IRS Form 6765 Instructions

The Internal Revenue Service allows companies of all sizes to claim tax credits for certain investments in their business. One significant opportunity is the tax credit for increasing research activities, also known as the R&D tax credit or research credit. Using IRS Form 6765 to claim this credit, taxpayers may reduce their federal income tax liability while investing in the future of their business.

In this article, we’ll walk through IRS Form 6765, including:

- How to complete & file IRS Form 6765

- Ways to obtain the maximum federal research credit

- Frequently asked questions about the research tax credit

Let’s start with a basic walkthrough of the form itself.

Table of contents

How do I complete IRS Form 6765?

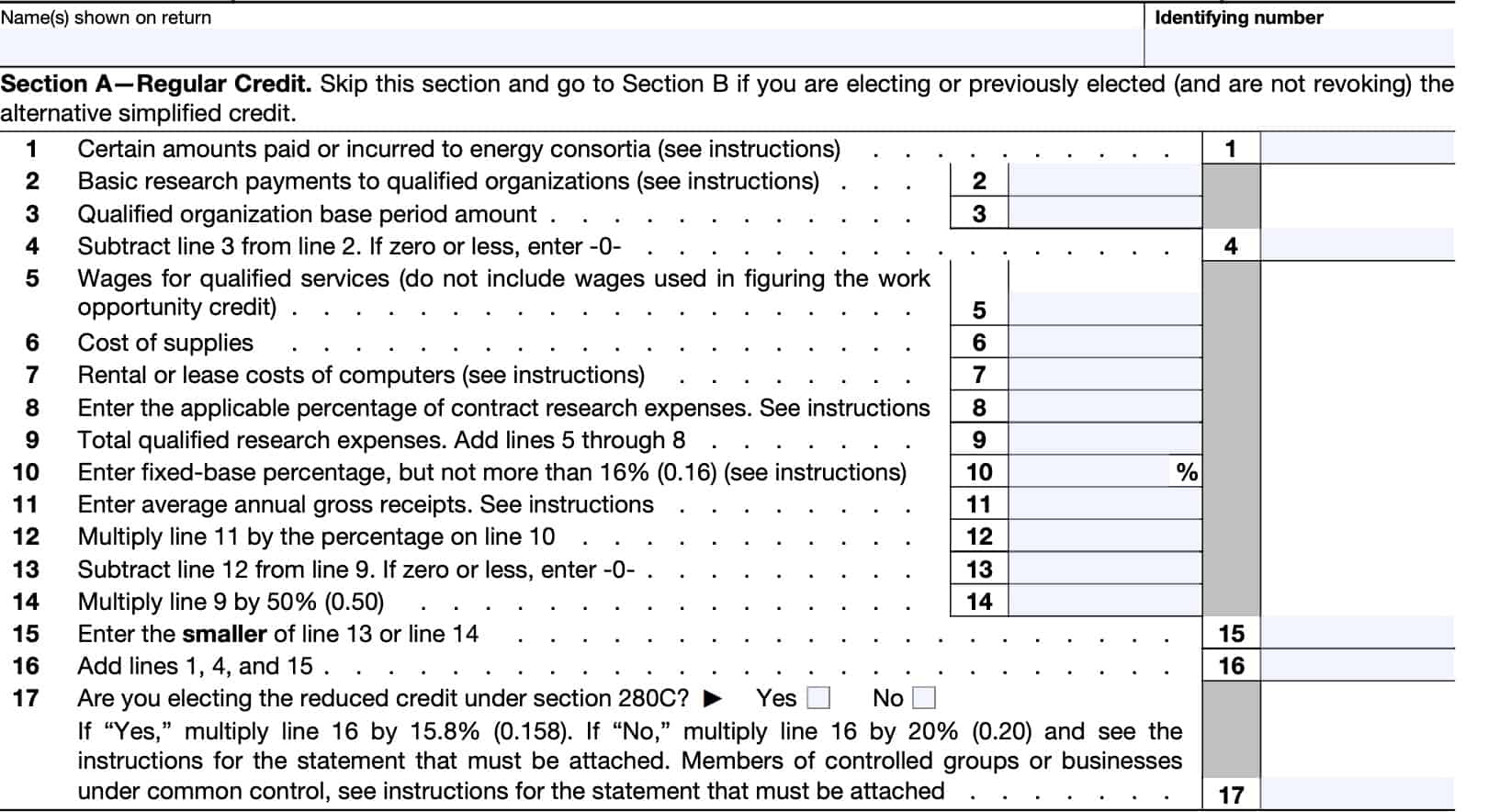

There are four sections to this tax form. If you are electing the alternative simplified credit or if you have previously elected the alternative method without revoking it, go directly to Section B of Form 6765. Otherwise, let’s start with Section A.

Section A: Regular credit

Line 1: Certain amounts paid or incurred to energy consortia

Enter the amounts you paid or incurred to energy research consortia for energy research. This must be qualified research.

Generally, an energy research consortium is any organization:

- Described in Internal Revenue Code Section 501(c)(3)

- Exempt from taxation under IRC Section 501(a)

- Organized and operated primarily to conduct energy research

- Not a private foundation

IRC Section 41(f)(6) contains additional information.

Line 2: Basic research payments to qualified organizations

Enter the amounts the corporation paid in cash, under a written contract, for basic research to one of the following:

- Qualified university

- Scientific research organization

- Scientific tax-exempt organization, or

- Grant organization

This does not apply to S corporations, personal holding companies, and service organizations.

Line 3: Qualified organization base period amount

In Line 3, enter the qualified organization base period amount. This amount is based on minimum basic research amounts plus maintenance-of-effort amounts for the 3 preceding tax years.

Line 4

Subtract Line 3 from Line 2. Enter the result in Line 4.

If the result is zero or a negative number, enter ‘0.’

Line 5: Wages for qualified services

