IRS Form 461 Instructions

In 2017, the federal government changed the tax law to limit the amount of losses a noncorporate taxpayer may deduct from ordinary income. The Internal Revenue Service created IRS Form 461, Limitation on Business Losses, to help taxpayers calculate the amount of these losses for tax reporting purposes.

In this article, we’ll walk through IRS Form 461, step by step, including:

- How to complete IRS Form 461

- How excess business losses work

- Frequently asked questions about excess business losses

Let’s start by going over this tax form.

Table of contents

How do I complete IRS Form 461?

There are three parts to this one-page tax form:

- Part I: Total Income/Loss Items

- Part II: Adjustment for Amounts Not Attributable to Trade or Business

- Part III: Limitation on Losses

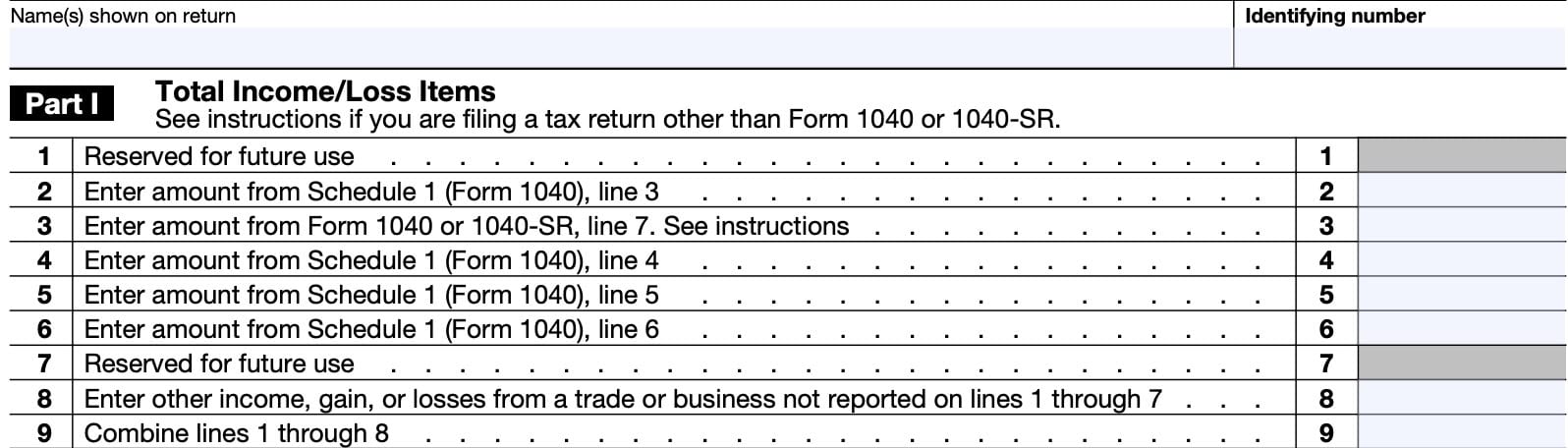

Part I: Total Income/Loss Items

In Part I, we’ll report all of the income and losses as such amounts are reflected on your federal income tax return.

Line 1: Reserved for future use

Skip Line 1 and go to Line 2, below.

Line 2: Profit or loss from Business

In Line 2, enter the amount from Line 3 on IRS Schedule 1, Additional Income & Adjustments to Income.

Line 3 represents the net profit or loss from Schedule C activities. If applicable, you’ll need to attach Schedule C to your tax return.

Line 3: Capital gains or losses

Enter the total amount from Line 7 of your Form 1040 or Form 1040-SR.

This is your total capital gain or loss from the sale of capital assets, which you may need to calculate on Schedule D, as well as IRS Form 8949, Sales and Dispositions of Capital Assets.

Losses from sales or exchanges of capital assets are not included in the calculation of the total deductions from the taxpayer’s trades or businesses.

If you include any amounts in Line 3, you’ll need to add the amount of losses on Line 11, below. This will help remove them from the calculation.

Line 4: Sales of business property

In Line 4, enter other losses or gains as calculated on IRS Form 4797, Sales of Business Property, if applicable. You should see this amount on Line 4 of Schedule 1.

Line 5: Supplemental income

In this line, enter the total supplemental income or loss that you reported on Schedule E of your tax return from the following sources:

- Rental real estate

- Royalty income

- Partnerships

- S corporations

- Trusts & estates

This amount will appear in Line 5 of your Schedule 1.

Line 6: Farming profit or loss

If applicable, enter the amount of farming profit or loss that you reported on Line 6 of your Schedule 1. This will also appear on Schedule F of your income tax return.

Line 7: Reserved for future use

Do not enter anything in Line 7.

Line 8: Other income, gain, or losses

In Line 8, enter any other income items, gains, or losses from a trade or a business that you did not previously report on your tax return.

