IRS Form 4684 Instructions

In 2018, the Tax Cuts & Jobs Act significantly changed how taxpayers were able to claim deductible casualty losses on their income tax return. Regardless, there are still plenty of opportunities for taxpayers to claim a casualty loss deduction on IRS Form 4684.

In this article, we’ll walk you through everything you need to know about this tax deduction, including:

- How to complete IRS Form 4684

- Who is eligible to claim a casualty loss deduction

- Frequently asked questions

Let’s start with a walk through on how to complete & file IRS Form 4684.

Table of contents

How do I complete IRS Form 4684?

There are four sections to this tax form:

- Section A: Personal Use Property

- Section B: Business & Income-Producing Property

- Section C: Theft Loss Deduction for Ponzi-Type Investment Scheme Using the Procedures in Revenue Procedure 2009-20

- Section D: Election To Deduct Federally Declared Disaster Loss in Preceding Tax Year

We’ll walk through each of these sections, one by one. Let’s start with reporting casualties and thefts of property not used in a trade or business in Section A.

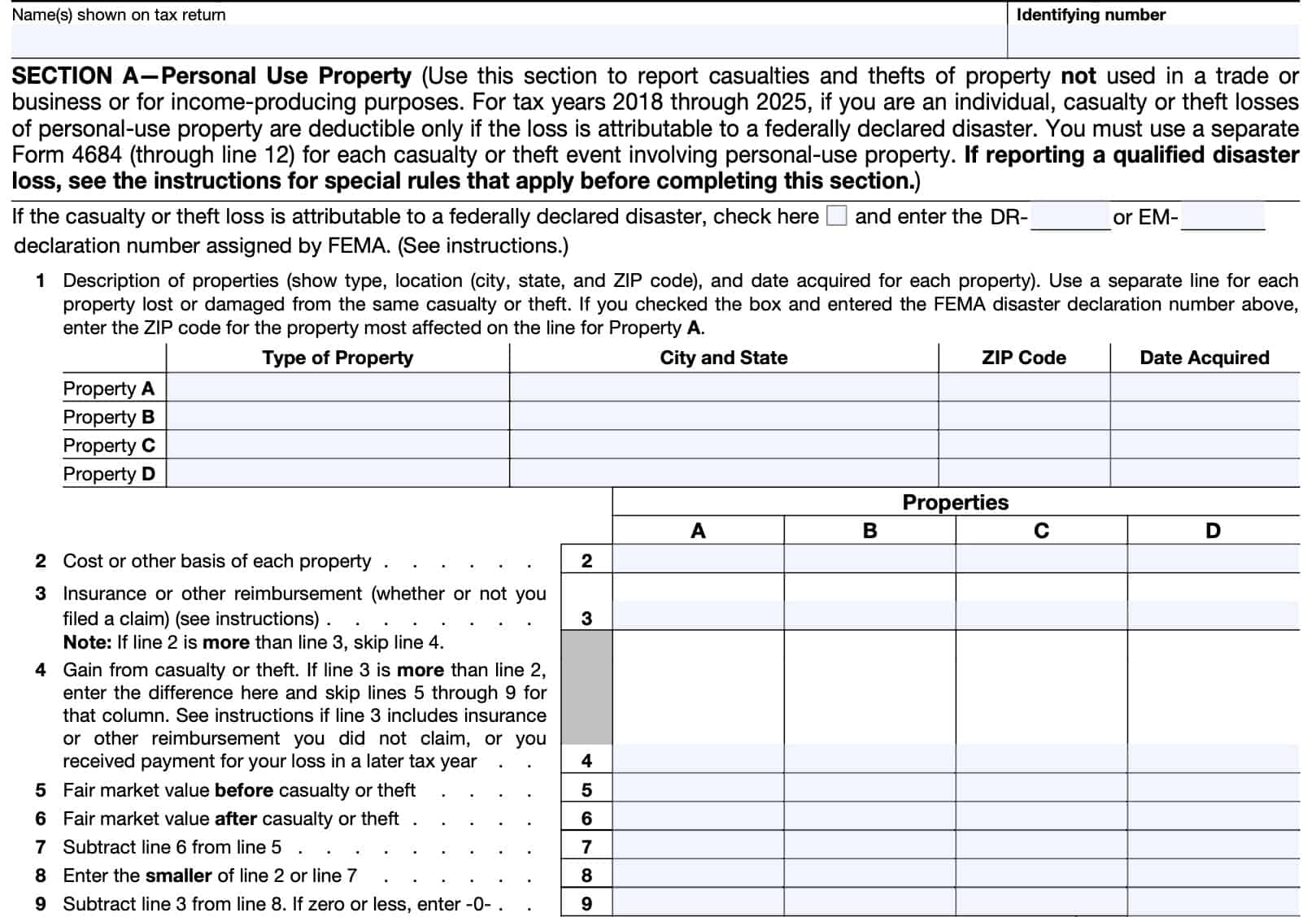

Section A: Personal Use Property

In Section A, we’ll focus on reporting the loss of personal-use property. We can also use Section A to calculate casualty or theft losses & gains related to the portion of your home used for business purposes, if you used the simplified method to determine deductible expenses related to the business use of your home.

Because of the Tax Cuts and Jobs Act (TCJA), casualty or theft losses of personal use property are only deductible in the case of a loss due to a federally declared disaster.

For reference, the Internal Revenue Service website contains a list of qualified disasters, as declared by the Federal Emergency Management Agency (FEMA). Let’s go through Section A, line by line.

Top of form

At the top of the form, enter your name and identifying number. For a business, the identifying number will be the employer identification number (EIN). For most individuals, the identifying number should be your Social Security number or individual taxpayer identification number (ITIN).

Just above Line 1, the form prompts you to check whether the property loss was due to a federally declared disaster. After this, the form asks you to enter the DR number (related to major disasters) or EM number (related to emergency declarations) assigned to your qualified disaster.

This should be a four-digit number assigned by FEMA. FEMA’s website maintains a list of declared disasters for taxpayer reference.

If you are claiming qualified disaster losses for multiple qualified disasters, or in more than one federally declared disaster area, you’ll need to complete a separate IRS Form 4684 for each event.

Line 1: Description of properties

In each row, enter the following information:

- Type of property

- City and state

- ZIP code

- Date that you acquired the property

You may enter up to 4 properties. If you have more than 4 properties for which you are claiming a qualified loss, you may need to use additional pages for Lines 1 through 9.

Line 2: Cost or other basis

For each property, enter the cost basis or other basis in the corresponding column. As an example, you should enter the cost basis for a property listed as Property A in Line 1 into Column A of Lines 2 through 9.

