IRS Form 673 Instructions

U.S. expats living overseas should be familiar with the tax benefits of excluding foreign earned income on their tax return. But did you know that you can use IRS Form 673 to instruct your employer to adjust your tax withholdings for this expected tax benefit?

In this article, we’ll go over what you need to know about IRS Form 673, including:

- How to complete & file IRS Form 673

- Residence test requirements for the foreign earned income tax exemption & housing exclusions

- Frequently asked questions

Let’s begin with an overview of the tax form itself.

Table of contents

How do I complete IRS Form 673?

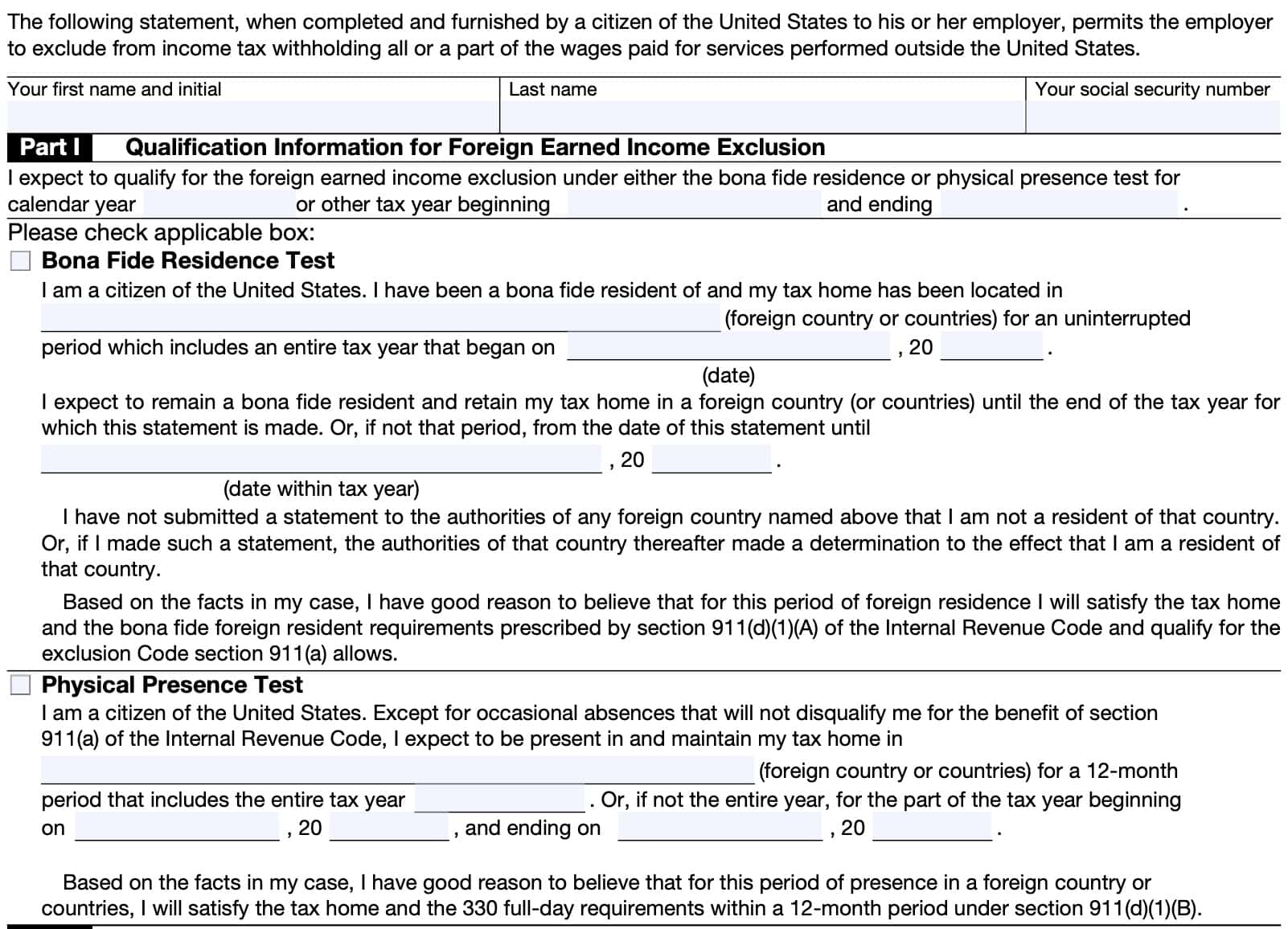

There are three parts to this one-page tax form:

- Part I: Qualification Information for Foreign Earned Income Exclusion

- Part II: Estimated Housing Cost Amount for Foreign Housing Exclusion

- Part III: Certification

Let’s take a look at each part, one step at a time.

Part I: Qualification Information for Foreign Earned Income Exclusion

Beginning at the top of Form 673, enter your full name and Social Security number. Below that, you’ll enter the calendar year or tax year for which you expect to qualify for the foreign earned income exclusion.

Tax year

According to the Internal Revenue Service, a tax year is any 12-month period. Most taxpayers use the calendar year as their tax year. However, taxpayers may also use a fiscal year.

