IRS Form 8825 Instructions

If you are part of a partnership or S corporation that manages rental real estate, you may need to report your rental income and expenses on IRS Form 8825, Rental Real Estate Income and Expenses of a Partnership or an S Corporation.

In this article, we’ll take an in depth look at IRS Form 8825, including:

- How to complete IRS Form 8825

- How to report rental income or loss on your business tax return

- Frequently asked questions

Let’s begin with an overview of IRS Form 8825 itself.

Table of contents

How do I complete IRS Form 8825?

This tax form is relatively straightforward. There is room to list up to 8 properties (marked A through H on the form). However, if you need to list more rental properties, you may use additional copies of Form 8825.

Let’s begin at the top of this tax form.

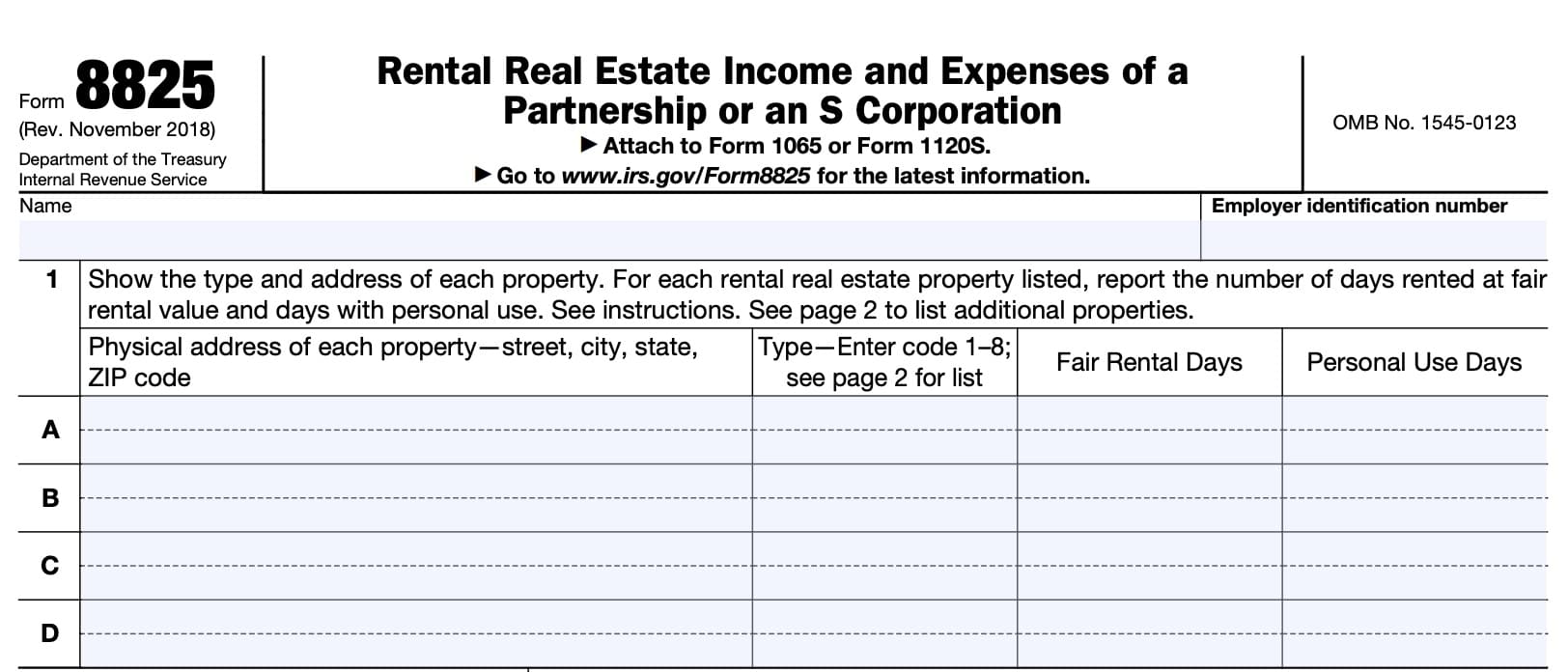

Taxpayer information

At the very top of the tax form, enter the name of the partnership or S corporation, followed by the tax entity’s employer identification number (EIN).

Line 1: Property information

In Line 1, you can list up to 4 different properties on Page 1 (marked A through D). If needed, you can use the information fields on Page 2 (marked E through H).

For each rental property, you’ll need to enter the following information:

- Physical address of the property

- Include the street address, city, state, and ZIP code

- Type of property code (see below)

- Number of fair rental days available during the tax year

- Number of personal use days during the tax year

Internal Revenue Code Section 280A contains additional information for determining the number of days for fair rental use and personal use.