For most taxpayers, the tax basis of your main home is the acquisition cost, plus the cost of any major improvements. However, in certain cases, you may need to refer to IRS Publication 551, Basis of Assets, as special rules may apply. Here are some examples:

- Postponed gain from the sale of a previous home

- Property received as a gift or inheritance

- Inheritance of property from someone who died in 2010 where the executor of the decedent’s estate made the election to file IRS Form 8939

Line 3: Insurance or other reimbursement

In Line 3, enter the amount of all reimbursement, from insurance claims or otherwise. Include the amount of insurance your policy covers, regardless of whether you filed a claim with the insurance company.

Other types of reimbursement might include:

- The portion of a federal disaster loan that is forgiven

- If someone who leases your property must make repairs or must repay you for any part of a casualty loss, the repayment and the cost of the repairs are considered reimbursements;

- Court-awarded damages for a casualty or theft loss

- Minus lawyers’ fees and other necessary expenses

- Repairs, restoration, or cleanup services provided by a relief agency

- Payments by a bonding company for a theft loss

If Line 2 exceeds Line 3, then you may skip Line 4 and proceed to Line 5. Otherwise, go to Line 4.

Line 4: Gain from casualty or theft

If Line 3 exceeds Line 2, enter the difference in Line 4, then skip Lines 5 through 9.

If you are entitled to an insurance payment, but you choose not to file a claim for the loss, you can’t realize a gain from that payment or reimbursement. In this situation, subtract your cost or other basis from Line 2 from the amount of reimbursement you actually received.

Enter the result on Line 4, but don’t enter a negative number.

If you filed a claim for reimbursement but didn’t receive it until after the year of the casualty or theft, include the gain in your income in the year you received the reimbursement.

Line 5: Fair market value before casualty or theft

Fair market value (FMV) is the price at which the property would be sold between a willing buyer and a willing seller, each having knowledge of the relevant facts. The difference between the FMV immediately before the casualty or theft and the FMV immediately after represents the decrease in FMV because of the casualty or theft.

In Line 5, enter the FMV for the property before the casualty or theft.

Line 6: Fair market value after casualty or theft

In Line 6, enter the new FMV as a result of the casualty. For determining the new market value, the IRS has some guidance:

- In cases of theft of personal property that is not recovered, the new FMV is zero

- IRS Revenue Procedure 2018-08 contains several safe-harbor provisions to help taxpayers calculate the loss amount

IRS Rev. Proc. 2018-08 Safe Harbor Provisions

There are two safe harbor provisions a taxpayer may use to determine the fair market value of their property loss:

- Contractor Safe Harbor Method

- Disaster Loan Appraisal Safe Harbor Method

Under the contractor safe harbor method, an individual may use the contract price for the repair as long as:

- Repairs are specified in a contract prepared by an independent contractor

- Contractor must be licensed or registered in accordance with state or local regulations,

- Itemized costs are to restore the individual’s personal-use residential real property to the condition existing immediately prior to the Federally declared disaster.

The cost of any improvements made by the contractor that increase the property’s FMV above its pre-disaster value must be excluded.

Under the disaster loan appraisal method, an individual may use an appraisal that meets the following conditions:

- The appraisal was prepared for the purpose of obtaining a loan of Federal funds or a loan guarantee from the Federal Government

- Appraisal contains the estimated loss the individual sustained as a result of the damage to or destruction of the individual’s personal-use residential real property

- Damage was caused by a Federally declared disaster

If using either of the safe harbor methods, you must attach a statement to Form 4684 stating that you used Revenue Procedure 2018-08 to determine the amount of your casualty loss. Include the specific safe harbor method used.

Also, do not enter an amount on Line 5 or Line 6 for each property. Instead, enter the decrease in the FMV determined in the relevant safe harbor method on Line 7.

Line 7

Subtract Line 6 from Line 5. This represents the amount of qualified disaster loss, subject to basis limitations.

Line 8

Enter the smaller of:

Line 9

Subtract Line 3 from Line 8. If the result is zero or less, enter ‘0.’

