IRS Form 5329 Instructions

If you’ve incurred additional taxes in your individual retirement account or one of your other tax-favored accounts, the IRS may require you or your tax professional to complete IRS Form 5329 to accompany your federal income tax return.

In this article, we’ll break down everything you need to know about this tax form, including:

- The purpose of IRS Form 5329

- How to complete IRS Form 5329

- Tax tips on how to avoid additional taxes in future tax returns

Table of contents

Let’s start by reviewing the form itself.

How to complete IRS Form 5329

There are 9 parts to this form, based on the different tax penalty calculations:

- Part I: Additional Tax on Early Distributions

- Part II: Additional Tax on Certain Distributions from Education Accounts and ABLE Accounts

- Part III: Additional tax on Excess Contributions to Traditional IRAs

- Part IV: Additional Tax on Excess Contributions to Roth IRAs

- Part V: Additional Tax on Excess Contributions to Coverdell ESAs

- Part VI: Additional Tax on Excess Contributions to Archer MSAs

- Part VII: Additional Tax on Excess Contributions to Health Savings Accounts

- Part VIII: Additional Tax on Excess Contributions to an ABLE Account

- Part IX: Additional Tax on Excess Accumulation in Qualified Plans

It’s highly unlikely that any taxpayer will need to use all 9 parts in a single tax return.

In this walk-through, we’ll break down each part of this form. This way, you can understand how the IRS would calculate any applicable tax penalty. We’ll also discuss tips on how to avoid each penalty in the future.

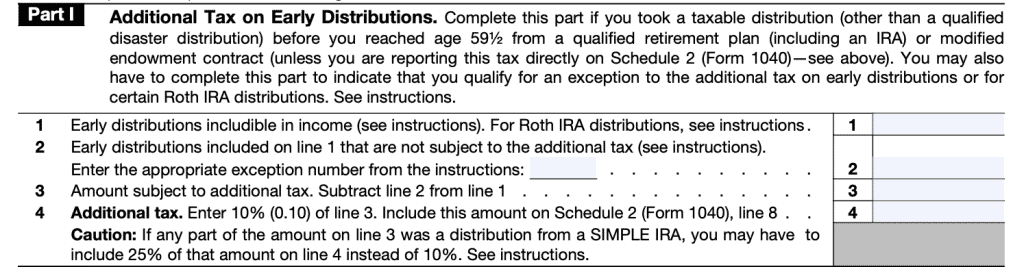

Part I: Additional Tax on Early Distributions

What is this tax penalty?

This early distribution penalty applies to retirement accounts where the account holder is under the age of 59 ½ and does not qualify for an early withdrawal exception. This applies to all pre-tax retirement accounts, including:

- Traditional IRAs

- Certain Roth IRA distributions

- SIMPLE IRAs

- SEP IRAs

- Employer plans, like a 401k

There are early withdrawal penalty exceptions, depending on the type of account. These exceptions may include:

- Qualified distributions for higher education expenses

- First-time homebuyer distributions

- Qualified reservist distribution for reservists on active duty

- Qualified reservist distributions require the member to be on active duty orders of 180 days or more

- Qualified disaster distributions or qualified disaster recovery distributions

- IRS Form 8915-F, Qualified Disaster Retirement Plan Distributions and Repayments, contains additional information

The IRS website maintains a comprehensive list of all exceptions to the early withdrawal penalty for qualified retirement plan distributions, based upon account type.

How does the IRS calculate the tax penalty?

For most accounts, the early withdrawal penalty is 10% of the total withdrawal amount. As an example, if you withdrew $10,000 from your IRA as an early withdrawal, then your penalty would be $1,000.

For withdrawals from a SIMPLE IRA, the early distribution penalty is 25% of the total withdrawal.

To calculate this, IRS Form 5329 will ask you to enter:

- Line 1: Enter the entire early withdrawal amount under Line 1

- Line 2: Enter the amount eligible for an early withdrawal exception according to the Form 5329 instructions

- Line 3: Subtract the difference

- Line 4: Multiply by 10% (or 25% for distributions from a SIMPLE IRA). This is your early distribution tax.

How do I avoid this additional tax in the future?

Depending on your particular situation, there are several ways you may have run afoul of this penalty rule. Below are some suggestions on avoiding this in future tax years.

Don’t move money between accounts by yourself

Sometimes, an IRA owner might run afoul of this rule when attempting to do Roth conversions or rolling over their 401k into an IRA. The best way to avoid this mistake is to never personally withdraw money from your account without knowing the rules, like the 60-day transfer rule.

When in doubt, discuss your options with your financial advisor or IRA custodian.

