IRS Form 8854 Instructions

If you’re a U.S. citizen who wishes to renounce their citizenship or a permanent U.S. resident who wishes to terminate their residency, you must meet certain tax reporting and payment requirements. Specifically, individuals must certify their tax compliance in the 5 taxable years prior to the year of expatriation using IRS Form 8854.

This in-depth article will walk you through this tax form, as well as some of tax issues surrounding it, including:

- How to complete IRS Form 8854

- Reporting requirements

- Tax obligations for expatriates

Let’s start with step by step guidance on completing IRS Form 8854.

Contents

Table of contents

How do I complete IRS Form 8854?

There are 3 parts to this tax form:

- Part I: General Information

- Part II: Initial Expatriation Statement for Persons Who Expatriated in 2023

- Part III: Annual Expatriation Statement for Persons Who Expatriated Before 2023

We’ll cover each part step by step. Let’s start with Part I.

Part I: General Information

All filers must complete Part I. Let’s walk through each line in detail.

Line 1: Mailing address and telephone number

Put down the contact information where you can be reached after the date of expatriation. If you have a post office box, enter your box number only if you do not receive mail at your street address.

Line 2: Address of principal foreign residence

Complete Line 2 if this is a different address from the address in Line 1. Enter the address information in the following order:

- Street address

- City

- Province or state

- Country

Follow the country’s practice for entering the postal code. Don’t abbreviate the country name.

Line 3: Country of tax residence

If this is different from Line 2, enter the country where you reside for tax purposes.

Line 4

Check the appropriate box.

If this is your first expatriation statement, complete Part II. If this is an annual expatriation statement, complete Part III.

Line 5: Date of expatriation

Enter the date you expatriated, based upon your citizenship status:

- U.S. citizens: Date you relinquished your US citizenship

- Long-term residents: Date you terminated your long-term residency

Line 6: List all countries of which you are a citizen

Including the United States, list the following:

- All countries of which you are a citizen

- The date you became a citizen of each country

- Including your birth date

Line 7: How you became a U.S. citizen

If you are a former U.S. citizen, describe how you became a citizen in the first place.

Line 8: Date you became a U.S. lawful permanent resident

For green card holders, enter the date you became a U.S. lawful permanent resident, or received your green card.

Part II: Initial Expatriation Statement for Persons Who Expatriated in 2023

If you expatriated in 2023, you must complete Part II. This part contains 4 sections:

- Section A: Expatriation Information

- Section B: Balance Sheet

- Section C: Property Owned on Date of Expatriation

- Section D: Deferral of Tax

We’ll go through Part II line by line. Only complete Section C (below) if you are a covered expatriate.

Section A

Line 1: U.S. income tax liability

For each of the 5 tax years ending before the date of your expatriation, determine your total tax minus any foreign tax credit.

For tax year 2022, use the amount shown on the 2022 Form 1040, Line 24, after subtracting any amount reported on Line 1 of Schedule 3, Additional Credits & Payments. This is the foreign tax credit.

Line 2: Net worth on date of expatriation

Use Part II, Section B (Balance sheet) to determine your net worth on the date of expatriation. Enter this amount here.

Line 3

Check “Yes” if both of the following apply:

- At birth, you became a U.S. citizen and a citizen of another country, AND

- You continue to be a citizen of, and taxed as a resident of that other country as of your expatriation date.

Line 4

Only answer Line 4 if you answered “Yes” to Line 3.

Including the year of your expatriation, have you been a U.S. resident for no more than 10 of the previous 15 taxable years?

Line 5

Were you under age 18 1/2 on the date of expatriation, AND a resident for not more than 10 years prior to expatriation?

Substantial presence test

To help determine U.S. residency, use the following substantial presence test as described in Chapter 1 of Publication 519: U.S. Tax Guide for Aliens:

To meet this test (in 2022), you must be physically present in the United States on at least:

- 31 days during 2022; and

- 183 days during the 3-year period that includes 2022, 2021, and 2020. This includes:

- All the days you were present in 2022

- 1/3 of the days you were present in 2021

- 1/6 of the days you were present in 2020

Line 6

Check the “Yes” box if you have complied with your tax obligations for the 5 tax years ending before the date on which you expatriated.

This includes, but is not limited to, the following:

- Obligations to file required tax returns, such as:

- Income tax return

- Employment tax return

- Gift tax return

- Required information returns

- Obligations to pay all relevant tax liabilities

- Including penalties and interest, if applicable

You will be subject to tax under Internal Revenue Code Section 877A if you have not certified your compliance with these obligations, regardless of whether your average annual income tax liability or net worth exceeds the applicable threshold amounts.

