IRS Form 5695 Instructions

In late 2022, the Inflation Reduction Act created many significant changes intended to help businesses and individuals invest more money in clean, energy-efficient improvements. This includes extending the federal tax credit for a variety of qualified residential energy improvements that taxpayers can claim using IRS Form 5695.

In this article, we’ll walk through everything you need to know about this tax form, to include:

- The impact of the Inflation Reduction Act on energy-related tax credits

- Which energy-saving improvements qualify for a tax credit

- Limitations to the tax credits you can take for energy efficiency projects

- How to complete Form 5695 to properly calculate the maximum tax credit

Let’s start by walking through this tax form, step by step.

Table of contents

- How do I complete IRS Form 5695?

- Impact of the inflation Reduction Act on Renewable Energy Tax Credits

- What tax credits can I claim with IRS form 5695?

- Tax credit limitations

- Which Residential improvements are eligible for tax credits in 2024?

- Video walkthrough

- Frequently asked questions

- Where can I find a copy of IRS Form 5695?

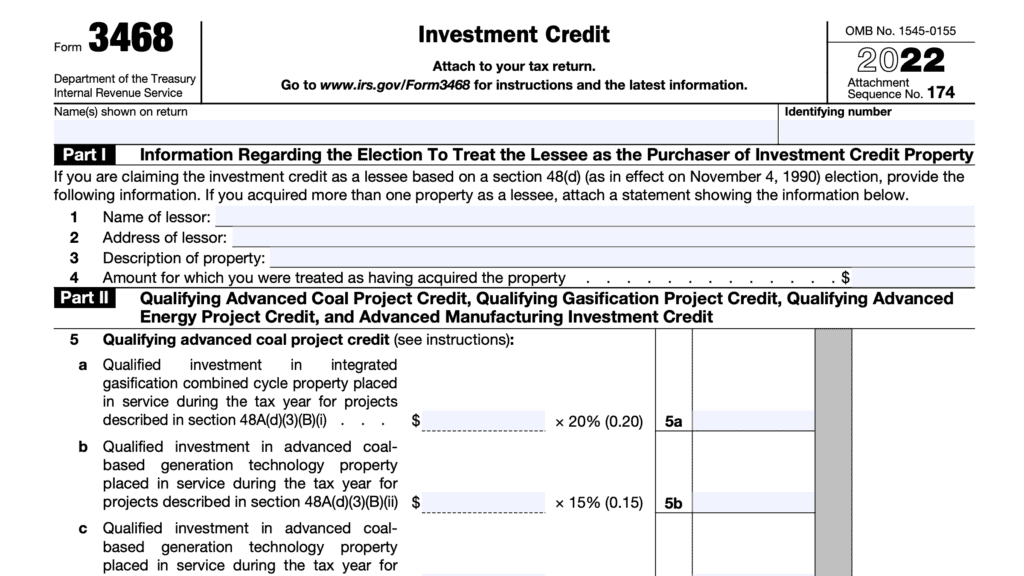

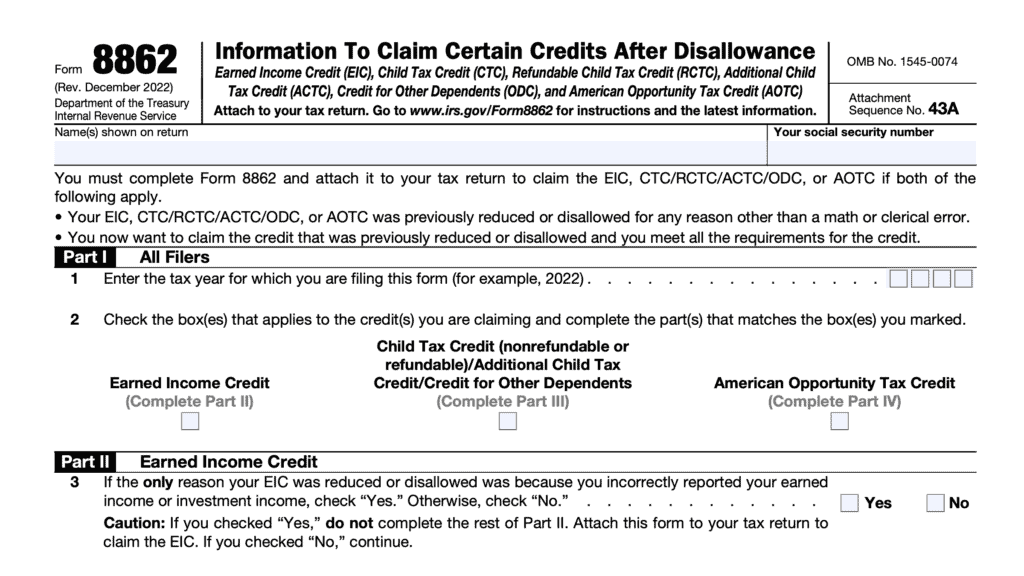

- Related tax forms

- What do you think?

How do I complete IRS Form 5695?

There are two parts to Form 5695:

Each of these tax credits is calculated separately, then incorporated into Schedule 3 of the taxpayer’s federal income tax return.

Below are the steps to complete the form for tax year 2024.

