IRS Form 8822-B Instructions

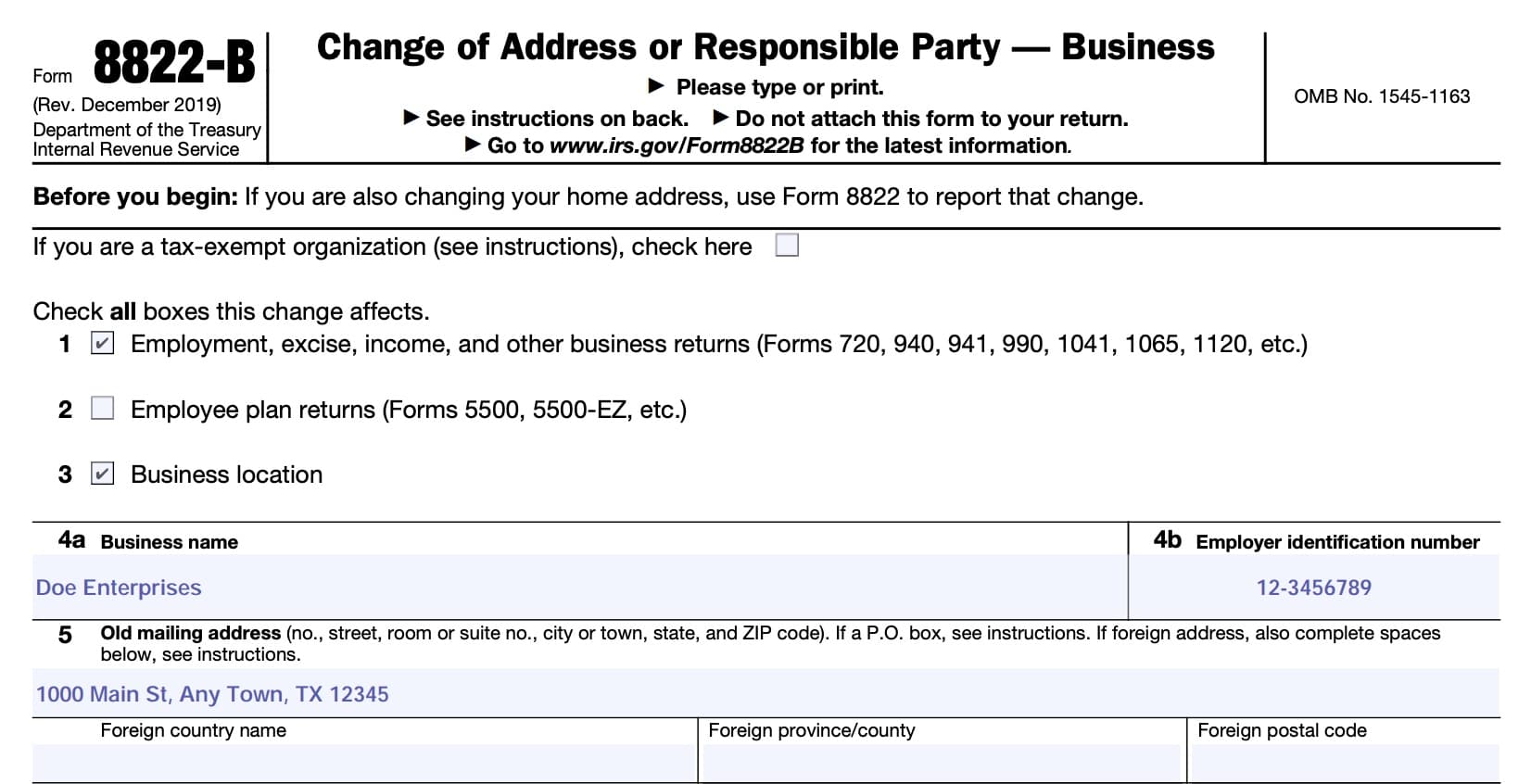

If you’re a business owner trying to notify the Internal Revenue Service of an address change, or the change of responsible party for a business entity, you may need to file IRS Form 8822-B, Change of Address or Responsible Party – Business.

In this article, we’ll walk you through everything you need to know about IRS Form 8822-B, including:

- How to complete IRS Form 8822-B

- Filing considerations

- Frequently asked questions

Let’s begin by going through this tax form, step by step.

Table of contents

How do I complete IRS Form 8822-B?

This one-page form is fairly straightforward to complete. Let’s start at the top of the form.

Tax-exempt organizations

Just above Line 1, there is a check box. If you are completing Form 8822-B on behalf of a tax-exempt organization, check this box.