Property code type

Below is a list of the types of property codes that you may use to describe your rental property.

- Single family residence

- Multi-family residence

- Vacation home or short-term rental

- Commercial property

- Unimproved land

- Royalties

- Self-rental

- Other: Include a description with the code on Form 8825 or on a separate statement attached to your income tax return

Rental real estate income

In this section, we’ll enter the income from rental real estate activity.

Under each column heading, the contents of that column should reflect the income and expenses for that particular property.

For example, an apartment building is listed under the column heading ‘A.’ All income and expenses under the column heading ‘A’ should reflect the total income and total expenses for that apartment building, as described in Line 1, above.

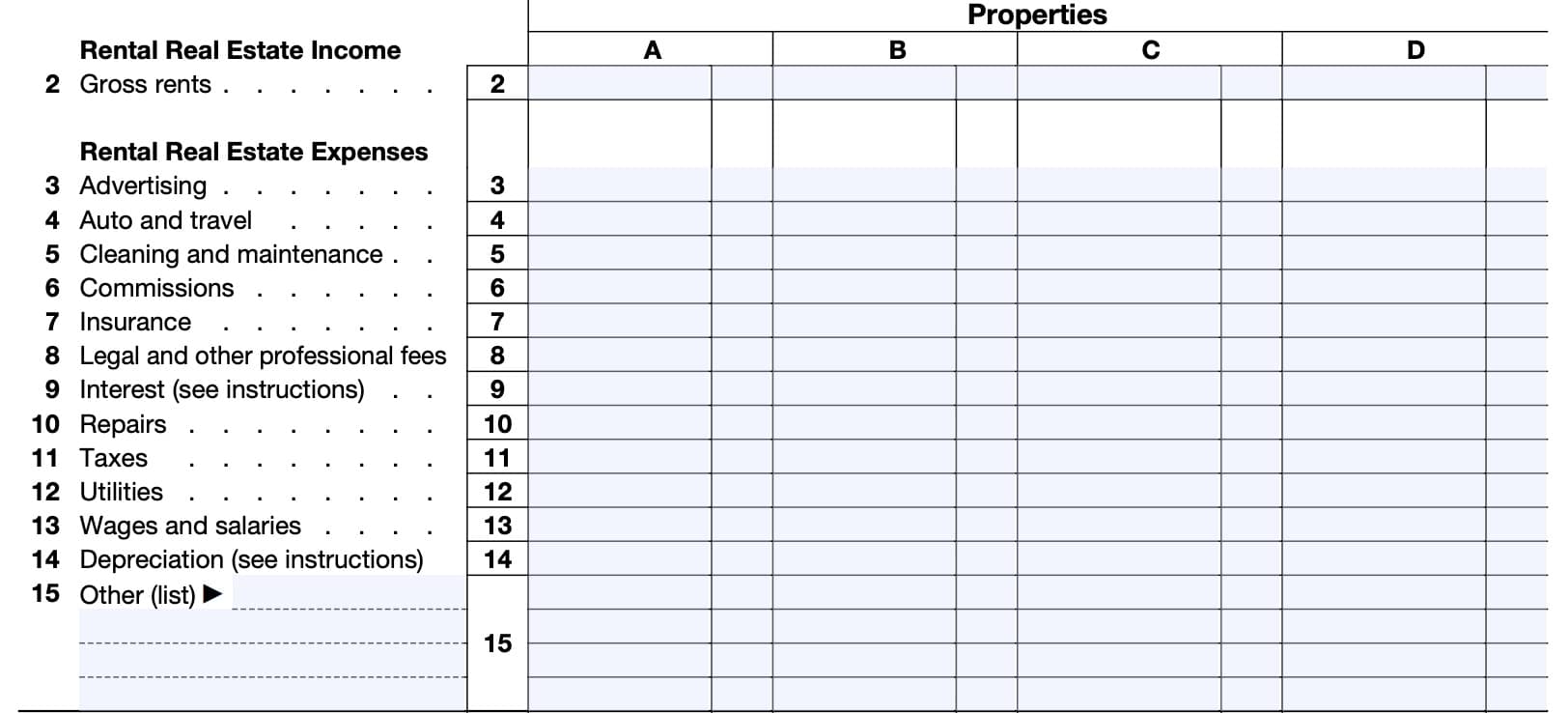

Line 2: Gross rents

For each rental property, enter the gross income from rents during the tax year.