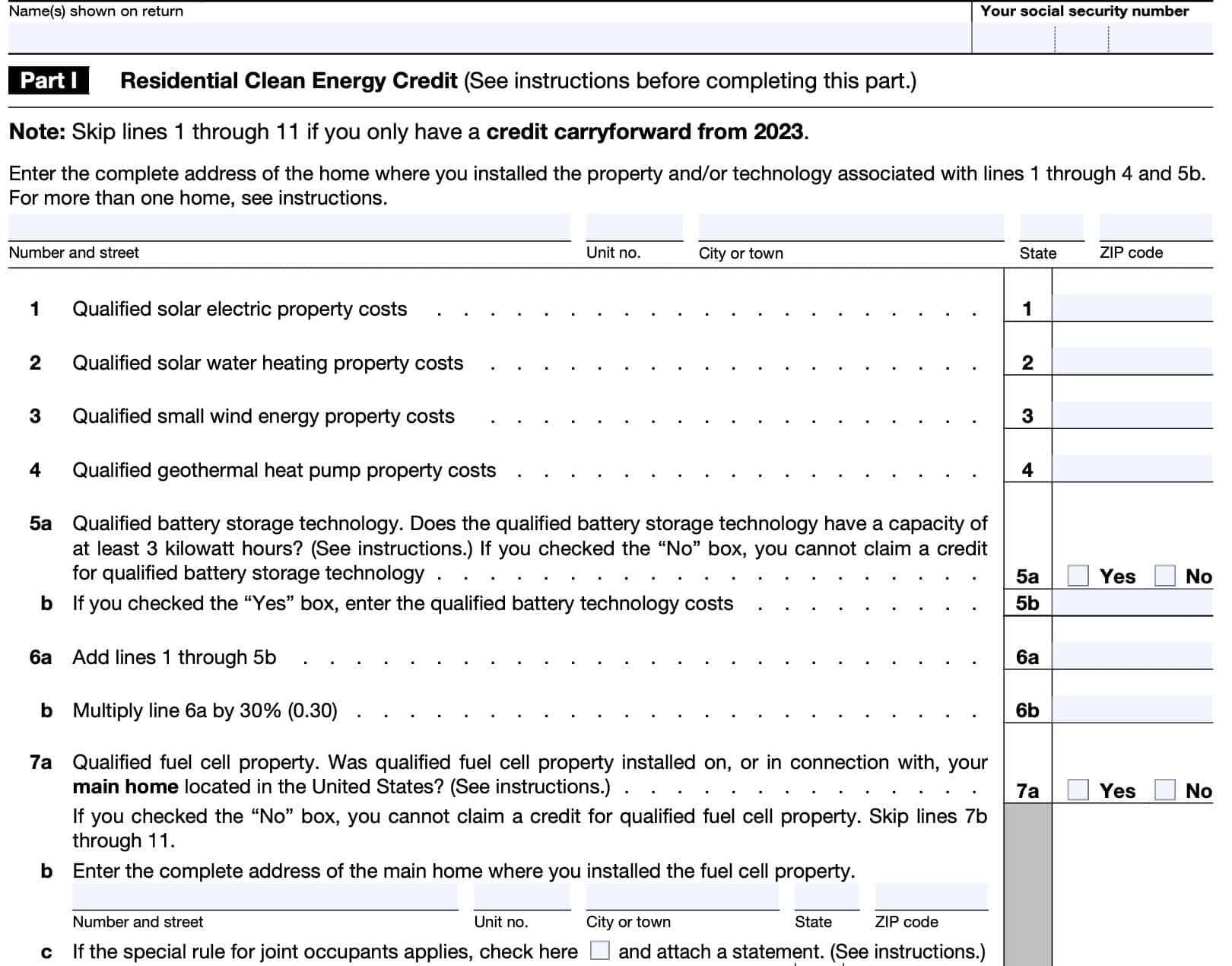

Part I: Residential Clean Energy Credit

If you only have a credit carryforward from tax year 2023, you can skip Lines 1 through 11 and go directly to Line 12. Otherwise, let’s start at the top.

Line 1: Qualified solar electric property costs

Enter the total costs for any qualifying solar electric property.

Line 2: Qualified solar water heating property costs

Enter the total costs for any qualifying solar water-heating property.

Line 3: Qualified Small Wind Energy property costs

Enter the total costs for any qualifying small wind energy property.

Line 4: Qualified Geothermal Heat Pump property costs

Enter the total costs for any qualifying geothermal heat pump property.

Line 5a: Qualified Battery storage technology

Does the qualified battery storage technology have a capacity of at least 3 kilowatt hours?

If No, then you cannot claim a tax credit for battery storage technology. If Yes, go to Line 5b.

Line 5b: Qualified battery technology costs

If you selected Yes in Line 5a, enter the qualified battery technology costs.

Line 6a

In Line 6a, add the totals of Lines 1 through 5.

Line 6b

For Line 6b, multiply the total in Line 6a by 30% (0.30). Enter the result here.

Line 7a: Qualified fuel cell property

In Line 7a, indicate whether or not the qualified fuel cell property was installed in your primary residence within the United States.

If you answer ‘Yes,’ proceed to Line 7b. If not, proceed to Line 12. You cannot take a tax credit for the fuel cell property.

Line 7b: Address of qualified fuel cell property

In Line 7b, enter the complete address for the primary residence where you installed the fuel cell property.