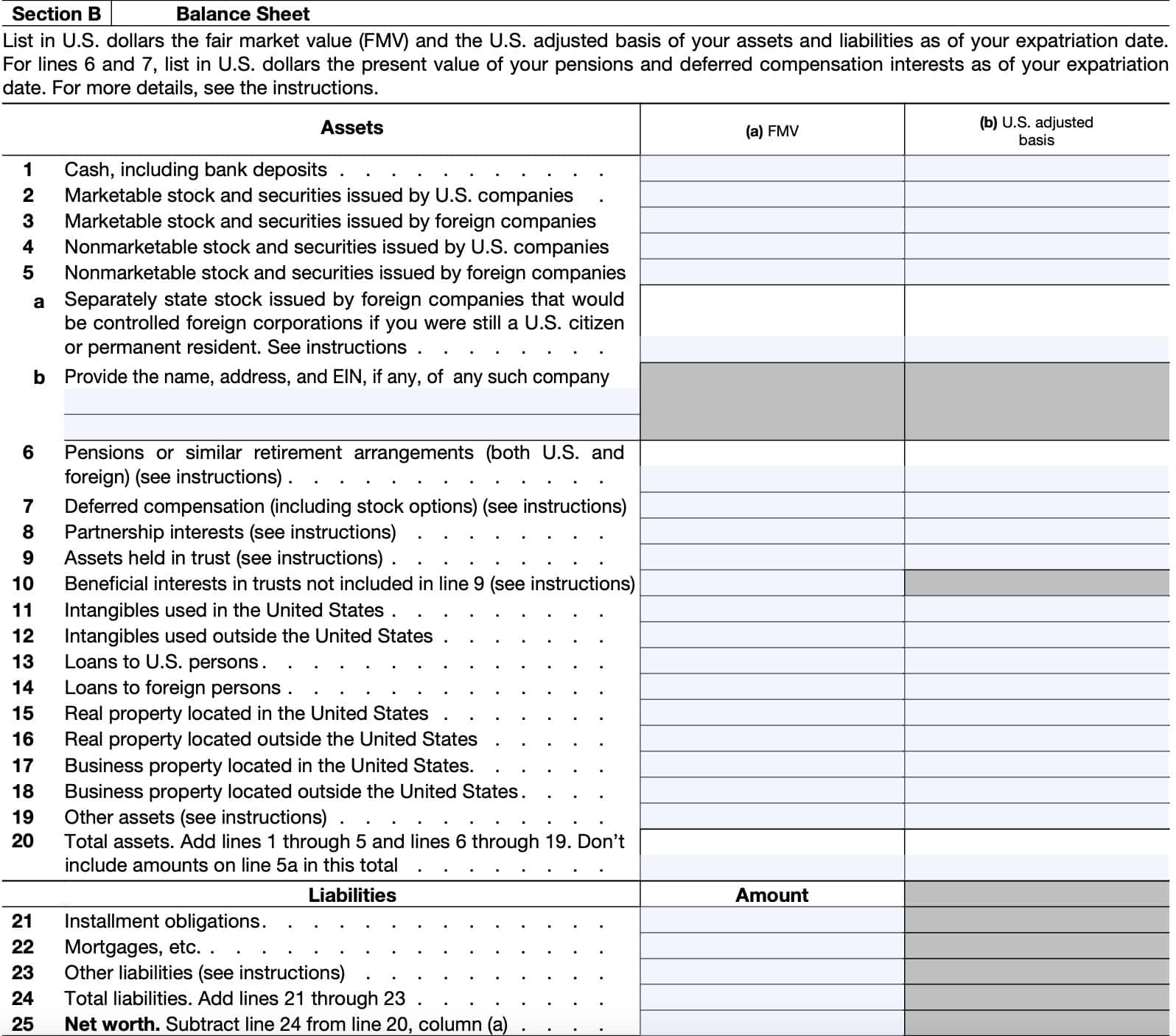

Section B

As required in IRC Section 6039G, in Section B, you will list the fair market value and your adjusted tax basis of all assets and liabilities as of the date of expatriation.

To determine these values, a good faith estimate is adequate. The IRS does not expect taxpayers to submit formal appraisals.

All lines contained in Section B are fairly straightforward. However, the IRS issues specific guidance for certain items, outlined below.

Line 5a: Nonmarketable stock and securities issued by foreign companies

List the appropriate amount in each column for all nonmarketable stock and securities issued by foreign corporations that would be controlled foreign corporations if you were still a U.S. citizen or resident.

Note that these amounts are already included on Line 5, so don’t include amounts from Line 5a in the total on Line 20.

Line 6: Pensions or similar retirement arrangements

In U.S. dollars, list the current value of any U.S. or foreign retirement pensions or similar arrangements as of the date of expatriation.

Line 7: Deferred compensation

Including stock options, list the current value of all deferred compensation in U.S. dollars, regardless of where you earned the compensation or performed services.

Line 8: Partnership interests

List the total value of all your partnership interests.

If you hold an interest in one or more partnerships, you must list each partnership separately in an attached statement. Include the employer identification number (EIN), if any, for each partnership.