Rental real estate expenses

In this section, we’ll outline the different types of deductible expenses. Limitations may apply to certain expenses, which we will point out as we move through the form instructions.

Line 3: Advertising

Enter any advertising expenses associated with each rental property.

Line 4: Auto and travel

In Line 4, enter the automobile and travel expenses related to the management of each rental property.

Line 5: Cleaning and maintenance

Enter cleaning and maintenance expenses in Line 5.

Line 6: Commissions

If you paid commissions to a property manager for your rental real estate activities, enter the commissions paid for each property in Line 6.

However, the following commissions might be part of the basis of your rental property, which you cannot deduct from taxable income:

- Mortgage commissions paid to a mortgage broker to obtain a qualifying mortgage

- Sales commissions paid to a real estate agent for the purchase or the sale of a rental property

Line 7: Insurance

In Line 7, enter the cost of insurance for each of your rental properties. This might include homeowner’s property and casualty insurance or liability insurance coverage.

However, title insurance purchased as part of the purchase transaction is not deductible as a rental expens. You must add this cost to the property’s basis.

Line 8: Legal and other professional fees

Enter the total of any legal or professional expenses of a partnership or S corporation, as they relate to each rental property. For example, you may deduct the cost of tax return preparation for your business entity.

You may also include any expenses you paid to resolve a tax underpayment related to a particular rental activity.

Line 9: Interest

Enter your deductible mortgage interest for each rental property in Line 9. Generally, interest from mortgage payments can be found on IRS Form 1098, Mortgage Interest Statement.

Your deductible interest payments may be limited. To find out more, you may need to complete IRS Form 8990, Limitation on Business Interest Expense Under Section 163(j).

Line 10: Repairs

Enter the cost of repairs to each rental property in Line 10.

Repairs vs. capital improvements

Please note that there is a difference between repairs and capital improvements. You cannot include capital improvements, such as a new air conditioning system or major renovations, as part of these income tax deductions.

Rather, you must capitalize the cost of improvements as part of the property’s basis for tax purposes.

Line 11: Taxes

Enter the cost of state and local taxes that you incurred for each property. However, you cannot deduct federal taxes or tax penalties.

However, you generally cannot include taxes assessed that result in a net improvement of your property or local benefits that increase the value of the property.

Examples of these nondeductible expenses might include:

- Putting in streets or sidewalks

- Installing water or sewage systems

These are considered nondepreciable capital expenditures that must be added to your property’s basis. Similarly, community development district (CDD) fees generally fall under this category to the extent that assessments are used for development or growth.

You can deduct local benefit taxes that are for the maintenance, repair, or upkeep of existing benefits.

Line 12: Utilities

Enter the cost of utilities provided or paid for for each rental property.

Line 13: Wages and salaries

In Line 13, enter the cost of wages and salaries paid during the tax year in the course of managing your real estate business.

Line 14: Depreciation

The partnership or S corporation may claim a depreciation deduction each year for rental property. This does not include land, which is not considered a depreciable asset.

If the partnership or S-corporation placed property in service during the current tax year, or claimed depreciation on any vehicle or listed property used in the management of a rental activity, then you may need to complete and attach IRS Form 4562, Depreciation and Amortization.

Line 15: Other expenses

In Line 15, enter the cost of other expenses as they relate to each rental property.