As a reminder, if you are also changing your home address, do not use this form. Instead, you should file IRS Form 8822, Change of Address, to notify the federal government of your new home mailing address.

For Lines 1 through 3, you will only check the box or boxes that your change of address form impacts.

Line 1

Check this box if this change of address impacts any of the following tax returns:

- IRS Form 720: Quarterly Federal Excise Tax Return

- IRS Form 940: Employer’s Annual Federal Unemployment (FUTA) Tax Return

- IRS Form 941: Employer’s QUARTERLY Federal Tax Return

- IRS Form 990: Return of Organization Exempt From Income Tax

- IRS Form 1041: U.S. Income Tax Return for Estates and Trusts

- IRS Form 1065: U.S. Return of Partnership Income

- IRS Form 1120: U.S. Corporation Income Tax Return

- Other business tax returns not listed on the form

Do not check this box for employee plan returns. Instead, see Line 2, below.

Line 2

Check this box if your change of address impacts employee plan returns, such as Form 5500, Form 5500-EZ, or other similar returns.

Line 3

Check this box if your business location changes. This may or may not include a change in your business mailing address.

Line 4a: Business name

In Line 4a, enter the business name.

Line 4b: Business employer identification number

For Line 4b, enter the business’s employer identification number.

Line 5: Old mailing address

Here, you’ll enter the old address for your business.

Enter your street address or P.O. Box number, followed by city, state, and zip code.

Foreign addresses

If you are located in a foreign country, enter the following:

- Complete foreign country name (do not abbreviate)

- Foreign province, state or county,

- Postal code

P.O Boxes

If you use a P.O. Box, you should only enter your P.O. Box number if the U.S. Postal Service does not deliver mail to your street address.

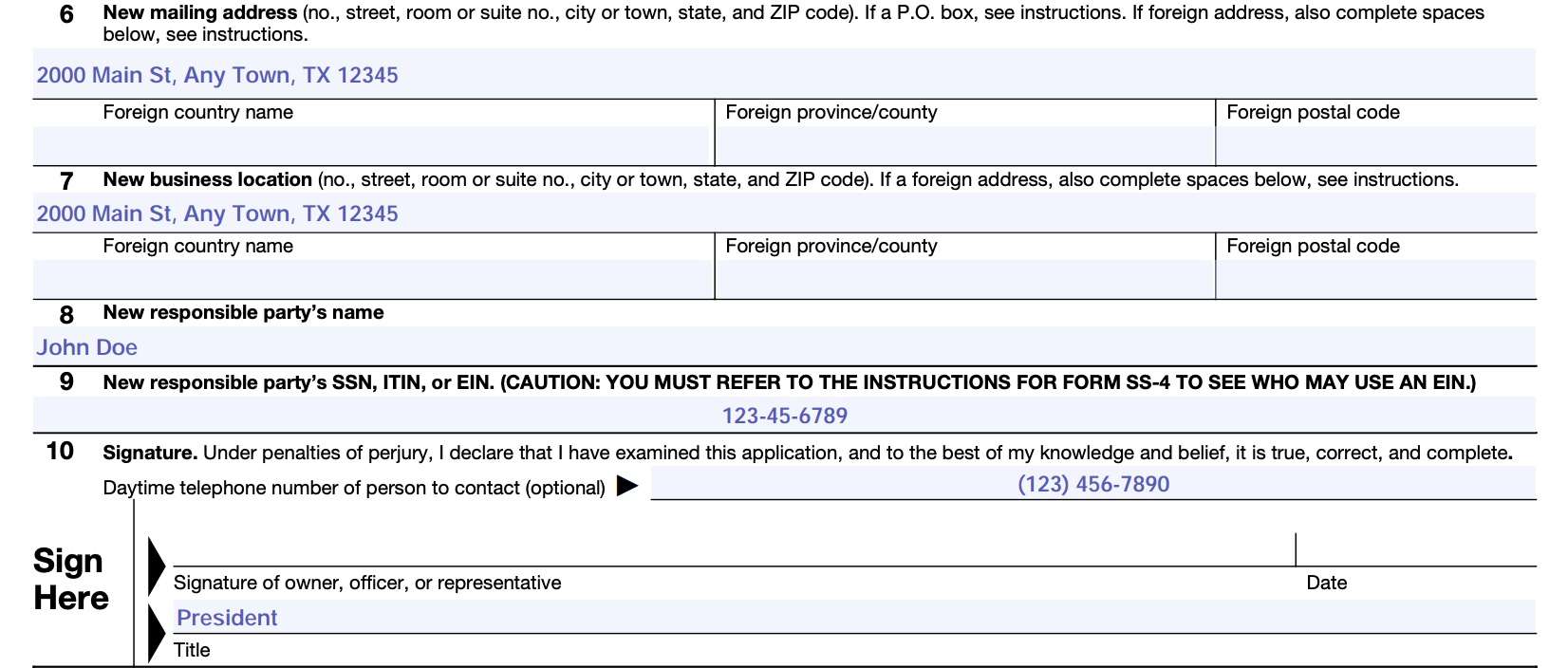

Line 6: New Business address

In Line 6, enter your new business address. This may be different from your new business’ physical location, which you’ll enter into Line 7.

