IRS Form 8275-R Instructions

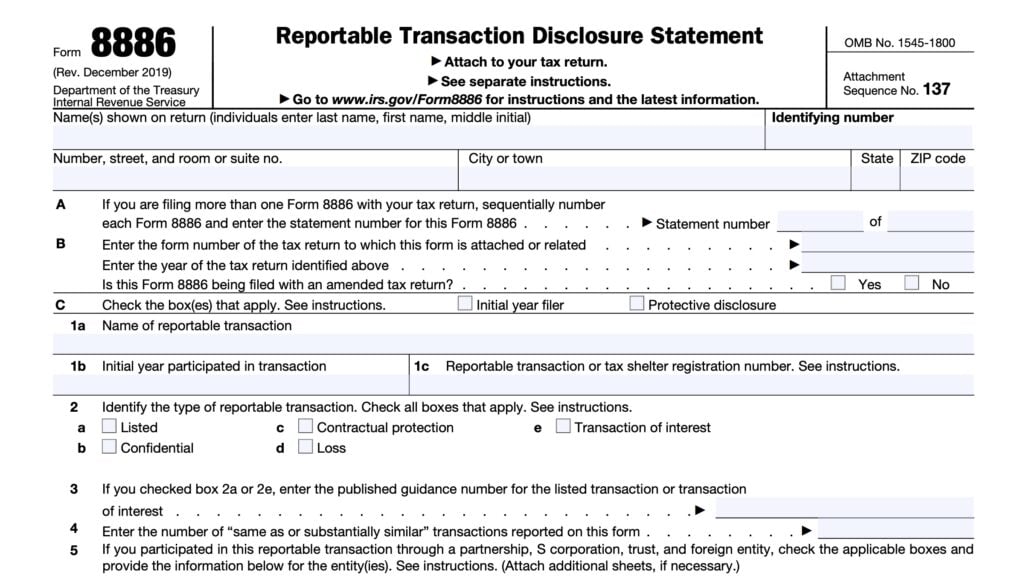

Taxpayers and tax return preparers who establish uncertain tax positions when filing an income tax return may need to declare their position and provide supporting documentation and references. To report positions that are contrary to existing authority, such as Treasury regulations, U.S. taxpayers must file IRS Form 8275-R, Regulation Disclosure Document.

In this article, we’ll walk through IRS Form 8275-R, including:

- How to complete & file IRS Form 8275-R

- Types of tax penalties you might face

- Frequently asked questions

Let’s start by walking through this tax form.

Table of contents

How do I complete IRS Form 8275-R?

There are four parts to this two-page tax form:

- Part I: General Information

- Part II: Detailed Explanation

- Part III: Information About Pass-Through Entity

- Part IV: Explanations

Before we get to Part I, let’s go over the taxpayer information fields at the very top.

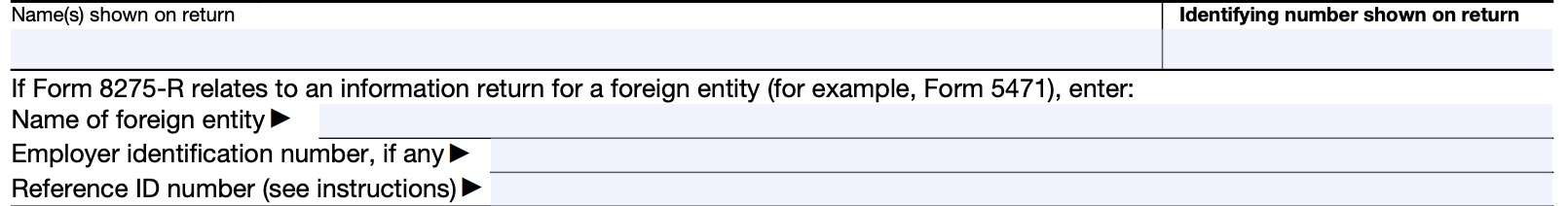

Taxpayer information

At the top of the form, enter the taxpayer name and identifying number, as shown on your income tax return.

