IRS Form 8821 Instructions

As a general rule, federal law prohibits the Internal Revenue Service from sharing a taxpayer’s confidential tax information with third parties. However, there might be times when a taxpayer facing IRS issues wants to disclose their personal tax information to a third party, such as a tax professional. Filing IRS Form 8821, Tax Information Authorization, allows the taxpayer to do just that.

In this article, we’ll cover IRS Form 8821 in depth, including:

- How to complete Form 8821

- Filing considerations

- Other options that a taxpayer may use to share their confidential information with tax professionals

- Frequently asked questions

Let’s start with some step-by-step guidance on completing IRS Form 8821.

Table of contents

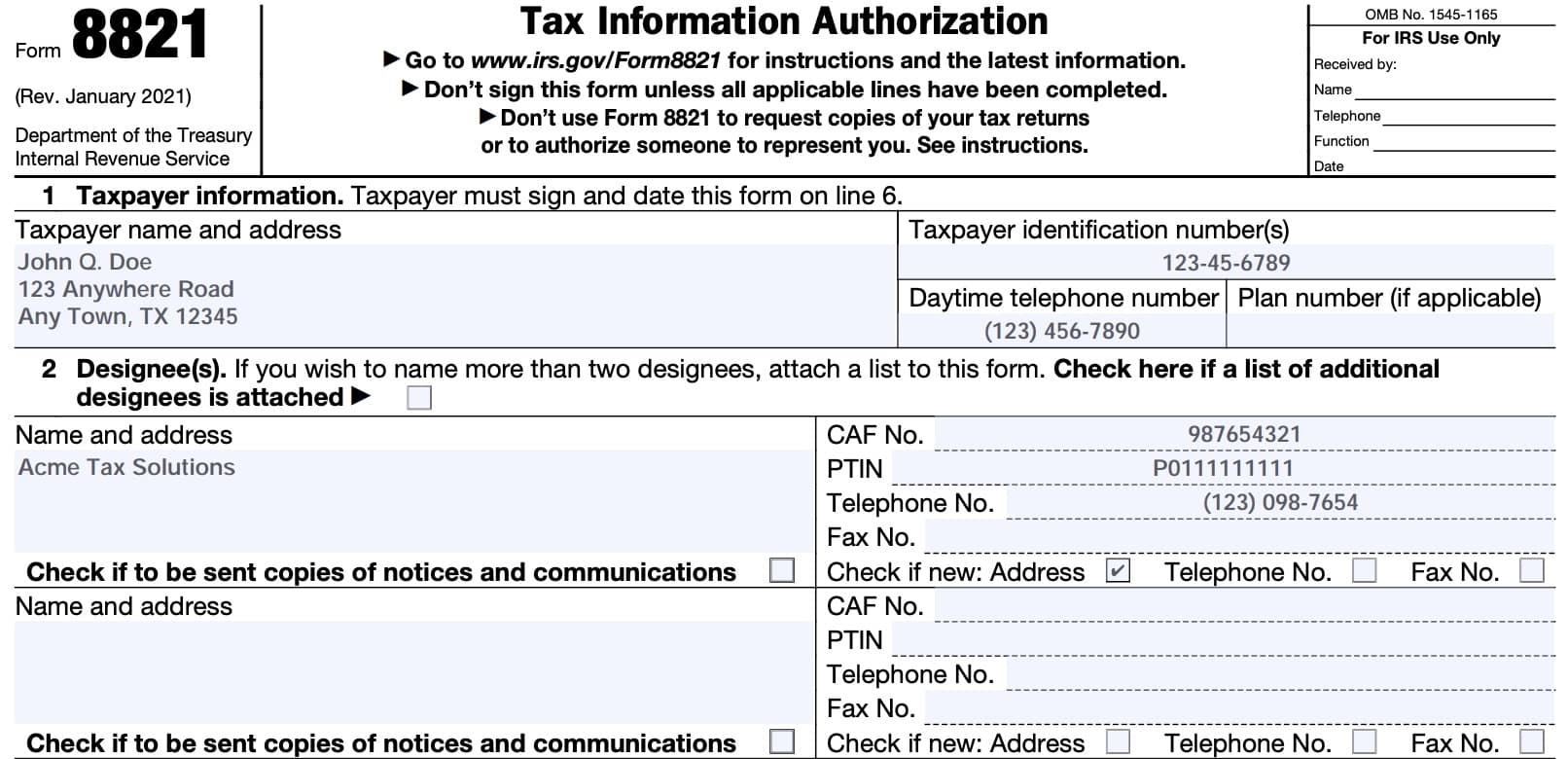

How do I complete IRS Form 8821?

