IRS Form 4506-F Instructions

If you believe that your identity has been stolen and used to create a tax return with a fraudulent refund, you can request a copy of a fraudulent return from the Internal Revenue Service with IRS Form 4506-F.

In this article, we’ll walk through everything you need to know about IRS Form 4506-F, including:

- How to complete and file IRS Form 4506-F

- Things you should know before filing IRS Form 4506-F

- Frequently asked questions

Let’s begin with step by step instructions on how to complete this tax form.

Table of contents

How do I complete IRS Form 4506-F?

This one-page tax form is relatively straightforward and contains 4 steps:

- Step 1: Provide Taxpayer Information

- Step 2: Provide Requestor Information

- Step 3: Provide Tax Year(s) Requested

- Step 4: Sign below

Before starting with Step 1, the IRS form instructions reiterate the purpose of this tax form. There are a couple of things you should be aware of before we dive in.

Before starting the form

There are many different versions of IRS Form 4506. Make sure you’re completing the correct one.

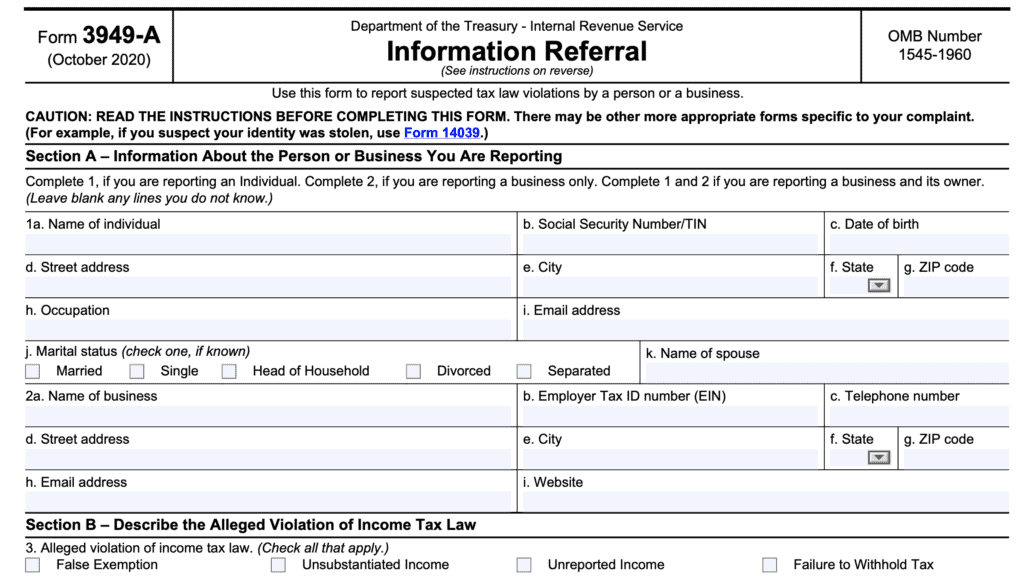

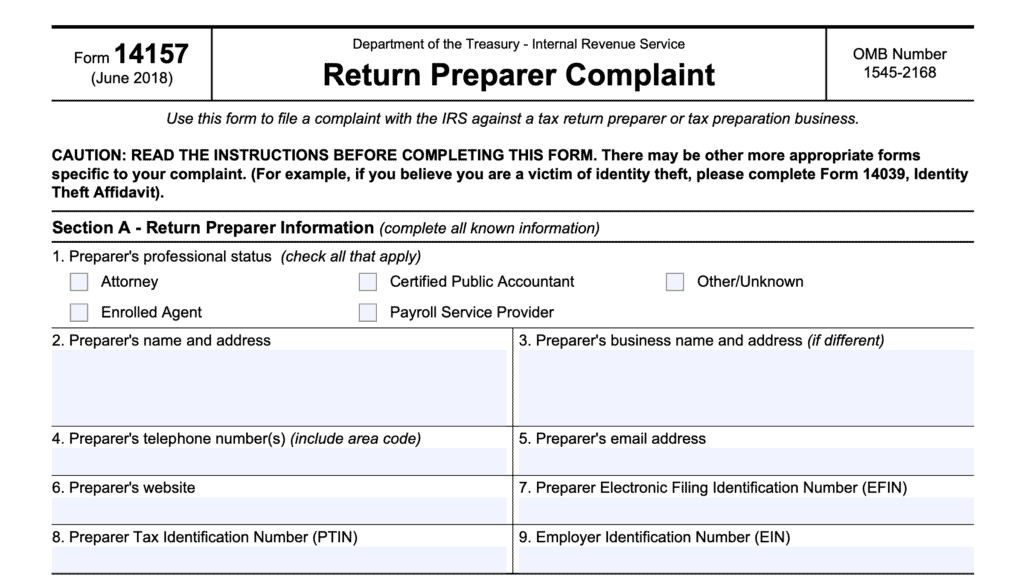

Before you begin, be sure that you’re using the correct version of IRS Form 4506. Below is a list of other similar tax forms, and a brief description for comparison.

