IRS Form 8300 Instructions

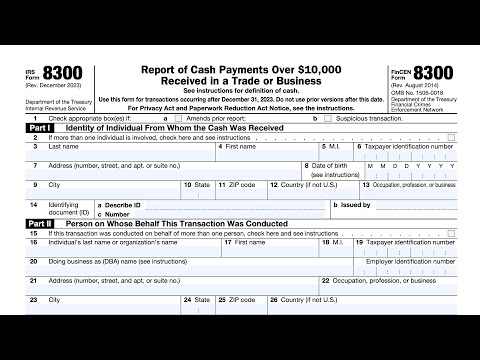

As part of the Bank Secrecy Act of 1970, federal laws require business to report large cash transactions, in excess of $10,000, to the IRS and the Financial Crimes Enforcement Network (FinCEN). Taxpayers can do this by filing IRS Form 8300, Report of Cash Payments Over $10,000 Received in a Trade or Business.

In this article, we’ll walk through what you need to know about IRS Form 8300, including:

- How to complete IRS Form 8300

- Filing requirements

- Frequently asked questions

Let’s start with an overview of IRS Form 8300.

Table of contents

How do I complete IRS Form 8300?

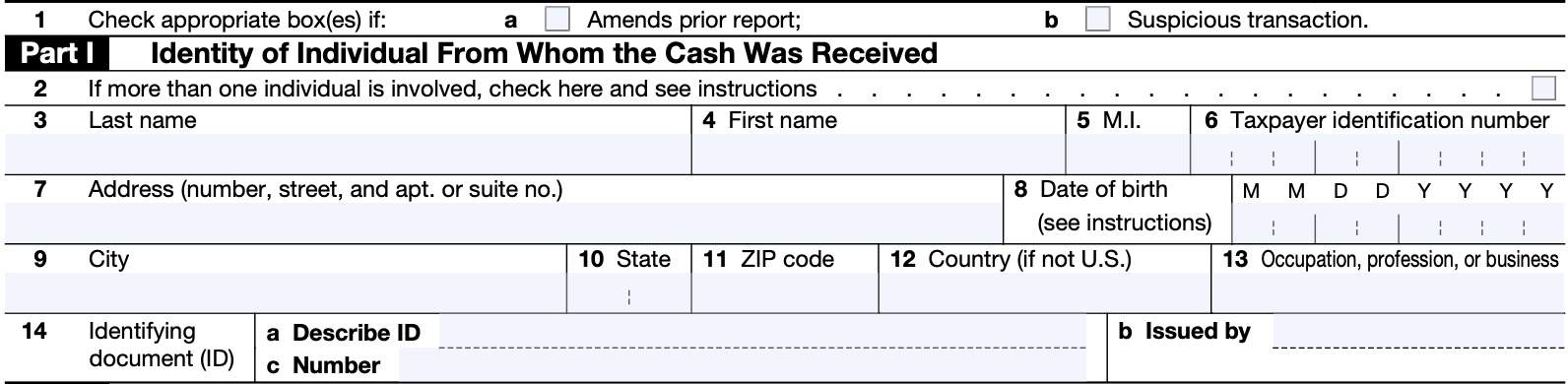

There are four parts to this tax form (also known as FinCEN Form 8300):

- Part I: Identity of Individual From Whom the Cash Was Received

- Part II: Person on Whose Behalf This Transaction Was Conducted

- Part III: Description of Transaction and Method of Payment

- Part IV: Business that Received Cash

Before we start Part I, we should begin with Item 1, located just above.

Item 1

There are two boxes in this item:

- Amends prior report

- Suspicious transaction

Amends prior report

If you are amending an existing report, check Box 1a, Amends prior report.

Complete the form in its entirety (Parts I–IV) and include the amended information. Do not attach a copy of the original report.

Suspicious transaction

If you wish to voluntarily report a suspicious transaction, check Box 1b. Use the Comments section to describe the suspicious nature of this transaction.

Any suspicious or illegal activities may be reported to your local IRS Criminal Investigation Division.

For any suspicious transactions related to money laundering or terrorist activity, such as terrorist financing, you should immediately report any imminent threat to local area law enforcement officials.

Part I: Identity of Individual From Whom the Cash Was Received

In this part, we’ll enter information about the individual or individuals from whom cash was received.

Item 2

If more than one individual is involved in this transaction, check this box, then use the Part I information fields on Page 2 of this tax form and complete Items 3 through 14 as necessary.

