IRS Form 5471 Instructions

Certain U.S. citizens who are officers, directors, or shareholders in certain foreign corporations must file IRS Form 5471, Information Return of U.S. Persons With Respect to Certain Foreign Corporations, to comply with reporting requirements. In this article, we’ll cover:

- Which U.S. persons must file Form 5471

- Who does not have to file Form 5471

- Failure to file penalties

- How to complete Form 5471

Let’s begin with discussing how to complete IRS Form 5471.

Table of contents

How do you complete Form 5471?

IRS Form 5471 contains many separate schedules. It is highly unlikely that any single taxpayer will need to use all schedules.

We’ve broken down each schedule with step-by-step instructions, starting with who must file in each section. Simply navigate to the schedule(s) that applies to your situation. All fields are marked self-explanatory unless they require additional information or instruction.

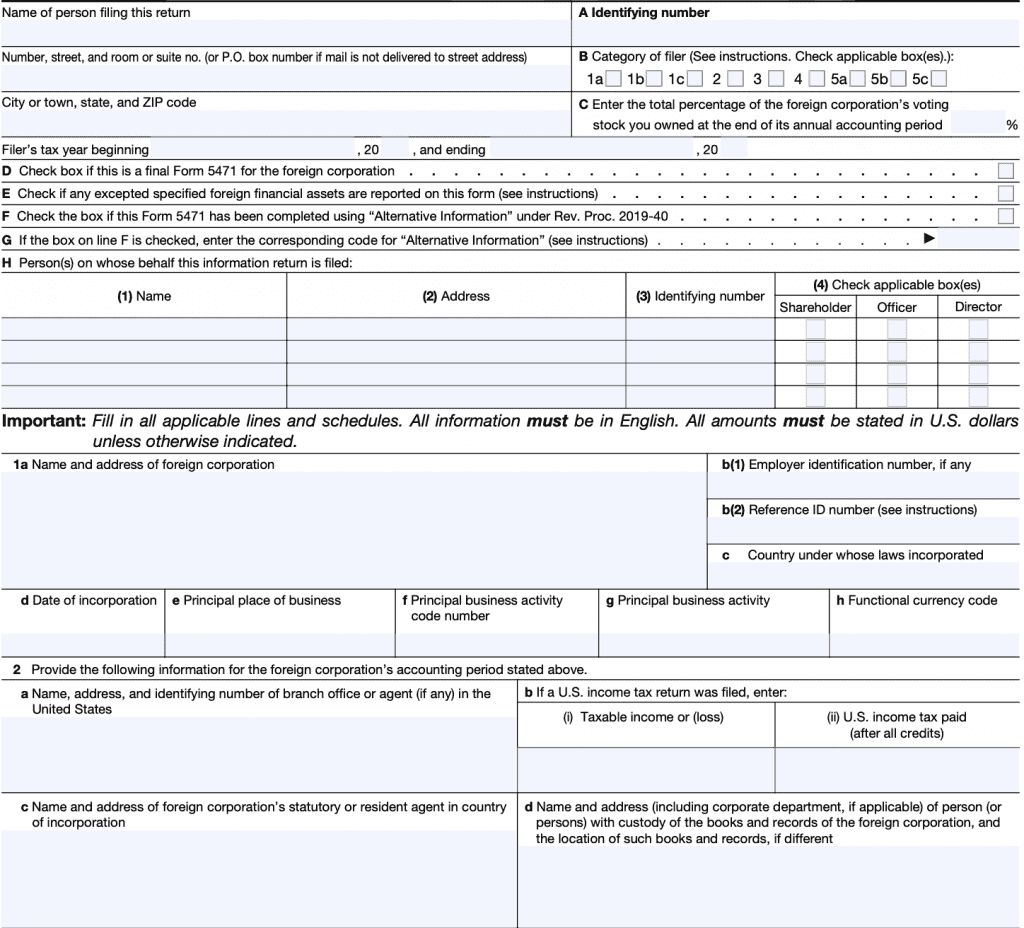

Identifying Information

Required by the following taxpayers

- Everybody who must file IRS Form 5471

Step by step guide

All taxpayers must complete this section of the form, regardless of which filing category they belong to.

Name of person filing this return

Self-explanatory. Your tax preparation software will likely repopulate this information from other sections of your federal tax return.

Address

Self-explanatory.

City, state, zip code

Self-explanatory.

A: Identifying number

For individual taxpayers, this likely will be your Social Security number. For all other entities, this will be the employer identification number (EIN).

B: Category of filer

Check the appropriate box, based upon the instructions. If more than one box applies, select all that apply.

C: Total percentage of voting stock owned at end of accounting period

Include percentage of stock owned, either directly, indirectly, or constructively, at the end of the current year.

Filer’s tax year

List the first day of the year and the last day of the year, for tax purposes.

D: Check box if final Form 5471 for the foreign corporation

Check the Item D checkbox only if this is the final year of the foreign corporation’s existence as a corporation for federal tax purposes. Examples may include:

- Reorganization

- Complete liquidation, or

- An election to treat the foreign corporation as a disregarded entity has been made

If this box is checked, the taxpayer must complete Schedule O.

E: Check if any excepted specified foreign financial assets are reported on this form

If this is the case, you do not have to also report these assets on Form 8938, Statement of Specified Foreign Financial Assets. It is only necessary to complete Form 8938, Part IV, Line 17.

For more information, see the Instructions for Form 8938, generally, and in particular, Duplicative Reporting and the specific instructions for Part IV, Excepted Specified Foreign Financial Assets.

F: Check the box if this Form 5471 has been completed using Alternative Information under Rev. Proc. 2019-40

As defined in Section 3.01.

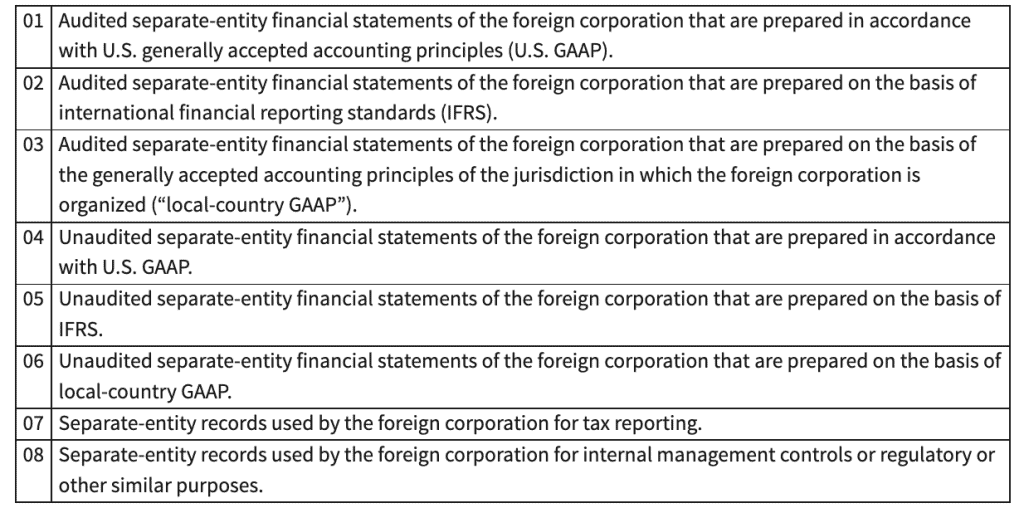

G: If Box F is checked, enter the corresponding code for “Alternative Information”

Use one of the following codes to complete this section.

H: Person(s) on whose behalf this information return is filed

One person may file Form 5471 and the applicable schedules for other persons who have the same filing requirements. The person that files the required information on behalf of other persons must complete a joint Form 5471 according to the applicable column(s) of the Filing Requirements for Categories of Filers.

A separate Schedule I must be filed for each person described in Category 4, 5a, or 5b.

Unless part of a consolidated tax return, members listed in Section H must attach a statement to their tax returns with the following information:

- The name, address, and EIN (or reference ID number) of the foreign corporation(s).

- A statement that their filing requirements with respect to the foreign corporation(s) have been or will be satisfied.

- The name, address, and identifying number of the taxpayer on the return with which the information was or will be filed.

- The IRS Service Center where the return was or will be filed. If the return was or will be filed electronically, enter “e-file.”

If one of the taxpayers named is filing a joint tax return with another taxpayer (married couple), they do not need to attach a separate statement to their tax return.

1a: Name and address of foreign corporation

Self-explanatory.

1b(1): Employer identification number

If applicable.

1b(2): Reference ID number

Required only in cases where no EIN was provided in Line 1b(1).

A reference ID number is a number established by or on behalf of the U.S. person identified at the top of page 1 of the form that is assigned to a foreign corporation with respect to which Form 5471 reporting is required. These numbers are used to uniquely identify the foreign corporation in order to keep track of the corporation from tax year to tax year.

1c: Country under whose laws incorporated

Self-explanatory.

1d: Date of incorporation

Self-explanatory.

1e: Principal place of business

Self-explanatory.

1f: Principal business activity code number

Enter the applicable business activity code number, based upon the IRS form instructions.

1g: Principal business activity

List the applicable business activity.

1h: Functional currency code

The foreign corporation’s functional currency is determined under Section 985. Enter the applicable three-character alphabet code for the foreign corporation’s functional currency using the ISO 4217 standard.

You can find these codes at either of the following websites:

- https://www.iso.org/iso-4217-currency-codes.html

- https://www.currency-iso.org/en/home/tables/table-a1.html

2a: Name, address, and identifying number of branch office (if any) in the United States

Self-explanatory.

2b: If a U.S. income tax return was filed

Enter the taxable income or loss, and U.S. income tax paid (after all credits).

2c: Name and address of foreign corporation’s resident agent in country of incorporation

Self-explanatory.

2d: Name and address of person with custody of books, and location of books (if different)

Self-explanatory.

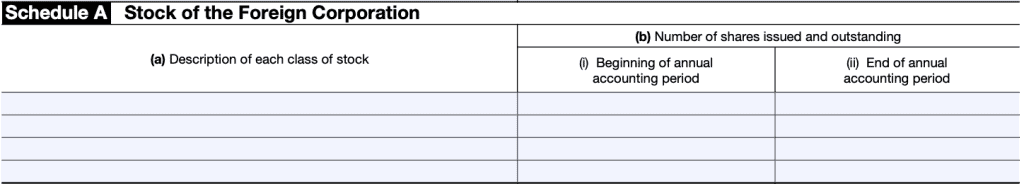

Schedule A: Stock of the foreign corporation

Required by the following taxpayers

- Category 3 filers

- Category 4 filers

Step by step guide

Schedule A is very brief. You’ll simply list the following:

- Description of each class of foreign stock you own

- Number of shares issued and outstanding at the beginning of the accounting period

- Number of shares issued and outstanding at the end of the accounting period

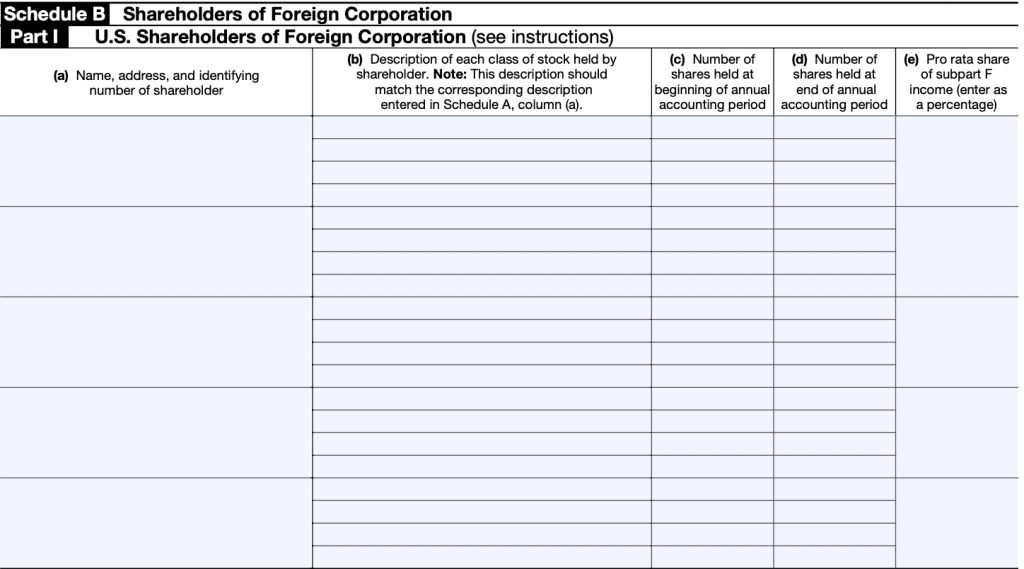

Schedule B, Part I: U.S. shareholders of a foreign corporation

Required by the following taxpayers

- Category 3 filers

- Category 4 filers

A person that is both a Category 3 and Category 5 filer because it is treated as a U.S. shareholder under Section 953(c)(1)(A) with respect to the foreign corporation must complete Schedule B, Part 1 for U.S. persons that owned (on the last day of the foreign corporation’s taxable year), directly or indirectly through foreign entities, any of the foreign corporation’s outstanding stock.