IRS Form 4506

IRS Form 4506, Request for Copy of Tax Return, is the request form you can use to request a copy of your tax return. There is a $30 user fee for each tax return that you request.

You can learn more about using IRS Form 4506 to request your tax return in this YT video.

IRS Form 4506-A

IRS Form 4506-A, Request for Public Inspection or Copy of Exempt or Political Organization IRS Form, is the form that taxpayers may use to request a copy of a tax return filed by a tax-exempt organization or a political group.

Taxpayers may also access this public information through the IRS website. For filed versions of IRS Form 8871 or Form 8872, taxpayers may go to the IRS page containing tax information for political organizations. For filed versions of Form 990, Form 990-EZ, Form 990-PF and

Form 990-T, you may go to the IRS’ Tax Exempt Organization Search Page instead.

IRS Form 4506-B

IRS Form 4506-B, Request for a Copy of Exempt Organization IRS Application or Letter, is used to request copies of an exempt organization’s exemption application or determination letter. Unlike Form 4506-A, you cannot use this tax form to request copies of tax returns.

However, you may also find related information on the IRS’ Tax Exempt Organization Search Page without filing IRS Form 4506-B.

IRS Form 4506-C

IRS Form 4506-C, IVES Request for Transcript of Tax Return, allows taxpayers to request tax return information through an authorized IVES participant.

IVES stands for Income Verification Express Service, and is a program administered by the IRS. IVES allows taxpayers to authorize third parties, known as IVES participants, to request tax return or wage transcripts for income verification purposes.

Generally your financial institutions, such as a bank, credit union, or mortgage broker, will use IVES to verify a taxpayer’s income as part of the approval process for a residential or commercial mortgage.

The IRS only provides tax records to a third party with the consent of the taxpayer. You can find more information about this form in this video.

IRS Form 4506-T

IRS Form 4506-T, Request for Transcript of Tax Return, is used to obtain a tax transcript from your IRS records. Taxpayers may request tax transcripts of the following:

- Return Transcript: A return transcript includes most of the line items of a tax return as filed with the IRS. However, a tax return transcript does not reflect any changes to that tax return after it was filed (i.e. amended tax return information). Available for the current year and 3 prior years.

- Account Transcript: An account transcript contains information on the financial status of the account, including tax payments, penalty assessments, or adjustments made after the return was filed.

- Record of Account: A record of account is a combination of the return transcript and the account transcript. This provides the most detailed information, and is available for the current tax year and three previous tax years

- Information returns: IRS Form 4506-T can be used to obtain transcript information for up to 10 years for the following information returns:

- Form W-2

- Form 1099 series

- Form 1098 series

- Form 5498

Learn more about IRS Form 4506-T in this video.

IRS Form 4506-T-EZ

The IRS Form 4506-T-EZ, Short Form Request for Individual Tax Return Transcript, may be used to request a tax return transcript for the current and the prior three years. This tax transcript will contain most lines of the original tax return, but will not reflect the following:

- Tax payments

- Penalty assessments

- Adjustments made to the original return

You should only file IRS Form 4506-F if you are a victim of identity theft

According to the form instructions, victims of identity theft should use IRS Form 4506-F to request a tax return transcript of a fraudulent return filed using their name and SSN as the primary or secondary taxpayer.

So in other words, if you’re not a victim of tax-related identity theft, then you’ll probably receive the information that you’re looking for in one of the previously mentioned tax record request forms.

There are limits to the information that the IRS will release

First, you don’t get the actual copy of a fraudulent tax return. According to the form instructions, you receive a transcript, not the actual copy of the fraudulent return.

Second, only the victim of tax identity theft (or the victim’s spouse, as the secondary taxpayer) may file this form, unless specifically granted permission. Unless your information is already on file with the IRS, any person requesting this information must send a copy of written permission with the completed Form 4506-F request. This can take the form of:

- IRS Form 2848, Power of Attorney and Declaration of Representative

- IRS Form 8821, Tax Information Authorization

- A court order granting such permission

Finally, you won’t get all of the information. The form instructions state that “some information on the transcript will be masked or partially masked, but there will be enough data to determine how the taxpayer’s personal information was used.”

