IRS Form 8233 Instructions

If you are a foreign person who is earning income for personal service performed in the United States, and your home country has a tax treaty in place, you might be eligible to claim a tax withholding exemption by filing IRS Form 8233.

In this article, we’ll walk you through everything you need to know about this tax form, including:

- How to complete IRS Form 8233

- Filing considerations

- Situations when another tax form might be more appropriate

Table of contents

How do I complete IRS Form 8233?

This two page tax form contains 4 parts:

- Part I: Identification of Beneficial Owner

- Part II: Claim for Tax Treaty Withholding Exemption

- Part III: Certification

- Part IV: Withholding Agent Acceptance and Certification

Let’s begin with Part I.

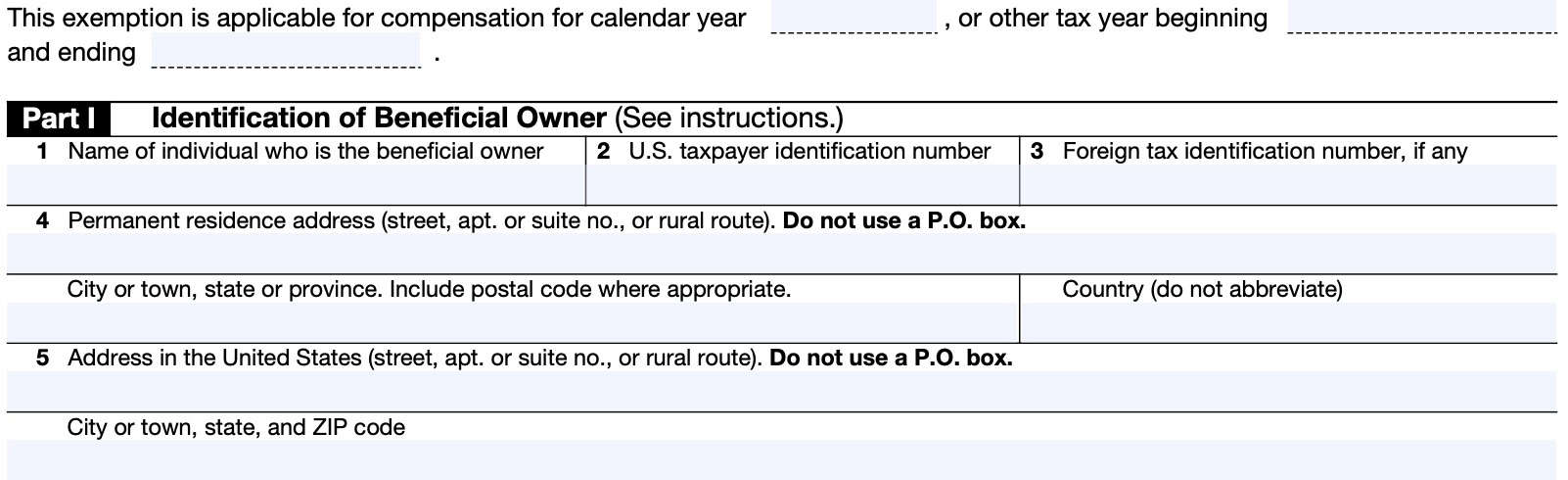

Part I: Identification of Beneficial Owner

Just above Part I, enter either of the following:

- Calendar year of the exemption

- Fiscal year beginning and end dates

A fiscal year is any 12 consecutive month period that ends on the last day of any month except December. For example, the federal government’s fiscal year begins on October 1 and ends on September 30 of the following year.

Let’s get into each of the line items in Part I..

Line 1: Name of individual who is the beneficial owner

Enter the name of the foreign person who is the countbeneficial owner here.

Beneficial owner

In most cases, the beneficial owner of income is the person who is required to include the income as part of gross income on a tax return, based upon U.S. tax principles.

However, a person is not a beneficial owner of income to the extent that person is:

- Receiving income as a nominee, agent, or custodian of another person, or

- A conduit whose participation in a transaction is disregarded

In cases where amounts paid do not constitute income, then beneficial ownership is determined as if the payment were income.

Line 2: U.S. taxpayer identification number

Enter the person’s U.S. taxpayer identification number (TIN) here. This can be one of the following:

- Social Security number (SSN)

- Individual taxpayer identification number (ITIN)

In most cases, you must enter your SSN here. If you do not have an SSN and are not eligible to get one, you must get an ITIN.