Step by step guide

For each shareholder, enter the following:

- Name, address, and identifying number of shareholder

- Description of each class of stock (which should match description in Schedule A)

- Number of shares held at beginning of accounting period

- Number of shares held at end of accounting period

- Pro rata share of subpart F income (as a percentage)

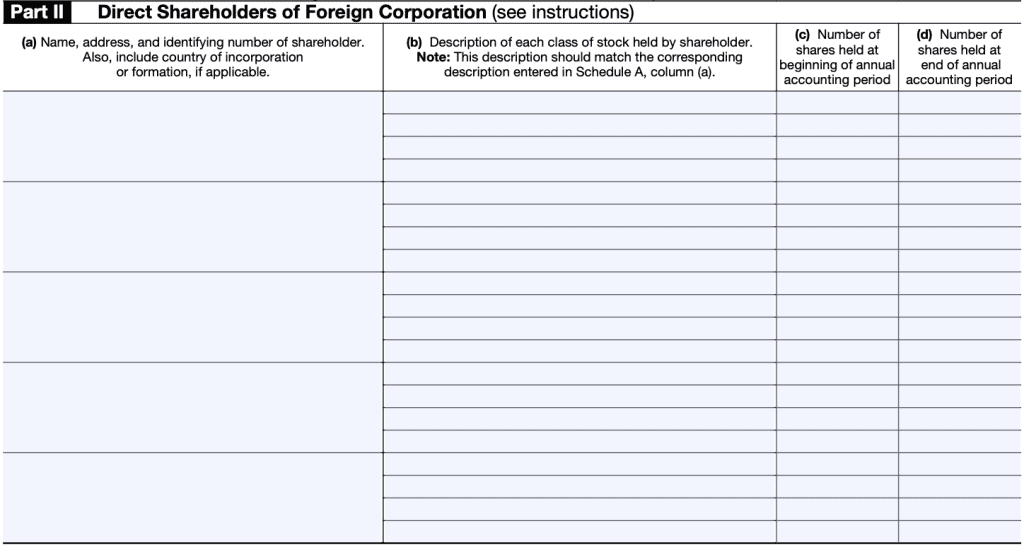

Schedule B, Part II: Direct shareholders of a foreign corporation

Required by the following taxpayers

- Category 1a filers

- Category 1c filers

- Category 3 filers

- Category 4 filers

- Category 5a filers

- Category 5c filers

Step by step guide

For each shareholder, enter the following:

- Name, address, and identifying number of shareholder

- Description of each class of stock (which should match description in Schedule A)

- Number of shares held at beginning of accounting period

- Number of shares held at end of accounting period

- Pro rata share of subpart F income (as a percentage)

Report the direct shareholders of the foreign corporation. In the case of a CFC owned by a foreign disregarded entity (FDE), please include the information of the FDE and the regarded entity owner. Indicate the regarded entity owner’s name in parentheses after the FDE’s name. If there is more than one regarded entity owner, use separate lines for each, listing each regarded entity owner in column (a) and reporting the information requested in columns (b), (c), and (d) for each such regarded entity owner.

Category 4 filers should list all direct owners of the CFC. Filers in Category 1a, 3, and 5a should list all direct owners of the SFC or CFC through which such filer indirectly owns the SFC or CFC as described in Section 958(a)(2).

Category 1c and 5c filers should list all direct owners of the SFC or CFC from which such filer is attributed ownership in the SFC or CFC as described in Section 958(b). If the filer is a direct owner, include the filer’s direct ownership.

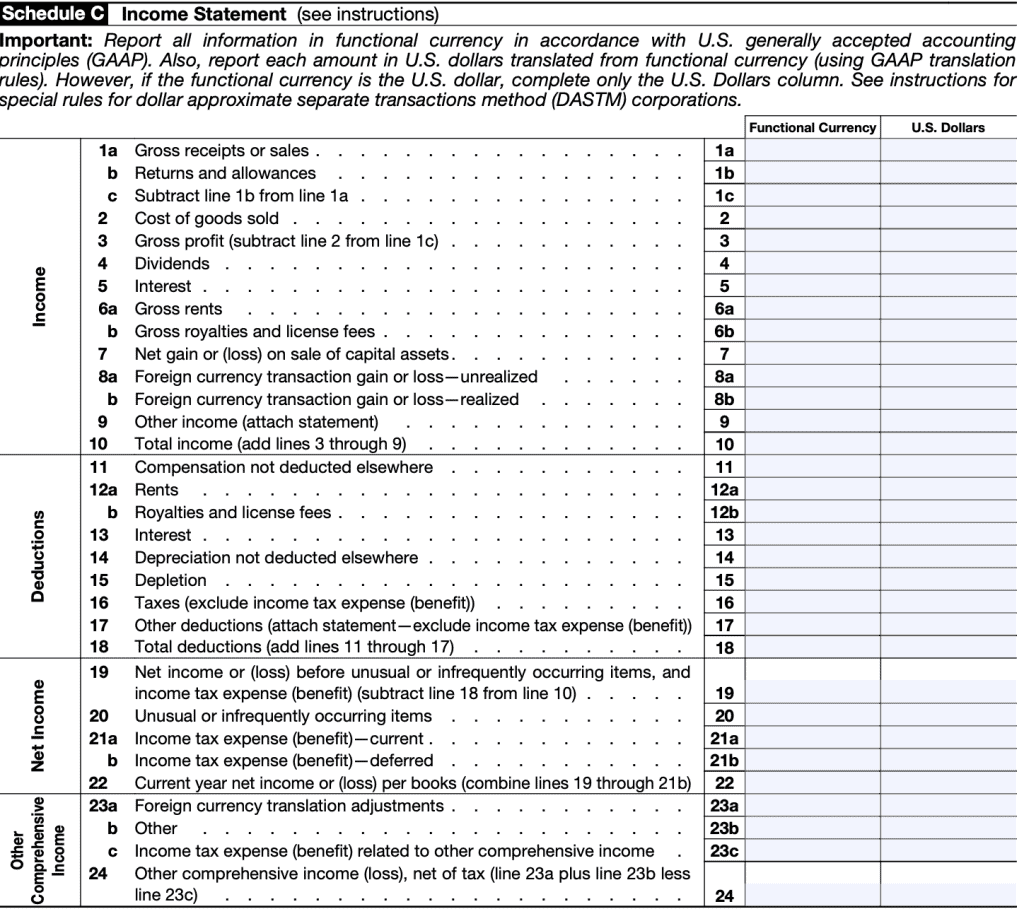

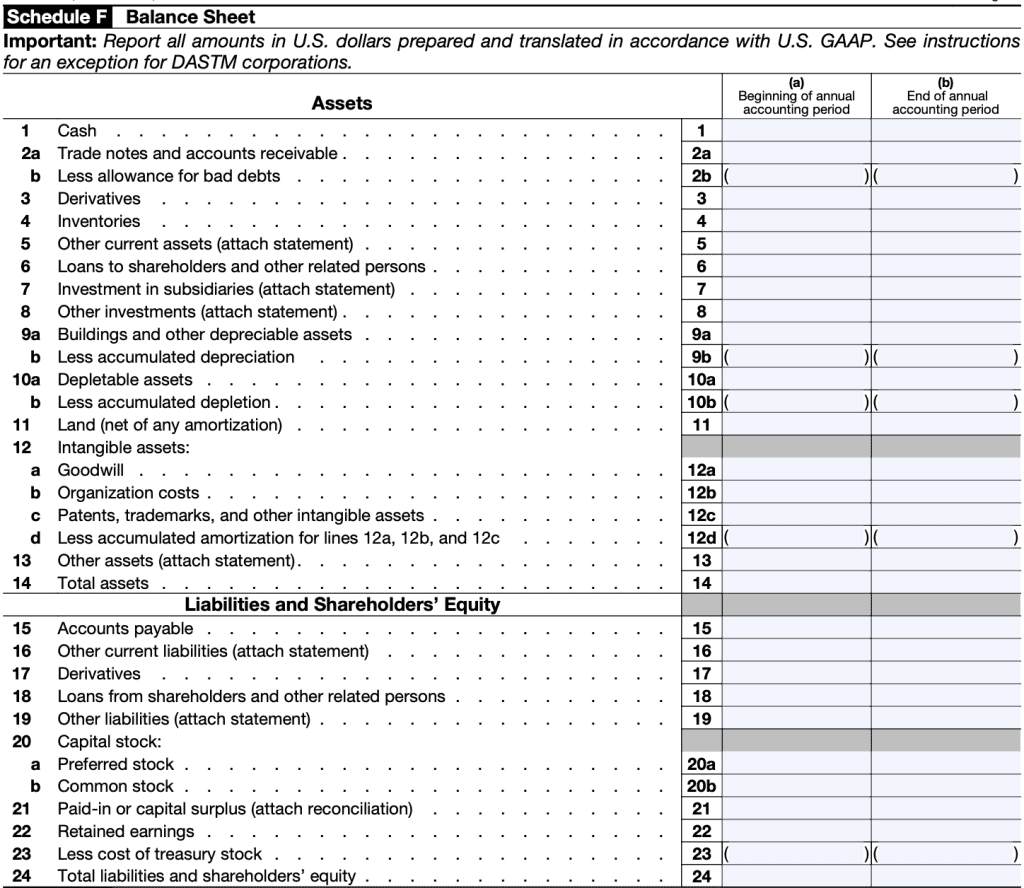

Schedules C & F: Income statement and balance sheet

Schedules C & F are included together in the IRS instructions because they are the income statement (Schedule C) and balance sheet (Schedule F) for the foreign company in question. Taxpayers should keep in mind that the IRS requires financial statements comply with U.S. GAAP (Generally Accepted Accounting Principles).

In cases where there is a functional currency other than the U.S. dollar, complete both schedules using both currency columns. If the U.S. dollar is the functional currency, then use only the U.S. Dollars column.

Required by the following taxpayers

- Category 3 filers

- Category 4 filers

Step by step guide (Schedule C)

Most lines should come directly from the company’s books. If the IRS form instructions contain additional guidance, that guidance is reflected below.

Line 1a: Gross receipts or sales

Self-explanatory.

Line 1b: Returns and allowances

Self-explanatory.

Line 1c: Subtract Line 1b from Line 1a

Self-explanatory.

Line 2: Cost of goods sold

Self-explanatory

Line 3: Gross profit

Subtract Line 2 from Line 1c

Line 4: Dividends

Enter dividends received during the reporting period.

Line 5: Interest

Enter interest income received during the reporting period.

Line 6a: Gross rents

Enter gross rent income received during the reporting period.

Line 6b: Gross royalties and license fees

Enter income received from royalties and license fees during the reporting period.

Line 7: Net gain or (loss) on sale of capital assets

Enter net income or loss on the sale of capital assets during the reporting period.

Line 8a: Unrealized foreign currency transaction gain or loss

Self-explanatory.

Line 8b: Unrealized foreign currency transaction gain or loss

Self-explanatory.

Line 9: Other income

Attach a statement as appropriate.

Line 10: Total income

Total Lines 3 through 9. This is your total income for the reporting period.

Line 11: Compensation not deducted elsewhere

Enter compensation costs paid during the accounting period not deducted elsewhere.

Line 12a: Rents

Enter rents paid during the accounting period.

Line 12b: Royalties and license fees

Enter royalties and license fees paid during the accounting period.

Line 13: Interest

Enter interest paid during the accounting period.

Line 14: Depreciation not deducted elsewhere

Enter depreciation expenses deducted during the accounting period.

Line 15: Depletion

Enter depletion deducted during the accounting period.

Line 16: Taxes

Enter taxes paid, except for income taxes paid. Enter income tax expenses on Line 21.

Line 17: Other expenses

If you incurred other expenses, attach a statement of explanation.

Line 18: Total deductions

Add Lines 11 through 17. These are your total deductions for the period.

Line 19: Net income (or loss) before unusual or infrequently occurring items

Subtract Line 18 from Line 10.

Line 20: Unusual or infrequently occurring items

The term “unusual or infrequently occurring items” is defined by U.S. GAAP (see FASB Accounting Standards Codification (ASC) Topic 220 (Income Statement), Subtopic 220-20 (Unusual or Infrequently Occurring Items) or subsequent guidance).

If “prior period adjustments” are not reported separately on the income statement, do not report such amounts on this line item (see ASC 250 (Accounting Changes and Error Corrections) or subsequent guidance).