For individual taxpayers, this can be a Social Security number (SSN) or individual taxpayer identification number (ITIN). For other taxpayers, such as corporate filers, this will probably be an employer identification number (EIN).

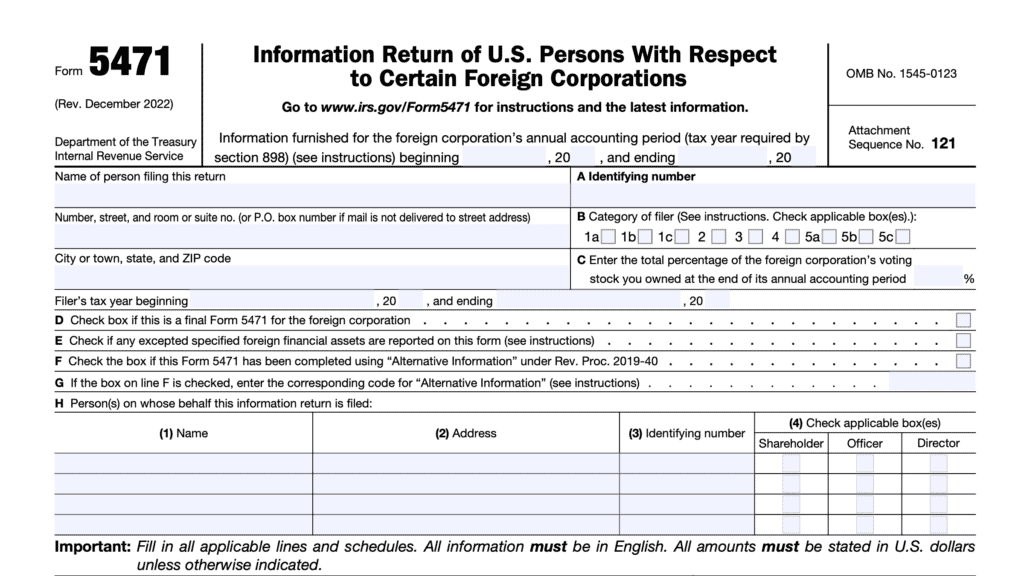

If you are filing Form 8275-R to disclose a position related to a foreign entity for which you are filing an information return, such as IRS Form 5471, then enter the following information:

- Name of the foreign entity

- Employer identification number, if applicable

- Reference ID number

Use the same reference ID number for the foreign entity that is on the information return.

If you are filing IRS Form 8275-R to report a position or positions related to multiple foreign entities, you must file a separate Form 8275-R for each foreign entity.

