IRS Form 8820 Instructions

The orphan drug credit is one way that the federal government tries to incentivize research and development into treating rare diseases. Qualifying taxpayers may use IRS Form 8820 to claim this rare tax credit.

In this article, we’ll walk through IRS Form 8820, to include:

- How to complete IRS Form 8820

- Qualified clinical testing expenses

- Other frequently asked questions

Let’s start by going over this tax form, step by step.

Table of contents

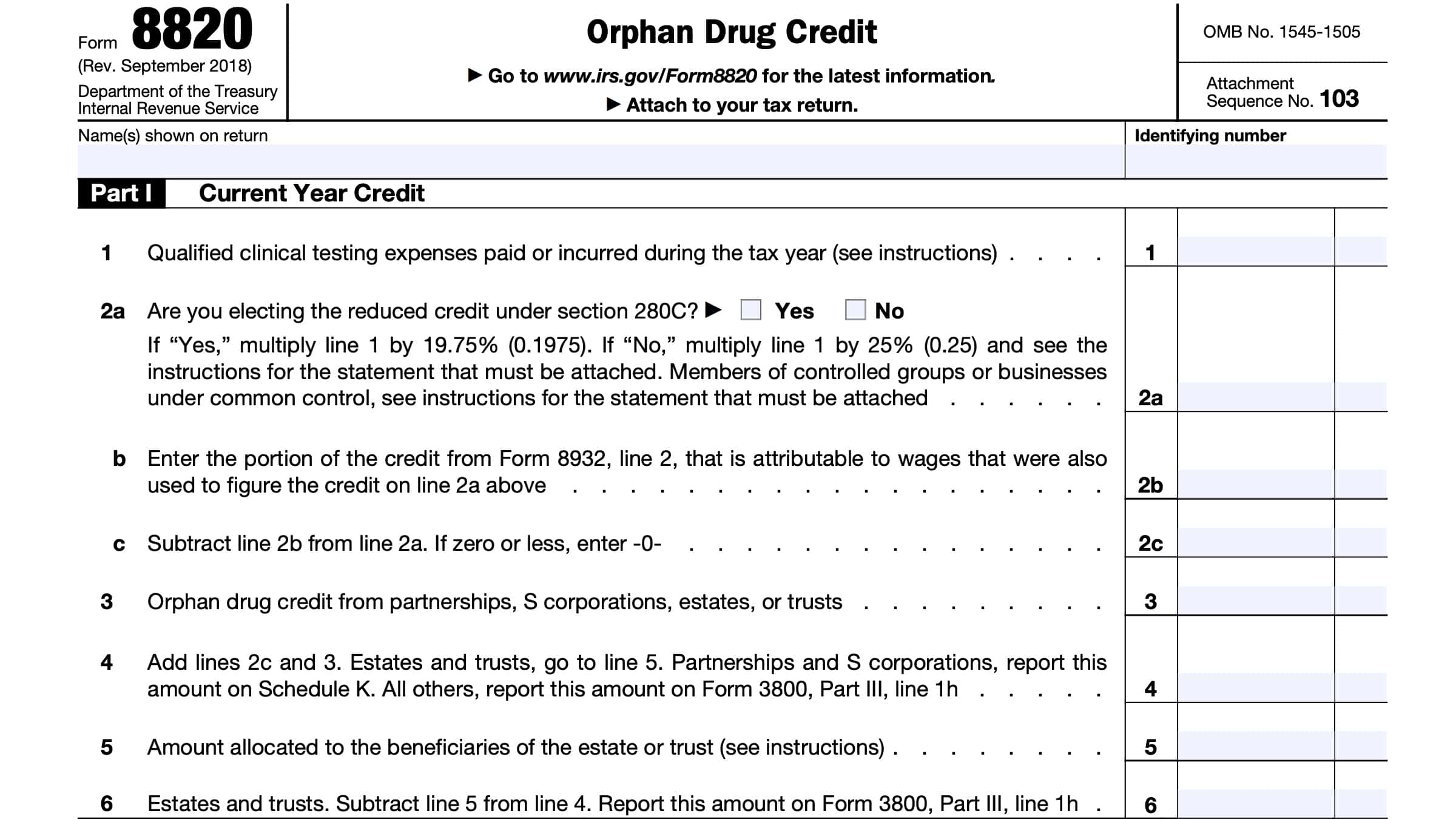

How do I complete IRS Form 8820?

There are two parts to this tax form:

Let’s start with Part I.

Part I: Current Year Credit

In Part I, we’ll calculate the orphan drug credit for the current tax year.

Line 1: Qualified clinical testing expenses

In Line 1, enter all qualified clinical testing expenses that you paid or incurred during the tax year.

