IRS Form 8832 Instructions

If you’re seeking a new classification for your business, or want to ensure that the Internal Revenue Service (IRS) recognizes your newly formed entity for tax purposes, then you’ll want to complete IRS Form 8832.

Table of contents

Introduction

This article will cover what you need to know about IRS Form 8832, including:

- Its intended purpose

- Who files IRS Form 8832

- What happens if you don’t complete the form

- How to complete the form

- How the IRS will process the form once received

Let’s begin by looking a little more closely how to complete this tax form.

How do I complete IRS Form 8832?

The tax form itself is fairly straightforward, having only 3 pages to complete. Your tax advisor or tax professional should be able to complete this form on your behalf.

Regardless, we’ll walk you step by step through this form if you’re completing it for the first time.

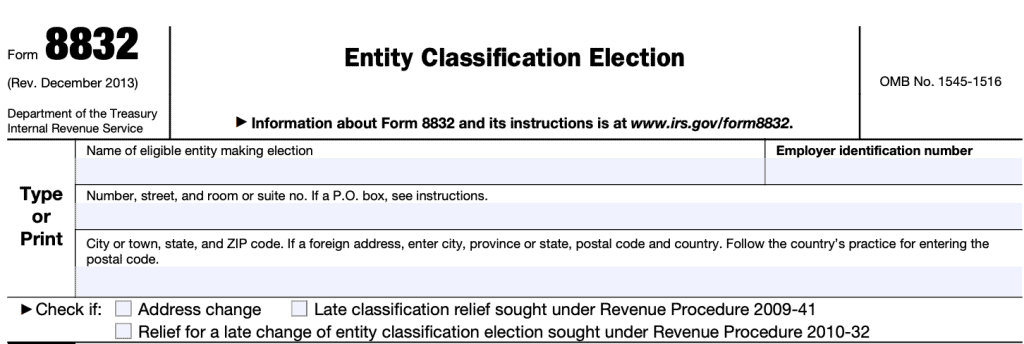

Taxpayer information

In the top of the form, you’ll enter:

- The name of the eligible entity

- Employer identification number (EIN)

- Street address

- City

- State

- Zip code

Also, you’ll check the appropriate box if any of the following apply:

- Address change

- Late classification relief sought under Revenue Procedure 2009-41

- Relief for a late change of entity classification election sought under Revenue Procedure 2010-32

