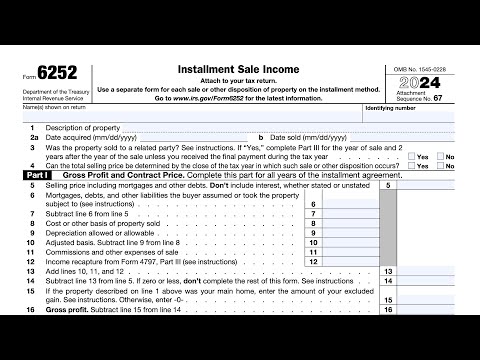

IRS Form 6252 Instructions

If you are selling assets using the installment sale method, you may need to report the transaction on IRS Form 6252 for each year in which you receive an installment payment. In this article, we’ll walk you through everything you need to know about this tax form, including:

- How to complete IRS Form 6252

- When you may need to use Form 6252

- Other frequently asked questions

Let’s begin with step by step guidance on completing this tax form.

Table of contents

How do I complete IRS Form 6252?

There are three parts to IRS Form 6252:

- Part I: Gross Profit and Contract Price

- Part II: Installment Sale Income

- Part III: Related Party Installment Sale Income

We’ll walk through reporting installment sale income on Form 6252, step by step. Let’s start at the top of the form.

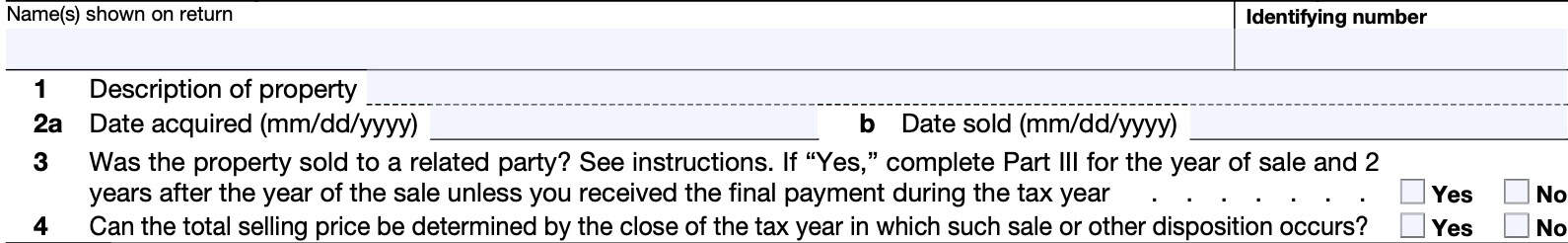

Top of form

At the top of Form 6252, enter your name and identifying number. For most taxpayers, your identifying number will be your Social Security number (SSN) or individual taxpayer identification number (ITIN).

If you are reporting more than one transaction under the installment sale basis, you must use a separate form for each piece of property sold.

Line 1

Enter one of the following codes, based upon the circumstances of the installment sale.

- Sale property is timeshare or residential lot. The Internal Revenue Service considers this to be unimproved land, not an existing rental property.

- Sale by an individual of personal-use property (within the meaning of Internal Revenue Code Section 1275(b)(3)).

- Sale of any property used or produced in the trade or business of farming (within the meaning of IRC Section 2032A(e)(4) or (5)).

- All other installment sales not listed

After entering the appropriate code, enter a description of property sold.

Line 2

In Line 2a, enter the date of acquisition for the property. In Line 2b, enter the date of the sale of the property.

Line 3

Answer whether or not the property was sold to a related party. If you sold the property to a related party, you must complete Part III for the year of the sale and for 2 tax years after the year of sale, unless you received the final payment during the tax year.

Line 4

Can the total selling price of the property be determined by the end of this tax year? Answer Yes or No.