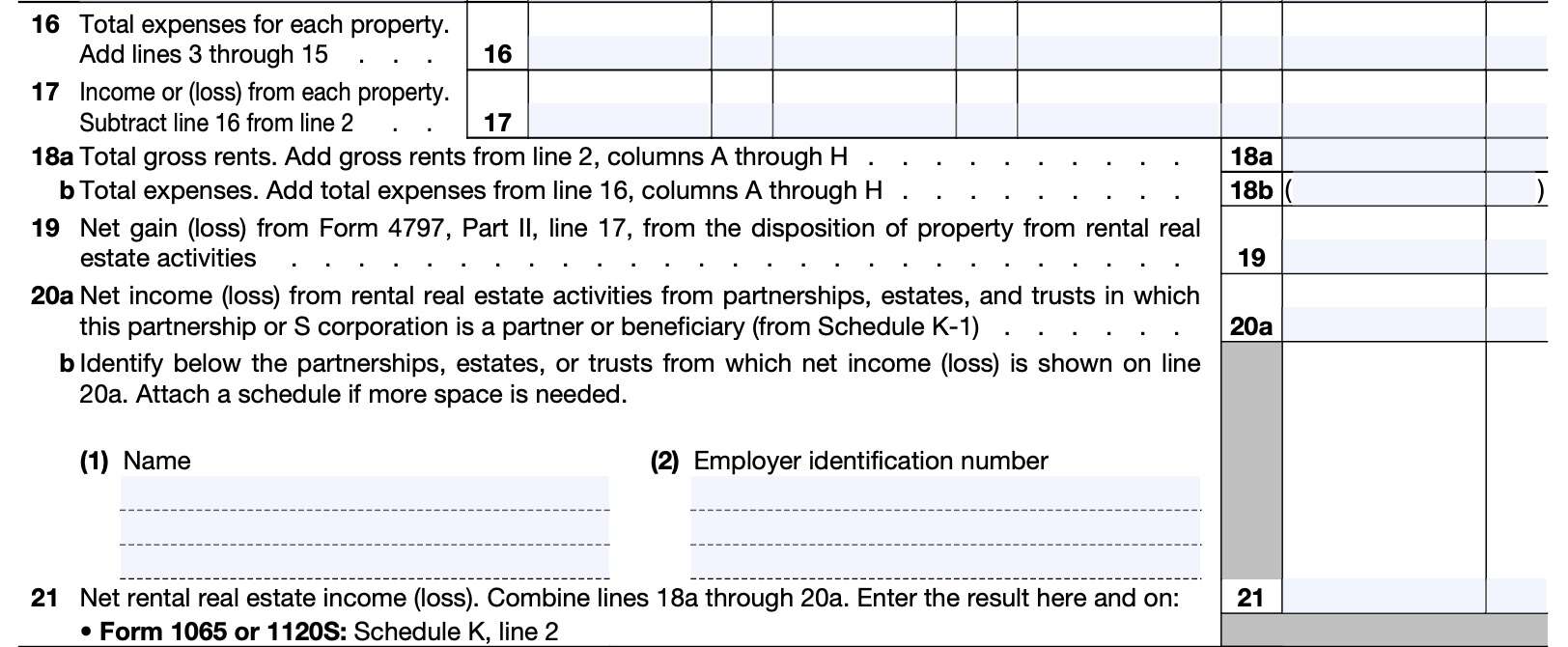

Line 16: Total expenses for each property

For each column, combine Lines 3 through Line 15. Enter the total expenses in Line 16 under each column heading.

Line 17: Income or loss from each property

For each column, subtract Line 16 from Line 2.

Line 18a: Total gross rents

Add the gross rents from Line 2, columns A through H. Enter the total in Line 18a.

If you have completed more than one Form 8825, you will need to combine items from Line 18a through Line 21 on just one form.

Line 18b: Total expenses

Add all expenses from Line 16, columns A through H. Enter the total in Line 18b.

Line 19: Net gain (loss) From disposition of property

Enter the net capital gains or losses from the disposition of rental real estate property, as reported on IRS Form 4797, Sales of Business Property, Part II, Line 17.

Line 20a: Net income (loss) from rental real estate activities

In Line 20a, enter the net profit or loss from rental real estate activities in which this partnership or S corporation is a partner or beneficiary. This income can be reported from any of the following:

- Partnerships (including limited partnerships)

- Estates

- Trusts

You should find the income or loss reported on the business entity’s copy of Schedule K-1.

Line 20b

Identify the partnerships, estates, or trusts, for which the income or loss was reported on Line 20a. For each entity, include the name and taxpayer identification number (EIN) as reported on Schedule K-1.

If you need more space, you may attach a schedule or separate document.

Line 21: Net rental real estate income or loss

Combine Lines 18a through 20a. Enter the result in Line 21 and on Schedule K, Line 2, of either:

- IRS Form 1065, U.S. Return of Partnership Income, or

- IRS Form 1120S, U.S. Income Tax Return for an S Corporation

Video walkthrough

Watch this instructional video, where we go through IRS Form 8825, step by step.

Frequently asked questions

Partnerships and S corporations use Form 8825 to report income and deductible expenses from rental real estate activities. This includes net income or loss from rental real estate activities that flow through from partnerships, estates, or trusts.

No. The Internal Revenue Service considers a single-member LLC to be a disregarded entity for tax purposes, unless it is also registered as an S corporation. In this case, you would report rental income an expenses on Schedule E, Supplemental Income.

Taxpayers should not include the following expenses on Form 8825: Income or deductions from a trade or

business activity or a rental activity other than rental real estate, portfolio income or deductions, Section 179 expense deductions, commercial revitalization deductions, or other items that must be reported separately to partners or shareholders.

Where can I find IRS Form 8825?

Generally, you can find the latest versions of IRS forms on the Internal Revenue Service website. For your convenience, we’ve included the latest copy of IRS Form 8825 here, in this article.