IRS Form 8809 Instructions

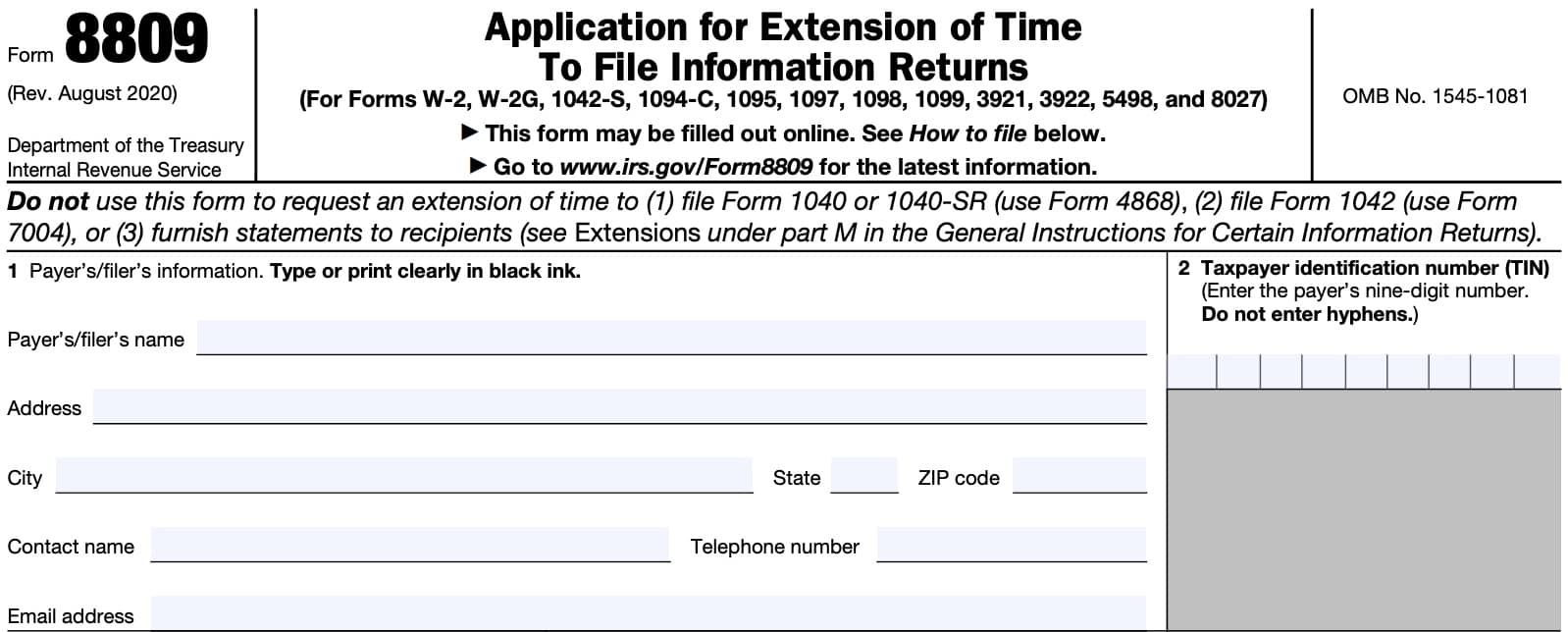

If you need to request an extension of time to file certain information returns, you may be filing IRS Form 8809, Application for Extension of Time To File Information Returns.

In this article, we’ll go over everything you need to know about IRS Form 8809, including:

- How to complete and file IRS Form 8809

- Filing considerations

- Frequently asked questions

Let’s begin with a top-down overview on completing this tax extension request form.

Table of contents

How do I complete IRS Form 8809?

This one-page extension form is pretty straightforward. Let’s start at the top with the taxpayer information fields.

Line 1: Payer’s/filer’s information

In this area, enter the following information:

- Filer’s name

- In care of name (ICO)

- Complete mailing address

- Including room number or suite number of the filer

- Include city, state, and zip code

You should use the name and address where you would like the Internal Revenue Service to send correspondence.