Using the categories on this balance sheet, describe the assets and liabilities from your interest in each partnership.

Line 9: Assets held in trust

For purposes of determining your net worth, the IRS considers you to own assets held in trusts that would be subject to U.S. gift tax if you had transferred your interest by gift immediately before your expatriation date, but without regard to the following IRC sections:

- Section 2503(b) through (g): Taxable Gifts

- Section 2513: Gifts by husband or wife to a third party

- Section 2522: Charitable and similar gifts

- Section 2523: Gift to spouse

- Section 2524: Extent of deductions

List the total FMV and basis of all such property on Line 9. Attach a statement to Form 8854 describing each asset. Include the employer identification number, or EIN, if applicable, for the trust in which the asset is held.

Line 10: Beneficial interests in trusts not included in Line 9

List the total value of your beneficial interest in a trust. You must attach a statement to Form 8854 that lists each trust separately.

Use the following two-step process outlined in IRS Notice 97-19, Section III:

- Allocate all property interests held by the trust to beneficiaries (or potential beneficiaries) based upon all relevant facts and circumstances, including:

- Terms of the trust instrument

- Letter of wishes (or similar documents)

- Historical patterns of trust distributions

- Any functions performed by a fiduciary or other advisor

- Property interests must be valued under the principles of IRC Section 2512, Valuation of Gifts, and supporting regulations without prohibition or restrictions

Any interests that cannot be allocated as described above will be allocated to trust beneficiaries under the principles of intestate succession as prescribed in the Uniform Probate Code.

Lines 11 & 12: Intangibles

For tax purposes, the term ‘intangibles’ includes any of the following items that have substantial value independent of the services of any individual:

- Patent, invention, formula, process, design, pattern, or know-how

- Copyright, literary, musical, or artistic composition

- Trademark, trade name, or brand name

- Franchise, license, or contract

- Method, program, system, procedure, campaign, survey, study, forecast, estimate, customer list, or technical data

- Similar items

Line 19: Other assets

Include any assets not previously listed in Lines 1- 18. Attach a separate statement describing each asset and its approximate value.

Line 20: Total assets

Combine Lines 1-19, not including Line 5a. Line 5a is a part of the Line 5 total.

Line 23: Other liabilities

Include any assets not previously listed in Lines 21-22. Attach a separate statement describing each liability and its approximate value.

Line 24: Total liabilities

Add Lines 21 through 23.

Line 25: Net worth

Subtract Line 24 from Line 20, Column (a).