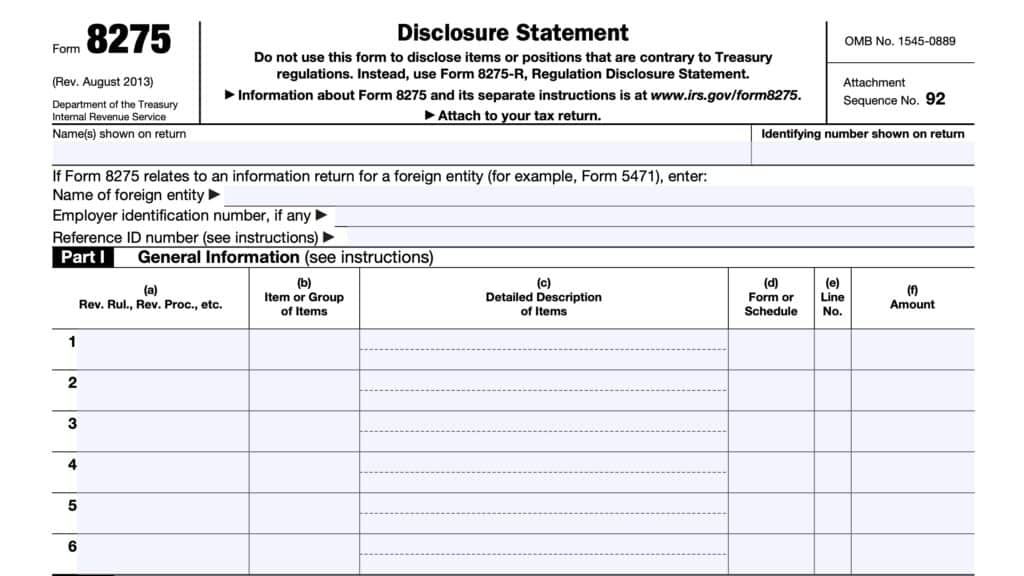

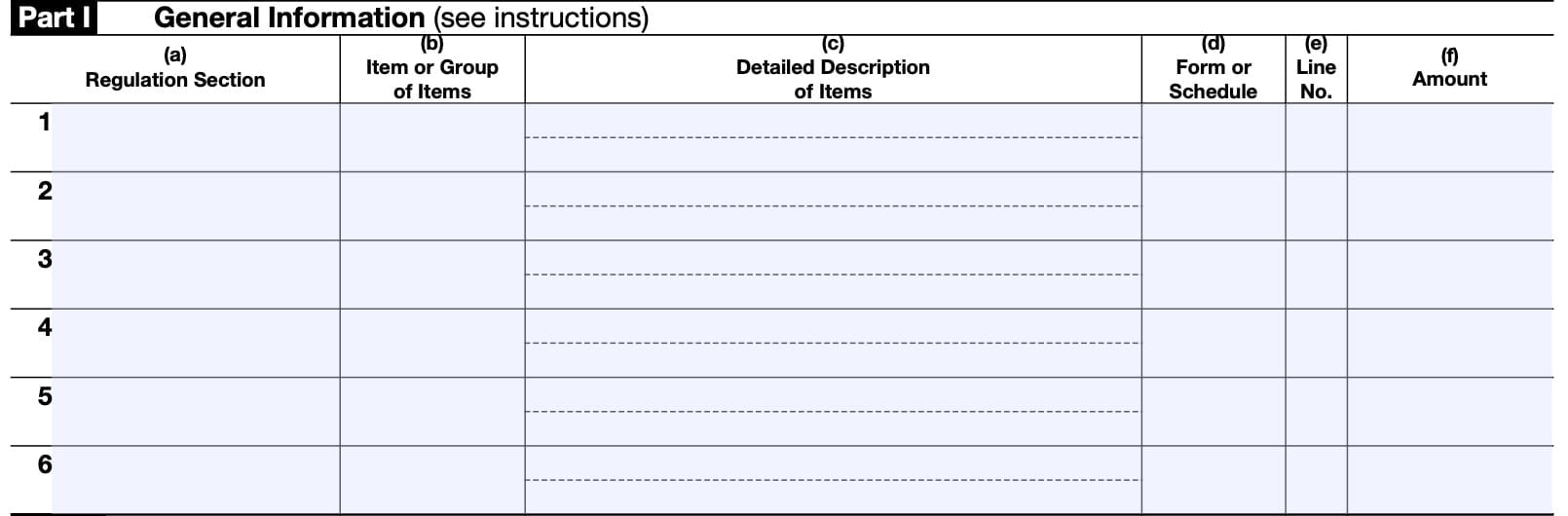

Part I: General Information

In Part I, you’ll enter general information about each position that you’ve taken that is contrary to Treasury Regulations.

Enter the following information for each position:

- Column (a): Regulation Section

- Column (b): Item or Group of Items

- Column (c): Detailed Description

- Column (d): Form or Schedule

- Column (e): Line number

- Column (f): Amount

We’ve broken down each column in a little more detail.

Column (a): Regulation Section

In Column (a), enter the full citation for each regulation where you’ve taken a contrary position. The citation should specify the Section number related to the contrary position, including all designations of smaller units.

For example, you should enter the following citation:

1.482-7(d)(1)(iii)

Instead of:

“482 regs”

or

“1.482-7”

Column (b): Item or Group of Items

In Column (b), identify the item by name.

If any item you disclose is from a pass-through entity, you must identify the item as having come from that pass-through entity.

If you disclose items from multiple pass-through entities, you must complete a separate IRS Form 8275-R for each entity.