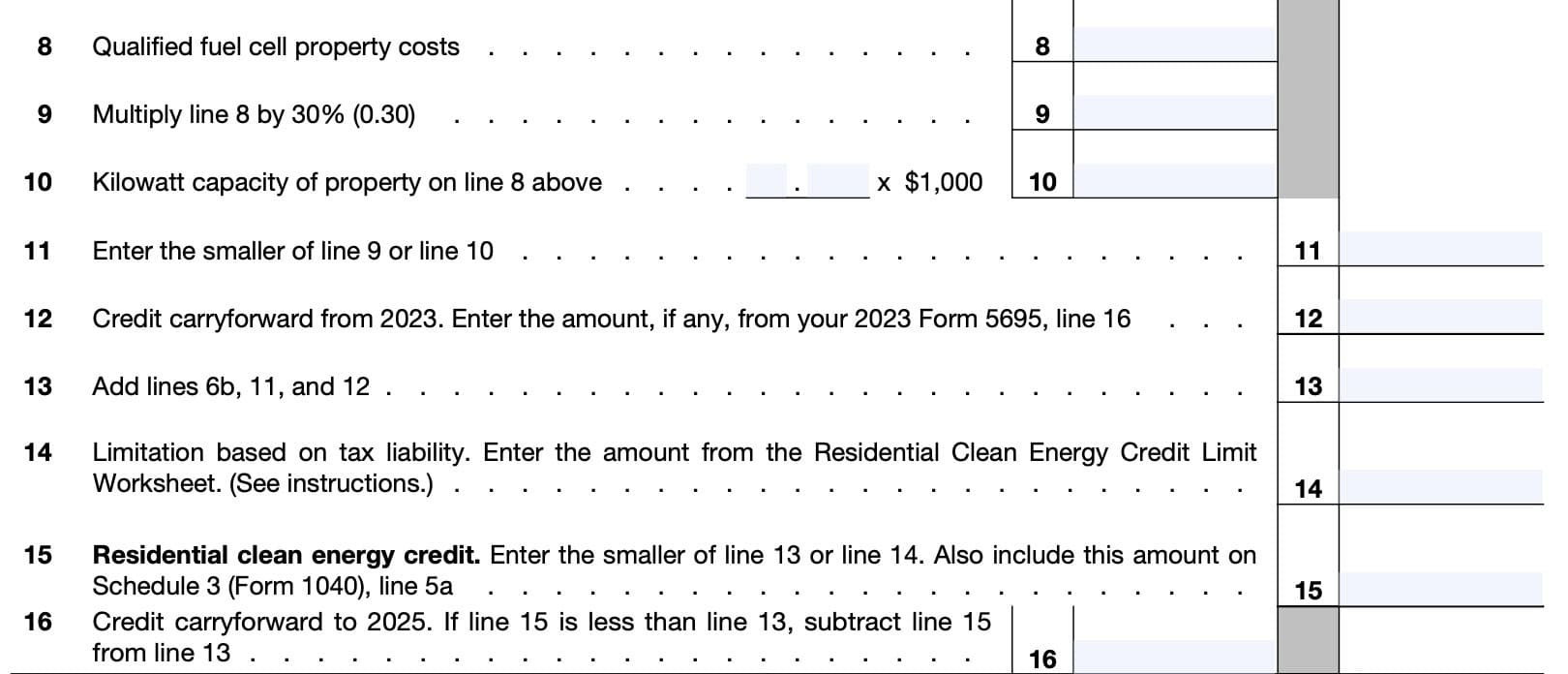

Line 8: Qualified Fuel Cell Property Costs

Enter the costs for your qualified fuel cell property.

Line 9

Multiply Line 8 by 30% (0.30), and enter the result here.

Line 10: Kilowatt capacity

Determine the kilowatt capacity of the fuel cell property. Multiply this number by $1,000 and enter the total into Line 10.

Line 11

Enter the smaller of either:

Line 12: Credit carryforward from previous tax year

Enter any tax credit carryforward from the previous tax year. You should find this number on your previous year’s Form 5695, Line 16.

Line 13

Add the totals of:

Line 14: Limit based upon Federal tax liability

The IRS website contains instructions on how to calculate this number. Here is the step-by-step process to calculate this, directly from the Residential Clean Energy Worksheet:

- Step 1: Enter the number from Line 18 of the current year’s Form 1040, 1040-NR, or 1040-SR

- Step 2: Enter the total of the following tax credits from your current year income tax return:

- Negative IRS Form 8978 Adjustment, Schedule 3 (Form 1040), Line 6l

- Foreign Tax Credit, Schedule 3 (Form 1040), Line 1

- Credit for Child and Dependent Care Expenses, Schedule 3 (Form 1040), Line 2

- Credit for the Elderly or the Disabled, Schedule R (Form 1040), Line 22

- Nonrefundable Education Credits, Schedule 3 (Form 1040), Line 3

- Retirement Savings Contributions Credit, Schedule 3 (Form 1040), Line 4

- Energy Efficient Home Improvement Credit, Form 5695, Line 32

- New Clean Vehicle Credit, Personal use part, IRS Form 8936, Line 10

- Child Tax Credit and Credit for Other Dependents, Form 1040, 1040-SR, or 1040-NR, Line 19

- Mortgage Interest Credit, Form 8396, Line 9

- Adoption Credit, IRS Form 8839, Line 16

- Carryforward of the District of Columbia First-Time Homebuyer Credit, Form 8859, Line 3

- Step 3: Subtract the total tax credits calculated in Step 2 from the number you entered in Step 1.

- Enter this total on Line 14. If the result is zero or less, enter ‘0’ on both Line 14 and Line 15.

For more detail on navigating the Residential Clean Energy Worksheet, check out our step-by-step video.

Line 15: Residential Clean Energy Credit

Enter the smaller of:

- Line 13

- Line 14

Enter this number on Schedule 3, Line 5.

Line 16: Credit carryforward

If Line 15 is less than Line 13, subtract Line 15 from Line 13 and enter the difference here.

This is your tax credit carryforward to next year.

Part II: Energy Efficient Home Improvement Credit

Follow the steps in Part II to calculate and claim the energy efficient home improvement credit. The Internal Revenue Service breaks down Part II into 2 sections:

- Section A: Qualified Energy Efficiency Improvements

- Section B: Residential Energy Property Expenditures

For this article, we’ll start with Line 17.

Line 17a: Were these improvements for your primary home?

In Line 17a, determine whether the qualified energy efficiency improvements or residential energy property costs were for your primary residence located in the United States.

Line 17b: Are you the original user of the qualified energy efficiency improvements?

To qualify for the credit, you must be the original user of the qualified energy efficiency improvements. If you check the No box, you can’t take the energy efficient home improvement credit.

Line 17c: Are the components reasonably expected to remain in use for at least 5 years?

If you answered No to any question in Line 17a, 17b, or 17c, stop here. You cannot claim the energy efficient home improvement credit, and you should not complete Part II.