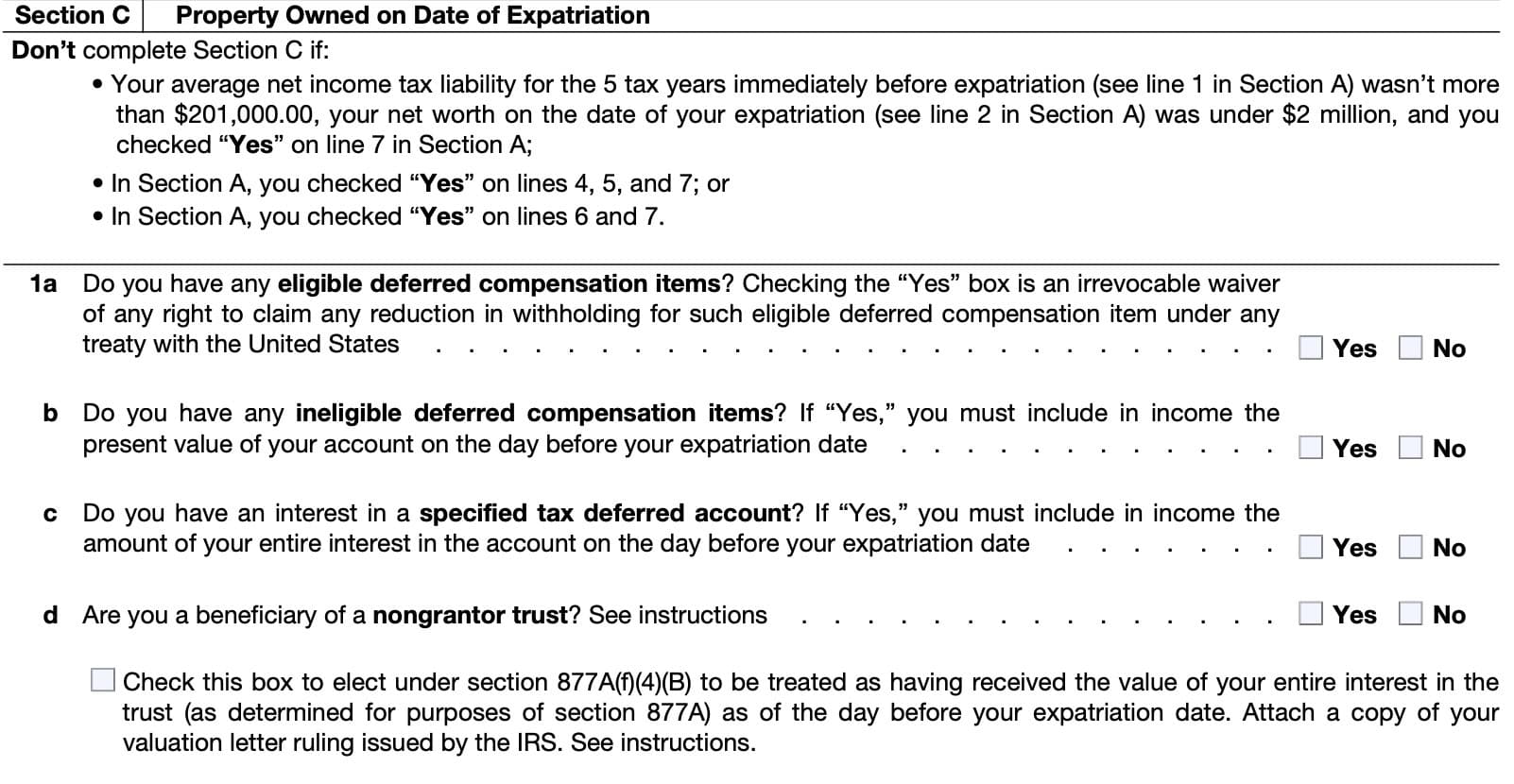

Section C

If you are not a covered expatriate, you do not need to complete Section C.

Covered expatriate

You are considered to be a covered expatriate unless one (or more) of the following conditions apply.

- All of the following:

- Your average net income tax liability for the 5 tax years immediately before expatriation (see Section A, Line 1) wasn’t more than $190,000,

- Your net worth on the date of your expatriation (see Section A, Line 2) was under $2 million, and

- You checked “Yes” on Line 6 in Section A;

- In Section A, you checked “Yes” on Lines 3, 4, and 6; or

- In Section A, you checked “Yes” on Lines 5 and 6.

If you are considered a covered expatriate, proceed to Line 1.

Line 1

Answer each question truthfully. None of these items are considered mark-to-market property, so do not include them in Line 2.

If applicable, you must attach a statement indicating the fair value of any such items on the day before expatriation.

Line 1a: Eligible deferred compensation items

According to the form instructions, this includes any of the following:

- Retirement plans: An interest in a plan or arrangement described in Section 219(g)(5). This includes:

- A qualified pension

- Profit-sharing plans (including 401(k))

- Annuity

- SEP plans

- SIMPLE plans.

- Foreign pension plans: Any interest in a foreign pension plan or similar retirement arrangement or program

- Deferred compensation: Any item of deferred compensation, whether or not substantially vested. This is any amount of compensation if, under the terms of the plan, contract, or other arrangement providing for such compensation, the following conditions were met:

- You had a legally binding right on your expatriation date to such compensation

- The compensation has not been actually or constructively received on or before your expatriation date

- The compensation is payable on or after your expatriation date.

- Examples of items of deferred compensation include:

- A cash-settled stock appreciation right

- A phantom stock arrangement

- A cash-settled restricted stock unit

- An unfunded and unsecured promise to pay money or other compensation in the future (other than such a promise to transfer property in the future), and

- An interest in a trust described in IRC Section 402(b)(1) or (4). This is also known as a secular trust

- Restricted stock or stock rights: Any property, or right to property, that you are entitled to receive in connection with the performance of services (whether or not such property or right to property is substantially vested) to the extent not previously taken into account under IRC Section 83 or in accordance with Section 83. Examples of these items include, but are not limited to:

- Restricted stock

- Stock-settled stock appreciation rights, and

- Stock-settled restricted stock units.

Eligible deferred compensation item

Eligible deferred compensation item means any deferred compensation item with respect to which:

- The payor is either a U.S. person or a non-U.S. person who elects to be treated as a U.S. person for purposes of Section 877A(d)(1),

- The covered expatriate notifies the payor of his or her status as a covered expatriate on Form W-8CE, and

- Irrevocably waives any right to claim any withholding reduction on such item under any treaty with the United States on Form 8854.

You must file Form 8854 annually to either:

- Verify that no distributions have been made, or

- Report distributions that were made during the tax year

Line 1b: Ineligible deferred compensation items

This is any deferred compensation item that cannot be included in Line 1a, above. Any ineligible deferred compensation items must be reported on IRS Form 1040 or IRS Form 1040-SR, for the tax year that includes the date of expatriation.

If you have more than one ineligible deferred compensation item, you must include an attached statement that lists the value of each item on the day before expatriation.