Line 21a: Income tax expense (current)

Enter current income tax expense (benefit) reported in accordance with U.S. GAAP (ASC 740 (Income Taxes)).

Line 21b: Income tax expense (deferred)

Enter deferred income tax expense (benefit) reported in accordance with U.S. GAAP (ASC 740 (Income Taxes)).

Line 22: Current year net income per books

Subtract expenses reported on either Line 21a or Line 21b (or both) from Line 19. If there is an income tax benefit in either line, add the number to Line 19.

Line 23a: Foreign currency translation adjustments

Enter amounts as defined in ASC 220.

Line 23b: Other

This might include items such as:

- Foreign currency gains or losses on certain hedging transactions,

- Pensions and other post-retirement benefits, and

- Certain investments available-for-sale

Line 23c: Income tax expense

Enter the income tax expense (benefit) allocated to other comprehensive income (OCI) items.

Line 24: Other comprehensive income or loss, net of tax

Add Lines 23a and 23b, then subtract Line 23c.

Step by step guide (Schedule F)

All line items are self-explanatory except for items broken out below.

Report all information in U.S. dollars. Generally, the foreign corporation’s balance sheet is prepared in functional currency and translated to U.S. dollars using U.S. GAAP translation rules.

If the foreign corporation uses DASTM, the tax balance sheet on Schedule F should be prepared and translated into U.S. dollars according to Regulations section 1.985-3(d), rather than U.S. GAAP.

Report all items in U.S. dollars at both:

- Column (a): Beginning of accounting period

- Column (b): End of accounting period

Line 3 & 17: Derivatives

Enter the total asset amount of derivatives on Line 3 and Line 17 reported in accordance with ASC 815 (Derivatives and Hedging). Do not net positions.

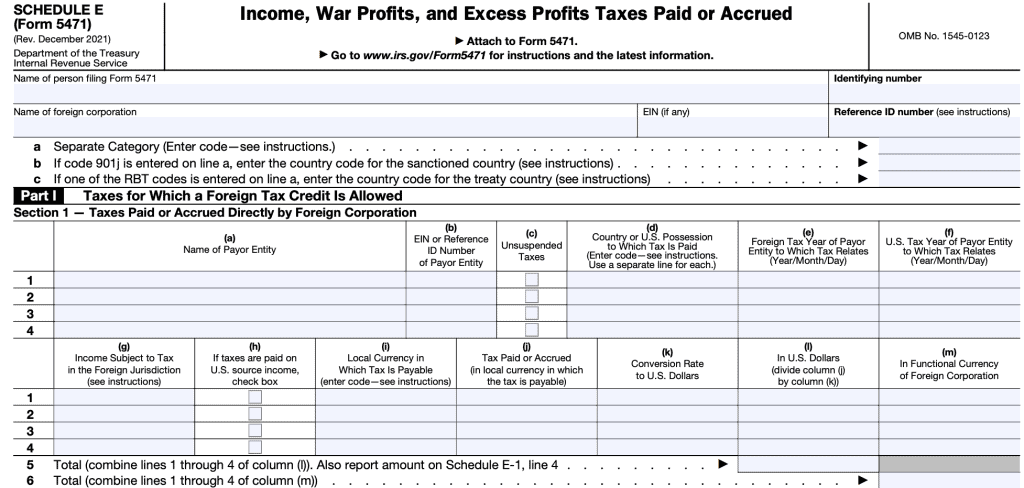

Separate Schedule E: Income, war profits, and excess profits taxes paid or accrued

Schedule E is on the IRS website as a separate attachment, as well as Schedule E-1.

Required by the following taxpayers

- Category 1a filers

- Category 1b filers

- Category 1c filers

- Category 4 filers

- Category 5a filers

- Category 5b filers

- Category 5c filers

Step by step guide

At the top of the form, complete the following information:

- Name of the person filing IRS Form 5471

- Identifying number

- Foreign corporation

- Employer ID number (if applicable)

Reference ID number (if applicable)

At the top of each page are the following information fields:

- Line a: Separate category code: Enter the appropriate code, based upon Categories of Income (IRS Form 1118, Foreign Tax Credit)

- Line b: Country code for the sanctioned country: If Code 901j is entered for Line a, select one of the IRS foreign country codes.

- Line c: If one of the RBT codes is entered on Line a, enter the country code for the treaty country

Once entered, this information will appear at the top of each page.

Part I: Taxes for which a foreign tax credit is allowed

In Section 1, enter the taxes paid or accrued directly by the foreign corporation, as well as:

- Name of the payer

- EIN or reference number

- Unsuspended taxes (see IRS instructions for more details)

- Country or U.S. possession to which taxes were paid

- Tax year (both foreign and U.S.)

- Amount of income subject to tax

- Conversion rate

- Amount of taxes paid in U.S. dollars

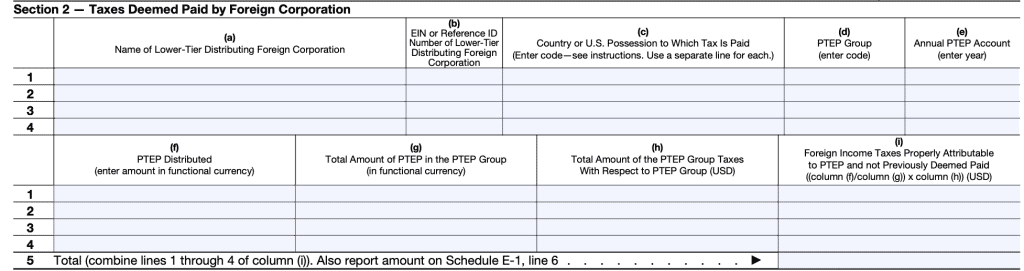

In Section 2, you’ll enter the taxes deemed paid by the foreign corporation with respect to current year previously taxed earnings and profits (PTEP) distributions from lower-tier foreign corporations.

Report a PTEP distribution by a lower-tier foreign corporation in Section 2 only if foreign income taxes are deemed paid under Section 960(b) by the foreign corporation regarding the PTEP distribution.

For each company, list:

- Name and EIN (or reference number) of lower-tier corporation

- Country to which the tax was paid

- PTEP Group as defined in Treasury Regulations Section 1.960-3(c)(2)). You can find a list of PTEP group codes in the Schedule E instructions.

- Annual PTEP account

- PTEP distribution (in functional currency)

- Total amount of PTEP in PTEP group (in functional currency)

- Total amount of PTEP group taxes (in US dollars)

- Foreign income taxes properly attributable to PTEP and not previously deemed paid.

Part II: Election

In Part II, enter whether or not an election has been made under Section 986(a)(1)(D) to translate taxes using the exchange rate on the date of payment.

Part III: Taxes for which a foreign tax credit is disallowed

Use Part III to report taxes for which foreign tax credits are not allowed. While disallowed as a tax credit, these taxes are considered in determining the foreign corporation’s earnings and profits (E&P).

You will enter the following:

- Name of payer

- EIN or reference number

- Disallowed taxes under each applicable section

- Section 901(j)

- Section 901(k) and (l)

- Section 901(m)

- U.S. Taxes: Only foreign taxes paid are allowed a credit

- Suspended taxes: Due to rules of Section 909

- Other taxes

- Total taxes, in both functional currency and US dollars

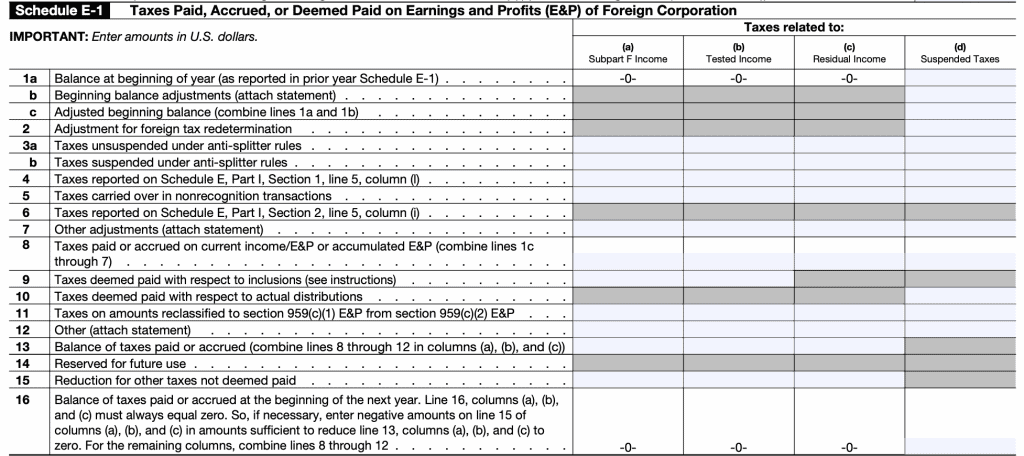

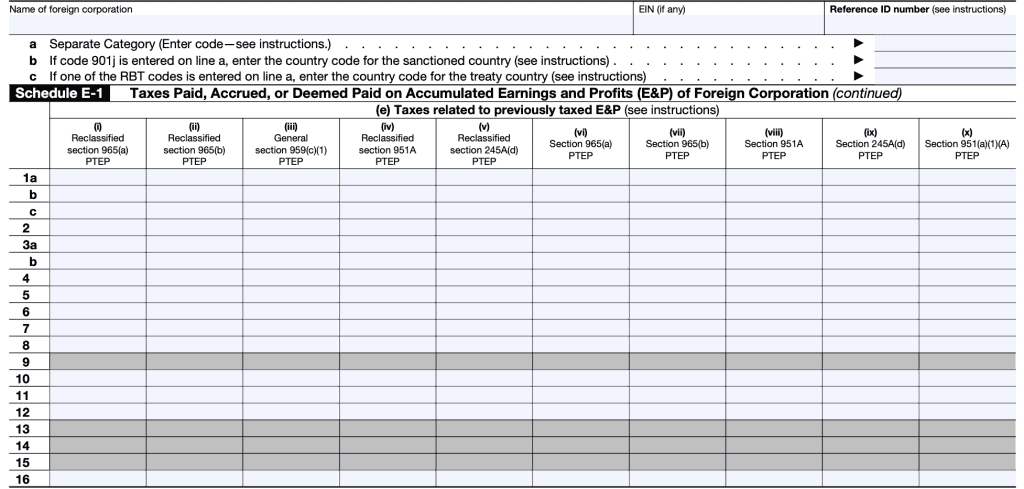

Schedule E-1: Taxes paid, accrued, or deemed paid on earnings and profits (E&P) of foreign corporation

Required by the following taxpayers

- Category 1a filers

- Category 1b filers

- Category 4 filers

- Category 5a filers

- Category 5b filers

Step by step guide

Related constructive U.S. shareholders (Category 1c and Category 5c filers) can leave Schedule E-1 blank.

In columns (a), (b), and (c), report only the foreign income taxes the foreign corporation pays or accrues attributable to the following groups as determined in Schedule Q:

- Subpart F income group,

- Tested income group, and

- Residual income group

Under column (d), enter suspended taxes under Section 909.

For columns (e)(i) through (e)(x), enter foreign taxes paid or accrued with respect to earnings and profits described in Sections 959(c)(1) and (c)(2).

For more information about the ten PTEP group columns, see the instructions for Schedule J, Column (e).