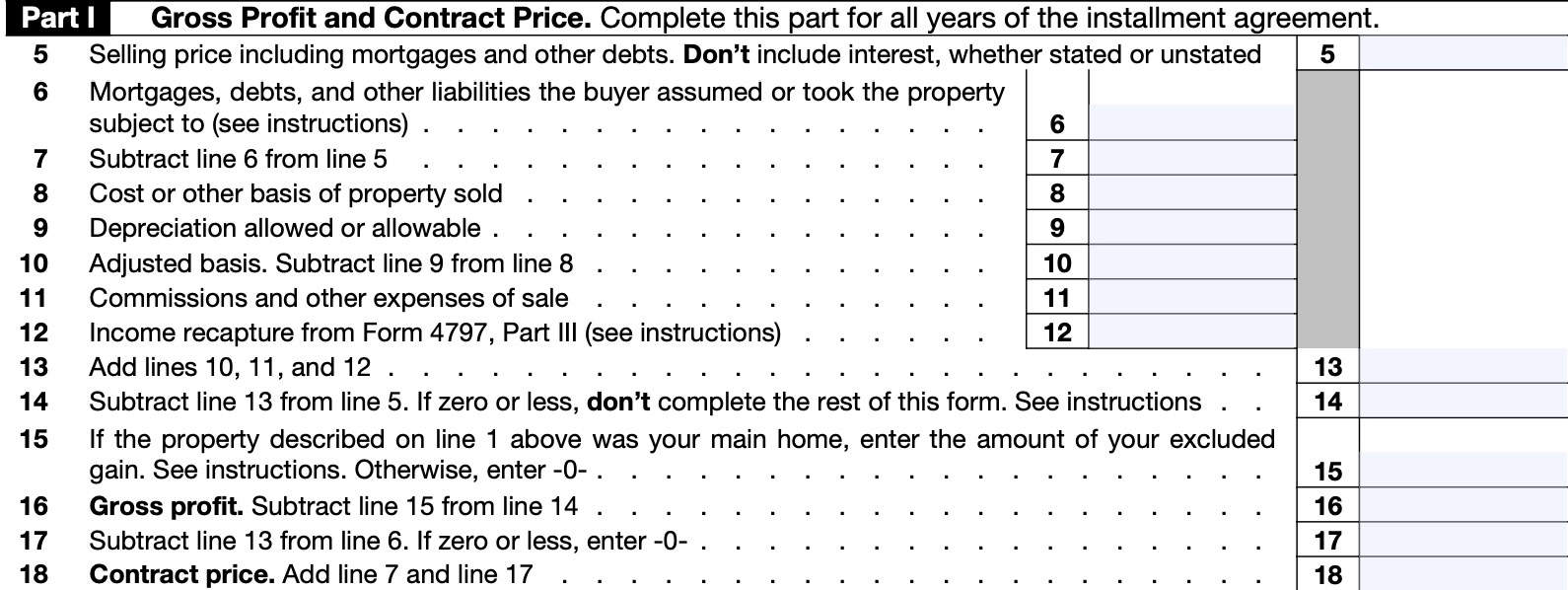

Part I: Gross Profit & Contract Price

Taxpayers will use Part I to calculate the gross profit and report the contract sale price on their tax return.

Line 5: Selling price

Enter the sales price for the property. Include the following:

- Cash received

- Face amount of the installment obligation

- Fair market value (FMV) of property or services received

- Mortgages or other debts assumed by the buyer as part of the sale of property

However, do not include any of the following types of interest income:

- Stated interest

- Unstated interest

- Recomputed or recharacterized interest

- Original issue discount (OID)

Line 6

In Line 6, enter only mortgages, debts, or other liabilities the buyer assumed from the seller or

took the property subject to.

Don’t include new mortgages the buyer gets from a bank, the seller, or other sources.

Line 7

Subtract Line 6 from Line 5.

Line 8: Cost basis of property sold

In Line 8, enter the cost or other basis of the property sold.

