IRS Form 7203 Instructions

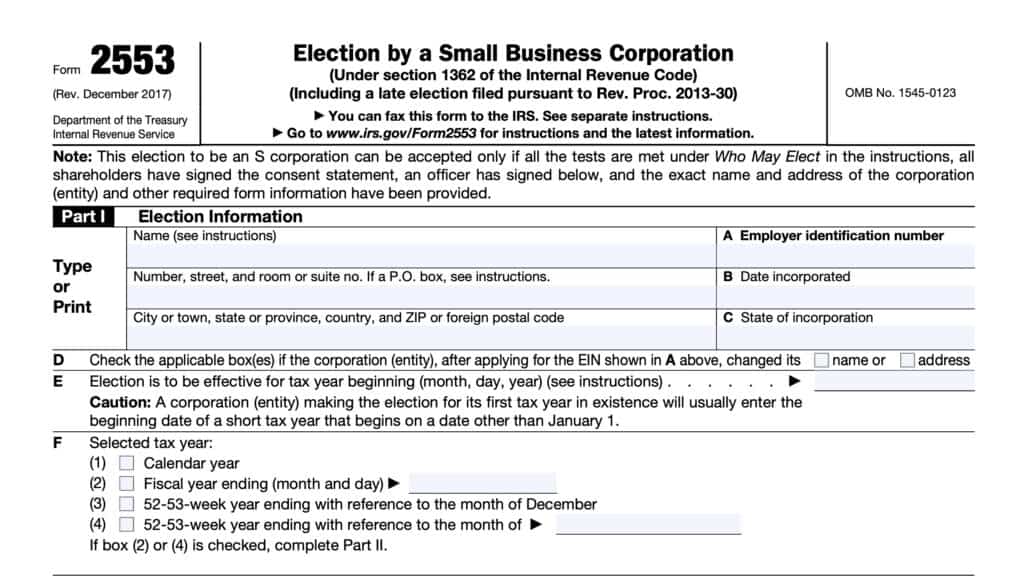

S corporation shareholders must report changes in debt and stock basis to the Internal Revenue Service each year, because debt basis limitations can impact tax deductions and other tax benefits. A few years ago, the IRS created a new form, IRS Form 7203, to replace the three-part worksheet in the Schedule K-1 instructions on the 1120-S return to help do this.

In this article, we’ll break down each part of IRS Form 7203, including:

- How to complete the tax form

- How items of income or deduction impact stock and debt basis

- Other frequently asked questions

Let’s start with a step by step overview of IRS Form 7203.

Table of contents

How do I complete IRS Form 7203?

There are three parts to this two page tax form:

- Part I: Shareholder Stock Basis

- Part II: Shareholder Debt Basis

- Part III: Shareholder Allowable Loss and Deduction Items

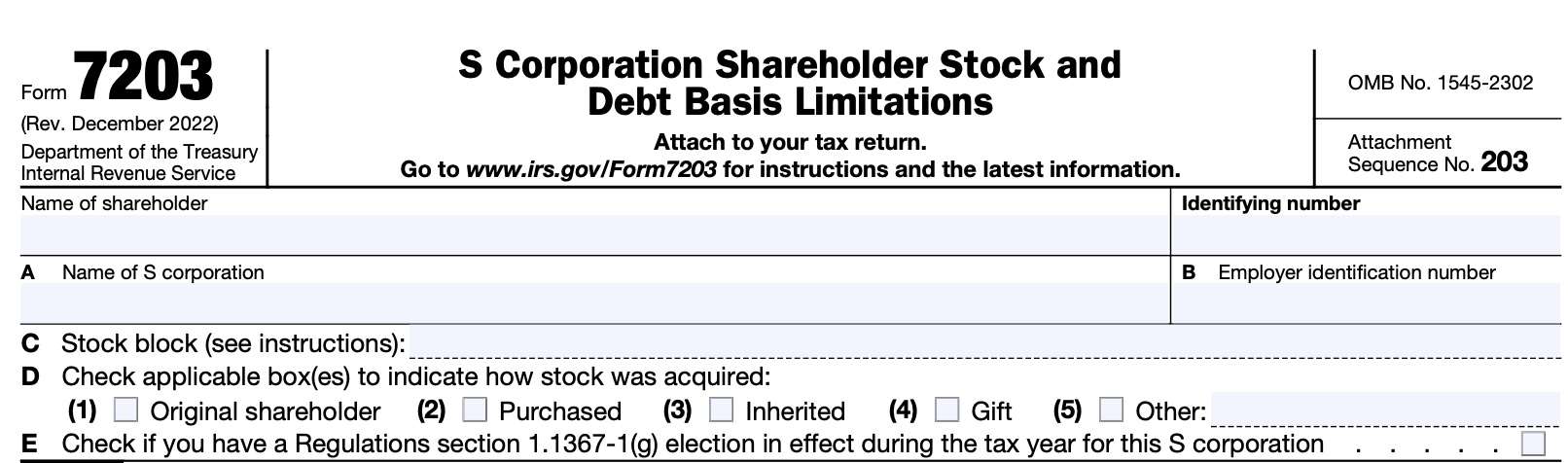

Before we start with Part I, let’s take a look at the taxpayer information at the top of IRS Form 7203.

Taxpayer information

At the very top of the form, you’ll want to make sure that this information reflects the rest of your tax return, starting with the taxpayer name.

Name of shareholder

In this field, you’ll need to enter the taxpayer name as shown on your Schedule K-1 (IRS Form 1120-S). For married couples filing a joint tax return, if each spouse received a Schedule K-1, then each spouse must complete a separate Form 7203.

Note: In this article, any reference to Schedule K-1 refers to the Schedule K-1 that accompanies IRS Form 1120-S, U.S. Tax Return for an S Corporation, not any other pass-through entity. For specific guidance on this form, see the Schedule K-1 instructions.

Identifying number

This field should reflect your Social Security number (SSN) as shown on your Schedule K-1.