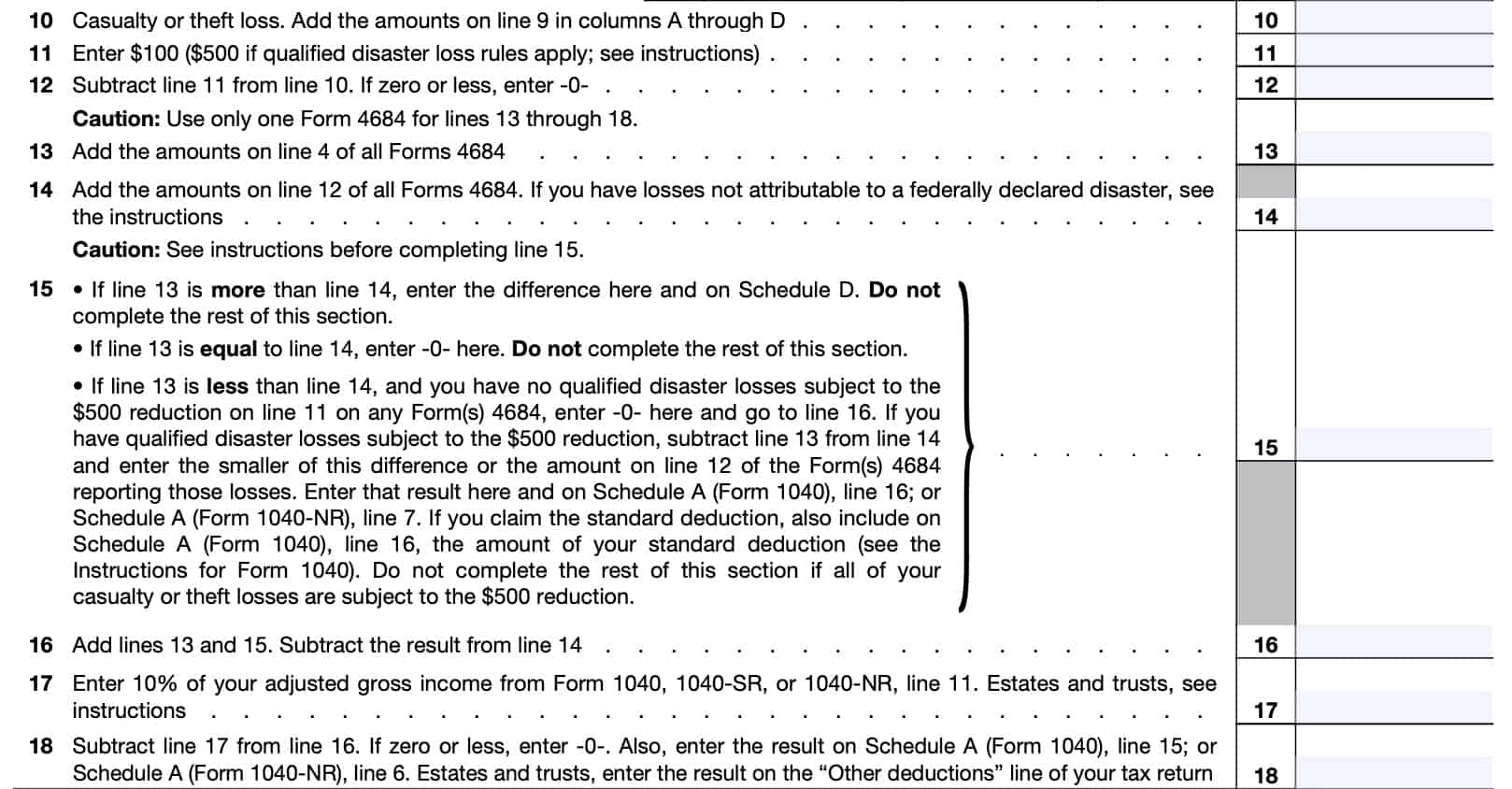

Line 10: Casualty or theft loss

Add the Line 9 amounts across all four columns. Enter the net result in Line 10.

Line 11

Enter $100 in Line 11.

If you sustained a qualified disaster loss, add the amounts on Line 4 of all Forms 4684. Compare the sum with the amount on Line 10.

If the amount on Line 10 is larger, enter $500 on Line 11 of the Form 4684 reporting the qualified disaster losses. If the Line 10 amount is smaller, enter $100 on Line 11.

Line 12

Subtract Line 11 from Line 10. If the result is zero or a negative number, enter ‘0.’

Line 13

For Lines 13 through 18, use only one Form 4684.

Add the amounts on Line 4 for all Form 4684 entries. Enter the total in Line 13.

Line 14

In Line 14, add the amounts for Line 12 on all copies of Form 4684. Enter the total here.

You will deduct the portion of your personal casualty losses not attributable to a federally declared disaster to the extent the loss doesn’t exceed your personal casualty gains.

If you have personal casualty losses not attributable to a federally declared disaster, then you may need to use Worksheet 1.1 from the Form 4684 instructions to calculate the number that you enter into Line 14.

Line 15

For Line 15, you must compare the Line 13 and Line 14 entries before taking your next step. If you are also filing IRS Form 6251, Alternative Minimum Tax, please review additional guidance contained in the form instructions.

Line 13 is more than Line 14

This results in a capital gain.

Enter the difference in Line 15 and on Schedule D of your federal income tax return. When doing this, you will need to combine short-term gains with short-term losses, and long-term gains with long-term losses.

Enter any net short-term gain or loss on Line 4 of Schedule D. Enter any net long-term gain or loss on Line 11 of Schedule D.

Do not complete the rest of Section A.

Line 13 equals Line 14

Your reimbursements equal your loss amount. Enter zero here and stop. Do not complete the rest of Section A.

Line 13 is less than Line 14

If you have no qualified disaster losses subject to the $500 reduction on Line 11, then enter ‘0’ and proceed to Line 16.

If you have qualified disaster losses, then subtract Line 13 from Line 14. Enter the smaller of this difference or the number in Line 12.

Line 16

Add Line 13 & Line 15. Subtract this result from the number in Line 14.

Line 17

Enter 10% of your adjusted gross income (AGI) from Line 11 of:

- IRS Form 1040

- IRS Form 1040-NR

- IRS Form 1040-SR

For estates & trusts, executors and trustees may include the costs of administration when determining AGI.

Line 18

Subtract Line 17 from Line 16. If the result is zero or a negative number, enter ‘0.’

If applicable, also enter the result on one of the following:

- Schedule A, Line 15 (IRS Form 1040)

- Schedule A, Line 6 (IRS Form 1040-NR)

- Other Deductions (Estates & Trusts)