Enter the original purchase price and other expenses you incurred in buying the property. Add the cost of improvements. Subtract any casualty losses and any of the following credits previously allowed with respect to the property:

- Nonbusiness energy property credit

- Residential energy efficient property credit

- Adoption credit

- District of Columbia first-time homebuyer credit

- Disabled access credit

- New markets credit

- Credit for employer-provided childcare facilities and services

- Energy efficient home credit

- Alternative motor vehicle credit

- Alternative fuel vehicle refueling property credit

- Qualified railroad track maintenance credit

- Enhanced oil recovery credit

- Qualified plug-in electric drive motor vehicle credit

- Qualified plug-in electric vehicle credit

- Qualified electric vehicle credit

For additional information, refer to IRS Publication 551, Basis of Assets.

Line 9: Depreciation allowed or allowable

In Line 9, enter any depreciation or amortization allowed or allowable from the date of purchase to the sales date. Also, add back any of the following deductions you may have previously taken:

- Commercial revitalization deduction

- Section 179 expense

- Deduction for clean-fuel vehicles and refueling property

- Deductions claimed under sections 190 and 193

- Deductions claimed under IRC Section 1253(d)(2) and (3)

- Basis reduction to investment credit property

Subtract the following recapture amounts and credits previously allowed with respect to the property:

- Section 179 or 280F

- Clean-fuel vehicles and refueling property

- Investment credit amount

- Credit for employer-provided childcare facilities and services

- Alternative motor vehicle credit

- Alternative fuel vehicle refueling property credit

- Qualified plug-in electric drive motor vehicle credit

- Qualified plug-in electric vehicle credit

- Qualified electric vehicle credit

Line 10: Adjusted basis

Subtract Line 9 from Line 8. This is your adjusted basis for tax purposes.

Line 11: Commissions and other sale expenses

In Line 11, enter any selling expenses you incurred when disposing the property. This might include:

- Sales commissions

- Advertising expenses

- Attorney and legal fees

Line 12: Income recapture

In Line 12, enter any ordinary income recapture under Section 1245 or 1250 (including sections 179 and 291). This is fully taxable in the year of sale even if no payments were received.

The ordinary income recapture is the amount on Line 31 of IRS Form 4797.

Line 13

Add the following:

- Line 10

- Line 11

- Line 12

Enter the result in Line 13.

Line 14

Subtract Line 13 from Line 5. If the result is zero or less, do not complete Form 6252. Instead, report the transaction on one of the following:

- IRS Form 4797, Sales of Business Property

- IRS Form 8949, Sales and Other Dispositions of Capital Assets

- IRS Form 1040, Schedule D

Line 15

If the property that you listed on Line 1 was your primary residence, you may be able to exclude part or all of the long-term capital gains related to the sale of your residence under Section 121 of the tax code. See IRS Publication 523, Selling Your Home, for more details.

Line 16: Gross Profit

Subtract Line 15 from Line 14. This represents your gross profit for the sale of your property.

Line 17

Subtract Line 13 from Line 6 and enter the result here. If the result is zero or less, enter ‘0.’

Line 18: Contract Price

Add Line 7 & Line 17. This is the contract price.