Item A: Name of S corporation

Review this field to make sure this properly reflects the name of the S-corporation as listed on your Schedule K-1.

Item B: Employer identification number

This field should contain the employer identification number (EIN) as listed on Schedule K-1.

Item C: Stock block

When a shareholder has a different basis in different blocks of stock, pass-through items are generally allocated pro rata to all shares, regardless of their different bases.

If there is a partial stock sale or partial redemption, you may file more than one Form 7203 and provide a description of what period the form covers. Treasury Regulations Section 1.1367-1(b)(2) and (c)(3) contain additional details.

Item D

Check applicable box(es) to indicate how stock was acquired:

- Original shareholder

- Purchased stock

- Inherited stock

- Received gifted shares of stock

If you didn’t acquire the stock through purchase, inheritance, gift, or as an original shareholder, check “Other” and enter the method by which you acquired your S-corporation stock.

Item E

Treasury Regulations Section 1.1367-1(g) is an elective ordering rule pertaining to the basis of S corporation stock. Check the box if you have this election in effect during the tax year for this particular S-corporation.

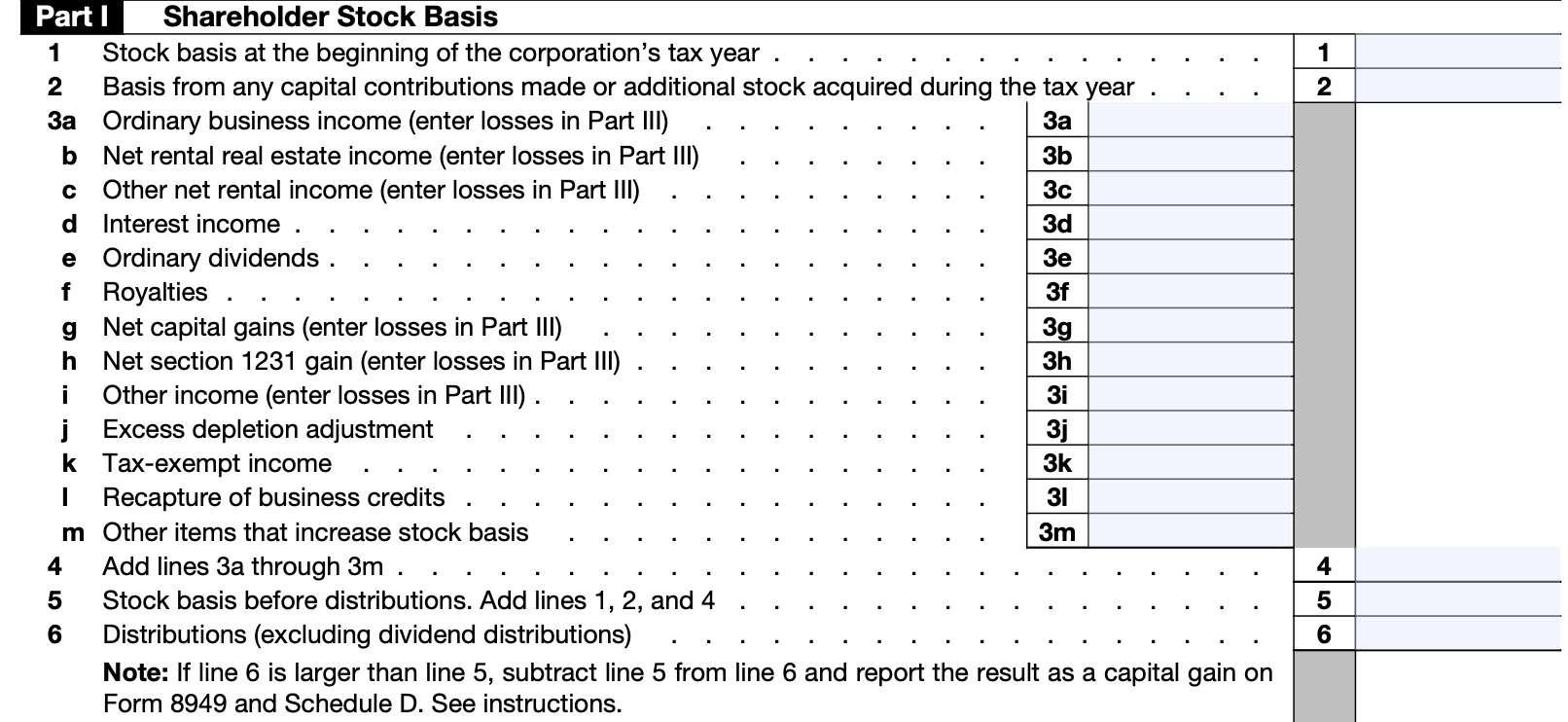

Part I: Shareholder stock basis

In Part I, we’ll make adjustments to the S corporation’s stock basis, in accordance with Internal Revenue Code Section 1367. Let’s begin at the top with Line 1.

Line 1: Stock basis at the beginning of the corporation’s tax year

Enter your basis in the stock of the S corporation at the beginning of the corporation’s tax year.

Unless this is your initial year owning stock in the S corporation, this amount should be the same as your ending stock basis from the prior tax year. You can find this amount on Line 15 of the prior year’s Form 7203.

Additional guidance

- Stock basis can’t be less than zero.

- Don’t include any basis from indebtedness on this line. Stock basis and debt basis must be figured separately.

- Debt basis is addressed in Part II of this form.

Line 2: Basis from capital contributions made or additional stock acquired during the tax year

Enter any additional contributions to the capital of the S corporation or any additional stock acquisitions. Don’t include any loans to the S corporation.

Determining stock basis

There are several ways to determine the stock basis, depending on how you acquired it.

Purchase: The basis of stock you purchased is usually the cost of the stock.

Section 351 transaction: If you contributed property to the S corporation in exchange for stock in a Section 351 transaction, you can figure your stock basis by taking the carryover basis of assets transferred to the corporation, less the liabilities assumed by the corporation.

