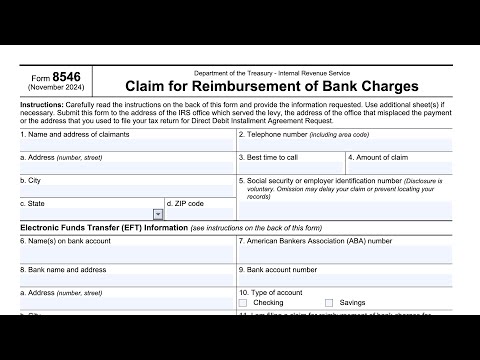

IRS Form 8546 Instructions

If you’ve incurred banking charges due to an IRS processing error, you may be entitled to reimbursement from the federal government. To make this claim, taxpayers must file IRS Form 8546, Claim for Reimbursement of Bank Charges.

In this article, we’ll walk through everything you need to know about IRS Form 8546, including:

- Step by step instructions on how to complete and file IRS Form 8546

- Types of charges that are eligible for reimbursement

- Frequently asked questions

Let’s begin with a walkthrough of how to complete IRS Form 8546.

Table of contents

How do I complete IRS Form 8546?

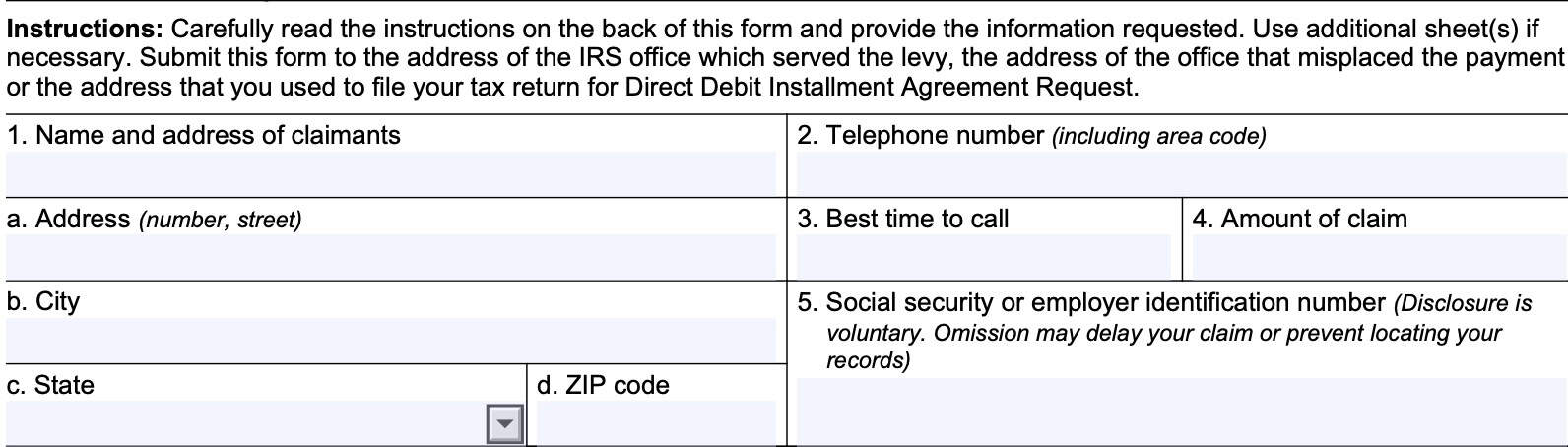

There are three sections to this one-page tax form:

We’ll walk through each section in order, beginning with the taxpayer information fields at the top of the form.

As you go through this form, you should complete each block. If there is a block that does not apply to your situation, enter ‘NONE.’

Taxpayer Information

Use Lines 1 through 5 to enter relevant information about yourself.

Line 1: Name and address of claimants

In Line 1, enter the name or names of all applicants.

Line 1a: Address

Enter the number and street name of your mailing address.

Line 1b: City

Enter the city or locality of your mailing address.

Line 1c: State

Use the drop down box to identify the correct state.

Line 1d: ZIP code

Enter the five-digit or 9-digit ZIP code for your mailing address.

Line 2: Telephone number

Use this line to enter the best phone number for the Internal Revenue Service to contact you. Include your area code.