Column (c): Detailed Description

Enter a complete description of the item or group of items that you described in Column (b), using additional information.

For example, if you reported ‘entertainment expense’ in Column (b), then you would list specific items in Column (c), such as: ‘Theater tickets, catering expenses, or banquet hall rentals.’

If you claim the same tax treatment for a group of similar items in the same tax year, you should enter a description identifying the group of items you are disclosing rather than a separate description of each item within the group.

Column (d): Form or Schedule

Enter the form number or the IRS schedule that pertains to the tax return position.

Column (e): Line Number

In Column (e), enter the line number from the IRS form or schedule in question.

Column (f): Amount

Enter the total dollar amount of the item or group of items in question.

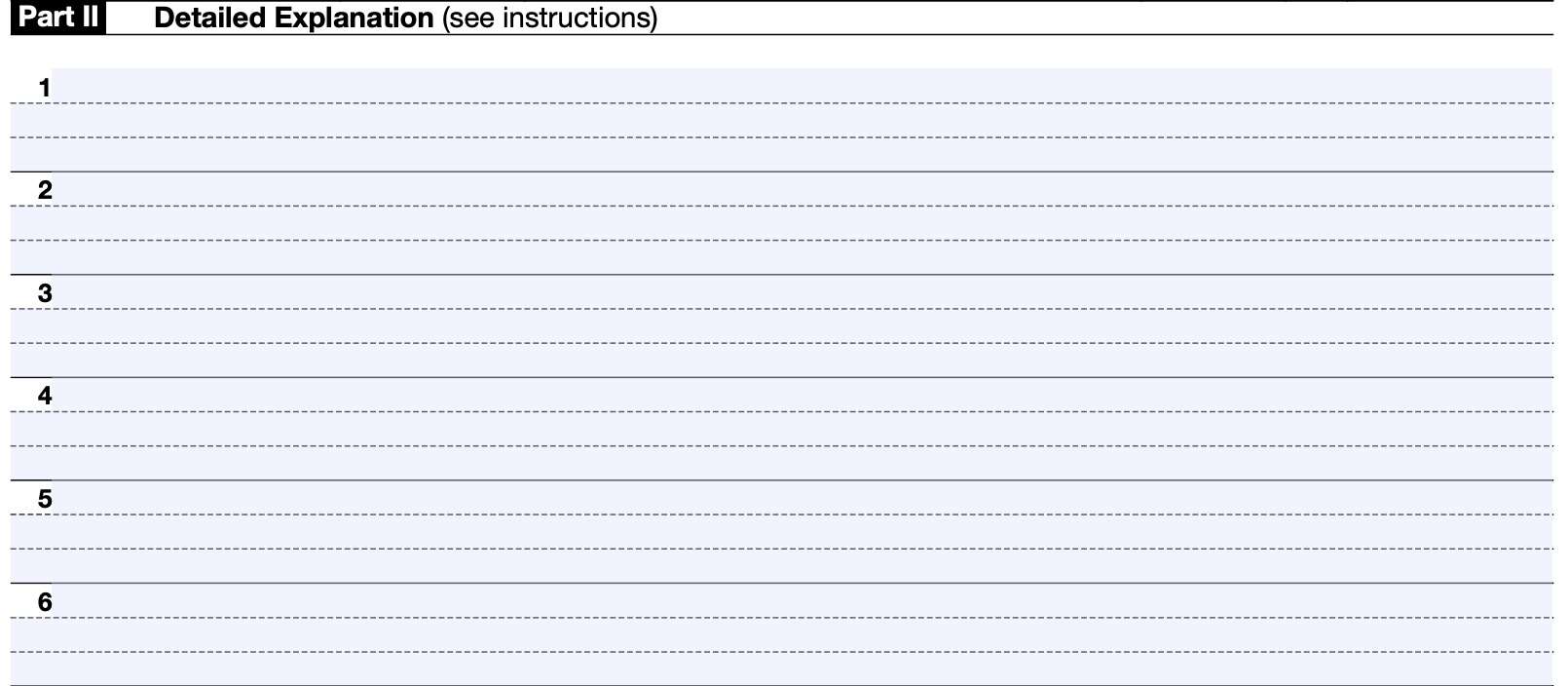

Part II: Detailed Explanation

In Part II, you must enter a detailed explanation of the position that you are taking. Your disclosure must include both of the following:

- A description of the relevant facts affecting the tax treatment of the item

- A statement explaining why you believe this regulation to be invalid

To satisfy the first requirement, you must include enough information that you reasonably believe will inform the IRS of the:

- Item’s identity

- Amount of the item

- Nature of the controversy or potential controversy about the item

This information can include a description of the legal issues presented by the facts.

