IRS Form 8857 Instructions

In general, when a married couple files a joint income tax return, both spouses are equally responsible for any taxes reported to the federal government. But if someone who believes that only their spouse is responsible for the additional tax, that person can request tax relief from the Internal Revenue Service by filing IRS Form 8857.

This in-depth article will walk you through what you need to know about IRS Form 8857, including:

- How to complete IRS Form 8857

- Filing considerations

- Frequently asked questions

Let’s start with step by step guidance on completing this innocent spouse relief form.

Table of contents

How do I fill out IRS Form 8857?

There are 7 parts to this 7-page tax form:

- Part I: Should you file this form?

- Part II: Tell us about yourself and the person listed on Line 6 for the tax years you want relief.

- Part III: Tell us if and how you were involved with finances and preparing returns for the tax years you want relief.

- Part IV: Tell us about your current financial situation.

- Part V: Complete this part if you were (or are now) a victim of domestic violence or abuse.

- Part VI: Additional information

- Part VII: Tell us if you would like a refund

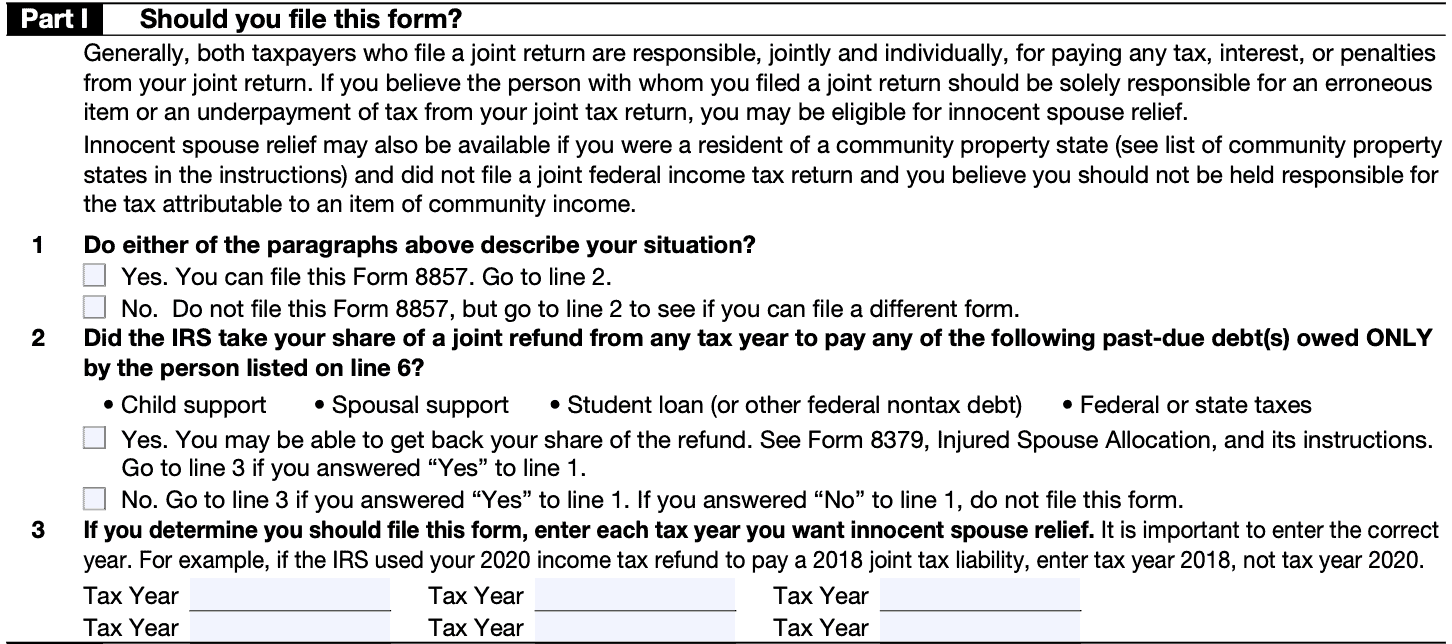

Part I: Should you file this form?

Part I of this tax form helps taxpayers determine whether they can actually use Form 8857 to claim taxpayer relief.

Line 1

The top of Part I describes situations in which innocent spouse relief might be available:

If you believe the person with whom you filed a joint return should be solely responsible for an erroneous item or an underpayment of tax from your joint tax return, you may be eligible for innocent spouse relief.

Innocent spouse relief may also be available if you were a resident of a community property state and did not file a joint federal income tax return, and you believe you should not be held responsible for the tax attributable to an item of community income.

If you believe either of those statements to be true, select “Yes.” Otherwise, select “No.”

In either situation, proceed to Line 2 once you’ve entered your answer.

Line 2

Did the IRS take your share of a joint refund from any tax year to pay one of the following past-due debts, owed only by the person listed on Line 6?

- Child support payments

- Spousal support

- Student loan or other federal nontax debt

- Federal or state income tax

If Yes, you may be able to get back your share of the tax refund by filing IRS Form 8379, Injured Spouse Allocation.

Go to Line 3 if you answered “Yes” to Line 1.

If No, then do not file this form if you also answered “No” to Line 1. If you answered Yes to Line 1, continue to Line 3.

Line 3

Enter each tax year that you want innocent spouse relief. Be sure to enter the correct year.

For example, if the IRS used your 2023 income tax refund to pay a 2021 joint tax liability, enter the tax year 2021, not 2023.