For example, if you are a tax return preparer, you would enter:

- Your client’s complete name

- Care of (c/o) your firm’s name

- Your complete mailing address, including zip code

Change of address

If you’ve recently changed your address, it is always a good practice to notify the IRS. A simple way to do this is to file a change of address notice with the IRS.

Individual tax filers can file IRS Form 8822, Change of Address, to update their address. Other tax entities, such as small businesses, will file Form 8822-B, Change of Address or Responsible Party – Business to do so.

When filing Form 8809, the legal name and taxpayer identification number (TIN) on your extension request must be identical to the name that you provided when you applied for your employer identification number (EIN) when you:

- Filed Form SS-4, Application for Employer Identification Number

- Used the online internet EIN application

- Called the EIN toll-free telephone number

If you have previously submitted a name change to the IRS, supply the current legal

name and TIN. Do not use abbreviations.

Enter the name of someone who is familiar with this request whom the IRS can contact if additional information is required. Also, you should provide your telephone number and email address.

Line 2: Taxpayer identification number

Enter one of the following identification numbers as it pertains to the payer’s status:

- Employer identification number (EIN)

- Qualified intermediary employer identification number (QI-EIN)

- Withholding foreign partnership employer identification number (WP-EIN), or

- Withholding foreign trust employer identification number (WT-EIN)

If you are not required to have an EIN or QI-EIN, then enter your Social Security number (SSN).

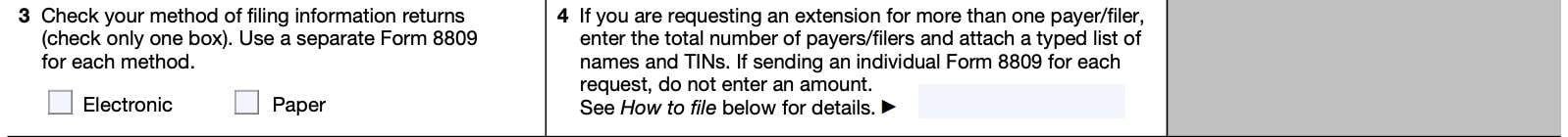

Line 3

Check the appropriate box that pertains to your method of filing information returns:

- Electronic method

- Paper method

Choose only one method per form. If you need to report both filing methods, then use a second Form 8809.

Line 4

If you are requesting an approved extension of time for multiple filers, then:

- Enter the total number of payers or filers, and

- Attach a typed list of filer names and TINs

If you are sending an individual form 8809 for a single taxpayer, then you do not need to enter anything in Line 4.