If there are more than three individuals, then paper filers should attach as many copies of Part I as necessary. Electronic filers may complete as many as 99 unique Part I entries.

Item 3: Last name

Enter the individual’s last name.

Item 4: First name

Enter the individual’s first name.

Item 5: M.I.

Enter the person’s middle initial, as applicable.

Item 6: Taxpayer identification number

Enter the taxpayer identification number (TIN), as appropriate. For an individual, the tax ID number may be:

- Social Security number (SSN), or

- Individual Taxpayer Identification number (ITIN)

- Used by U.S. residents who may not qualify for an SSN or nonresidents required to file income tax returns

For corporations, partnerships, and estates, this will be the employer identification number (EIN).

Reporting requirements

The Internal Revenue Service requires Form 8300 filers to furnish the correct TIN for each individual or entity involved in this transaction.

If you have requested but are not able to get a TIN for one or more of the parties to a transaction within 15 days following the transaction, you may file the report, then use the Comments section on Page 2 of Form 8300 to explain why the TIN is not included.

Exceptions

Form 8300 filers are not required to obtain the TIN of a person who is a nonresident alien individual or a foreign organization that:

- Does not have income effectively connected with the conduct of a U.S. trade or business;

- Does not have an office or place of business, or a fiscal or paying agent, in the United States;

- Does not furnish a withholding certificate described in either:

- Treasury Regulations Section 1.1441-1(e)(2) or (3), or

- Regulations Section 1.1441-5(c)(2)(iv) or (3)(iii) to the extent required under Regulations Section 1.1441-1(e)(4)(vii); or

- Does not have to furnish a TIN on any return, statement, or other document as required by the income tax regulations under:

- Internal Revenue Code Section 897, Disposition of investment in U.S. real property, or

- Internal Revenue Code Section 1445, Withholding of tax on dispositions of United States real property interests

Item 7: Address

Enter the street address, including apartment or suite number, for the person or entity you are reporting.

Item 8: Date of birth

Enter the person’s date of birth in the following format: MM/DD/YYYY. For example, if the date of birth is July 6, 1960, enter 07/06/1960.

Item 9: City

Enter the city that corresponds the the individual’s or entity’s address.

Item 10: State

Enter the state.

Item 11: ZIP Code

Enter the zip code.

Item 12: Country

If not the United States, enter the country of residence or where the entity is located.

Item 13: Occupation, profession, or business

Provide a clear description of the occupation, profession, or business. Electronic filers are limited to a maximum of 25 characters.

Acceptable examples

Acceptable examples include:

- Plumber

- Attorney

- Automobile dealer

For retired or unemployed persons, you may describe their previous occupation:

- Retired attorney

- Unemployed roofer

Unacceptable examples

Unacceptable examples include general or nondescriptive terms such as:

- Businessperson

- Self-employed

Item 14: Identifying document

You must verify the name and address of the named individual(s). You must verify their name and address by examining a document normally accepted as a means of identification when cashing checks.

Examples include:

- Driver’s license

- Passport

- Alien registration card

- Other official documents

Item 14a: Describe ID

Enter the type of document that you examined.

For example, if you examined someone’s driver’s license to verify his or her identity, then enter “Driver’s license.”

Item 14b: Issued by

Enter the name of the entity that issued the ID.

For example, if the driver’s license was issued by the state of Utah, you would enter “Utah.”

Item 14c: Number

Enter the identifying number located on the identification document. This could be a driver’s license number, or other ID number appearing on the document. Enter this number without formatting or special characters.

Note: If you do not enter values in all three areas, the IRS might not be able to properly process your completed Form 8300.