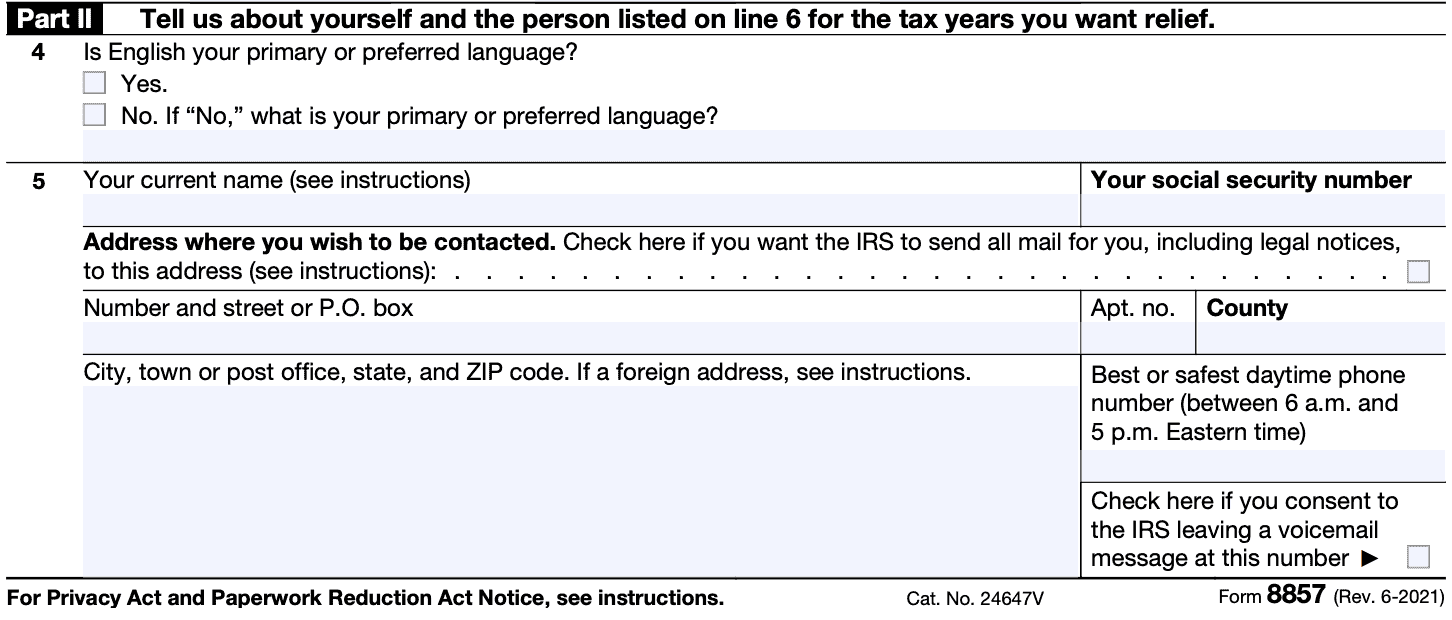

Part II: Tell us about yourself and the person listed on line 6 for the tax years you want relief.

In Part II, you’ll give the IRS some personal information about yourself and the other spouse.

Line 4: Is English your primary language?

If English is not your primary language, then check No and indicate your preferred language. Otherwise, select Yes and go to Line 5.

Line 5: Current taxpayer information

In Line 5, you’ll enter your taxpayer information. This includes:

- Your current name

- Social Security number

- Address

- City, state, zip code

- Contact phone number

- Whether or not you want the IRS to leave a voicemail

If you have an individual taxpayer identification number (ITIN) instead of a Social Security number, enter your ITIN instead.

Line 6: Other spouse’s contact information

In Line 6, you’ll enter the identifying information for the spouse from whom you’re claiming relief. This includes:

- Current name

- Social Security number (or ITIN if applicable)

- Home address

- City, state, zip code

- Daytime phone number

Only enter a P.O. Box if you do not know the mailing address or if the postal service does not deliver mail to that address.

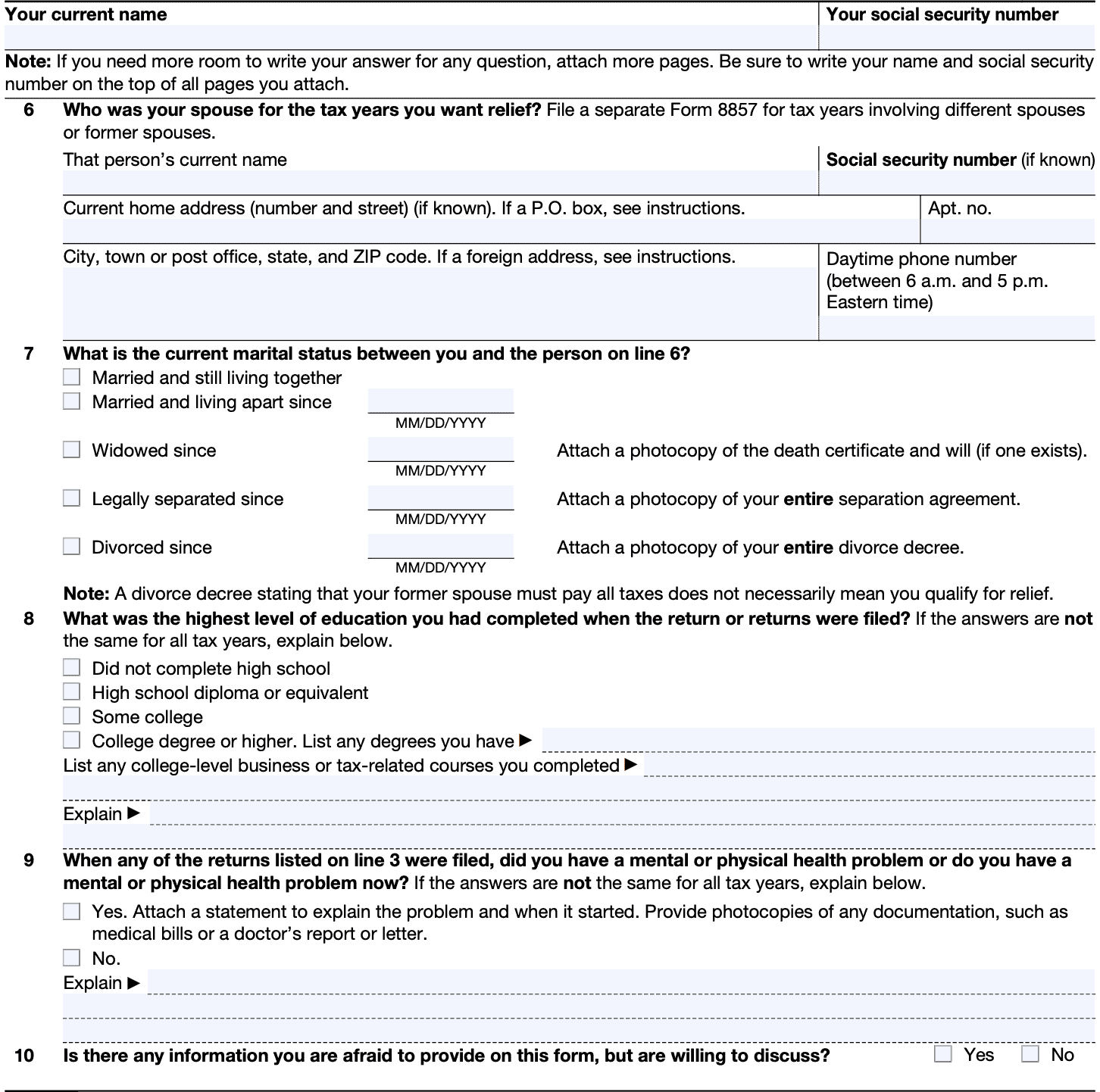

Line 7: Marital status

Enter the marital status that applies:

- Married and still living together

- Married and living apart

- If applicable, enter the date you started living apart

- Widowed

- If applicable, enter the date and attach a copy of your spouse’s death certificate and will (if a will exists)

- Legally separated

- Attach a copy of your entire separation agreement

- Divorced

- Attach a copy of your entire divorce decree

Line 8: Highest level of education

In Line 8, enter the highest level of formal education that you have achieved:

- Did not complete high school

- High school diploma or equivalent

- Some college

- College degree or higher

If applicable, enter any college-level business or tax courses that you may have completed.

Line 9: Mental or physical health problems

If applicable, attach a statement to explain the problem. Provide copies of any supporting documentation, such as medical bills, medical record, doctor’s report, etc.

Line 10

Select Yes if you have information that you cannot provide on the form, but you’d like to discuss with the IRS. Otherwise, select No and go to Part III.