If the assumed liabilities exceed the adjusted tax basis of the contributed assets, refer to IRC Section 357(c) for additional information.

Inherited property: The basis of inherited property is generally the fair market value (FMV) at either:

- Date of death

- Alternate valuation date

IRC Section 1014 contains more detail.

Gift: The basis of stock acquired by gift is generally the basis of the stock in the hands of the donor. However, special rules may apply if the FMV of the stock is less than the donor’s adjusted basis.

Received as compensation: The basis for stock that you received as compensation is generally the stock’s fair market value on the date that you include the compensation as income. IRS Publication 551, Basis of Assets, contains more details.

Line 3

There is no Line 3 on this tax form. However, there is specific guidance for entries in Lines 3a through 3m.

Enter all separately figured and non-separately figured items of income from Schedule K-1. However, you will only enter positive amounts in Part I. If there is an item that shows a negative amount, you will enter that item in the corresponding line in Part III.

Line 3a: Ordinary business income

Enter ordinary business income as it appears in Box 1 on Schedule K-1. Enter any ordinary business losses in Line 35, below.

Line 3b: Net rental real estate income

Enter net rental real estate income as it appears in Box 2 on Schedule K-1. Enter any losses from rental real estate in Line 36, below.

Line 3c: Other net rental income

Enter rental income from other sources as reported in Box 3 on Schedule K-1. Enter any net rental losses from other sources in Line 37, below.

Line 3d: Interest income

Enter interest income reported on Schedule K-1, Box 4.

Line 3e: Ordinary dividends

Enter ordinary dividend income as reported in Box 5a on Schedule K-1.

Line 3f: Royalties

Enter royalty income as reported on Schedule K-1. You’ll find this item in Box 6.

Line 3g: Net capital gains

Enter any net capital gains as reported on Schedule K-1. Net short-term capital gains can be found in Box 7, while net long-term capital gains are located in Box 8a.

If netting capital gains and losses results in a net capital loss, enter that figure in Line 38, below.

Line 3h: Net Section 1231 gain

Enter net Section 1231 gain as reported in Box 9 on the Schedule K-1 statement. If there is a net Section 1231 loss, enter that number in Line 39, below.

Line 3i: Other income

In Line 3i, enter other income as you might find it in Box 10 of Schedule K-1.

Under Notice 2020-69, increase the shareholder’s basis under IRC Section 961(a) when the U.S. shareholder has either:

- A subpart F inclusion, as defined in Section 959(a)(2), or

- A global intangible low-taxed income (GILTI) inclusion amount that is attributable to an S corporation-owned controlled foreign corporation (CFC).

If this is a negative number, enter it as a loss on Line 40.

Line 3j: Excess depletion adjustment

For depletion other than oil and gas depletion, enter the amount by which your cumulative depletion deduction exceeds your proportionate share of basis in the property subject to depletion.

This corresponds to information provided in Schedule K-1, Box 15, using code C. This number might also be reported as an AMT adjustment on Line 2d of IRS Form 6251.

For oil and gas depletion, don’t enter an amount here. Instead, go to Line 8b to determine any basis adjustment for oil and gas depletion.

Line 3k: Tax-exempt income

Enter the sum of the amounts from Schedule K-1 (Form 1120-S), Box 16, codes A and B. Code A indicates tax-exempt interest income, while Code B represents tax-exempt income from other sources.

Excluded discharge of indebtedness income of the S corporation under IRC Sections 108(a) and 108(d)(7)(A) does not increase basis.

Line 3l: Recapture of business credits

In Line 3l, enter the recapture of any business credits reported to you on Schedule K-1.

Where to locate business credit recaptures on Schedule K-1

You should find most business credit recaptures in Box 17, as well as other tax forms that flow to an individual tax return. Below, we’ll outline the types of credit recaptures and how they are coded.

Code E: Code E indicates your share of any recapture of a low-income housing credit to which the provisions of IRC Section 42(j)(5) are applicable

Code F: Code F refers to the recapture of any other low-income housing credit. Both Code E and Code F recaptures should also be found on IRS Form 8611, Recapture of Low-Income Housing Credit.

Code G: This code refers to information you might need to calculate the recapture tax on investment credit using IRS Form 4255. You may also find necessary information on the original Form 3468 you used to claim the investment credit.

Code H: Code H refers to recapture of other business credits as located on IRS Form 3800. Below is a list of such credits and their accompanying IRS forms.

- New markets credit, IRS Form 8874

- Indian employment credit, IRS Form 8845

- Credit for employer-provided child care facilities and services, IRS Form 8882

- Alternative motor vehicle credit, IRS Form 8910

- Alternative fuel vehicle refueling property credit, IRS Form 8911

- Qualified plug-in electric drive motor vehicle credit, IRS Form 8936

Line 3m: Other items that increase stock basis

In Line 3m, enter any other items that might increase stock basis not already entered.

Line 4

Add Lines 3a through 3m. Enter the total in Line 4.

Line 5: Stock basis before distributions

Add the following:

This represents your stock basis before distributions.

Line 6: Distributions

Enter the distributions reported on Schedule K-1, Box 16, Code D.

Don’t include any Form 1099-DIV distributions on this line. IRS Form 1099-DIV distributions are dividend distributions from the accumulated earnings and profits of a C corporation.

If the amount of the distribution is more than the S corporation stock basis before distributions, you’ll need to report the excess amount as a capital gain on IRS Form 8949, Sales and Other Dispositions of Capital Assets, and on Schedule D, Capital Gains and Losses, of your income tax return.

Don’t increase your stock basis for the amount of capital gain reported for the excess distribution. Instead, see the non-dividend distribution section in the IRS Form 8949 Instructions.