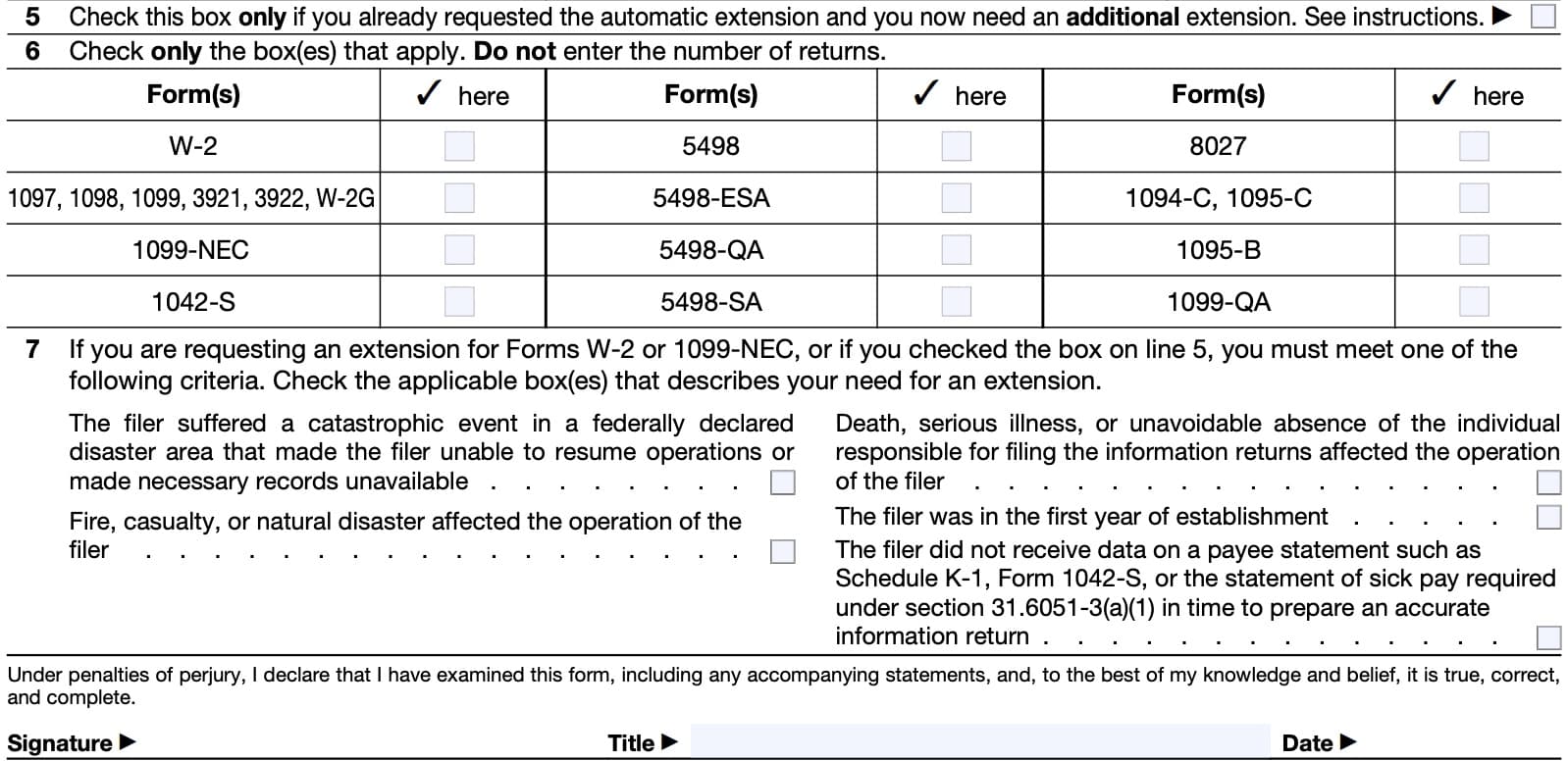

Line 5

Check this box only if you’ve already received an automatic 30-day extension of time to file, and you need an additional extension of time to file your information returns in the same tax year.

Do not check this box unless you originally requested an extension. Although you can file Form 8809 online, you must use a paper form to request the additional 30-day extension.

If you check this box, then you must complete Line 7.

Line 6

In this section, you’ll check only the boxes that apply. You can choose from the following forms, which we’ve listed below with a brief explanation.

IRS Form W-2

IRS Form W-2, Wage and Tax Statement, should be familiar to most taxpayers. Individual taxpayers receive the W-2 Form, which reports the following:

- Wages earned during the tax year

- Federal, state, and local taxes paid during the year

- FICA taxes paid (Social Security and Medicare tax)

Under normal circumstances, taxpayers. should expect to receive Form W-2 no later than January 31.

IRS Form 1097, 1098, 1099, 3921, 3922, or W-2G

These tax returns are known as information returns. Below is a brief explanation on each tax form.

IRS Form 1097

Officially known as IRS Form 1097-BTC, Bond Tax Credit, mutual funds and partnerships may use this tax form to report tax credits that bond owners may be entitled to.

IRS Form 1098, Mortgage Interest Statement

IRS Form 1098 reports mortgage interest paid by a taxpayer over the course of a calendar year. Mortgage interest may be included as an itemized deduction on Schedule A of your income tax return.

IRS Form 1099

1099 forms report certain items of income that may be subject to tax. Here is a detailed list of the different types of 1099 tax forms.