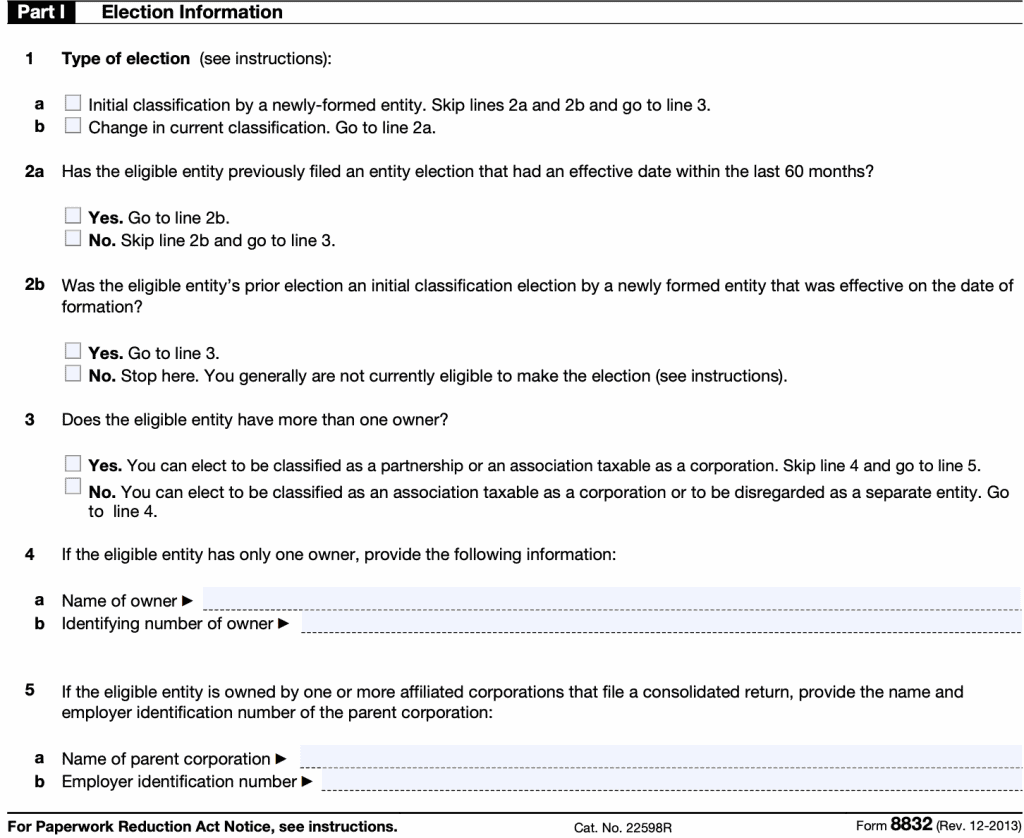

Part I: Election Information

Part I is relatively straightforward. We’ll go through question by question.

Question 1: Type of election

Either it’s a newly formed entity or a change in current classification. If it’s a new entity structure, select box 1a and proceed to Question 3, below.

Question 2a: Effective date

Was this within the past 60 months (5 years)? If yes, go to line 2b. If not, go to line 3.

Question 2b: Prior election

Was the prior election an initial classification election by a newly formed business entity? If not, you cannot change your classification without an IRS-issued private letter ruling (PLR) that grants you permission to do so.

Question 3: Number of owners

If there is only one owner, then the owner can choose to be taxed as a corporation or to be disregarded as a separate entity. Multiple owners can choose to be taxed as a corporation or partnership.

Question 4: Owner information

Only applicable if the eligible entity has one owner.

Question 5: Name and EIN of the parent corporation

Only applicable if the entity is owned by one or more corporations that file a consolidated return.

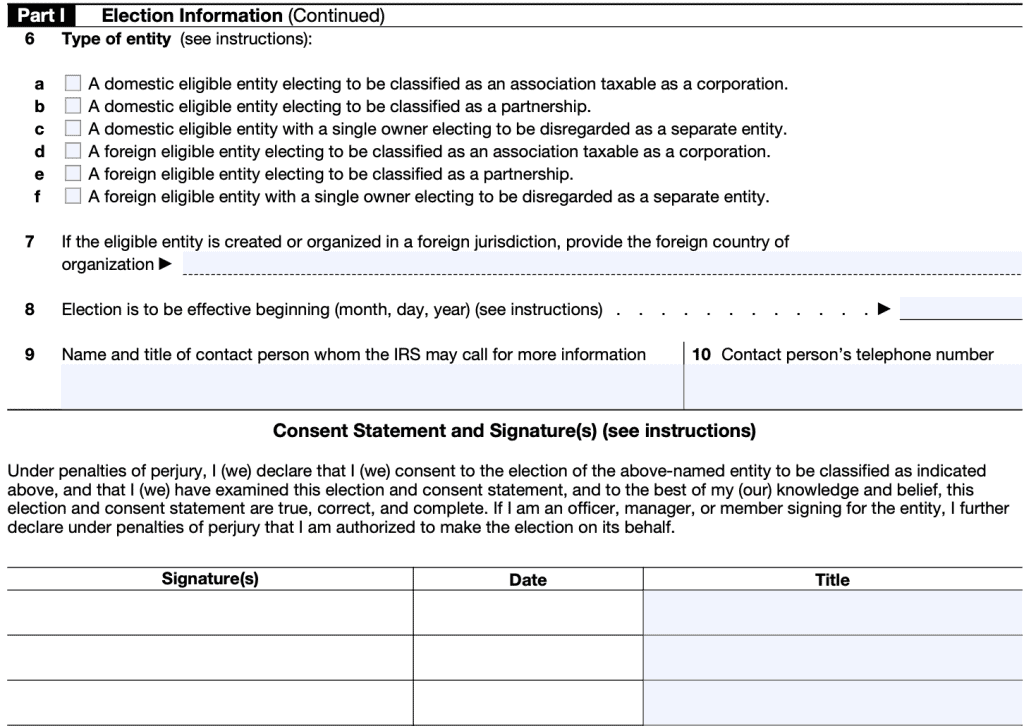

Questions 6 through 9, on the following page, allow for:

- Selection of the preferred classification

- Name of foreign country of jurisdiction (if applicable)

- Effective date of election

- Contact information

At the bottom of Part I, the Consent Statement and Signature requires the owners signature, sworn under penalty of perjury.

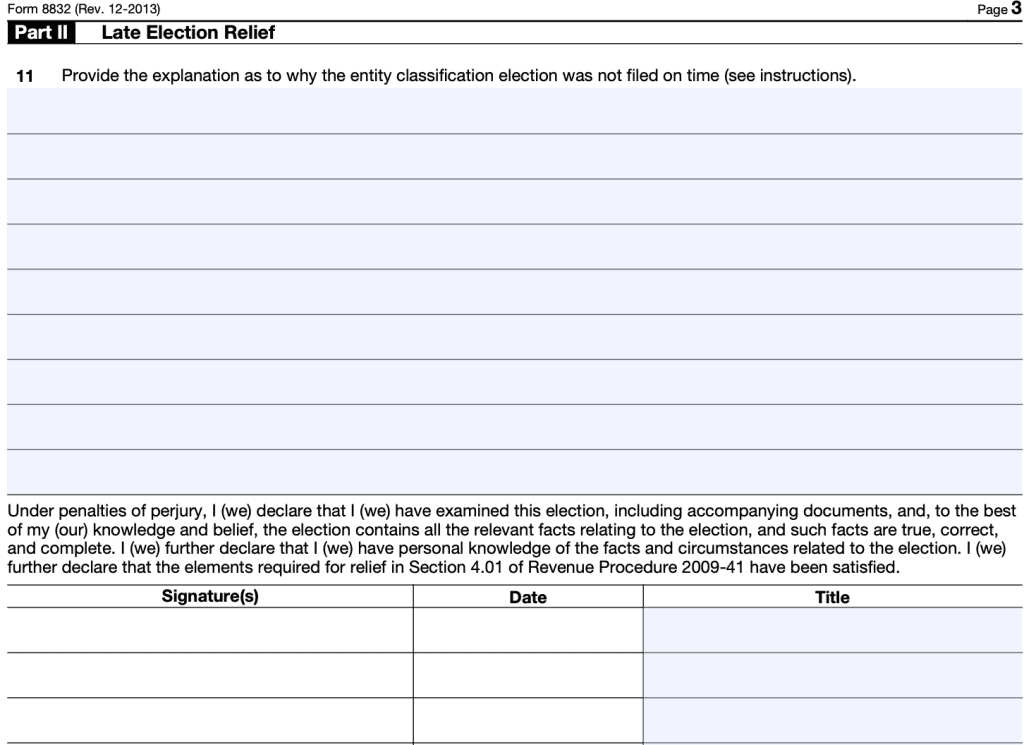

Part II: Late Election Relief

The filing entity will only complete Part II in the case of late entity classification elections. The entity must seek relief under Rev. Proc. 2009-41.

If true, then the following must also be true:

- The entity failed to obtain its requested classification as of the date of its formation (or upon the entity’s classification becoming relevant) or failed to obtain its requested change in classification solely because Form 8832 was not filed timely.

Additionally, at least ONE of the following must apply:

- The entity has not filed a federal tax or information return for the first year in which the election was intended because the due date has not passed for that year’s federal tax or information return; OR

- The entity has timely filed all required federal tax returns and information returns (or if not timely, within 6 months after its due date, excluding extensions) consistent with its requested classification for all of the years the entity intended the requested election to be effective and no inconsistent tax or information returns have been filed by or with respect to the entity during any of the tax years OR

- The entity has reasonable cause for its failure to timely make the entity classification election, OR

- Three years and 75 days have not yet passed

Who files IRS Form 8832?