Line 2

For Line 2a, are you electing to take the reduced credit under IRC Section 280C? If Yes, then you must do the following:

- Multiply Line 1 by 19.75% (0.1975)

- Complete the rest of IRS Form 8820, even you do not claim an orphan drug on your original income tax return

- File Form 8820 with your original, timely-filed U.S. income tax return

- May include extensions from the tax return’s original due date

If No, then multiply Line 1 by 25%. You must also follow these instructions:

- Reduce your otherwise allowable deduction for qualified clinical testing expenses by the amount of credit on this line

- If your tax credit exceeds the amount allowed as a tax deduction, you must reduce the amount chargeable to your capital account for the year by the excess amount

- Attach a statement to your tax return listing the deduction amounts or capitalized expenses that you reduced

- Identify the specific lines on your tax return, schedule, or forms where you made the reductions

For Line 2b, enter any amount from IRS Form 8932, Line 2, that is from wages also used to figure this tax credit.

In Line 2c, subtract this amount from the amount in Line 2a.

Line 3: Orphan drug credit from pass through entities

Enter any drug orphan tax credit reported to you from any of the following entities:

- Partnerships

- S-corporations

- Estates

- Trusts

For any taxpayers that are not a partnership, S-corporation, estate, or trust: If your only source of this tax credit is from a pass-through entity, you do not have to complete this form.

Instead, you may claim this tax credit as part of the general business credit on IRS Form 3800.

If the estate or trust is subject to passive activity rules, include on Line 3 any orphan drug credit from passive activities disallowed in a prior year and carried forward to this year.

Complete Form 8582-CR, Passive Activity Credit Limitations, to determine the allowed credit that

must be allocated between the estate or trust and the beneficiaries.

Line 4

Add Line 2c and Line 3. Enter the total in Line 4.

Estates and trusts: Continue to Line 5.

Partnerships & S corporations will report this total on Schedule K.

All other taxpayers will report this number on IRS Form 3800, Part III, Line 1h as a general business credit.

Line 5: Amount allocated to beneficiaries

In Line 5, enter the amount allocated to the estate or trust beneficiaries.

You must allocate the orphan drug credit from Line 4 between the beneficiaries in the same proportion as income was allocated on the tax return.

Line 6

Estates and trusts: Subtract Line 5 from Line 4. Enter the amount in Line 6 and on IRS Form 3800, Part III, Line 1h.