Unless provided otherwise in the form instructions, the IRS will not consider your disclosure to be adequate unless you provide both a description of relevant facts and a statement using IRS Form 8275-R.

For example, your disclosure will not be considered adequate if you simply attach a copy of an

acquisition agreement to your tax return to disclose the issues involved in determining the basis of certain acquired assets.

In this situation if you do not complete and attach IRS Form 8275-R to the tax return, the IRS will not consider this disclosure to be valid, even if you provide the requested information in a different form or an attached letter.

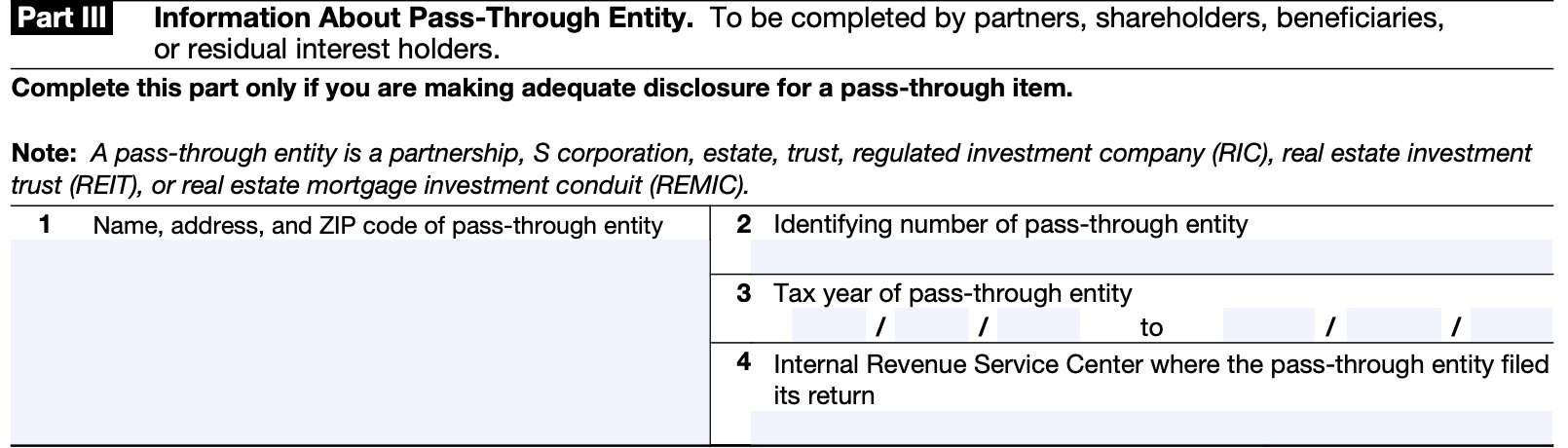

Part III: Information About Pass-Through Entity

In Part III, partners, shareholders, beneficiaries, or residual interest holders will enter information to provide adequate disclosure for a pass-through item.

For the purpose of this part, the following are pass-through entities:

- Partnerships

- S corporations

- Estates & trusts

- Regulated investment companies (RIC)

- Real estate investment trusts (REIT)

- Real estate mortgage investment conduits (REMIC)

Line 1: Name, address, and ZIP code of pass-through entity

Enter the name and address, including ZIP code, of the pass-through entity that you are including on the disclosure form.

Line 2: Identifying number of pass-through entity

Enter the identifying number of the pass through entity. This will likely be the employer identification number (EIN).

Line 3: Tax year of pass-through entity

Enter the beginning date and ending date of the pass-through entity’s tax year.