Consider other sources of cash

If you don’t have any other place to get cash from, perhaps you’ll have to accept the IRS penalties that come from taking money from your IRA. But if you have assets elsewhere, you should talk with your financial planner about the most tax-efficient way to generate cash for your needs.

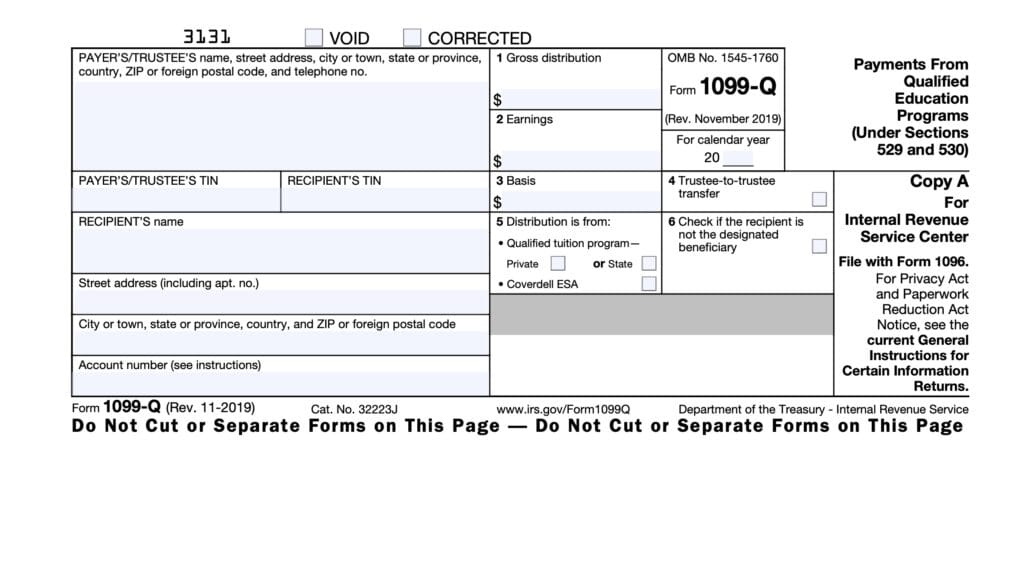

Check the distribution code on your tax forms

If you believe that your transaction should have been a tax-free one, check the distribution code on your IRS Form 1099-R. If your IRA custodian or financial institution improperly coded the distribution code as a taxable transaction, you may need to address that issue with them.

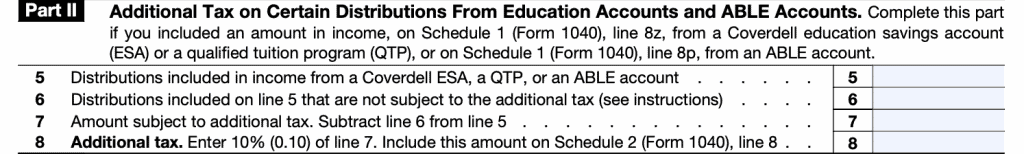

Part II: Additional Tax on Certain Distributions From Education Accounts and ABLE Accounts

What is this tax penalty?

This tax penalty applies to withdrawals that are included in taxable income, and not otherwise exempt. This applies to:

- Coverdell ESAs

- ABLE accounts

- Qualified tuition plans (also known as 529 plans)

How does the IRS calculate the tax penalty?

The tax penalty is 10% of the total amount that is subject to additional tax.

To calculate this, IRS Form 5329 will ask you to enter:

- Line 5: Enter the entire early withdrawal amount included in income from any of the following:

- Coverdell ESA

- QTP or 529 plan

- ABLE account

- Line 6: Enter the amount that is not subject to additional tax

- Line 7: Subtract the difference

- Line 8: Multiply by 10% and include this amount on Schedule 2, Line 8

How do I avoid this additional tax in the future?

The best way to avoid this tax is to ensure that your withdrawals are made to cover either qualified educational expenses (for QTP plans or ESAs), or qualified special needs expenses (for ABLE accounts).

Coverdell ESAs

For Coverdell ESAs, there is an age limit. The entire account must be completely withdrawn by the beneficiary’s 30th birthday.

If not, the money is automatically disbursed to the beneficiary, and the 10% penalty is applied to any withdrawal amount not used for college expenses.

Part III: Additional Tax on Excess Contributions to Traditional IRAs

What is this tax penalty?

This penalty applies to excess IRA contributions to a traditional IRA. If you contributed more than the annual limit to a traditional IRA in the current tax year or a prior year, you’ll follow the steps outlined in Part III.

How does the IRS calculate the tax penalty?

The tax penalty is 6% of the smaller of:

- Excess amount of contributions for current tax year and prior tax years, OR

- Total value of traditional IRAs, including nondeductible IRAs, on December 31 of the current tax year

Enter this taxable amount on Schedule 2, Line 8.

