IRS Form 8689 Instructions

In the United States, the federal tax system primarily applies to the 50 states and the District of Columbia. When it comes to territories of the United States, like Puerto Rico, the U.S. Virgin Islands, Guam, and American Samoa, different tax rules may apply.

This article will walk you through how those tax rules impact people with income from the U.S. Virgin Islands. Specifically, we’ll discuss:

- Special rules for certain types of income, employment, and filing status for the U.S. Virgin Islands

- Who must file IRS Form 8689 to calculate their tax liability to the Virgin Islands Bureau of Internal Revenue

- How to complete IRS Form 8689

Let’s begin by walking by this tax form, step by step.

Table of contents

How do I complete IRS Form 8689?

This one-page form is relatively straightforward and simple to complete. We’ll walk through how to complete Form 8689, step by step.

At the top of Form 8689, there are name and Social Security number fields. Normally, your tax preparation software will auto-populate these fields from your original return.

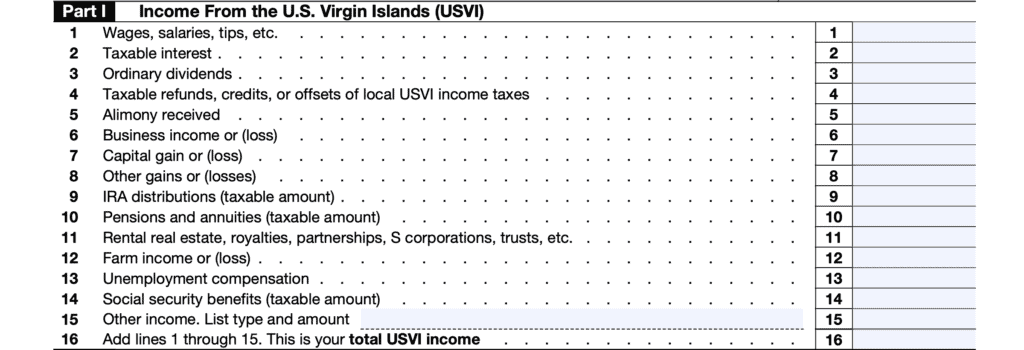

Part I: Income From the U.S. Virgin Islands

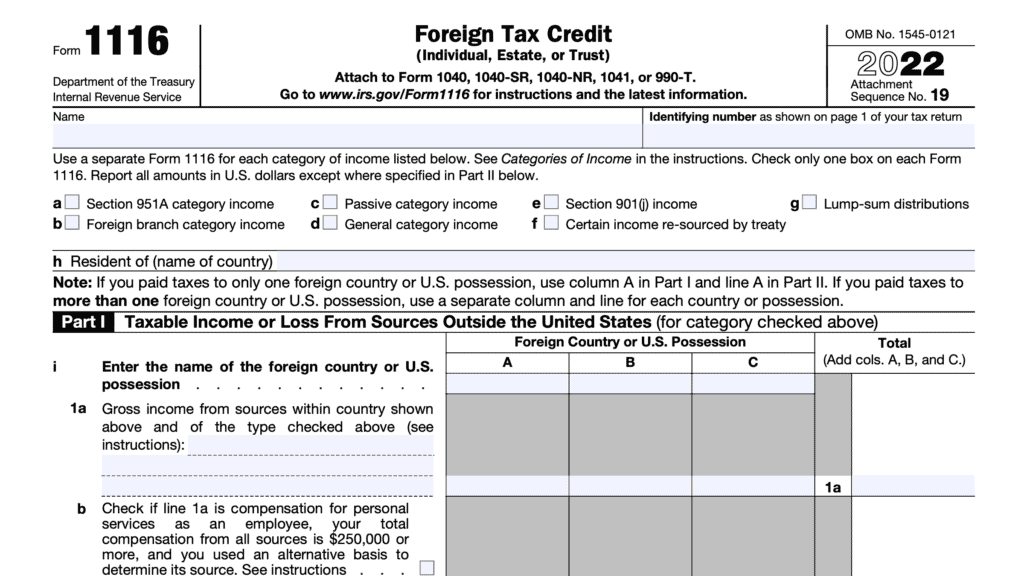

In Part I, we’ll input the income items that are sourced from the USVI. The rules for determining the source of income are explained in:

- Internal Revenue Code (IRC) Sections 861 through 865

- IRC Section 937

- Treasury Regulations Section 1.937-2

- Chapter 2 of Publication 570

Line 1: Wages, Salaries, Tips, etc.