Line 4: Internal Revenue Service Center where the pass-through entity file its return

Enter the IRS center where the entity filed its tax return. You may need to contact the entity if you do not know where the office is.

Partners and S corporation shareholders can find this information on the Schedule K-1 that you received from the partnership or S corporation.

If the entity filed its tax return using IRS e-file, then enter ‘e-file’ on Line 4.

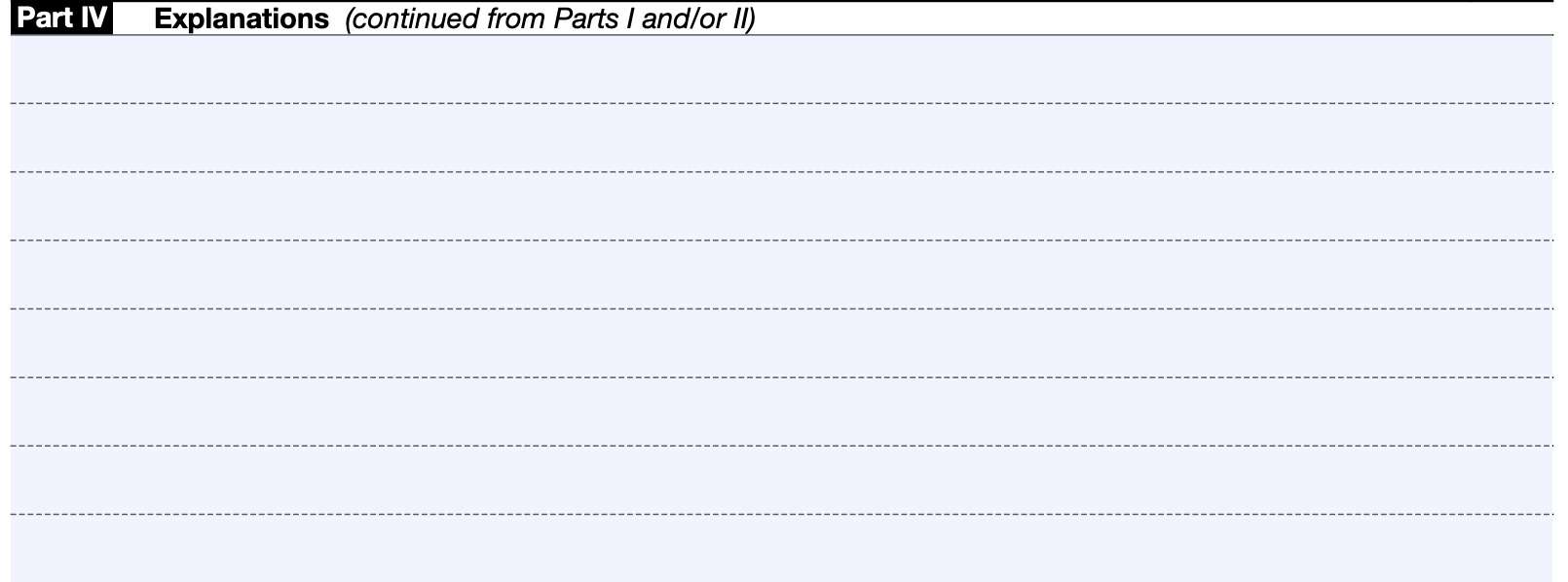

Part IV: Explanations

Part IV is completely voluntary. You only need to use the space in Part IV if you are entering additional information from Part I or Part II, above.

Otherwise, you may leave Part IV blank.

Accuracy related penalties

Taxpayers complete IRS Form 8275-R to avoid the portions of the accuracy-related penalty due to disregard of regulations or to a substantial understatement of income tax for non-tax shelter items if the tax return position as a reasonable basis.

Taxpayers may also use IRS Form 8275-R for disclosures relating to the economic substance penalty and tax preparer penalties for tax understatements due to positions taken contrary to regulations.

What is the accuracy related penalty?

