IRS Form 5495 Instructions

If you’re filing an income, gift, or estate tax return on behalf of a decedent, you might be held responsible for the decedent’s back taxes that you did not properly report. However, the federal government allows executors and fiduciaries to file IRS Form 5495 and request a discharge of personal liability when operating in good faith.

In this article, we’ll cover everything you need to know, including:

- How to complete and file IRS Form 5495

- What to include when you request relief from tax liability

- How the tax law protects executors and fiduciaries from personal liability

Let’s start by going over how to complete IRS Form 5495.

Table of contents

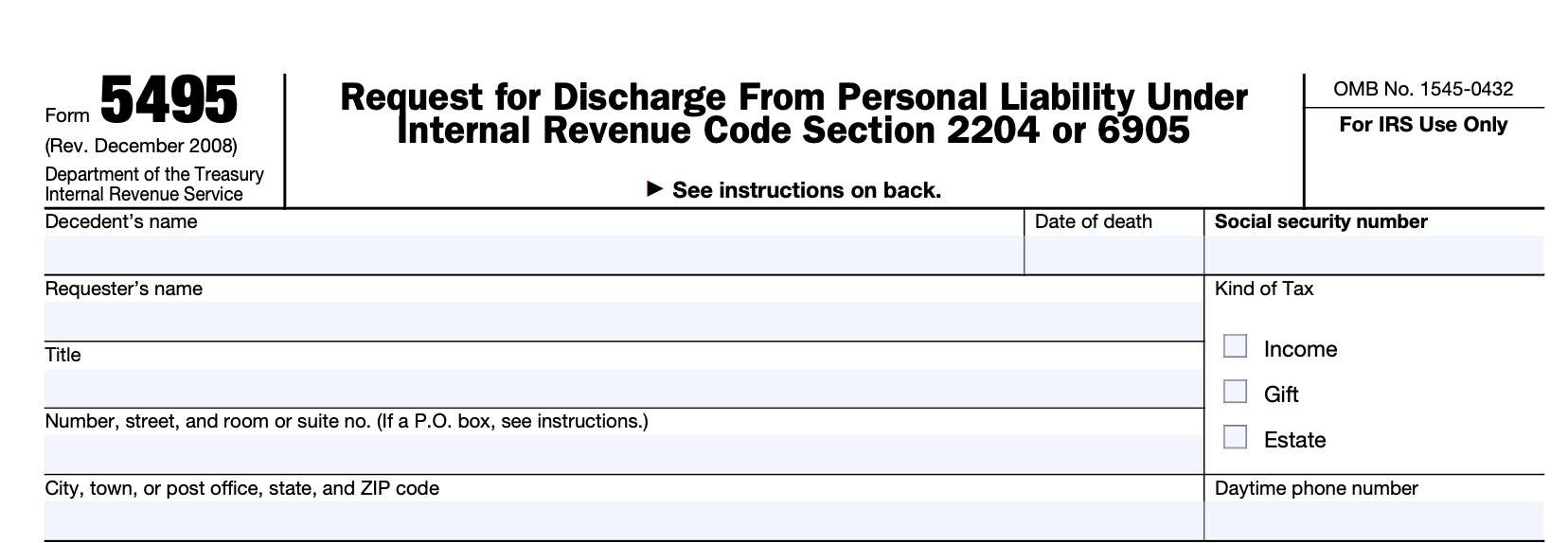

How do I complete IRS Form 5495?

This one-page tax form is relatively straightforward to complete. Let’s start at the top with the required taxpayer information.

Decedent’s name

At the top of the form, enter the decedent’s complete name.

Date of death

Enter the date of the decedent’s death.

Social Security number

In this field, enter the full Social Security number. Do not truncate or omit anything.

Requester’s name

Enter your name, as the requester.

Title

If applicable, enter your title.

If you are the personal representative, executor, or administrator of the estate of the decedent, then enter that title.

In the case of a fiduciary relationship, then state that you are a fiduciary.

Executor definition: The IRS considers an executor to be “an executor or administrator of a decedent, who was appointed, qualified, and acting within the United States.”

Street address

Enter your street address in this field, including street name and number.

Just below, enter the city, state, and zip code for your location.

Kind of tax

Check one or more boxes, depending on the type of tax return for which you are requesting a discharge of personal liability:

- Income tax: Income tax returns are filed on one of the following:

- IRS Form 1040

- IRS Form 1040-SR

- IRS Form 1040-NR, or

- IRS Form 1040-X

- Gift tax return: Gift tax returns are filed on IRS Form 709

- Estate tax return: Estate tax returns are filed on IRS Form 706

Daytime telephone number

Enter a telephone number so that the Internal Revenue Service may contact you for more information, if necessary.