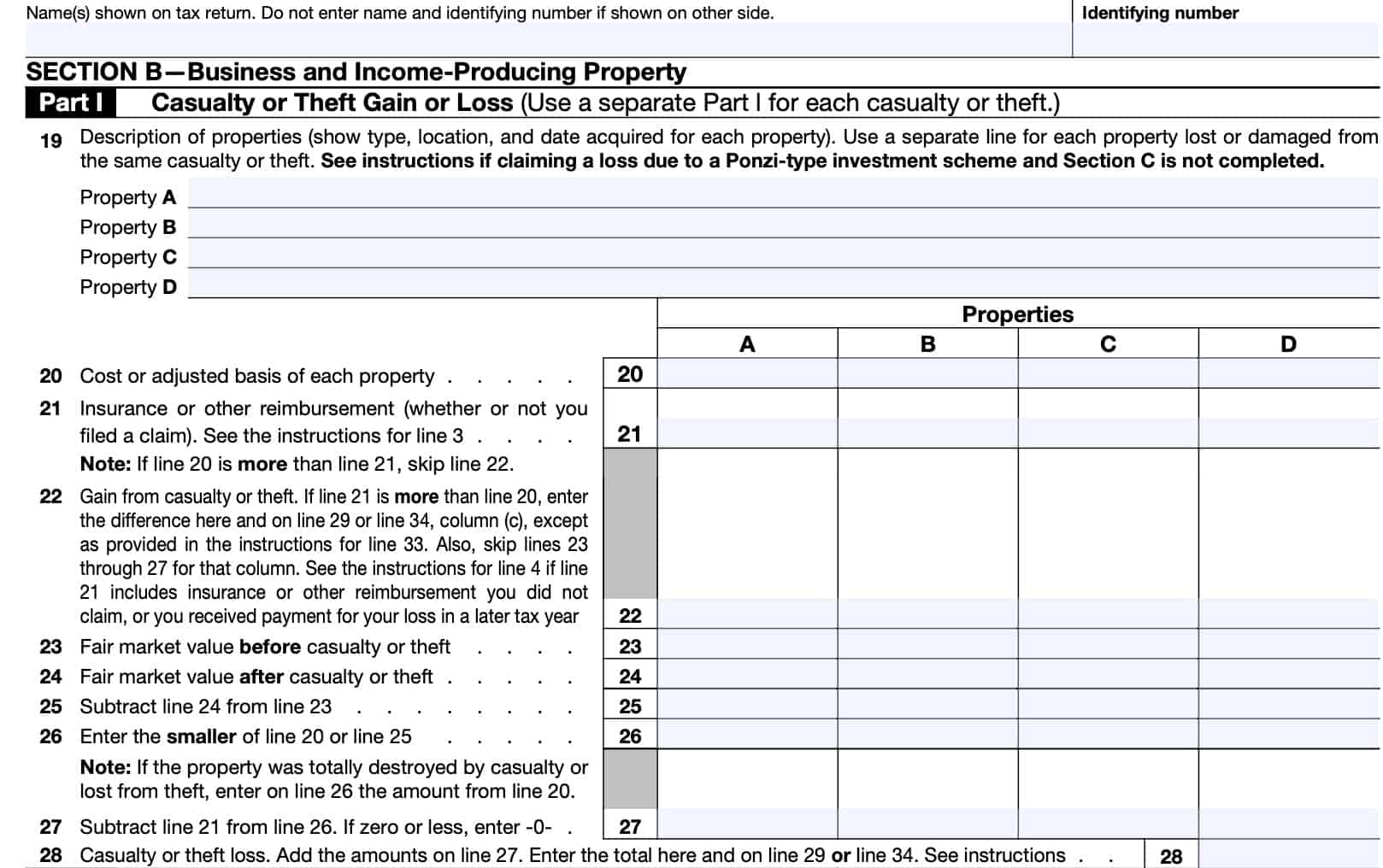

Section B: Business & Income-Producing Property

Use Section B to figure casualty or theft gains and losses for property that is used in a trade or business or for income-producing purposes.

If property is used partly in a trade or business and partly for personal purposes, such as a personal home with a rental unit, figure the personal part in Section A and the business part in Section B.

There are two parts in Section B:

- Part I: Casualty or Theft Gain or Loss

- Part II: Summary of Gains & Losses

Use a separate Part I (Lines 19 through 28) for each event of casualty or theft, or if you need to add additional forms because you have more than 4 qualifying properties.

The form instructions contain special rules for specific conditions that may apply. Refer to the form instructions if any of the following situations apply to you:

- Primary residence used for business or producing rental income

- Property used in a passive activity

- Losses from Ponzi-type schemes

- May use Section B or Section C

- Section 179 property of a partnership or S-corporation

- May be required to use IRS Form 4797 instead of Form 4684

Line 19

In Line 19, enter the property description for each item of property. If you have more than four items of business property for which you are claiming a tax deduction, you may need to use more than one Part I.

Line 20: Cost or adjusted basis of each property

Enter the cost basis or other basis, as adjusted, for each property, as listed in Line 19. For example, the cost basis for Property A should correspond to the property description of Property A in Line 19.

If you dispose of a portion of a Modified Accelerated Cost Recovery System (MACRS) asset as a result of a casualty event, you may need to complete IRS Form 4562, Depreciation and Amortization. See additional guidance in the form instructions.

Line 21: Insurance or other reimbursement

Follow the instructions for Line 3. Enter insurance or other reimbursement information in a similar manner.

Line 22

Follow the instructions for Line 4.

If Line 21 exceeds Line 20, enter the difference in Line 22, Line 29, and Line 34, Column (c). Skip Lines 23 through 27 for each column where this applies.

In cases where you had a casualty or theft gain from certain trade, business, or income-producing property held more than 1 year, you may have to recapture part or all of the gain as ordinary income.

If recapture rules apply, complete Form 4797, Part III, and this line, instead of Line 34, below.

Line 23: Fair market value before casualty or theft

You may use the instructions for Line 5 to help determine FMV before the casualty or theft event.

Line 24: Fair market value after casualty or theft

You may use the instructions for Line 6 to help determine FMV before the casualty or theft event. However, unlike personal use property, business property generally requires that you calculate improvements to each property separately, instead of collectively.

For example, if casualty damage occurs to both a building and to trees on the same piece of business real estate, measure the amount of loss separately for the building and for the trees.

Line 25

Subtract the Line 24 value from Line 23. This represents the decline in FMV due to the casualty or theft.

Line 26

In Line 26, enter the smaller of:

Line 27

Subtract Line 21 from Line 26. If this results in a negative number, enter ‘0.’

Line 28: Casualty or theft loss

Add the results across all columns in Line 27. Enter the total in Line 28 and either:

- Line 29, if the loss is related to property held one year or less, or

- Line 34, if the loss is related to property held for more than one year

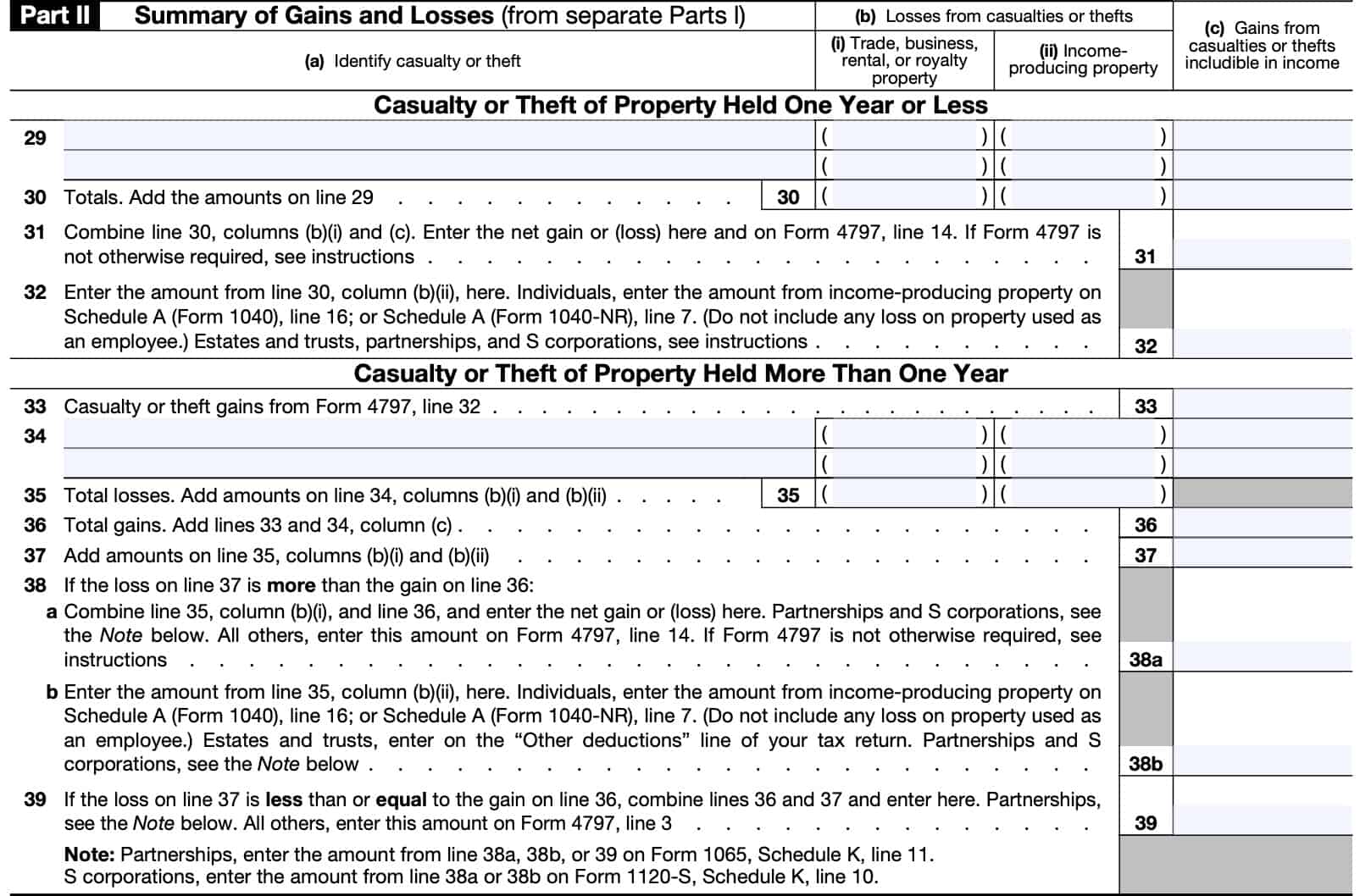

Line 29

For Line 29, you must list each property on a separate line. If you need more than 2 lines, add additional sheets for Part II.

In Line 29, enter the following information as it pertains to property held for one year or less:

Column (a)

Enter the type of casualty or theft event that occurred. As an example, if you’re declaring property loss due to a fire, you would enter ‘Fire.’

Column (b)

In Column (b)(i), enter the part of Line 28 that occurred from trade, business, rental, or royalty property.

In Column (b)(ii), enter the part of Line 28 that occurred to income-producing property, or property held for investment. This could include items such as:

- Stocks

- Notes

- Bonds

- Gold & silver

- Vacant lots

- Works of art

Column (c)

Enter the part from Line 22 that applies to property held for one year or less.

Line 30

Add all the amounts from Line 29 and enter the totals here. If using more than one sheet, combine all Line 29 totals and enter the result in the respective column.

Line 31

Combine Line 30, column (b)(i) and column (c). Enter the net gain or loss here and on IRS Form 4794, Line 14.

Line 32

Enter the amount from Line 30, column (b)(ii) in Line 32.

For individuals, enter this amount in the corresponding place on Schedule A:

- Form 1040: Schedule A, Line 16

- Form 1040-NR: Schedule A, Line 7

Estates and trusts, enter the amount from Line 32 on the “Other deductions” line of your tax return.

Partnerships, enter on Form 1065, Schedule K, Line 13d.

S-corporations, enter this amount on Form 1120-S, Schedule K, Line 12d. Next to that line, enter “Form 4684.”

Line 33

Enter any casualty or theft gains from IRS Form 4797, Line 32 here.

Line 34

For Line 34, you must list each property on a separate line. If you need more than 2 lines, add additional sheets for Part II.

In Line 34, enter the following information as it pertains to property held for more than one year:

Column (a)

Enter the type of casualty or theft event that occurred.

Column (b)

In Column (b)(i), enter the part of Line 28 that occurred from trade, business, rental, or royalty property.

In Column (b)(ii), enter the part of Line 28 that occurred to income-producing property, or property held for investment.

Column (c)

Enter the part from Line 22 that applies to property held for more than one year.

Line 35: Total Losses

Add the amounts on Line 34, columns (b)(i) and (b)(ii).

Line 36: Total Gains

Add the amounts on Line 33 and Line 34, column (c).

Line 37

Add the amounts on Line 35, columns (b)(i) and (b)(ii).

Line 38

Line 38a

If the Line 37 loss is more than the gain on Line 36, combine Line 35, column (b)(i), and Line 36. Enter the net gain or loss in Line 38a.

Taxpayers, other than partnerships and S corporations, if Form 4797 isn’t otherwise required, enter the amount from this line on the appropriate line for the form you are filing.

Line 38b

Enter the amount from Line 35, column (b)(ii) here. Individuals should enter this amount on the appropriate line in Schedule A:

- Form 1040: Line 16

- Form 1040-NR: Line 7

Estates and trusts enter this amount under ‘other deductions’ on your income tax return.

Partnerships, enter the amount for Line 38a, Line 38b, or Line 39 on Form 1065, Schedule K, Line 11.

S-corporations, should enter the amount for Line 38a, Line 38b, or Line 39 on Form 1120-S, Schedule K, Line 10.

Line 39

If the Line 37 loss is less than or equal to the gain on Line 36, combine Line 35 & Line 36, then enter the total here. Partnerships & S-corporations should follow the Line 38 instructions.

All other taxpayers should enter this amount on Line 3 of IRS Form 4797.

