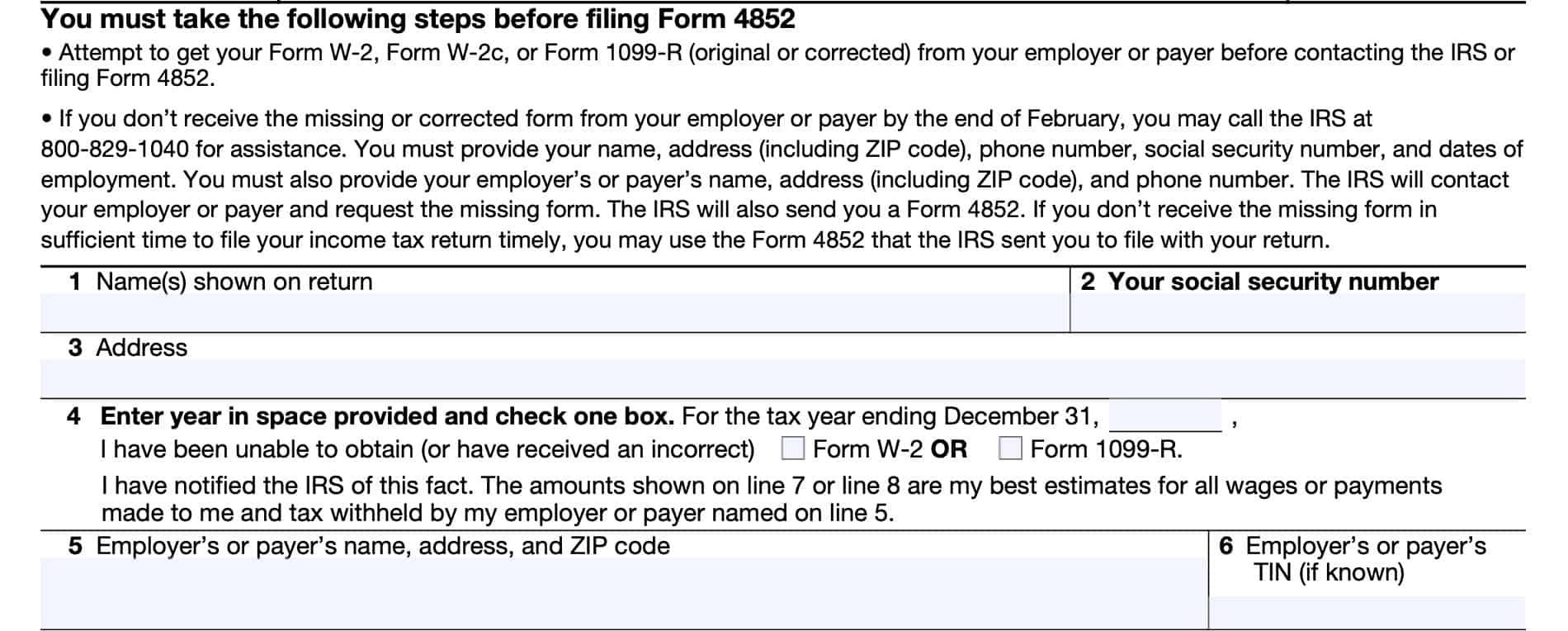

IRS Form 4852 Instructions

It’s tax time. You’re scrambling to find all of your documents, but realize that your Form W-2 is missing. If you cannot get a copy of your W-2 form, then you may be able to use IRS Form 4852 as a substitute for a missing form when you file your federal income tax return.

This in-depth article will break down what you need to know about this tax form, including:

- Which IRS forms you can use this form in place of

- Steps you should take before using Form 4852

- How to complete this form

- Things to watch out for when using this form

Let’s start with step by step instructions on completing IRS Form 4852.

Table of contents

How do I fill out IRS Form 4852?

This form is relatively easy to fill out, assuming you have the correct information at hand. Let’s go through this form, step by step.