Line 17d

Enter the address in Line 17d. Include the street address, city, state, and zip code.

Line 17e: Were any of these improvements related to the construction of this main home?

If you checked Yes, you can only claim the energy efficient home improvement credit for

qualifying improvements that were not related to the construction of the home.

Do not include expenses related to the construction of your main home, even if the improvements were made after you moved into the home.

Line 18: Insulation or air sealing material or system

Line 18a: Insulation or air sealing material or system costs

In Line 18a, enter the cost of insulation material or systems that:

- Are specifically designed to reduce heat loss or gain of your home

- Meet the criteria established by the IECC

Line 18b

For Line 18b, multiply the Line 18a amount by 30%. Enter the result here, but do not enter a number greater than $1,200.

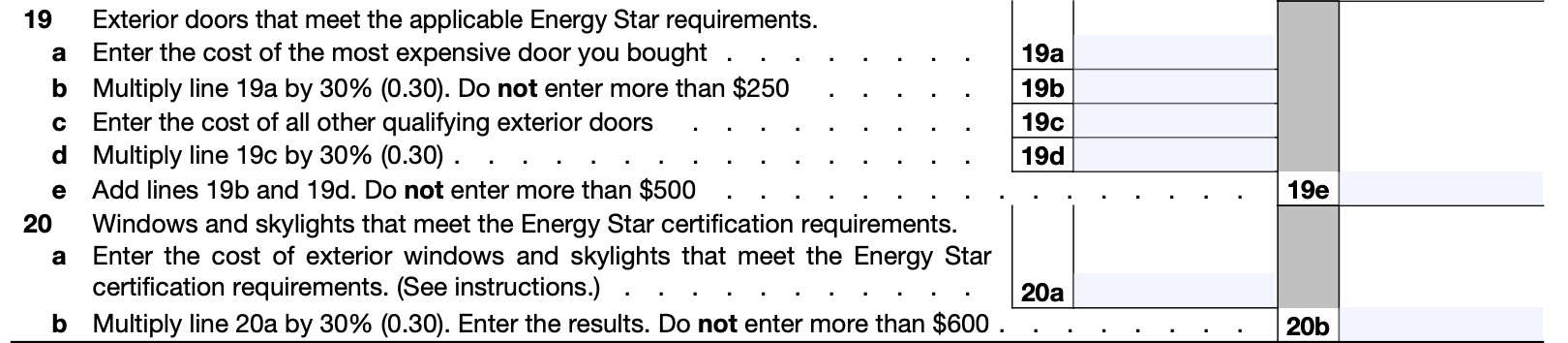

Line 19: Exterior doors that meet energy star requirements

Line 19a: cost of most expensive door

Enter the cost of the most expensive exterior door that you purchased that meets Energy Star program requirements.

Line 19b: Exterior doors

Multiply Line 19a by 30%. Do not enter a number greater than $250.

Line 19c: Cost of all other qualifying exterior doors

Enter the costs for all other qualifying exterior doors.

Line 19d

Multiply Line 19c by 30%. Do not enter a number greater than $250.

Line 19e: Maximum costs

Add Lines 19b and 19d, then enter the total here. Do not enter a number greater than $500.

Line 20: Windows and skylights

Line 20a: Cost of windows and skylights

Enter the cost of exterior windows and skylights that meet Energy Star certification requirements.

Line 20b

Multiply Line 20a by 30%. Do not enter more than $600.