If you worked both in and outside the USVI, include only wages, salaries, or tips earned while you were in the USVI.

However, do not include income that falls under the de minimis exception, previously described.

Line 2: Taxable interest

Only include taxable interest if the payer is located in the USVI.

Line 3: Ordinary dividends

Include ordinary dividends paid by a corporation created or organized in the USVI.

Line 4: taxable refunds, credits, or offsets of local uSVI income taxes

Only include non mirror system income taxes.

Line 5: Alimony received

Only include if the alimony payer is a bona fide resident of USVI.

Line 6: Business income (or loss)

Unless otherwise indicated in Treasury Regulations, income that is from sources within the United States or effectively connected with the conduct of a trade or business in the United States is not income from the USVI.

Only include business income items that are considered to be sourced in USVI.

Line 7: Capital Gain (or loss)

Only include capital gains or losses attributable to property acquired or disposed of in USVI. If you spent time as both a U.S. resident and as a bona fide resident of USVI, you may be subject to special rules, as outlined in IRS Publication 570, Chapter 2.

Line 8: Other gains (or losses)

Only include gains or losses that qualify as USVI-sourced income items.

Line 9: Taxable IRA distributions

Unless your IRA custodian is located in USVI, this will likely be U.S. sourced income.

Line 10: Pensions and annuities

For pension income, taxation may depend on the following factors:

- Where services were performed that earned the pension

- Investment earnings may be taxed based upon where the pension trust is located

Line 11: Rental real estate, royalties, partnerships, S-corporations, trusts, etc.

These income items are reflected in Schedule E of your federal income tax return. Only include income items from assets located in USVI.

Line 12: Farm income

These income items are reflected in Schedule F of your federal income tax return. Only include if your farm income is attributable to USVI.

Line 13: Unemployment compensation

Only include unemployment compensation that you received from USVI.

Line 14: Social Security benefits

Generally considered to be U.S. sourced income.

Line 15: Other income

Include any other income items that may be considered USVI source income.

Line 16: Total income

Add Lines 1 through 15. This represents your total income attributable to USVI sources. This should be a percentage of your total income as reported on your federal return.

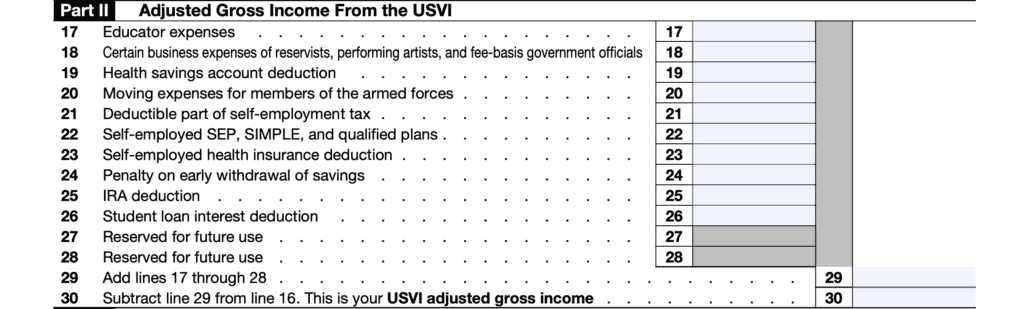

Part II: Figure Your Exclusion

Generally speaking, you will need to allocate each AGI adjustment based upon the percentage of USVI income vs. worldwide income. Line items with specific instructions appear below.