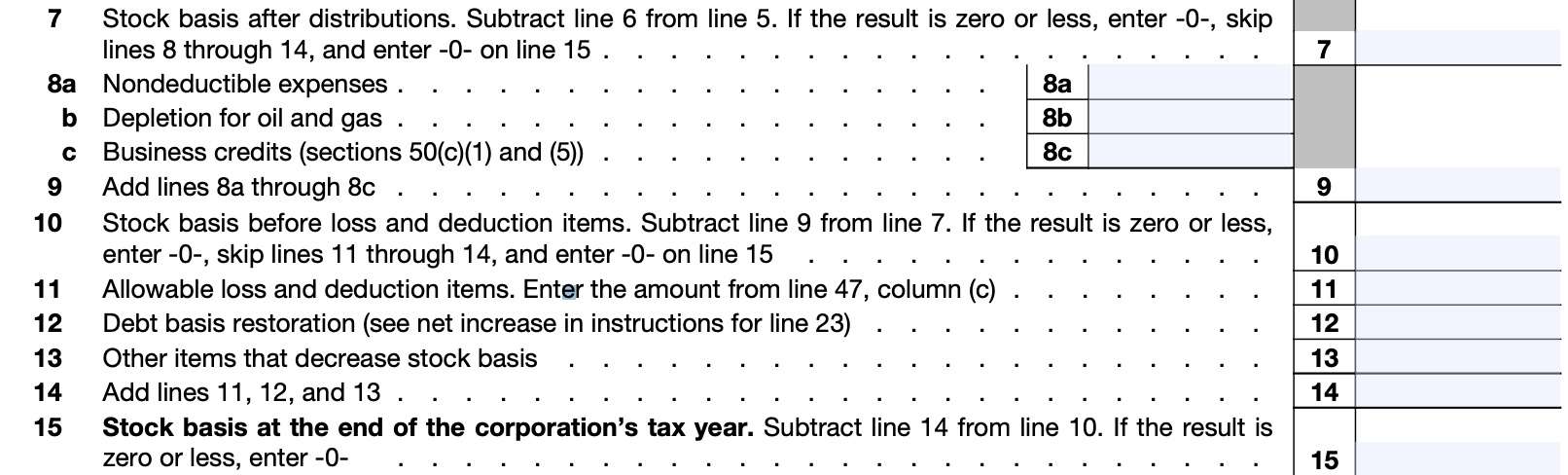

Line 7: Stock basis after distributions

Subtract Line 6 from Line 5. This represents your S corporation stock basis after distributions

Line 8a: Nondeductible expenses

Leave Lines 8a, 8b, and 8c blank if you made an election under Treasury Regulations Section 1.1367-1(g), in Item E, above. If you made this election, enter the information on Line 13.

Otherwise, enter the amount from Schedule K-1, Box 16, Code C. Although these expenses are not deductible on your income tax return, you still need to reduce the stock basis by the amount of these expenses.

Line 8b: Depletion for oil and gas

Enter the amount of oil and gas depletion claimed on your personal return up to your proportionate share of basis in the property that subject to depletion.

Any cumulative depletion in excess of your proportionate share of basis in the property subject to depletion won’t reduce your basis.

Don’t enter an amount for depletion not related to oil and gas property.

Line 8c: Business credits

Certain tax credits may require a reduction of both:

- An S corporation’s assets

- Shareholder’s stock basis in that S corporation

If applicable, enter any such business credits in Line 8c. IRC Section 50(c) contains additional details.

Line 9

Add Lines 8a through 8c. Enter the total in Line 9.

Line 10: Stock basis before loss and deduction items

Subtract Line 9 from Line 7. This represents stock basis before loss and deduction items.

If this amount is zero or a negative number, then do the following:

- Skip Lines 11 through 14 below

- Enter ‘0’ on Line 15

Line 11: Allowable loss and deduction items

Enter the result from Column (c), Line 47, at the end of Part III, below. Use Part III to figure the total allowable loss and deduction items from stock basis.

However, this amount can’t exceed the amount on Line 10.

Line 12: Debt basis restoration

Use Part II to calculate any debt basis restoration. Enter the total from Line 23, if applicable.

Line 13: Other items that decrease stock basis

Enter any other decrease to stock basis otherwise not previously accounted for. This may include the reduction to basis for the sale or redemption of part of your stock.

If you made an election under Treasury Regulations Section 1.1367-1(g) in Item E, then enter the items that you would have entered in Line 8a, Line 8b, and Line 8c, above.

If you sold, redeemed, or otherwise disposed of a portion of your S corporation shareholder stock during the tax year, you may need to complete two forms.

The first form will perform the basis computation for the sold stock at the date of sale. The second form will contain the computation of shareholder basis (both stock and debt basis) at the end of the year.

Line 14

Add the following:

Enter the result here.

Line 15: Stock basis at the end of the corporation’s tax year

Subtract Line 14 from Line 10. This represents the basis of your stock at the end of the current tax year.