Line 1c: Specified tax-deferred account

This includes the following:

- Any IRA, except for:

- A SEP IRA, as identified in IRC Section 408(k)

- A SIMPLE IRA, as identified in IRC Section 408(p)

- A Coverdell education savings account

- A health savings account (HSA) or Archer medical savings account (MSA)

Any such accounts must be reported on IRS Form 1040 or 1040-SR, for the tax year that includes the date of expatriation.

If you have more than one specified tax-deferred account, you must include an attached statement that lists the value of each item on the day before expatriation.

Line 1d: Beneficiary of a nongrantor trust?

A nongrantor trust is the part of any trust, either a domestic trust or a foreign trust, of which you were not considered the owner under Sections 671 through 679 on the day before your expatriation date. You are considered a beneficiary of such trust if:

- You are entitled or permitted, under the terms of the trust instrument or applicable local law, to receive a direct or indirect distribution of trust income or corpus (including, for example, a distribution in discharge of an obligation);

- You have the power to apply trust income or corpus for your own benefit; or

- You could be paid from the trust income or corpus if the trust or the current interests in the trust were terminated.

Unless you elect to be treated as having received the value of your interest in the trust, as determined for purposes of section 877A, as of the day before your expatriation date, you cannot claim a reduction in withholding on any distribution from the trust under any treaty with the United States. However, you must obtain a letter ruling, in accordance Rev. Proc. 2020-01 before making such an election.

Line 2: Recognition of gain or loss on the deemed sale of mark-to-market property

In Line 2, do not include any property described under Line 1.

Mark-To-Market property

The Internal Revenue Service will treat the property of a covered expatriate as if it were sold at fair market value on the day prior to the expatriation date.

The expatriate is then responsible for the ‘exit tax’ on these deemed sales unless he or she chooses to defer paying taxes on them.

From there, the expatriate may elect to defer payment of tax on the sale of this property by:

- Making the election on a property-by-property basis.

- Providing adequate security, such as a bond, to ensure the U.S. Government eventually receives the tax proceeds

- Making an irrevocable waiver of any rights under any tax treaty that would preclude collection or assessment of exit tax imposed by Section 877A

Adequate security

For deferral of exit tax, the IRS considers adequate security to be either of the following:

- A bond that is furnished to, and accepted by, the IRS, that is conditioned on the payment of tax (and interest thereon), and that meets the requirements of Section 6325; or

- Another form of security (including letters of credit) that is acceptable to the IRS.

In addition to paying mark-to-market tax, the expatriate must:

- Pay interest for the period the exit tax is deferred

- Pay the deferred tax no later than:

- The tax year in which the property is actually sold or disposed of

- The time that security fails to be adequate

- The due date of the tax return required for the year of death

For each item that you report in Line 2, you must include:

- Column (a): Property description

- Column (b): Fair market value on day before date of expatriation

- Column (c): Cost or other basis (cannot be less than the FMV of the property on the day you became a U.S. resident)

- Column (d): Gain or loss

- Calculate by subtracting Column (c) from Column (b)

- Column (e): Gain after allocation of exclusion amount

- Must calculate separately and attach to form

- See instructions for more detail

- Column (f): Form or schedule where gain/loss is reported

- Column (g): Amount of tax to be deferred

- Attach computations separately

Line 3: Total

Add the amounts in Column (d) and Column (e).

Line 4: Total tax deferred

Add the amounts in Column (g). Enter in Line 4 and in Section D, Line 5.