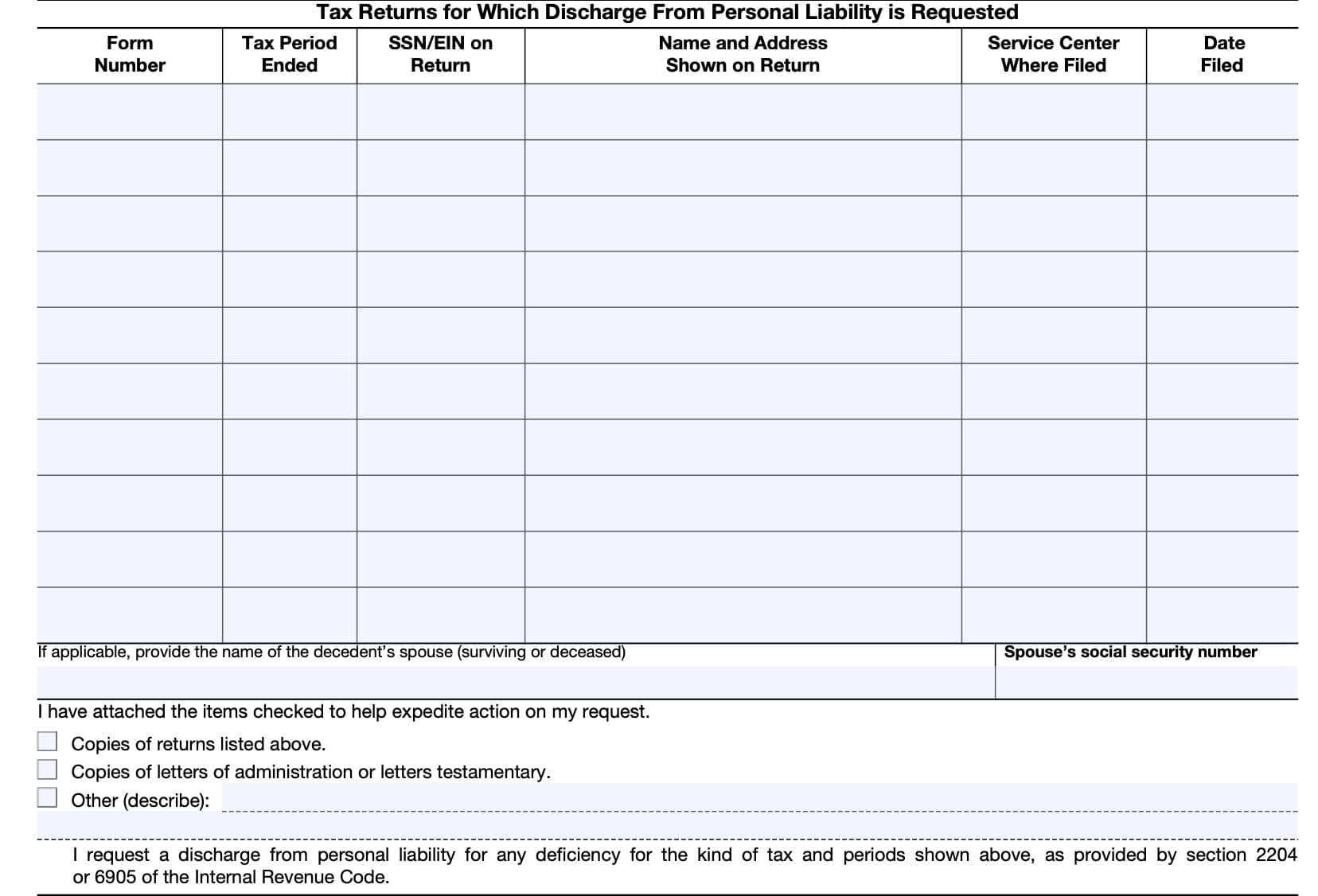

Tax returns for which discharge from personal liability is requested

In this section, you’ll enter each tax return for which you are requesting a discharge from liability. Enter the following information for each tax return:

- Form number (i.e. IRS Form 1040, IRS Form 706, IRS Form 709)

- Tax period ended

- Social Security number or employer identification number (EIN) on the tax return

- Name and address on the tax return

- Internal Revenue Service Center where the tax return was filed

- If you previously filed tax returns at different service centers, you must file IRS Form 5495 at each IRS center for each of the separate forms

- Date that the tax return was filed

Decedent’s spouse

If applicable, enter the name of the decedent’s spouse, whether he or she is a surviving spouse, or if the spouse was deceased at the time of the decedent’s death.

Spouse’s Social Security number

As applicable, enter the spouse’s Social Security number.

Additional information

At the bottom, just above the signature field, you’ll see several boxes that you can check to help the IRS expedite any required actions.

Check all that apply:

- Copies of tax returns listed above

- Copies of letters of administration or letters testamentary

- Other documents (provide a written description of any additional documentation that you plan to include, such as a trust document)

Finally, by filing IRS form 5495, you’re stating that you’re requesting a discharge from personal liability (executor liability or fiduciary liability) under one of two sections of the Internal Revenue Code.

It might be worth taking the extra step to understand a little more about each code section, under federal law.

Internal Revenue Code Section 2204

IRC Section 2204 specifically discusses the discharge of a fiduciary from personal liability.

Limitation period

Specifically, an executor or fiduciary of a decedent will be discharged from personal liability for any tax deficiency after:

- For executor liability: 9 months from the date of the IRS’s receipt of IRS Form 5495

- For fiduciary liability: 6 months from the date of the IRS receipt

In certain instances where the date for payment of an estate tax liability has been extended, the IRS may require that the executor or fiduciary post a bond as a condition of discharge.