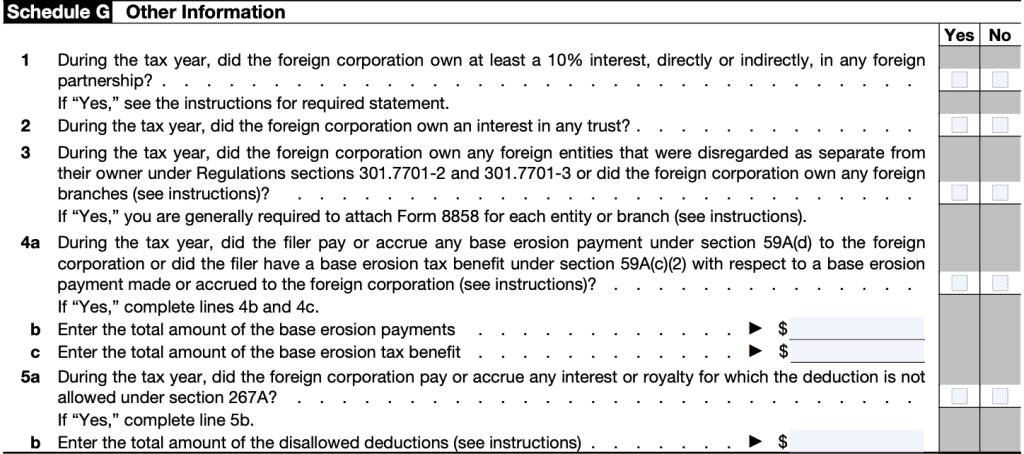

Schedule G: Other information

Required by the following taxpayers

- Category 1c filers

- Category 3 filers

- Category 4 filers

- Category 5a filers

- Category 5c filers

Step by step guide

Question 1

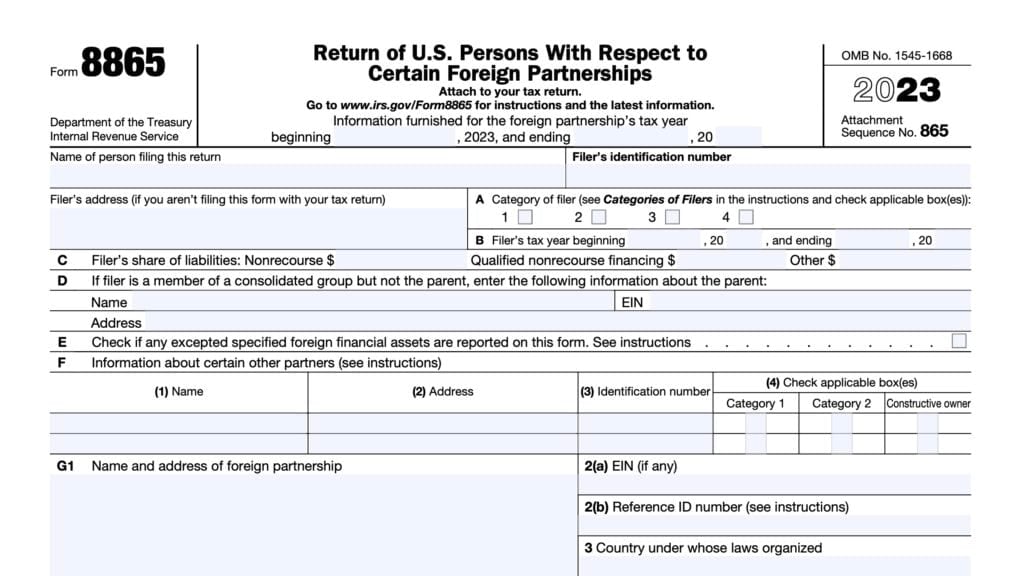

If the foreign corporation owned at least a 10% interest, directly or indirectly, in any foreign partnership, attach a statement listing the following information for each foreign partnership.

- Name and EIN (if any) of the foreign partnership.

- Identify which, if any, of the following forms the foreign partnership filed for its tax year ending with or within the corporation’s tax year: Form 1042, 1065, or 8804.

- Name of the partnership representative (if any).

- Beginning and ending dates of the foreign partnership’s tax year.

Question 2

Self-explanatory.

Question 3

Check the “Yes” box if the foreign corporation is the tax owner of a foreign disregarded entity (FDE) or foreign branch (FB). The “tax owner” of an FDE is the person that is considered to own the assets and liabilities of the FDE for purposes of U.S. income tax law.

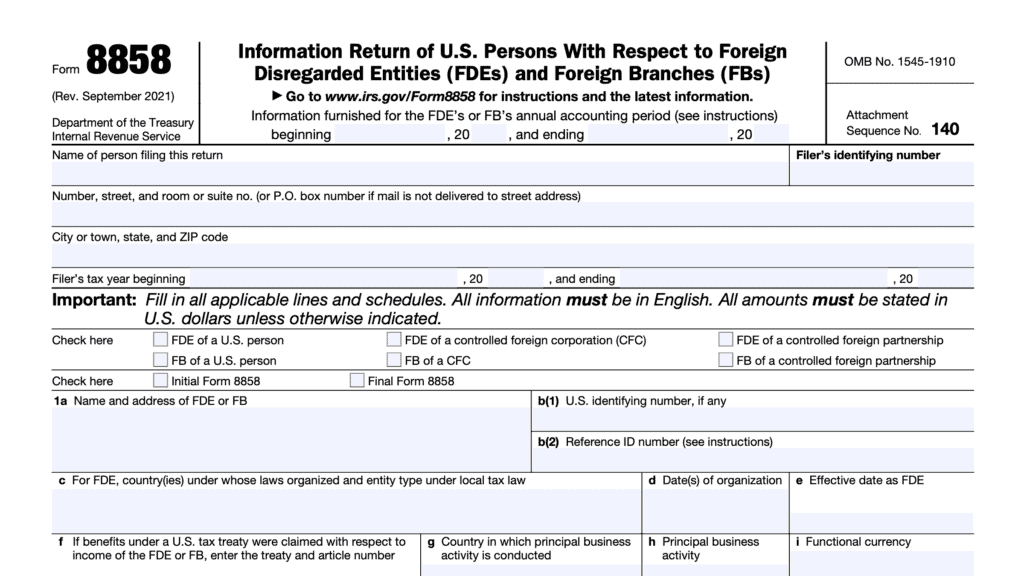

If the foreign corporation is the tax owner of an FDE or FB and you are a Category 4, 5a, or 5c filer, you are required to attach Form 8858 to Form 5471.

If the foreign corporation is the tax owner of an FDE or FB and you are not a Category 1b, 4, or 5 filer of Form 5471, you must attach a statement that outlines the following in lieu of Form 8858:

- Name of FDE or FB

- Country under whose laws the FDE or FB is organized

- Employer identification number (if any)

Question 4

Complete lines 4b and 4c if:

- The foreign corporation is a related party to the U.S. filer within the meaning of Section 59A(g); and

- The U.S. filer made or accrued a base erosion payment to, or has a base erosion tax benefit with respect to, the foreign corporation.

The term “base erosion payment” generally means any amount paid or accrued by the U.S. filer to a foreign corporation that is a related party to the U.S. filer:

- Within the meaning of Section 59A(g) and

- With respect to which a U.S. deduction is allowed under Chapter 1 of the Internal Revenue Code.

Base erosion payments also include amounts received or accrued by the foreign corporation in connection with:

- The acquisition of depreciable or amortizable property (Section 59A(d)(2)),

- Reinsurance payments (Section 59A(d)(3)), and

- Certain payments relating to expatriated entities (Section 59A(d)(4))

The term “base erosion tax benefit” generally means any U.S. deduction that is allowed under chapter 1 for the tax year with respect to any base erosion payment. See Section 59A(c)(2)(A) and (B) for further details.

Question 5

If applicable, enter the amount of disallowed deductions. Do not include disallowed deductions attributable to interest or royalty paid or accrued by a U.S. taxable branch of the foreign corporation.

Question 6

Answer ‘Yes’ if claiming a deduction under Section 250 for foreign-derived intangible income deduction. If applicable, complete Lines 6b, 6c, and 6d.

Question 7

If applicable, complete a separate Schedule G-1 for each cost sharing arrangement.

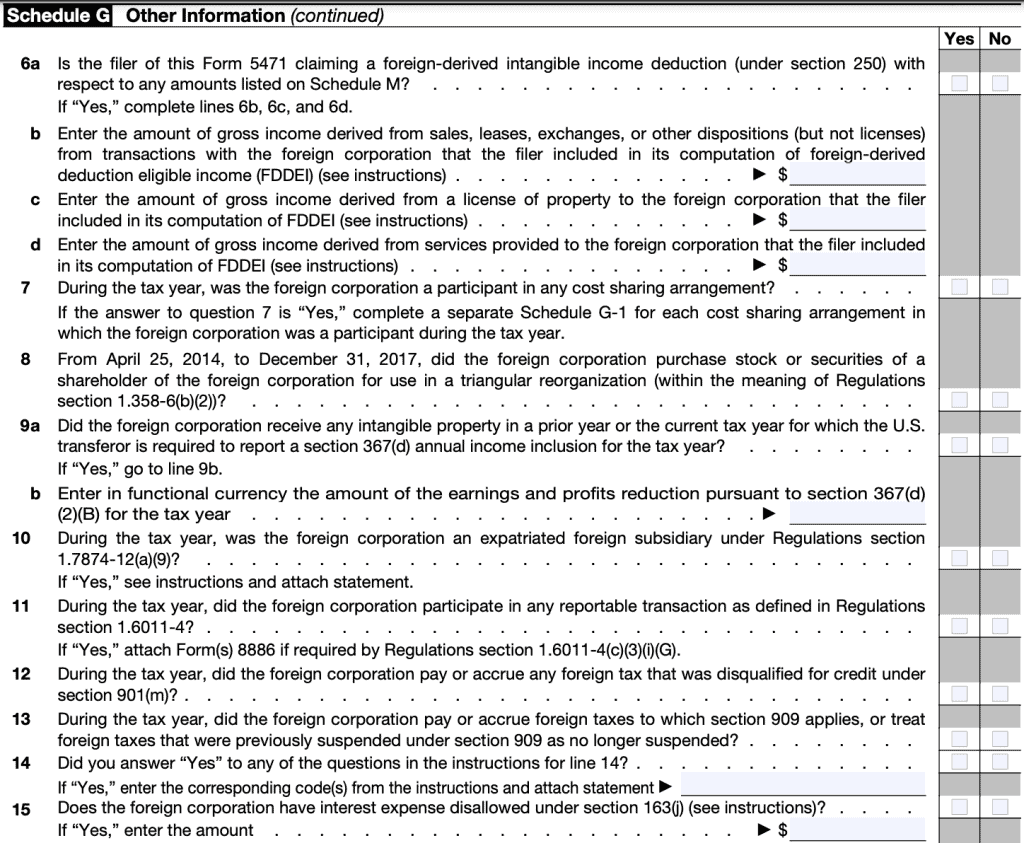

Question 8

Self-explanatory.

Question 9

Check “Yes” if the foreign corporation received any intangible property in a prior year or the current tax year in an exchange under Section 351 or Section 361 from a U.S. transferor that is required to report a Section 367(d) annual income inclusion for the tax year.

If applicable, complete Line 9b.

Question 10

If the answer is ‘Yes,’ attach a statement providing the name and EIN of the domestic corporation or partnership, as defined in Treasury Regulations Section 1.7874-12(a)(6) and the relationship of the foreign corporation to the domestic corporation or partnership.

Question 11

If the answer is ‘Yes,’ attach a copy of IRS Form 8886 if required by Treasury Regulations Section 1.6011-4.

Question 12

Check ‘Yes’ if the corporation paid or accrued foreign tax that was disqualified for tax credit under Section 901(m).

Question 13

Select ‘Yes’ if applicable under Section 909.

Question 14

Read the questions contained in instructions for IRS Schedule G, Question 14. Select Yes if any apply.

Question 15

If “Yes,” enter the amount from the current year IRS Form 8990, Line 31.

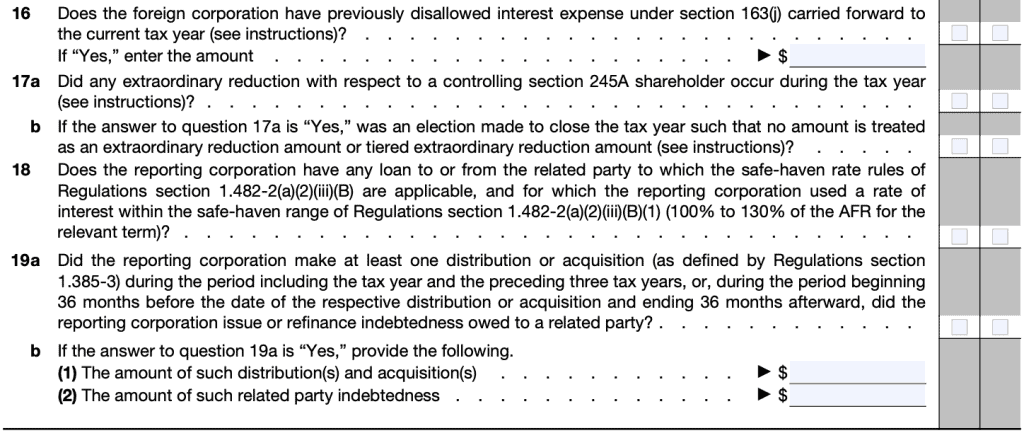

Question 16

If “Yes,” enter the amount from the prior year Form 8990, Line 31.

Question 17

See Treasury Regulations Section 1.245A-5(e)(2)(i) for the definition of extraordinary reduction. If ‘Yes,’ complete Line 17b.

Question 18

Check the “Yes” box if during the tax year the reporting corporation had any loans to or from the related party:

- To which the safe haven rate rules of Regulations section 1.482-2(a)(2)(iii)(B) are applicable, and

- For which the reporting corporation used a rate of interest within the safe-haven range of Regulations section 1.482-2(a)(2)(iii)(B)(1)

This safe-haven range is 100% to 130% of the AFR for the relevant term.