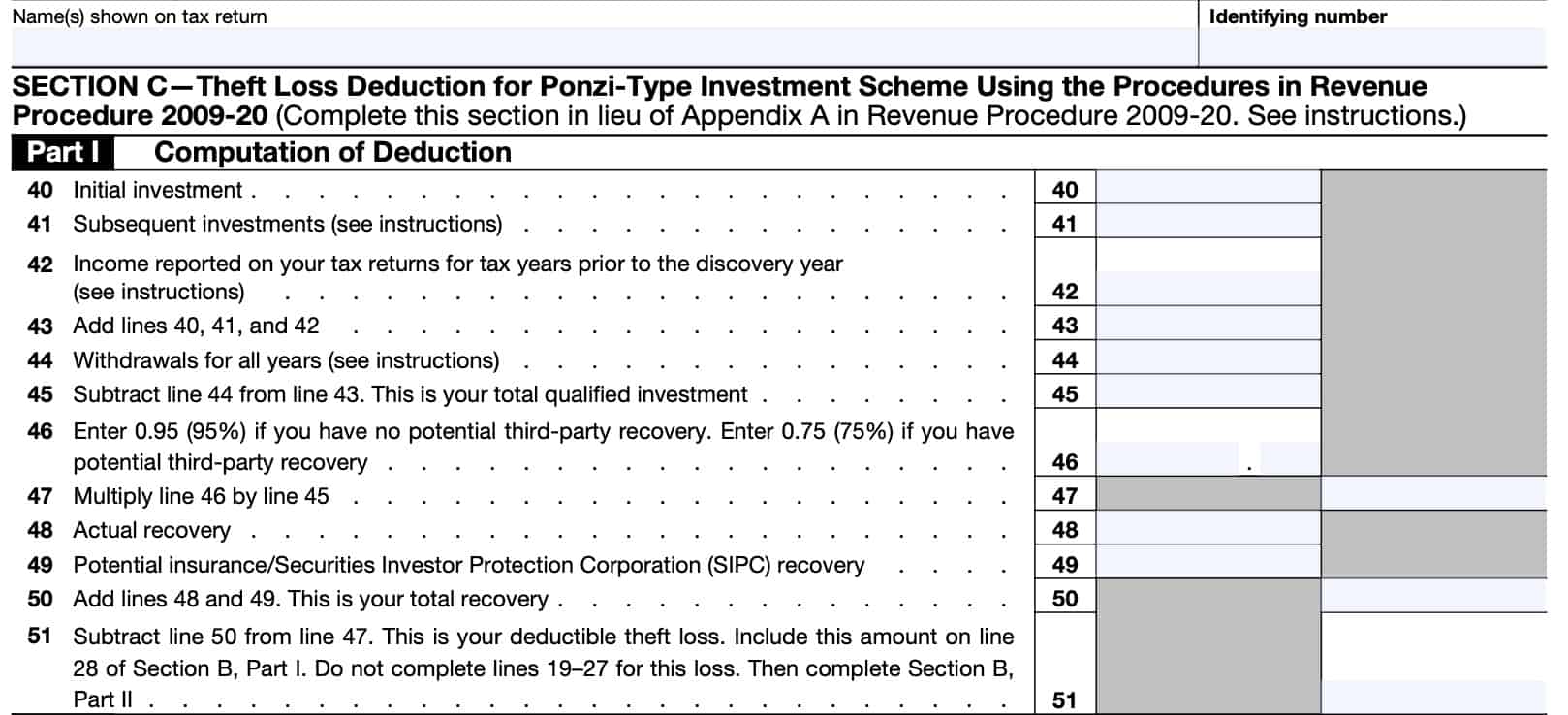

Section C: Theft Loss Deduction

Use Section C to figure a theft loss deduction from a Ponzi-type investment scheme if you qualify to use Revenue Procedure 2009-20, as modified by Revenue Procedure 2011-58, and choose to follow the procedures in the guidance.

Section C of Form 4684 replaces Appendix A, previously listed in Revenue Procedure 2009-20. You don’t need to complete Appendix A.

Don’t fill out Section C if you don’t qualify to use the procedures in Revenue Procedure 2009-20, as modified by Revenue Procedure 2011-58, or you don’t choose to follow them. Instead, go to the instructions for Section B.

Line 40: Initial investment

Enter the initial amount of cash or basis of property that you invested in the investment arrangement.

Don’t include any of the following on this line, Line 41, or Line 42.

- Amounts borrowed from the responsible group and invested in the specified fraudulent arrangement

- To the extent the borrowed amounts weren’t repaid at the time the theft was discovered.

- Amounts such as fees that were paid to the responsible group and deducted for federal income tax purposes

- Amounts reported to you as taxable income that weren’t included in gross income on the investor’s federal income tax returns

- Cash or property that you invested in a fund or other entity that invested in a specified fraudulent arrangement

- Separate from you (the qualified investor) for federal income tax purposes

Line 41: Subsequent investments

In Line 41, enter the amounts of cash or the basis of property that you invested after you made the initial investment. This includes any amounts reinvested into the scheme.

Line 42: Income reported on your tax return

Enter the total amounts of net income from the specified fraudulent arrangement that, consistent with information received from that arrangement, you included in income for federal tax purposes for all tax years before the discovery year.

For example, you would include interest and dividends, minus expenses, as income reported on a previous tax return. This includes tax years for which a refund for an amended return is barred by the statute of limitations.

Line 43

Add the following:

- Line 40

- Line 41

- Line 42

Enter the sum here.

Line 44: Withdrawals for all years

Enter the total amount of cash or property that you withdrew from the investment arrangement in all years, regardless of whether it was designated as income, return of principal, or both.

Line 45: Total qualified investment

Subtract Line 44 from Line 43. Enter the total here.

This represents your total qualified investment.

Line 46

Enter either of the following, based upon whether you have potential third-party recovery for any of your stolen property:

- If you have no potential third-party recovery: Enter .95 (95%)

- If you have potential third-party recovery: Enter .75 (75%)

Potential third-party recovery is the amount of all actual or potential claims for recovery, as of the last day of the discovery year, that are not from potential insurance or Securities Investor Protection Corporation (SIPC) recovery, or a potential direct recovery.

The discovery year is the tax year when one of the following occurs.

- The indictment, information, or complaint described in Section 4.02(1) or (2) of Revenue Procedure 2009-20 (as modified by Revenue Procedure 2011-58) is filed.

- The complaint or similar document described in Section 4.02(3) of Revenue Procedure 2009-20 (as modified by Revenue Procedure 2011-58) is filed, or the death of the lead figure occurs, whichever is later.

Line 47

Line 48: Actual recovery

Enter amounts you actually received as a reimbursement or recovery from any source.

Don’t include amounts that are potential direct recoveries or potential third-party recoveries.

Line 49: Potential insurance/SIPC recovery

Enter the potential recovery from either insurance or the Securities Investor Protection Corporation (SIPC). This is the total of all actual or potential claims for reimbursement that, as of the last day of the discovery year, are attributable to:

- Insurance policies in your name that protect you from this type of loss;

- Contractual arrangements, other than insurance, that guaranteed or otherwise protected against this type of loss; or

- Amounts payable from SIPC, as advances for customer claims under the Securities Investor Protection Act of 1970, or by a similar entity under a similar provision.

Line 50: Total recovery

Add Lines 48 & 49. This represents your total recovery.

Line 51: Deductible theft loss

Subtract Line 50 from Line 47. This represents the amount of your theft loss that you may deduct. Include this amount on Line 28 in Section B, but do not complete Lines 19-27.

Instead, complete Section B, Part II.