A fiscal year is any uninterrupted period that:

- Consists of 12 consecutive months

- Ends on the last day of any month except for December

Once you’ve completed the taxpayer information and tax year fields, you’ll check either Bona Fide Residence Test or Physical Presence Test.

For each test we’ll go over:

- Qualification criteria to meet each test, and

- How to complete the applicable section

Let’s start by taking a closer look at the Bona Fide Residence Test.

Bona fide residence test

According to the Internal Revenue Service, taxpayers meet the bona fide residence test if they are a bona fide resident for an uninterrupted period that includes an entire tax year.

bona fide residence test Eligibility Requirements

If you are a calendar year taxpayer, an entire tax year is from January 1st through December 31st.

During your period of bona fide residence in a foreign country, you may leave that foreign country for brief or temporary trips back to the United States or elsewhere. However, you must clearly intend to do one of the following without unreasonable delay:

- Return to your foreign residence

- Relocate to a new foreign bona fide residence

Once you establish bona fide residency in a foreign country for an uninterrupted period that includes the entire year, you will qualify as a bona fide resident:

- Beginning with the date you began the residency, and

- Ending with the date you abandon your foreign residence

This means you could qualify as a bona fide resident for parts of one or two other tax years in addition to the full tax year(s) of bona fide residency.

You can use the bona fide residence test to qualify for the foreign earned income exclusion, the foreign housing exclusion and/or the foreign housing deduction only if you are either:

- A U.S. citizen, or

- A U.S. resident within the meaning of Internal Revenue Code Section 7701(b)(1)(A)

- Must be a citizen or national of a country with which the United States has an income tax treaty in effect.

You do not automatically acquire bona fide resident status merely by living in a foreign country or countries for one year.

How to complete Part I

If you meet the bona fide residence test, then you’ll need to complete certain portions of Part I. Enter the following information, in order:

- Name of country or countries where you believe your tax home to be

- Beginning of the tax year in which you first became a bona fide resident

- Date that you expect to leave the foreign country

- If you expect to remain through the end of the tax year, leave this portion blank

Once complete, go to Part II of Form 673.

Physical presence test Eligibility Criteria

The IRS states taxpayers meet the physical presence test if you are physically present in a foreign country or countries at least 330 full days during any period of 12 consecutive months including some part of the year at issue.

The 330 qualifying days do not have to be consecutive. The physical presence test applies to both US citizens and US residents.

The physical presence test is only based on how long you stay in a different country, without respect to any of the following:

- Kind of residence you establish

- Intentions about returning to the United States

- Nature or purpose of your stay abroad

Full day definition

A full day is a period of 24 consecutive hours, beginning and ending at midnight. You must spend the full day in a foreign country or countries for that day to be counted.

When you leave the United States to go to a foreign country or when you return to the United States from a foreign country, the time you spend on or over international waters does not count as time in a foreign country.

How to complete Part I

If you meet the physical presence test, then you’ll need to complete certain portions of Part I. Enter the following information, in order:

- Name of country or countries where you expect to maintain your tax home

- Tax year you expect to maintain your tax home

- Must be entire year

- If not the entire year, then enter the beginning date and ending date of the tax year you expect to maintain your tax home

In this section, you’re certifying that you have good reason to believe that you will satisfy the tax home and the 330 full day requirements within a 12-month period as outlined in IRC Section 911(d)(1)(B).

Once complete, go to Part II of Form 673.

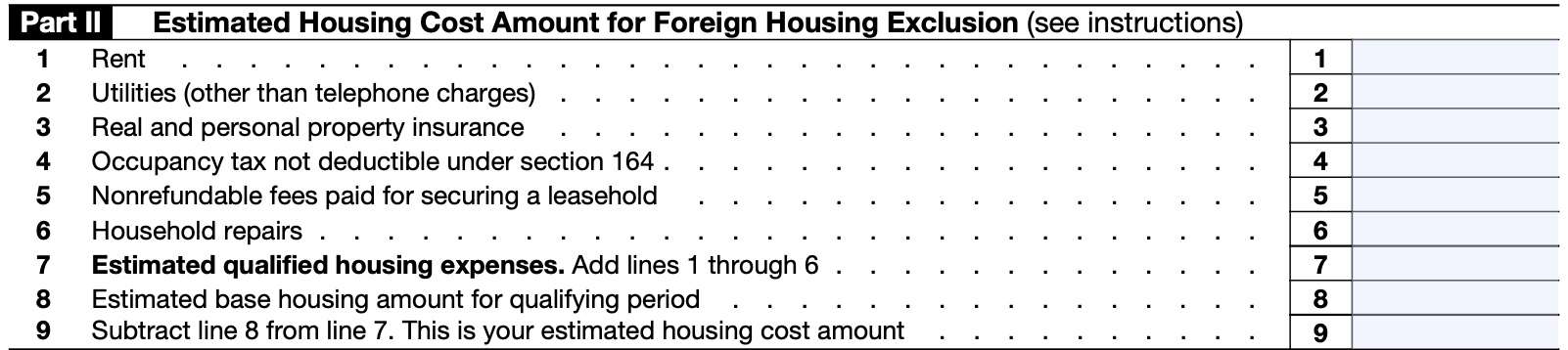

Part II: Estimated Housing Cost Amount for Foreign Housing Exclusion

In Part II, we’ll enter the estimated housing cost amount for the foreign income exclusion.