Line 1-Name

Insert your full name, as shown on your tax return.

Line 2-Social Security number

Insert your Social Security number, as shown on your tax return.

Line 3-Address

Insert your address, as shown on your tax return.

Line 4-Tax year

Which tax year is in question?

Line 5-Employer or payer information

Insert your employer’s name, address, and zip code

Line 6-Employer or payer’s taxpayer identification number (TIN)

If known, insert employer’s TIN. If not, check previous year W-2 or 1099-R information.

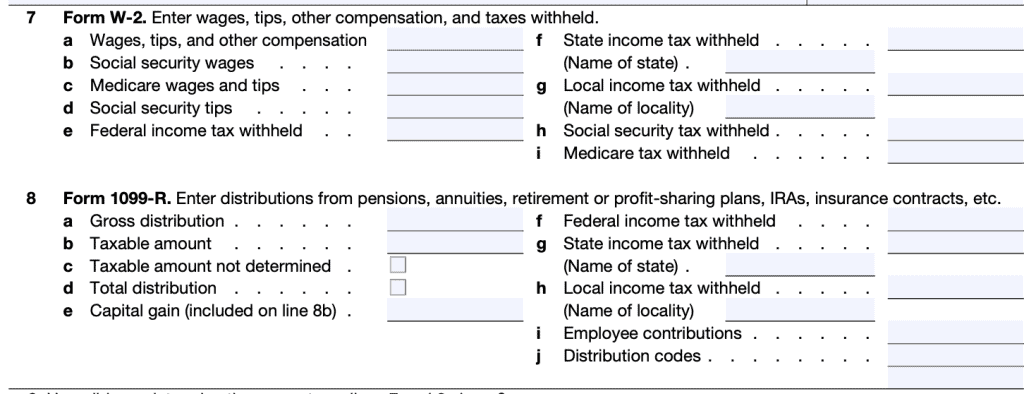

Line 7-Form W-2 information

If you don’t have a copy of your W-2, you may be able to use your final pay stub for the previous year. You should have all the information you need to complete the form as shown below.

This would include:

- Wages, tips, or other compensation

- Social Security wages

- Medicare wages and tips

- Social Security tips, if applicable

- Federal, state, and local income tax withheld-If state and local income tax are withheld, names of state & locality

- Social Security tax withheld

- Medicare tax withheld

Line 8-Form 1099-R information

You’ll use line 8 to enter distributions from pensions, annuities, retirement or profit-sharing plans, IRAs, or insurance contracts.

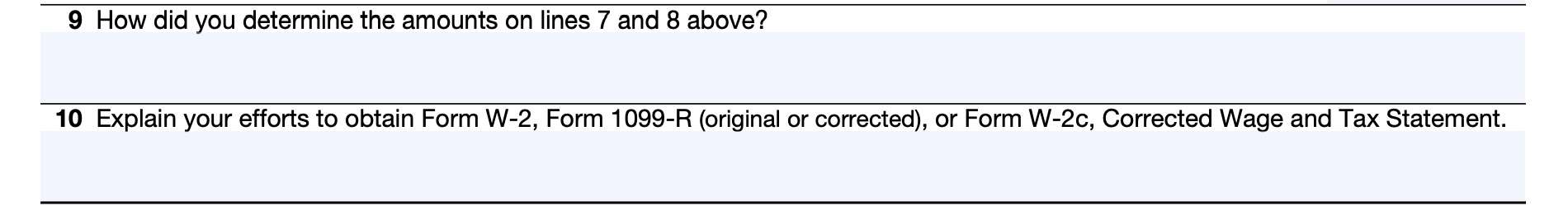

Line 9-How you came up with information in Lines 7 or 8

You’ll use this line to explain how you came up with the information reported in line 7 or 8. This could be with:

- Paystub information

- Estimate

- Written statement

- Other documentation you obtained or kept

Line 10-Efforts to obtain official form

Use this line to explain your attempts to obtain an official copy from your employer or payer.