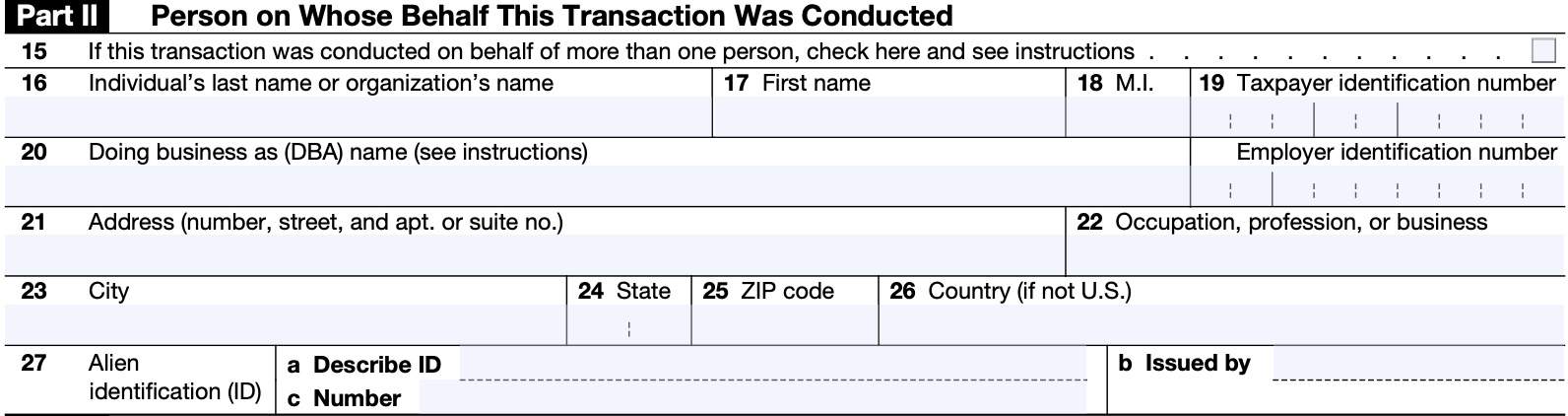

Part II: Person on Whose Behalf This Transaction Was Conducted

In Part II, we’ll enter the information for the person or entity on whose behalf this transaction was conducted.

Item 15

If the transaction is being conducted on behalf of more than one person, then check this box and complete Part II for any one of the persons. This includes parent and child or sibling relationships.

Provide the same information for the other person(s) by completing Part II on Page 2.

If there are more than three individuals, then paper filers should attach as many copies of Part II as necessary. Electronic filers may complete as many as 99 unique Part II entries.

Item 16: Individual’s last name or organization’s name

If this is an individual, enter the person’s last name in Item 16, then:

- Complete Items 17 & 18

- Enter the person’s TIN in Item 19

- For a sole proprietor with an EIN, enter both the SSN & EIN in Item 19

If this is an organization, enter its name as shown on required tax filings here. Go to Item 19 and enter the organization’s EIN.

Item 17: First name

Enter the individual’s first name here.

Item 18: M.I.

Enter the person’s middle initial, as applicable.

Item 19

If the person is an individual, enter that person’s SSN or ITIN. If the individual is a sole proprietor with an EIN, enter their SSN and EIN in the space provided.

For organizations, enter the EIN.

Item 20: Doing Business As (DBA) name

If the person or organization named in Item 16 is conducting business under a different name, enter that name in Item 20.

Item 21: Address

Enter the individual’s or organization’s street address here.

Item 22: Occupation, profession, or business

Provide a clear description of the occupation, profession, or business. Electronic filers are limited to a maximum of 25 characters.

For more detailed information, see Item 13, above.

Item 23: City

Enter the city that corresponds the the individual’s or entity’s address.

Item 24: State

Enter the state.

Item 25: ZIP code

Enter the ZIP code or postal code of the corresponding address.

Item 26: Country (if not U.S.)

If not the United States, enter the full name of the country where the individual or organization is located.

Item 27: Alien identification

If the person is not required to furnish a TIN based upon the previously listed exceptions criteria, complete this item. You must enter all three of the following to ensure that the IRS can process this form correctly.

Item 27a: Describe ID

Enter the type of official document issued to the person here.

Item 27b: Issued by

Enter the name of the country that issued this document in Item 27b.

Item 27c: Number

Enter the document’s corresponding ID number here. Do not format or enter special characters.