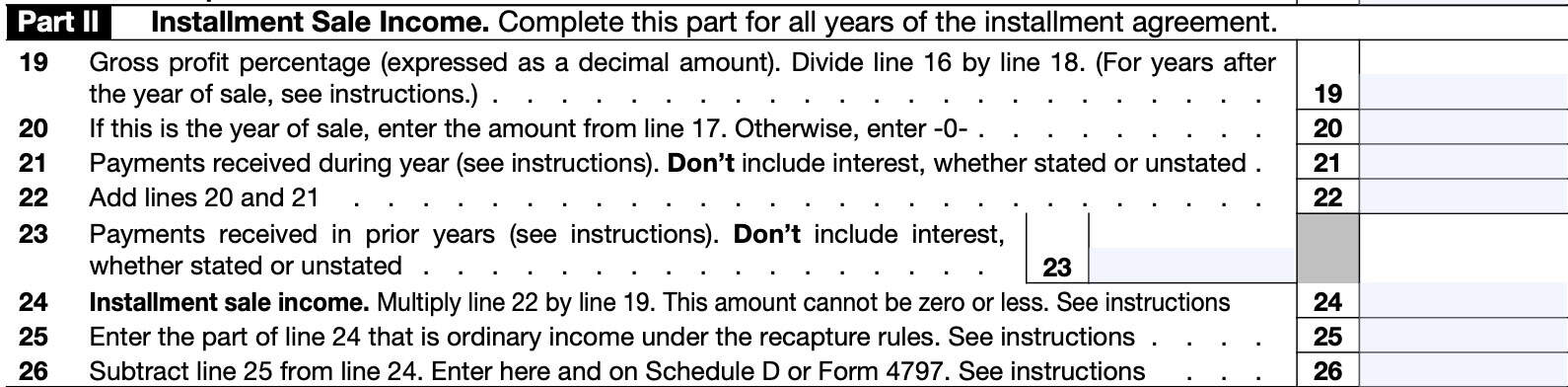

Part II: Installment Sale Income

Taxpayers will need to complete Part II for each year of the installment sale.

Line 19: Gross profit percentage

Divide Line 16 by Line 18. Dividing the gross profit by the contract price gives you the gross profit percentage.

You’ll need to calculate the gross profit percentage for the year of sale, even if you did not file Form 6252 in the first year of the installment agreement.

Line 20

If this is the year of the installment sale, enter the number from Line 17. For subsequent years, enter ‘0.’

Line 21: Payments received during the year

In Line 21, enter all money and the fair market value of any property or services you received in the given tax year. Include any amount withheld to pay off a mortgage or other debt or to pay real estate broker or legal fees.

Generally, don’t include as a payment the buyer’s note, a mortgage, or other debt assumed by the buyer. However, a note or other debt that is payable on demand or readily tradable on an established securities market is considered a form of payment.

Line 22

Add Line 20 and Line 21. Enter the result here.

Line 23: Payments received in prior years

Enter the total of all payments you received prior to the current year. Include allocable installment income and any other deemed payments from previous years.

Deemed payments include amounts deemed received because of:

- A second disposition by a related party,

- The pledge rule of IRC Section 453A(d), or

- Liabilities assumed by the buyer in excess of the seller’s basis. This amount is Line 20

from the year of sale (within the meaning of Treasury Regulations section 15a.453-1(b)(3)(i)).

Line 24: Installment Sale Income

Multiply Line 22 by Line 19. The result is installment sale income.

This number cannot be zero or a negative number.

Line 25: Ordinary income under recapture rules

Enter any ordinary income recapture on Section 1252, 1254, or 1255 property for the year of sale, or remaining recapture from prior year installment sales. Enter this here and on IRS Form 4797, Line 15.

Don’t enter ordinary income from a Section 179 expense deduction.

Don’t enter more than the amount shown on Line 24. Any excess must be reported in a later year on Form 6252 up to the taxable part of the installment sale until all income recaptures have been reported.

Line 26

Subtract Line 25 from Line 24.

When reporting the sale or disposition of trade or business assets held more than 1 year, enter this amount on Form 4797, Line 4.

For property held one year or less, or if you have an ordinary gain from the sale of a noncapital asset, report this amount on Form 4797, Line 10. Enter ‘From Form 6252’ in the space available.

If the sold property was Section 1250 property held for over a year, you may need to calculate the total amount of unrecaptured Section 1250 gain by using the Unrecaptured Section 1250 Gain Worksheet. See the Schedule D form instructions for more information.

When reporting the gain on the sale of capital assets, enter this amount on Schedule D as a short-term or long-term gain, based upon holding rules.