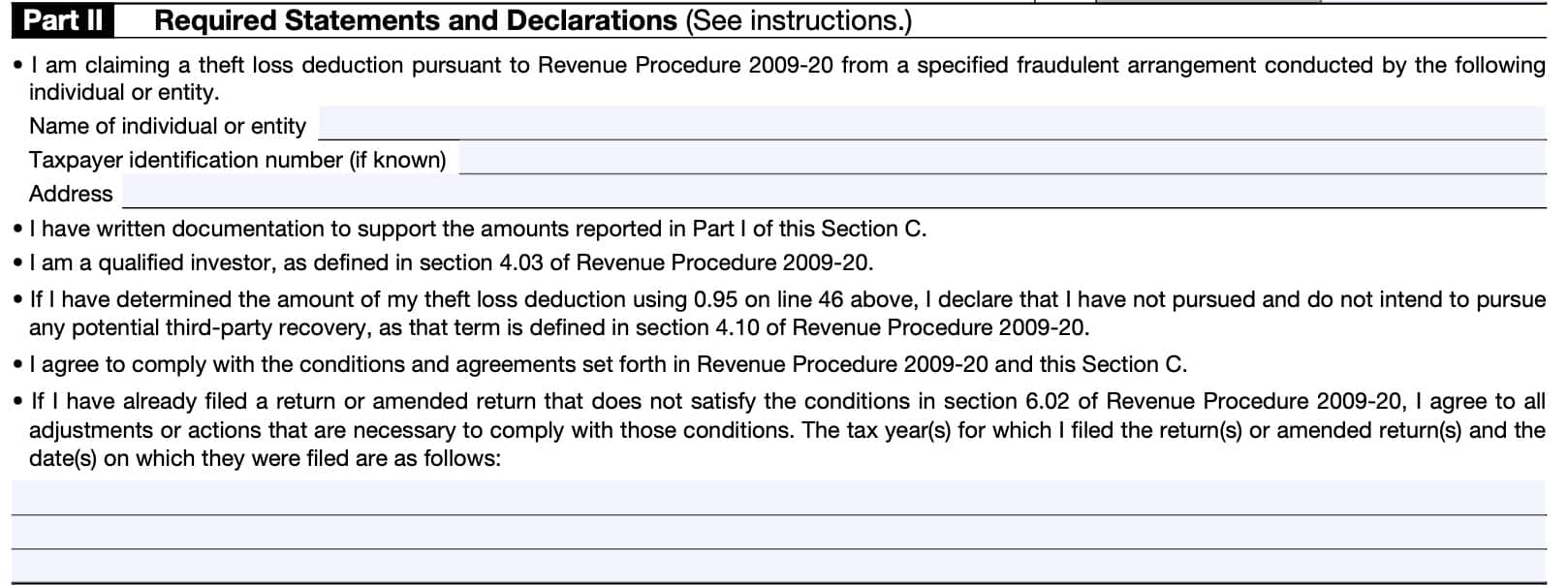

Part II

In Part II, you are claiming a theft loss deduction from a specified fraudulent arrangement conducted by a specific individual or entity.

Enter the name, taxpayer identification number (if known), and address of the person or entity.

In Part II, you are agreeing to the following:

- You have written documentation to support everything you reported in Section C

- You are a qualified investor, according to the definition in Revenue Procedure 2009-20

- You have not pursued, and do not intend to pursue third-party recovery, if you’ve determined the amount of your loss using .95 on Line 46, above

- You agree to comply with the conditions and agreements outlined in Rev. Proc. 2009-20 and this form

- If you have already filed a tax return or amended return that doesn’t satisfy all conditions outlined in Rev. Proc. 2009-20, you will agree to any adjustments or necessary actions.

- List the tax years for which you’ve previously filed a federal income tax return or amended tax return, as well as the filing dates.

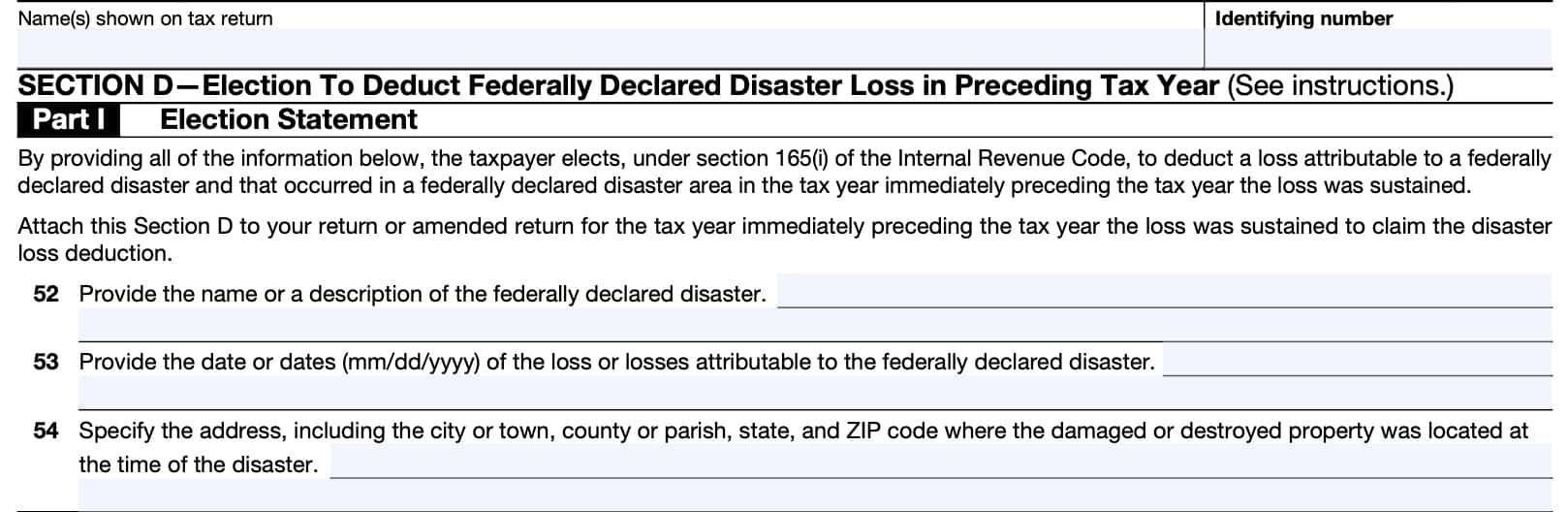

Section D: Election to Deduct Federally Declared Disaster Loss in Preceding Tax Year

Use Section D to elect to deduct in the immediately preceding tax year a loss that was attributable to a federally declared disaster and occurred in a federally declared disaster area. You can also use Section D to revoke such an election.

You must make this election on or before the date that is 6 months after the regular due date for filing your original return (without extensions) for the disaster year.

Attach this Section D to your tax return for the tax year immediately preceding the tax year that the loss was sustained to claim the disaster loss deduction.

Line 52

Part I, the election statement, consists of Lines 52 through 54.

In Line 52, provide the name or description of the federally declared disaster.

Line 53

Provide the date of the loss attributable to the disaster. If more than one date, enter all applicable dates.