Applying for an ITIN

To apply for an ITIN, you can file IRS Form W-7, Application for Individual Taxpayer Identification Number, with the Internal Revenue Service. In most cases, you apply for an ITIN when you file your tax return for which you need the ITIN.

However, if the reason for your ITIN request is because you need to provide IRS Form 8233 to the withholding agent, you must:

- File IRS Form W-7 with the IRS

- Provide proof that you are not eligible for an SSN

- For example, your Form SS-5 was rejected by the Social Security Administration

- Include a Form 8233 with your application

According to the Form 8233 instructions, the IRS should notify you of your ITIN application status within 7 weeks. However, your application may take between 9 and 11 weeks if one of the following occurs:

- You submit your application during peak processing periods, or

- Between January 15 and April 30

- You file IRS Form W-7 from overseas

Expired ITIN

As a general rule, ITINs issued after December 31, 2012, will remain in effect as long as the individual to whom the ITIN was issued:

- Has filed a tax return at least once in the previous 3 tax years, or

- Was listed as a dependent on another person’s tax return at least once in the prior 3 years

Otherwise, the ITIN will expire at the end of the third consecutive tax year in which the individual did not file a tax return.

All expired ITINs must be renewed before being used on a U.S. tax return.

Line 3: Foreign tax identification number, if any

If your home country for tax purposes has issued you a tax identification number, enter it here.

For example, Canadian residence should enter their Social Insurance Number.

Line 4: Permanent residence street

Enter the permanent street address in Line 4.

Permanent residence address

Your permanent residence address is the address in the country where you claim to be a resident for purposes of that country’s income tax.

If you are completing Form 8233 to claim a tax treaty withholding exemption, you must determine your residency in the manner required by the treaty. Do not show the address of any of the following:

- Financial institution

- Post office box (P.O. Box)

- Any address solely used for mailing purposes

If you are an individual who does not have a tax residence in any country, then your permanent residence is where you normally reside.

Tax treaty withholding exemptions

Most tax treaties that provide for a tax treaty withholding exemption for students, trainees, teachers, or researchers require that the recipient be a resident of the treaty country at the time of, or immediately before, entry into the United States.

Thus, in most cases, a student or researcher can claim the withholding exemption even if he or she no longer has a permanent address in the treaty country after entry into the United States.

If this is the case, you can provide a U.S. address on Line 4 and still be eligible for the withholding exemption if you meet all other conditions required by the tax treaty.

Depending on your tax situation, you must also identify the tax treaty country of which you were a resident when you entered the United States, on either:

- Line 12a

- Line 13b

Line 5: Address in the United States

Enter your address in the United States, if applicable. Give the following information:

- Street number and street name

- City, state, ZIP code

As with Line 4, do not enter a post office box in this field.

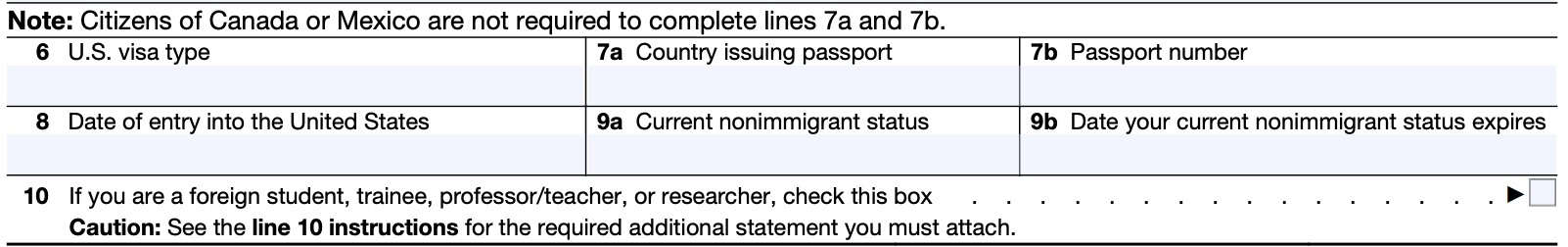

Line 6: U.S. visa type

Enter the type of U.S. visa that you have. below are common examples of visa types, based upon status:

- F-1 visa: Foreign students

- J-1: Foreign professors, teachers, or researchers

- May also be considered business or vocational trainees

- M-1: Business or vocational trainees

- O-1: Individual who possesses either:

- Extraordinary ability in the sciences, arts, education, business, or athletics, or

- Record of extraordinary achievement in the motion picture or television industry and has been recognized nationally or internationally for those achievements

If you do not have a U.S. visa, enter ‘None.’

