax

Section 6161 allows the Treasury Secretary broad discretion to grant tax relief in the form of an extension to pay.

IRC Section 6163: Extension of time for payment of estate tax on value of reversionary or remainder interest in property

According to IRC Section 6163, if the value of a reversionary or remainder interest in property is included under Chapter 11 in the value of the gross estate, the Treasury Secretary may postpone payment of the part of the tax under Chapter 11 for up to 6 months after “termination of the precedent interest or interests in the property.”

After the six-month period, the federal government may grant an extension not to exceed 3 additional years, with reasonable cause.

IRC Section 6166: Extension of time for payment of estate tax where estate consists largely of interest in closely held business

IRC Section 6166 allows certain taxpayers to make installment payments, instead of making a lump payment of the tax owed. This applies primarily to taxpayers with a significant amount of the estate in one or more closely held businesses, due to their illiquid nature.

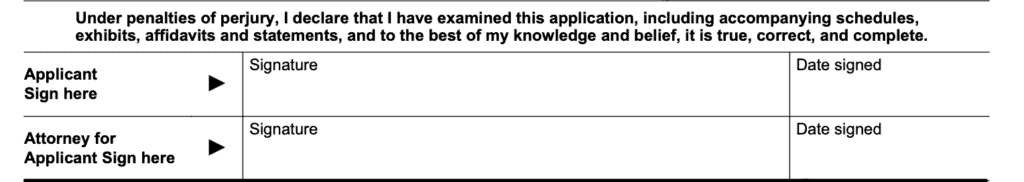

Signature

Note that the signature field contains the following provision:

Under penalties of perjury, I declare that I have examined this application, including accompanying schedules, exhibits, affidavits and statements, and to the best of my knowledge and belief, it is true, correct, and complete.

Sign and date this field. If you are working with one or more estate attorneys, an attorney must also sign and date this field.

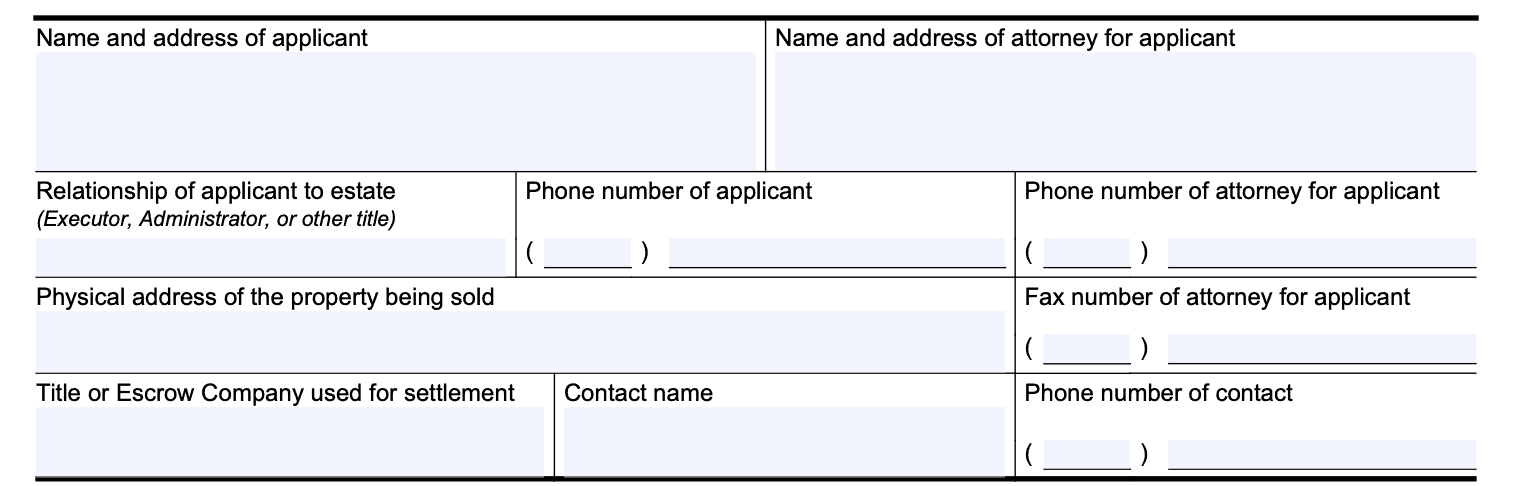

Applicant information

The applicant’s information goes on the next page of the tax form, at the top. Here, you will enter:

- Name and mailing address of applicant

- Name and mailing address of applicant’s attorney (if applicable)

- Relationship of applicant to decedent’s estate

- Phone number of applicant

- Attorney’s phone number, if applicable

- Address of the property being sold

- Title company or escrow company used

- Point of contact and phone number required

How do I file IRS Form 4422?

Unlike most tax forms, you cannot file Form 4422 electronically. Instead, the IRS instructs taxpayers to send the completed application to:

Internal Revenue Service

Advisory Estate Tax Lien Group

55 South Market St.

Mail Stop 5350

San Jose, CA 95113-2324

Attn: Group Manager

Alternatively, you may fax the completed form to the Advisory Estate Tax Lien Group at: 877-477-9243.

Video walkthrough

What is the estate tax?

Usually, the representative of an estate will receive a Notice of Federal Estate Tax Lien if the IRS files one. Finally, there will be a notice in public records if the IRS does file such a notice.

The estate tax is a type of tax that the Internal Revenue Service may impose on the right for taxpayers to transfer property to their heirs upon death. However, only taxpayers with a taxable estate are required to:

- File an estate tax return on IRS Form 706

- Pay estate taxes at all

What is a taxable estate?

A taxable estate consists of the decedent’s gross estate minus any applicable deductions, credits, or exclusions. Any taxable estate must file IRS Form 706 to calculate estate tax responsibility, then actually pay the applicable estate tax within the reporting timeline. Usually, the reporting timeline is 9 months after the death of the decedent.

For most households, however, there is no taxable estate, because of the basic exclusion amount.

What is the basic exclusion amount?

The basic exclusion amount, or BEA is the most notable estate tax deduction. The BEA is a lifetime tax exclusion that applies to both gift taxes (during one’s lifetime), and the estate tax (upon death).

For married couples, any surviving spouse may use their deceased spouses unused BEA to further minimize gift and estate taxes.

Each year, the BEA is adjusted upwards for inflation. For tax year 2023, the BEA is $12.92 million per person. In other words, the surviving spouse of a married couple filing jointly may be able to exclude up to $25.84 million, if the decedent passed away without using any of his or her exclusion.

For obvious reasons, the precludes the vast majority of taxpayers from having to report, much less pay, estate tax. Let’s switch our focus to estates that are subject to estate tax.

What happens to property that is subject to estate tax?

According to Internal Revenue Code Section 6324, the Internal Revenue Service can attach a federal estate tax lien on all property subject to estate tax. This might be true even in cases where the administrator has not filed a federal estate tax return, and even if the administrator has not yet been recognized as the fiduciary of the decedent’s estate.

This can cause a significant challenge for executors and estate administrators who are managing taxable estates that do not have a lot of liquid assets. In such cases, the executor might have to sell property to pay the estate tax.

But the decedent’s property lien interest makes it more difficult for the executor of the estate to actually sell the property to pay the taxes.

So the IRS allows estate tax lien discharges subject to transfer of property. In other words, Form 4422 allows taxpayers to discharge the lien on property that the estate is selling for repayment of the estate tax liability.

Where can I find IRS Form 4422?

You can find this tax form on the IRS website. For your convenience, we’ve enclosed the latest version below.

Frequently asked questions

Generally speaking, you can assume that there is an estate tax lien on all estates, since the IRS describes a federal estate tax lien as “a statutory lien that does not need to be filed to be effective.” However, since only estates with a taxable estate value above the basic exclusion amount are required to pay estate tax, most taxpayers do not need to worry about an estate tax lien.

IRS Form 4422 is the tax form that allows for the executor of the decedent’s estate to sell a specific piece of property. Upon approval, the IRS will approve the release of lien attached to the property, as long as the sales proceeds are used towards payment of the estate tax.