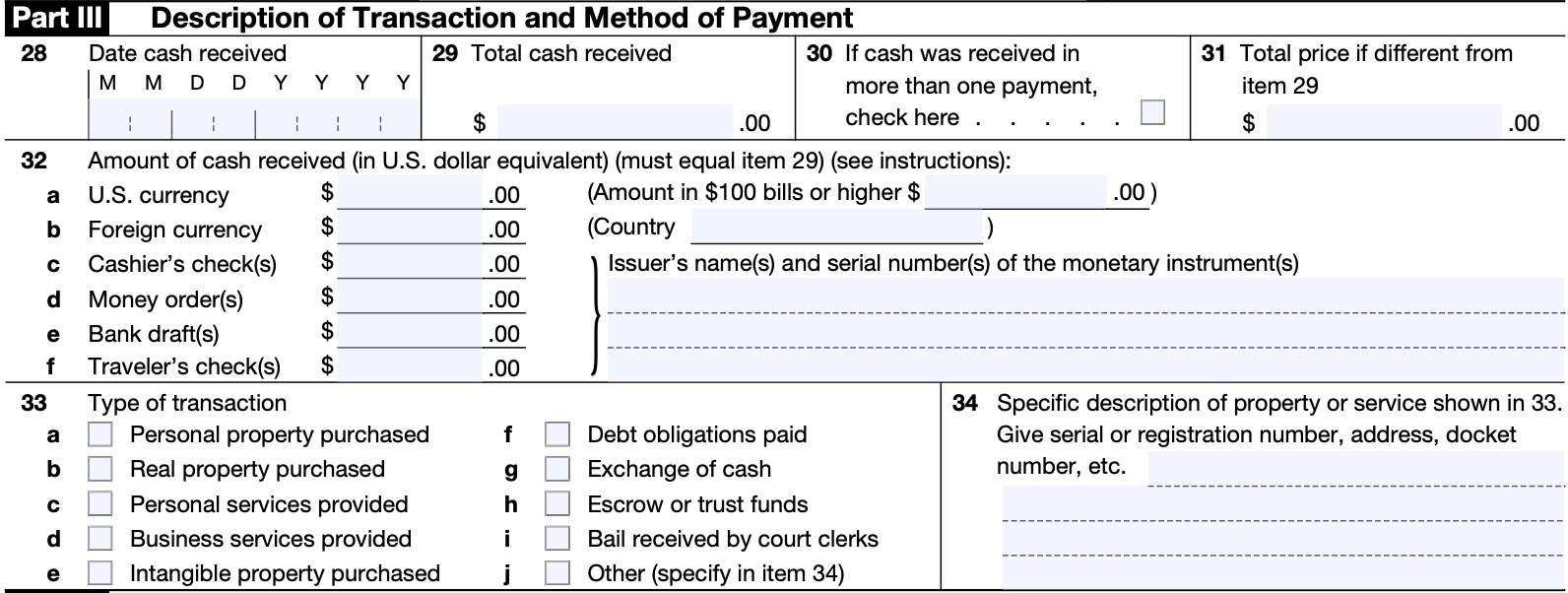

Part III: Description of Transaction and Method of Payment

In Part III, we’ll enter details about the transaction and method of payment.

Item 28: Date cash received

Enter the date you received the cash in MM/DD/YYYY format. For example, if you received the cash on January 1, 2024, enter 01/01/2024.

If you received the cash in more than one payment, enter the date you received the payment that caused the combined amount to exceed $10,000.

Multiple payments

If you receive more than one cash payment for a single transaction or for related transactions, you must report the multiple payments any time you receive a total amount of cash that exceeds $10,000 within any 12-month period. This does not have to be within a calendar year.

You must submit this report within 15 days of the date you receive the payment that causes the total amount of cash to exceed $10,000.

If you must file more than one report within 15 days, you may file a combined report. File the report no later than the due date for the earliest report, if the reports were filed separately.

Item 29: Total cash received

Enter the total cash received as of the date that cash amount exceeded $10,000 within a 12-month period.

If you filed a previous Form 8300 filed on a reportable payment or related payments and you have since received additional related payments, record the total amount received as of the date the total of new related payments exceeded an additional $10,000 within a new 12-month period.

Item 30

Check if you received cash in more than one payment.

Item 31: Total price

If different from Item 29, enter the total price of the:

- Property

- Services

- Amount of cash exchanged, etc.

For example, you would enter the total of any of the following items:

- Cost of a vehicle purchase

- Cost of catering services provided

- Exchange of currency

Item 32: Amount of cash received

Enter the dollar amount of each form of cash received. This must equal the amount reported in Item 29, above.

Below are specific notes related to each category.

Item 32a: U.S. Currency

Separately, enter any amounts given to you in cash with a face amount of $100 or higher in the space provided to the right.

Item 32b: Foreign currency

Enter foreign currency amounts in U.S. dollar equivalent at a fair market rate of exchange available to the public. To the right, enter the name of the foreign country.