We’ll walk through this one-page tax form, step by step. There are only 6 fields that you need to complete.

Line 1: Taxpayer information

Enter the following information:

- Taxpayer name and mailing address

- Taxpayer identification number (TIN)

- Daytime telephone number

Individuals

If your taxpayer status is married filing jointly, this authorization will only be for the spouse listed on this form. You must submit a separate 8821 form to release tax information for your spouse or former spouse.

Corporations

Enter the corporation’s name, employer identification number (EIN), and business address.

Employee plans or exempt organizations

Enter the three-digit plan number, if available.

Trusts

Enter the name, title, and address of the trustee, and the name and EIN of the trust.

Estates

If the estate does not have a separate TIN, then enter the decedent’s Social Security number or TIN.

Line 2: Designee(s)

For each designee, enter the designee’s full name, mailing address, telephone number and fax number.

Also enter the 9-digit CAF number for the designee and preparer tax identification number (PTIN), if available.

Check the appropriate box(es) for any of the following:

- You wish the designee receive copies of IRS notices and communications that you receive

- No more than 2 designees

- Any designee has updated any of the following from their most recent IRS filing:

- Address

- Telephone number

- Fax number

Should the designee have a CAF number from a previously filed Form 8821 or Form 2848, use that CAF number. In cases where the designee does not have a CAF number, enter ‘NONE’ in the CAF number field and the IRS will assign a CAF number to the designee.

What is a CAF number?

A CAF number is a unique nine-digit identification number and is assigned to a tax professional the first time they file a third party authorization with the IRS.

More than 2 designees

If you wish to name more than two designees, check the appropriate box and attach a list to the completed form. This list must contain the requested information for each additional designee.