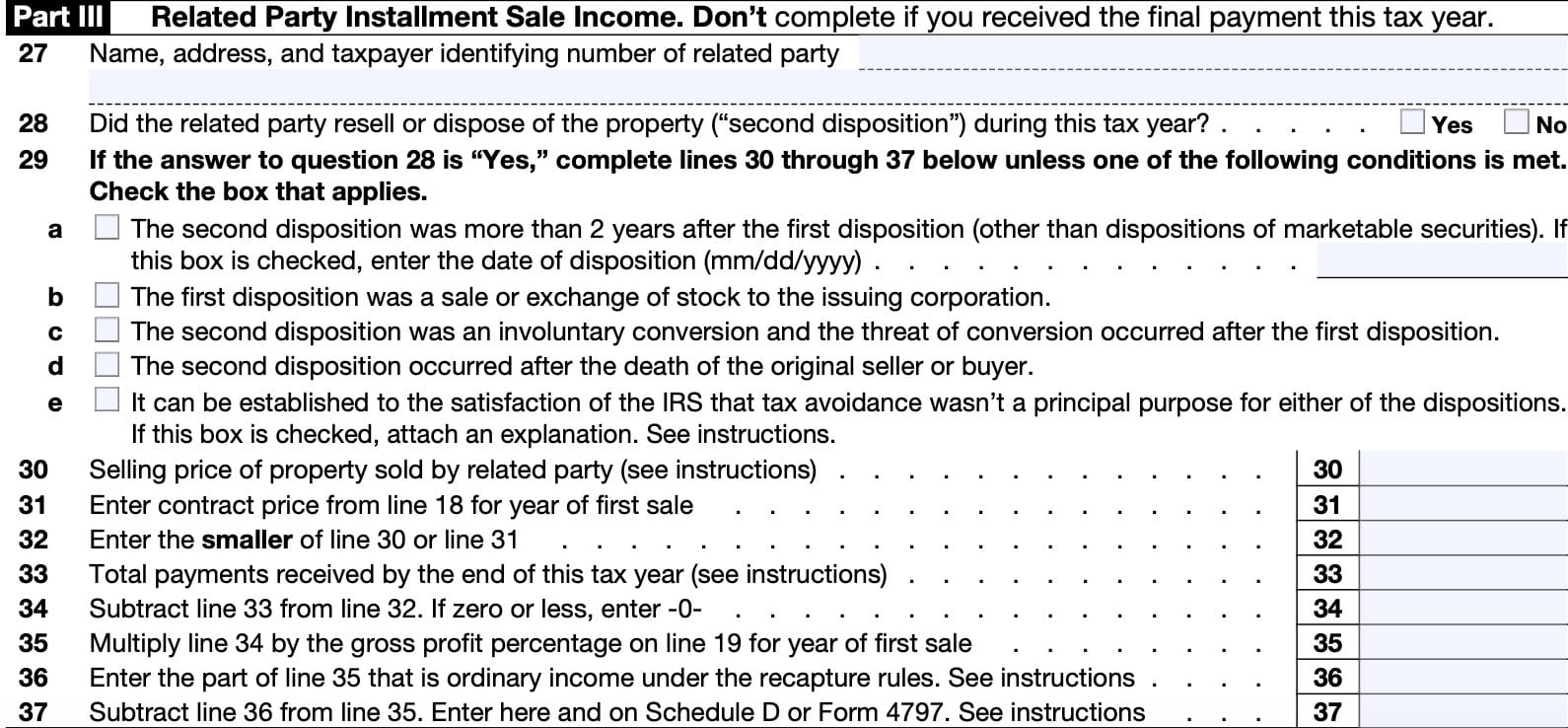

Part III: Related Party Installment Sale Income

Taxpayers use Part III to report installment sale treatment of property sold to a related party. However, you do not need to complete Part III if the final installment payment was made during this tax year.

Line 27

In Line 27, enter the following information as it relates to the related party:

- Related party’s name

- Address

- Identifying number

Line 28

Answer whether the related party resold or disposed of the property during the year. This is referred to as a second disposition of property.