Item 32c through Item 32f

For any of the following, provide the name of the issuer and the serial number of each financial instrument:

- Cashier’s check

- Money orders

- Bank drafts

- Traveler’s checks

Names of all issuers and all serial numbers involved must be provided. If you need additional space, you may provide this information in the Comments section on Page 2.

Item 33: Type of transaction

Check the appropriate box or boxes that describe the transaction.

If the transaction is not specified in Boxes a through i, then:

- Check Box j

- Briefly describe the transaction

You may select up to three types of transactions. If more are required, select “other.” Then add details in the Comments section.

Receipt of bail by a court clerk

Check Box (i) for transactions relating to the receipt of bail by a court clerk. Only court clerks should check this box.

Cash received by a bail bondsman

Check (d), “Business services provided.”

Item 34: Specific description or property or service

Provide a specific description of the property or service provided in Item 33. As necessary, provide information such as:

- Serial number

- Registration number

- Address

- Docket number

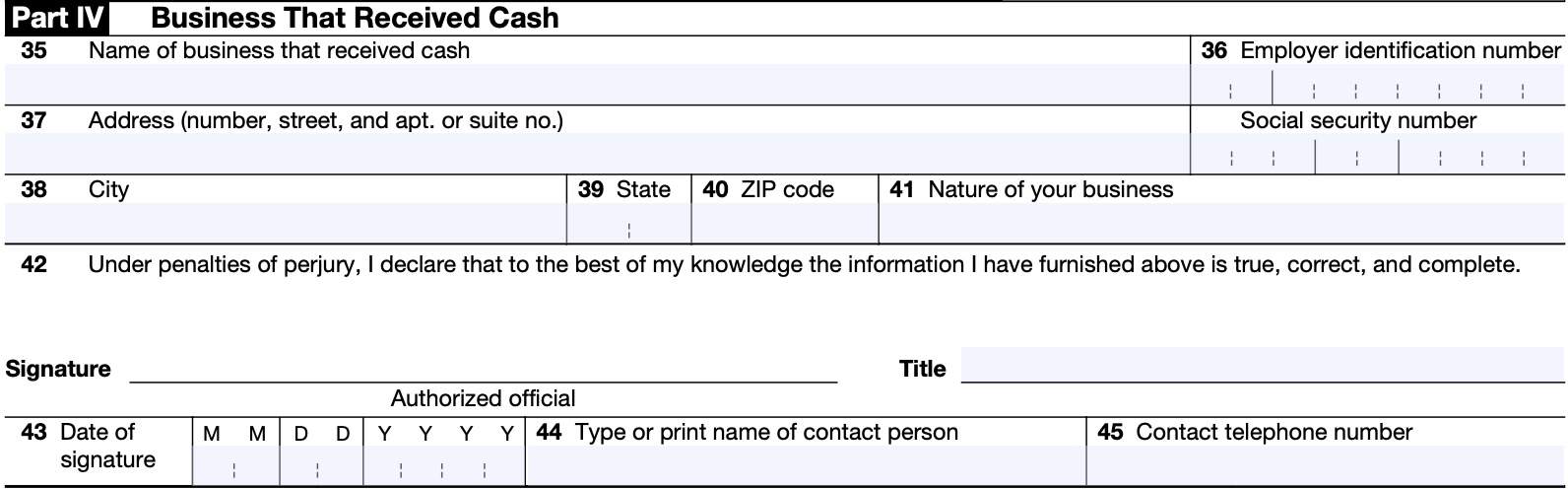

Part IV: Business that Received Cash

In this part, you’ll enter information on behalf of the business that received the cash. You’ll also sign this document under penalty of perjury.

Item 35: name of business that received cash

Enter the name of your business here.

Item 36: identification number

If you are an individual, enter your SSN. If you are a sole proprietor with an EIN, enter both your SSN and your EIN.

All other business entities must enter an EIN.

Item 37: address

Enter the street address for your business here.

Item 38: City

Enter the city that your business is located in here.

Item 39: State

Enter your state here.

Item 40: ZIP code

Enter the ZIP code of your business.

Item 41: Nature of your business

Clearly describe the nature of your business. For example, enter terms like “attorney” or “jewelry dealer.”

Do not enter general terms such as “store” or “business.”

Item 42: Signature

Enter your sworn signature here.

This form must be signed by an individual who has been authorized to do so for the business that received the cash.

Item 43: Date of signature

Enter the date of signature here.

Item 44: Name of contact person

Enter the name of the point of contact in Item 44.