Question 19

Complete lines 19a and 19b only if the filer is a domestic corporation.

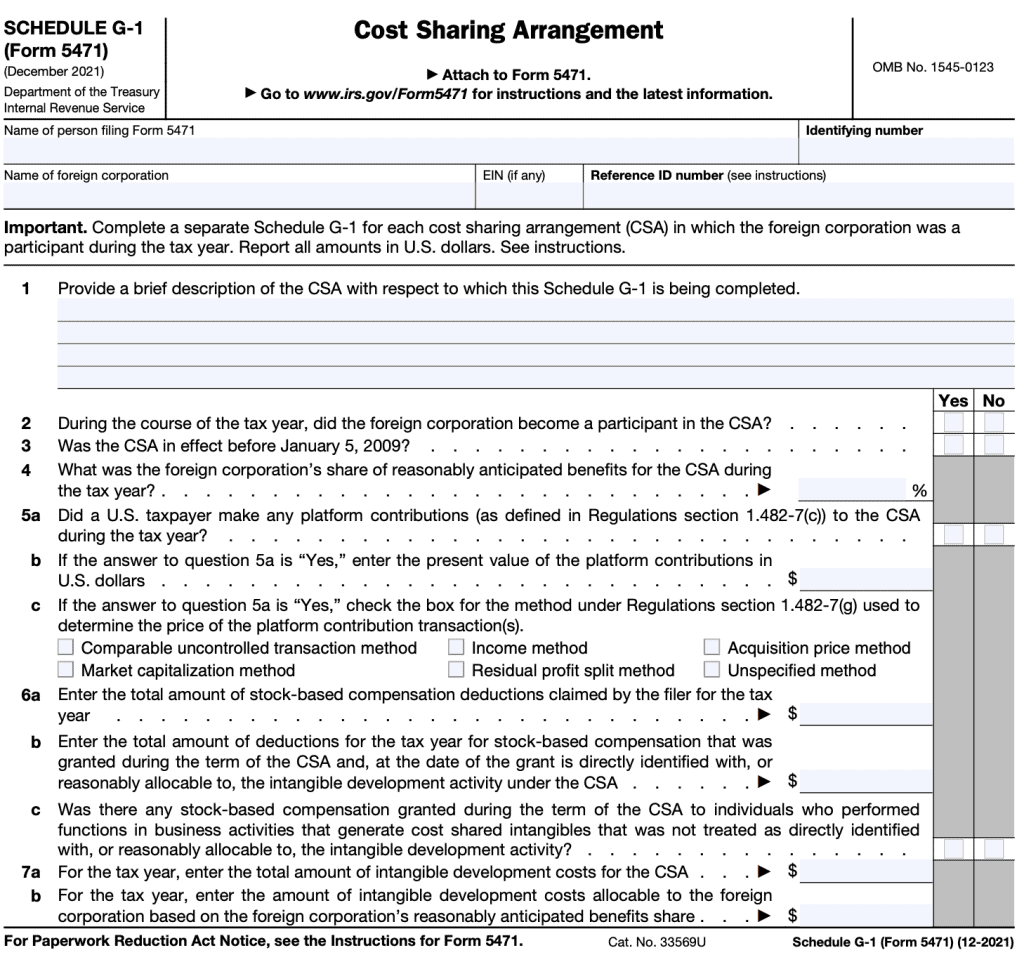

Separate Schedule G-1: Cost sharing agreement

Required by the following taxpayers

- Category 1c filers

- Category 3 filers

- Category 4 filers

- Category 5a filers

- Category 5c filers

Step by step guide

A separate Schedule G-1 must be filed for each cost sharing arrangement (CSA) as defined in Treasury Regulations Section 1.482-7(b) in which the foreign corporation was a controlled participant during the tax year.

Line 1

Self explanatory.

Line 2

Self explanatory.

Line 3

Self explanatory.

Line 4

Enter the foreign corporation’s share of reasonably anticipated benefits (RAB) for the CSA during the tax year based upon Treasury Regulations Section 1.482-7(e).

Line 5

If ‘Yes,’ answer 5b and 5c.

Line 6

See the following for more information

- Treasury Regulations Section 1.482-7 for more information on determining whether stock-based compensation is directly identified with, or reasonably allocable to, the intangible development activity (IDA) under the CSA

- Treasury Regulations Section 1.482-7(d)(3) and Notice 2005-99 for more information on determining the measurement and timing of stock-based compensation IDCs, including an election available with respect to options on publicly traded stock and certain other stock-based compensation.

Line 7

On Line 7a, enter the total amount of intangible development costs (IDCs) for the CSA during the tax year.

On Line 7b, enter the total amount of IDCs allocable to the foreign corporation based upon the corporation’s reasonably anticipated benefits share.

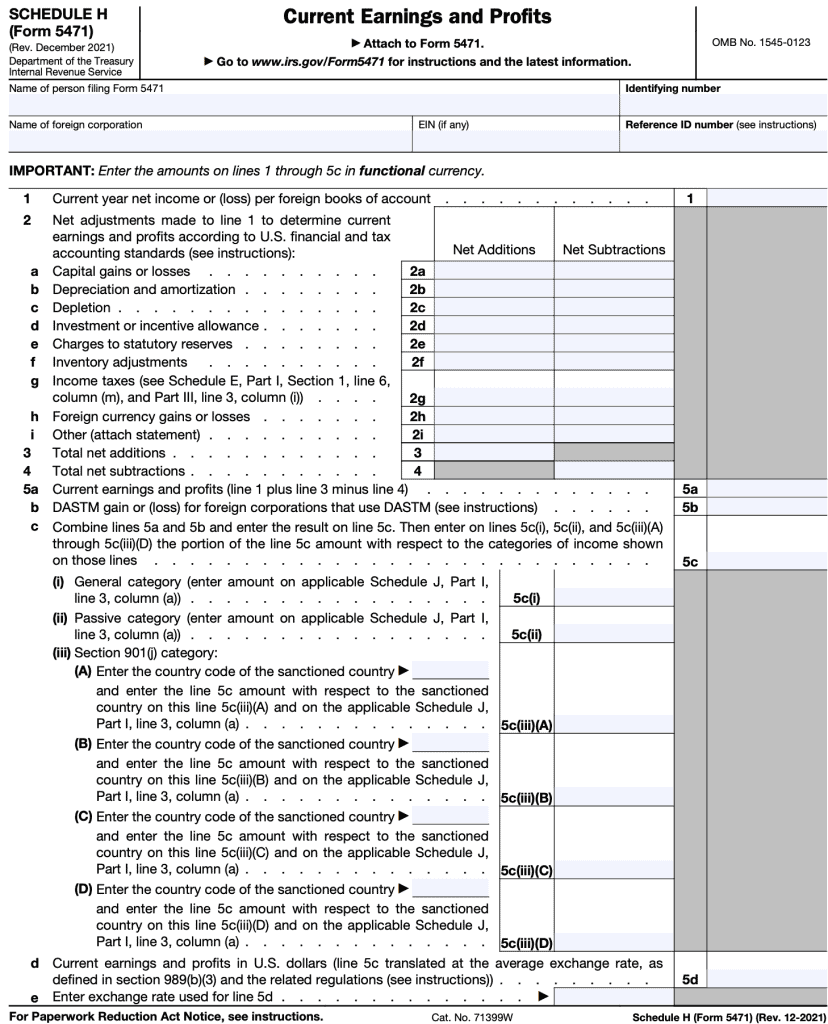

Separate Schedule H: Current earnings and profits

Required by the following taxpayers

- Category 4 filers

- Category 5a filers

Step by step guide

Use Schedule H to report the foreign corporation’s current earnings and profits for U.S. tax purposes. Complete Lines 1 through 5c in the corporation’s functional currency, not U.S. dollars.

At the top, enter the name of the person filing the form and name of foreign corporation, as well as the person’s identifying number, corporation’s EIN (if applicable), or reference ID number.

Line 1

Self-explanatory.

Line 2

Certain adjustments, required by Treasury Regulations Sections 1.964-1(b) and (c), must be made to the foreign corporation’s Line 1 net book income or (loss) to determine its current E&P.

These adjustments may include both positive and negative adjustments to conform the foreign book income to U.S. GAAP and to U.S. tax accounting principles.

See form instructions for more details on each line item.

Line 3

Add all items under the ‘Net Additions’ column for Lines 2a through 2i.

Line 4

Add all items under the ‘Net Subtractions’ column for Lines 2a through 2i.

Line 5

This line converts net income from the functional currency to U.S. dollars.

Line 5a equals net income (Line 1) plus net additions (Line 3) minus net subtractions (Line 4).

Line 5b is only applicable for foreign corporations that use DASTM. If applicable, see form instructions.

The line 5c current year E&P amount may include amounts with respect to:

- The general category

- Passive category, or

- Section 901(j) category

See Treasury Regulations Section 1.960-1(d)(2) and form instructions for more detail.

For Line 5d, enter the amount in U.S. dollars, based upon Section 989 guidance. For Line 5e, enter the exchange rate used for the conversion.

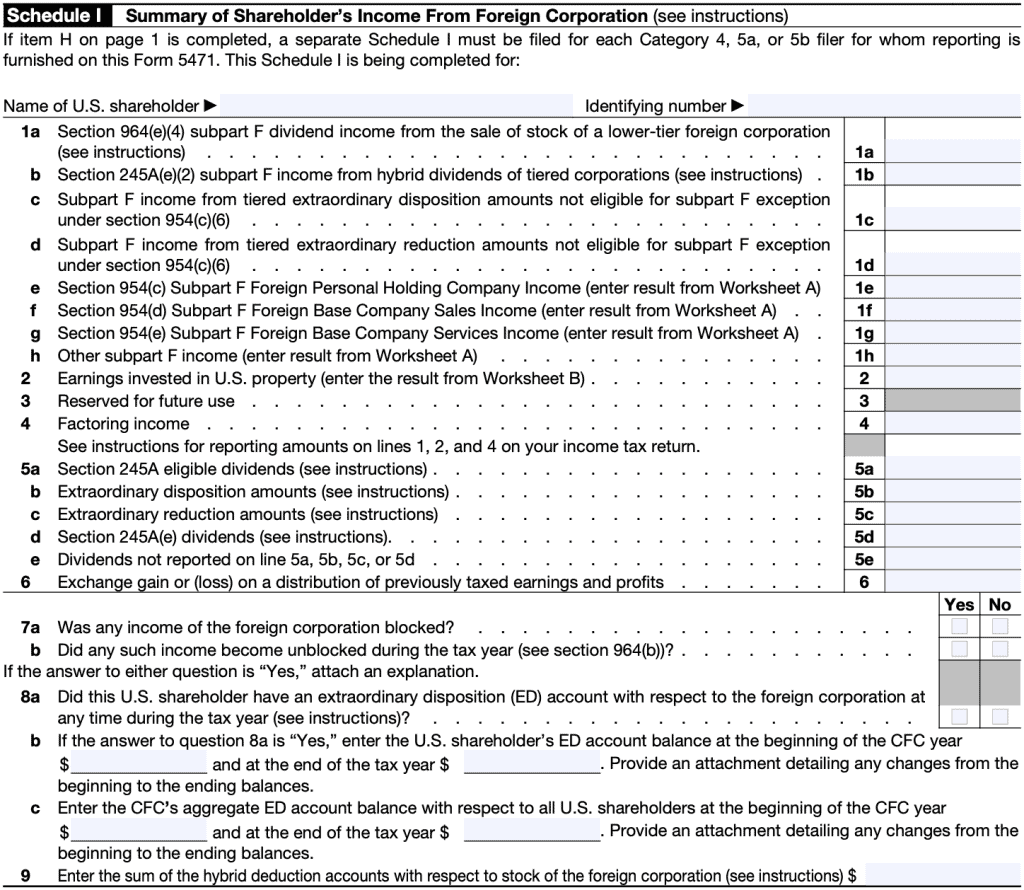

Schedule I: Summary of shareholder’s income from foreign corporation

Required by the following taxpayers

- Category 4 filers

- Category 5a filers

- Category 5b filers

Step by step guide

Line 1

U.S. shareholders of CFCs with subpart F income must report that income on their tax returns.

Under Line 1a, corporate U.S. shareholders should enter the foreign-source portion of any subpart F income inclusions attributable to the sale or exchange by a CFC of stock of another foreign corporation that is eligible for the Section 245A dividends received deduction pursuant to Section 964(e)(4).

For Line 1b, enter the amount of the U.S. shareholder’s subpart F income inclusion attributable to tiered hybrid dividends received by the CFC.

Line 1c: Enter the subpart F income inclusion attributable to tiered extraordinary disposition amounts resulting from distributions from an extraordinary disposition account of the shareholder filing this Form 5471 and received by the foreign corporation.