Enter your mailing address, followed by city, state, and zip code. If you are located in a foreign country, enter the following:

- Complete foreign country name (do not abbreviate)

- Foreign province, state or county,

- Postal code

If you receive your mail in the care of a third party, such as your accountant or attorney, then enter ‘C/O,’ followed by the third party’s name and address.

Line 7: New business location

Enter your new business location’s physical address. This may be different from your new mailing address, particularly if you receive mail at a post office box or in care of a third party.

Enter your new location in the same manner as you entered your new mailing address in Line 6.

Line 8: New responsible party’s name

If you are changing responsible parties, enter the responsible party information in Lines 8 & 9.

In Line 8, enter the name of the new responsible party.

According to the instructions for IRS Form SS-4, Application for Employer Identification Number, only government entities may use EIN holders as a responsible party. All other entities, such as businesses and non profit organizations, must list an individual as the responsible party.

Line 9: New responsible party’s tax identification number

For Line 9, enter the new responsible party’s tax identification number. This can be one of the following:

- Social Security number (SSN)

- Individual taxpayer identification number (ITIN)

- Employer identification number (EIN)

Only government entities, such as local governments, may have a responsible party that uses an EIN as their tax identification number. All other entities must list an individual with either an SSN or ITIN.

Line 10: Signature

In Line 10, the owner, officer, or an authorized representative will sign and date the form, attesting to the accuracy of the new address and identity of the responsible party.

How do I file Form 8822-B?

You cannot file the 8822-B form electronically.

You must file by mailing your completed Form 8822-B to the Internal Revenue Service office responsible for service at your old location. There are two IRS offices that handle change of business address forms: Kansas City and Ogden.

Kansas City office locations

If your old business address is located in one of the following states, then send your completed copy of Form 8822-B to:

Internal Revenue Service

Kansas City, MO 64999

| Connecticut | Maryland | Pennsylvania |

| Delaware | Massachusetts | Rhode Island |

| District of Columbia | Michigan | South Carolina |

| Georgia | New Hampshire | Tennessee |

| Illinois | New Jersey | Vermont |

| Indiana | New York | Virginia |

| Kentucky | North Carolina | West Virginia |

| Maine | Ohio | Wisconsin |

Ogden office locations

If your old business address is located in one of the following states, or outside the United States, then send your completed copy of Form 8822-B to:

Internal Revenue Service

Ogden, UT 84201-0023

| Alabama | Iowa | New Mexico |

| Alaska | Kansas | North Dakota |

| Arizona | Louisiana | Oklahoma |

| Arkansas | Minnesota | Oregon |

| California | Mississippi | South Dakota |

| Colorado | Missouri | Texas |

| Florida | Montana | Utah |

| Hawaii | Nebraska | Washington |

| Idaho | Nevada | Wyoming |

Video walkthrough

Watch this instructional video for step by step guidance on completing Form 8822-B, Change of Address or Responsible Party – Business.

Frequently asked questions

According to the IRS website, it usually takes between 4 and 6 weeks to process a taxpayer’s address or responsible party change notification. You should receive confirmation notices, known as CP148 notices, at your old and new business locations.

Taxpayers must mail your change of address notification to the IRS office assigned to your old business location. For example, a business owner moving their business from Connecticut to another location would send their change of address form to the Kansas City office.

No, you do not have to use Form 8822-B to notify the IRS of your business location change. You may also call the IRS directly, notify the IRS in writing, or list your new address on your business income tax or employment tax returns.

According to the IRS, you must notify the IRS of a change in the identity of the responsible party by filing IRS Form 8822-B within 60 days of any change in responsible party.

IRS Form 8822-B, Change of Address or Responsible Party – Business, is the tax form that business owners may use to notify the Internal Revenue Service of address changes or a changes in responsible party.

Where can I find IRS Form 8822-B?

You may download this form from the IRS website. For your convenience, we’ve enclosed the most recent version of this form in this article.