Item 45: Contact telephone number

Enter the best business phone number for the point of contact in Item 44.

Filing IRS Form 8300

What’s new

New requirement: Beginning January 1, 2024, any taxpayer who must file certain other information returns electronically (such as IRS Form W-2 or Form 1099 series forms) must also e-file Form 8300.

Who must file IRS Form 8300

Each person engaged in a trade or business who receives more than $10,000 in cash in either one transaction or two or more related transactions, must file IRS Form 8300 no later than the 15th day after the date that the cash was received.

If the receipt of cash falls on a weekend or legal holiday, this form is due the next business day.

Exceptions

The federal government does not mandate filing Form 8300 if the cash is received:

- By a financial institution required to file FinCEN Currency Transaction Report (FinCEN Report 112);

- By a casino required to file (or exempt from filing) FinCEN Report 112

- If the cash is received as part of its gaming business

- By an agent who receives the cash from a principal, if the agent:

- Uses all of the cash within 15 days in a second transaction that is reportable on Form 8300 or on FinCEN Report 112, and

- Discloses all the required information to complete Part II of Form 8300 or FinCEN Form 112 by the recipient of the cash in the second transaction;

- In a transaction occurring entirely outside the United States.

- For additional information, see IRS Publication 1544, Reporting Cash Payments of Over $10,000 (Received in a Trade or Business), regarding transactions occurring in Puerto Rico and territories of the United States; or

- In a transaction that is not in the course of a person’s trade or business.

Casinos

A casino required to file FinCEN Report 112 does not have to report cash received in the course of operating gaming business on IRS Form 8300. However, casinos must file IRS Form 8300 to report cash received in through non-gaming activities, such as restaurants, shops, or nightclubs.

Court clerks

Clerks of federal or state courts must file Form 8300 if more than $10,000 in cash is received as bail for an individual or individuals charged with a specified criminal offense.

Both dollar threshold and the specified criminal offense criteria must be met.

Specified criminal offense

Specified criminal offense means one of the following criminal activities:

- A federal criminal offense involving a controlled substance (as defined in section 802 of Title 21 of the U.S. Code);

- Racketeering (as defined in Section 1951, 1952, or 1955 of Title 18 of the U.S. Code);

- Money laundering (as defined in section 1956 or 1957 of Title 18 of the U.S. Code); and

- Any state criminal offense substantially similar to stated offenses 1–3 above.

For these purposes, a court clerk can also include any office, department, division, branch, or unit of the court that is authorized to receive bail money.

Definitions

Below are some key definitions you should understand before beginning Form 8300.

Cash

According to the Internal Revenue Service, the term “cash” means the following.

- U.S. and foreign coin and currency received in any transaction; or

- A cashier’s check, money order, bank draft, or traveler’s check having a face amount of $10,000 or less that is:

- Received in a designated reporting transaction, or

- Received in any transaction in which the recipient knows that the instrument is being used in an attempt to avoid the reporting of the transaction under federal law

Cash does not include personal checks or wire transfer from the payer’s own account, regardless of the amount.

Designated reporting transaction

A designated reporting transaction is a retail sale (or the receipt of funds by a broker or other intermediary in connection with a retail sale) of a:

- Consumer durable

- Collectible

- Travel or entertainment activity

Retail sale

A retail sale is any sale (whether or not the sale is for resale or for any other purpose) made in the course of a trade or business if that trade or business principally consists of making sales to ultimate consumers.

Consumer durable

A consumer durable is an item of tangible personal property that, under ordinary usage,

- Can be reasonably expected to remain useful for at least 1 year, and

- Has a sales price of more than $10,000

Collectible

A collectible is any work of art, rug, antique, metal, gem, stamp, coin, or other item of value.

Travel or entertainment activity

An item of travel or entertainment that pertains to a single trip or event if the combined sales price of the item and all other items relating to the same trip or event that are sold in the same transaction (or related transactions) exceeds $10,000.

Video walkthrough

Watch this instructional video to learn more about reporting large cash transactions on IRS Form 8300.

Frequently asked questions

Taxpayers must file IRS Form 8300 with the IRS by the 15th day after the date the cash was received. If that date falls on a Saturday, Sunday, or legal holiday, file the form on the next business day.

Where can I find IRS Form 8300?

As with most tax forms, you can find IRS Form 8300 on the IRS website. For your convenience, we’ve enclosed the latest copy of the form right here, in our article.