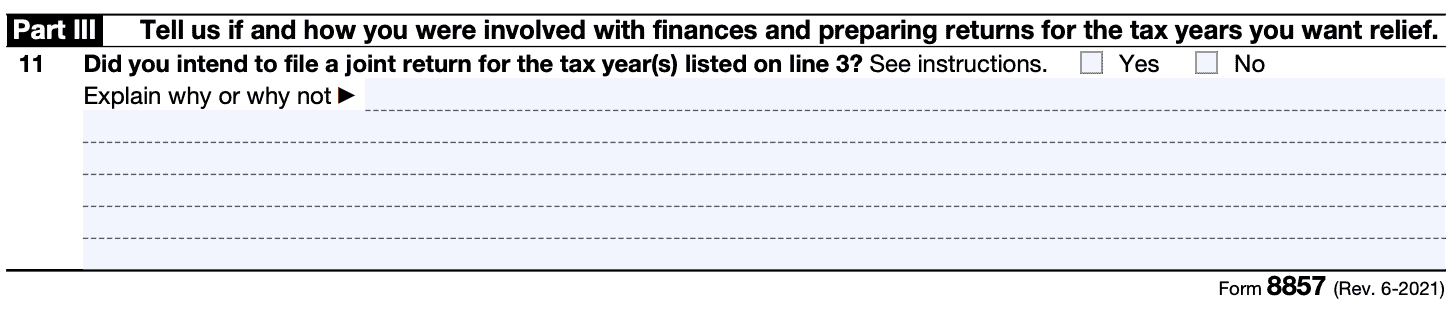

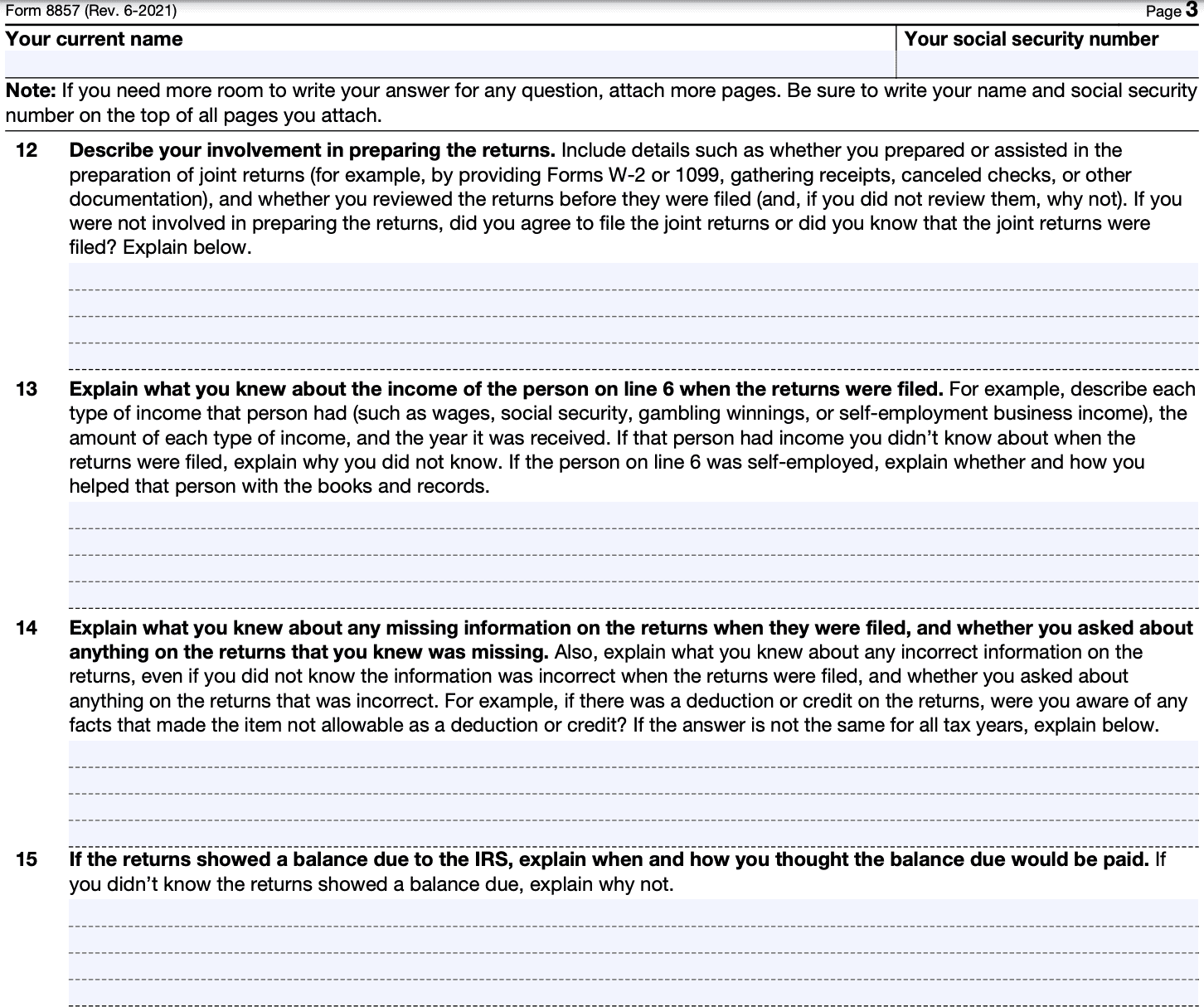

Part III: Tell us if and how you were involved with finances and preparing returns for the tax years you want relief.

In Part III, you’ll outline your involvement, if any, in either household finances or tax preparation.

Line 11: Did you intend to file a joint return for the year(s) listed on Line 3?

By law, if a person’s name is signed to a return, the IRS will assume that person signed the return, unless that person proves otherwise.

If you believe someone forged your signature or that you signed under duress, check Yes and explain in the space provided.

If your signature was forged or you signed under duress, the election to file jointly is not valid and you have no valid joint return. Should the IRS determine your signature was not valid, then you will be removed from the account and you will no longer be liable for any taxes owed for that return.

If the IRS determines that a valid joint return was filed, they will then consider whether you would be entitled to innocent spouse relief.

Line 12: Describe your involvement in preparing the returns

Include details such as:

- Whether you prepared or helped in preparing the tax return

- If you gathered documents required to file the return

- Whether you reviewed the tax return before filing

Explain in the lines provided. If you need more room, attach additional pages.

Line 13: Explain what you knew about the income of the person on Line 6

To the extent possible, describe:

- The type of income your significant other had

- How much income

- When it was received

If you did not know, explain why you did not. If the other person was self-employed, explain whether you helped that person with maintaining books and records.

Line 14: Explain what you knew about any missing information on the returns

If you were aware about missing information, or whether you asked about missing or incorrect information on the tax return, please explain.

Line 15: If the returns showed a balance due, explain when and how you thought the taxes would be paid

If you did not know the returns showed a balance due, explain why you did not know.