Now that we’re finished with the fine print, let’s start at the top with Step 1.

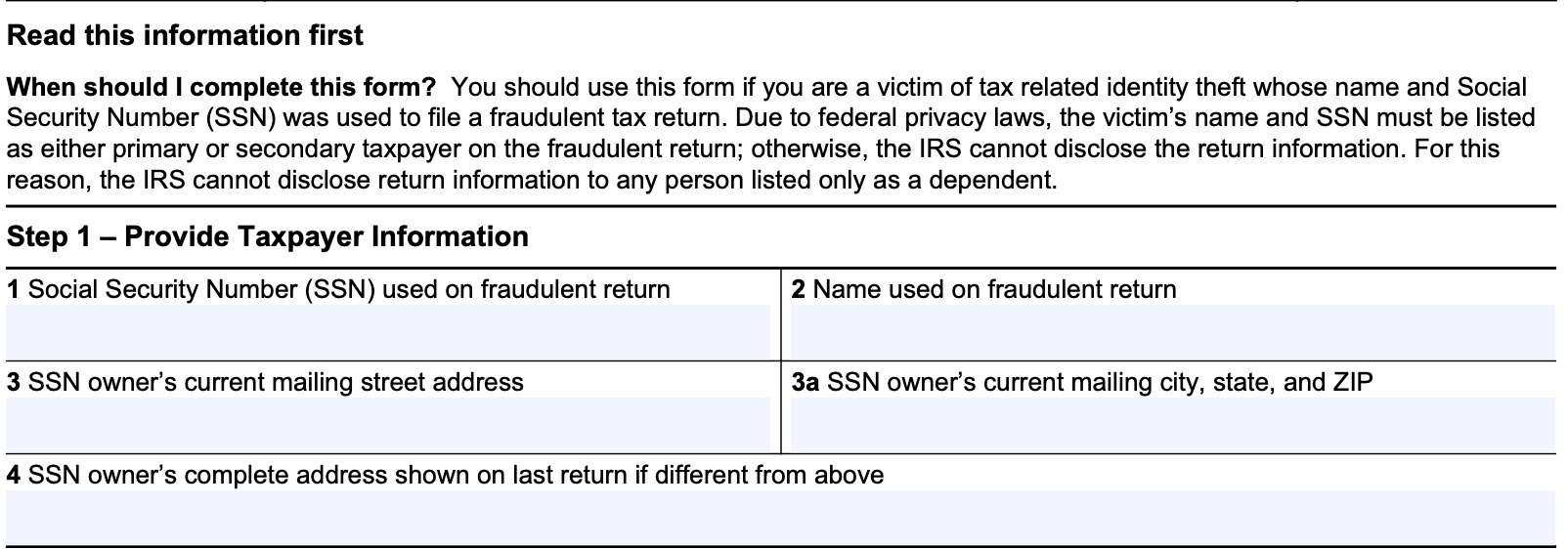

Step 1: Provide Taxpayer Information

In this portion, you’ll enter the identity theft victim’s tax information.

Line 1: Social Security number (SSN) used on fraudulent return

In this line, enter the SSN used on the fraudulent return.

Line 2: Name used on fraudulent return

Enter name of the taxpayer used on the fraudulent income tax return.

Line 3: SSN owner’s current mailing street address

In Line 3, enter SSN owner’s current mailing address. If you use a P.O. Box, please include it on this line.

Line 3a: SSN owner’s current mailing city, state, and ZIP

Finish entering the SSN owner’s mailing address by entering the current mailing city, state and zip code.

Line 4: SSN owner’s complete address shown on last return if different from above

Enter the SSN owner’s complete address shown on the last return filed if different from the current mailing address entered above.

If the current mailing addresses on Lines 3 & 4 are different, and you have not previously informed the Internal Revenue Service of your new address of record, then you’ll need to file IRS Form 8822, Change of Address.