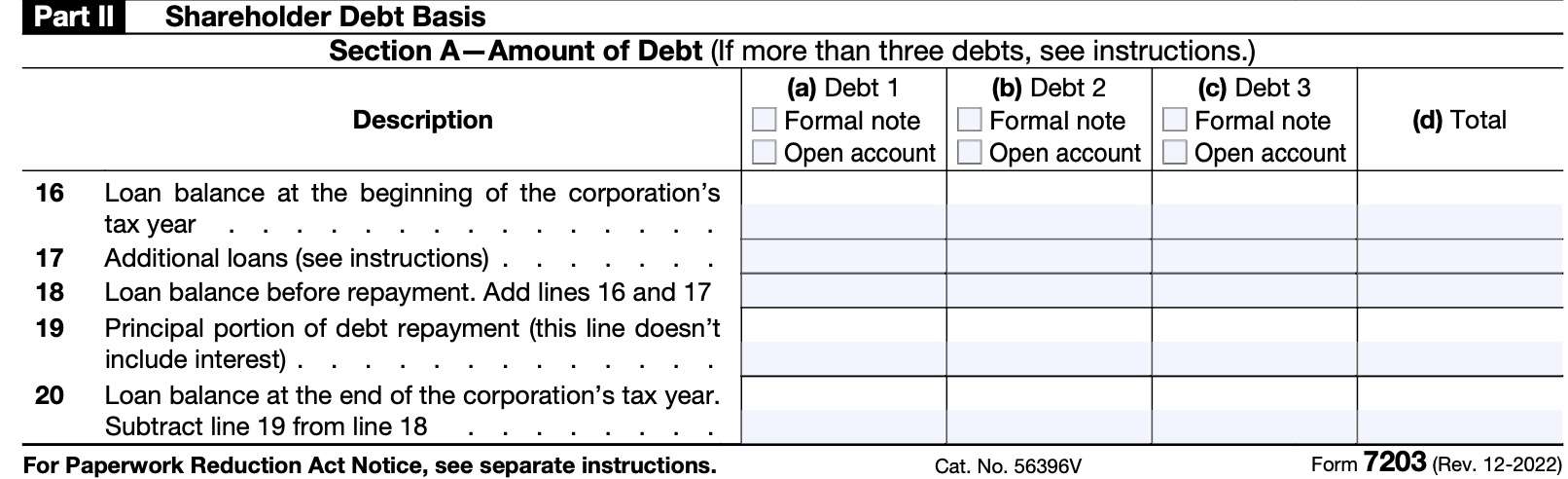

Part II: Shareholder debt basis

Part II contains information about shareholder debt basis, as applicable.

There is sufficient room to calculate debt basis for up to 3 loans. If you have more than three loans, then you’ll need to use additional copies of Part II to continue the debt basis worksheet. List the total sum of all loans on the first page only.

Below are some basic guidelines.

- You must complete this section if you have personally made a shareholder loan to the S corporation.

- You must account for each formal note (notes with a written instrument) made to your S corporation by entering it separately in its own column.

- You can’t aggregate multiple loans into a single column.

- Loans made to the S corporation that aren’t evidenced by a written instrument are referred to as an open account debt and aren’t tracked separately.

- If an open account debt has a year-end balance of more than $25,000, it will be classified as a formal note at the beginning of the next tax year and must be separately tracked.

- Loans that a shareholder guarantees or co-signs aren’t part of a shareholder’s loan basis except to the extent the shareholder makes a payment on the loan guaranteed or co-signed

The first three columns represent up to three different loans. Check each one as a formal note or open account debt as applicable. The fourth column represents the total loan amounts.

Line 16: loan balance at the beginning of the corporation’s tax year

Enter the balance of each loan to the S corporation at the beginning of the corporation’s tax year in a separate column.

Line 17: Additional loans

Enter any new loans made during the tax year and evidenced by a formal note in a separate column.

Formal notes

If a formal note is refinanced, enter any increase on Line 17 under the same column as the original loan.

Open accounts

Advances and repayments made during the S corporation’s tax year on an open account are netted at the close of the S corporation’s tax year to determine the amount of any net advance or net repayment.

Enter any net advances on Line 17 under the same column as the open account debt. If this is the first year of the open account debt, enter the net advance in its own column on Line 17.

Any debt that exceeded $25,000 at the end of the prior tax year is treated as a formal note for purposes of calculating the gain on loan repayment in the subsequent year.

Line 18: Loan balance before repayment

Add Line 16 and Line 17 for each column. Enter the totals in Line 18.

Line 19: principal portion of debt repayment

Enter the amount of principal repaid for each loan over the course of the tax year.

For a formal note, enter the amount of principal repayment specific to each loan.

For open account debt, if the repayments exceed the advances for the tax year, then enter the net repayment on Line 19.

Line 20: Loan balance at the end of the corporation’s tax year

Subtract Line 19 from Line 18.

This should represent the loan balance at the end of the S corporation’s current year.