Line 3: Best time to call

Enter a preferred time for the IRS to call to discuss any questions.

Line 4: Amount of claim

Enter the dollar amount of the claim here.

Line 5: Social Security or employer identification number

Enter your Social Security number (SSN) here. If you are applying on behalf of a business entity, then enter the employer identification number (EIN) in this field instead.

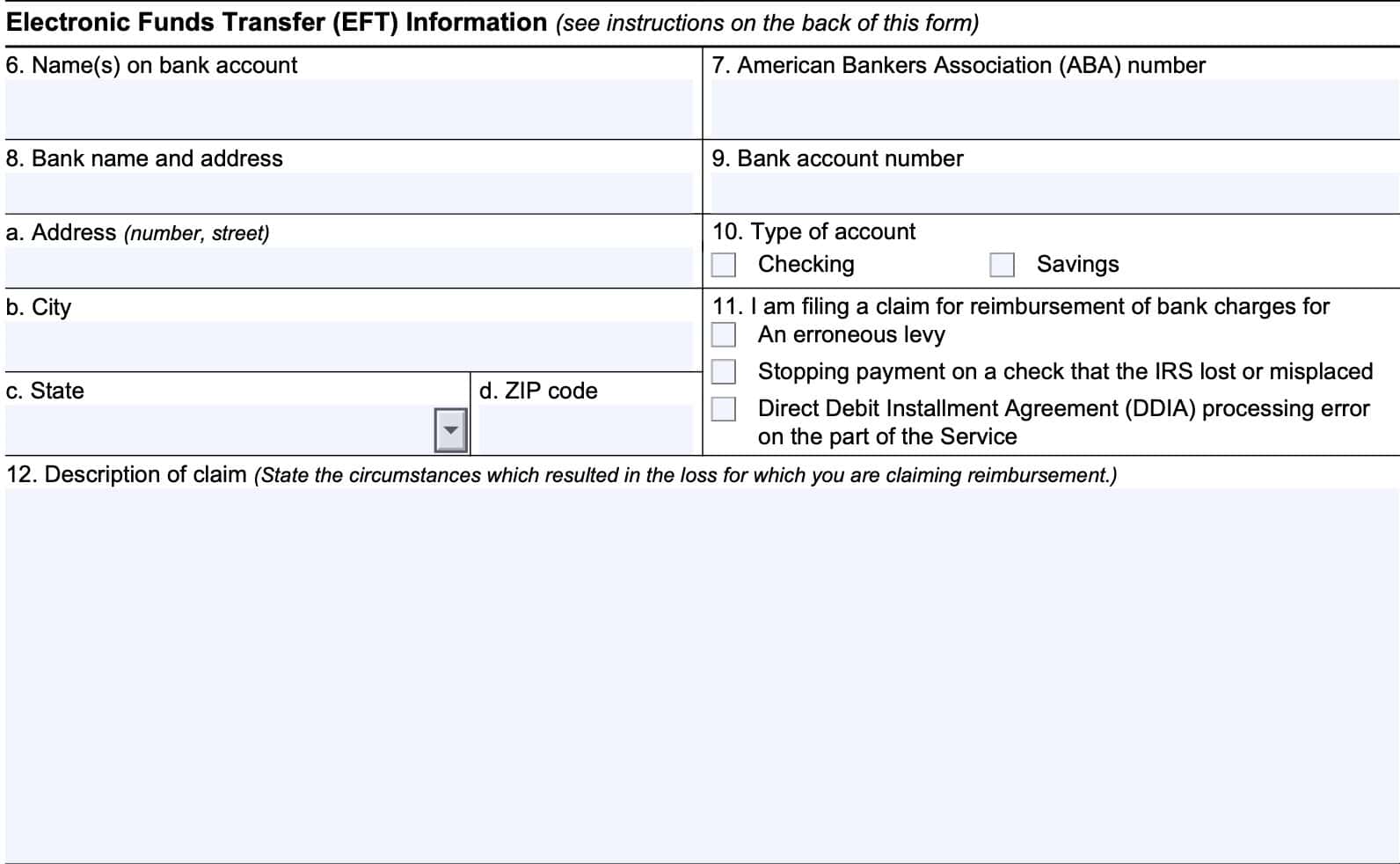

Electronic Funds Transfer (EFT) Information

In this section, you’ll enter the appropriate information about your bank account so the IRS can properly reimburse you. The IRS may reimburse you by check if you do not enter the complete information for your bank or financial institution in Lines 6 through 10, or if it cannot complete the EFT transaction.