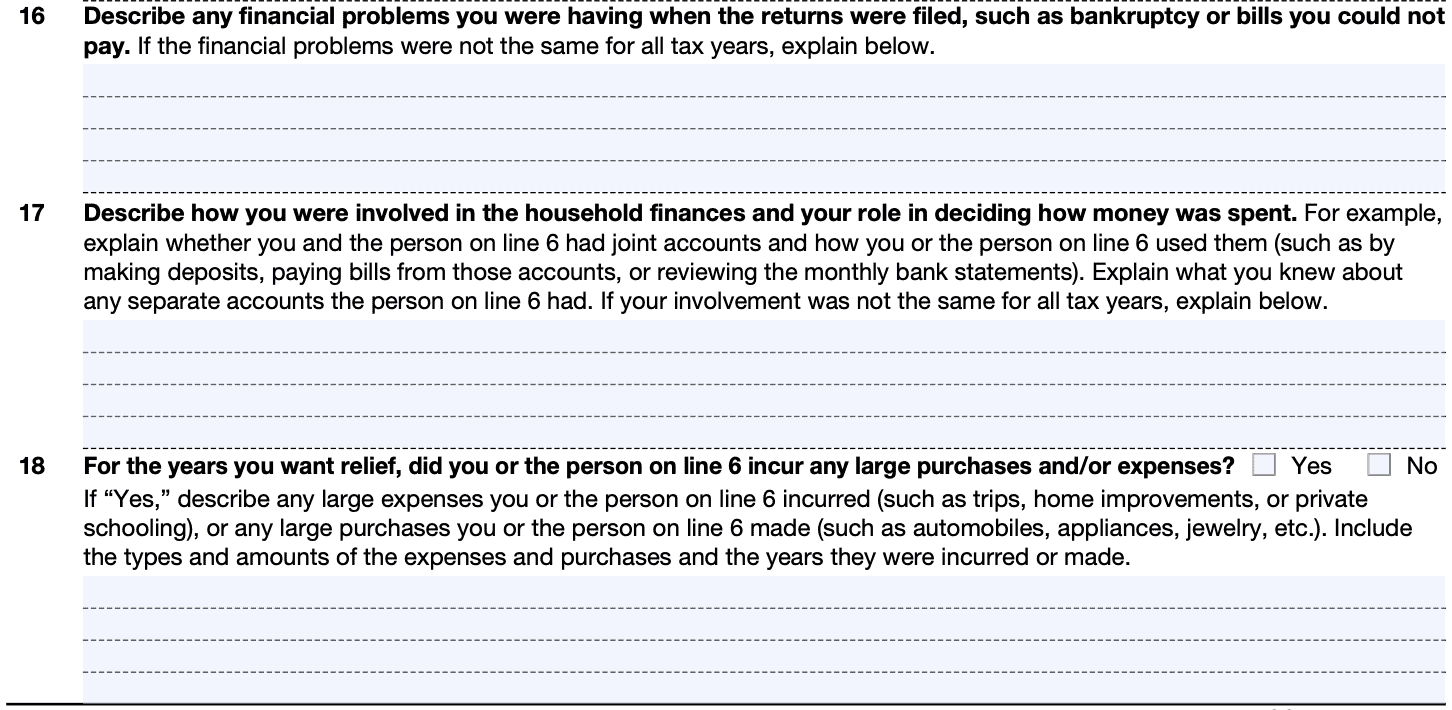

Line 16: Describe any financial problems, if any

Describe any and all financial problems you may have been facing during the tax period. If there was more than one financial problem, explain all of them.

Line 17: Describe how you were involved in the household finances and your role in spending money

Explain whether you and the other spouse had joint accounts or separate accounts. Also explain who paid bills, made deposits, etc.

Line 18: Did either spouse incur large purchases or expenses?

If Yes, then explain the following:

- Who made large purchases or incurred expenses

- What was purchased

- How much money was spent

- Years in which these expenses were incurred

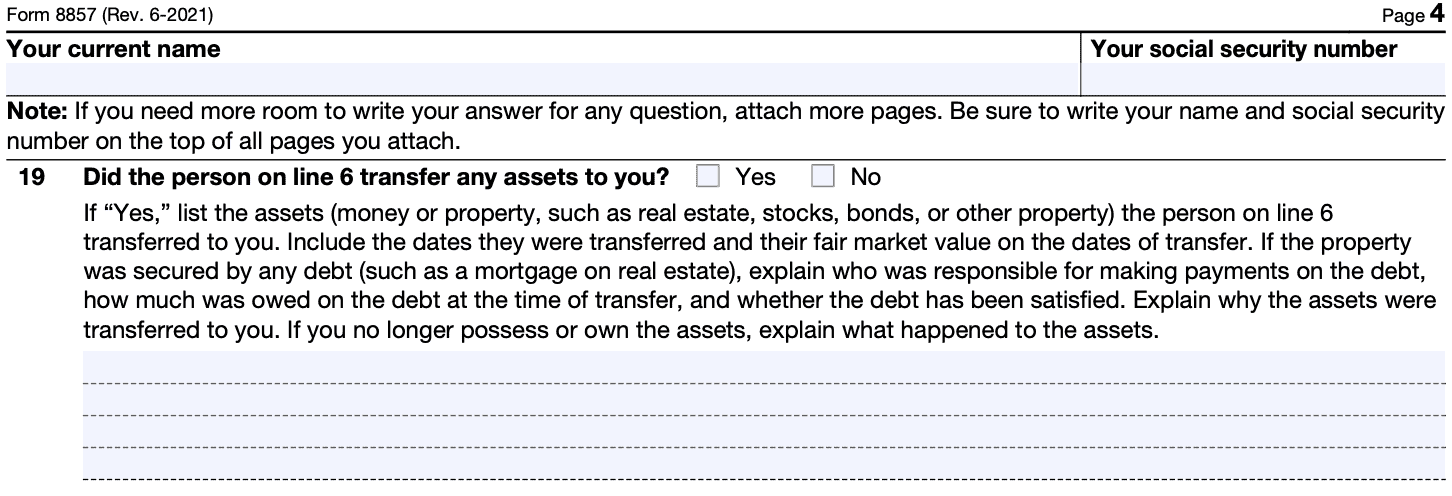

Line 19: Did the other spouse transfer any assets to you?

If Yes, explain. List the assets transferred, dates transferred, and fair market value on the date(s) of transfer.

If there is debt associated with an asset, explain who is responsible for the debt, how much debt was outstanding, and whether that debt has been satisfied.

Finally, explain why the assets were transferred to you. If you no longer possess the assets, explain what happened.

When you might not be entitled to relief

If the IRS determines one or both of the following, you might not be entitled to innocent spouse relief:

- Your spouse (or former spouse) transferred property (or the right to property) to you for the main purpose of avoiding tax or payment of tax.

- A transfer will be presumed to meet this condition if the transfer is made after the date that is 1 year before the date on which the IRS sent its first letter of proposed deficiency.

- You and your spouse (or former spouse) transferred property to one another as part of a fraudulent scheme.