- IRS Form 1099-A, Acquisition or Abandonment of Secured Property

- IRS Form 1099-B, Proceeds from Broker and Barter Exchange Transactions

- IRS Form 1099-C, Cancellation of Debt

- IRS Form 1099-CAP, Changes in Corporate Control and Capital Structure

- IRS Form 1099-DIV, Dividends and Distributions

- IRS Form 1099-G, Certain Government Payments

- IRS Form 1099-H, Health Coverage Tax Credit (HCTC) Advance Payments

- IRS Form 1099-INT, Interest Income

- IRS Form 1099-K, Payment Card and Third Party Network Transactions

- IRS Form 1099-LS, Reportable Life Insurance Sale

- IRS Form 1099-LTC, Long Term Care and Accelerated Death Benefits

- IRS Form 1099-MISC, Miscellaneous Information

- IRS Form 1099-NEC, Nonemployee Compensation

- IRS Form 1099-OID, Original Issue Discount

- IRS Form 1099-PATR, Taxable Distributions Received From Cooperatives

- IRS Form 1099-Q, Payments from Qualified Education Programs (Under Sections 529 and 530)

- IRS Form 1099-QA, Distributions from ABLE Accounts

- IRS Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc.

- IRS Form 1099-S, Proceeds from Real Estate Transactions

- IRS Form 1099-SA, Distributions From an HSA, Archer MSA, or Medicare Advantage MSA

- IRS Form 1099-SB, Seller’s Investment in Life Insurance Contract

IRS Form 3921, Exercise of an Incentive Stock Option Under Section 422(b)

Employers may use IRS Form 3921 to report the exercise of an incentive stock option, or ISO.

IRS Form 3922, Transfer of Stock Acquired Through An Employee Stock Purchase Plan Under Section 423(c)

Employers use IRS Form 3922 to report the purchase of a company’s stock under an employee stock purchase program.

IRS Form W-2G, Certain Gambling Winnings

Taxpayers may receive IRS Form W-2G when certain gambling winnings reach a certain threshold.

IRS Form 1099-NEC

Many corporate taxpayers, particularly small business owners, will issue IRS Form 1099-NEC, Nonemployee Compensation, to team members who are classified as independent contractors.

IRS Form 1042-S, Foreign Person’s U.S. Source Income Subject to Withholding

This tax form is used certain items of income paid to a foreign resident, which might be subject to mandatory tax withholding.

IRS Form 5498, IRA Contribution Information

Custodians file IRS Form 5498 to report contributions to a taxpayer’s IRA.

IRS Form 5498-ESA, Coverdell ESA Contribution Information

Custodians file IRS Form 5498-ESA to report taxpayer contributions to a Coverdell Education Savings Account, or Coverdell ESA.

IRS Form 5498-QA, ABLE Account Contribution Information

State governments may use IRS Form 5498-ESA to report taxpayer contributions to an ABLE account.

IRS Form 5498-SA, HSA, Archer MSA, or Medicare Advantage MSA Information

Trustees and custodians file IRS Form 5498-SA to report contributions to any of the following:

- Health Savings Account (HSA)

- Archer Medical Savings Account (MSA)

- Medicare Advantage MSA

IRS Form 8027, Employer’s Annual Information Return of Tip Income and Allocated Tips

IRS Form 1094-C or IRS Form 1095-C

Applicable Large Employers must file IRS Form 1095-C, Employer-Provided Health Insurance Offer and Coverage, to report on health care coverage to their employees.

IRS Form 1094-C, Transmittal of Employer-Provided Health Insurance Offer and Coverage Information Returns, is the mandatory transmittal document that must be included with Form 1095-C.

IRS Form 1095-B, Health coverage

Form 1095-B is used to report certain information to the IRS and to taxpayers about individuals who are:

- Covered by minimum essential coverage and

- Not liable for the individual shared responsibility payment

IRS Form 1099-QA, Distributions from ABLE accounts

Reports distributions from a state-managed ABLE account.

Line 7

You must complete this line if you checked the box in Line 5, or if you’re requesting additional time to file either Forms W-2 or 1099-NEC.

If this applies to you, you must meet one or more of the following conditions:

- The filer suffered a catastrophic event in a federally declared disaster area that made the filer unable to resume operations or made necessary records unavailable

- Fire, casualty, or natural disaster affected the operation of the filer

- Death, serious illness, or unavoidable absence of the individual responsible for filing the information returns affected the operation of the filer

- The filer was in the first year of establishment

- The filer did not receive data on a payee statement in time to prepare an accurate information return. This might include forms such as:

- Schedule K-1

- Form 1042-S, or

- The statement of sick pay required under Internal Revenue Code Section 31.6051-3(a)(1)

Check one or more of the boxes that may apply.