Enter wages paid to employees for qualified services. However, do not include wages that used to calculate the work opportunity credit on IRS Form 5884.

Line 6: Cost of supplies

In Line 6, enter the cost of supplies used in qualified research.

Line 7: Rental or lease costs of computers

Enter the cost that you paid or incurred for the use of computers used in qualified research.

The computer must be located off your premises. You cannot be the operator or primary user of the computer.

Reduce this amount by the amount that you (or any member of a controlled group of corporations or businesses under common control) received or accrued for the right to use substantially identical property.

Line 8: Applicable percentage of contract research expenses

Enter the total qualified contract expenses you paid or incurred for research. These amounts are subject to the following limitations.

- 100% of amounts you paid (or incurred) for qualified energy research performed by one of the following:

- An eligible small business

- A university, or

- A federal laboratory (see IRC Section 41(b)(3)(D) for definitions of those entities).

- Include payments made to the extent they are included as basic research payments on Line 2, not to exceed the base period amount on Line 3.

- 75% of amounts you paid (or incurred) for qualified research by a qualified research consortium

- 65% of amounts you paid (or incurred) for all other qualified research by any other person.

In all cases, prepaid contract research expenses are considered paid in the year the research is actually done.

Line 9: Total qualified research expenses

Add Lines 5 through 8 and enter the total in Line 9. This represents the total qualified research expenses.

Line 10: Fixed base percentage

The fixed-base percentage depends on whether you are an existing company or a start-up company.

Start-up company

A start-up company is a taxpayer that had both gross receipts and qualified research expenses either:

- For the first time in a taxable year beginning after 1983, or

- For fewer than 3 tax years beginning after 1983 and before 1989.

Fixed-base percentage

The fixed-base percentage for a start-up company is figured as follows.

- For the first 5 tax years beginning after 1993 for which you have qualified research expenses, the percentage is 3%.