- A fraudulent scheme includes a scheme to defraud the IRS or another third party. This could include a creditor, former spouse, or business partner.

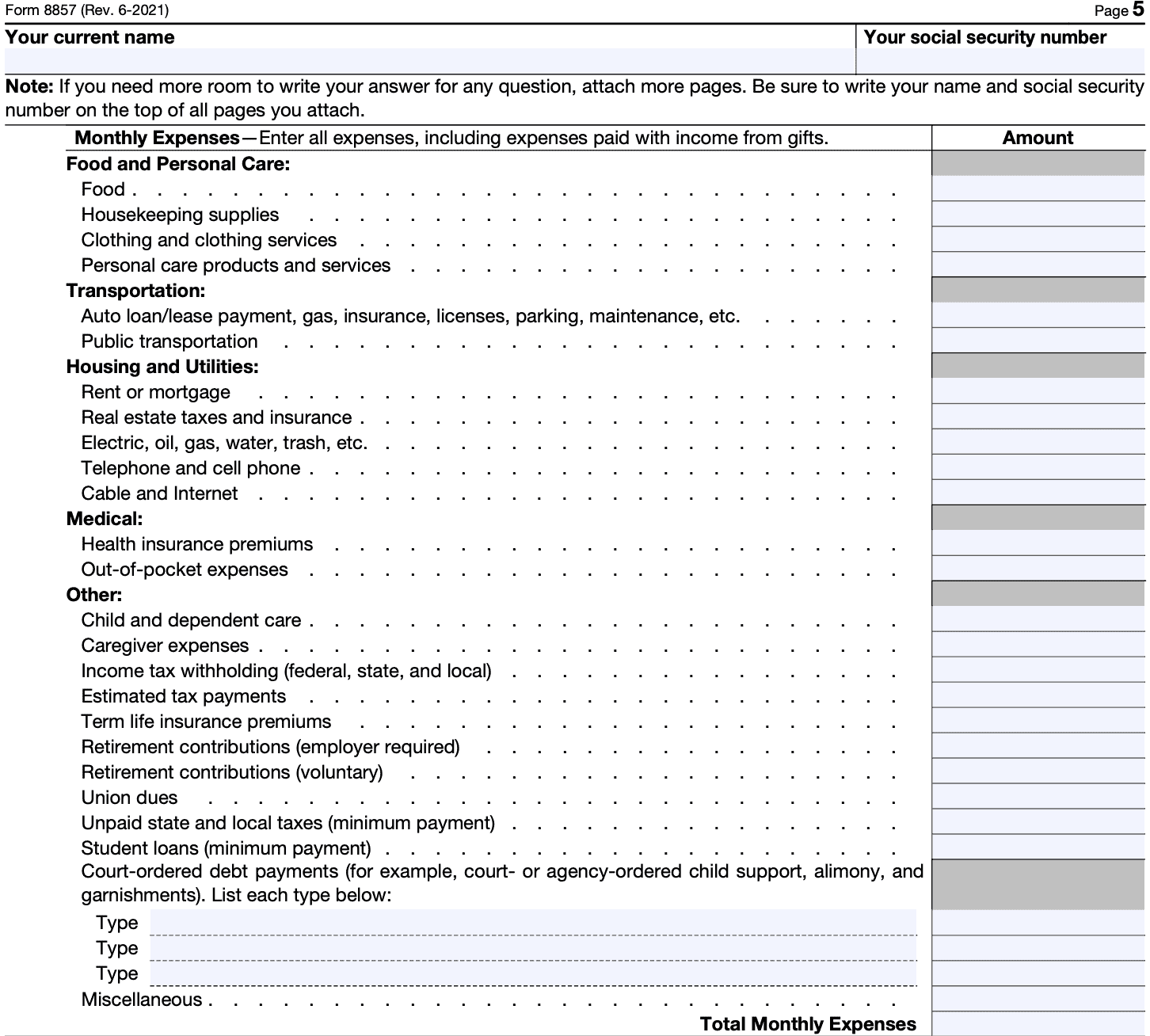

Part IV: Tell us about your current financial situation.

In Part IV, you’ll describe your current financial situation.

Line 20: Assets

Include your assets, such as real estate, cars, investments, or other property that you own. For each item, include:

- Description of the asset

- Fair market value

- Loan balance, if applicable

The IRS deems fair market value to be the price at which property would change hands between a willing buyer and a willing seller when both have reasonable knowledge of the relevant facts and neither has to buy or sell. This is not necessarily the replacement cost of the item.