Line 7a: Country issuing passport

Enter the name of the country that issued your foreign passport.

Line 7b: Passport number

In Line 7b, enter the passport number for the passport mentioned in Line 7a.

Line 8: Date of entry into the United States

Enter the date of your arrival in the United States.

In most cases, you must enter your date of entry into the United States that relates to your current nonimmigrant status. For example, enter the date of arrival shown on your current Immigration Form I-94, Arrival-Departure Record.

Exception

If you are claiming a tax treaty benefit that is determined by reference to more than one date of arrival, enter the earlier date of arrival.

Example

For example, you are currently claiming treaty benefits (as a teacher or a researcher) under Article 15 of the tax treaty between the United States and Norway. You previously claimed treaty benefits (as a student) under Article 16, paragraph 1, of that treaty.

Under Article 16, paragraph 4, of that treaty, the combination of exemptions under Articles 15 and 16, paragraph 1, cannot extend beyond 5 tax years from the date you entered the United States.

If Article 16, paragraph 4, of that treaty applies, enter on the date you entered the United States as a student on Line 8.

Line 9a: Current nonimmigrant status

In Line 9a, enter your current nonimmigrant status. If possible, enter your current nonimmigrant status shown on your current Immigration Form I-94.

Line 9b: Date your current nonimmigrant status expires

In Line 9b, enter the date that your current nonimmigrant status expires. If possible, enter the date shown on your current Form I-94.

Enter “DS” on this line if the date of expiration is based on “duration of status.”

Line 10

Check the box in Line 10 if, as a nonresident, you are any of the following:

- Student

- Trainee

- Professor or teacher

- Researcher

Nonresident alien students, trainees, professors/teachers, and researchers using Form 8233 to claim a tax treaty withholding exemption for compensation for personal services must attach a tax treaty statement to Form 8233.

Required statements

You may find examples of the format and contents for required statements, based upon your tax situation, in Appendix A and Appendix B of IRS Publication 519, U.S. Tax Guide for Aliens

- Appendix A: Tax Treaty Exemption Procedure for Students

- Appendix B: Tax Treaty Exemption Procedure for Teachers and Researchers

Part II: Claim for Tax Treaty Withholding Exemption

In Part II, we’ll provide additional information about the actual claim of tax exemptions, based upon the existing tax treaty.

Line 11: Compensation for independent (and certain dependent) personal services

In Line 11a, enter a description of the personal services that you are providing.

Examples of personal services

The IRS form instructions break down examples of personal services as follows:

- Independent personal services

- Dependent personal services

Let’s take a closer look at each.

Compensation for independent personal services

The form instructions define compensation for independent personal services as:

Services performed as an independent contractor in the United States by a nonresident alien who is self-employed rather than an employee.

Compensation for these services includes the following:

- Payments for professional services made directly to the person performing those services

- Consulting fees

- Honoraria paid to visiting professors, teachers, researchers, scientists, and speakers

For compensation for independent personal services, examples of acceptable descriptions to enter on this line include the following:

- Consulting contract to design software

- Give 3 lectures at University of XYZ

Compensation for dependent personal services

According to the IRS, dependent personal services are services performed as an employee in the United

States by a nonresident alien.

Dependent personal services include compensatory scholarship or fellowship income. Compensation for such services includes the following:

- Wages

- Salaries

- Fees

- Bonuses

- Commissions

For compensation for dependent personal services, acceptable descriptions to enter on this line include

the following examples:

- Nonresident alien student:

- Part-time library assistant

- Part-time on-campus restaurant worker

- Teaching one mathematics course per semester to undergraduate students

- Nonresident alien professor:

- Teaching at ABC College

- Nonresident alien researcher:

- Research at ABC University’s school for applied science research

- Nonresident alien business or vocational trainee:

- Neurosurgical residency at United Hospital

- One-year internship in hydraulic engineering at Acme Corporation

In Line 11b, enter the total amount of compensation for personal services you will receive from this withholding agent during the tax year. If you do not know the exact amount of compensation, enter an estimated amount.