Line 9

Add Lines 1 through 8, then enter the total here. The result can be a positive or negative number.

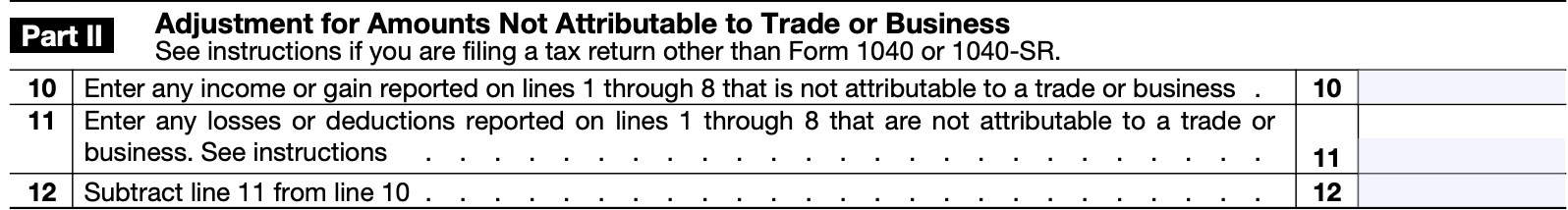

Part II: Adjustment for Amounts Not Attributable to Trade or Business

In Part II, we’ll report the income, gain, or loss from your tax return, that is not from a trade or business. This information will help us calculate the excess business loss.

Line 10: Income or gain not attributable to a trade or business

Enter any income or gain that you reported in Part I, that is not attributable to a trade or business.

Line 11: Losses or deductions not attributable to a trade or business

Enter any losses or deductions that you reported in Part I, that is not attributable to a trade or business.

Losses from sales or exchanges of capital assets are not included in the calculation of trade or business deduction. Any amounts that you included on Line 3 should be added back here to

remove it from the computation.

Line 12

Subtract Line 11 from Line 10, then enter the result here.

The resulting is your gain or loss that’s not from a trade or business. We will use this amount in Part III to figure your excess business loss.

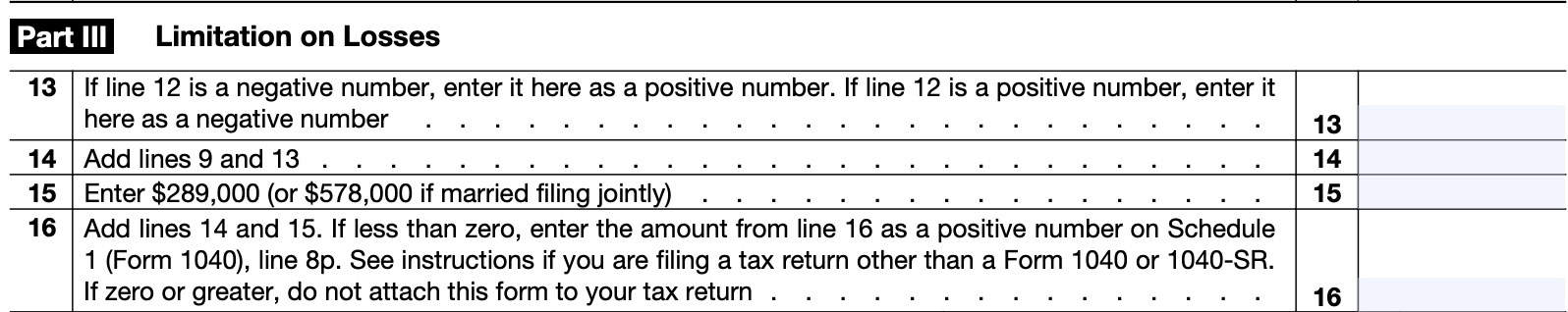

Part III: Limitation on Losses

In Part III, we’ll determine the excess business loss by applying the threshold limitation.

Line 13

If Line 12 is negative, enter the number here as a positive number. If Line 12 is positive, enter it here as a negative number.

Line 14

Add Line 9 and Line 13 together. Enter the result here.

Line 15: Excess business loss limitation

Enter the threshold amount for the current tax year. For 2023, the number is:

- $289,000 for single filers

- $578,000 in the case of a joint return

2024 threshold amounts

For 2024, the number is:

- $305,000 for single filers

- $610,000 in the case of a joint return

2025 threshold amounts

For 2025, the number is:

- $313,000 for single filers

- $626,000 in the case of a joint return

Line 16

Add Line 14 and Line 15, then enter the result here. This is the excess business loss calculation.

If the result is negative, enter the amount on IRS Schedule 1, Line 8p as a Section 461(l) excess business loss adjustment.

If the number is positive, then you do not need to attach IRS Form 461 to your income tax return.

Keeping track of excess business loss calculations

The Internal Revenue Service requires taxpayers to keep a record of your excess business losses from each tax year because they are treated as net operating losses.