Line 6: Name(s) on Bank Account

Enter the name or names associated with the banking account you wish the reimbursement to be sent to.

Line 7: American Bankers Association (ABA) number

Enter the ABA number (also known as the routing number) for the bank or financial institution where your account resides. This is the 9-digit number on the left-hand side of your checks.

If you do not know the bank’s routing number, you can ask your bank, check online, or get the information from your bank’s mobile app.

Line 8: Bank name and address

In Line 8, enter the full name of the bank or financial institution where your account is.

Line 8a: Address

Enter the bank’s address here.

Line 8b: City

Enter the city name in Line 8b.

Line 8c: State

Use the drop down box to identify the state.

Line 8d: ZIP Code

Enter your bank’s ZIP code here.

Line 9: Bank account number

Enter your bank account number in this field. Unlike your bank’s routing number, your account number is unique to each account.

Be sure that the account number matches the type of account you select in Line 10 below.

Line 10: Type of account

If you wish the EFT deposit to go into a checking account, select Checking. Otherwise, select Savings.

Line 11

Select the category for your claim of reimbursement:

- Erroneous levy

- Stopping payment on a check that the IRS lost or misplaced

- Direct Deposit Installment Agreement (DDIA) processing error on the part of the Service

Below is additional information for each type of claim. In all cases, supporting documentation is required. Be sure to include copies (not originals) of IRS correspondence related to the claim.

Erroneous levy

If the IRS places an erroneous service levy on your tax account, which results in bank charges, you may request reimbursement for those associated charges.

To qualify for reimbursement, all of the following must be true:

- The IRS acknowledges the levy was erroneous;

- The taxpayers or taxpayers must not have contributed to the continuation or compounding of the error; and

- Prior to the levy, the taxpayer did not refuse (either orally or in writing) to timely respond to Service inquiries or provide information relevant to the liability for which the levy was made.

Required documentation

Include the following with your completed Form 8546:

- A copy of the levy notice

- Records showing the bank charges caused by the erroneous levy

- Records showing that the bank charges have been paid

Stopping payment on a check that the IRS lost or misplaced

If you must stop payment on a check that the IRS lost or misplaced, and this results in bank charges, you may request reimbursement for those associated charges.

To qualify for reimbursement, all of the following must be true:

- The IRS acknowledges it lost or misplaced the check during processing;

- The IRS asks the taxpayer for a replacement of the payment; and

- The IRS is satisfied that the replacement payment has been received

Required documentation

Include the following with your completed Form 8546:

- Records showing the bank charges caused by the request for replacement of a lost or misplaced check on the part of the IRS,

- Records showing that the bank charges have been paid

Direct Deposit Installment Agreement (DDIA) processing error on the part of the Service

If the IRS places incorrectly processed your DDIA as part of a payment plan, and this results in bank charges, you may request reimbursement for those associated charges.

To qualify for reimbursement, all of the following must be true:

- The IRS failed to act timely, took an incorrect or improper action, or a systemic failure caused the bank fees;

- The taxpayer must not have contributed to the continuation or compounding of the error that caused the bank fees; and

- Prior to the processing error, the taxpayer did not refuse (either orally or in writing) to timely respond to the Service’s inquiries or provide sufficient information for the DDIA processing change to be made.

Required documentation

Include the following with your completed Form 8546:

- Records showing the bank charges caused by the DDIA error caused by the IRS

- Records showing that the bank charges have been paid

Line 12: Description of claim

In this section, provide as much necessary information to describe the circumstances around your erroneous service levy, lost or misplaced check, or DDIA processing error. Use additional sheet(s) if

necessary to document the circumstances.