Line 1: Rent

Enter the annual amount of rent that you expect to pay for the entire year.

Line 2: Utilities

Enter an estimate for the amount you expect to pay in utilities for the year. This does not include telephone charges.

Line 3: Real and personal property insurance

Enter any real property insurance or personal property insurance costs.

Real property insurance covers damage to the dwelling or housing unit, while personal property insurance covers your non-real estate property, such as furniture, clothing, or valuables.

Line 4: Occupancy tax not deductible under Section 164

If your lease includes a specific amount designated as an occupancy tax, you may enter that number in Line 4.

Line 5: Nonrefundable fees paid for securing a leasehold

If you had to pay any nonrefundable fees or costs to secure your lease, enter that amount here. This should not include any refundable security deposits that you pay as a condition of the rental agreement.

Line 6: Household repairs

Enter any expected household repair costs in Line 6.

Line 7: Estimated qualified housing expenses

Add Lines 1 through 6. This represents your estimated qualified housing expenses.

Line 8: Estimated base housing amount for qualifying period

Enter your estimated base housing amount for the reporting period.

Base housing amount

Your base housing amount, located on Line 32 of IRS Form 2555, is related to the maximum foreign earned income exclusion.

The base housing amount equals 16% of the exclusion amount multiplied by the number of days in the qualifying period that fall within the current year. If you are present in the country for the entire tax year, then the base housing amount simply equals 16% of the foreign-earned income exclusion amount.

Line 9: Estimated housing cost amount

Subtract the base housing amount in Line 8 from the estimated qualified housing expenses in Line 7. This is your estimated housing cost amount.

Qualified housing expenses limitation

Generally, your housing deduction cannot be more than your foreign earned income minus the total of:

- Your foreign earned income exclusion, plus

- Your housing exclusion

The amount of qualified housing expenses eligible for the housing exclusion is limited depending on the location of your foreign tax home.

IRS Publication 54, Tax Guide for U.S. Citizens and Resident Aliens Abroad may have additional information on these limits. You can also learn more about the maximum foreign earned income exclusion in the instructions for IRS Form 2555, Foreign Earned Income.

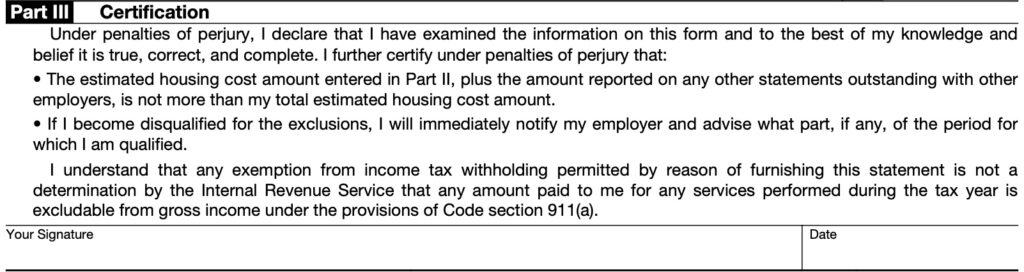

Part III: Certification

Part III requires your full signature and the date of your filing. Since you’re certifying this information under penalties of perjury, it’s worth taking a moment to understand what you’re certifying.

In essence, you’re stating that:

- Everything you’re submitting to your employer is true, correct, and complete to the best of your knowledge

- The estimated housing cost amount that you entered, plus amounts reported on other statements for other employers, does not exceed the total estimated housing cost

- In other words, you’re not trying to claim housing exclusions that exceed your housing costs

- You will immediately notify your employer:

- If you no longer qualify for the housing exclusion, and what part of the reporting period you remain eligible

As long as you recognize that you cannot claim more than your expected tax benefit, and that you must notify your employer when you no longer meet the eligibility criteria, then go ahead and sign.

Filing IRS Form 673

Taxpayers don’t need to file Form 673 with the IRS.

This tax form simply instructs your U.S. employer to take into consideration your foreign housing tax benefits for federal income tax withholding purposes.

Your American employer simply will adjust their tax withholdings, from IRS Form W-4, based on the information that you provided in your completed Form 673.

Video walkthrough

To learn more about claiming your exemption from withholding taxes on foreign earned income on IRS Form 673, check out our video!

Frequently asked questions

Taxpayers may use IRS Form 673 to claim an exemption from U.S. income tax withholding on wages earned abroad to the extent of the foreign earned income exclusion and foreign housing exclusion.

No. To reduce your taxable income when filing your income tax return, you claim the foreign earned income exclusion on IRS Form 2555. You might use IRS Form 673 to instruct your employer to account for your housing exclusions when withholding taxes from your pay.

Where can I find IRS Form 673?

As with most tax forms, you may find IRS Form 673 on the IRS website. For your convenience, we’ve included the most recent version of this tax form here in this article.