- For the 6th tax year beginning after 1993 for which you have qualified research expenses, divide the aggregate qualified research expenses for the 4th and 5th such tax years by the aggregate gross receipts for those tax years, then divide the result by 6.

- For the 7th tax year beginning after 1993 for which you have qualified research expenses, divide the aggregate qualified research expenses for the 5th and 6th such tax years by the aggregate gross receipts for those tax years, then divide the result by 3.

- For the 8th tax year beginning after 1993 for which you have qualified research expenses, divide the aggregate qualified research expenses for the 5th, 6th, and 7th such tax years by the aggregate gross receipts for those tax years, then divide the result by 2.

- For the 9th tax year beginning after 1993 for which you have qualified research expenses, divide the aggregate qualified research expenses for the 5th, 6th, 7th, and 8th such tax years by the aggregate gross receipts for those tax years, then divide the result by 1.5.

- For the 10th tax year beginning after 1993 for which you have qualified research expenses, divide the aggregate qualified research expenses for the 5th through 9th such tax years by the aggregate gross receipts for those tax years, then divide the result by 1.2.

- For the 11th and later tax years beginning after 1993 for which you have qualified research expenses, divide the aggregate qualified research expenses for any 5 of the 5th through 10th such tax years by the aggregate gross receipts for those tax years.

Existing company

An existing company is any company that is not a start-up company. The fixed-base percentage for an existing company is figured by dividing the aggregate qualified research expenses for the tax years beginning after 1983 and before 1989 by the aggregate gross receipts for those tax years.

Fixed-base percentage

The fixed-base percentage for all companies (existing and start-up) must be rounded to the nearest 1/100th of 1% (that is, four decimal places) and can’t exceed 16%.

In addition, when figuring your fixed-base percentage, you must reflect expenses for qualified research conducted in Puerto Rico or a U.S. possession for all prior tax years included in the computation.

If short tax years are involved, see Treasury Regulations Section 1.41-3(b).

Line 11: Average annual gross receipts

In Line 11, enter the average annual gross receipts for the 4 tax years preceding the tax year for which you are determining the credit. Reduce this amount by returns and allowances.

You may be required to annualize gross receipts for any short tax year. For a foreign corporation, include only gross receipts that are effectively connected with a trade or business in the United States (or in Puerto Rico or a U.S. possession, if applicable).

For a tax year that the credit ends, the average annual gross receipts for the 4 tax years preceding the termination tax year is prorated for the number of days that you applied the credit during the tax year.

Line 12

Multiply the average annual gross receipts (Line 11) by the fixed base percentage (Line 10). Enter the result in Line 12.

Line 13

Subtract Line 12 from Line 9. If the answer is zero or a negative number, enter ‘0.’

Line 14

Multiply the number in Line 9 by 50%. Enter the result in Line 14.

Line 15

Enter the smaller of either Line 13 or Line 14.

Line 16

Add the following & enter the result in Line 16:

Line 17: Section 280C election

Are you electing the reduced credit under IRC Section 280C? Check the appropriate box.

Making Section 280C election

If “Yes,” multiply Line 16 by 15.8% (0.158).

Also, if you are electing the reduced research credit, you must complete Form 6765 and clearly indicate your intent to make this election. This is true even if there is no R&D tax credit claim on the original return.

In order for the election to apply, the Form 6765 must be filed with your original timely filed (including extensions) return for the tax year. Once made, the election is irrevocable for that tax year.

Not making Section 280C election

If “No,” multiply Line 16 by 20% (0.20).

For taxpayers who don’t elect the reduced credit, you must reduce your otherwise allowable deduction for qualified research expenses or basic research expenses by the amount of the credit on this line.

If the credit exceeds the amount allowed as a deduction for the tax year, you reduce the amount chargeable to capital account for the year for such expenses by the amount of the excess.

Attach a statement to your tax return that lists the deduction amounts or capitalized expenses that you reduced. Identify the lines of your return (schedule or forms for capitalized items) on which you reduced these items.