Line 54

Enter the address where the disaster loss took place. Specify the following:

- Street address

- City

- Count

- State

- Zip code

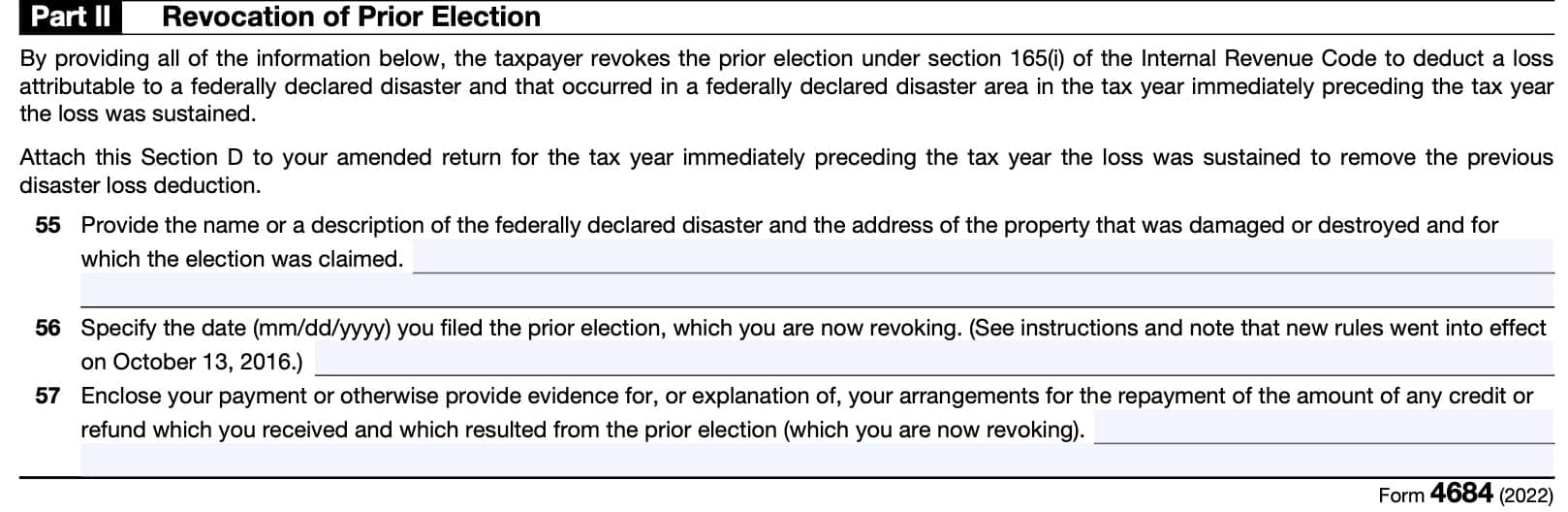

Line 55

Part II, Revocation of Prior Election, consists of Lines 55 through 57.

Attach Section D of Form 4684 to your amended return for the tax year immediately preceding the tax year the loss was sustained to revoke the previous disaster loss deduction. You must file this amended return for the preceding year on or before the date you file the original return or amended return for the disaster year on which you claim the disaster loss.

You can revoke the prior election on or before the date that is 90 days after the due date for making the election.

In Line 55, enter the name or description of the disaster, and the address of the damaged or destroyed property for which you claimed the prior election.

Line 56

Specify the date you filed the prior election.

Line 57

If you received a credit or refund for the prior election, you may either:

- Enclose your outstanding tax payment

- Provide evidence or an explanation for your plan to repay the outstanding credit or refund

Losses you can deduct from taxable income

For tax years 2018 through 2025, individuals can only claim a tax deduction for casualty losses due to a federally declared major disaster. These are known as federal casualty losses.

The exception to this rule exists for when a taxpayer has personal casualty gains and losses on different properties. This exception then allows the taxpayer to use losses to offset the capital gains, to the extent that the losses don’t exceed the gains.

The IRS website highly encourages insured taxpayers to file a timely insurance claim for reimbursement. If you don’t file a timely insurance claim, you can’t deduct the full unrecovered amount as a casualty or theft loss. In this situation, only the part of the loss that isn’t covered by your insurance policy is deductible.

For example, John Smith’s car, worth $2,000, is completely destroyed in a flood caused by a federally declared disaster. His deductible is $500, but he decides not to file a claim because he believes that the insurance company will cancel the policy. Because John’s insurance policy technically covers the loss of the car (minus the deductible), John is only able to claim the deductible amount as a casualty loss on his tax return.

Losses you cannot deduct from taxable income

According to the IRS, you cannot deduct any of the following losses on IRS Form 4684:

- Misplaced or lost cash or property

- Breakage of personal property, such as china, glassware, or furniture, under normal conditions

- Progressive deterioration to property over time

- Decline in market value of investments, even if caused by accounting misconduct or other illegal behavior by officers or directors of the corporation issuing the stock, if the stock was acquired on the open market.

- Might be deductible as a capital loss on Schedule D if the stock is sold, exchanged, or becomes worthless

Video walkthrough

Watch this tutorial video to walk through claiming casualty and theft tax deduction on IRS Form 4684.

Do you use TurboTax?

If you don’t, is it because the choices are overwhelming to you?

If so, you should check out our TurboTax review page, where we discuss each TurboTax software product in depth. That way, you can make an informed decision on which TurboTax offering is the best one for you!

Click here to learn more about which TurboTax option is best for you!

Frequently asked questions

To qualify as a casualty loss, the lost must result from the damage, destruction, or loss of your property from any sudden, unexpected, or unusual event. Examples include flood, hurricane, tornado, fire, earthquake, or volcanic eruption. A casualty doesn’t include normal wear and tear or progressive deterioration. Federal casualty losses, disaster losses and qualified disaster losses are three categories of casualty losses that refer to federally declared disasters.

The IRS considers business property to have been stolen if someone with criminal intent specifically intended to deprive you of the money or property. The taking must be illegal under the law of the state where it occurred and must have been done with criminal intent.

The Robert T. Stafford Disaster Relief & Emergency Assistance Act, signed into public law in 1988, amended the Disaster Relief Act of 1974 to specifically grant FEMA statutory authority over most federal disasters, including natural disasters.

You may deduct qualified disaster losses on IRS Form 4684 without itemizing other deductions on Schedule A, and your net casualty loss does not need to exceed 10% of adjusted gross income. However, the $100 limit per casualty increases to $500.

Where can I find IRS Form 4684?

Related tax forms

This tax form is one of the fillable tax forms provided by the Internal Revenue Service, to help taxpayers reduce their tax preparation costs. To see more forms like this, visit our free fillable tax forms page, where you’ll also find articles like this.

Unlike the IRS, our articles contain step by step instructions for each tax form, as well as video walkthroughs. You can also check out all of our videos by subscribing to our YouTube channel!