For Line 1d, enter the subpart F income inclusion attributable to tiered extraordinary reduction amounts resulting from extraordinary reductions.

Use Worksheet A in the IRS Form 5471, Schedule I instructions to complete Lines 1e through 1h.

Line 2

Self-explanatory. Use Worksheet B to complete.

Line 3

Do not enter anything. Reserved for future use.

Line 4

Enter the factoring income, as defined in Section 864(d)(1), if no subpart F income is reported on line 1a of Worksheet A, because of the operation of the de minimis rule.

Line 5

See form instructions on how to report categories of dividends received, if applicable.

Line 6

If previously taxed E&P (PTEP) were distributed, enter the amount of foreign currency gain or (loss) recognized on the distribution, computed under Section 986(c).

Line 7

Self-explanatory. See Section 964(b) for details.

Line 8

See Treasury Regulations Section 1.245A-5(c) for rules regarding an extraordinary disposition account. If you answer ‘Yes’ to Line 8a, complete Lines 8b and 8c.

Line 9

Answer only if the foreign corporation is a CFC and the filer is a domestic corporation. If applicable, see the form instructions for more details.

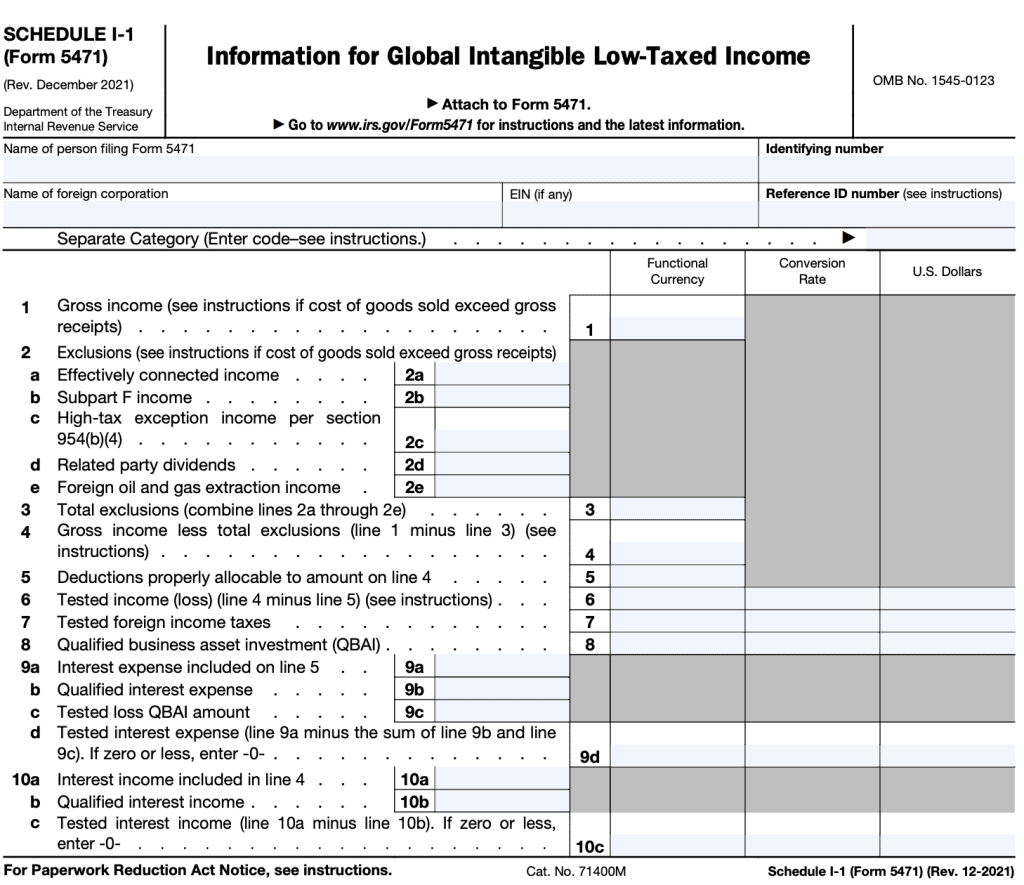

Separate Schedule I-1: Information for global intangible low-taxed income

Required by the following taxpayers

- Category 4 filers

- Category 5a filers

- Category 5b filers

Step by step guide

This schedule is used to report information determined at the CFC level with respect to amounts used in the determination of income inclusions by U.S. shareholders under Section 951A.

For Lines 1-5, enter all values in the functional currency of the foreign corporation.

At the top of the Schedule, enter the following:

- Name of the person filing IRS Form 5471

- Identifying number

- Name of foreign corporation

- EIN or reference ID number, as applicable

Schedule I-1 is now completed once. (It is no longer completed separately for each applicable

category of income.) Therefore, Schedule I-1 is completed once (for general category income, passive category income, or both).

Line 1

Enter the CFC’s gross income. See the IRS Form 5471 instructions if cost of goods sold (COGS) exceed gross revenue.

Line 2

Enter the CFC’s exclusions as described in Treasury Regulations Section 1.951A-2(c).

For Line 2a, enter the amount of the CFC’s income/loss described in Section 952(b). This is generally income or loss from sources within the United States that:

- Is effectively connected to the conduct of a trade or business by the CFC in the United States, and

- Is not reduced or exempt from tax pursuant to an income tax treaty with the United States

Under Line 2b, enter the amount, if any, of the CFC’s gross income or loss taken into account in determining the CFC’s subpart F income.

Line 2c contains the CFC’s gross income excluded from foreign base company income, defined in Section 954, and insurance income, defined in Section 953, by reason of the high-tax exception.

In Line 2d, enter the amount of dividend income received by the CFC from a related person, defined in Section 954(d)(3).

Line 2e contains the amount of the CFC’s taxable income or loss from sources outside the United States from:

- Extraction of minerals from oil or gas wells located outside the United States and its possessions

- The sale or exchange of assets used in the trade or business of extracting minerals from oil or gas wells located outside the United States and its possessions.

Line 3

Combine Lines 2a through 2e.

Line 4

Subtract Line 3 from Line 1.

Line 5

Enter the deductions properly allocable on Line 4. For further guidance, see:

Line 6

Subtract Line 5 from Line 4.

Line 7

If the CFC has a tested loss on Line 6, enter zero.

If the CFC has tested income on Line 6, enter only those foreign income taxes that are properly attributable to the CFC’s tested income group.

Line 8

If the CFC has a tested loss on Line 6, enter zero.

If the CFC has tested income on Line 6, enter the Qualified Business Asset Investment (QBAI). The QBAI is the average of the CFC’s aggregate adjusted bases, as of the close of each quarter of the tax year, in specified tangible property used in trade or business in the production of tested income, and for which a deduction is allowable under Section 167.

Line 9

In Line 9a, enter the interest expense included on Line 5.

Under Line 9b, enter the CFC’s qualified interest expense, as defined in Treasury Regulations Section 1.951A-4(b)(1)(iii).

Line 9c contains the CFC’s tested loss QBAI amount, as defined in Treasury Regulations Section 1.951A-4(b)(1)(iv).

Subtract Lines 9b and 9c from Line 9a. Enter the result under Line 9d.

LIne 10

Under Line 10a, enter the amount of interest income included on Line 4.

For Line 10b, enter the CFC’s qualified interest income.

Subtract Line 10b from Line 10a to arrive at Line 10c. If zero or less, enter ‘0.’

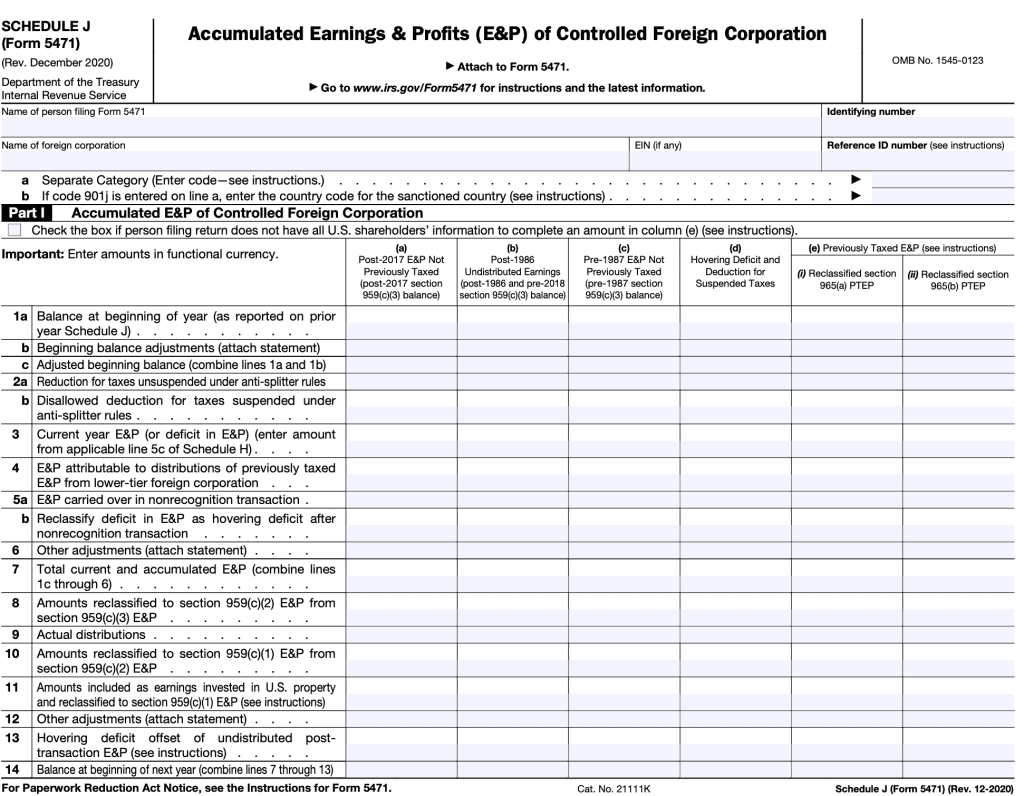

Separate Schedule J: Accumulated earnings & profits of controlled foreign corporation

Required by the following taxpayers

- Category 1a filers

- Category 4 filers

- Category 5a filers

Step by step guide

Use Schedule J to report a CFC’s accumulated E&P in its functional currency, computed under Sections 964(a) and 986(b).

Due to its technical nature, please follow the detailed instructions for Schedule J on the IRS website.

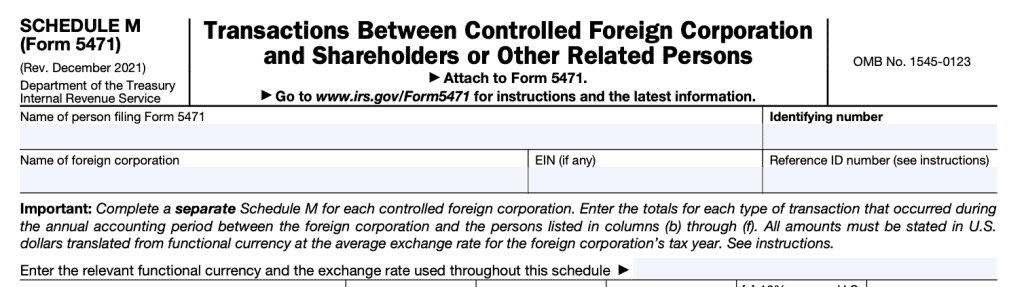

Separate Schedule M: Transactions between controlled foreign corporation and shareholders or other related persons

Required by the following taxpayers

- Category 4 filers

Step by step guide

You must complete a separate Schedule M for each controlled foreign corporation. All amounts must be stated in U.S. dollars translated from functional currency at the average exchange rate for the foreign corporation’s tax year.

Due to its technical nature, please follow the detailed instructions for Schedule M on the IRS website.