Controlled groups

For purposes of the reduced credit election, a member of a controlled group may make the election under Section 280C(c)(3).

However, only the common parent (within the meaning of Treasury Regulations Section 1.1502-77(a)(1)(i)) of a consolidated group may make the election on behalf of the members of a consolidated group.

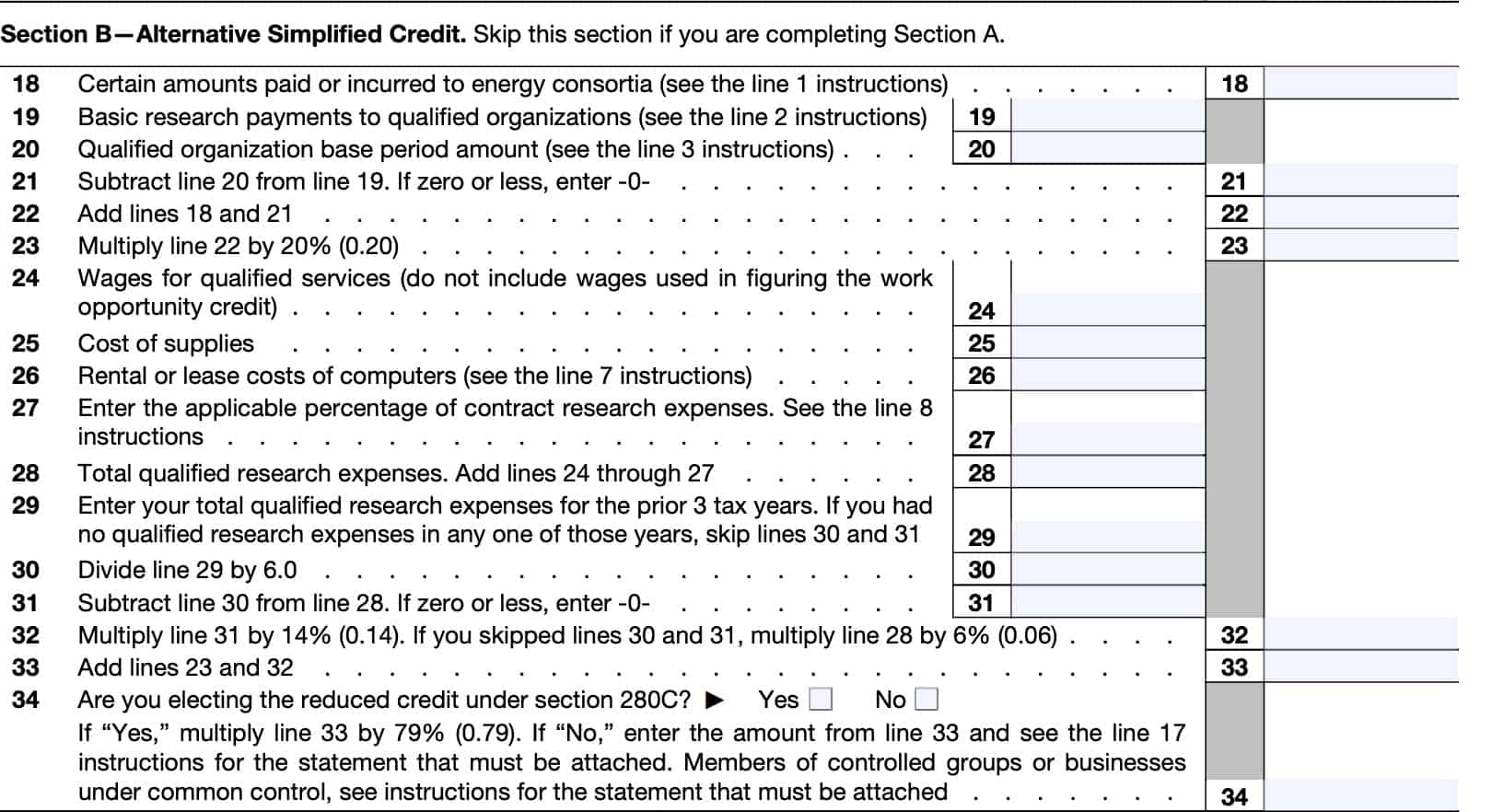

Section B: Alternative simplified credit

Complete Section B only if:

- You are electing the alternative simplified credit (ASC), or

- You previously elected the ASC and aren’t revoking the election on this return

You can only make an ASC election on an amended return for a tax year if you hadn’t previously claimed the research credit on an original return or amended return for that tax year.

The IRS will not grant an extension of time to make the ASC election.

Line 18: Certain amounts paid or incurred to energy consortia

Following the Line 1 instructions, enter the amounts you paid or incurred to energy research consortia for energy research. This must be qualified research.

Line 19: Basic research payments to qualified organizations

Following the Line 2 instructions, enter the amounts the corporation paid in cash, under a written contract, for basic research to one of the following:

- Qualified university

- Scientific research organization

- Scientific tax-exempt organization, or

- Grant organization

Line 20: Qualified organization base period amount

Following the Line 3 instructions, enter the qualified organization base period amount.

Line 21

Subtract Line 20 from Line 19. If the result is zero or a negative number, enter ‘0.’

Line 22

Add Line 18 and Line 21. Enter the result here.

Line 23

Multiply the number in Line 22 by 20% (0.20), and enter the answer here.

Line 24: Wages for qualified services

Enter wages for qualified services in Line 24.

Line 25: Cost of supplies

Enter the total qualified supply expenses for supplies used in qualified research.

Line 26: Rental or lease costs of computers

As in Line 7, enter the cost that you paid or incurred for the use of computers used in qualified research.

The computer must be located off your premises. You cannot be the operator or primary user of the computer.

Reduce this amount by the amount that you (or any member of a controlled group of corporations or businesses under common control) received or accrued for the right to use substantially identical property.

Line 27: Applicable percentage of total qualified research expenses for the prior 3 tax years

Using Line 8 instructions, enter the amounts you paid or incurred in terms of total qualified research expenses for the prior 3 tax years. These amounts are subject to the same percentage limitations outlined in Line 8.

Line 28: Total qualified research expenses

Add the following lines:

This amounts represents the total amount of qualified research expenses for which you can claim the research tax credit.

Line 29: Total qualified research expenses for the prior 3 tax years

Enter your qualified research expenses for the prior 3 tax years.

If the credit terminates during the tax year, prorate the qualified research expenses for the prior 3 tax years for the number of days the credit applied during the tax year.

If you had no qualified research expenses in any one of those years, skip Lines 30 and 31. Proceed directly to Line 32.

Line 30

Divide Line 29 by 6.0. Enter the result here.

Line 31

Subtract Line 30 from Line 28 and enter the result in Line 31. If the result is zero or less, enter ‘0.’

Line 32

If you skipped Lines 30 & 31, multiply Line 28 by 6% (0.06). Otherwise, multiply Line 31 by 14% (0.14).

Line 33

Add Line 23 and Line 32. Enter the result here.

Line 34: Section 280C election

Are you electing the reduced R&D credit under IRC Section 280C? Check the appropriate box.

Making Section 280-C election

If “Yes,” multiply Line 33 by 79% (0.79).

Also, if you are electing the reduced research credit, you must complete Form 6765 and clearly indicate your intent to make this election. This is true even if no research credits are claimed on the original federal return.

In order for the election to apply, the Form 6765 must be filed with your original timely filed (including extensions) return for the tax year. Once made, the election is irrevocable for that tax year.

Not making Section 280-C election

If “No,” enter the amount from Line 33.

For taxpayers who don’t elect the reduced credit, you must reduce your otherwise allowable deduction for qualified research expenses or basic research expenses by the amount of the credit on this line.