If you answered ‘Yes,’ then proceed to Line 29. If you answered, ‘No,’ stop here. You do not need to complete Lines 29-37.

Line 29

You must complete Lines 30 through 37 unless one of the following exceptions in Line 29 applies.

- The second disposition was more than 2 years after the first. If this box is checked, enter the date of disposition.

- Does not include disposition of marketable securities

- First disposition was a sale or exchange of stock to the issuing corporation

- Second disposition was an involuntary conversion and the thread of conversion occurred after the first disposition

- Second disposition occurred after the death of the original buyer or seller

- You can establish that tax avoidance was not a principal purpose for either disposition, to the IRS’ satisfaction

If you select the final exception, you must attach a written explanation. In general, the IRS will apply the nontax avoidance exception to the second disposition if:

- The disposition was involuntary (foreclosure, bankruptcy, etc.), or

- The disposition was an installment sale under which the terms of payment were substantially equal to or longer than the terms of payment for the first installment sale. The resale must not permit significant deferral of recognized gain from the first sale

- Gains from the first sale must be recognized before gains from the subsequent sale

Line 30

If you answered ‘Yes’ to Line 28, and your installment sale does not meet one of the exceptions outlined in Line 29, then you must complete Lines 30 through 37.

In Line 30, enter the sales price of the property that was sold.

Line 31: Contract price

Enter the contract price from Line 18 for the year of the first sale.

Line 32

In Line 32, enter the smaller of:

Line 33: Total payments received by the end of tax year

If you completed Part II, enter the combined total of Line 22 and Line 23.

Otherwise, enter all money and the FMV of property you received from the sale before the tax year. In this total, include allocable installment income and any other deemed payments from prior years.

However, do not include the interest part of these payments, whether stated or unstated.

Line 34

Subtract Line 33 from Line 32. If the result is zero or a negative number, enter ‘0.’

Line 35

Multiply Line 34 by the gross profit percentage reported on Line 19 of the year of the first sale.

Line 36: Ordinary income

Enter the portion of Line 35 considered to be ordinary income under recapture rules. Follow the instructions for Line 25.

However, do not enter more than the amount reported on Line 35.

Line 37

Subtract Line 36 from Line 35. Follow the instructions for Line 26.

Video walkthrough

Watch this instructional video for more tips on reporting installment sale income using Form 6252.

Do you use TurboTax?

If you use TurboTax, and you’re completing this tax form for the first time, you might be ready to try TurboTax Federal Premium instead of the free or deluxe versions. TurboTax Federal Premium comes in two offerings, DIY or Live Assisted.

Do it yourself

To learn more about using TurboTax Federal Premium’s DIY option, click here.

Live Assisted

If you feel more comfortable having a tax expert guide you for the first time through this new form (or any other new forms), get started here.

Ready to hand the reins over to someone else completely? Go here to learn more about TurboTax’s Live Assisted Full Service offering!

Frequently asked questions

Taxpayers need to file IRS Form 6252 for any year in which an installment sale of property occurs, or in which the taxpayer receives an installment sale payment.

The Internal Revenue Service considers a related party to be any person or entity bearing a relationship to the taxpayer. This can be a person, business entity, or other tax entity, such as a trust, estate, or nonprofit organization.

There are two requirements for an installment sale. The first is that if an asset is sold and payments will be made over time that at least one payment be received in a year following the tax year of the sale. The second is that the installment sale is recorded on IRS Form 6252.

How can I find IRS form 6252?

You can find this tax form on the IRS website. For your convenience, we’ve attached the latest version of the form below.

Related tax articles

This tax form is one of the fillable tax forms provided by the Internal Revenue Service, to help taxpayers reduce their tax preparation costs. To see more forms like this, visit our free fillable tax forms page, where you’ll also find articles like this.

Unlike the IRS, our articles contain step by step instructions for each tax form, as well as video walkthroughs. You can also check out all of our videos by subscribing to our YouTube channel!