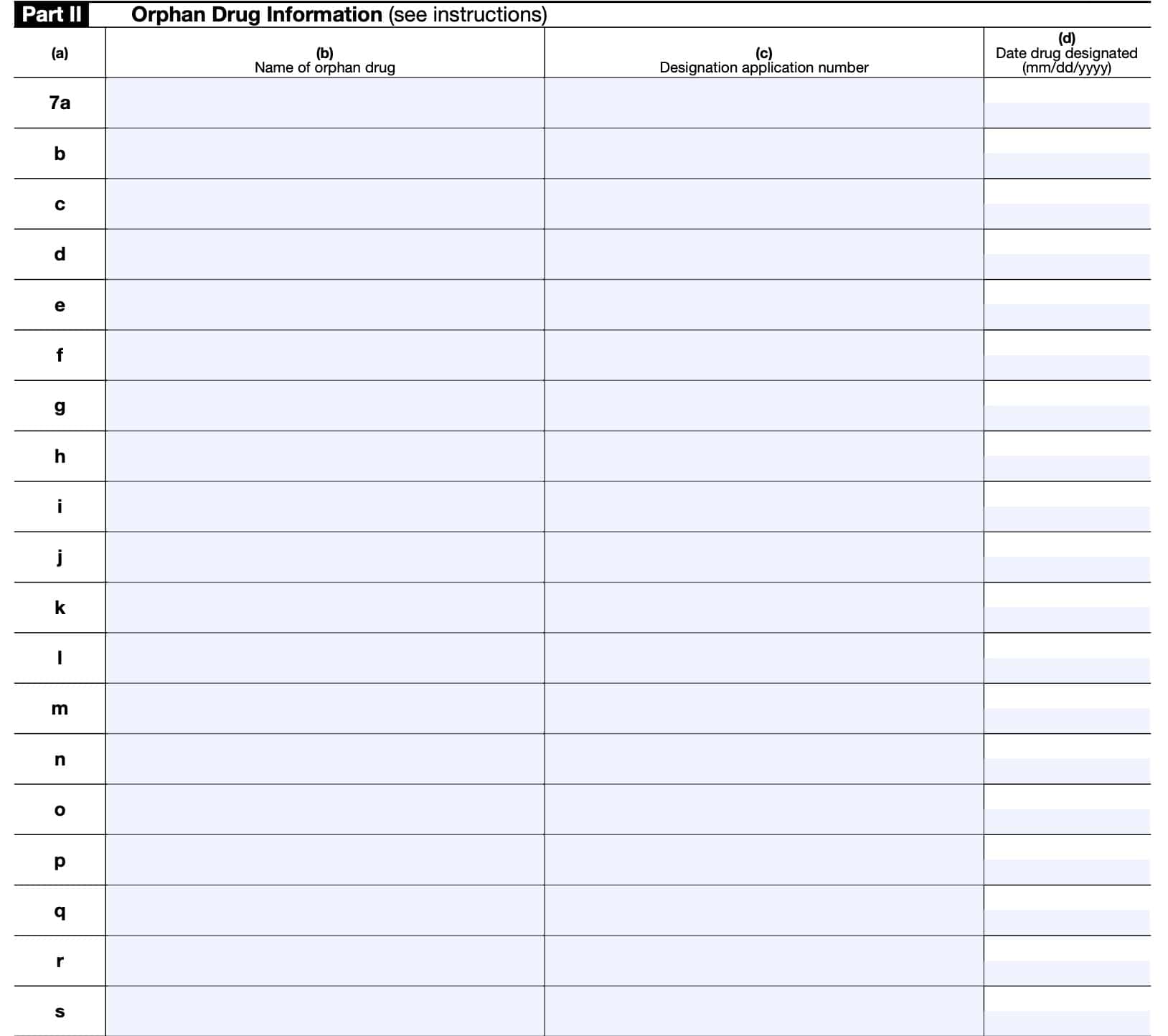

Part II: Orphan Drug Information

In Part II, enter the pertinent information for each orphan drug for which you incurred qualified clinical testing expenses.

To do this, you will need to enter the following information:

- Generic name of the orphan drug

- Designation application number

- Date the drug was designated under Section 526 of the Federal Food, Drug, and Cosmetic Act

If you have more than 26 different eligible drugs, you may attach additional Part II sheets as required.

Qualified clinical testing expenses

The Internal Revenue Service generally considers qualified clinical testing expenses as amounts paid or incurred by the taxpayer for qualified research expenses under Internal Revenue Code Section 41, with two modifications.

- In IRC Sections 41(b)(2) and (3), “clinical testing” is substituted for “qualified research.”

- 100% (instead of 65% or 75%) of contract research expenses are treated as clinical testing expenses.

However, the IRS does not consider testing expenses otherwise funded by a grant, contract, governmental organization, or another tax entity to be qualified clinical testing expenses.

Clinical testing

In general, clinical testing refers to any human clinical testing that meets the following conditions:

- The testing is carried out under an exemption for a drug being tested for a rare disease or condition under Section 505(i) of the Federal Food, Drug, and Cosmetic Act

- The testing occurs after the date that the drug is designated under Section 526 of the Federal Food, Drug, and Cosmetic Act, and before the date on which an application for the drug is approved under Section 505(b)

- Or Section 351 of the Public Health Service Act for biological products

- The testing is conducted by or for the taxpayer to whom the designation applies

- Testing relates to the use of the drug for the rare disease or condition for which it was designated under Section 526

Rare diseases or conditions

For purposes of the orphan drug credit, a rare disease or condition is one that affects:

- 200,000 or fewer persons in the United States

- More than 200,000 people, but for which there is no reasonable expectation of recovering the development costs through drug sales

Video walkthrough

Watch this informative video to learn more about claiming the orphan drug credit for qualified clinical testing expenses by filing IRS Form 8820.

Frequently asked questions

The IRS considers qualified clinical testing expenses to be amounts paid or incurred by the taxpayer as qualified research expenses under IRC Section 41 to the extent they are not otherwise funded by a grant, contract, or another tax entity.

The orphan drug credit is 25% of qualified clinical testing expenses paid or incurred during the tax year. There is a reduced credit option under Section 280C for qualifying taxpayers.

Where can I find IRS Form 8820?

As with other reproducible copies of federal tax forms, you may find IRS Form 8820 in PDF format on the Internal Revenue Service website, which is an excellent electronic resource. For your convenience, we’ve attached the latest version of this IRS tax form to this article.

Related tax articles

This tax form is one of the fillable tax forms provided by the Internal Revenue Service, to help taxpayers reduce their tax preparation costs. To see more forms like this, visit our free fillable tax forms page, where you’ll also find articles like this.

Unlike the IRS, our articles contain step by step instructions for each tax form, as well as video walkthroughs. You can also check out all of our videos by subscribing to our YouTube channel!