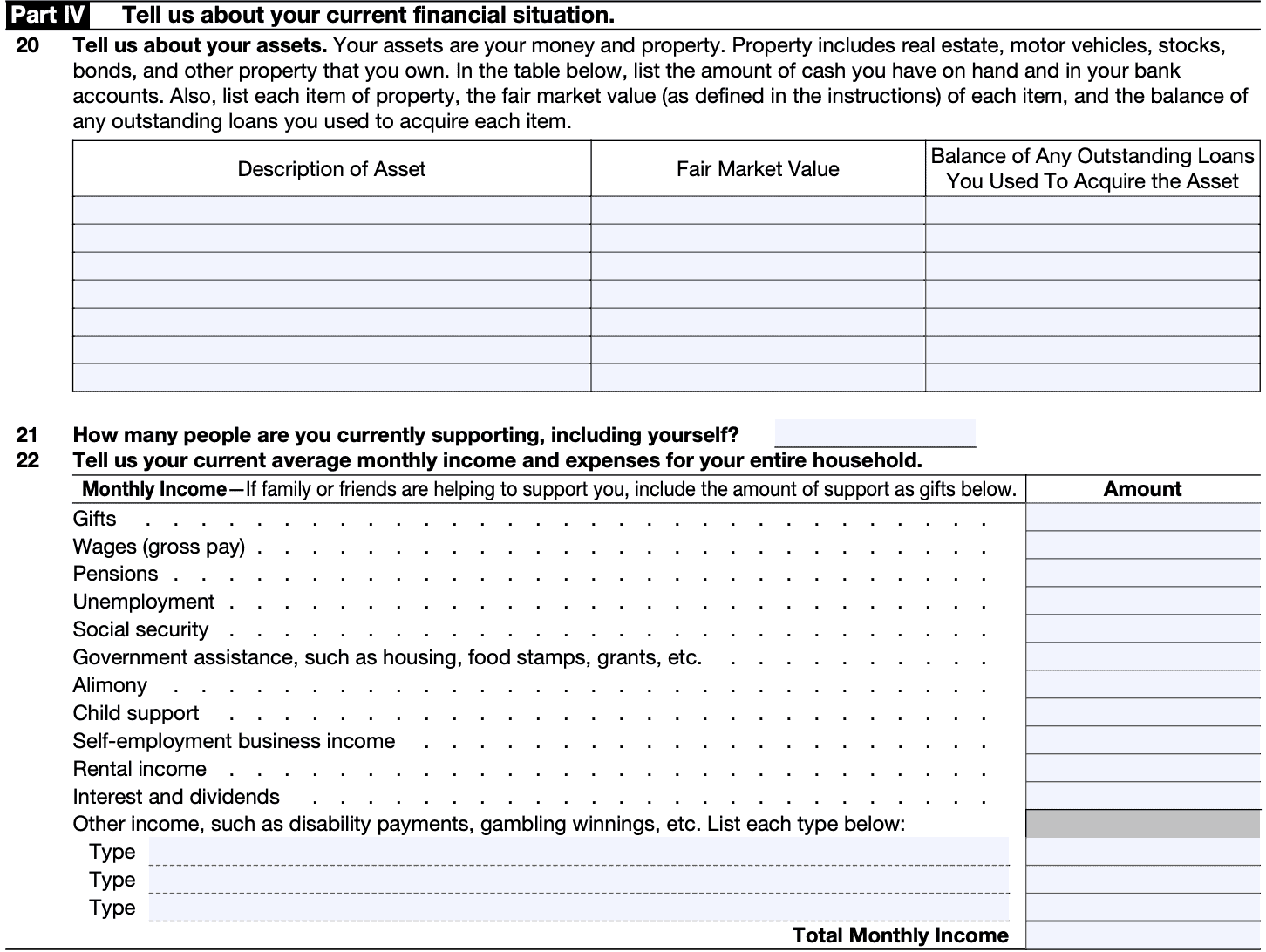

Line 21: People you are supporting

Including yourself, how many people are you supporting on your income?

Line 22: Monthly income

For each item, list the monthly amount in the applicable row. If you are receiving financial assistance from friends or family, then include that amount under “Gifts,” below.

Line 22 (continued): Expenses

Enter all expenses by monthly amount.

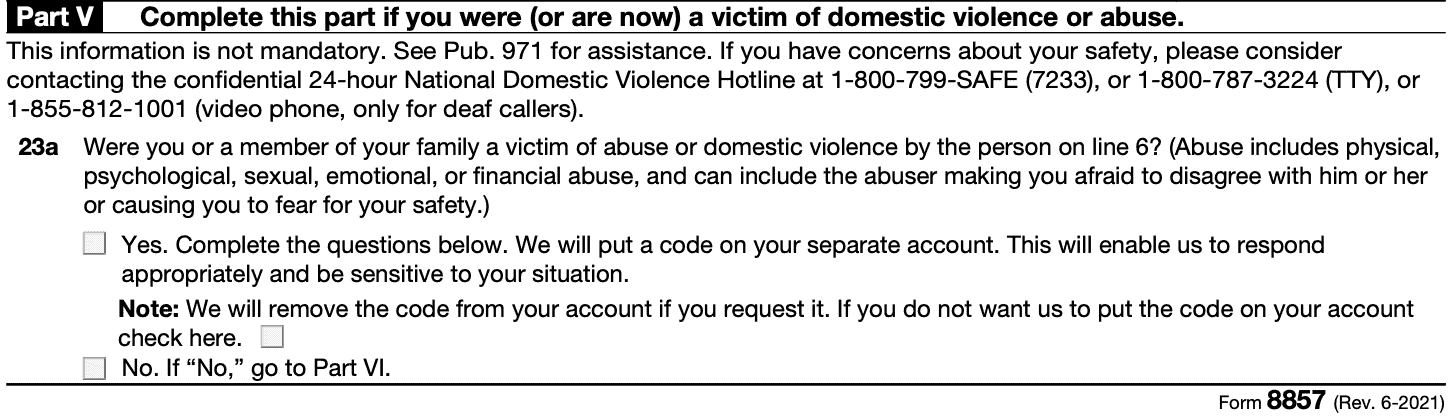

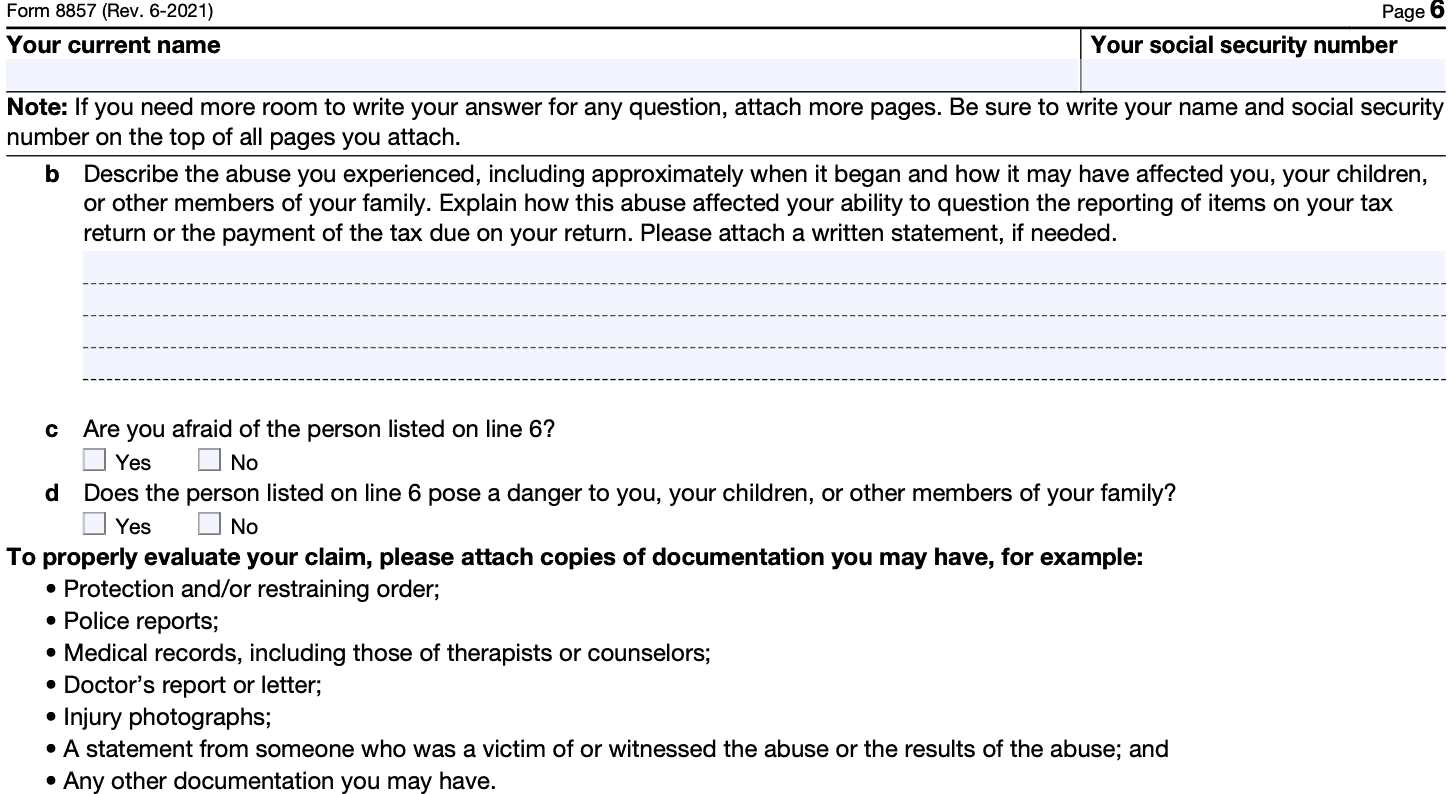

Part V: Complete this part if you were (or are now) a victim of domestic violence or abuse.