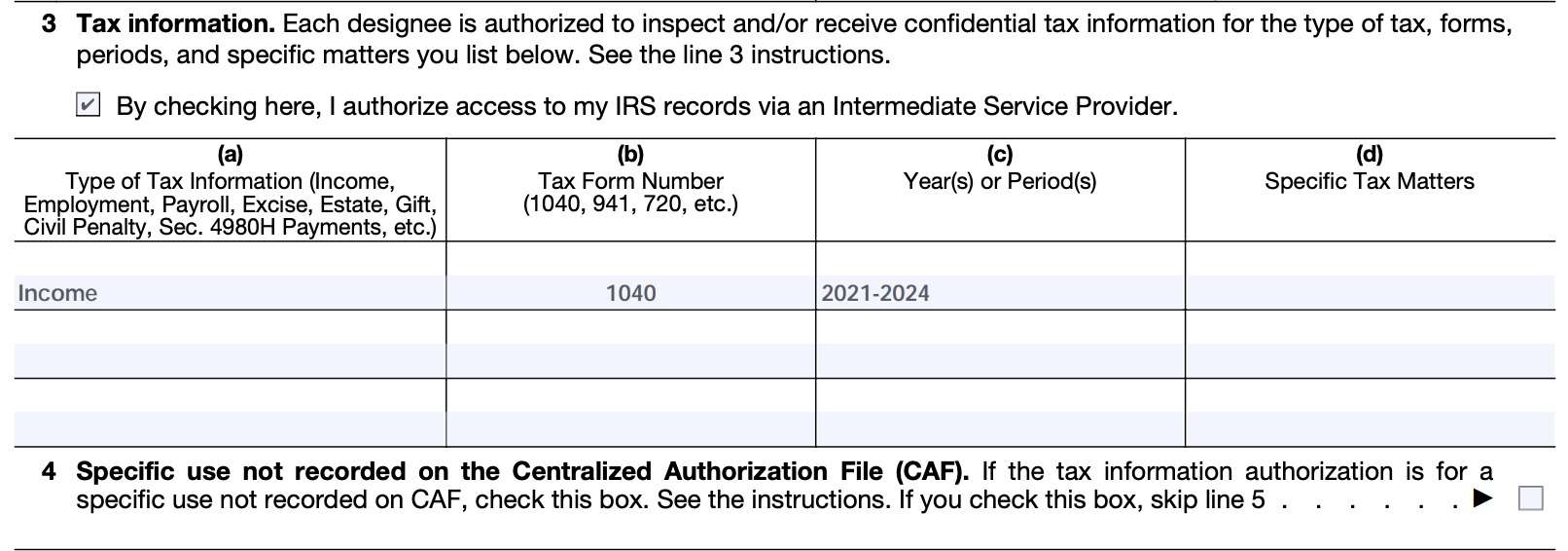

Line 3: Tax information

In this next step, you must specify the tax information that you are authorizing:

Column (a): Type of tax information

Enter the type of tax information here. Examples include:

- Income tax

- Employment tax

- Payroll tax

- Excise tax

- Gift tax

Column (b): Tax form number

Enter the tax form number, such as Form 1040, or Form 720, that you wish to release.

Column (c): Year(s) or Period(s)

You may enter specific years or tax periods (such as tax quarters for quarterly returns).

Column (d): Specific tax matters

If you wish to limit your appointee’s authority to receive or inspect all of the requested tax information, specify the information here. Otherwise, you may enter “not applicable” to authorize your designee to receive all of the requested information.

What you may specify

Multiple years or periods: You can specify more than one year or period. For example, to grant access for tax years 2018 through 2021, you would simply enter, “2018-2021.”

Note that listed dates are considered to be inclusive, not exclusive. In other words, entering “2018-2021” would authorize the release of information related to tax years 2018 and 2021.

Future periods: You can specify future years or periods, in addition to the current year. However, the IRS will not release information for tax periods more than 3 years after December 31 of the calendar year that you file.

For example, if you submit a request in January 2023, the IRS will not release any information for tax years or time periods beginning in 2027.

Use of an intermediate service provider (ISP): You can authorize access to your IRS records via an ISP by checking the appropriate box. If you do not do this, your designee can still access the requested information through the IRS e-Services Transcript Delivery System.

What you may NOT specify

Blanket requests: The IRS will not consider overly broad, general requests, such as “all tax years,” “all forms” or “all tax matters.” Instead, the IRS will send the 8821 form back to the requestor.

Line 4: Specific use not recorded on the Centralized Authorization File (CAF)

There is certain tax information that the IRS does not record on the CAF. If the authorization is for one of the following purposes, check this box and skip Line 5:

- Requests to disclose information to loan companies or educational institutions

- Requests to disclose information to federal or state agency investigators for background checks

- Requests for information regarding the following forms:

- Form SS-4, Application for Employer Identification Number

- Form W-2 Series

- Form W-4, Employee’s Withholding Certificate

- Form W-7, Application for IRS Individual Taxpayer Identification Number

- Form 843, Claim for Refund and Request for Abatement

- Form 966, Corporate Dissolution or Liquidation

- Form 1096, Annual Summary and Transmittal of U.S. Information Returns

- Form 1098, Mortgage Interest Statement

- Form 1099 Series returns

- IRS Form 1128, Application to Adopt, Change, or Retain a Tax Year

- Form 2553, Election by a Small Business Corporation or

- Form 4361, Application for Exemption From Self-Employment Tax for Use by Ministers, Members of Religious Orders, and Christian Science Practitioners.

If you check this box, your designee should mail or fax a completed Form 8821 to the IRS office handling the specific matter. Otherwise, your designee should bring a copy of Form 8821 to each appointment to inspect or receive sensitive information.

A specific-use tax information authorization will not revoke any prior tax information authorizations.