Good faith reliance on gift tax returns

IRC Section 2204 also protects an executor from liability in relying on gift tax returns furnished under IRC Section 6103(e)(3) when determining the decedent’s adjusted taxable gifts for gift tax return purposes if the gifts are:

- Made more than 3 years prior to the date of the decedent’s death, and

- Not reflected on any gift tax returns

Internal Revenue Code Section 6905

Under IRC Section 6905, the federal government will discharge the executor or fiduciary from any personal responsibility for any personal liability related to a decedent’s unpaid taxes after filing Form 5495. This specifically refers to either income taxes or gift taxes.

This discharge of responsibility happens after:

- Payment of a decedent’s federal taxes that the fiduciary or executor is aware of, or

- A statutory period of 9 months from the date of the written request, if no acknowledgement is received from the IRS

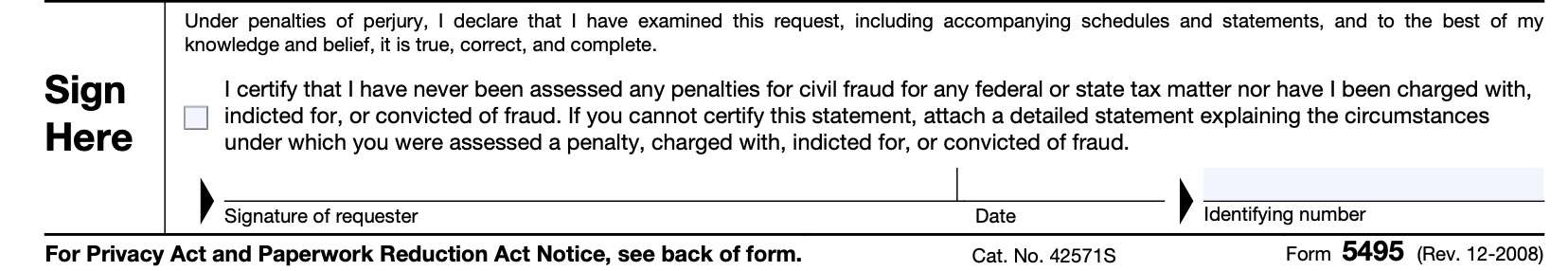

Signature field

You’ll sign at the bottom of this form, under penalties of perjury, that everything is true, correct, and complete, to the best of your knowledge. You are also certifying that you have never been:

- Assessed any penalties for civil fraud related to federal or state tax matters, and

- You have never been:

- Charged with fraud

- Indicted for fraud, or

- Convicted of fraud

If you cannot certify the statement, then you may provide a written statement that explains the situation in which you were:

- Assessed a penalty, or

- Charged with, indicted for, or convicted of fraud

When do I file IRS Form 5495?

If you are requesting a discharge from income or gift tax liability, you cannot file Form 5495 until you have filed the tax returns that you list on the front of this form.

If you are requesting a discharge from personal tax liabilities related to estate taxes, you can:

- Attach your completed Form 5495 to IRS Form 706, or

- Separately file IRS Form 5495 at any time during the 3-year period after you’ve filed Form 706

You must submit a separate request for discharge from personal liability for any federal tax returns that you file after submitting Form 5495.

Where do I file IRS Form 5495?

Send your completed Form 5495 to the IRS center where you filed the tax returns that you list on the front of the form. If you’re requesting liability relief from taxes reported on multiple tax returns filed at different IRS centers, then you must send a separate Form 5495 to each center to receive a discharge from liability for each type of tax.

To request a discharge of gift tax liability that you reported on IRS Form 709, or discharge of estate taxes reported on Form 706, send your completed Form 5495 to:

Internal Revenue Service

Stop 824G

7940 Kentucky Drive

Florence, KY 41042‐2915

How do I file IRS Form 5495?

Attach to your request the information and documentation requested on Form 5495.

If you are submitting this request with your estate tax return, you do not need to provide an additional copy. If you are filing this form after you’ve already filed a federal estate tax return, then you must also attach copies of:

- Pages 1-3 of Form 706

- Schedules A through I, as applicable

For fiduciaries requesting discharge from personal liability under IRC Section 2204, then you must:

- Check the ‘Other’ box

- Include the following:

- Copy of the trust instrument(s)

- List of assets transferred from the decedent to the trust

- Other relevant information

You may use your own format of reporting, as long as your written request contains the same information requested on the tax form and you include the applicable attachments.

Video walkthrough

Frequently asked questions

According to the IRS, the executor representing a decedent’s estate or a fiduciary of a decedent’s trust file IRS form 5495 to request a discharge from personal liability for a decedent’s income, gift, and estate taxes.

If you filed an estate tax return on behalf of a decedent, then you should file Form 5495 for all taxes at the address where the estate tax return was filed.

Where can I find IRS form 5495?

You may find a copy of IRS Form 5495 on the IRS website. For your convenience, we’ve enclosed the most recent version of this tax form right here.