Line 12

If your compensation is exempt from federal income tax withholding based upon tax treaty benefits, then you’ll need to complete the following line items under Line 12.

Line 12a: Tax treaty on which you are basing exemption from withholding of tax

Enter the specific income tax treaty on which you are basing your claim for exemption from United States tax withholding.

For example, you can enter “U.S.–Germany tax treaty” or “U.S.–Belgium tax treaty”.

Line 12b: Treaty article on which you are basing withholding exemption

Enter the specific tax treaty article of the treaty identified on Line 12a on which you are basing your claim for exemption from withholding of income tax. For example, you can list:

- Article 14, Paragraph 2

- Article 7-Business profits

Services permanent establishment provision

If you are a resident of a country that has a services permanent establishment provision in the treaty, and you are claiming to be exempt from tax withholding because you are not performing services for more than the specified period under that provision, then enter that treaty provision.

An example of this provision is Article 5, paragraph 9, of the United States–Canada tax treaty.

Line 12c: Total compensation listed on Line 11b that is exempt from tax under this treaty

If all income received for the services performed to which this Form 8233 applies is exempt, write “All.”

If only part is exempt, enter the exact dollar amount that is exempt from withholding.

Line 12d: Country of residence

Enter the country of your residence here.

Foreign nationals must be a resident of a country if they are claiming a benefit under either of the following articles from the tax treaty:

- Income from employment/dependent personal services article, or

- Income from independent services/business profits article

If you are claiming a tax benefit from either the student/trainee or teacher/researcher article of a treaty, then you generally only need to have been a resident of the treaty country at the time of entry into the United States or immediately beforehand.

Line 13: Noncompensatory scholarship or fellowship income

Do not complete Lines 13a through 13d unless you also received compensation for personal services from the same withholding agent.

Line 13a: Amount

Enter the total amount of noncompensatory scholarship or fellowship income that you are declaring.

Line 13b: Tax treaty on which you are basing exemption from withholding

Enter the specific income tax treaty on which you are basing your claim for exemption from United States tax withholding.

For example, you can enter “U.S.–Germany tax treaty” or “U.S.–Belgium tax treaty”.

Line 13c: Treaty article on which you are basing exemption from withholding

Enter the specific tax treaty article of the treaty identified on Line 13b on which you are basing your claim for exemption from withholding of income tax. For example, you can list:

- Article 14, Paragraph 2

- Article 7-Business profits

Line 13d: Total income listed on Line 13a that is exempt from tax under this treaty

Enter the total income that is exempt from taxation under this tax treaty.

Line 14

In Line 14, provide sufficient facts to justify the exemption from withholding claimed on Line 12 and/or Line 13.

Be sure you provide enough details to allow the IRS to determine the tax treaty benefit you are claiming.