What is IRS Form 4852?

IRS Form 4852 is also known as Substitute for Form W-2, Wage and Tax Statement, or Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc.

In other words, this form serves as a substitute for the following tax forms:

- Form W-2

- Form W-2c

- Form 1099-R

What you should know before using Form 4852

According to the Internal Revenue Service, there are a some things you should know before reporting this information on your own.

You should try to contact your employer first.

Employers are supposed to file their employee W-2 forms by January 31st of the year following the tax year in question. But if you haven’t received your form by then, you should follow up with your employer as the first option.

Similarly, if you notice that your W-2 is incorrect, you should work with your employer to obtain a correct version with accurate information. At this point, you still have sufficient time to get your documents so that you (or your tax professional) can submit your tax return on time.

If, by the end of February, you’re still missing your W-2, then you might need to enlist the IRS for help.

You can contact the IRS for assistance

The IRS website recommends reaching out directly to the IRS about your missing W-2 after the end of February. You can reach the IRS at: (800) 829-1040.

During this call, be prepared to provide the following information:

- Taxpayer name

- Taxpayer address, including zip code

- Phone number

- Social Security number

- Dates of employment

- Employer’s name or payer’s name

- Employer’s address (including zip code)

- Employer’s phone number

The IRS will attempt to contact your employer to obtain your missing form, and will send you a copy of Form 4852 to complete. If you don’t receive the forms from your employer in a timely manner, you can complete the IRS form as a substitute.

What happens if my employer sends a W-2 after I’ve filed my tax return?

It depends. If the information that you originally submitted is found to be incorrect, you may have to file an amended return. You would file an amended return by using IRS Form 1040-X, Amended U.S. Individual Income Tax Return.

However, you should consult with your tax professional before moving forward with an amended return.

If you feel that your information is correct, you probably will need to justify your position with pay stubs, an earnings statement, or other additional information that shows what compensation you actually received. Again, discuss this with your tax professional, and proceed with caution.

Penalties may apply if you use IRS Form 4852 incorrectly

The IRS website clearly states that individuals who incorrectly use this form to reduce their federal tax liability will face stiff consequences. Below are a few of the penalties that the IRS can impose:

- Accuracy-related penalty. This can be equal to 20% of the taxes that should have been paid had the return been filed correctly

- Civil fraud penalty. This penalty can be equal to 75% of the taxes that should have been paid with a correctly filed tax return

- $5,000 civil penalty for filing a frivolous tax return

Taxpayers are responsible for reporting accurate information on their income tax return. However, you’ll want to keep accurate records for Social Security purposes.

You’ll want to keep a copy for your records

The Social Security Administration uses your tax information to calculate your Social Security payments. If you keep a copy of IRS Form 4852 on hand, you can use this information to ensure your pay history information is accurate.

Video walkthrough

Watch this instructional video to learn more about using Form 4852 as a substitute for missing wage statements or 1099-R forms.

Do you use TurboTax?

If you don’t, is it because the choices are overwhelming to you?

If so, you should check out our TurboTax review page, where we discuss each TurboTax software product in depth. That way, you can make an informed decision on which TurboTax offering is the best one for you!

Click here to learn more about which TurboTax option is best for you!

Frequently asked questions

A taxpayer may use Form 4852 as a substitute for a Form W-2 or 1099-R when your employer or payer does not issue you a Form W-2 or 1099-R, OR your employer or payer has issued an incorrect Form W-2 or 1099-R without correcting it.

Before filing IRS Form 4852 with your tax return, you should attempt to contact your employer to see if they will issue a new W-2. If not, contact the IRS for assistance. If the IRS cannot help you, then you may need to file Form 4852 using information from your pay records.

How can I obtain a copy of IRS Form 4852?

You may download a copy of the tax form from the IRS website or by clicking the attachment below.