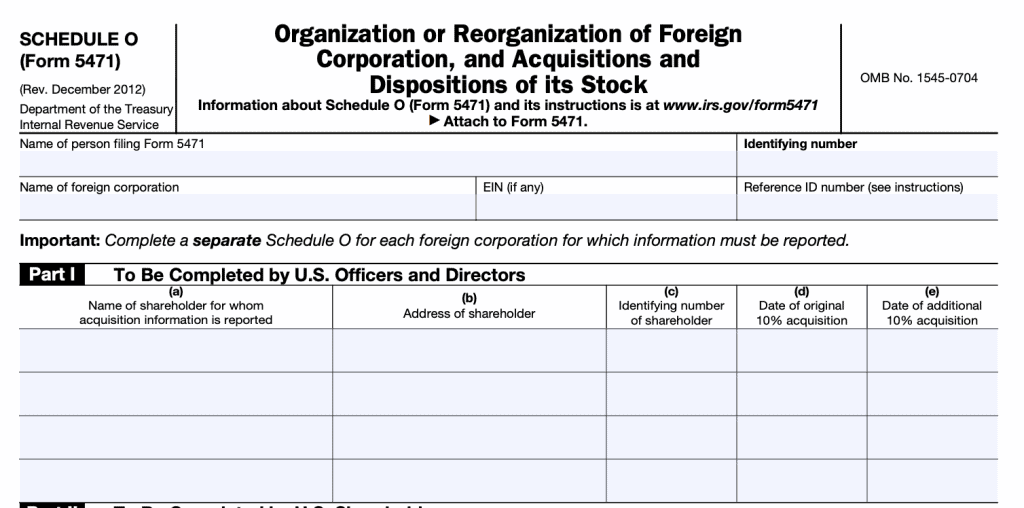

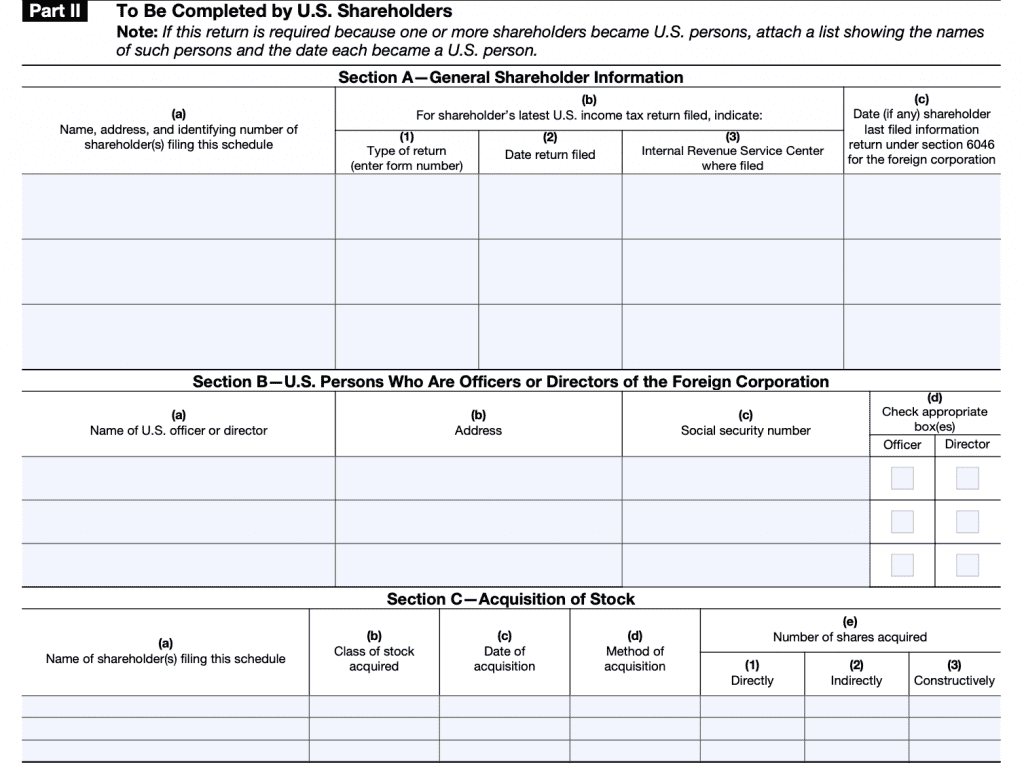

Separate Schedule O, Part I: To be completed by U.S. officers and directors

Required by the following taxpayers

- Category 2 filers

Step by step guide

At the top, list the following:

- Name and identifying number of taxpayer filing IRS Form 5471

- Name of foreign corporation and EIN or reference ID number, as applicable

Part I contains the following for each shareholder:

- Name

- Address

- Identifying number

- Date of original 10% acquisition

- Date of additional 10% acquisition

Separate Schedule O, Part II: To be completed by U.S. shareholders

Required by the following taxpayers

- Category 3 filers

Step by step guide

At the top, list the following:

- Name and identifying number of taxpayer filing IRS Form 5471

- Name of foreign corporation and EIN or reference ID number, as applicable

In Section A, enter the following:

- Name, address, and identifying number of each shareholder on Schedule O

- Information on taxpayer’s most recent U.S. income tax return:

- Type of return

- Date filed

- IRS center where filed

- Date shareholder last filed information return under Section 6046 for the foreign corporation

Under Section B, enter the following:

- Name of U.S. officer or director

- Address

- Social Security number

- Officer/Director: Check the appropriate box

For Section C, include:

- Name of each shareholder filing this schedule

- Class of stock acquired

- Date and method of acquisition

- Number of shares acquired, either directly, indirectly, or constructively

- Amount paid

- Name and address of person from whom shares were acquired

For Section D, enter the following:

- Name of shareholder disposing of stock

- Class of stock disposed

- Date and method of disposition

- Number of shares disposed, either directly, indirectly, or constructively

- Amount received

- Name and address of person to whom disposition was made

In Section E, enter the following:

- Name and address of transferor

- Identifying number

- Date of transfer

- Assets transferred

- Description

- Fair market value

- Adjusted basis

- Description of assets transferred by foreign corporation

Complete Section F questions as applicable. See form instructions for additional details.

Separate Schedule P: Previously taxed earnings and profits of U.S. shareholder of certain foreign corporations

Required by the following taxpayers

- Category 1a filers

- Category 1b filers

- Category 4 filers

- Category 5a filers

- Category 5b filers

Step by step guide

Use Schedule P to report:

- The PTEP in the U.S. shareholder’s annual PTEP accounts with respect to a CFC in the CFC’s functional currency (Part I) and

- The U.S. shareholder’s U.S. dollar basis in that PTEP (Part II)

Due to its technical nature, please follow the detailed instructions for Schedule P on the IRS website.

Separate Schedule Q: CFC income by CFC income groups

Required by the following taxpayers

- Category 4 filers

- Category 5a filers

- Category 5b filers

Step by step guide

Use Schedule Q to report the CFC’s income, deductions, taxes, and assets by CFC income groups for purposes of Sections 960(a) and (d).

Due to its technical nature, please follow the detailed instructions for Schedule Q on the IRS website.

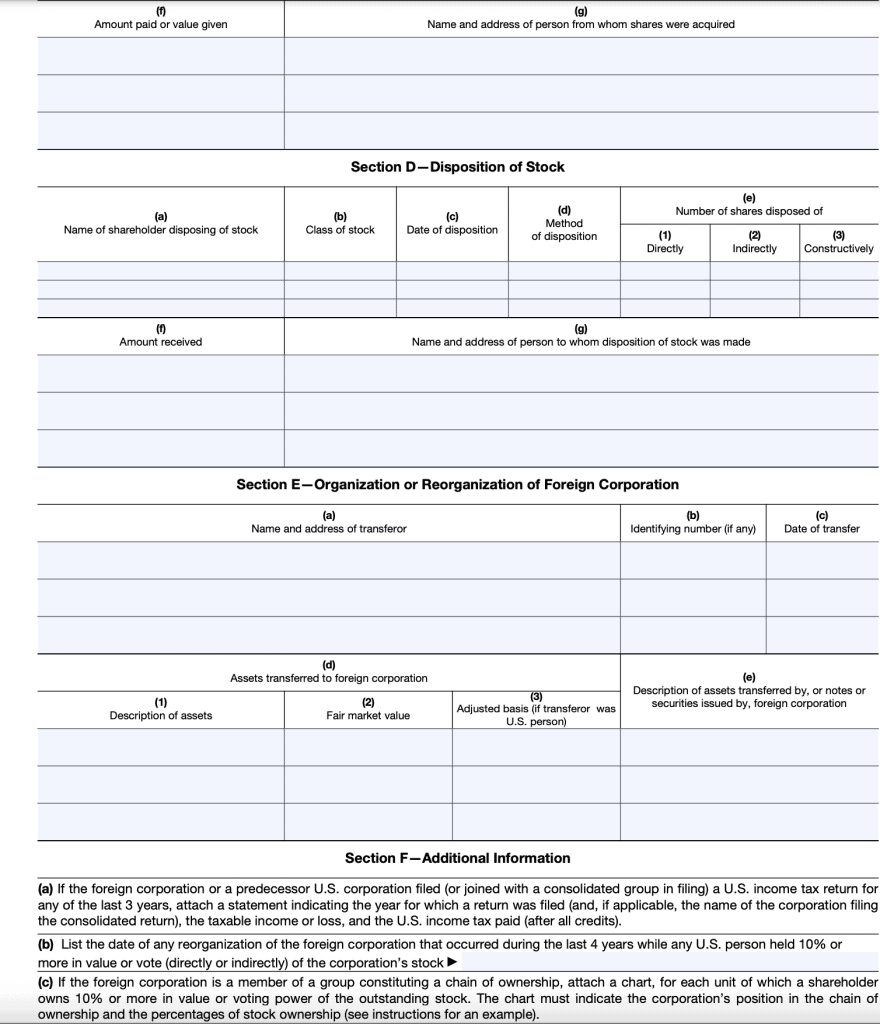

Separate Schedule R: Distributions from a foreign corporation

Required by the following taxpayers

- Category 4 filers

- Category 5a filers

Step by step guide

At the top, complete the following information:

- Name of person filing IRS Form 5471

- Identifying number

- Name of foreign corporation

- EIN or reference ID number, as applicable

For each distribution, include:

- Description of distribution

- Date

- Amount of distribution in functional currency

- Amount of earnings and profits distribution in functional currency

Who must file IRS Form 5471?

The Internal Revenue Service uses categories to describe certain U.S. taxpayers. Any taxpayer meeting the description of any of the categories must file IRS Form 5471 in accordance with the applicable IRS guidelines.

For purposes of determining who must fill out this form, there are 5 categories of taxpayers. Each category of filer has a certain filing obligation, as outlined below.

Category 1

Category 1 consists of U.S. shareholders:

- Of a foreign corporation that is a Section 965 specified foreign corporation (SFC) at any time during any tax year of the foreign corporation, and

- Who owned that stock on the last day in that year on which it was an SFC, taking into account the regulations under Section 965.

What is an SFC?

For Category 1 filers, an SFC is:

- A controlled foreign corporation, or

- Any foreign corporation with respect to which one or more domestic corporations is a U.S. shareholder

Within category 1, there are 3 subcategories, which further describe the taxpayer’s filing obligation regarding Form 5471.

Category 1a

A Category 1a filer is any Category 1 filer that does not qualify to file as a Category 1b or Category 1c filer, as outlined below.

Category 1a filers must complete the following information & schedules:

- Identifying information (top of the form)

- Schedule B, Part II

- Separate Schedule E

- Schedule E-1 (included with Schedule E)

- Separate Schedule J

- Separate Schedule P

Category 1b: Unrelated section 958(a) U.S. shareholder

For purposes of Category 1 and Category 5 filers, an unrelated Section 958(a) U.S. shareholder is a U.S. shareholder with respect to a foreign-controlled corporation (defined below) who:

- Owns, within the meaning of Section 958(a), stock of a foreign-controlled corporation; and

- Is not related (using principles of Section 954(d)(3)) to the foreign-controlled corporation.

Category 1b filers must complete the following information & schedules:

- Identifying information (top of the form)

- Separate Schedule E

- Schedule E-1 (included with Schedule E)

- Separate Schedule P

Schedules E and E-1 are required for an unrelated section 958(a) U.S. shareholder only if the filer claims deemed paid foreign income taxes of the foreign-controlled corporation under Section 960 for the filer’s tax year. Rev. Proc. 2019-40 contains more details.

Category 1c: Related constructive U.S. shareholder

For purposes of Category 1 and Category 5 filers, a related constructive U.S. shareholder is a U.S. shareholder with respect to a foreign-controlled corporation who:

- Does not own, within the meaning of Section 958(a), stock of the foreign-controlled corporation; and

- Is related (using principles of Section 954(d)(3)) to the foreign-controlled corporation.

Category 1c filers must complete the following information & schedules:

- Identifying information (top of the form)

- Schedule B, Part II

- Separate Schedule E

- Schedule G

- Separate Schedule G-1

According to Rev. Proc. 2019-40, related constructive U.S. shareholders only need to complete Schedule E. They can leave Schedule E-1 blank.

Category 2

Category 2 includes a U.S. citizen or resident who is an officer or director of a foreign corporation in which a U.S. person (defined below) has acquired (in one or more transactions):

- Stock which meets the 10% stock ownership requirement with respect to the foreign corporation, or

- An additional 10% or more (in value or voting power) of the outstanding stock of the foreign corporation.

A U.S. person has acquired stock in a foreign corporation when that person has an unqualified right to receive the stock, even though the stock is not actually issued. See Treasury Regulations Section 1.6046-1(f)(1) for more details.