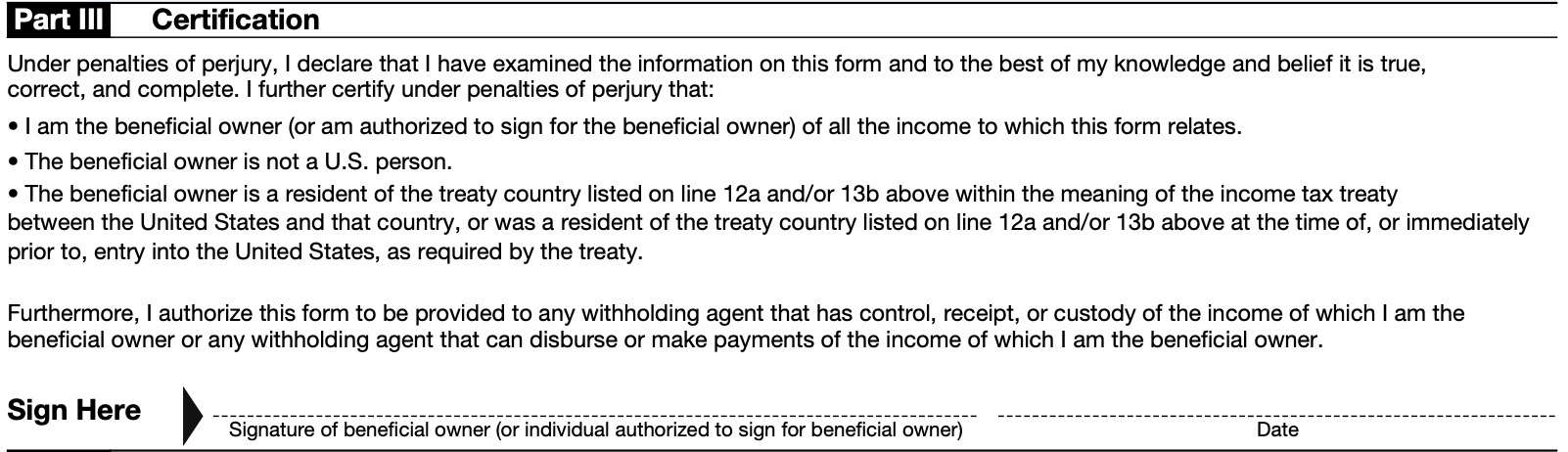

Part III: Certification

In Part III, you will sign and date this form, as the beneficial owner (or a person authorized to sign on the beneficial owner’s behalf). By signing this form, you are certifying, under penalties of perjury, the following:

- That you are the beneficial owner of this income, or that the beneficial has authorized you to sign on his or her behalf

- The beneficial owner is not a U.S. person

- Neither U.S. citizen or resident alien

- The beneficial owner is a resident of the country listed above within the meaning of the income tax treaty between the United States and the treaty country

- Or was a resident at the time of, or immediately prior to entering the United States

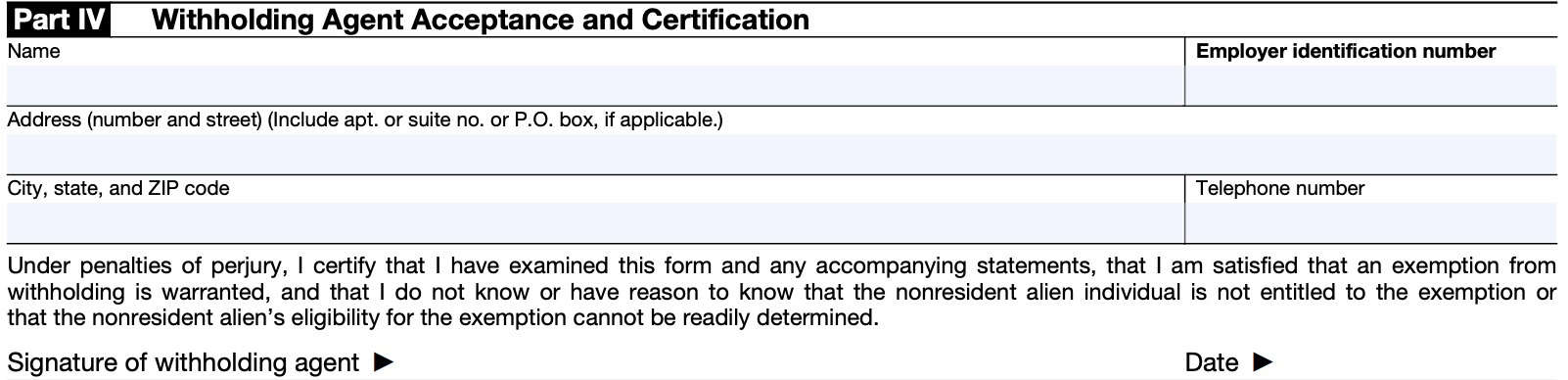

Part IV: Withholding Agent Acceptance and Certification

Part IV of the form contains the withholding agent’s acceptance and certification of the statements presented by the foreign individual.

Withholding agent

A withholding agent is any person that

- Has control, receipt, or custody of any amount, or

- Can disburse or make payments of an amount subject to income tax withholding

A withholding agent can be a U.S. person or a foreign person. The withholding agent can be any of the following entities:

- Individual

- Corporation

- Partnership

- Trust

- Association

- Other tax entities, including the following:

- Foreign intermediaries

- Foreign partnerships

- Foreign corporations

- U.S. branches of certain foreign banks and insurance companies

In most cases, the person who pays (or causes to be paid) the amount subject to withholding to the nonresident alien individual (or to his or her agent) must withhold.