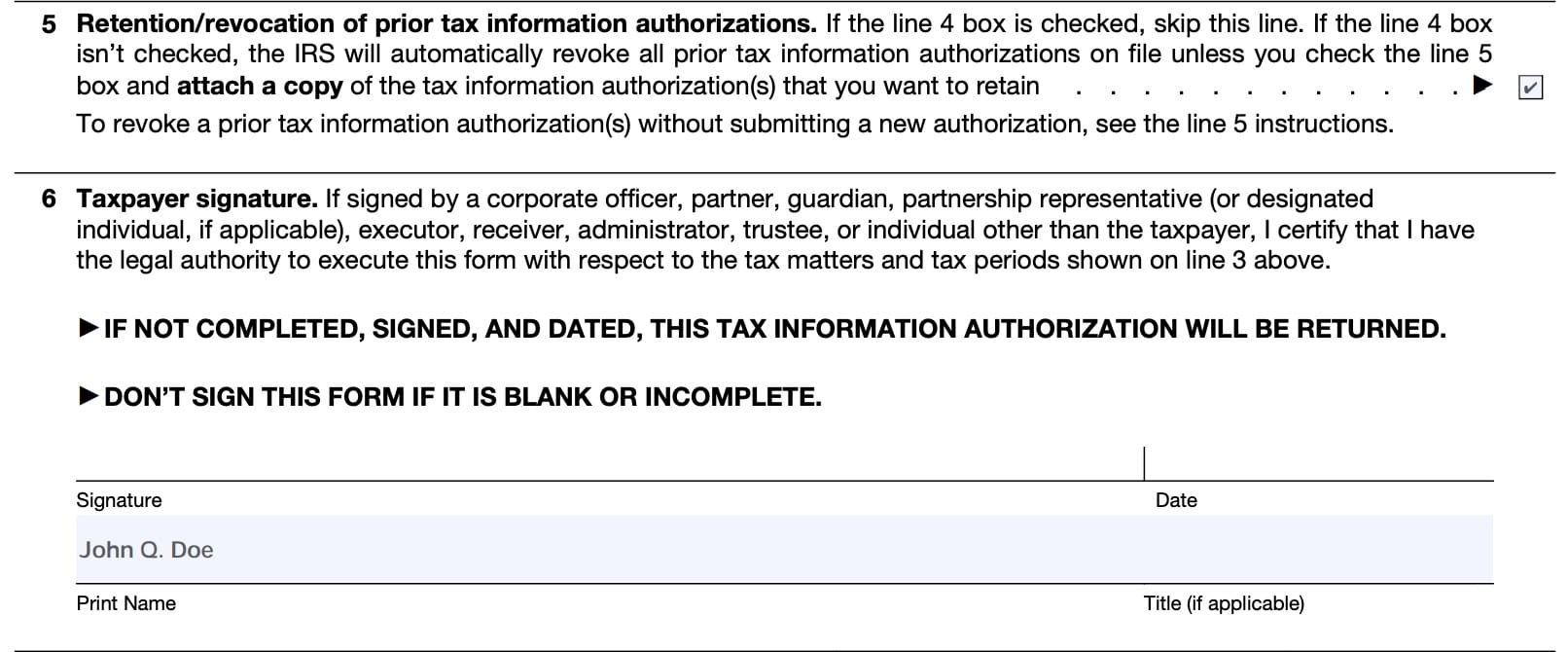

Line 5: Retention or revocation of prior tax information authorizations

If you checked the box in Line 4, skip this field. The IRS will automatically revoke all prior tax authorizations on file, unless you:

- Check the box in Line 5

- Attach a copy of all tax authorizations that you wish to retain

If you want to revoke a prior taxpayer’s tax information authorization without submitting a new authorization, simply write “REVOKE” across the top of the authorization that you wish to revoke. For taxpayers who do not have a copy of the prior authorization and it is not a specific use authorization, then send a letter to the appropriate IRS location with the following information:

- A statement that you are revoking the designee’s authority

- Name and address of each designee whose authority is being revoked,

- Related tax matters and tax periods, and

- Dated signature

Line 6: Taxpayer signature

In Line 6, sign and date the form. Beneath your signature, clearly print your full name and title, if you have one.

Filing considerations

Below are some things to consider when filing Form 8821.

Does IRS Form 8821 authorize tax practitioners to do anything on behalf of their clients?

While this tax form authorizes the release of a client’s tax information to his or her tax professional or other third party, it does not authorize that third party to be an authorized agent of the taxpayer or to act as a representative on any tax matter.

The form instructions clearly state that Form 8821 does not authorize a designee to do any of the following:

- Speak on your behalf

- To execute a request to allow disclosure of return or return information to another third party

- To advocate a taxpayer’s position regarding federal tax laws

- To execute waivers, consents, closing agreements, or

- To represent you in any other manner before the IRS

When should I NOT use IRS Form 8821?