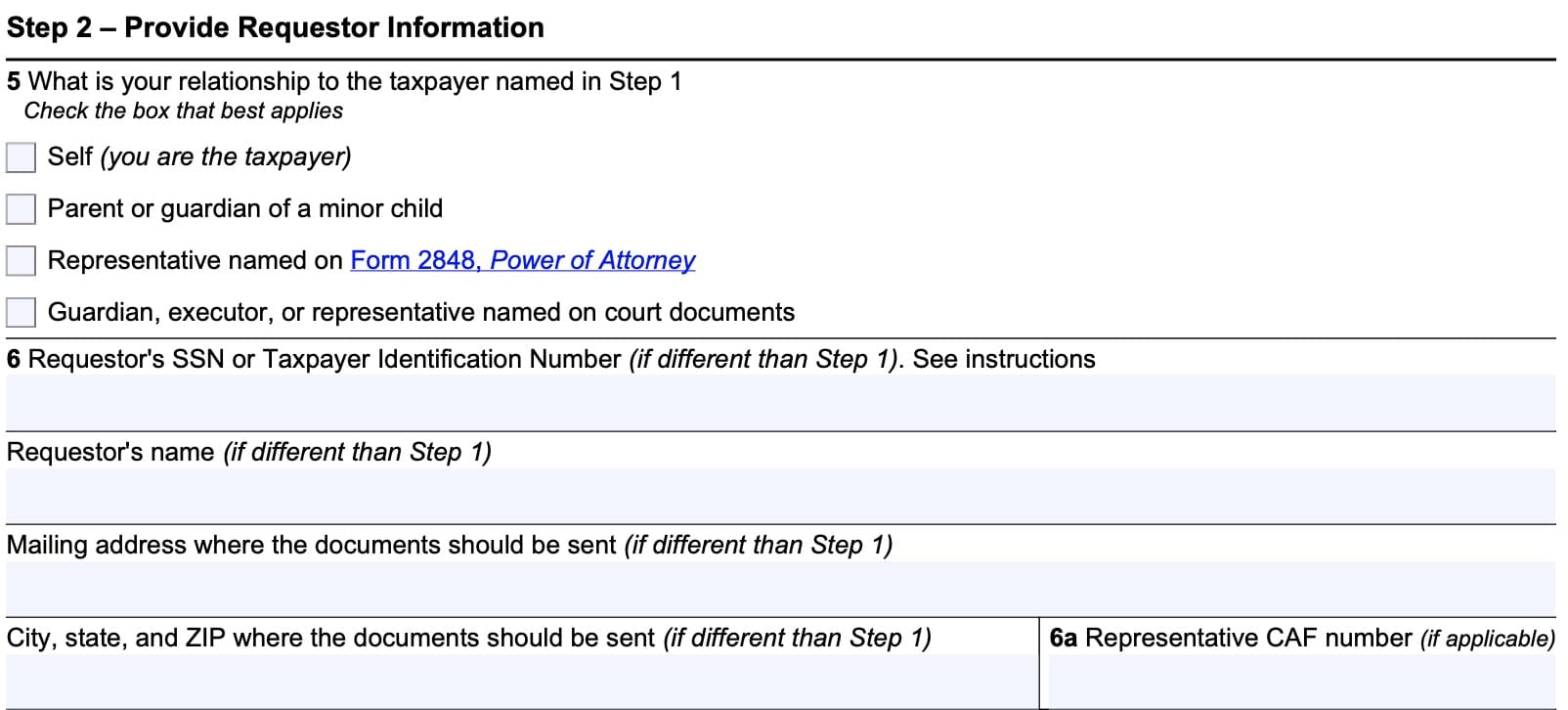

Step 2: Provide Requestor Information

In this part, you’ll provide information related to who is requesting this tax information.

Line 5: What is your relationship to the taxpayer named in step 1

Check the appropriate box:

- Yourself (you are the taxpayer listed on the form)

- Parent or guardian of a minor child

- Representative named on IRS Form 2848

- Guardian, executor, or representative named on court documents

Line 6

If different from Step 1, enter the following information on behalf of the requestor:

- SSN or taxpayer identification number

- Can be centralized account file (CAF) or employer identification number (EIN)

- Requestor’s name

- Mailing address

Line 6a

In Line 6a enter the assigned CAF number if your authority to obtain tax return information for the requested year or years is on file with the IRS.

If your information is not on file with the IRS, the Form 4506-F must also be accompanied by documents demonstrating your authority to receive the requested tax return information, such as IRS Form 2848 or Form 8821.

Parents or legal guardians of a minor child do not need to provide additional information if your request is for a fraudulently filed tax return using your child’s identity.

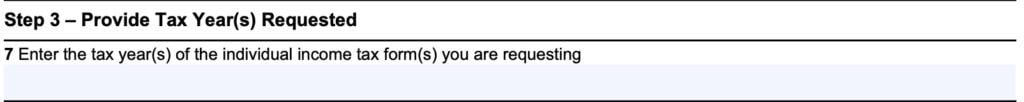

Step 3: Provide Tax Year(s) Requested

Line 7

Enter the tax year or years that you are requesting tax returns for. You can request copies of fraudulent returns for the current tax year and previous six tax years.