In Part IV, you should see the following information for the withholding agent:

- Name

- Employer identification number (EIN)

- Address, including city, state, and zip code

- Telephone number

Filing considerations

Below are some additional filing considerations.

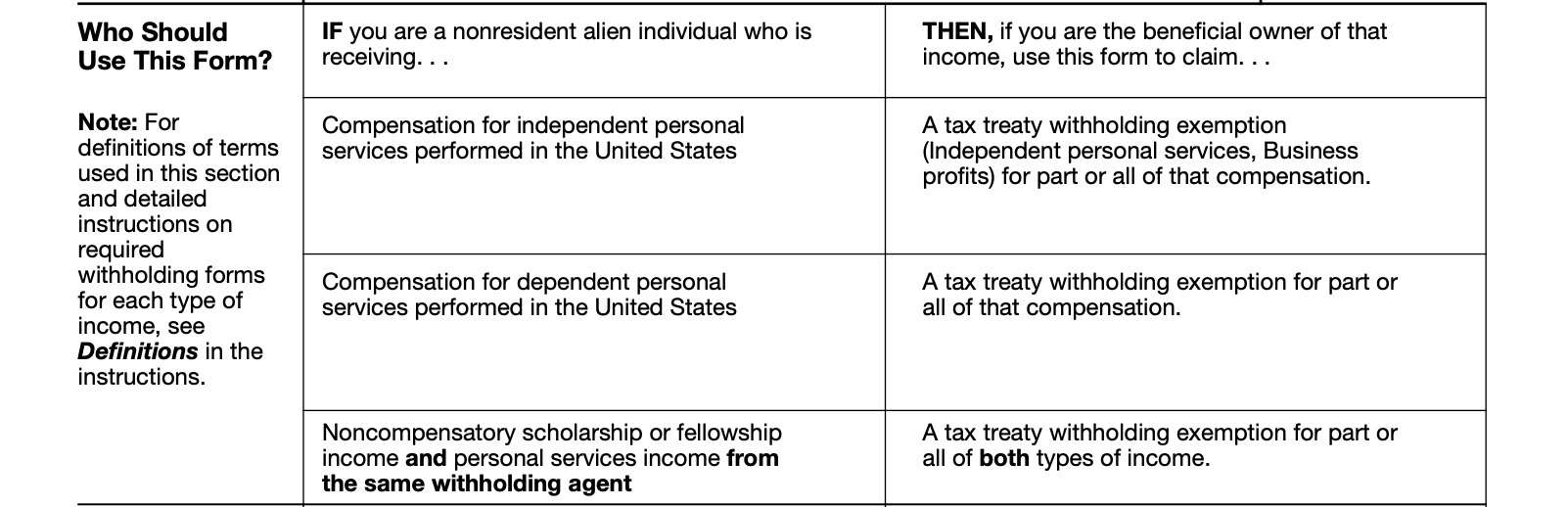

When should I complete IRS Form 8233?

Fortunately, the tax form itself contains guidance on when you should file IRS Form 8233.

File IRS Form 8233 if you are a nonresident alien individual who is the beneficial owner of income under the following circumstances:

Compensation for independent personal services performed in the United States (independent contractors)

Use IRS Form 8233 to claim a tax treaty withholding exemption for part or all of that compensation under independent personal services or business profits.

Compensation for dependent personal services performed in the United States (employees)

File to claim a tax withholding exemption for part or all of your employee compensation.

Noncompensatory scholarship or fellowship income and personal services from the same withholding agent

File to claim a withholding exemption for part or all of both types of income.