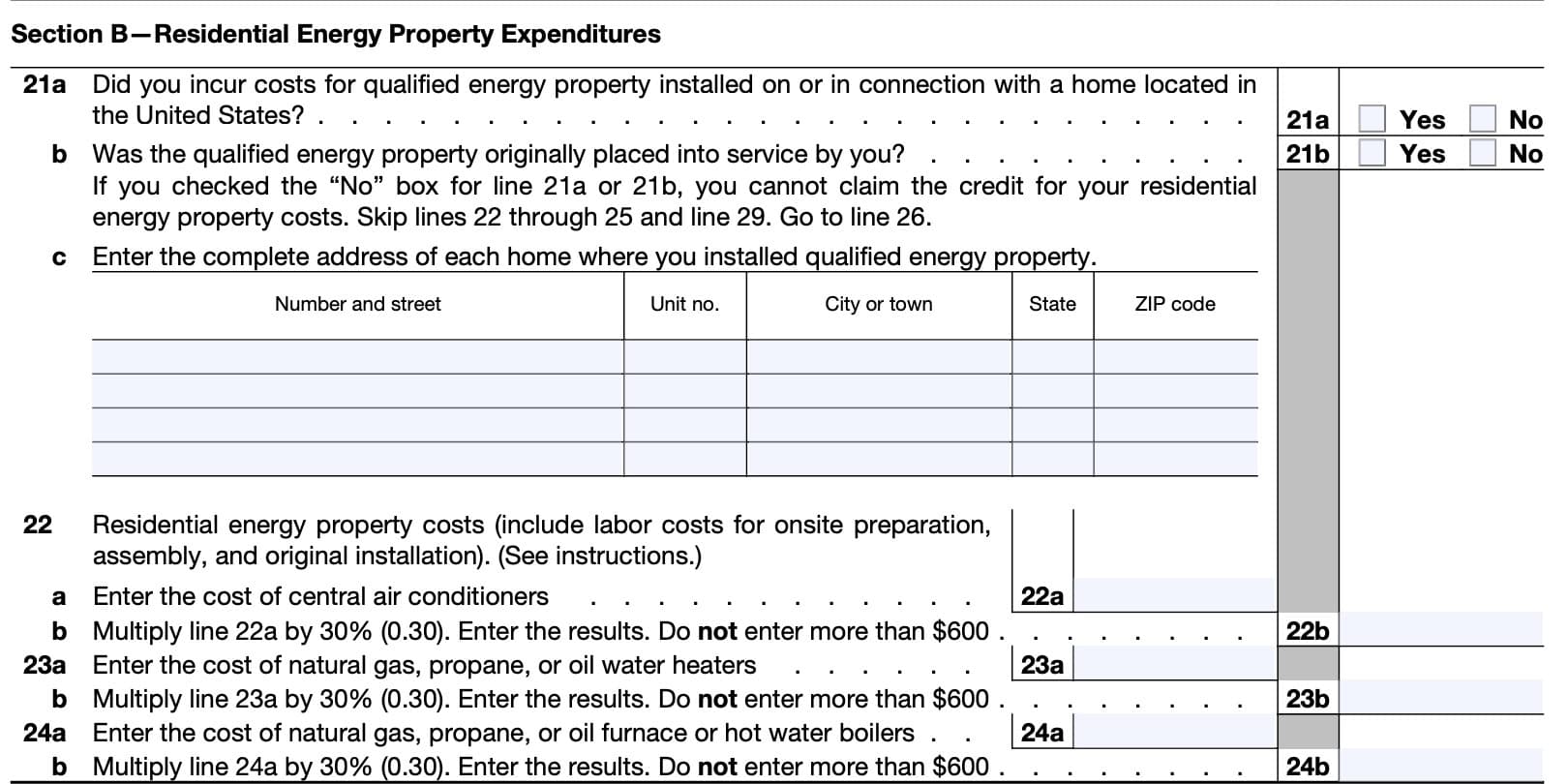

Line 21a

Did you incur costs for qualified energy property installed on or in connection with a home located in the United States?

Check Yes or No.

Line 21b

Did you originally place the qualified energy property into service? Check Yes or No.

If you checked No to either Line 21a or Line 21b, then you cannot claim any federal tax credits for residential energy property costs.

Skip Lines 22 through 25, and Line 29. Go directly to Line 26.

Line 21c: Qualified energy property address

Enter the complete address of each home where you installed qualified energy property. Include the following information:

- Street name and number

- Unit number (if applicable)

- City or town

- State

- ZIP code

Line 22: Residential energy property costs

These costs can include labor costs for onsite preparation, assembly, and original installation. However, this must have been placed in service by the taxpayer in the current tax year.

Line 22a: Central air conditioners

Enter the amounts you paid for central air conditioners that achieve the highest efficiency tier that has been established by the Consortium for Energy Efficiency (CEE) that is in effect as of the beginning of the calendar year in which the property is placed in service.

Line 22b

Multiply Line 22a by 30%. Do not enter more than $600.

Line 23a: Natural gas, propane, or oil water heaters

Enter the amounts you paid for natural gas, propane, or oil water heaters that achieve the highest efficiency tier established by the CEE that is in effect as of the beginning of the calendar year in which the property is placed in service.

Line 23b

Multiply Line 23a by 30%. Do not enter more than $600.

Line 24a: Natural gas, propane, or oil furnace or hot water boilers

Enter the amounts you paid for natural gas, propane, or oil furnace or hot water boilers that achieve the highest efficiency tier established by the CEE that is in effect as of the beginning of the calendar year in which the property is placed in service.

In addition, oil furnaces and hot water boilers placed in service after December 31, 2022, and before January 1, 2027, must meet the 2021 Energy Star efficiency criteria and be rated by the manufacturer for use with fuel blends at least 20% of the volume of which consists of an eligible fuel.

Line 24b

Multiply Line 24a by 30%. Do not enter more than $600.