You do not have to complete Part V. If Part V does not apply, skip to Part VI, below.

If applicable, answer honestly and completely.

You may need to attach copies of supporting documentation, to include:

- Protection orders or restraining orders

- Police reports

- Medical records

- Doctor’s report

- Injury photographs

- Additional statements or evidence, if available

You may also consider calling the 24/7 National Domestic Violence Hotline:

- Toll free: 800 799-SAFE (7233)

- TTY: 800 787-3224

- Sorensen relay: 855 812-1001

Please note whether or not the person continues to pose a danger to you or your family.

Part VI: Additional information

In Part VI, you’ll provide information that you believe will help the IRS make a decision.

Line 24

Provide supporting information that you were not able to provide above.

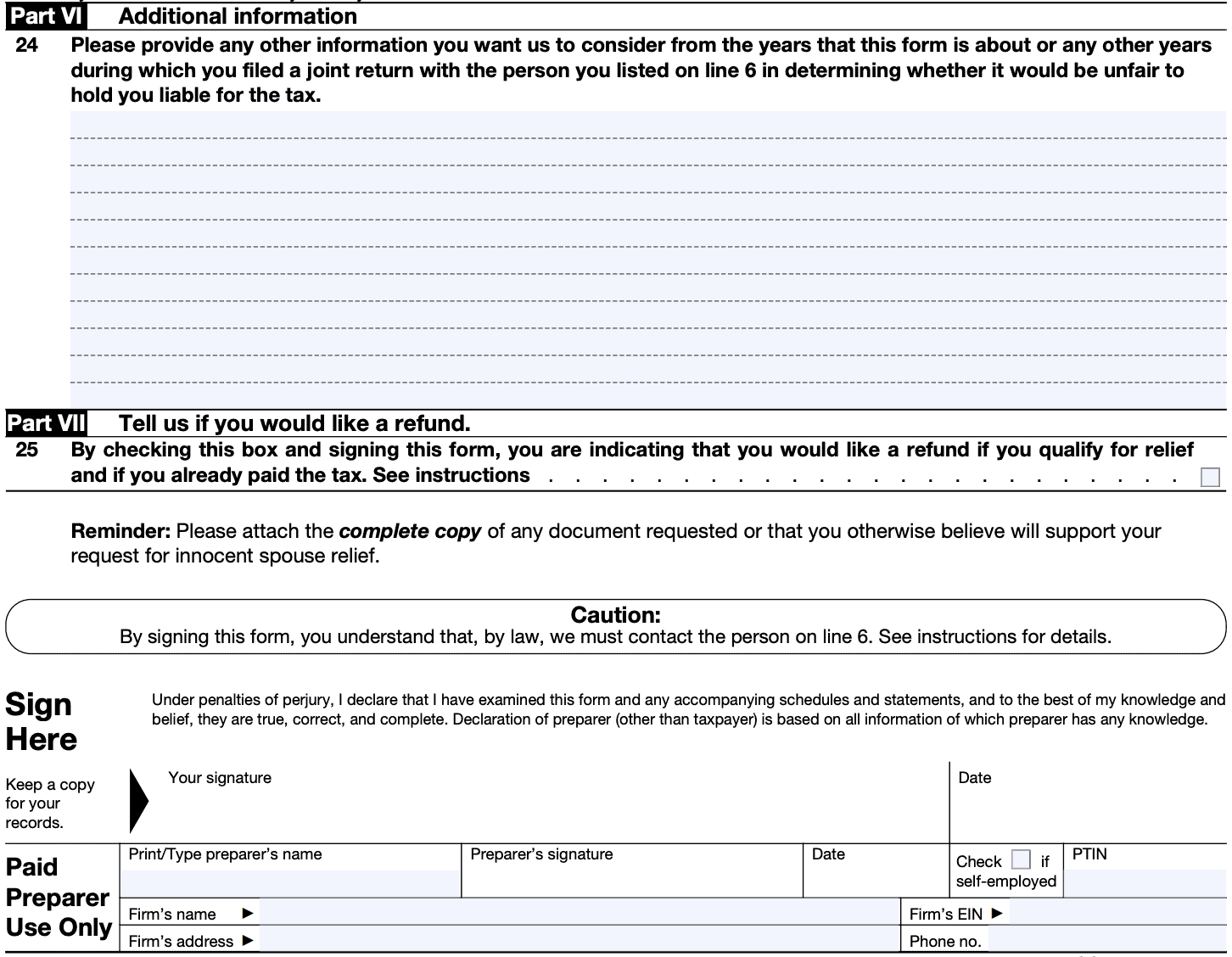

Part VII: Tell us if you would like a refund.

Select the box and sign the form if you have already paid the tax and are seeking a refund.

Signature block

Sign and date the form. This is a declaration, under penalties of perjury, that you believe this statement to be true, correct, and complete.

If you’re using a paid tax preparer, he or she will enter their information below your signature.

Filing considerations

Below are some common filing considerations when requesting innocent spouse relief.

What types of relief can I request on IRS Form 8857?

IRS Form 8857, Request for Innocent Spouse Relief, is the IRS form that one spouse can use when requesting relief from a joint tax liability that they believe to be the other spouse’s responsibility.

According to IRS Publication 971, Innocent Spouse Relief, There are three types of tax relief that a spouse may request on Form 8857:

- Innocent spouse relief

- Separation of liability relief

- Equitable relief

We’ll take a closer look at each type of relief.

Innocent spouse relief

Innocent relief indicates that the requesting spouse is not responsible in any way for any additional tax liability, penalties, or interest arising from the actions of the other spouse. By granting innocent spouse relief, the IRS has determined that the tax liability belongs solely to the non-requesting spouse, and must only be collected from that person.

The IRS may grant innocent spouse relief if the requesting spouse meets the following criteria:

- You filed a joint return

- There is an understated tax on the return that is due to erroneous items of the spouse or former spouse.

- You can show that when you signed the joint return you did not know, and had no reason to know, that the understated tax existed (or the extent to which the understated tax existed)

- Taking into account all the facts and circumstances, it would be unfair to hold you liable for the understated tax.

In other words, the IRS must determine that a reasonable person would not have known about the understatement of tax, and that the joint tax liability was solely the result of erroneous items that the other spouse was responsible for.

If granted, the IRS may permit tax refunds under innocent spouse relief.

Separation of liability relief

Separation of liability relief is available for liabilities resulting from an understated tax. However, this relief can only apply in a situation where there is a balance due.

The IRS may grant separation of liability relief to a taxpayer under the following circumstances:

- You are no longer married to, or are legally separated from, the spouse with whom you filed the joint return for which you are requesting relief.

- Under this rule, you are no longer married if you are widowed.