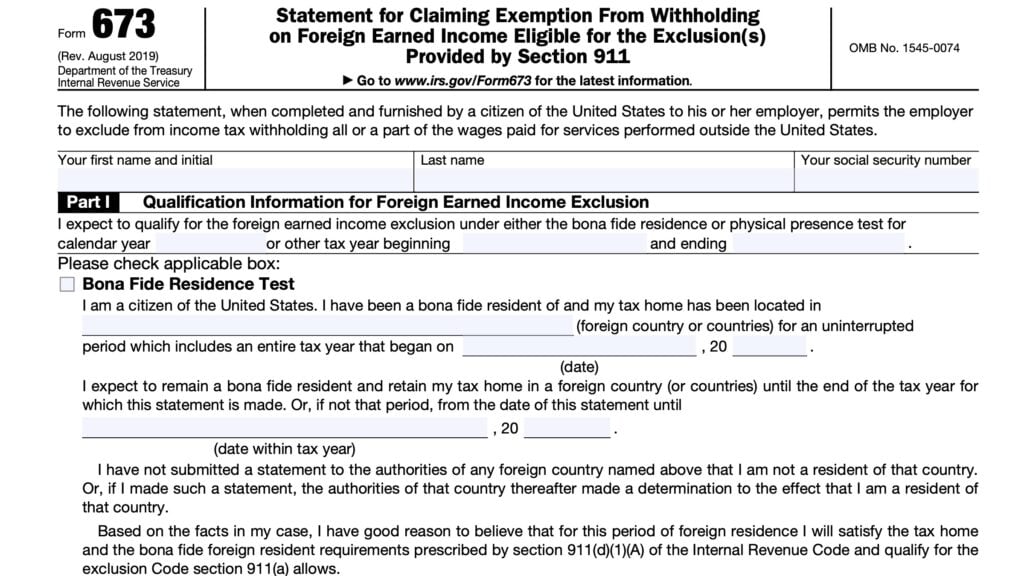

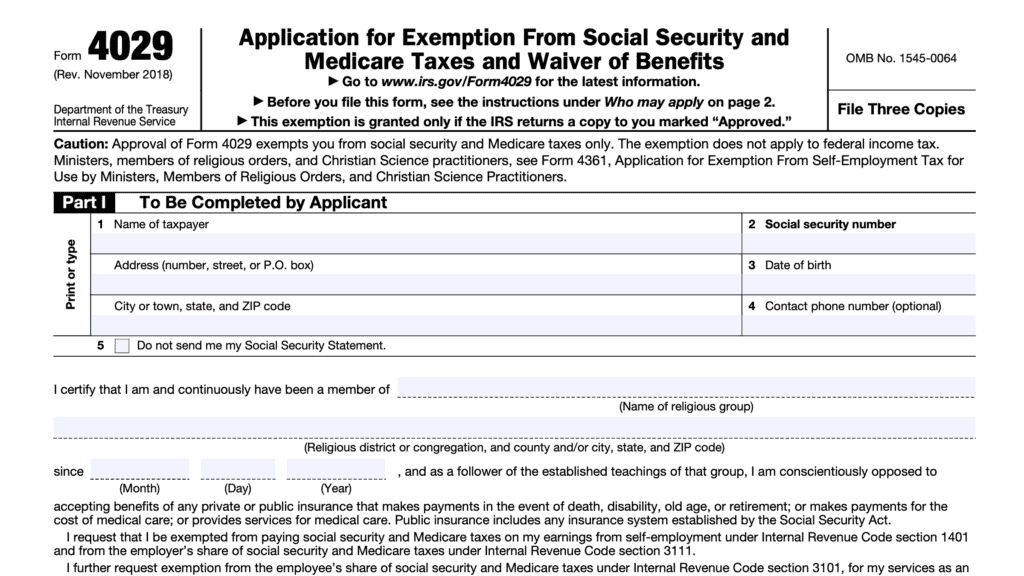

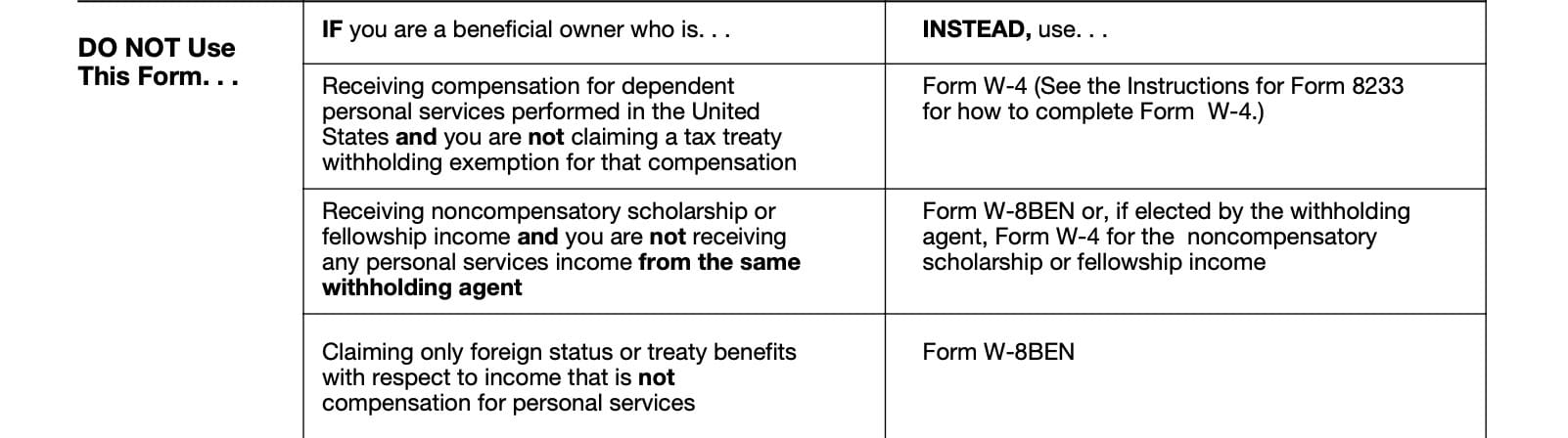

When should I not file IRS Form 8233?

You should not use IRS Form 8233 under certain circumstances. Instead, file one of the following tax forms.

IRS Form W-4

File IRS Form W-4, Employee’s Withholding Certificate, if you are receiving compensation for dependent personal services performed in the United States, and you are not claiming a tax treaty withholding exemption for that compensation.

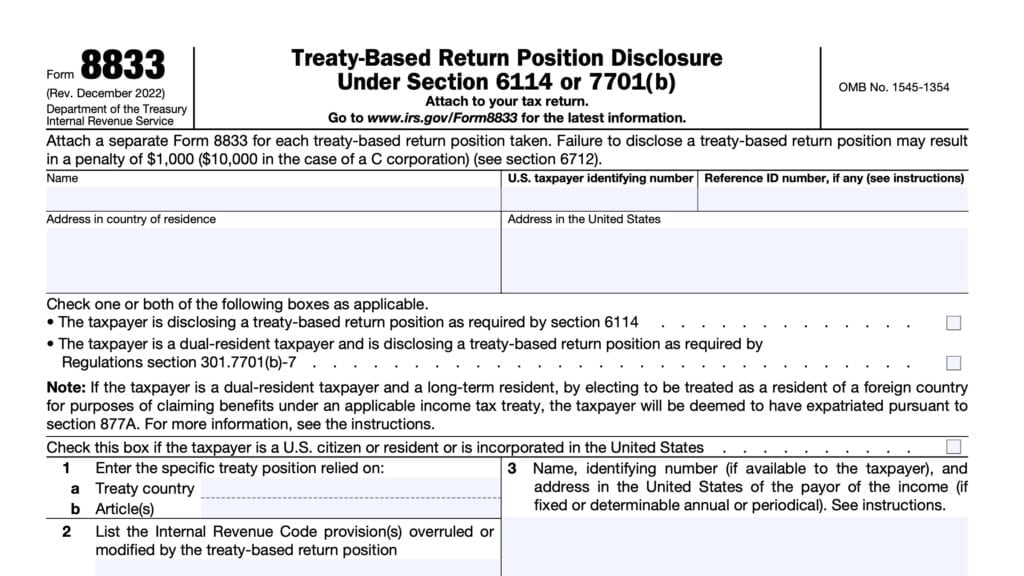

IRS Form W-8BEN

File IRS Form W-8BEN, Certificate of Foreign Status of Beneficial Owner for United

States Tax Withholding and Reporting (Individuals), if you are:

- Receiving noncompensatory scholarship or fellowship income, and you are not receiving personal services income from the same withholding agent, or

- May use Form W-4 if elected by the withholding agent

- Claiming only foreign status or treaty benefits with respect to income that is not compensation for personal services

Video walkthrough

Frequently asked questions

Nonresident aliens use IRS Form 8233 to claim exemption from income tax withholding on compensation for personal services because of an income tax treaty or the personal exemption amount.

Taxpayers should complete Form W-8BEN for any income that isn’t deemed personal service income. Conversely, foreign nationals will complete IRS Form 8233 to outline personal services income, either as an employee or as an individual contractor.

Where can I find IRS Form 8233?

You can find tax forms such as IRS Form 8233 on the IRS website. For your convenience, we’ve included the latest version of this form in this article.