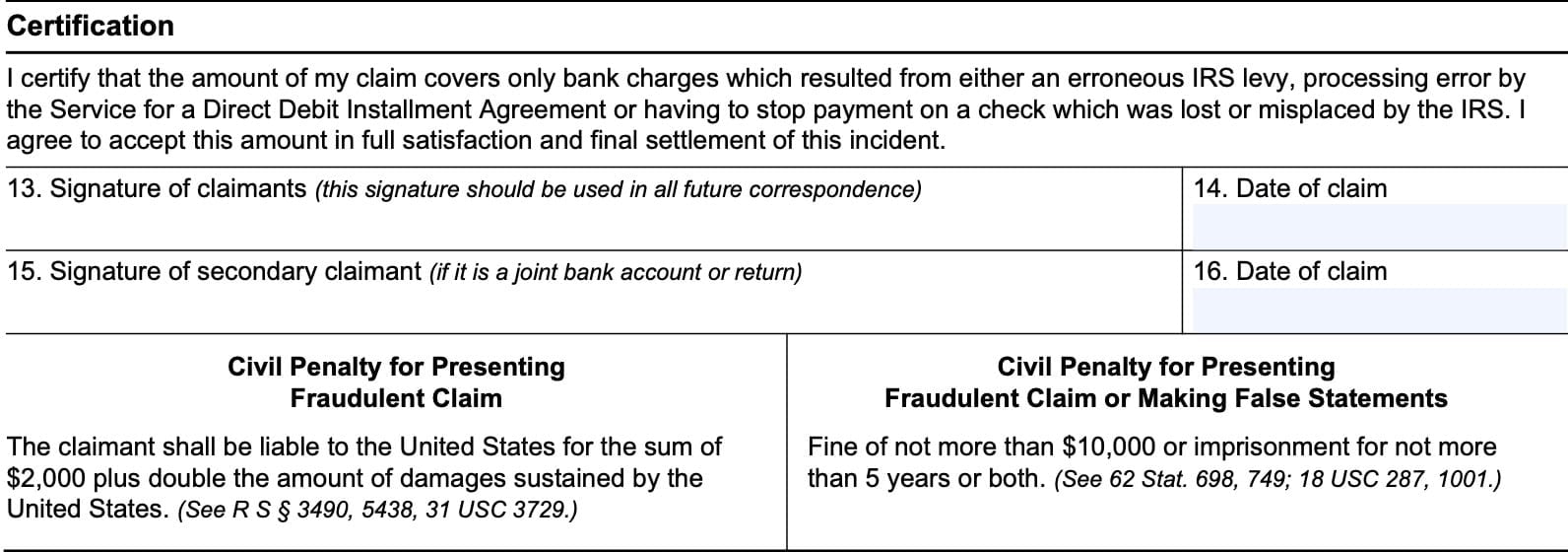

Certification

In this section, you (and your spouse or other secondary claimant) will sign and date Form 8546. Be sure to pay attention to the civil penalty statements below the signature fields:

- Civil penalty for presenting a fraudulent claim

- Fine of $2,000 plus

- Double the amount of damages sustained by the United States government

- Civil penalty for presenting fraudulent claim or making false statements

- Fine of up to $10,000

- Imprisonment for up to 5 years

- Or both.

Filing considerations

There are a couple of filing considerations for IRS Form 8546.

Where do I send my completed Form 8546?

According to the form instructions, taxpayers should submit the completed form to one of the following addresses, as applicable:

- IRS office which served the levy

- IRS office that misplaced the payment

- Address that you used to file your tax return for the Direct Debit Installment Agreement Request

When must I file IRS Form 8546?

According to the form instructions, taxpayers have up to 1 year from the date that the claim accrues to file for reimbursement of bank charges.

Video walkthrough

Watch this video to learn more about filing IRS Form 8546 to be reimbursed for bank fees caused by the IRS.

Frequently asked questions

The Internal Revenue Service will reimburse taxpayers for bank charges due to an erroneous levy,

stopping payment on a check that the IRS lost or misplaced, or due to Direct Debit Installment Agreement (DDIA) processing error committed by the IRS.

No. The IRS will send a Treasury check to your mailing address if you do not complete Items 6 through 10 on IRS Form 8546.

The IRS allows an authorized agent or legal representative to file and sign the claim if the claimant can’t because of disability, death, or other acceptable reason. You must include proof of authorization if the claim is being filed on behalf of someone.

According to the Form 8546 instructions, the maximum limit is $1,000 per reimbursement.

Where can I find IRS Form 8546?

You can find the latest versions of IRS forms on the Internal Revenue Service website. For your convenience, we’ve included the most recent version of IRS Form 8546 in this article.