10% stock ownership requirement

For purposes of Category 2 and Category 3, the stock ownership threshold is met if a U.S. person owns:

- 10% or more of the total value of the foreign corporation’s stock, or

- 10% or more of the total combined voting power of all classes of stock with voting rights.

U.S. person

For purposes of Category 2 and Category 3, a U.S. person is:

- A citizen or resident of the United States,

- A domestic partnership,

- A domestic corporation, and

- An estate or trust that is not a foreign estate or trust as defined in Section 7701(a)(31).

Category 2 filers must complete the following information & schedules:

- Identifying information (top of the form)

- Schedule O, Part I

Category 3

This category includes:

- A U.S. person who acquires stock in a foreign corporation which, when added to any stock owned on the date of acquisition, meets the 10% stock ownership requirement (described above) with respect to the foreign corporation;

- A U.S. person who acquires stock which meets the 10% stock ownership requirement with respect to the foreign corporation;

- A person who is treated as a U.S. shareholder under Section 953(c) with respect to the foreign corporation;

- A person who becomes a U.S. person while meeting the 10% stock ownership requirement with respect to the foreign corporation; or

- A U.S. person who disposes of sufficient stock in the foreign corporation to reduce his or her ownership interest to less than the 10% stock ownership requirement.

For more information, see Internal Revenue Code Section 6046 and Regulations Section 1.6046-1.

Category 3 filers must complete the following information & schedules:

- Identifying information (top of the form)

- Schedule A

- Schedule B, Part I

- Schedule B, Part II

- Schedules C & F

- Schedule G

- Separate Schedule G-1

- Separate Schedule O, Part II

Category 4

This category includes a U.S. person who had control of a foreign corporation during the annual accounting period of the foreign corporation.

U.S. person

The definition of U.S. person is different for Category 4 than for Categories 2 and 3. Below are examples of U.S. persons under Category 4:

- A US citizen or resident of the United States;

- A nonresident alien for whom an election is in effect under Section 6013(g) to be treated as a resident of the United States;

- An individual for whom an election is in effect under Section 6013(h), relating to nonresident aliens who become residents of the United States during the tax year and are married at the close of the tax year to a citizen or resident of the United States;

- A domestic partnership;

- A domestic corporation; and

- An estate or trust that is not a foreign estate or trust as defined in Section 7701(a)(31).

Control of a foreign corporation

A U.S. person has control of a foreign corporation if, at any time during that person’s tax year, it owns stock possessing:

- More than 50% of the total combined voting power of all classes of stock of the foreign corporation entitled to vote, or

- More than 50% of the total value of shares of all classes of stock of the foreign corporation.

A person in control of a corporation that, in turn, owns more than 50% of the combined voting power, or the value, of all classes of stock of another corporation is also treated as being in control of such other corporation.

Category 4 filers must complete the following information & schedules:

- Identifying information (top of the form)

- Schedule A

- Schedule B, Part I

- Schedule B, Part II

- Schedules C & F

- Separate Schedule E

- Schedule E-1 (included with Separate Schedule E)

- Schedule G

- Separate Schedule G-1

- Separate Schedule H

- Schedule I

- Separate Schedule I-1

- Separate Schedule J

- Separate Schedule M

- Separate Schedule P

- Separate Schedule Q

- Separate Schedule R

Category 5

These categories include a U.S. shareholder:

- Who owns stock in a foreign corporation that is a CFC at any time during any tax year of the foreign corporation, and

- Who owned that stock on the last day in that year on which it was a CFC.

U.S. Shareholder

For purposes of Category 5 filers, a U.S. shareholder is a U.S. person who:

- Owns (directly, indirectly, or constructively, within the meaning of Sections 958(a) and (b))

- 10% or more of the total combined voting power of all classes of voting stock of a CFC or,

- in the case of a tax year of a foreign corporation beginning after December 31, 2017, 10% or more of the total combined voting power or value of shares of all classes of stock of a CFC; or

- Owns (either directly or indirectly, within the meaning of Section 958(a)) any stock of a CFC (as defined in Sections 953(c)(1)(B) and 957(b)), unless the foreign corporation has an effective Section 953(c)(3)(C) election in place for the tax year.

U.S. Person

For purposes of

Category 5 filers, a U.S. person is:

- A US citizen or resident of the United States,

- A domestic partnership,

- A domestic corporation, and

- An estate or trust that is not a foreign estate or trust, as defined in

Section 7701(a)(31).

As with Category 1, there are 3 sub-categories under Category 5.

Category 5a

A Category 5a filer is any Category 5 filer that does not qualify to file as a Category 5b or Category 5c filer, as outlined below.

Category 5a filers must complete the following information & schedules:

- Identifying information (top of the form)

- Schedule B, Part II

- Separate Schedule E

- Schedule E-1 (included with Schedule E)

- Schedule G

- Separate Schedule G-1

- Separate Schedule H

- Schedule I

- Separate Schedule I-1

- Separate Schedule J

- Separate Schedule P

- Separate Schedule Q

- Separate Schedule R

Category 5b

For purposes of Category 1 and Category 5 filers, an unrelated Section 958(a) U.S. shareholder is a U.S. shareholder with respect to a foreign-controlled corporation (defined below) who:

- Owns, within the meaning of Section 958(a), stock of a foreign-controlled corporation; and

- Is not related (using principles of Section 954(d)(3)) to the foreign-controlled corporation.

Category 5b filers must complete the following information & schedules:

- Identifying information (top of the form)

- Separate Schedule E

- Schedule E-1 (included with Schedule E)

- Schedule I

- Separate Schedule I-1

- Separate Schedule P

- Separate Schedule Q

Schedules E and E-1 are required for an unrelated section 958(a) U.S. shareholder only if the filer claims deemed paid foreign income taxes of the foreign-controlled corporation under Section 960 for the filer’s tax year. Rev. Proc. 2019-40 contains more details.

Category 5c

For purposes of Category 1 and Category 5 filers, a related constructive U.S. shareholder is a U.S. shareholder with respect to a foreign-controlled corporation who:

- Does not own, within the meaning of Section 958(a), stock of the foreign-controlled corporation; and

- Is related (using principles of Section 954(d)(3)) to the foreign-controlled corporation.

Category 5c filers must complete the following information & schedules:

- Identifying information (top of the form)

- Schedule B, Part II

- Separate Schedule E

- Schedule G

- Separate Schedule G-1

- Separate Schedule I-1

According to Rev. Proc. 2019-40, related constructive U.S. shareholders only need to complete Schedule E. They can leave Schedule E-1 blank.

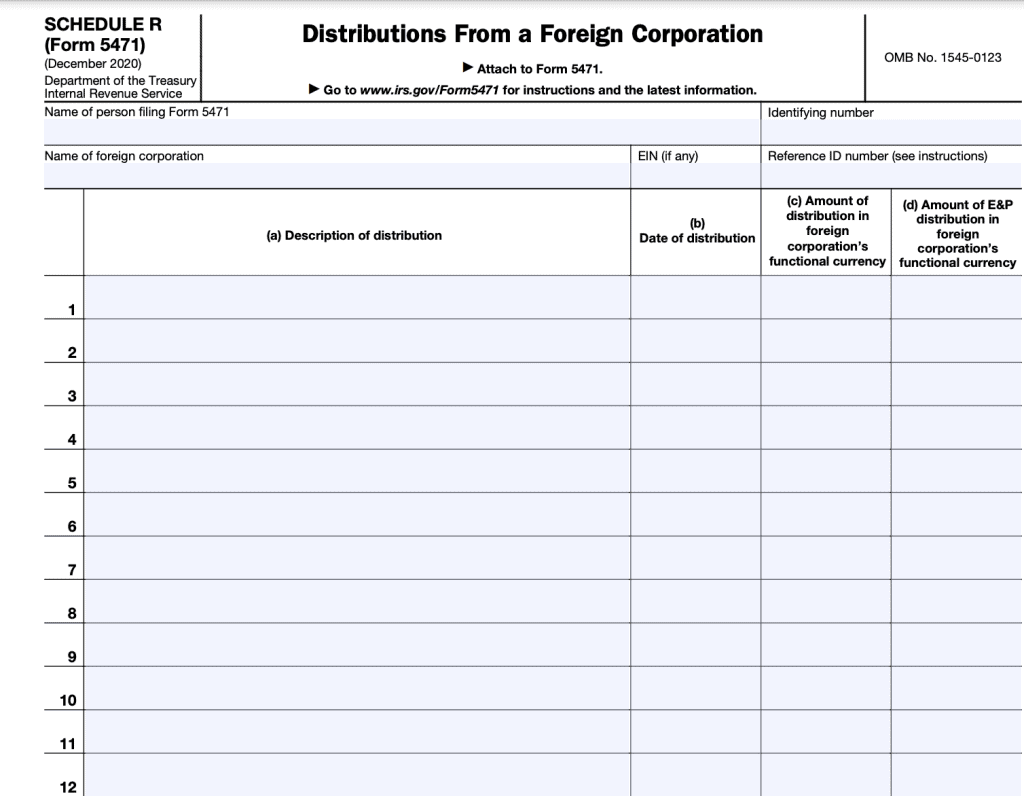

Summary of Filing Requirements for Categories of Filers

The below chart summarizes the filing requirements by filing category.

Who does NOT have to file IRS Form 5471?

Generally speaking, any taxpayer that does not fall into one of the above categories does not have to file Form 5471. However, there are certain exceptions within these taxpayer categories as well.

Multiple filers of same information

One person may file Form 5471 and the applicable schedules for other persons who have the same filing requirements. If you and one or more other persons are required to furnish information for the same foreign corporation for the same period, you may file a joint information return that contains the required information with your tax return or with the tax return of any one of the other persons.

Domestic corporations

Shareholders are not required to file the information checked in the chart, later, for a foreign insurance company that has:

- Elected, under Section 953(d), to be treated as a domestic corporation and

- Has filed a U.S. income tax return for its tax year under that provision.

Certain constructive owners

The IRS form instructions contain more detailed information about which constructive owners of foreign corporations may be excluded from Form 5471 filing requirements.

Penalties

Failure to file penalties can be severe.

Depending on the type of information missing from the informational return, disregarding the filing instructions can add up to substantial penalties.

Failure to file information required by Section 6038(a) (Form 5471 and Schedule M)

- A $10,000 penalty is imposed for each annual accounting period of each foreign corporation for failure to furnish the information required by Section 6038(a) within the time prescribed.

- If the information is not filed within 90 days after the IRS has mailed a notice of the failure to the U.S. person, an additional $10,000 penalty (per foreign corporation) is charged for each 30-day period, or fraction thereof, during which the failure continues after the 90-day period has expired. The additional penalty is limited to a maximum of $50,000 for each failure.

- Any person who fails to file or report all of the information required within the time prescribed will be subject to a reduction of 10% of the foreign taxes available for credit under Sections 901 and 960.

- If the failure continues 90 days or more after the date the IRS mails notice of the failure to the U.S. person, an additional 5% reduction is made for each 3-month period, or fraction thereof, during which the failure continues after the 90-day period has expired. See Section 6038(c)(2) for limits on the amount of this penalty.

See Treasury Regulations Sections 1.6038-1(j) and 1.6038-2(k)(3) for alleviation of this penalty in certain cases.

Failure to file information required by Section 6046 (Form 5471 and Schedule O)

Any person who fails to file or report all of the information requested by Section 6046 is subject to a $10,000 penalty for each such failure for each reportable transaction.

If the failure continues for more than 90 days after the date the IRS mails notice of the failure, an additional $10,000 penalty will apply for each 30-day period, or fraction thereof, during which the failure continues after the 90-day period has expired.

The additional penalty is limited to a maximum of $50,000. See Section 6679.

Criminal penalties

Criminal penalties under the following sections may apply for failure to file the information required by Sections 6038 and 6046:

Section 6662(j)

Certain penalties under sections 6038 and 6662 may be waived for certain persons under Section 7 of Rev. Proc. 2019-40.

Video walkthrough

Watch this instructional video to learn more about reporting information on IRS Form 5471.

Frequently asked questions

Generally, taxpayers must file Form 5471 to report detailed information about their involvement with certain foreign corporations. You may find additional guidance in the Who Must File section of this article.

Taxpayers who are required to file Form 5471, but do not do so may be subject to failure to file penalties. After the first 90 days, failure to file penalties are imposed in $10,000 increments every 30 days for a maximum of $50,000. Failure to file might also result in criminal charges.

You must file IRS Form 5471 with your federal income tax return, on or before your tax return’s due date.

How do I get IRS Form 5471?

This form and required attachments can be found on the IRS website. For your convenience, we’ve included a copy of this tax form in this article.