IRS Publication 536, Net Operating Losses (NOLs) for Individuals, Estates, and Trusts, contains additional information on NOL carryovers and reporting NOLs on future year tax returns.

What are excess business losses?

In 2017, the Tax Cuts and Jobs Act (TCJA) placed a limit on the amount of losses that non-corporate taxpayers can deduct from taxable income each tax year. This limit is known as the excess business loss, or EBL limitation.

Taxpayers cannot deduct an excess business loss in the current year. However, noncorporate taxpayers can bring forward an excess business loss to report on a noncorporate tax return in subsequent years, such as a net operating loss, or NOL carryover amount.

Excess business losses defined

An excess business loss is the amount by which the total deductions from your trades or business activities exceed your total gross income or gains from your trades or businesses, plus a specified threshold amount.

This excess business loss calculation is performed without deductions allowed under either:

- Internal Revenue Code Section (IRC) 172, Net Operating Loss Deduction, or

- IRC 199A, Qualified Business Income Deduction

These net business losses should be determined without regard to any of the following:

- Tax deductions

- Gross income

- Gains attributable to any trade or business of performing services of an employee:

Excess business loss ordering rules

There are special rules to determine the excess business loss in the first place:

- At-risk rules

- Passive activity limitations

- Excess business loss rules

At-risk rules

First, you must apply the at-risk rules. These determine at-risk limits on your net business losses.

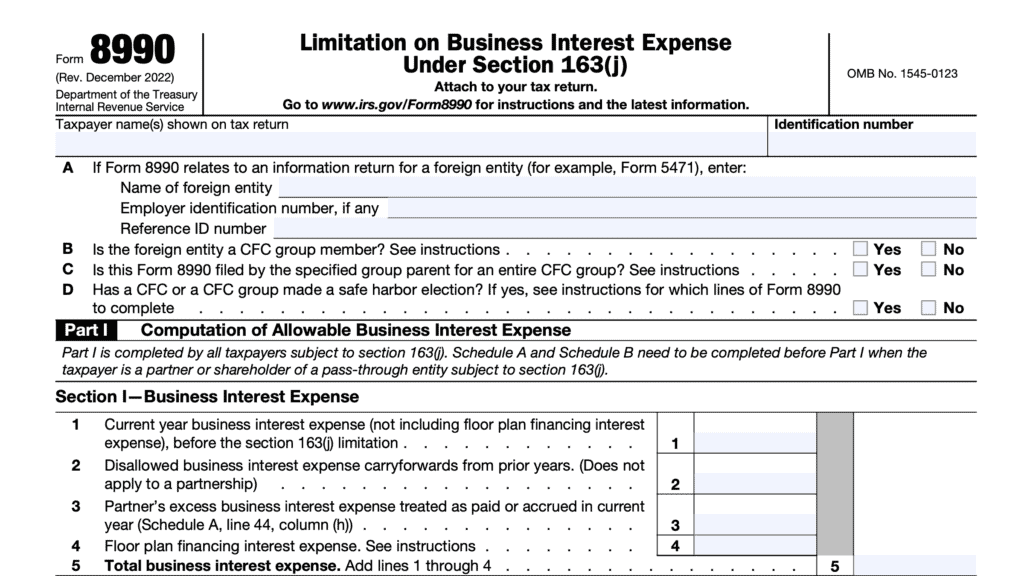

Essentially, at-risk limits mean that your business deductions are limited based upon the amount of your investment that you personally have at risk. You can read more about in the instructions for IRS Form 6198, At-Risk Limitations.