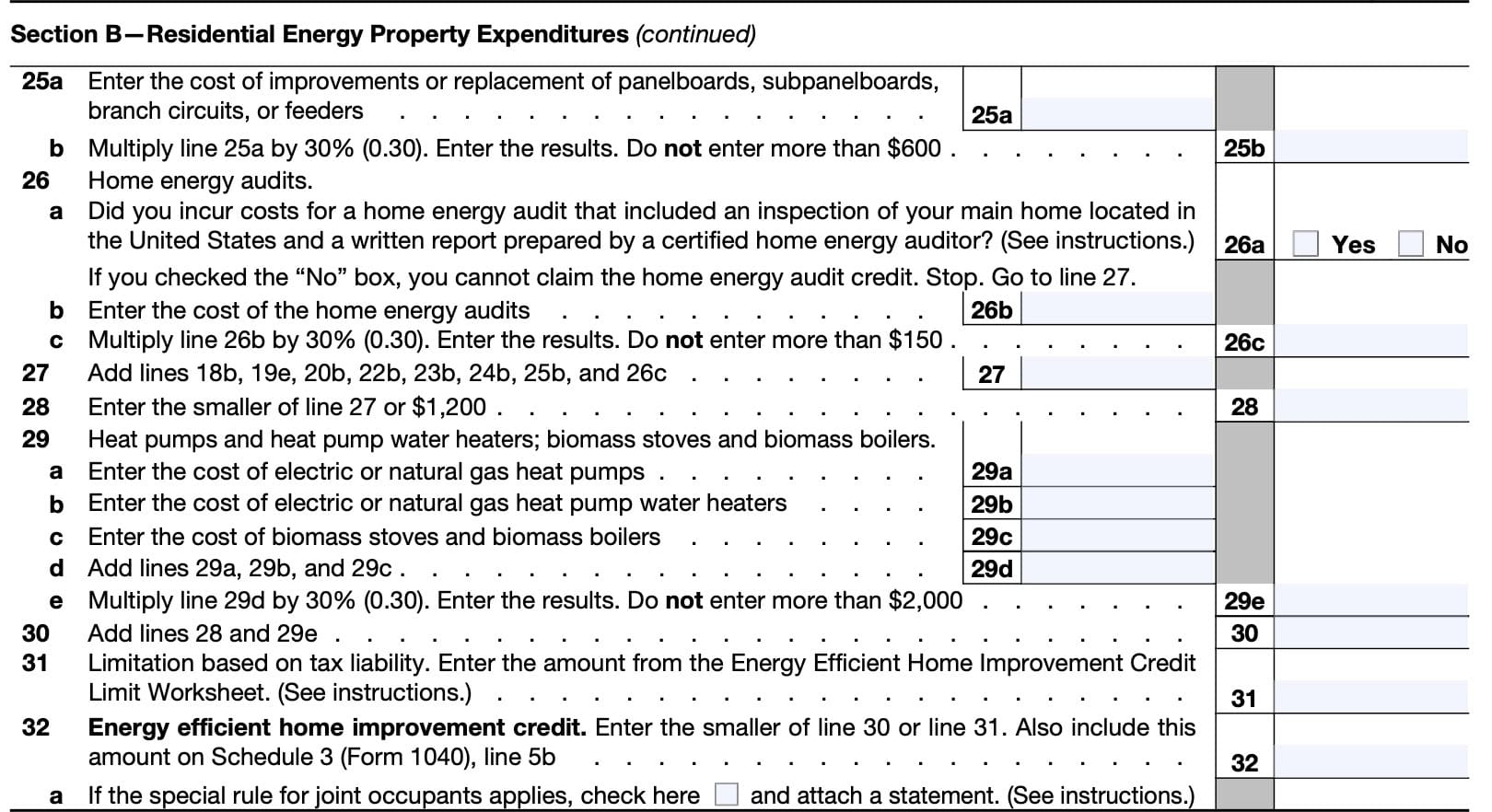

Line 25a: Electrical panel upgrades

Enter the cost of improvements or replacement of panelboards, subpanelboards, branch circuits, or feeders.

Line 25b

Multiply Line 25a by 30%. Do not enter more than $600.

Line 26: Home energy audits

Line 26a

Did you incur costs for a home energy audit that included:

- An inspection of your main home located in the United States and

- A written report prepared by a certified home energy auditor

Check Yes or No. If No, then you cannot claim the home energy audit credit. Skip down to Line 27.

Line 26b: Home energy audit costs

Enter the qualifying expenses for qualifying home energy audits here.

Line 26c

Multiply Line 26b by 30%. Do not enter more than $150.

Line 27

Add the following and enter the total here:

- Line 18b: Insulation or air sealing material or system

- Line 19e: Exterior doors

- Line 20b: Windows & skylights

- Line 22b: Central air conditioners

- Line 23b: Natural gas, propane, or oil water heaters

- Line 24b: Natural gas, propane, or oil furnace or hot water boilers

- Line 25b: Electrical panel upgrades

- Line 26c: Home energy audit costs

Line 28

Enter the smaller of:

- Line 27

- $1,200

Line 29: Heat pumps and heat pump water heaters, biomass stoves and biomass boilers

Line 29a: Electric or natural gas heat pumps

Enter the cost of electric or natural gas heat pumps.

Line 29b: Electric or natural gas heat pump water heaters

Enter the cost of electric or natural gas heat pump water heaters.

Line 29c: Biomass stoves and biomass boilers

Enter the cost of biomass stoves and biomass boilers.

Line 29d

Add Lines 29a, 29b, and 29c. Enter the total here.

Line 29e

Multiply Line 29d by 30%. Do not enter more than $2,000.

Line 30

Enter the total of Line 28 and Line 29e here. Do not enter a number exceeding $3,200.

Line 31: Limitation based upon tax liability

This represents the limit based upon other tax credits you may have taken for the 2024 tax year.

- Negative Form 8978 Adjustment, Schedule 3 (Form 1040), Line 6l

- Foreign Tax Credit, Schedule 3 (Form 1040), Line 1

- Credit for Child and Dependent Care Expenses, Schedule 3 (Form 1040), Line 2

- Credit for the Elderly or the Disabled, Schedule R (Form 1040), Line 22

- Nonrefundable Education Credits, Schedule 3 (Form 1040), Line 3

- Retirement Savings Contributions Credit, Schedule 3 (Form 1040), Line 4

- Step 1: Enter the number from Line 18 of the current year’s Form 1040, 1040-NR, or 1040-SR

- Step 2: Enter the total of the following tax credits from your current year income tax return:

- Negative IRS Form 8978 Adjustment, Schedule 3 (Form 1040), Line 6l

- Foreign Tax Credit, Schedule 3 (Form 1040), Line 1

- Credit for Child and Dependent Care Expenses, Schedule 3 (Form 1040), Line 2

- Credit for the Elderly or the Disabled, Schedule R (Form 1040), Line 22

- Nonrefundable Education Credits, Schedule 3 (Form 1040), Line 3

- Retirement Savings Contributions Credit, Schedule 3 (Form 1040), Line 4

- Step 3: Subtract the total tax credits calculated in Step 2 from the number you entered in Step 1.

- Enter this total on Line 31. If the result is zero or less, enter ‘0’ on both Line 31 and Line 32.

Watch the video below for a step by step walkthrough of the energy efficient home improvement credit limit worksheet from the IRS form instructions.

Line 32: Energy efficient home improvement credit

Enter the smaller of Line 30 or Line 31.

Also include this amount on Schedule 3, Line 5b.

Impact of the inflation Reduction Act on Renewable Energy Tax Credits

In late 2022, the federal government passed the Inflation Reduction Act, which provides tax credits for individuals and businesses who invest in a variety of energy efficiency improvements.

This new legislation was passed to address energy improvement projects across many areas, including:

- Businesses which invest in energy efficiency or clean energy projects

- Taxpayers who invest in energy efficient vehicles

- Residential energy efficiency projects

At the time of this writing, the Internal Revenue Service was still working to implement many of these new tax credits. As a result, please note that this article was written for educational purposes. Do not interpret this article as tax advice. For specific tax advice for your situation, please contact a tax professional.