If the credit exceeds the amount allowed as a deduction for the tax year, you reduce the amount chargeable to capital account for the year for such expenses by the amount of the excess.

Attach a statement to your tax return that lists the deduction amounts or capitalized expenses that you reduced. Identify the lines of your federal income tax return (schedule or forms for capitalized items) on which you reduced these items.

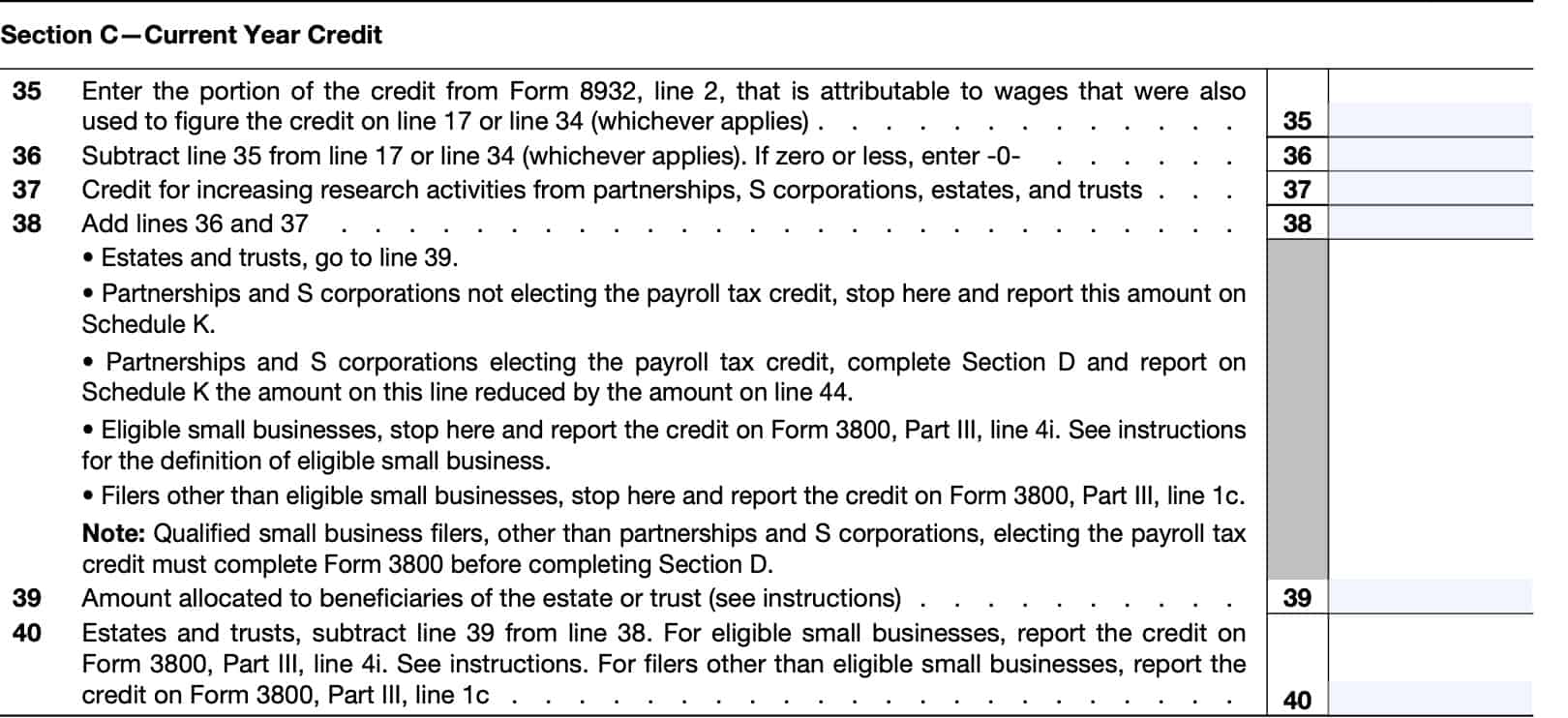

Section C: Current year credit

Line 35

In Line 35, enter the portion of the federal tax credit for employer differential wage payments, from IRS Form 8932, Line 2, that is attributable to wages used to calculate the tax credit on either Line 17 or Line 34.