How do I avoid this additional tax in the future?

This penalty is fairly easy to avoid. There are two things worth noting:

You can remove the excess contribution before the tax-filing deadline without penalty

If you catch your mistake before tax day, simply contact your IRA custodian to move the money to another account before tax day arrives. No harm, no foul.

You still have options after the tax deadline

You can either:

- Remove the contributions (plus earnings attributed to those contributions) by October 15, and file an amended tax return (known as corrective distributions), or

- Reduce your next year contributions by the appropriate amount to offset the over-contribution

In the first scenario, you’ll probably want to engage your accountant to help you calculate the correct amount for withdrawal.

With the second scenario, you’ll still be on the hook for your 6% penalty until the excess contribution no longer exists.

Part IV: Additional Tax on Excess Contributions to Roth IRAs

What is this tax penalty?

Like Part III, this tax penalty applies to excess IRA contributions. However, Part IV primarily focuses on excess Roth IRA contributions.

How does the IRS calculate the tax penalty?

Just like with Part III, the tax penalty is 6% of the smaller of:

- Excess contributions for current tax year and prior tax years, OR

- Total value of Roth IRAs on December 31 of the current tax year

How do I avoid this additional tax in the future?

The most common mistake people make with Roth IRA contributions is making them when their adjusted gross income is too high. If that’s the case, the Internal Revenue Service allows the taxpayer to move Roth IRA contributions to a traditional account.

Filing an amended return

According to the IRS instructions, if you timely filed your return without withdrawing the excess contributions, you can still make the withdrawal no later than 6 months after the due date of your tax return, excluding extensions.

If you do, file an amended return with “Filed pursuant to Section 301.9100-2” entered at the top.

Part V: Additional Tax on Excess Contributions to Coverdell ESAs

What is this tax penalty?

Coverdell ESAs are subject to a $2,000 annual contribution limit per beneficiary. This section covers excess Coverdell ESA contributions, either in the current tax year or in a previous year.

How does the IRS calculate the tax penalty?

The tax penalty is 6% of the smaller of:

- Excess contributions for current tax year and prior tax years, OR

- Total value of Coverdell ESAs on December 31 of the current tax year

How do I avoid this additional tax in the future?

The simplest way to avoid overcontributing to a Coverdell ESA is to open a qualified tuition plan, or 529 plan.

Many states offer income tax benefits for 529 plan contributions, and the annual maximum contribution limit is significantly higher than with a Coverdell education savings account.

Part VI: Additional Tax on Excess Contributions to Archer MSAs

What is this tax penalty?

If you participate in an Archer medical savings account (known as an Archer MSA,) either you or your employer may be eligible to contribute to your Archer MSA account to help pay for qualified medical expenses.

This tax applies to excess contributions that are not withdrawn from the MSA account by the tax filing date.

How does the IRS calculate the tax penalty?

The tax penalty is 6% of the smaller of:

- Excess contributions for current tax year and prior tax years, OR

- Total value of your Archer MSAs on December 31 of the current tax year

How do I avoid this additional tax in the future?

The best way to avoid this additional tax is to fully understand your employer’s contribution policy. Once you understand the contribution policy, then you can talk with your certified public accountant (CPA) or tax professional about how much you can contribute without incurring a penalty.

Part VII: Additional Tax on Excess Contributions to Health Savings Accounts

What is this tax penalty?

If you participate in a health savings account (HSA), either you or your employer may be eligible to contribute to your HSAnt. This tax applies to excess contributions that are not withdrawn from the HSA account by the tax filing date.

How does the IRS calculate the tax penalty?

The tax penalty is 6% of the smaller of:

- Excess contributions for current tax year and prior tax years, OR

- Total value of your HSA balances on December 31 of the current tax year

How do I avoid this additional tax in the future?

The best way to avoid this additional tax is to fully understand your employer’s HSA contribution policy.

Once you understand the contribution policy, then you can talk with your tax professional about how much you can contribute without incurring a penalty.

Part VIII: Additional Tax on Excess Contributions to an ABLE Account

What is this tax penalty?

According to the Internal Revenue Code, ABLE account contributions are limited to the annual gift tax limit ($18,000 in 2024).

Certain working ABLE account beneficiaries are able to contribute an additional amount.

This additional amount is the lesser of:

- Total compensation

- The annual poverty line amount for the beneficiary’s geographic location.

How does the IRS calculate the tax penalty?

The tax penalty is 6% of the smaller of:

- Excess contributions for current tax year and prior tax years, OR

- Total value of your HSA balances on December 31 of the current tax year

How do I avoid this additional tax in the future?