According to the form instructions, the following eligible entities should file Form 8832:

- A domestic entity electing to be taxed as a corporation

- A domestic entity electing to change its current classification, even if it currently has default tax status under the default rule

- A foreign entity that has more than one owner, electing to be classified as a partnership

- A foreign entity that has at least one owner without limited liability, electing to be taxed as a corporation

- A foreign entity with a single owner having limited liability, electing to be a disregarded entity

- A foreign entity electing to change its current classification, even if currently receiving default treatment

It’s important to note that each member of the entity must file their federal income tax return in a manner consistent with the entity election. Otherwise, penalties may apply.

Who does NOT file Form 8832?

The following entities should not file IRS Form 8832:

- Tax-exempt organizations

- Real estate investment trusts (REITs)

- Companies that have elected S corporation status

Where do you send Form 8832?

There are two separate IRS locations to send IRS Form 8832, depending on your location.

Kansas City Office

Taxpayers in the states below will send their completed form to:

Department of the Treasury

Internal Revenue Service

Kansas City, MO 64999

- Connecticut

- Delaware

- District of Columbia

- Georgia

- Illinois

- Indiana

- Kentucky

- Maine

- Maryland

- Massachusetts

- Michigan

- New Hampshire

- New Jersey

- New York

- North Carolina,

- Ohio

- Pennsylvania

- Rhode Island

- South Carolina

- Vermont

- Virginia

- West Virginia

- Wisconsin

Ogden Office

Department of the Treasury

Internal Revenue Service

Ogden, UT 84201

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Florida

- Hawaii

- Idaho

- Iowa

- Kansas,

- Louisiana

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Mexico

- North Dakota

- Oklahoma

- Oregon

- South Dakota

- Tennessee

- Texas

- Utah

- Washington

- Wyoming

If you live outside the continental United States, in a foreign country or U.S. possession, you’ll send the form to:

Department of the Treasury

Internal Revenue Service

Ogden, UT 84201-0023

IRS Form 8832 Video Walkthrough

Watch this instructional video for step by step guidance on how to complete this tax form.

Frequently asked questions

Under § 7701 of the Internal Revenue Code, Revenue Procedure 2009-41 provides guidance for an eligible entity that requests relief for a late classification election. This election must be filed with the applicable IRS service center within 3 years and 75 days of the requested effective date of the eligible entity’s classification election.

The revenue procedure also provides guidance for those eligible entities that do not qualify for relief under this revenue procedure and that are required to request a letter ruling in order to request relief for a late entity classification election.

Revenue Procedure 2010-32 provides guidance and relief for certain foreign entities who may have made an erroneous election on a previous filing.

If none of these blocks are applicable, leave them blank.

IRS Form 8832, Entity Classification Election, directs the IRS how to treat eligible businesses for federal tax purposes. There are several options available.

A newly formed entity might select to be treated as a corporation, partnership, or disregarded entity.

For tax purposes, a disregarded entity is one that the IRS does not distinguish from its owner for the purpose of federal income taxes. Examples of disregarded business entities might include: a sole proprietorship or a single-member LLC.

In other words, the IRS treats the owner of a disregarded business entity as if he or she were reporting personal income without respect to the business itself. The owner would report the business income on their personal tax return.

It’s important to note that a disregarded entity is only disregarded for income tax purposes. A disregarded entity is still regarded for the purpose of excise tax and employment tax.

The IRS does not require anyone to file IRS Form 8832. However, if there is no filing, then the IRS assigns a default tax classification.

Unless an election is made on IRS Form 8832, a domestic eligible entity is either:

-A partnership if there are two or more partners, such as in a multi-member LLC

-Disregarded as a separate entity from its owner if there is only one business owner

Where can I obtain a copy of IRS Form 8832?

You may download a copy of the form from the IRS website or you may download the copy below.

Related articles

What do you think?

Let me know what you think of this article in the comments. If you feel like this article helped you, please share it, pin it or tag me. And if you have any additional tips, please share them in the comments.