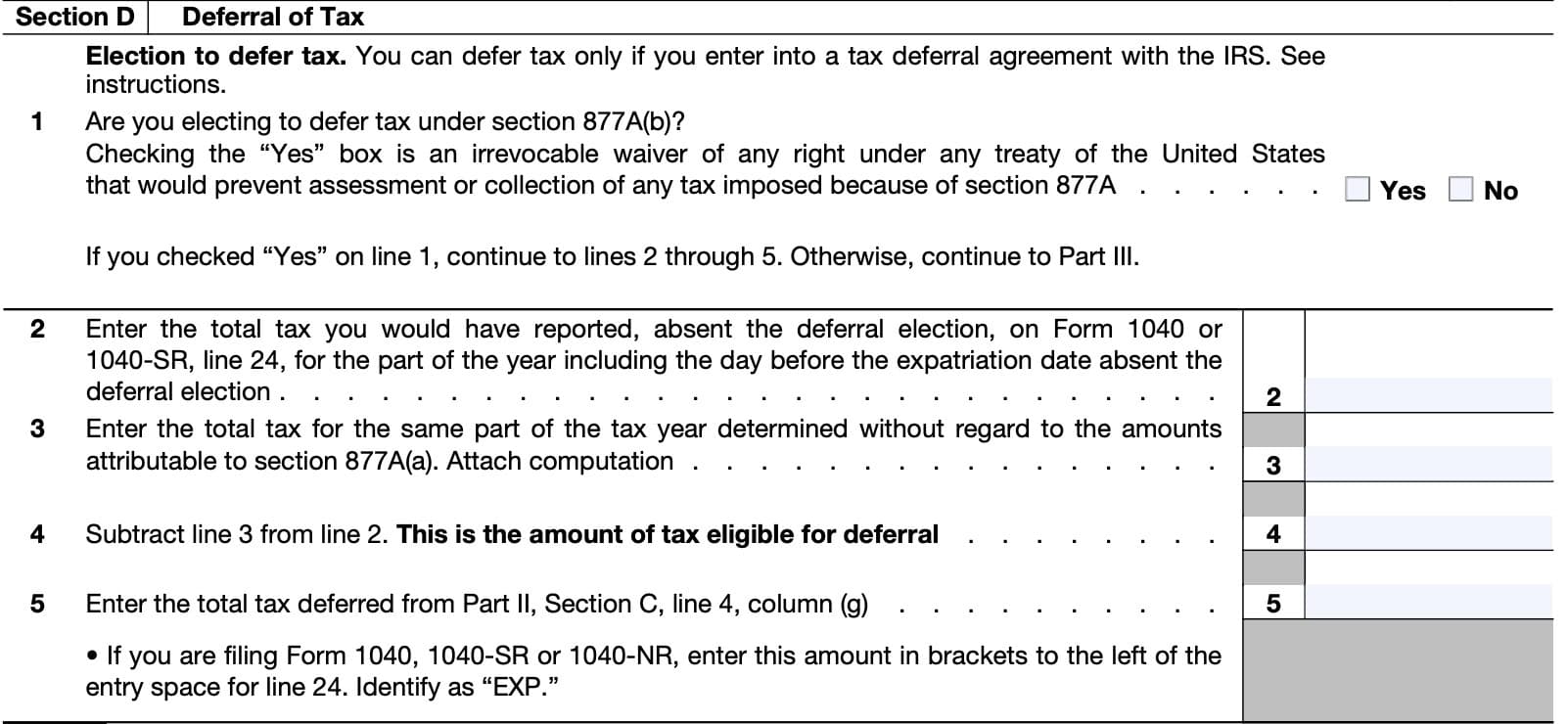

Section D: Deferral of Tax

If you elected to defer taxes, use Section D to calculate how much tax you may defer.

Before completing Lines 2 through 5 of Section D, you must fill out two hypothetical individual income tax returns using IRS Form 1040 or IRS Form 1040-SR.

The first return includes all income, including the Section 877A(a) gain and loss.

The second return includes all income except the Section 877A(a) gain and loss. Attach both hypothetical returns to this Form 8854.

Line 1: Are you electing to defer tax under Section 877A(b)?

If no, do not complete Lines 2 through 5.

If yes, complete both hypothetical Form 1040 returns before completing Lines 2 through 5.

Line 2: Total tax, including Section 877A(a) gain/loss

Enter the amount of tax on Line 24 of the first return. This includes the Section 877A(a) gain and loss as well as all other income.

Line 3: Total tax, not including Section 877A(a) gain/loss

Enter the amount of tax on Line 24 of the second return. This does not include the Section 877A(a) gain and loss, but does include all other income.

Line 4: Amount of tax eligible for deferral

Subtract Line 3 from Line 2.

Line 5: Total tax deferred

Enter the number from Part II, Section C, Line 4, Column (g).

Requesting a deferral of the payment of tax

In order to defer any part of the mark-to-market tax, you must enter into a tax deferral agreement with the IRS and provide adequate security. Internal Revenue Notice 2009-85 contains a sample agreement (Appendix A).