Line 20: Moving expenses for members of the Armed Forces

Enter the deductible amount as calculated on IRS Form 3903, Moving Expenses.

Line 21: Deductible part of self-employment tax

For Lines 21 through 23, if you had USVI source self-employment income, you must figure the amount to enter on each line by:

- Dividing your USVI source self-employment income by your total self-employment income

- Multiplying each deduction by the percentage calculated

For example, let’s imagine that you have $100,000 in worldwide self-employment income. Of that, $20,000 is USVI source income, or 20%.

You must calculate 20% of each deduction in Line 21 through Line 23 and enter that result.

In Line 21, enter the applicable part of self-employment tax.

Line 22: Self-employed SEP, SIMPLE, and qualified plans

Enter the amount of self-employed retirement plan contribution deductions attributable to USVI income.

Line 23: Self-employed health insurance deduction

Enter the amount of self-employed health insurance deductions attributable to USVI income.

Line 24: Penalty on early withdrawal of savings

Enter the amount of penalty on early withdrawals from savings accounts in USVI banks or USVI branches of U.S. banks. You should see the penalty amount indicated on Form 1099-INT or Form 1099-OID.

Line 25: IRA deduction

Enter the total of your and your spouse’s IRA deductions attributable to USVI compensation or earned income.

Calculate this deduction by dividing USVI compensation or earned income by total, or worldwide compensation or earned income. Multiply this percentage by the amount of your deductible IRA contribution.

Line 29

Add Lines 17 through 28.

Include in the total on Line 29 the amount of any other deductions included on the Archer MSA deduction line and the Total other adjustments line of Schedule 1 (Form 1040) that are attributable to your USVI income. You may find this calculated on IRS Form 8853, Archer MSAs.

Line 30: USVI Adjusted gross income

Subtract Line 29 from Line 16.

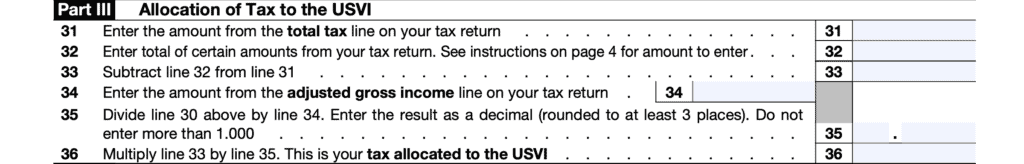

Part III: Allocation of Tax to the USVI

In Part III, you will allocate part of your income tax liability to the USVI.

Line 31: Total tax

Enter the tax liability from the total tax line on your income tax return.

Line 32

Enter the total of the following amounts from your income tax return:

- Form 1040

- Earned income credit (EIC);

- Refundable child tax credit or additional child tax credit;

- American opportunity credit.

- Schedule 2

- Self-employment tax

- Social security and Medicare tax on unreported tip income;

- Uncollected social security and Medicare tax on wages;

- Household employment tax;

- Uncollected social security and Medicare or RRTA tax on tips or group-term life insurance from Form W-2, Box 12

- Tax on excess golden parachute payments;

- Excise tax on insider stock compensation from an expatriated corporation; and

- Additional tax on excess contributions or accumulation from IRS Form 5329.

- Schedule 3

- Health coverage tax credit from IRS Form 8885;

- Credit for repayment of amounts included in income from earlier years;

- Net section 965 liability remaining to be paid in future years; and

- Other payments or refundable credits reported on Line 13z

Line 33

Subtract Line 32 from Line 31.

Line 34: Adjusted gross income

Enter your adjusted gross income (AGI) from your income tax return.

Line 35: Allocation percentage

Divide Line 30 by Line 34. Round this to 3 decimal places, but do not enter more than 1.000. This is the percentage of your AGI attributable to USVI sourced income.

Line 36: Tax allocated to the USVI

Multiply Line 33 by Line 35. This is your income tax allocated to USVI.