There are some situations which call for different types of requests not covered by this tax form.

Power of attorney

Taxpayers who wish to appoint a someone as a representative before the IRS should file IRS Form 2848, Power of Attorney and Declaration of Representative, instead of the tax information authorization form.

The key difference is that the power of attorney form allows the designee to represent the client in front of the IRS on a tax-related issue.

Completing the power of attorney form is more appropriate for a tax situation which requires the tax expert to act on behalf of the client in representative matters.

Fiduciary relationships

If you wish to disclose a fiduciary relationship, you should instead file IRS Form 56, Notice Concerning Fiduciary Relationship. In a fiduciary relationship, the specified person acts as the taxpayer, not as the taxpayer’s representative.

For financial institutions acting as a fiduciary on behalf of the taxpayer, IRS Form 56-F, Notice Concerning Fiduciary Relationship of Financial Institution, would be filed instead of Form 56.

Release of tax transcripts or tax returns from previous tax years

If you’re simply looking to obtain copies of previous returns or tax information related to those returns, the easiest way to obtain them is to file one of the following forms:

- IRS Form 4506, Request for Copy of Tax Return

- IRS Form 4506-T, Request for Transcript of Tax Return

- IRS Form 4506T-EZ, Short Form Request for Individual Tax Return Transcript

- IRS Form 4506-C, IVES Request for Transcript of Tax Return

Please note: there may be additional fees associated with obtaining additional copies of previous income tax returns.

How do I file IRS Form 8821?

You may file a completed authorization form via mail or fax to the IRS office assigned to your location. See the table below based on your location.

| If you live here | Mail your completed Form 8821 here | Fax your completed Form 8821 here |

| Alabama, Arkansas, Connecticut, Delaware, District of Columbia, Florida, Georgia, Illinois, Indiana, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Michigan, Mississippi, New Hampshire, New Jersey, New York, North Carolina, Ohio, Pennsylvania, Rhode Island, South Carolina, Tennessee, Vermont, Virginia, or West Virginia | Internal Revenue Service 5333 Getwell Road, Stop 8423 Memphis, TN 38118 | 855-214-7519 |

| Alaska, Arizona, California, Colorado, Hawaii, Idaho, Iowa, Kansas, Minnesota, Missouri, Montana, Nebraska, Nevada, New Mexico, North Dakota, Oklahoma, Oregon, South Dakota, Texas, Utah, Washington, Wisconsin, or Wyoming | Internal Revenue Service 1973 Rulon White Blvd., MS 6737 Ogden, UT 84201 | 855-214-7522 |

| All APO and FPO addresses, American Samoa, Commonwealth of the Northern Mariana Islands, Guam, U.S. Virgin Islands, Puerto Rico, a foreign country, or otherwise outside the United States. | Internal Revenue Service International CAF Team 2970 Market Street MS 4-H14.123 Philadelphia, PA 19104 | 855-772-3156 304-707-9785 (For taxpayers outside the United States) |

What are the most common mistakes people make when filing IRS Form 8821?

According to the IRS website, here are some of the most common mistakes that people make when filing a tax authorization form:

- Missing taxpayer signature and/or date.

- Page 4 of the form instructions provides the requirement for the signature and date

- Non-specific identification of tax periods (tax matters), generalizations.

- For example, All Years, All future periods

- Incorrect EIN/SSN for taxpayer

Video walkthrough

Watch this instructional video for for a step-by-step guide to IRS Form 8821.

Frequently asked questions

The IRS recommends that you not use Form 8821 to release your tax information if there is another viable option. Examples of situations where Form 8821 is not warranted include: powers of attorney, fiduciary relationships, and release of tax return transcripts.

Any taxpayer may file this form with the IRS to authorize the release of specific information, such as tax returns, to any individual, corporation, firm, organization, or partnership they choose.

IRS Form 8821, Taxpayer Information Authorization, is the official IRS form that taxpayers may use to authorize the IRS to release specific account information to a third party. Taxpayers may also use this form to revoke previous tax information authorizations on file in the IRS’ Centralized Authorization File (CAF).

Where can I find a copy of IRS Form 8821?

You can find a copy of this form, as well as other tax forms, on the IRS website. For your convenience, we’ve attached the latest version to the bottom of this article.