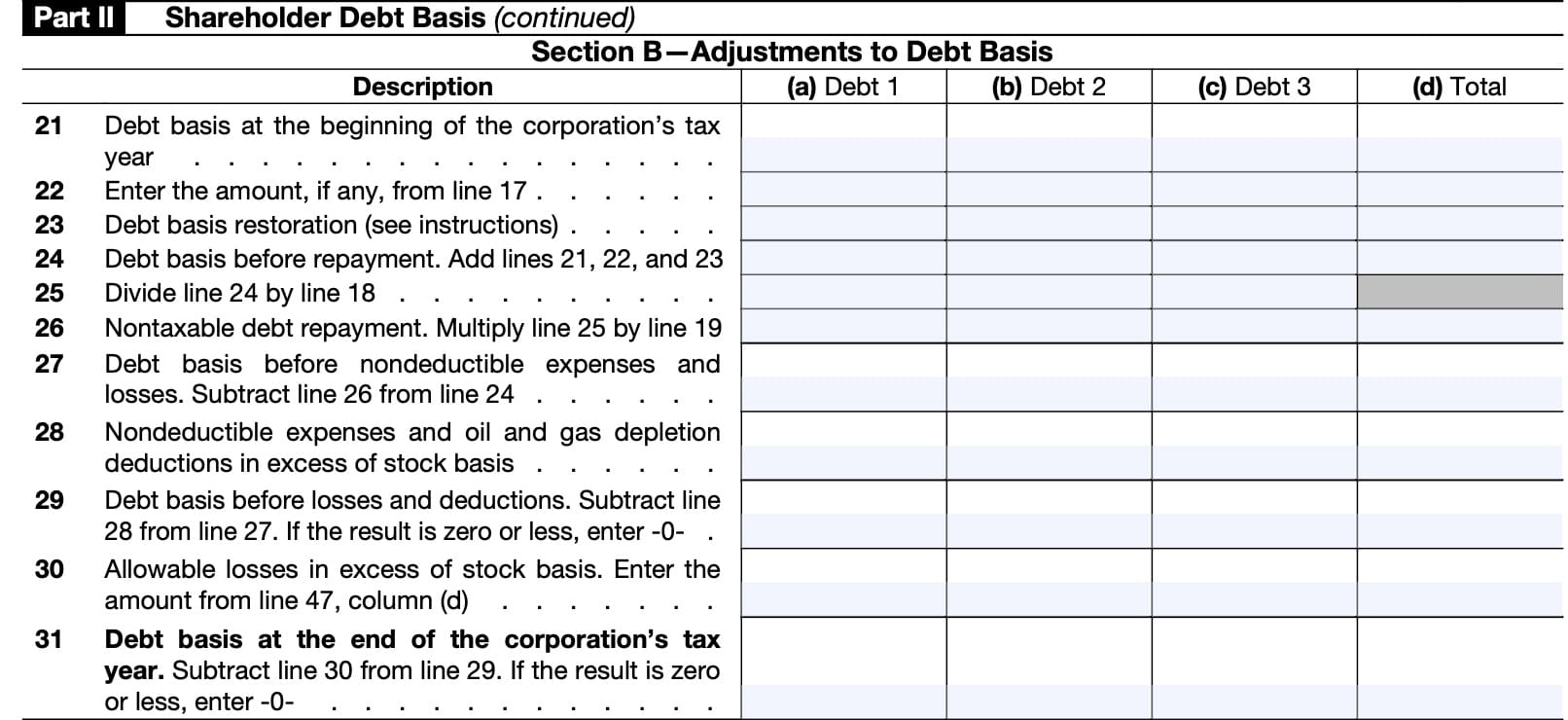

Line 21: Debt basis at the beginning of the corporation’s tax year

In Line 21, enter the debt basis of each S corporation loan at the beginning of the corporation’s tax year.

Line 22

Enter any additional loans, as applicable, from Line 17.

Line 23: Debt basis restoration

If Line 21 is less than Line 16, then you have reduced the debt basis of that loan. According to IRC Section 1367(b)(2)(B), reduced debt basis can only be restored with a net increase.

A net increase is the amount by which the items that increase stock basis exceed the items that decrease stock basis.

You can calculate net increase as follows:

- Start with Line 4 (sum of increases in stock basis in Part I)

- Subtract Line 6 (Distributions)

- Subtract Line 9 (total of nondeductible expenses, oil and gas depletion, and certain business credits)

- Subtract Line 13 (Other items that decrease stock basis)

- Subtract Line 47(a) (current year losses and deductions)

- Subtract Line 47(b) (carryover amounts from previous tax year)

If the net increase calculation exceeds the total reduction in debt basis (Line 16 minus Line 21), then the restoration is limited to the amount needed to restore debt basis to the face of the loan.

In other words, you cannot restore debt basis above the loan’s value.

Multiple debts

If you have multiple debts, the net increase is applied first to restore the reduction of basis in any debt repaid in the tax year to the extent necessary to offset any gain that would otherwise be realized.

Any remaining net increase is applied to each debt in proportion to its reduced basis.

Line 24: debt basis before repayment

Add the following:

Enter the total here.

Line 25

For each column, except column (d), divide Line 24 by Line 18. Enter the result here.

Line 26: Nontaxable debt repayment

Multiply Line 25 by Line 19, then enter the result. This is the nontaxable debt repayment.

Line 27: Debt basis before nondeductible expenses and losses

Subtract Line 26 from Line 24 and enter the result in Line 27.

Line 28: Nondeductible expenses and oil and gas depletion deductions in excess of stock basis

Enter the smaller of:

- Line 9 minus Line 7 (nondeductible expenses and oil/gas depletion deductions in excess of stock basis), or

- Line 27

If you an election under Regulations Section 1.1367-1(g) in Item E, enter the smaller of

Nondeductible expenses in excess of stock and debt basis do not carry forward unless you made this election.

Line 29: Debt basis before losses and deductions

Subtract Line 28 from Line 27. If the result is zero or a negative number, enter ‘0.’

Line 30: Allowable losses in excess of stock basis

Enter the Line 47(d) amount in the total column for Line 30.

If you have more than one loan to the corporation, then you’ll have to prorate any allocated reduction based on the ratio that each individual loan basis bears to the aggregate loan bases.

Line 31: Debt basis at the end of the corporation’s tax year

Subtract Line 30 from Line 29. This represents the S corporation’s debt basis at the end of the current year for each loan.

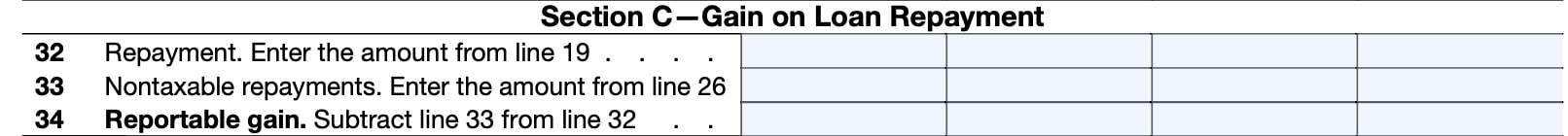

Line 32: Repayment

Enter any amount from Line 19, as applicable. This is the principal repayment on each loan.

Line 33: Nontaxable repayments

Enter nontaxable loan repayments for each loan from Line 26.

Line 34: Reportable gain

Subtract Line 33 from Line 32. Enter the result in Line 34.

The character of the gain on repayment is dependent on whether the debt is evidenced by a formal note or is an open account.

Formal notes

Debt evidenced by a formal note will result in capital gain. Report this capital gain on IRS Form 8949 and Schedule D of your income tax return.

Open account debt

Any open account debt will result in ordinary gain. Report this ordinary gain on IRS Form 4797, Sales of Business Property.