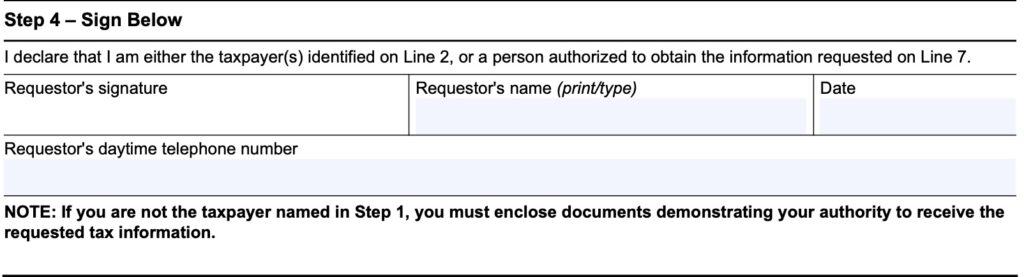

Step 4: Sign below

In Step 4, you’ll type your name and a daytime telephone number. Then sign and date the form. This form must be signed by one of the following:

Filing IRS Form 4506-F

Once you’ve completed the IRS Form 4506-F, you’ll need to either mail or fax (but not both) your completed form to the IRS.

Mailing Form 4506-F

To submit your request by mail, use the following address:

Department of the Treasury

Internal Revenue Service

Fresno, CA 93725

For requests sent using a private delivery service, such as FedEx or UPS, use the following address instead:

Internal Revenue Service

3211 S Northpointe Dr

Fresno, CA 93725

“Identity Theft – Request for Fraudulent Return”

When mailing supporting documentation, such as your power of attorney form or court documents, be sure to make copies of these documents for your records.

Faxing Form 4506-F

To send your request by fax, use the following number: 855-807-5720. Be sure to include a cover sheet marked ‘Confidential.’

Video walkthrough

Watch this instructional video for more information about IRS Form 4506-F.

Frequently asked questions

Victims of identity theft may file IRS Form 4506-F with the IRS to request a copy of a fraudulent return that was filed with their sensitive tax information.

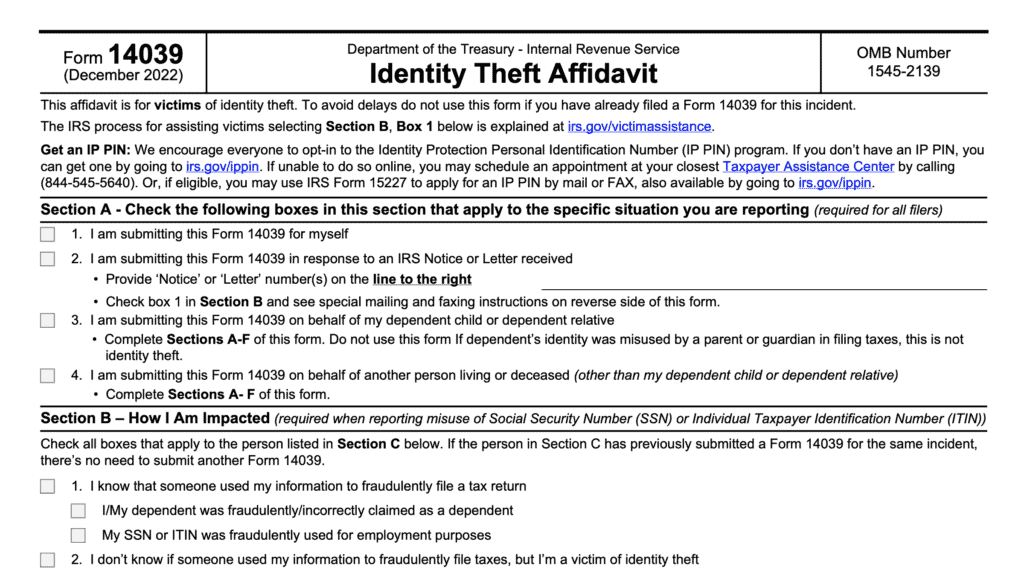

No. If you suspect that an identity thief stole your tax information and used it to file a fraudulent tax return, file IRS Form 14039, Identity Theft Affidavit, instead of Form 4506-F. Use Form 4506-F to request copies of returns that may have been used to obtain a fraudulent refund.

Where can I find IRS Form 4506-F?

Most people can download the latest versions of IRS forms directly from the IRS website. For your convenience, we’ve enclosed the latest copy of IRS Form 4506-F within this article.