- You were not a member of the same household as the spouse with whom you filed the joint return at any time during the 12-month period ending on the date you filed Form 8857

If relief is granted, taxpayer may not request a refund of additional taxes paid under separation of liability relief.

Equitable relief

Equitable relief might be available for taxpayers who do not qualify for either innocent spouse relief or separation of liability relief.

A taxpayer may qualify for equitable relief for their tax situation if they meet the following requirements:

- You submitted the innocent spouse relief form in a timely manner

- No assets were transferred as part of a fraudulent scheme or to avoid paying tax

- You did not knowingly participate in the filing of a joint tax return

- The entire tax liability is attributable to your spouse’s (or former spouse’s) income

- If part of the tax is attributable to you, then you may only receive partial relief

When considering whether to grant equitable relief, the IRS weighs the following conditions:

- Marital status

- Economic hardship

- Knowledge or reason to know

- Legal obligation

- Significant benefit

- Compliance with income tax laws

- Mental or physical health

If granted, the IRS may permit tax refunds under equitable relief.

When should I file IRS Form 8857?

The IRS recommends that taxpayers apply for innocent spouse relief as soon as they become aware of a tax problem which they believe only the other spouse is responsible. However, you generally have up to 2 years from the time that the IRS first attempts collection activity for unpaid taxes to file for relief.

Here are indications that the IRS has started collection activity:

- The IRS offset your income tax refund against an amount you owed on a joint return for another tax year

- As part of the offset, the IRS informed you about your right to file Form 8857

- The IRS files a claim in a tax court proceeding in which you were a party or where your property is involved

- Includes bankruptcy proceedings

- The United States government has filed a suit against you to collect your joint tax debt

- The IRS has issued a Section 6330 notice, notifying you of the IRS’s intent to levy and your right to a collection due process (CDP) hearing

- Usually done by issuing a Letter 11 or Letter 1058

IRS Publication 971 contains more information about the time period requirements related to filing for relief.

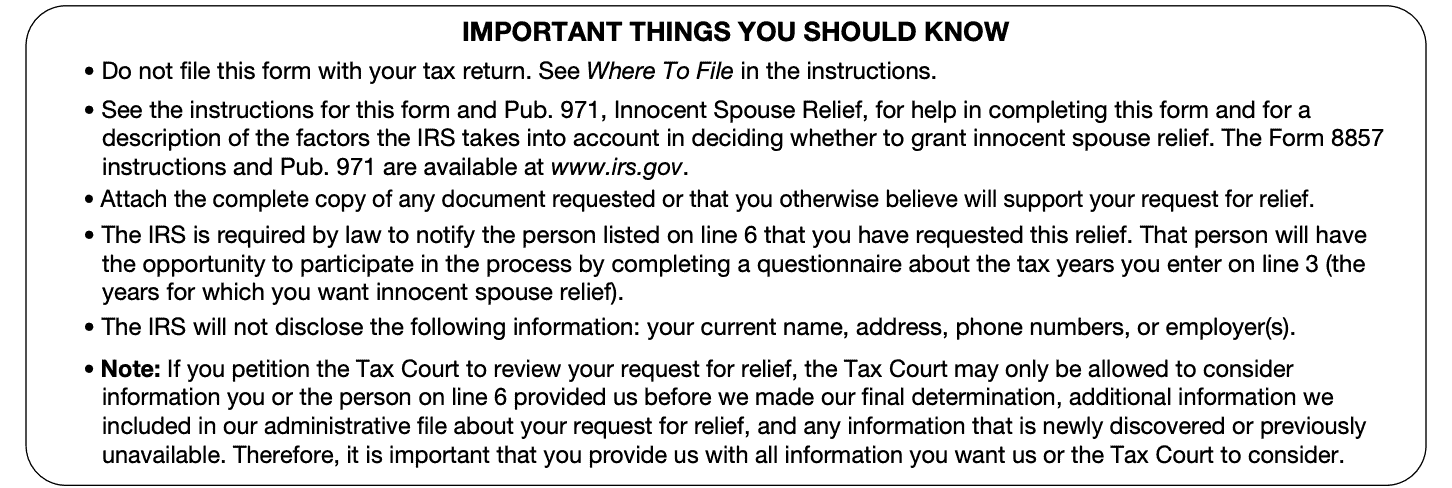

What should I know before I file IRS Form 8857?

The IRS clearly states certain conditions for which a taxpayer should file Form 8857. But it also issues pretty clear guidance, on the form itself.

Don’t file this form with your tax return.

This is fairly straightforward. But the form instructions specifically state that you must send your Form 8857 to one of the following addresses:

If using the U.S. Postal Service

Internal Revenue Service

P.O. Box 120053

Covington, KY 41012

If using a private delivery service (like FedEx or UPS)

Internal Revenue Service

7940 Kentucky Drive, Stop 840F

Florence, KY 41042

Read the form instructions and IRS publication before completing the form.

There are many factors that the IRS considers in determining whether you’re eligible for relief, or in determining the type of relief you’re eligible for. You should take some time to understand how the instructions and Internal Revenue Code apply to your financial situation before filing this form.

During your review, you might find the need to hire a tax professional. There are certain tax professionals who help their clients obtain tax relief. It might be a good idea to set up an appointment to learn more.

Attach a copy of all additional documents that might support your innocent spouse relief request.

While you should include all required documentation, the IRS guidance also states that you cannot let this impact your timely filing of this form.

The IRS must notify the other spouse

This is a very important item to consider, especially for victims of domestic violence or abuse.

While the IRS must provide the other party a questionnaire to determine their perspective, the form states that the IRS does not share the following information with the other party:

- Name

- Address

- Phone number

- Current employer(s)

Keep this in mind as you look to apply for innocent spouse relief.

What the tax court will consider

Finally, a taxpayer may petition the tax court for relief. However, the tax court can only consider the following information:

- Information that you, or the person on Line 6 provided to the IRS before the IRS issued a final determination letter

- Additional information the IRS included in their administrative file regarding the relief request

- Newly discovered or previously unavailable information

So submit your required documentation and supporting items when you apply, because there’s no guarantee that you have the opportunity to send supporting documents later on.

Video walkthrough

Watch this instructional video to learn more about how to complete Form 8857 and claim relief.

Do you use TurboTax?

If you don’t, is it because the choices are overwhelming to you?

If so, you should check out our TurboTax review page, where we discuss each TurboTax software product in depth. That way, you can make an informed decision on which TurboTax offering is the best one for you!

Click here to learn more about which TurboTax option is best for you!

Frequently asked questions

No. An injured spouse situation occurs when one spouse’s tax refund is diverted to pay the other spouse’s debt. To request injured spouse relief, you should file IRS Form 8379, Injured Spouse Allocation.

Unfortunately, yes. However, by filing for innocent spouse relief in a timely manner, you may be able to qualify for special consideration, if the federal government determines that you were not responsible for your husband’s tax mistakes.

Generally, the spouse seeking relief has two years from the first attempt by the IRS to collect the debt to file for relief under Form 8857.

Where can I find IRS Form 8857?

You may find a copy of this tax form on the IRS website, or by selecting the file below.