Signature

If necessary, sign and date the form.

No signature is required for the 30 day automatic tax-filing extension. However, this option is not available for Forms W-2 or 1099-NEC.

For an additional extension or to request a 30-day nonautomatic extension for Form W-2 and/or Form 1099-NEC, Form 8809 must be signed by the filer/transmitter or person duly authorized to sign a return.

Filing IRS Form 8809

Below are some general discussion points about requesting extra time to file information returns with IRS Form 8809.

Who should file IRS Form 8809?

Payers/filers who need more time to file information returns with the IRS should file this form before the due date of the return. Information return due dates depend on the type of form, and whether you are filing this form by paper or electronically.

Information return due dates

Below is a list of information returns and their due dates, by format.

| If you file IRS Form(s) | Electronically | By Paper |

| W-2 | January 31 | January 31 |

| W-2G | February 28 | March 31 |

| 1042-S | March 15 | March 15 |

| 1094-C | February 28 | March 31 |

| 1095 | February 28 | March 31 |

| 1097, 1098, or 1099 | February 28 | March 31 |

| 1099-NEC | January 31 | January 31 |

| 3921 or 3922 | February 28 | March 31 |

| 5498 | May 31 | May 31 |

| 8027 | Last day of February | March 31 |

How can I request an extension?

Taxpayers may request an automatic extension of time in several different ways.

Online

Filers can complete a fill-in Form 8809 through the FIRE (Filing Information Returns Electronically) System for an automatic 30-day extension. This is not available for the following:

- Form W-2

- Form 1099-NEC

- Form 1099-QA

- Form 5498-QA

- Additional 30-day extension requests

Acknowledgements are automatically displayed online if the request is made through the FIRE production system by the due date of the return. However, you cannot attach a list that contains names and TINs to the fill-in Form 8809.

You can also file through the FIRE system in a file formatted according to specifications outlined in IRS Publication 1220.

Paper

Mail your completed Form 8809 to:

Department of the Treasury

Internal Revenue Service Center

Ogden, UT 84201-0209

This is the only filing option for Forms W-2 or 1099-NEC.

When should I file IRS Form 8809?

You should file Form 8809 as soon as you know an extension of time to file is necessary, but not before January 1 of the year in which the return is due. You must file Form 8809 by the regular deadline for your specific information return.

Requesting an extension for several types of information returns

You may use one Form 8809 to request an extension period for multiple returns. However, you must file by the earliest due date.

The IRS will not grant an extension if you file a copy of Form 8809 after the regular due date of your return.

How long is the extension period once my extension request is approved?

For all forms other than Forms W-2 or 1099-NEC

You may request an automatic extension of 30 days from the original filing deadline. For these forms, an additional 30-day extension of time to file information returns may be submitted if:

- The initial 30-day extension was granted, and

- You requested the additional extension prior to the expiration of the first extension period

You must submit additional 30-day extension requests on a paper Form 8809.

For Forms W-2 or 1099-NEC

You may only request one 30-day extension of time. You can request the one extension for Forms W-2 or 1099-NEC or the additional extension for the other forms if you meet and select one of the criteria listed on Line 7.

Video walkthrough

Watch this instructional video for a step by step walkthrough of IRS Form 8809.

Frequently asked questions

IRS Form 8809, Application for Extension of Time to File Information Returns, used by businesses and individuals to request an extension of the due date to file information returns, such as 1099-MISC forms, 1099-NEC forms, and W-2 forms.

Payers/filers may be subject to a late filing penalty if they file a tax return after the filing deadline without receiving a valid extension. In 2024, the IRS penalty for late information returns can range from $60 to $630 per information return filed after the regular deadline.

Where can I find IRS Form 8809?

You can find tax forms on the IRS website. For your convenience, we’ve included the latest version of IRS Form 8809 here, in this article.