As a general rule, the accuracy-related penalty is 20% of any portion of a tax underpayment attributable to:

- Negligence or disregard of rules or Treasury regulations

- Any substantial understatement of income tax

- Any substantial valuation misstatement under Chapter 1 of the Internal Revenue Code

- Any substantial overstatement of pension liabilities

- Any substantial estate or gift tax valuation understatement or

- Any claim of tax benefits from a transaction lacking economic substance,

- Defined by IRC Section 7701(o), or

- Failing to meet the requirements of any similar rule of law

The accuracy-related penalties increase to 40% of any portion of a tax underpayment attributable to one or more gross valuation misstatements in (3), (4), or (5) above, if the applicable dollar threshold under IRC Section 6662(h)(2) is met or exceeded.

This tax penalty also increases to 40% if the taxpayer fails to adequately disclose reportable transactions that lack economic substance, in (6) above.

The portions of the accuracy-related penalty attributable to one of these types of misconduct cannot be avoided, even through disclosure on IRS Form 8275-R.

The penalty for reckless or intentional disregard of a regulation can be avoided by disclosure only if the taxpayer’s position represents a good-faith challenge to the validity of the regulation and has a reasonable basis.

Taxpayers should use IRS Form 8275, Disclosure Statement, for the disclosure of items or positions which are not contrary to regulations but which are not otherwise adequately disclosed.

Reasonable basis

Reasonable basis is a relatively high standard of tax reporting that is significantly higher than not frivolous or not patently improper.

The reasonable basis standard is not satisfied by a return position that is merely arguable.

If the return position is reasonably based on one of the authorities set forth in Treasury Regulations Section 1.6662-4(d)(3)(iii), taking into account the relevance and persuasiveness of the authorities, and subsequent developments, the return position will generally satisfy the reasonable basis standard. This is true even though it may not satisfy the substantial authority standard as defined in Regulations Section 1.6662-4(d)(2).

Substantial understatement

An understatement is the excess of:

- The amount of tax required to be shown on the return for the tax year, over

- The amount of tax actually shown on the return for the tax year, reduced by any rebates.

There is a substantial understatement of income tax if the amount of understatement exceeds the greater of:

- 10% of the tax liability, or

- $5,000

Tax return preparer penalties

A preparer who files a return or claim for refund and takes a position which the preparer knew or reasonably should have known would understate any part of the tax liability is subject to a penalty equal to the greater of:

- 50% of the income derived (or to be derived) by filing the claim, or

- $1,000

This penalty applies under any of the following circumstances:

- There is or was no substantial authority for the position;

- The position is a tax shelter or a reportable transaction to which IRC Section 6662A applies and it was not reasonable to believe that the position would more likely than not be sustained on its merits; or

- As defined in IRC Section 6662(d)(2)(C)(ii)

- The position disclosed as provided in IRC Section 6662(d)(2)(B)(ii) is not a tax shelter or a reportable transaction to which section 6662A applies, and there was no reasonable basis for the position.

This penalty will not apply if the tax preparer can show reasonable cause and demonstrate that he or she acted in good faith.

Video walkthrough

Watch this instructional video for a step by step walkthrough of IRS Form 8275-R.

Frequently asked questions

Taxpayers IRS Form 8275 to provide an extra explanation surrounding uncertain tax positions that are not contrary to existing regulations. Taxpayers should file IRS Form 8275-R if they believe they have reasonable cause to disclose a position, and that their position is made in good faith.

Taxpayers and tax return preparers file IRS Form 8275-R to disclose items or positions contrary to a regulation, that are not otherwise adequately disclosed on a tax return to avoid certain penalties.

Where can I find IRS Form 8275-R?

As with most tax forms, you can find IRS Form 8275-R on the IRS website. We’ve enclosed the latest version in this article for your convenience.

Related tax articles

This tax form is one of the fillable tax forms provided by the Internal Revenue Service, to help taxpayers reduce their tax preparation costs. To see more forms like this, visit our free fillable tax forms page, where you’ll also find articles like this.

Unlike the IRS, our articles contain step by step instructions for each tax form, as well as video walkthroughs. You can also check out all of our videos by subscribing to our YouTube channel!