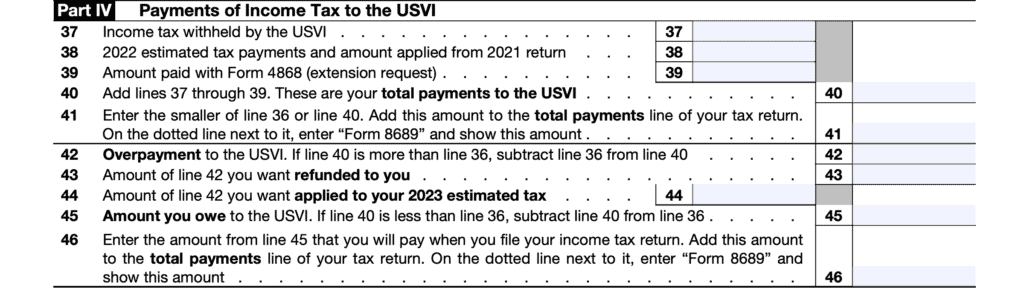

Part IV: Payments of Income Tax to the USVI

In Part IV, we’ll determine the amount of income tax you’ve paid, and the amount of the outstanding tax liability or overpayment.

In the case of overpayments, overpayments to the U.S. government generally will not be applied to taxes that you owe to USVI. Similarly, overpayments to USVI will generally not be applied to income taxes you owe on your federal return.

Line 37: Income tax withheld by USVI

Enter the income tax payments previously withheld by USVI.

Line 38: Estimated tax payments and amount applied from previous year’s return

Enter any estimated tax payments or amounts applied from a previous year’s tax return that you have applied to a future USVI tax liability.

Line 39: Amount paid with Form 4868

If you filed an extension request, include any amount that you paid when filing Form 4868.

Line 40: Total tax payments to USVI

Add Lines 37 through 39. This represents your total payments to USVI.

Line 41

Enter the smaller of:

- Line 36

- Line 40

Add this amount to the total payments line of your income tax return. Enter ‘Form 8689’ on the dotted line next to this amount.

If Line 40 is more than Line 36, go to Line 42, below. If Line 36 is more than Line 40, skip to Line 45.

Line 42: Overpayment to USVI

Subtract Line 36 from Line 40. This represents your tax overpayment. You may have this amount:

- Refunded (Line 43)

- Applied to your tax return for the following year (Line 44)

- Partially refunded and partially applied to your return for the next taxable year

Line 43

From Line 42, enter the amount that you want issued to you as a refund.

Line 44

From Line 42, enter the amount that you want applied to next year’s tax bill.

Line 45: Outstanding tax liability to USVI

Subtract Line 40 from Line 36. This represents the amount that you still owe to USVI.

Line 46

From Line 45, enter the amount that you will pay when you file your tax return. Add this amount to the total payments line of your tax return. On the dotted line, enter “Form 8689.”

How do taxes in the Virgin Islands work?

The Virgin Islands has its own tax system, which is related to the tax system that applies to the United States. However, there are a few differences that apply.

The primary difference is that bona fide residents must pay taxes to the U.S. Virgin Islands, while U.S. citizens or residents who are non bona fide residents must prorate their federal income tax liability to the U.S. Internal Revenue Service and the U.S. Virgin Islands Treasury based upon the amount of income sourced from the Virgin Islands.

Let’s take a closer look at this distinction.

Bona Fide Residents only pay taxes to the USVI

According to IRS Publication 570, Tax Guide For Individuals With Income From U.S. Possessions, a bona fide resident of the U.S. Virgin Islands must file a U.S. Virgin Islands return. Generally, a bona fide resident does not have to file U.S. tax returns as long as:

- The resident reports all worldwide income on their USVI tax return

- All tax is paid to the USVI as calculated, and in a timely manner

Self-employed individuals may have to file Form 1040-SS with the Internal Revenue Service to report self-employment income, and if necessary, pay self-employment tax.