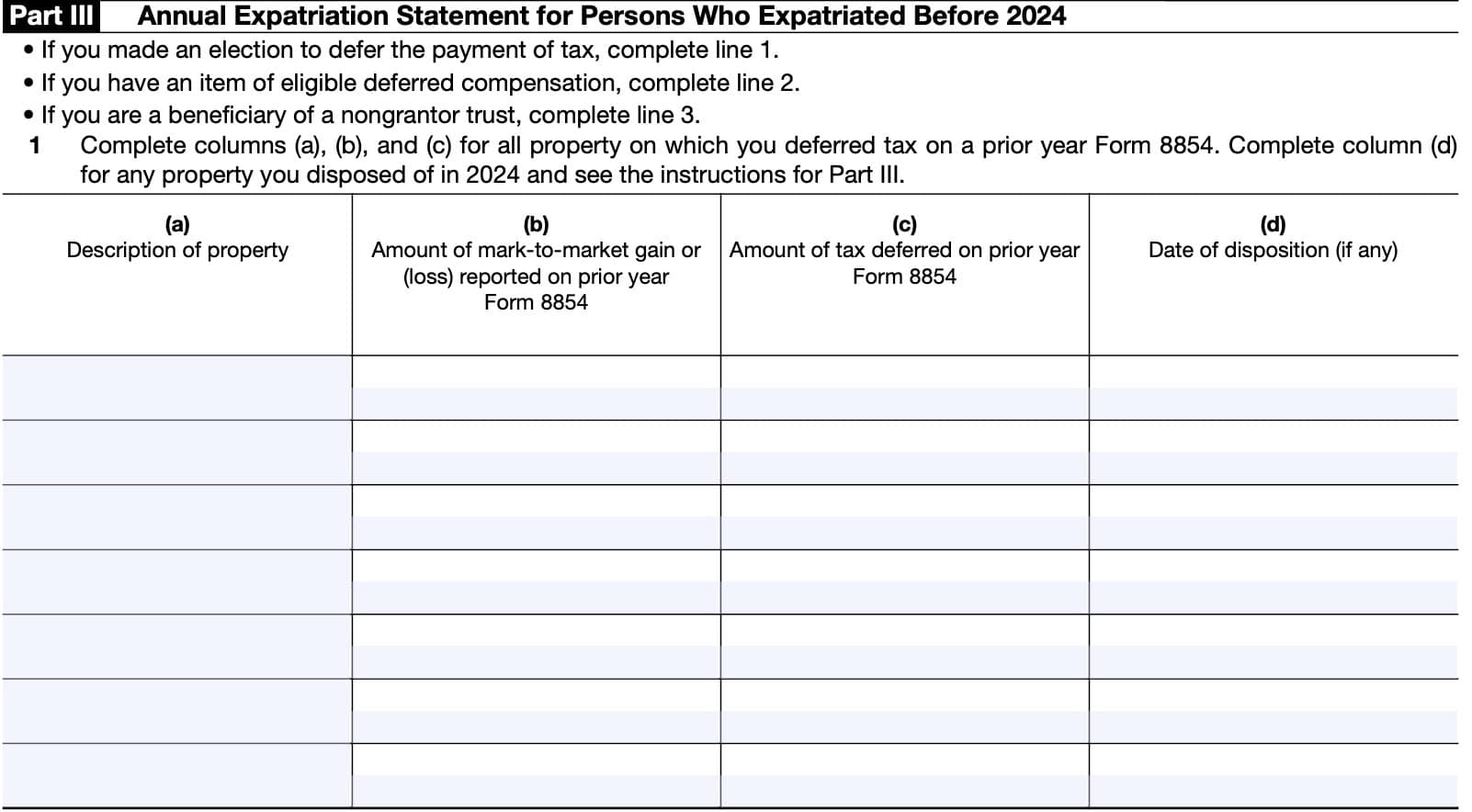

Part III: Annual Expatriation Statement for Persons Who Expatriated Before 2022

You must file Part III if you:

- Deferred the payment of tax on any property on a Form 8854 filed in a previous year,

- Reported an eligible deferred compensation item on a Form 8854 filed in a previous year, or

- Reported an interest in a nongrantor trust on a Form 8854 filed in a previous year.

You must pay the deferred tax, plus interest, on any property you disposed of, no later than the due date (without extensions) of your 2023 income tax return.

Line 1

Complete Columns (a), (b), and (c) for all property on which you deferred tax in a prior year.

Complete Column (d) for any property you disposed of in the current tax year. You must report the gain or loss from the property disposed of on the appropriate line (or schedule) of your income tax return.