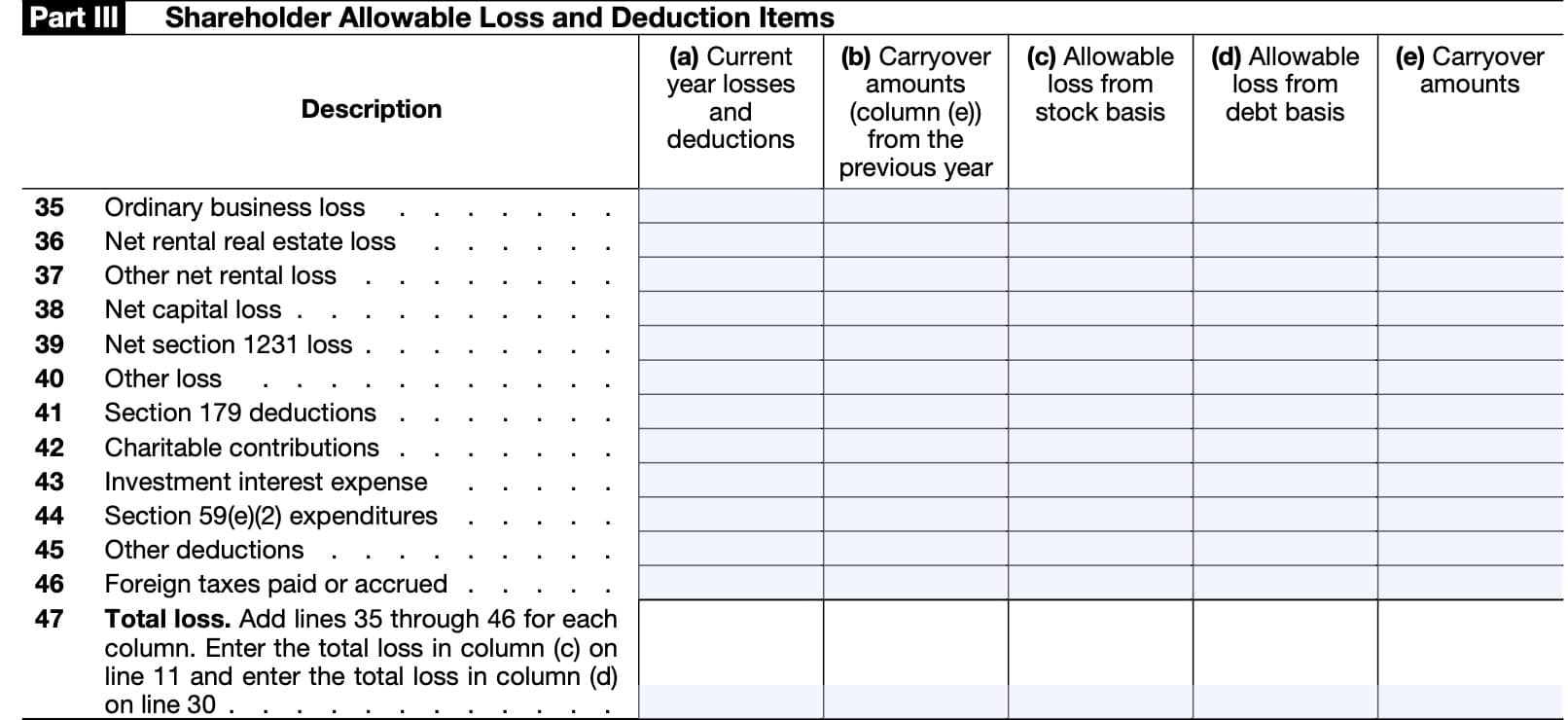

Part III: Shareholder allowable loss and deduction items

Corporate losses and other deduction items are limited to the sum of your stock and debt basis.

When stock and debt basis is insufficient, and there is more than one type of loss or deduction item that reduces basis, the amounts allowed as a loss or deduction are allocated on a pro rata basis. Treasury Regulations Sections 1.1366-2(a)(4) and (5) provide additional guidance.

Loss and deductions in excess of basis are suspended and carried forward indefinitely. During this time, the character of the loss and deduction items is retained.

Part III shows the pro rata allocation and tracks any loss or deduction carryforward.

There are 5 columns in Part III:

- Column (a): Current year losses and deductions

- Column (b): Carryover amounts (previous year’s Column (e) amount)

- Column (c): Allowable loss from stock basis

- Column (d): Allowable loss from debt basis

- Column (e): Carryover amounts for next year

Before we give line by line guidance, let’s go over guidelines for each column.

Column (a)

Enter the loss and deduction amounts for each item as reported on your Schedule K-1.

Column (b)

Enter any loss or deduction items disallowed due to basis limitations in prior years that were carried forward.

Column (c)

Stock basis is zero

If Line 10 (stock basis before loss or deductions) is zero, skip column (c).

Stock basis is greater than losses

If stock basis, as reported on Line 10, is greater than the sum of column (a) and column (b) on Line 47, enter the sum of each line for column (a) plus column (b) in column (c).

Stock basis is less than losses

If stock basis, as reported on Line 10, is less than the sum of column (a) and column (b) for Line 47, enter the pro rata amount on the corresponding line in column (c).

The total allocation amount reported in column (c), Line 47, can’t exceed the amount reported on Line 10.

Column (d)

Debt basis is zero

If Line 29 (debt basis before losses and deductions) is zero, skip column (d). If column (c), Line 47, is less than Line 10, skip column (d).

Debt basis is greater than losses

If debt basis, as reported on Line 29, is greater than column (a) plus column (b) minus column (c), Line 47, enter column (a) plus column (b) minus column (c), in column (d) for each line item.

Debt basis is less than losses

If debt basis, as reported on Line 29, is less than column (a) plus column (b) minus column (c) for Line 47, enter the pro rata amount on the corresponding line in column (d).

The total allocation amount reported in column (d), Line 47, can’t exceed the amount reported on Line 29.

The allowable losses and deductions from columns (c) and (d) should be reported on the appropriate areas of your return.

Column (e)

If the sum of column (a) plus column (b) exceeds the sum of column (c) plus column (d), enter the excess in column (e) for each line item.

If you disposed of all your stock, see Treasury Regulations Section 1.1366-2(a)(6).

Now that we understand each column’s use, we should be able to complete each line in Part III.

For each numbered line, enter the appropriate amount from the corresponding Schedule K-1, or as instructed in the corresponding line in Part I, above. If this is not apparent, then the line instructions will indicate where you may be able to obtain this information.