ABLE account over-contributions may be withdrawn, without penalty, if done before the tax filing deadline for the tax year. If done after the deadline, then earnings on the over-contribution must also be withdrawn.

Part IX: Additional Tax on Excess Accumulation in Qualified Plans

What is this tax penalty?

Taxpayers age 72 or older generally must start withdrawing a certain minimum amount from either their qualified retirement plan or IRA each year. This is known as a required minimum distribution, or RMD.

If a taxpayer does not take the required minimum distributions for a given tax year, this penalty applies.

How does the IRS calculate the tax penalty?

This penalty is either 10% or 25% of the RMD that should have been taken in a given tax year, but was not.

The form instructions contain a worksheet to help taxpayers determine whether or not they qualify for the 10% tax rate on excess accumulations. For a step by step walkthrough, you can watch this brief YouTube video.

How do I avoid this additional tax in the future?

The only way to avoid the excess accumulation tax is to take the money from your account each year.

Qualified charitable distributions

However, if you do not wish to pay the taxes on your withdrawal, you can consider qualified charitable distributions, or QCDs.

There are a few things you should know if considering a QCD:

- QCDs can only be done from an IRA. If you have RMDs from a workplace retirement plan, you must transfer that to an IRA, then perform your QCD.

- QCDs are counted in the calendar year they are made. Unlike IRA contributions, which can be made prior to the tax filing deadline, a QCD must be done by December 31 in the calendar year in order to be considered for that tax year.

- There is a limit. Each taxpayer may make $100,000 in QCDs per year. Any RMD amount for a taxpayer above $100,000 must be withdrawn, and taxes paid to avoid penalty.

- Only qualified charities count.

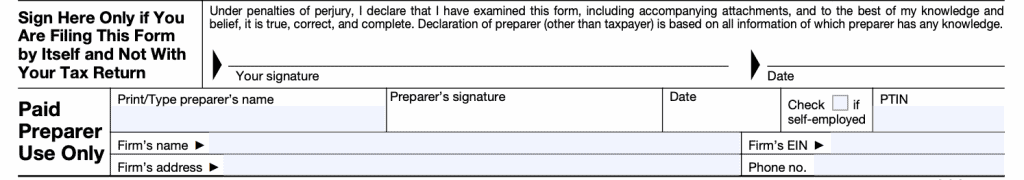

Signature field

If you are completing this form as part of your tax return, then you do not sign IRS Form 5329. Your tax preparer will complete the information under the Paid Preparer Use Only field.

In some instances, you may be required to complete this form even if you are not filing a federal income tax return. The most common instance of this might be for ABLE account holders who otherwise would not be required to file a tax return, due to income.

In this case, your signature states that this form and accompanying attachments are accurate to the best of your knowledge, under penalties of perjury.

When do additional taxes apply to a tax-advantaged account?

Generally speaking, additional taxes apply to a tax-advantaged account when the taxpayer runs afoul of the provisions that provide the tax advantage.

These might include:

- Excess contributions in a given tax year

- Early withdrawals

- Not withdrawing money when required

- Withdrawals for unqualified expenses

When you’re reporting additional taxes, you may (or may not) be able to correct the mistake on the current year’s tax return. However, you should always be able to understand what actions you can take to ensure the same taxes don’t apply in the following year.

Video walkthrough

Do you use TurboTax?

If you don’t, is it because the choices are overwhelming to you?

If so, you should check out our TurboTax review page, where we discuss each TurboTax software product in depth. That way, you can make an informed decision on which TurboTax offering is the best one for you!

Click here to learn more about which TurboTax option is best for you!

Frequently asked questions

A qualified charitable distribution, or QCD, is a nontaxable contribution of funds from a taxpayer’s IRA directly to a qualified charity. QCDs are not taxable to the taxpayer, but they do fulfill the RMD requirement, dollar for dollar.

IRS Form 5329 is the form that taxpayers use to calculate and report additional taxes on certain tax-preferred accounts to the Internal Revenue Service. Taxes calculated on Form 5329 are reported on Schedule 2 of the taxpayer’s Form 1040 or Schedule G of Form 1041.

Where can I find a copy of IRS Form 5329?

Related tax forms

This tax form is one of the fillable tax forms provided by the Internal Revenue Service, to help taxpayers reduce their tax preparation costs. To see more forms like this, visit our free fillable tax forms page, where you’ll also find articles like this.

Unlike the IRS, our articles contain step by step instructions for each tax form, as well as video walkthroughs. You can also check out all of our videos by subscribing to our YouTube channel!

What do you think?

Let me know what you think of this article in the comments. If you feel like this article helped you, please share it, pin it or tag me. And if you have any additional tips, please share them in the comments.