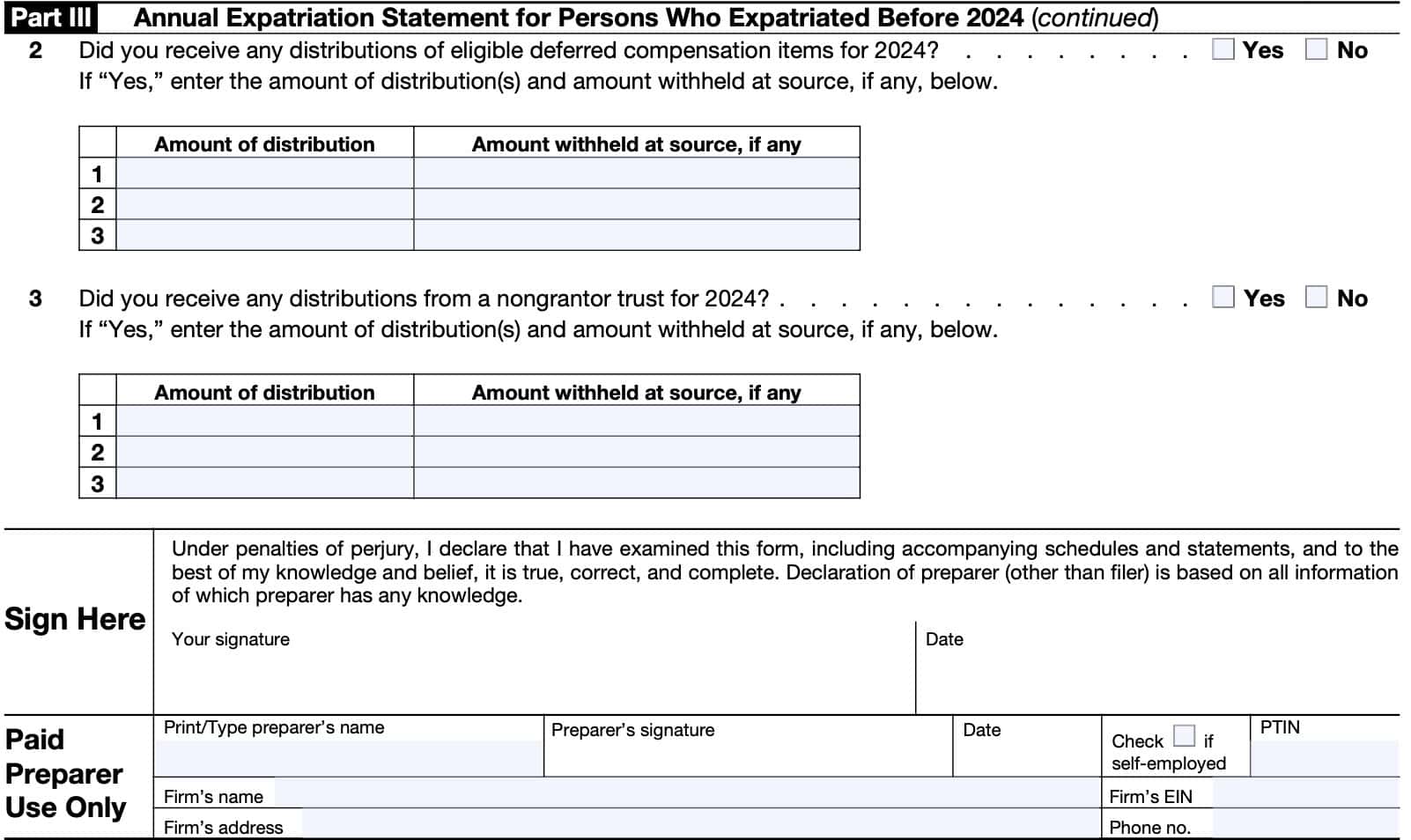

Line 2: Receipt of eligible deferred compensation

Enter the part of the distribution that you would include in gross income if you continued to be subject to tax as a U.S. citizen or resident. Also enter the total amount of tax withheld by the payor(s) of any eligible deferred compensation items.

Don’t enter the part of any payment that is attributable to services performed outside the United States before or after your expatriation date while you weren’t a citizen or resident of the United States.

Line 3: Distributions from a nongrantor trust

Unless the exception at the end of this section applies, check the “Yes” box if you received any direct or indirect distributions of property (including money) from a nongrantor trust in 2023.

Enter the part of the distribution that you would include in gross income if you continued to be subject to tax as a U.S. citizen or resident. Also enter the total amount of tax withheld by the payor(s) of any distribution.

Don’t include any distribution from a trust if your interest in the trust was treated in an earlier year as a deferred compensation item or part of a specified tax deferred account.

Exception

Don’t check the “Yes” box if you elected on a previously filed Form 8854 to be treated as having received the value of your entire interest in the trust as of the day before your expatriation date.

Signature

Sign and date the form as indicated. Please note that you are certifying, under penalty of perjury, as to the accuracy and truthfulness of the information provided.

How to file IRS Form 8854

Attach your initial Form 8854 to your income tax return for the year that includes your expatriation date. You must file your return by the due date of your tax return (including extensions).

You must also submit a copy of this form, marked ‘Copy,’ to the following IRS address:

Internal Revenue Service

3651 S IH35

MS 4301AUSC

Austin, TX 78741

Video walkthrough

Watch this instructional video to learn more about filing IRS Form 8854.

Frequently asked questions

IRS Form 8854, Initial and Annual Expatriation Statement, is the tax form that expatriates must use to report the U.S. Government uses to certify their federal tax obligations before expatriation and to comply with filing requirements under U.S. tax laws

Taxpayers must file IRS Form 8854 on or before the due date of their tax return (including extensions). If you are not required to file a tax return, you must file IRS Form 8854 on the date your tax return would have been due.

Failure to file IRS Form 8854 in a timely manner can result in a fine of up to $10,000, unless that failure is due to reasonable cause, and not willful neglect.

Internal Revenue Code Section 877A, Tax Responsibilities of Expatriation, establishes tax responsibilities for people who renounce their U.S. citizenship or terminate a long-term U.S. residency.

If you were a U.S. person for any portion of the tax year, you may be required to file FinCEN Form 114, Report of Foreign Bank and Financial Accounts (FBAR) and IRS Form 8938, Statement of Specified Foreign Financial Assets.

Where can I find IRS Form 8854?

You may download a copy of the form from the IRS website or by selecting the file below.