Non Bona Fide Residents must prorate taxes owed to the USVI and to the IRS

A U.S. citizen or resident alien who is not a bona fide resident of the USVI during the tax year must file IRS Form 1040 or Form 1040-SR with the IRS, and an identical tax return with the USVI if either of the following exist:

- Income from sources in the USVI, or

- Income effectively connected with the conduct of a trade or business in the USVI

As a citizen or resident, you must file both individual income tax returns by the tax filing deadline, and use IRS Form 8689 to calculate the portion of your total tax due to the Virgin Islands Treasury.

If you are a non citizen or non-resident, you must file a USVI income tax return reporting only USVI-sourced income, and IRS Form 1040-NR, based upon filing requirements for non-residents.

How do I qualify as a bona fide Resident of the USVI?

Generally speaking, to qualify as a bona fide resident of the U.S. Virgin Islands, you must meet 3 criteria:

- Presence test

- You do not have a tax home outside USVI, and

- You do not have a closer connection to the United States or to a foreign country than to the relevant territory.

What Is The Presence Test?

If you are a U.S. citizen or resident alien, you can satisfy the presence test by meeting one of the 5 qualifying criteria:

- You were present in the USVI for at least 183 days of the previous tax year

- You were present in the USVI for at least 549 days during the 3-year period that includes the current tax year and the 2 immediately preceding tax years

- During each year of the 3-year period, you must be present in the USVI for at least 60 days

- You were present in the United States for no more than 90 days during the tax year.

- You had earned income in the United States of no more than a total of $3,000 and were present for more days in USVI than in the United States during the tax year.

- The IRS considers earned income to be compensation for personal services performed, such as wages, salaries, or professional fees

- You had no significant connection to the United States during the tax year

Different rules, such as the substantial presence test, apply to non-resident aliens. IRS Publication 519, U.S. Tax Guide for Aliens, contains more information.

How Do I Count Days Of Presence For The Presence Test?

You do not have to be physically present in a territory, such as USVI, to meet the IRS criteria for the presence test. IRS Publication 570 allows for the following exceptions:

- Days that you are outside the territory to receive medical care for yourself or one of the following family members:

- Parent

- Spouse

- Child: includes stepchildren, foster children, or adopted children

- Days you are unable to return due to a FEMA-declared disaster or because mandatory evacuation orders are in effect

- Any day (up to 30 days total) in which you are outside the USVI and the United States

- Only applies if you are present in the USVI more than you are present in the U.S.

- Does not count for the 60-day minimum presence to meet the 549-day presence test, above

Special Rules for Determining USVI Income

It’s important to note several special rules applicable to this situation.

De Minimis Exception for Determining Income

Generally speaking, a de minimis exception exists for determining the source of income earned in a territory. This exception applies to taxpayers who:

- Are a U.S. citizen or resident;

- Are not a bona fide resident of that territory;

- Are not employed by or under contract with an individual, partnership, or corporation

- that is engaged in a trade or business in that territory;

- Temporarily performed services in that territory for 90 days or less; and

- Earned $3,000 or less from such services

Joint Tax Returns

Married taxpayers filing a joint income tax return should file their tax return with, and pay taxes to, the jurisdiction where the spouse with the greater adjusted gross income (AGI) would have to file, if filing a separate return.

If the spouse with a greater AGI is a bona fide resident of the USVI during the tax year, the couple should file their joint tax return with the USVI Bureau of Internal Revenue. If the spouse with greater AGI is a U.S. citizen, but not a bona fide resident, then the married couple should file their income tax return with the IRS.

U.S. military

A servicemember’s military status does not impact their status as a resident of the USVI. In other words, if you were previously a bona fide resident of the USVI, you will remain a resident even if you are stationed elsewhere.

If you did not qualify as a bona fide resident in a prior tax year, being stationed in the USVI will not qualify you as a bona fide resident.