Passive activity limitations

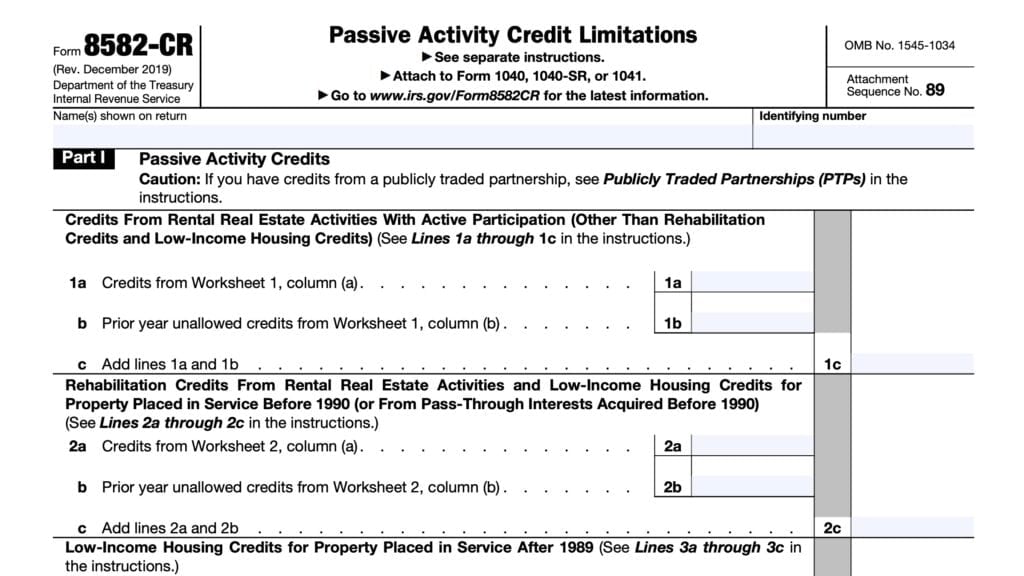

Next, you’ll apply the passive activity limits. The amount of any deduction for passive activity losses are limited to the amount of net gains from passive activities. More details are contained in the IRS Form 8582, Passive Activity Losses instructions.

Excess business loss rules

After applying the at-risk limitations rules and the passive loss limitations rules, you’ll apply the excess business loss rules.

Farming losses

Farmers are able to carry back excess business losses up to 2 prior years, similar to an NOL carryback. However, taxpayers with losses from a farming business must apply the excess business loss limitation before applying the loss to any carryback year.

More information is in the instructions for IRS Form 1045, Application for Tentative Refund.

Farming losses and non-farming losses

If you are in the business of farming, and you incur both farming and nonfarming business losses that exceed the threshold amount, you must allocate the threshold amount first to the farming losses to the extent you have an NOL.

Trade or business

An activity qualifies as a trade or business if:

- Generating income is your primary purpose for engaging in the activity is for income or profit, and

- You’re involved in the activity on a regular and continuous basis

The facts and circumstances of each case determine whether an activity is a trade or business. You do not have to actually make a profit to be in a trade or business, as long as you have a profit motive. However, you do need to continuously work to further the purpose of your business.

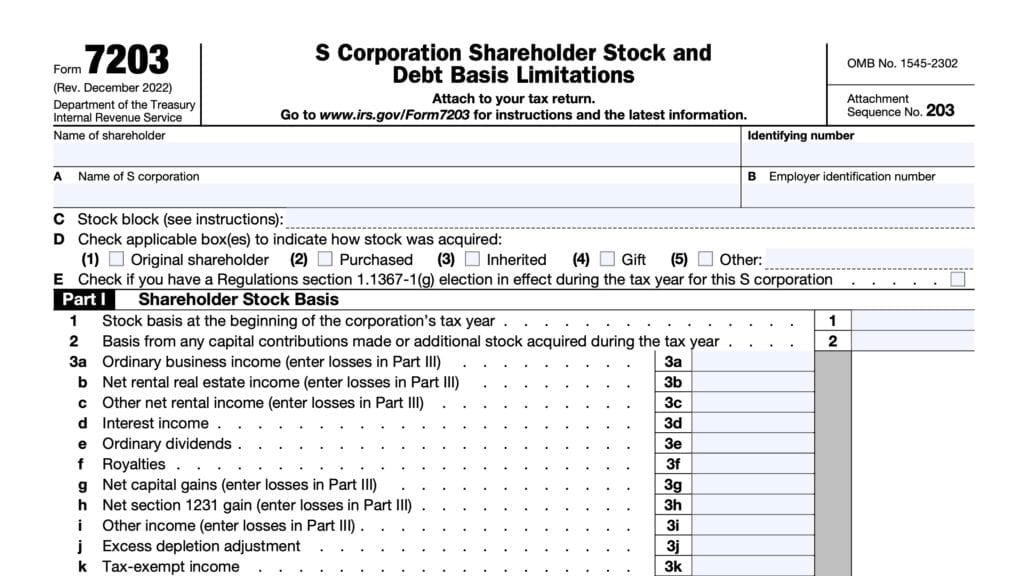

If you own an interest in a partnership or S corporation, the trade or business determination is made at the pass-through entity’s level.

Video walkthrough

Frequently asked questions

For the 2023 tax year, the excess business loss limit was $289,000 for single filers and $578,000 for married taxpayers filing a joint return. In 2024, this limit is $305,000 for single taxpayers and $610,000 for joint returns. For the 2025 taxable year, the limit is $313,000 and $626,000, respectively.

Noncorporate taxpayers with a net loss that exceeds the excess business loss limitation must file IRS Form 461.

An excess business loss is the amount by which the total deductions from trading or business activities exceed your gross income or gains from your trades or business.

Your completed form should accompany your federal income tax return, such as IRS Form 1040, Form 1040-SR, Form 1040-NR, or Form 1041.

Where can I find IRS Form 461?

As with other tax forms, you may find IRS Form 461 on the Internal Revenue Service website. For your convenience, we’ve included the most recent version of this tax form here.