In other words, business owners cannot use any wage payments for both the research and development tax credit and the tax credit for employer differential wage payments.

Line 36

Subtract Line 35 from either Line 17 or Line 34, as applicable. If the result is zero or a negative number, enter ‘0.’

Line 37: Credit for increasing research activities from partnerships, S-corporations, estates, and trusts

In Line 37, enter total credit for increasing research activities from any of the following:

- Partnerships: Schedule K-1 (Form 1065), Partner’s Share of Income, Deductions, Credits, etc., Box 15 (code M);

- S-corporations: Schedule K-1 (Form 1120S), Shareholder’s Share of Income, Deductions, Credits, etc., Box 13 (code M); and

- Estates & trusts: Schedule K-1 (Form 1041), Beneficiary’s Share of Income, Deductions, Credits, etc., Box 13 (code I).

The following entities report the above credits on Line 37:

- Partnerships

- S corporations

- Estates

- Trusts

- All other filers figuring a separate credit in Section A or Section B, above

Any taxpayer not calculating a separate credit can report this as a general business credit on IRS Form 3800, Part III, as outlined below:

- Eligible small businesses: Report the credit on Line 4i. See the definition of “eligible small business” under Definitions, earlier. Also see Treatment of partners and S corporation shareholders, earlier.

- All other taxpayers: Report the credit on Line 1c.

Eligible small business

For the purpose of offsetting alternative minimum tax (AMT), an eligible small business is:

- A corporation whose stock isn’t publicly traded,

- A partnership, or

- A sole proprietorship.

Also, the average annual gross receipts of the corporation, partnership, or sole proprietorship for the 3-tax-year period preceding the tax year of the credit can’t exceed $50 million.

Gross receipts for any tax year must be reduced by returns and allowances made during the year. If your business wasn’t in existence for the entire 3-year period, base your average annual gross receipts on the period your business existed.

Also, if your business had a tax year of less than 12 months, your gross receipts must be annualized by multiplying the gross receipts for the short period by 12 and dividing the result by the number of months in the short period.

However, it is important not to confuse an eligible small business with a qualified small business, as outlined below.

Qualified small business

For the purpose of payroll tax election, a qualified small business is a corporation or partnership with:

- Gross receipts of less than $5 million for the tax year, and

- No gross receipts for any tax year before the 5-year period ending with the current tax return

Qualified small businesses may offset the employer portion of Social Security taxes by directing a specific amount of their research credit claim towards their payroll tax obligations. This tax credit is the smallest of:

- Current year research credit

- $250,000

- General business credit carryforward for the tax year

For more details, see the form instructions.

Line 38

Estates & trusts: Go directly to Line 39.

Partnerships and S corporations not electing the payroll tax credit: Stop here. Report this amount on Schedule K.

Partnerships and S corporations electing the payroll tax credit: Complete Section D, below. On Schedule K, report the amount on this line reduced by the amount on Line 44.

Eligible small businesses: Stop here. Report the credit on IRS Form 3800, Part III, Line 4i.

Filers other than eligible small businesses: Stop here. Report the credit on IRS Form 3800, Part III, Line 1c

Line 39: Amount allocated to beneficiaries of the estate or trust

Estates & trusts must allocate the credit for increasing research activities on Line 38 between the estate or trust and the beneficiaries in the same proportion as taxable income was allocated. Enter the beneficiaries’ share on Line 39.

If the estate or trust is subject to the passive activity rules, include any credit for increasing research from passive activities disallowed for any prior year and carried forward to this year.

Complete Form 8582-CR, Passive Activity Credit Limitations, to determine the allowed credit that must be allocated between the estate or trust and the beneficiaries.