Military spouses

Under the Military Spouses Residency Relief Act (MSRRA), wages, salaries, tips, and self-employment income is not considered USVI income if the following applies:

- You are a civilian spouse of a member of the U.S. armed forces

- You work in the USVI and maintain a residence in the United States, District of Columbia, or another U.S. territory

For MSRRA to apply, the military spouse must be in the USVI solely for the purpose of accompanying the servicemember who is stationed there on official orders.

However, other sources of income may be treated as USVI income as follows:

Interest income

Interest income is generally taxed based upon where the interest payer is located. For example, interest on a certificate of deposit (CD) issued by a USVI bank or USVI branch of a U.S. bank is USVI source income.

Dividend Income

The source of dividend income is where the paying corporation is located, created, or organized.

Tax refunds, credits, or offsets

This includes only non-mirror code income tax.

Alimony

Alimony income is sourced based upon whether the payer is a bona fide USVI resident.

Sales of real property

This generally depends on the location of the real estate in question.

Moving expenses

The moving expense deduction is suspended for all taxpayers except for members of the U.S. armed forces relocating based upon permanent change of station (PCS) orders.

If you are a bona fide resident in the tax year of your move, enter your deductible expenses on your USVI tax return.

For non bona fide residents:

- Enter your deductible expenses on IRS Form 3903

- Enter the deductible amount on:

- Schedule 1 (Form 1040), Line 14, and on

- Form 8689, Line 20

If your move was to the United States, complete Form 3903, and enter the deductible

amount on Schedule 1 (Form 1040), line 14.

Self-employment taxes

If you have no U.S. filing requirement, but you have income that is effectively connected with a trade or business in the USVI, you must file Form 1040-SS with the United States to report your self-employment income. If necessary, you must also pay self-employment tax.

Additional Medicare Tax

If your income exceeds a certain amount, you may be required to pay additional Medicare tax, and report additional Medicare tax paid by your employer. If applicable, see the instructions for IRS Form 8959, Additional Medicare Tax.

How do I file Form 8689?

You must file identical tax returns with the United States and the USVI.

If you are not enclosing a check or money order, file your original tax return

(including Form 8689) with IRS Service Center Austin. Send your completed return to:

Department of the Treasury

Internal Revenue Service

Austin, TX 73301-0215

If you are including a check or money order, file your original return with the IRS Service Center Charlotte. Send your completed return and payment to:

Internal Revenue Service,

P.O. Box 1303

Charlotte, NC 28201-1303

File a signed copy of your tax return (with all attachments, forms, and schedules, including Form 8689) with the Virgin Islands Bureau of Internal Revenue. To do this, send your completed return to:

Virgin Islands Bureau of Internal Revenue

6115 Estate Smith Bay

Suite 225

St. Thomas, VI 00802

They will accept a signed copy of your U.S. return and process it as an original return.

Video walkthrough

Watch this instructional video to learn more about how to properly report your taxes on IRS Form 8689.

Frequently Asked Questions About IRS Form 8689

Below are some commonly asked questions about this tax form.

You must file Form 8689 if you were a U.S. citizen or resident alien, other than a bona fide resident of the USVI, and had income from sources in the USVI or income effectively connected with the conduct of a trade or business in the USVI.

IRS Form 8689, Allocation of Individual Income Tax to the U.S. Virgin Islands, is the tax form that U.S. citizens and residents use to prorate the amount of U.S. tax allocable to USVI sourced income.

According to IRS Publication 570, this does not increase a taxpayer’s tax bill, but simply allocates the amount of tax that the taxpayer must pay to the federal government and the VI Bureau of Internal Revenue.

Where Can I Find IRS Form 8689?

You may find a copy of From 8689 in PDF format on the IRS website. For your convenience, we’ve attached the latest version to the bottom of this article.

Related tax articles

This tax form is one of the fillable tax forms provided by the Internal Revenue Service, to help taxpayers reduce their tax preparation costs. To see more forms like this, visit our free fillable tax forms page, where you’ll also find articles like this.

Unlike the IRS, our articles contain step by step instructions for each tax form, as well as video walkthroughs. You can also check out all of our videos by subscribing to our YouTube channel!