For residential projects, this represents an extension of existing tax credits that were due to expire at the end of the year, an increase in many other tax credits, and new tax credits that might not have been previously available. Now, many of these tax credits are available for up to 10 years, expiring with the 2032 tax year.

Before we discuss specific qualifying improvements, let’s dig a little further to learn about the changes to the tax credits themselves.

What tax credits can I claim with IRS form 5695?

There are two categories of tax credits that a homeowner may claim using this tax form:

- Residential clean energy credit, and

- Energy efficient home improvement credit

These credits are not new, but they are new names for previously existing tax credits. The residential clean energy credit used to be the residential energy efficient property credit.

Likewise, the nonbusiness energy property credit became the energy efficient home improvement credit.

For each credit, there are certain limitations to be aware of. Also, there are differences between the limits that apply for the 2022 tax year, and the applicable limits for future tax years.

Tax credit limitations

For each residential improvement, there is a general limitation, by percentage and dollar amount. However, the total tax credit available is limited as well. Let’s look at the limitation for each available tax credit.

Residential clean energy credit limits

The residential clean energy credit is 30% of the total expenditure costs for a qualified project. The Inflation Reduction Act extended this credit to be effective for tax year 2022 through 2035, as outlined below.

There are no lifetime or annual limitations. However, there is a phase-out period after 2032:

- Tax year 2033: 26% of costs

- Tax year 2034: 22% of costs

- Tax year 2035 and beyond: 0%

There is a limitation based upon your current year’s federal income tax bill.

Energy efficient home improvement Credit limits (2022)

For tax years leading up to, and including 2022, the energy efficient home improvement credit was 10% of qualified expenditures, with a lifetime dollar limit of $500. Additionally, there were line-item limitations on certain expenditures, which included:

This includes the following annual limits for 2022 only:

- Air source heat pumps: $300

- Central A/C units: $300

- Furnaces or hot water boilers: $150

- Furnaces or hot water boilers: $150

- Advanced main air circulating fan (for furnace systems): $50

- Insulation: $500

- Roofs: $500

- Exterior doors: $500

- Windows: $200

If you are looking to claim a tax credit for the 2022 tax year, the ENERGY STAR website contains important information regarding qualifying requirements for each of these improvements.

Energy efficient home improvement Credit limits (2023 through 2032)

For tax years 2023 through 2032, this credit has increased from 10% of expenditures to 30% of expenditures (not including installation costs). The lifetime limit has changed to an annual dollar limit of $1,200. This change allows homeowners to invest in more projects over a longer period of time while still qualifying for the credit.

This includes the following annual limits:

- Home energy audits: $150

- Exterior doors: $250 per door, or $500 per year

- Exterior windows and skylights: $600

- Central A/C units: $600

- Electric panels and related equipment: $600

- Natural gas, propane and oil water heaters: $600

- Furnaces or hot water boilers: $600

Additionally, an annual $2,000 credit exists for:

- Electric or natural gas heat pump water heaters

- Electric or natural gas heat pumps, and

- Biomass stoves and biomass boilers

This extra credit limitation is in addition to the $1,200 aggregate limit on other qualifying investments. This represents a total annual limit of $3,200 for energy efficient home improvement credits.

Which Residential improvements are eligible for tax credits in 2024?

According to the government’s EnergyStar website, residential improvements in the following categories are eligible for tax credits starting in 2024:

- Air source heat pumps

- Battery storage technology

- Biomass stoves

- Central air conditioning

- Electric panel upgrades

- Exterior doors

- Fuel cells

- Furnaces (Natural gas & oil)

- Geothermal heat pumps

- Heat pump water heaters

- Home energy audits

- Hot water boilers

- Insulation

- Small wind turbines

- Solar energy systems

- Water heaters (natural gas)

- Windows and skylights

Before we explore each of these in depth, it’s important to recognize that there are certain annual and lifetime aggregation limits that may apply.

Let’s take a closer look at each one in more detail.

Air source heat pumps

Maximum tax credit: 30% of the project cost, up to a maximum of $2,000.

Qualifying requirements: For heat pumps, the maximum ENERGY STAR offers a general certification and a cold climate certification.

For general certification, all ducted heat pumps that have earned the ENERGY STAR label are eligible. Additionally, certified non-ducted (mini-split) systems with the following energy ratings:

- SEER2 > 16

- EER2 > 12

- HSPF2 > 9

For the ENERGY STAR Cold Climate designation, eligible systems are:

- ducted with EER2 > 10

- mini-splits with

- SEER2 > 16

- EER2 > 9

- HSPF2 > 9.5

Battery storage technology

Qualifying requirements: Qualified battery storage technology must have a capacity of at least 3 kilowatt hours.

Biomass fuel stoves

Maximum tax credit: 30% of the project cost, up to a maximum of $2,000.

Qualifying requirements: Biomass stoves burn biomass fuel to heat a home or water. Biomass fuel includes:

- Agricultural crops and trees

- Wood, wood waste, and residues (including wood pellets)

- Plants, grasses, residues, and fibers

Biomass stoves must have a thermal efficiency rating of at least 75% to qualify for any credits.

Central air conditioning

Maximum tax credit: 30% of the project cost, up to a maximum of $600.

Qualifying requirements: For split systems, ENERGY STAR certified equipment with SEER2 ≧ 16 is eligible. All ENERGY STAR certified packaged systems are also eligible for the tax credit.

Electric Panel Upgrades

This tax credit is available to homeowners who invest in an upgrade to their existing electrical panel.

Maximum tax credit: 30% of the project cost, up to a maximum of $600.

Qualifying requirements: To qualify, an electrical panel must meet the following criteria:

- Must be installed in a manner consistent with the National Electric Code,

- Must have a load capacity of at least 200 amps,

- Must be installed in conjunction with, and enable the installation and use of:

- any qualified energy efficiency improvements, or

- any qualified energy property (heat pump water heater, heat pump, central air conditioner, water heater, furnace or hot water boiler, biomass stove or boiler)

Exterior Doors

Maximum tax credit: 30% of the project cost, up to a maximum of $500.