Line 40

Subtract Line 39 from Line 38.

For eligible small businesses, report the credit on IRS Form 3800, Part III, Line 4i. For filers other than eligible small businesses, report the credit on Form 3800, Part III, Line 1c.

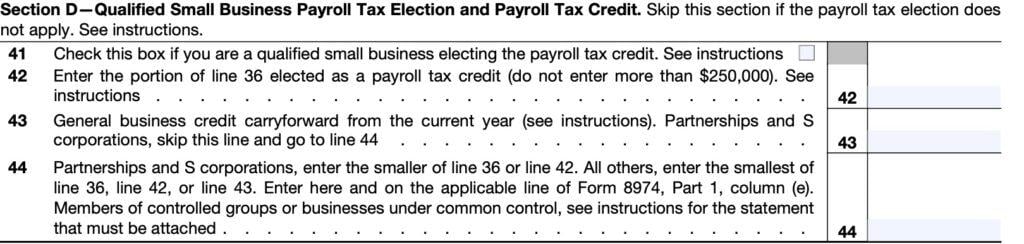

Section D: Qualified small business payroll tax election & payroll tax credit

Line 41: Qualified small business electing the payroll tax credit

Check this box if you are a qualified small business choosing to claim part of your tax credit for qualified research activities as a payroll tax credit.

Do not confuse this with an eligible small business, as there are two different sets of criteria for each definition.

Line 42

Enter the portion of Line 36 that you elect to be treated as a payroll tax credit. Do not enter more than $250,000.

Line 43: General business credit carryforward from the current year

If you are a partnership or S-corporation, go directly to Line 44.

Otherwise, follow these steps as outlined in the worksheet for figuring the general business credit carryforward, contained in the form instructions.

Figuring the general business credit carryforward

- Enter the sum of the following lines from IRS Form 3800:

- Part I, Line 6

- Part II, Line 25

- Part II, Line 36

- Enter the amount from IRS Form 3800, Part II, Line 38

- Subtract Line 2 from Line 1

- Enter the amount from IRS Form 3800, Part I, Line 5, and Part II, Line 35

- Subtract Line 4 from Line 3. If zero or less, enter ‘0.’

The result in Step 5 represents the amount of general business credit carryforward for furture tax years.

Line 44

Partnerships and S corporations, enter the smaller of:

All others, enter the smallest of:

- Line 36

- Line 42

- Line 43

Enter this number here and on the applicable line of IRS Form 8974, Part 1, column (e). This is the tax form for claiming the qualified small business payroll tax credit for increasing research activities.

Members of controlled groups or businesses under common control, see the form instructions for the statement that must be attached to IRS Form 6765.

Video walkthrough

Watch this instructional video to learn more about how to claim the maximum credit for research and development activities using IRS Form 6765.

Frequently asked questions

This credit, also known as the federal research credit or R&D tax credit, allows entities who invest in research and development activities to offset their income tax liability based on the amount of their R&D investments.

According to the Internal Revenue Code, qualified research means research for which expenses may be treated as Section 174 expenses. This research must be undertaken for discovering information that is technological in nature, and its application must be intended for use in developing a new or improved business component of the taxpayer.

Eligible taxpayers file IRS Form 6765 to figure and claim the federal tax credit for increasing research activities, to elect a reduced tax credit under IRC Section 280C, and to elect to claim a certain amount of the credit as a payroll tax offset against the employer portion of payroll taxes.

Where can I find IRS Form 6765?

You can find this tax form on the IRS website. For your convenience, we’ve attached the latest version of this form here.

Related tax articles

This tax form is one of the fillable tax forms provided by the Internal Revenue Service, to help taxpayers reduce their tax preparation costs. To see more forms like this, visit our free fillable tax forms page, where you’ll also find articles like this.

Unlike the IRS, our articles contain step by step instructions for each tax form, as well as video walkthroughs. You can also check out all of our videos by subscribing to our YouTube channel!