Line 35: Ordinary business loss

Enter ordinary business loss as reported in Box 1 on the Schedule K-1 statement. If there is ordinary business income, enter that number in Line 3a, in Part I.

Line 36: Net rental real estate loss

Enter net rental real estate loss as reported in Box 2 on the Schedule K-1 statement. If there is net rental real estate income, enter that number in Line 3b, in Part I.

Line 37: Other net rental loss

Enter other net rental loss as reported in Box 3 on the Schedule K-1 statement. If there is other net rental income, enter that number in Line 3c, in Part I.

Line 38: Net capital loss

Enter net capital loss as reported in Box 8a on the Schedule K-1 statement. If there is a net capital gain, enter that number in Line 3g, in Part I.

Line 39: Net Section 1231 loss

Enter net Section 1231 loss as reported in Box 9 on the Schedule K-1 statement. If there is net Section 1231 gain, enter that number in Line 3h, in Part I.

Line 40: Other loss

Enter other loss as reported in Box 10 on the Schedule K-1 statement. If there is other income instead of a loss, enter that number in Line 3a, in Part I.

Line 41: Section 179 deductions

Enter any Section 179 deduction reported in Box 11 on the Schedule K-1 statement.

Line 42: Charitable contributions

Enter any charitable contributions reported in Box 12 on the Schedule K-1 statement. Charitable contributions reported in Box 12 will be accompanied by Codes A through G for various charitable contributions.

If you received a copy of IRS Form 8283, Noncash Charitable Contributions, from the S corporation, you may need to attach this copy to your tax return.

Line 43: Investment interest expense

Enter any investment interest expense reported in Box 12 on the Schedule K-1 statement. Investment interest expense reported in Box 12 will be accompanied by Code H.

You may also need to report this investment interest expense on IRS Form 4952, Line 1, if applicable.

Line 44: Section 58(e)(2) Expenditures

Enter any Section 58(e)(2) expenditures reported to you in Box 12 on the Schedule K-1 statement, marked with Code J.

You may also need to report any current year amortization of Section 58(e)(2) expenditures on IRS Form 4562, Depreciation and Amortization, and IRS Schedule E when filing your tax return.

Line 45: Other deductions

Enter any other deductions reported to you in Box 12 on the Schedule K-1 statement, marked with Code S.

According to the shareholder’s instructions on Schedule K-1, Code S may include any of the following:

- Itemized deductions as reported on IRS Schedule A

- Soil and water conservation expenditures & endangered species recovery expenditures

- Expenditures to remove architectural and transportation barriers for the elderly and disabled

- Interest expense allocated to debt-financed distributions

- May be subject to passive activity loss limitations on IRS Form 8582

- Contributions to a capital construction fund

- Penalty on early withdrawal of savings

- Reported on IRS Schedule 1, Line 18

- Film, television, and live theatrical production expenses

Line 46: Foreign taxes paid or accrued

Enter any foreign taxes paid or accrued as reported to you in Box 16 on the Schedule K-1 statement, marked with Code F. This is not necessarily the same amount reported on IRS Form 1116 for purposes of claiming the foreign tax credit.

Line 47: Total loss

Add Lines 35 through 46 for each column.

Enter the total loss in column (c) on Line 11.

Enter the total loss in column (d) on Line 30.

Video walkthrough

Watch this informative video for a detailed breakdown of how IRS Form 7203 works!

Frequently asked questions

S corporation shareholders must file IRS Form 7203 to report certain events, such as loan repayments or stock disposition. However, the IRS recommends that S-corporation shareholders complete and keep Form 7203 to properly calculate stock and debt basis each year.

IRS Form 7203 first replaced the 3-part worksheet titled, Figuring a Shareholder’s Stock and Debt Basis, located in the Schedule K-1 instructions for IRS Form 1120-S in 2021.

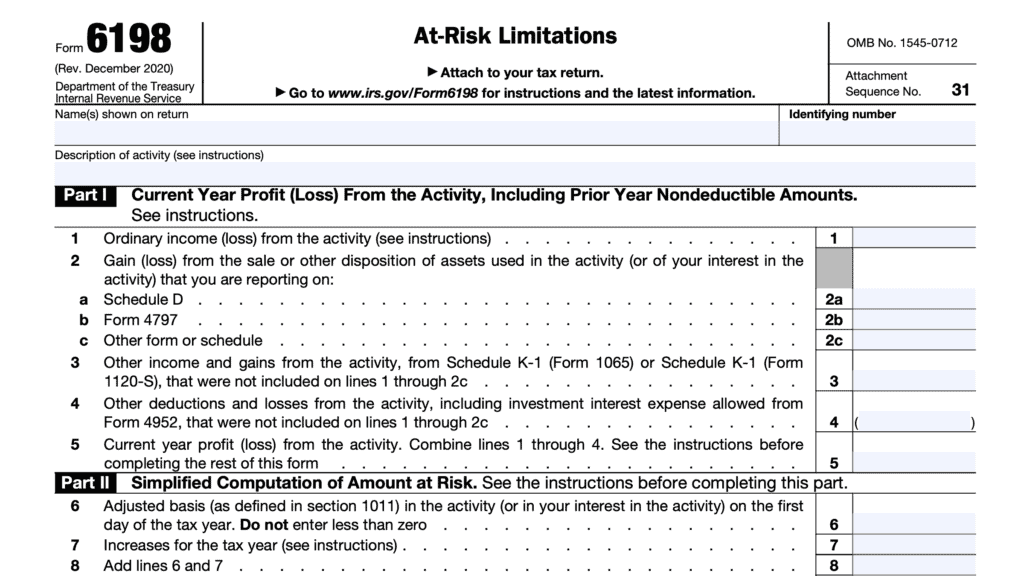

Many tax deductions are subject to basis limitations or at-risk limitations. Additionally, certain items, such as nondividend distributions, become items of capital gain once stock basis is reduced to zero. The IRS expects each S corporation shareholder to properly track changes to shareholder basis.