Qualifying requirements: Exterior doors must be ENERGY STAR certified to qualify for a tax credit.

Fuel cells

Maximum tax credit: In addition to the previously stated guidelines, the maximum credit is $500 per half kilowatt (kW) of electric capacity.

Qualifying requirements:

- The fuel cell must have a nameplate capacity of at least 0.5 kW of electricity using an electrochemical process and an electricity-only generation efficiency greater than 30%.

- The home served by the system MUST be the taxpayer’s principal residence.

- In case of joint occupancy, the maximum qualifying costs that can be taken into account by all occupants for figuring the credit is $1,667 per 0.5 kW.

- This does not apply to married individuals filing a joint return.

- The credit that may be claimed by each individual is proportional to the costs he or she paid.

Furnaces

Maximum tax credit: 30% of the project cost, up to a maximum of $600.

Qualifying requirements:

For gas furnaces, ENERGY STAR certified gas furnaces with AFUE ≧ 97% are eligible.

For oil furnaces, the equipment must be rated by the manufacturer for use with fuel blends containing at least 20% (by volume) of one or more of the following:

- Biodiesel

- Renewable diesel, or

- Second-generation biofuel

Geothermal heat pumps

Qualifying requirements: Qualified geothermal heat pump property must be ENERGY STAR certified and use the ground or ground water as either:

- A thermal energy source for heating purposes, or

- A thermal energy sink for cooling purposes

Heat Pump Water Heaters

Maximum tax credit: 30% of the project cost, up to a maximum of $2,000.

Qualifying requirements: All ENERGY STAR rated heat pump water heaters are eligible for the tax credit.

Home energy audits

A home energy audit allows a homeowner to identify the most significant and cost-effective energy improvements for their primary residence.

Maximum tax credit: 30% of the project cost, up to a maximum of $150.

Qualifying requirements: To qualify, a home energy audit must:

- Identify the most significant and cost-effective energy efficiency improvements with respect to the residence

- Must include an estimate of the energy and cost savings for each improvement

- Be conducted and prepared by a certified home energy auditor

Hot water Boilers

Maximum tax credit: 30% of the total cost, up to a maximum of $600.

Qualifying requirements:

For gas boilers, ENERGY STAR certified gas boilers with AFUE ≧ 95% are eligible for the credit.

For oil boilers, the equipment must be rated by the manufacturer for use with fuel blends containing at least 20% (by volume) of one or more of the following:

- Biodiesel

- Renewable diesel, or

- Second-generation biofuel

Insulation

Maximum tax credit: 30% of the project cost, up to a maximum of $1,200.

Qualifying requirements: Typical bulk insulation, such as batts, rolls, blow-in fibers, rigid boards, expanding spray, and pour-in-place products qualify for the tax credit.

Other products that reduce air leaks can qualify, as long as they come with a manufacturer’s certification. These products can include:

- Weather stripping

- Spray foam in a can, designed to air seal

- Caulking products

- House wrap

Small wind turbines

Qualifying requirements: A qualified small wind energy property must use a wind turbine to generate electricity for use in connection with a home:

- Located in the United States

- Used as a residence by the taxpayer

Tax credits may include installation costs.

Solar energy systems

Qualifying requirements:

For solar water heaters, at least 50% of the energy created must come from the sun. The solar panel system must be certified by the Solar Rating and Certification Corporation (SRCC) or a similar entity endorsed by the state government where the property is located.

For solar panels, (also known as a photovoltaic system or a solar electric system), the system must provide electricity for the residence, and must meet applicable fire and electrical code safety requirements.

The qualifying property does not have to be the taxpayer’s principal residence.

Water Heaters using natural gas, oil, or propane

Maximum tax credit: 30% of the project cost, up to a maximum of $600.

Qualifying requirements: ENERGY STAR certified models are eligible, based on the following:

- Tanks less than 55 gallons: At least 0.81 UEF

- Tanks greater than or equal to 55 gallons: At least 0.86 UEF

- Tankless gas water heaters: ENERGY STAR models with > 0.95 UEF are eligible.

Windows and Skylights

Maximum tax credit: 30% of the project cost, up to a maximum of $600.

Qualifying requirements: To qualify for the tax credit, exterior windows or skylights must meet the ENERGY STAR most efficient criteria.

Video walkthrough

Watch this instructional video to get step by step guidance on filing IRS Form 5695 to claim residential energy tax credits.

Do you use TurboTax?

If you don’t, is it because the choices are overwhelming to you?

If so, you should check out our TurboTax review page, where we discuss each TurboTax software product in depth. That way, you can make an informed decision on which TurboTax offering is the best one for you!

Click here to learn more about which TurboTax option is best for you!

Frequently asked questions

The energy efficient home improvement credit has been extended to 2032. The residential clean energy credit (30% of qualified costs) has been extended in full to 2032. This phases down to 26% in 2033, 22% in 2034, and 0% after 2034.

Through tax year 2022, the maximum lifetime credit taxpayers could take was $500. For tax years 2023 through 2032, there is a maximum of $1,200 per year, or $12,000 total during the life of the tax credit.

In 2022, Congress changed the nonbusiness energy property credit to the energy efficient home improvement tax credit.

Where can I find a copy of IRS Form 5695?

You may obtain a copy of this federal tax form from the IRS website. For your convenience, we’ve included the most current version at the end of this article.

Related tax forms

This tax form is one of the fillable tax forms provided by the Internal Revenue Service, to help taxpayers reduce their tax preparation costs. To see more forms like this, visit our free fillable tax forms page, where you’ll also find articles like this.

Unlike the IRS, our articles contain step by step instructions for each tax form, as well as video walkthroughs. You can also check out all of our videos by subscribing to our YouTube channel!